Which states have Tesla insurance? Tesla’s foray into the insurance market has sparked curiosity among electric vehicle owners, and the company’s expansion continues to grow. This article delves into the availability of Tesla Insurance, exploring the factors that influence its reach and comparing it to traditional auto insurance providers.

Tesla Insurance offers a unique blend of technology and personalized coverage, leveraging data from its vehicles to tailor premiums and provide benefits specific to Tesla owners. This approach aims to create a more transparent and potentially cost-effective insurance experience for Tesla drivers.

Tesla Insurance Availability

Tesla Insurance, a relatively new entrant in the insurance market, is currently available in a limited number of states. The company is gradually expanding its reach, aiming to offer its services nationwide.

States Where Tesla Insurance is Available

Tesla Insurance is currently available in the following states:

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- Wisconsin

Factors Influencing Tesla Insurance Expansion

Tesla’s expansion into new states is influenced by several factors:

- Regulatory Environment: Each state has its own set of insurance regulations. Tesla needs to ensure its insurance offerings comply with these regulations before entering a new state.

- Market Demand: Tesla assesses the demand for its insurance services in a particular state, considering the number of Tesla vehicles and potential customers.

- Competition: Tesla evaluates the competitive landscape in the insurance market of a state, considering the presence of established insurance providers and their offerings.

- Infrastructure: Tesla needs to establish partnerships with local insurance agents and brokers, as well as build its own infrastructure to support its operations in a new state.

Tesla Insurance Availability Compared to Other Major Insurance Providers

Tesla Insurance is available in a smaller number of states compared to other major insurance providers. For instance, companies like Geico, State Farm, and Progressive offer insurance nationwide. However, Tesla is aggressively expanding its reach, and its availability is expected to increase in the coming years.

Key Features of Tesla Insurance

Tesla Insurance is a unique auto insurance product designed specifically for Tesla owners. It leverages the advanced technology and safety features of Tesla vehicles to offer a tailored and potentially more affordable insurance experience.

Features of Tesla Insurance

Tesla Insurance offers several unique features that differentiate it from traditional auto insurance policies.

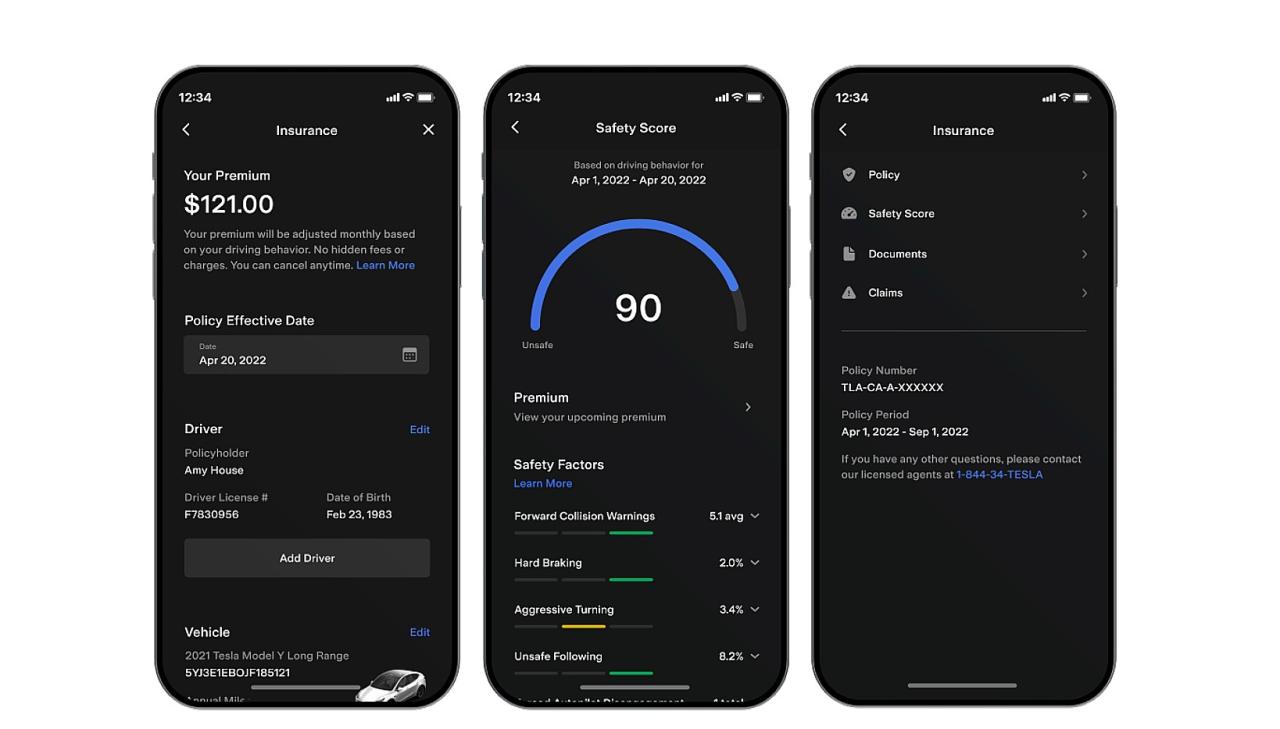

- Safety Score-Based Pricing: Tesla Insurance uses a proprietary safety score system that analyzes driving data from Tesla vehicles to determine premiums. This system considers factors like braking, acceleration, and lane keeping, potentially leading to lower premiums for safer drivers.

- Tesla Autopilot Discount: Owners who use Tesla’s Autopilot features may be eligible for discounts on their insurance premiums. This is because Autopilot is designed to enhance safety and reduce the risk of accidents.

- Direct-to-Consumer Model: Tesla Insurance is offered directly to customers through Tesla’s website and app, eliminating the need for traditional insurance brokers. This allows for a more streamlined and potentially faster insurance experience.

- Enhanced Coverage Options: Tesla Insurance offers a range of coverage options tailored to the specific needs of Tesla owners. This may include features like coverage for damage to the vehicle’s battery and other electric components.

Benefits of Tesla Insurance

Tesla Insurance offers several potential benefits for Tesla owners.

- Lower Premiums: The safety score-based pricing model and potential Autopilot discounts could lead to lower insurance premiums compared to traditional policies.

- Convenience: The direct-to-consumer model provides a convenient way to purchase and manage insurance policies online or through the Tesla app.

- Tailored Coverage: Tesla Insurance offers coverage options designed specifically for Tesla vehicles, addressing potential concerns related to electric components and other unique features.

Comparison to Traditional Auto Insurance

Here’s a comparison of Tesla Insurance to traditional auto insurance policies:

| Feature | Tesla Insurance | Traditional Auto Insurance |

|---|---|---|

| Pricing | Safety score-based, potential Autopilot discounts | Based on factors like driving history, age, location |

| Availability | Limited to Tesla owners | Widely available |

| Distribution | Direct-to-consumer | Through brokers or agents |

| Coverage Options | Tailored for Tesla vehicles | Standard coverage options |

Eligibility and Requirements

To qualify for Tesla Insurance, you must meet certain eligibility criteria. These criteria ensure that Tesla Insurance can accurately assess your risk and offer you a fair and competitive insurance rate.

Vehicle Requirements

Tesla Insurance is specifically designed for Tesla vehicles. This means that you must own a Tesla to be eligible for coverage. The insurance policy covers a wide range of Tesla models, including the Model S, Model 3, Model X, and Model Y.

Application Process

The application process for Tesla Insurance is straightforward. You can apply online through the Tesla website or through the Tesla mobile app. The application process typically involves providing your personal information, vehicle information, and driving history.

Documentation Needed

When applying for Tesla Insurance, you will need to provide certain documentation to verify your eligibility and complete the application process. The required documentation may vary depending on your location and individual circumstances. However, some common documents include:

- Proof of Identity: This may include your driver’s license, passport, or other government-issued identification.

- Proof of Residence: You may need to provide a utility bill, bank statement, or other document that shows your current address.

- Vehicle Registration: This document verifies that you are the legal owner of the Tesla vehicle.

- Driving History: You will need to provide information about your driving record, including any accidents or traffic violations.

- Insurance History: If you have had previous insurance coverage, you may need to provide information about your insurance history, such as your previous insurer and coverage details.

Pricing and Cost Factors: Which States Have Tesla Insurance

Tesla Insurance is designed to be competitive and potentially offer savings compared to traditional insurance providers. However, the actual cost of your policy will depend on several factors.

Factors Influencing Premium Costs

Several factors influence the pricing of Tesla Insurance, including:

- Vehicle Model and Year: The cost of your Tesla will impact your insurance premium. Newer and more expensive models generally have higher premiums due to their higher repair costs.

- Driving History: Your driving record, including accidents, violations, and claims history, plays a significant role in determining your premium. A clean driving record can lead to lower premiums.

- Location: The location where you live can affect your premium. Areas with higher crime rates or a higher frequency of accidents tend to have higher insurance costs.

- Coverage Options: The level of coverage you choose, such as comprehensive, collision, or liability, will impact your premium. More comprehensive coverage generally comes with a higher premium.

- Safety Features: Tesla vehicles are known for their advanced safety features, which can potentially reduce your premium. Features like Autopilot and Full Self-Driving may be considered in the pricing calculation.

- Driving Habits: Your driving habits, such as mileage and driving style, can also influence your premium. Drivers with lower mileage and a safer driving style may qualify for lower premiums.

Comparison to Other Insurance Providers

Tesla Insurance is generally considered to be competitive in pricing compared to other insurance providers. However, the exact cost comparison can vary depending on your individual circumstances.

- Potential Advantages: Tesla Insurance may offer advantages such as lower premiums for Tesla owners due to their understanding of the vehicle’s safety features and technology. It may also offer more tailored coverage options specific to Tesla vehicles.

- Potential Disadvantages: Tesla Insurance may not be the most affordable option for all drivers, particularly those with a less favorable driving history or those living in high-risk areas. It’s essential to compare quotes from multiple providers to find the best deal.

Potential Cost Savings

Tesla Insurance may offer potential cost savings through various factors, including:

- Discounts: Tesla Insurance may offer discounts for safe driving, bundling insurance policies, or having a Tesla vehicle with advanced safety features.

- Telematics: Tesla vehicles can track driving data through their built-in systems, which can be used to assess driving behavior and potentially offer lower premiums for safe drivers.

- Direct-to-Consumer Model: Tesla Insurance operates directly with customers, potentially eliminating some of the overhead costs associated with traditional insurance providers, which could translate into lower premiums.

Customer Experience and Reviews

Tesla Insurance has garnered mixed reviews from customers, with some praising its innovative features and personalized approach, while others express concerns about its pricing and customer service. To understand the customer experience better, it’s crucial to analyze both positive and negative feedback.

Customer Reviews and Feedback

Customer reviews provide valuable insights into the strengths and weaknesses of Tesla Insurance. Here’s a table summarizing some common themes:

| Review Source | Positive Feedback | Negative Feedback |

|---|---|---|

| Trustpilot | – Lower premiums for Tesla owners – Personalized pricing based on driving habits – Seamless integration with Tesla vehicles |

– Limited availability in some states – Higher premiums compared to traditional insurers – Limited customer service options |

| Google Reviews | – User-friendly online platform – Fast claims processing – Dedicated Tesla experts for support |

– Issues with online portal functionality – Lack of transparency in pricing calculations – Difficulties contacting customer support |

Strengths of Tesla Insurance Based on User Experience

– Personalized Pricing: Tesla Insurance leverages driving data from Tesla vehicles to personalize premiums, rewarding safe drivers with lower rates. This approach is appreciated by many customers who believe it’s fairer than traditional insurance models.

– Seamless Integration with Tesla Vehicles: Tesla Insurance seamlessly integrates with Tesla vehicles, offering features like automatic accident detection and remote assistance. This convenience is highly valued by Tesla owners.

– Innovative Features: Tesla Insurance offers features like Safe Driving Rewards, which incentivize safe driving habits. This gamification approach is well-received by customers who enjoy the competitive aspect and potential for discounts.

Weaknesses of Tesla Insurance Based on User Experience

– Limited Availability: Tesla Insurance is not available in all states, limiting its accessibility to a wider audience. This is a major drawback for potential customers who live in states where it’s not offered.

– Higher Premiums: Some customers have reported that Tesla Insurance premiums are higher than those offered by traditional insurers. This can be a significant barrier for budget-conscious individuals.

– Customer Service Challenges: While Tesla Insurance offers dedicated Tesla experts for support, some customers have encountered difficulties reaching customer service representatives or resolving issues promptly.

Comparison of Customer Service and Support

Tesla Insurance offers a dedicated team of Tesla experts to assist customers with their insurance needs. These experts are familiar with Tesla vehicles and can provide specialized support. However, some customers have reported difficulties contacting customer service representatives or resolving issues promptly.

Traditional insurance providers generally offer a wider range of customer service channels, including phone, email, and live chat. They also have established complaint resolution processes and regulatory oversight.

Overall, Tesla Insurance offers a unique customer experience with its focus on personalized pricing and seamless integration with Tesla vehicles. However, its limited availability, higher premiums, and customer service challenges are areas where it can improve.

Tesla Insurance vs. Traditional Insurance

Choosing the right insurance for your Tesla can be a complex decision, especially with the emergence of Tesla Insurance. While traditional auto insurance offers a wide range of options, Tesla Insurance presents a unique proposition specifically tailored to Tesla owners. Understanding the differences and advantages of each option is crucial for making an informed choice.

Comparison of Tesla Insurance and Traditional Insurance, Which states have tesla insurance

This section will Artikel the key differences between Tesla Insurance and traditional auto insurance, highlighting their respective advantages and disadvantages.

- Data-Driven Pricing: Tesla Insurance utilizes data from your Tesla’s sensors and driving habits to assess your risk, potentially leading to lower premiums for safe drivers. Traditional insurance relies primarily on demographic factors, driving history, and vehicle details.

- Coverage Options: Tesla Insurance offers a range of coverage options similar to traditional insurance, including collision, comprehensive, and liability coverage. However, it may have unique features or limitations specific to Tesla vehicles.

- Claim Process: Tesla Insurance claims may be handled directly through Tesla, potentially simplifying the process for Tesla owners. Traditional insurance claims typically involve dealing with a separate insurance company.

- Availability: Tesla Insurance is currently only available in a limited number of states, while traditional insurance is widely available across the country.

- Pricing: Tesla Insurance pricing can vary depending on your driving record, location, and Tesla model. It may be more affordable for some Tesla owners, particularly those with excellent driving habits. Traditional insurance pricing can be influenced by a wider range of factors, including age, gender, and credit score.

Advantages of Tesla Insurance

Tesla Insurance offers several advantages specifically for Tesla owners:

- Personalized Pricing: Tesla Insurance utilizes data from your Tesla’s sensors to personalize your premium based on your driving habits, potentially offering lower rates for safe drivers.

- Simplified Claims Process: Tesla Insurance claims can be handled directly through Tesla, streamlining the process for Tesla owners.

- Integration with Tesla Features: Tesla Insurance may integrate seamlessly with Tesla features, such as Autopilot and Full Self-Driving, potentially offering enhanced coverage and benefits.

Disadvantages of Tesla Insurance

While Tesla Insurance offers unique advantages, it also has some drawbacks:

- Limited Availability: Tesla Insurance is currently only available in a limited number of states, limiting its accessibility for many Tesla owners.

- Potential for Higher Premiums: Despite the potential for lower premiums for safe drivers, Tesla Insurance may be more expensive for some Tesla owners, especially those with less-than-perfect driving records.

- Limited Coverage Options: Tesla Insurance may offer fewer coverage options or have specific limitations compared to traditional insurance.

Suitability of Tesla Insurance for Different Driving Profiles

The suitability of Tesla Insurance depends on individual driving profiles and needs.

- Safe Drivers with Excellent Driving Records: Tesla Insurance may be a good option for safe drivers with clean driving records, as they are more likely to benefit from data-driven pricing.

- Tesla Owners in States Where Tesla Insurance is Available: Tesla Insurance is only available in certain states, so it is only a viable option for Tesla owners residing in those areas.

- Drivers Seeking a Simplified Claims Process: Tesla Insurance may be attractive to drivers who prefer a streamlined claims process handled directly through Tesla.

- Drivers with Unique Coverage Needs: If you have specific coverage needs that are not readily available through traditional insurance, Tesla Insurance may offer a suitable alternative.

The Future of Tesla Insurance

Tesla Insurance, a relatively new entrant in the insurance market, has already made significant strides. As Tesla continues to expand its electric vehicle (EV) market share, its insurance arm is poised for substantial growth and influence.

Potential Developments and Expansion Plans

Tesla’s ambition to become a dominant force in the insurance industry is evident in its ongoing expansion plans. The company is continuously working on enhancing its insurance offerings and expanding its geographical reach. This includes:

* Expanding into new markets: Tesla Insurance is currently available in a limited number of states. The company is actively seeking to expand its footprint across the United States and potentially into international markets.

* Introducing new insurance products: Tesla is exploring the development of additional insurance products beyond its current offerings. This could include insurance for other Tesla products like solar panels, energy storage systems, and even other EV brands.

* Leveraging data and technology: Tesla has a vast amount of data about its vehicles and drivers. The company is exploring ways to leverage this data to personalize insurance premiums and offer more tailored coverage. This could involve using telematics data, driver behavior analysis, and predictive analytics to create more accurate risk assessments.

Impact of Tesla’s Growing EV Market on the Insurance Industry

Tesla’s rapid growth in the EV market is having a profound impact on the traditional insurance industry. This is due to:

* Changing risk profiles: EVs have different safety features and driving characteristics than traditional gasoline-powered vehicles. This requires insurers to re-evaluate their risk models and pricing strategies.

* Increased competition: Tesla Insurance is disrupting the market by offering competitive premiums and personalized coverage options. This is forcing traditional insurers to adapt and innovate to remain competitive.

* Data-driven insights: Tesla’s ability to collect and analyze data about its vehicles and drivers is giving it a competitive edge in understanding and managing risk. This could lead to a shift towards more data-driven insurance models in the future.

Potential for Tesla Insurance to Become a Major Player in the Insurance Market

Tesla Insurance has the potential to become a major player in the insurance market due to:

* Strong brand recognition: Tesla enjoys a strong brand reputation, which can translate into increased trust and loyalty among its customers.

* Direct-to-consumer model: Tesla Insurance operates a direct-to-consumer model, eliminating the need for intermediaries and allowing for more efficient operations and potentially lower premiums.

* Focus on technology and innovation: Tesla is known for its focus on technology and innovation. This translates into its insurance offerings, where it is constantly exploring ways to leverage data and technology to improve customer experience and enhance coverage.

Tesla’s focus on data-driven insights and its strong brand reputation could give it a significant advantage in the future of insurance.

Closure

Tesla Insurance is evolving, and its future trajectory will likely be shaped by its ability to adapt to changing consumer preferences and regulatory landscapes. The company’s commitment to innovation, coupled with its growing market share in the electric vehicle sector, suggests that Tesla Insurance could become a significant player in the insurance industry. As the company continues to expand its reach and refine its offerings, it will be interesting to observe its impact on the traditional insurance landscape.

Expert Answers

What are the benefits of Tesla Insurance?

Tesla Insurance offers benefits like lower premiums for safe driving, access to Tesla’s extensive network of service centers, and potential discounts for Tesla owners.

How do I get a quote for Tesla Insurance?

You can get a quote for Tesla Insurance through the Tesla website or mobile app. You’ll need to provide basic information about your vehicle and driving history.

Is Tesla Insurance available in all states?

No, Tesla Insurance is not currently available in all states. The company is gradually expanding its reach, but its availability is still limited.

What are the requirements for Tesla Insurance?

To be eligible for Tesla Insurance, you must own a Tesla vehicle and meet the company’s general eligibility criteria, such as a clean driving record.

Can I switch to Tesla Insurance from another provider?

Yes, you can switch to Tesla Insurance from another provider. You’ll need to provide information about your current policy and vehicle.