Which states do not require car insurance? This question might surprise some, as most Americans assume car insurance is mandatory nationwide. However, there are a few states that don’t require it, opting instead for financial responsibility laws. These laws dictate that drivers must demonstrate their ability to cover damages in case of an accident, often through surety bonds, cash deposits, or other financial instruments. While these states might seem to offer a financial advantage, driving without insurance carries significant risks, including hefty fines, legal troubles, and the potential for financial ruin in the event of an accident.

This article delves into the unique situation of states without mandatory car insurance, exploring the legal framework, financial responsibility requirements, and potential consequences of driving without insurance. We’ll also discuss alternative insurance options available in these states and the broader impact of driving without insurance on road safety.

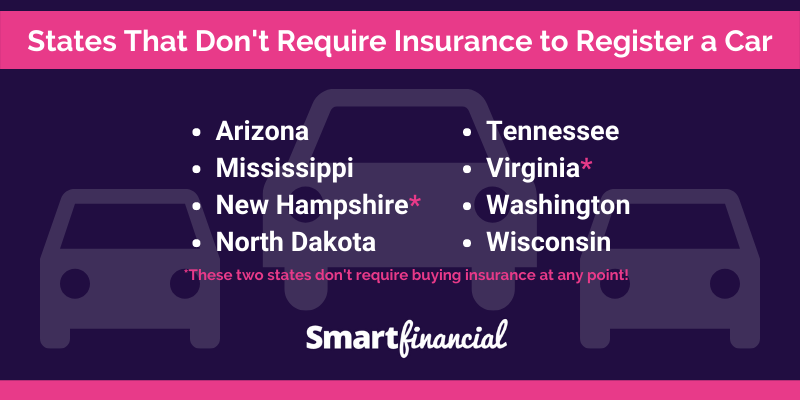

States Without Mandatory Car Insurance

While most states in the United States require drivers to carry car insurance, there are a few exceptions. These states do not mandate car insurance, meaning drivers are not legally obligated to purchase a policy. However, this does not mean they are completely exempt from financial responsibility.

States Without Mandatory Car Insurance

There are only two states in the US that do not require drivers to carry car insurance:

- New Hampshire

- Virginia

These states have a unique approach to financial responsibility, relying on a system of financial responsibility laws instead of mandatory insurance.

Legal Basis for Exemption

In these states, the legal basis for the exemption from mandatory car insurance stems from the principle of individual responsibility. The argument is that drivers should be responsible for their own financial liabilities, and requiring insurance might interfere with individual choices.

Potential Risks of Driving Without Insurance

While drivers in these states are not legally required to carry insurance, they face significant risks if they are involved in an accident. These risks include:

- Financial Ruin: If a driver without insurance causes an accident, they could be held financially responsible for all damages, including medical expenses, property damage, and lost wages. This could lead to financial ruin, especially if the accident involves serious injuries or significant property damage.

- License Suspension: Even though these states do not mandate insurance, they have financial responsibility laws that require drivers to demonstrate their ability to pay for damages. If a driver is involved in an accident and cannot prove financial responsibility, their license could be suspended.

- Legal Action: The injured party in an accident caused by an uninsured driver could take legal action to recover damages. This could lead to costly legal fees and judgments against the uninsured driver.

Financial Responsibility Laws

While these states do not require insurance, they have financial responsibility laws in place to protect victims of accidents. These laws require drivers to demonstrate their ability to pay for damages, even if they are not insured.

- Proof of Financial Responsibility: Drivers in these states can demonstrate financial responsibility through various means, including:

- Self-Insurance: Drivers can self-insure by providing proof of sufficient assets to cover potential damages. This often involves a significant amount of money or property.

- Surety Bond: Drivers can obtain a surety bond from an insurance company, which guarantees payment for damages up to a certain amount.

- Cash Deposit: Drivers can deposit a substantial amount of cash with the state as proof of financial responsibility.

- Uninsured Motorist Coverage: Even though these states do not mandate insurance, drivers can still purchase uninsured motorist coverage from insurance companies. This coverage protects them from damages caused by uninsured or underinsured drivers.

Financial Responsibility Laws in Non-Insurance States

While some states require drivers to carry car insurance, others rely on financial responsibility laws to ensure drivers can cover the costs of accidents they cause. These laws are designed to protect the public and ensure that victims of accidents can receive compensation for their injuries and damages.

Financial Responsibility Options

States without mandatory insurance typically offer various options for demonstrating financial responsibility. These options provide drivers with flexibility in meeting the requirements while ensuring they have the financial means to cover potential liabilities.

- Surety Bonds: These bonds, issued by insurance companies, guarantee payment for damages up to a specific amount. Drivers purchase these bonds, which act as a financial guarantee for their responsibility.

- Cash Deposits: States may allow drivers to deposit a specific amount of cash with the state government as proof of financial responsibility. This deposit serves as a financial reserve to cover potential accident-related costs.

- Self-Insurance: Some states allow drivers to self-insure if they can demonstrate sufficient financial resources to cover potential liabilities. This typically involves providing proof of financial stability, such as a substantial bank balance or a strong investment portfolio.

Demonstrating Financial Responsibility

The procedures for demonstrating financial responsibility vary depending on the state. However, common methods include:

- Filing an Affidavit of Financial Responsibility: Drivers may need to file an affidavit stating their financial resources and ability to cover potential liabilities. This affidavit often requires documentation, such as bank statements or investment records.

- Providing Proof of Insurance: Even in states without mandatory insurance, drivers may be required to provide proof of insurance if they are involved in an accident. This can be a temporary insurance policy or a certificate of self-insurance.

- Paying a Financial Responsibility Fee: Some states require drivers to pay a financial responsibility fee annually, which ensures they have the means to cover potential accident-related costs.

Minimum Financial Responsibility Requirements

The minimum financial responsibility requirements vary by state. Here is a table comparing the minimum requirements for some states without mandatory insurance:

| State | Minimum Liability Coverage | Minimum Property Damage Coverage | Minimum Uninsured Motorist Coverage |

|---|---|---|---|

| New Hampshire | $25,000 per person/$50,000 per accident | $25,000 | Optional |

| Virginia | $25,000 per person/$50,000 per accident | $25,000 | Optional |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 | Optional |

Potential Consequences of Driving Without Insurance

While some states do not mandate car insurance, driving without coverage can have significant consequences. These consequences extend beyond legal penalties and encompass substantial financial risks, impacting both the uninsured driver and potentially influencing insurance premiums in other states.

Legal Consequences of Driving Without Insurance

Driving without insurance in states that do not require it can still result in legal repercussions. While the specific penalties may vary, these consequences can include:

- Fines and Penalties: Even without mandatory insurance, many states impose fines and penalties on drivers caught operating a vehicle without coverage. These fines can be substantial and may increase with repeated offenses.

- License Suspension or Revocation: Driving without insurance can lead to license suspension or revocation, preventing the driver from legally operating a vehicle.

- Vehicle Impoundment: In some cases, authorities may impound the uninsured vehicle, adding to the driver’s financial burden.

Financial Risks of Accidents Involving Uninsured Drivers

Accidents involving uninsured drivers can lead to substantial financial losses, particularly for the other party involved.

- Unpaid Medical Bills: If an uninsured driver causes an accident resulting in injuries, the injured party may be responsible for their own medical bills, which can be substantial.

- Property Damage Costs: Damage to vehicles or other property involved in an accident with an uninsured driver may not be covered, leaving the other party responsible for repair or replacement costs.

- Lost Wages: Injuries sustained in an accident with an uninsured driver can lead to lost wages, further compounding the financial burden on the injured party.

Impact on Insurance Premiums in Other States

Driving without insurance in a state that does not require it can have implications for insurance premiums in other states.

- Higher Premiums: Insurance companies may consider driving history in all states, including those without mandatory insurance. A record of driving without insurance in any state can lead to higher insurance premiums in other states.

- Difficulty Obtaining Coverage: Some insurance companies may be hesitant to provide coverage to drivers with a history of driving without insurance, even in states where it is not mandatory.

Financial Burden of an Accident for an Uninsured Driver

Consider a scenario where an uninsured driver is involved in an accident that results in $10,000 in property damage and $20,000 in medical bills for the other party.

- Legal Fees: The uninsured driver may face legal fees for defending against a lawsuit filed by the injured party.

- Judgment Costs: If the court finds the uninsured driver liable, they may be ordered to pay the full amount of damages, including medical bills, property damage, and legal fees.

- Wage Garnishment: If the uninsured driver cannot afford to pay the judgment, creditors may seek to garnish their wages to recover the debt.

Alternatives to Traditional Car Insurance

Even though states like New Hampshire and Virginia do not mandate car insurance, drivers still need to demonstrate financial responsibility in case of an accident. Thankfully, there are various alternatives to traditional car insurance that offer coverage and peace of mind.

Self-Insurance

Self-insurance, also known as “going bare,” is a risky approach where drivers choose not to purchase any car insurance. They assume full financial responsibility for any accidents they may cause, covering damages, injuries, and legal fees. This option can be attractive for individuals with significant financial resources and a low-risk driving history.

Financial Responsibility Bonds

Financial responsibility bonds are a type of surety bond that guarantees the driver’s ability to pay for damages caused by an accident. The bond acts as a financial guarantee, ensuring that the insurance company will cover the driver’s liability up to the bond’s limit. This option is typically used by drivers who own high-value vehicles or have a history of accidents.

Self-Insurance Plans

Some states offer self-insurance plans, allowing drivers to set aside a specific amount of money in a dedicated account to cover potential accident costs. These plans require drivers to meet certain financial requirements and may have specific coverage limitations. While they offer a degree of financial protection, self-insurance plans do not provide the same level of coverage as traditional insurance policies.

Cash Deposits, Which states do not require car insurance

In certain states, drivers can choose to deposit a substantial amount of cash with the state government as proof of financial responsibility. This deposit acts as a guarantee that the driver can cover accident costs. However, this option is not widely available and often requires a significant upfront payment.

Other Alternatives

While less common, other alternatives include joining a driving club or obtaining a certificate of self-insurance from a reputable financial institution. These options may provide limited coverage and are subject to specific eligibility criteria.

Comparing Alternatives

| Alternative | Cost | Coverage | Advantages | Disadvantages |

|—|—|—|—|—|

| Self-Insurance | Low | Minimal | No premiums, full control | High risk, potentially costly |

| Financial Responsibility Bonds | Moderate | Varies depending on bond amount | Financial guarantee, less risk than self-insurance | Bond premiums, limited coverage |

| Self-Insurance Plans | Moderate | Varies depending on plan | Potentially lower premiums than traditional insurance | Limited coverage, strict requirements |

| Cash Deposits | High | Varies depending on deposit amount | Financial guarantee, no premiums | Significant upfront payment, limited availability |

Impact on Uninsured Drivers: Which States Do Not Require Car Insurance

Driving without insurance in states that do not mandate it presents a significant risk, not only for the uninsured driver but also for other road users. While these states may have financial responsibility laws, the absence of mandatory insurance creates a higher likelihood of uninsured drivers on the road, leading to potential consequences for everyone involved.

Accident Rates and Injury Severity

The lack of mandatory car insurance in certain states can contribute to higher accident rates and more severe injuries. Studies have shown that uninsured drivers are more likely to be involved in accidents, and these accidents often result in more serious injuries.

- A study by the Insurance Institute for Highway Safety (IIHS) found that uninsured drivers are 2.5 times more likely to be involved in a fatal crash than insured drivers.

- The study also found that uninsured drivers are more likely to flee the scene of an accident, leaving victims with limited options for compensation.

This increased risk is attributed to several factors, including:

- Lack of financial responsibility: Uninsured drivers may be less likely to prioritize safe driving practices due to the absence of financial repercussions for accidents.

- Higher risk-taking behavior: Some uninsured drivers may engage in riskier driving habits, such as speeding or driving under the influence, knowing they are not financially responsible for potential consequences.

- Limited access to vehicle maintenance: The financial burden of driving without insurance may limit an uninsured driver’s ability to afford regular vehicle maintenance, increasing the likelihood of mechanical failures and accidents.

Final Summary

While the decision to forgo traditional car insurance might seem appealing at first, the potential risks far outweigh any perceived benefits. Driving without insurance in these states can lead to significant financial burdens, legal complications, and even endanger other drivers and pedestrians. Ultimately, understanding the nuances of financial responsibility laws and the consequences of driving uninsured is crucial for anyone considering this option. By carefully weighing the risks and exploring alternative insurance options, drivers can make informed decisions that protect themselves and others on the road.

FAQ

What are the consequences of getting into an accident without insurance in a state that doesn’t require it?

You could face hefty fines, legal action, and potentially be held financially responsible for all damages caused by the accident, even if it wasn’t your fault.

What are the advantages and disadvantages of using a surety bond instead of traditional car insurance?

A surety bond can be cheaper than traditional insurance, but it doesn’t provide the same level of coverage. It’s also important to note that surety bonds typically require a credit check and may not be available to everyone.

Can I drive in other states without insurance if I live in a state that doesn’t require it?

No, you are still required to have car insurance when driving in other states, even if your home state doesn’t require it. Failure to do so could result in fines and other penalties.

What are the statistics on accident rates and injury severity involving uninsured drivers?

Studies have shown that uninsured drivers are more likely to be involved in accidents and that these accidents often result in more severe injuries. This is partly because uninsured drivers may be less likely to take precautions to avoid accidents and may also be less likely to seek medical attention after an accident.