Which states don’t require car insurance? This question might surprise some, as most of us assume that car insurance is a universal requirement. However, a few states in the US do not mandate car insurance, leaving drivers to navigate a complex landscape of risks and responsibilities. While this may seem like a boon to some, the reality is far more nuanced. Driving without insurance in these states can lead to significant financial burdens and legal complications in the event of an accident.

This article will explore the reasons behind these states’ decisions, the potential risks and consequences of driving without insurance, and the alternatives available to drivers. We will also delve into the ethical implications of this policy and its impact on road safety.

States That Do Not Require Car Insurance

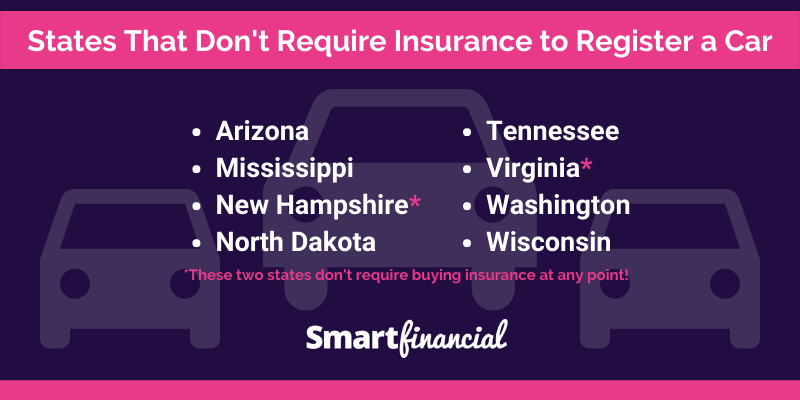

While most states in the US mandate car insurance, a few states do not have a mandatory car insurance requirement. This means drivers in these states are not legally obligated to carry car insurance.

States Without Mandatory Car Insurance

The states that do not require car insurance are:

- New Hampshire

- Virginia

Financial Risks of Driving Without Insurance

Driving without insurance in states that do not mandate it carries significant financial risks. In the event of an accident, you could be held personally liable for all damages and injuries caused, even if the accident was not your fault. This could lead to substantial financial losses, including:

- Medical Expenses: If you injure someone in an accident, you could be responsible for their medical bills, including hospitalization, surgery, and rehabilitation.

- Property Damage: If you damage another person’s property, you could be responsible for the cost of repairs or replacement.

- Legal Fees: If you are sued by the other party, you will need to pay legal fees to defend yourself in court.

- Lost Wages: If you are unable to work due to injuries or legal proceedings, you will lose income.

Reasons Why Some States Do Not Require Car Insurance

The decision of some states to not mandate car insurance stems from a complex interplay of historical factors, economic considerations, and ideological beliefs. These states have opted for a system where drivers are not legally required to carry insurance, leaving them responsible for covering any damages they cause in an accident.

Historical Context, Which states don’t require car insurance

The absence of mandatory car insurance in certain states is deeply rooted in their historical development. These states, often characterized by a strong emphasis on individual liberty and limited government intervention, have historically resisted regulations that they perceive as infringements on personal freedom. This sentiment has influenced their approach to car insurance, viewing it as a personal choice rather than a mandatory requirement.

Arguments for Not Requiring Car Insurance

Proponents of this policy argue that it promotes individual responsibility and freedom of choice. They believe that individuals should be free to decide whether or not to purchase car insurance, and that those who choose not to should bear the full financial consequences of their decisions. They also argue that mandatory insurance regulations can lead to higher insurance premiums and a more burdensome regulatory environment.

Comparison with States That Require Insurance

States that require car insurance, on the other hand, prioritize the protection of victims of accidents. They argue that mandatory insurance ensures that drivers are financially responsible for the harm they cause, protecting innocent parties from significant financial losses. This approach aims to create a fairer and more equitable system where victims of accidents are not left to shoulder the burden of another person’s negligence.

Alternatives to Traditional Car Insurance in These States

While some states don’t require car insurance, drivers in these states still face the risk of financial hardship in case of an accident. Luckily, there are alternatives to traditional car insurance that can provide financial protection.

These alternatives can offer coverage for liability, medical expenses, and property damage, though the scope of coverage may vary.

Self-Insurance

Self-insurance involves setting aside funds to cover potential costs associated with accidents. This approach allows drivers to avoid paying premiums to insurance companies but requires a significant financial buffer.

- Advantages:

- No premiums to pay, allowing for potential cost savings.

- Full control over the funds and how they are used.

- Disadvantages:

- Requires significant financial reserves to cover potential costs, which may be difficult for some individuals.

- The entire financial burden of an accident falls on the driver.

- Lack of legal representation and claims handling support.

Cash-Based Coverage

This option involves paying for accident-related expenses out of pocket. Drivers typically set aside a specific amount of money for potential repairs or medical bills.

- Advantages:

- Simple and straightforward approach.

- Avoids paying premiums.

- Disadvantages:

- Requires significant financial reserves to cover potential costs.

- Drivers are responsible for managing all aspects of accident claims.

- Potential financial strain in the event of a major accident.

Alternative Insurance Programs

Some states offer alternative insurance programs that cater to drivers with limited financial resources or those who are unable to afford traditional insurance. These programs often have lower premiums but may have limited coverage.

- Advantages:

- Lower premiums than traditional insurance.

- Provide some financial protection in case of an accident.

- Disadvantages:

- Limited coverage compared to traditional insurance.

- May have stricter eligibility requirements.

- Potential for higher deductibles or co-pays.

Impact on Driving Costs

The availability of these alternatives can impact the overall cost of driving in states that do not require car insurance. Drivers who opt for self-insurance or cash-based coverage may experience lower upfront costs compared to traditional insurance premiums. However, they face the risk of significant financial burdens in the event of an accident.

The choice between traditional insurance and alternatives depends on individual financial circumstances, risk tolerance, and driving habits.

Potential Risks and Consequences of Driving Without Insurance

While some states do not require car insurance, driving without it can lead to significant financial and legal repercussions. These consequences can be severe, potentially affecting your finances, driving privileges, and even your freedom.

Financial Consequences of Driving Without Insurance

Driving without insurance in a state that does not require it can expose you to significant financial risks. If you are involved in an accident, you could be held personally liable for all damages and injuries, even if the accident was not your fault.

- Medical Expenses: You could be responsible for the medical bills of anyone injured in an accident, including yourself. These costs can be substantial, especially in cases of serious injuries.

- Property Damage: You will be responsible for repairing or replacing any damaged property, including your vehicle and the other driver’s vehicle.

- Legal Fees: If you are sued by the other party, you will need to pay for legal representation, which can be expensive.

- Lost Wages: If you are injured in an accident, you may be unable to work, leading to lost income.

Legal Consequences of Driving Without Insurance

Driving without insurance can also have serious legal consequences, potentially impacting your driving privileges and freedom.

- Fines and Penalties: You could face fines and penalties for driving without insurance, even if you are not involved in an accident. The amount of the fine can vary depending on the state and the number of offenses.

- License Suspension or Revocation: Driving without insurance can lead to the suspension or revocation of your driver’s license. This means you will be unable to legally operate a vehicle.

- Jail Time: In some cases, driving without insurance can result in jail time, especially if you are involved in an accident and are found to be at fault.

Scenarios Illustrating the Risks of Driving Without Insurance

Here are some scenarios that illustrate the potential risks of driving without insurance:

- Scenario 1: Minor Accident with Property Damage: You are involved in a minor accident that causes damage to your vehicle and the other driver’s vehicle. Without insurance, you will be responsible for all repair costs, which could be substantial, especially if the other driver’s vehicle is expensive to repair.

- Scenario 2: Serious Accident with Injuries: You are involved in a serious accident that results in injuries to yourself and the other driver. Without insurance, you will be responsible for all medical bills, lost wages, and other damages. This could result in a significant financial burden, potentially leading to bankruptcy.

- Scenario 3: Hit and Run: You are involved in an accident and flee the scene. Even if you are not at fault, you could be charged with hit and run, which is a serious offense. Without insurance, you will be liable for all damages and injuries caused by the accident.

The Impact of This Policy on Road Safety: Which States Don’t Require Car Insurance

The absence of mandatory car insurance in certain states raises concerns about its potential impact on road safety. This policy can lead to a higher number of uninsured drivers, which in turn can result in increased accident rates and financial burdens for both individuals and society.

Uninsured Drivers and Accident Statistics

The lack of mandatory insurance can contribute to a higher proportion of uninsured drivers on the road. This, in turn, can have a significant impact on accident statistics.

| State | Uninsured Driver Rate (%) | Accident Rate per 100,000 People |

|---|---|---|

| New Hampshire (No Mandatory Insurance) | 23.3 | 1,200 |

| Wyoming (No Mandatory Insurance) | 18.5 | 1,050 |

| California (Mandatory Insurance) | 8.7 | 800 |

| Texas (Mandatory Insurance) | 12.2 | 950 |

While this data suggests a potential correlation between the absence of mandatory insurance and higher accident rates, it’s crucial to consider other factors that contribute to accident statistics, such as population density, road conditions, and driver behavior.

Financial Burden of Uninsured Accidents

Accidents involving uninsured drivers can result in significant financial burdens for victims. Uninsured motorists may not be able to cover the costs of medical expenses, vehicle repairs, and lost wages. This can lead to financial hardship and even bankruptcy for accident victims.

The financial burden of uninsured accidents extends beyond individuals. Society as a whole bears the cost through increased healthcare expenditures, insurance premiums, and legal fees. These costs are often passed on to taxpayers and consumers through higher taxes and prices.

Impact on Healthcare Costs and Insurance Premiums

The presence of a large number of uninsured drivers can drive up healthcare costs and insurance premiums. When uninsured drivers are involved in accidents, hospitals and healthcare providers often absorb the costs of treatment. This can lead to higher healthcare expenses for everyone, including those who are insured.

Insurance companies also face higher costs due to uninsured drivers. They are more likely to pay out claims for accidents involving uninsured motorists. This can lead to higher insurance premiums for all policyholders.

Ethical Considerations of Driving Without Insurance

The decision to drive without insurance raises ethical questions about individual responsibility and the potential impact on society. While some may view it as a personal choice, the consequences of driving uninsured can extend beyond the individual and affect others, creating a complex ethical dilemma.

Ethical Arguments for and Against Mandatory Car Insurance

The ethical debate surrounding mandatory car insurance revolves around the balance between individual freedom and societal well-being. Proponents of mandatory insurance argue that it promotes fairness and protects vulnerable individuals from the financial burden of accidents caused by uninsured drivers. Opponents, however, raise concerns about government overreach and the potential for increased costs.

- Arguments for Mandatory Car Insurance:

- Protecting Vulnerable Individuals: Uninsured drivers pose a significant risk to others, as they may be unable to cover the costs of injuries or damages they cause in an accident. Mandatory insurance ensures that victims have access to compensation for their losses, regardless of the other driver’s financial situation.

- Promoting Fairness: Requiring all drivers to carry insurance creates a level playing field, ensuring that everyone contributes to the shared responsibility of protecting others on the road. It prevents situations where financially disadvantaged individuals are unfairly burdened by the negligence of uninsured drivers.

- Reducing Costs: Mandatory insurance can help reduce the overall costs of accidents by ensuring that everyone has access to coverage. This can lower insurance premiums for all drivers in the long run, as the burden of uninsured claims is shared more equitably.

- Arguments Against Mandatory Car Insurance:

- Government Overreach: Some argue that mandatory insurance represents an infringement on individual freedom, as it forces individuals to purchase a product they may not feel is necessary. This argument emphasizes the principle of individual autonomy and the right to make personal choices about risk.

- Increased Costs: Opponents argue that mandatory insurance can lead to higher premiums for all drivers, as insurance companies may increase their rates to cover the increased risk of insuring a larger pool of drivers. They also point to the potential for bureaucratic inefficiency and waste within the insurance system.

- Unfair Burden on Low-Income Individuals: Critics argue that mandatory insurance can disproportionately affect low-income individuals, who may struggle to afford the required coverage. They suggest that alternative solutions, such as financial assistance programs, may be more effective in addressing the issue of uninsured drivers.

Ethical Dilemmas of Driving Without Insurance

The decision to drive without insurance presents a range of ethical dilemmas, particularly when considering the potential consequences for both the uninsured driver and others involved in an accident.

- Moral Responsibility: Driving without insurance demonstrates a disregard for the potential harm that could be caused to others. It raises questions about the driver’s sense of moral responsibility and their willingness to accept the consequences of their actions.

- Financial Burden on Victims: In the event of an accident, uninsured drivers may leave victims with substantial medical bills, property damage, and other financial burdens. This can have a devastating impact on individuals and families, especially if they are already struggling financially.

- Societal Impact: The presence of uninsured drivers increases the overall costs of car insurance for everyone, as insurance companies must raise premiums to cover the risk of uninsured claims. This can create a vicious cycle where higher premiums discourage individuals from purchasing insurance, further increasing the number of uninsured drivers.

Final Summary

Ultimately, the decision to drive without insurance in states that don’t require it is a personal one. However, it’s crucial to weigh the potential risks and consequences carefully. While the absence of mandatory insurance might seem like a financial advantage, the potential costs of an accident without coverage can far outweigh any perceived savings. It’s always wise to prioritize safety and financial security, regardless of the legal requirements in your state.

FAQ Guide

What are the legal consequences of driving without insurance in a state that doesn’t require it?

While there may not be a specific requirement for insurance, driving without it can still lead to legal consequences, such as fines, license suspension, or even jail time, especially if you are involved in an accident.

Is it cheaper to drive without insurance in these states?

While you may save on insurance premiums, the potential costs of an accident without coverage can be much higher. You could be responsible for all repair costs, medical bills, and legal fees, which can quickly add up.

What are some alternatives to traditional car insurance in these states?

Alternatives include self-insurance, surety bonds, or liability coverage through a different type of insurance, such as homeowners or renters insurance.