As which states allow electronic proof of insurance takes center stage, this opening passage beckons readers into a world where technology meets tradition on the open road. Across the United States, drivers are increasingly embracing the convenience and efficiency of digital insurance cards. This shift is fueled by a desire for streamlined interactions with law enforcement and a growing reliance on mobile technology. This exploration delves into the legal landscape of electronic proof of insurance, examining the states that have embraced this modern approach and the regulations governing its acceptance.

From the official names of the laws to the specific types of electronic proof accepted, this analysis provides a comprehensive overview of the current state of electronic proof of insurance. It also examines the benefits and challenges associated with this digital evolution, considering its impact on drivers, law enforcement, and insurance companies alike.

Types of Electronic Proof Accepted

Many states now accept electronic proof of insurance, but the specific types accepted can vary. Understanding these differences is crucial for drivers to ensure they are compliant with the law.

Types of Electronic Proof Accepted

States typically accept a few common forms of electronic proof of insurance. Here are the most prevalent types:

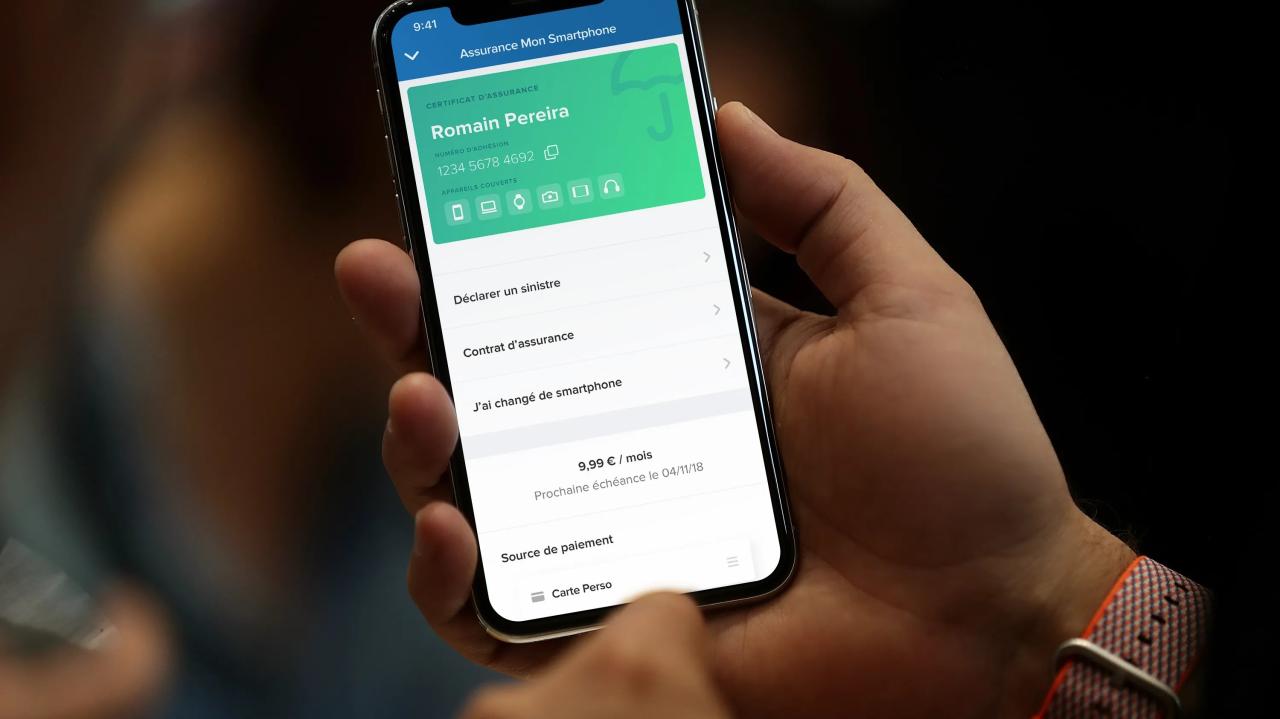

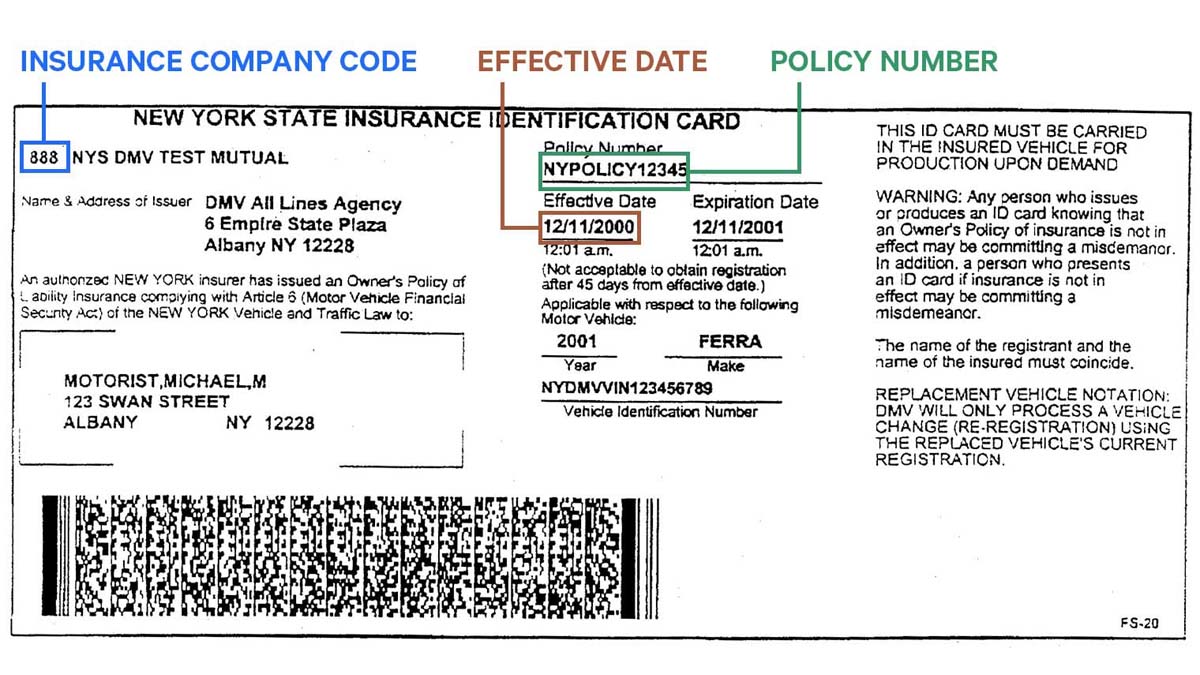

- Digital Insurance Card: This is a digital version of the traditional paper insurance card. It usually contains the same information, such as the policy number, coverage details, and effective dates. Many insurance companies provide this option through their mobile apps or online portals.

- Electronic Policy Document: Some states accept a complete digital copy of the insurance policy document as proof. This document often contains more comprehensive information about the policy, including coverage details, exclusions, and premium information.

- Third-Party App Proof: A growing number of states allow drivers to use third-party apps that provide proof of insurance. These apps typically connect to the driver’s insurance company and can display their policy information upon request.

Specific Requirements for Format and Content, Which states allow electronic proof of insurance

Some states have specific requirements regarding the format or content of electronic proof of insurance. These requirements may include:

- Specific Information: Some states require electronic proof to include specific information, such as the policyholder’s name, the vehicle’s identification number (VIN), and the effective dates of coverage.

- Format Requirements: Certain states may require electronic proof to be in a specific format, such as a PDF or a digital image. This ensures that the information is easily accessible and readable.

Digital Versions of Paper Insurance Cards

Most states allow drivers to present a digital version of their paper insurance card as proof of insurance. This digital version is typically provided by the insurance company through their mobile app or online portal. The digital card usually contains the same information as the paper card, including the policy number, coverage details, and effective dates.

Specific Apps or Platforms

While some states accept proof of insurance from any reputable source, others may require drivers to use specific apps or platforms. These platforms are typically developed by the state government or in partnership with insurance companies. These apps often allow drivers to store their insurance information securely and provide it to law enforcement officers upon request.

Enforcement and Penalties

Law enforcement officers use various methods to verify electronic proof of insurance. They have access to state databases that can be queried to confirm if the driver has valid insurance. Additionally, officers can use mobile devices with specialized applications that allow them to scan QR codes or barcodes on electronic insurance cards.

Drivers who fail to present valid proof of insurance, regardless of format, face a range of penalties. These penalties vary by state and can include:

Penalties for Lack of Proof of Insurance

- Fines: Drivers may be issued a hefty fine, ranging from a few hundred dollars to thousands of dollars depending on the state and the number of offenses.

- Suspension of Driving Privileges: Failure to provide proof of insurance can lead to the suspension of driving privileges. This can be temporary or permanent depending on the severity of the offense and the state’s regulations.

- Vehicle Impoundment: In some cases, the vehicle may be impounded until proof of insurance is provided.

- Court Appearance: Drivers may be required to appear in court to answer charges related to driving without insurance.

- Increased Insurance Premiums: Even if the driver eventually provides proof of insurance, they may face higher insurance premiums in the future.

Penalties for Electronic vs. Paper Proof

Generally, there is no difference in penalties between presenting electronic proof of insurance and traditional paper cards. As long as the proof is valid and meets the state’s requirements, it should be accepted by law enforcement.

Benefits and Challenges of Electronic Proof: Which States Allow Electronic Proof Of Insurance

The adoption of electronic proof of insurance (e-proof) has brought about significant changes in the way drivers, law enforcement, and insurance companies interact. This section will delve into the advantages and potential drawbacks associated with e-proof, comparing its accessibility and security to traditional paper cards.

Advantages of Electronic Proof of Insurance

Electronic proof of insurance offers numerous benefits for drivers, law enforcement, and insurance companies.

- Convenience for Drivers: Drivers can easily access their proof of insurance on their smartphones or tablets, eliminating the need to carry physical cards. This convenience saves time and effort, especially during routine traffic stops or unexpected incidents.

- Enhanced Security: E-proof often utilizes secure digital platforms with encryption and authentication features, making it more difficult for unauthorized individuals to access or tamper with insurance information. This increased security helps to deter fraud and protect sensitive data.

- Real-Time Verification for Law Enforcement: Law enforcement officers can quickly verify the validity of insurance policies using electronic databases, streamlining the process of checking for coverage. This real-time verification reduces delays and helps to ensure that drivers are properly insured.

- Improved Efficiency for Insurance Companies: Insurance companies can leverage e-proof to automate processes, reducing administrative costs and improving efficiency. For example, they can quickly access policy information and verify coverage claims, leading to faster claim processing and improved customer satisfaction.

Challenges of Electronic Proof of Insurance

While e-proof offers numerous advantages, there are also some potential challenges that need to be addressed.

- Accessibility Issues: Not all drivers have access to smartphones or reliable internet connections, which can hinder their ability to utilize e-proof. Ensuring equitable access to e-proof for all drivers is crucial for its successful implementation.

- Privacy Concerns: Some individuals may have privacy concerns regarding the storage and sharing of their insurance information through digital platforms. Addressing these concerns through robust security measures and transparent data handling practices is essential.

- Technological Dependence: The reliance on technology for e-proof can pose challenges in situations where electronic devices are unavailable or malfunctioning. Backup mechanisms and contingency plans are necessary to ensure that drivers can still demonstrate proof of insurance in such scenarios.

- Compatibility and Standardization: The lack of standardized e-proof systems across different states and insurance companies can lead to compatibility issues and complicate verification processes. Establishing uniform standards for e-proof can improve interoperability and facilitate seamless data exchange.

Accessibility and Security Comparison

Electronic proof of insurance offers a number of advantages over traditional paper cards in terms of accessibility and security.

- Accessibility: E-proof is generally more accessible than paper cards, as drivers can easily store and retrieve their insurance information on their smartphones or tablets. This accessibility is particularly beneficial for drivers who may not have a physical wallet or are prone to losing important documents.

- Security: E-proof systems often employ advanced security measures, such as encryption and authentication, to protect insurance information from unauthorized access or tampering. These measures enhance the security of e-proof compared to paper cards, which are more susceptible to theft or damage.

Future Trends and Developments

The use of electronic proof of insurance (e-proof) is rapidly evolving, driven by technological advancements and changing consumer preferences. As we move forward, we can expect to see a significant shift in the way insurance is verified, with technology playing a crucial role in shaping the future of the industry.

Role of Technology and Mobile Apps

Mobile apps are playing an increasingly important role in simplifying insurance verification. Many insurance companies now offer mobile apps that allow policyholders to access their digital insurance cards, making it easy to show proof of insurance during traffic stops or other situations. These apps often integrate with other features, such as roadside assistance, claims filing, and policy management, providing a comprehensive and convenient experience for users.

Last Recap

The journey toward widespread adoption of electronic proof of insurance is paved with innovation and collaboration. As technology continues to evolve, the landscape of insurance verification is poised for further transformation. With states actively embracing digital solutions and drivers increasingly opting for electronic proof, the future of insurance documentation promises to be both seamless and secure. This exploration serves as a guide for navigating the evolving world of electronic proof of insurance, empowering drivers, law enforcement, and insurance companies to embrace the convenience and efficiency of the digital age.

FAQ Overview

What are the benefits of using electronic proof of insurance?

Electronic proof of insurance offers several advantages, including convenience, accessibility, and environmental sustainability. Drivers can easily access their insurance information on their smartphones, eliminating the need to carry paper cards. This digital format also reduces the risk of losing or damaging physical documents. Furthermore, electronic proof contributes to a more environmentally friendly approach to insurance documentation.

Are there any security concerns associated with electronic proof of insurance?

While electronic proof of insurance offers convenience, it’s essential to address potential security concerns. Insurance companies employ robust encryption and authentication measures to protect sensitive data. Drivers should ensure they download and use reputable apps from trusted sources and avoid sharing their insurance information on unsecured websites or networks.

Can I use a screenshot of my digital insurance card as proof?

In most states, a screenshot of a digital insurance card may not be considered valid proof. It’s crucial to consult the specific requirements of your state to ensure you are using an accepted form of electronic proof. Some states may require specific apps or platforms for verifying electronic insurance.