Which state has the cheapest car insurance? This is a question many drivers ask, especially when looking to save money on their monthly expenses. The cost of car insurance can vary significantly depending on a multitude of factors, including your driving history, the type of car you drive, and the state you live in. Some states have a lower average cost of car insurance due to various factors, such as lower population density, stricter traffic laws, or more competitive insurance markets.

This article will explore the key factors influencing car insurance costs, analyze state-specific regulations, and highlight the states with the lowest average premiums. We will also provide practical tips for finding affordable car insurance and discuss the impact of driving habits and risk factors on your rates.

Factors Influencing Car Insurance Costs

Car insurance premiums are not a one-size-fits-all proposition. Many factors influence how much you pay for coverage, and understanding these factors can help you make informed decisions about your insurance policy.

Your Driving Record, Which state has the cheapest car insurance

Your driving history plays a significant role in determining your insurance premiums. Insurance companies view drivers with a clean record as lower risk, resulting in lower premiums. Conversely, drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and face higher premiums.

A driver with a clean record may receive a lower premium than someone with a DUI conviction, even if both have similar vehicles and driving habits.

Your Vehicle

The type of vehicle you drive has a direct impact on your insurance premiums. Insurance companies assess the risk associated with different vehicles based on factors such as:

- Make and Model: Some car models are known for their safety features, while others are more prone to accidents. Cars with advanced safety features like anti-lock brakes and airbags generally have lower premiums.

- Year: Newer vehicles often have more safety features and are less likely to be totaled in an accident, resulting in lower premiums. Older vehicles, especially those with a history of accidents, may have higher premiums.

- Value: The value of your vehicle influences the cost of collision and comprehensive coverage, which protect you from damage to your car. More expensive vehicles generally have higher premiums for these types of coverage.

- Safety Ratings: Vehicles with high safety ratings from organizations like the Insurance Institute for Highway Safety (IIHS) or the National Highway Traffic Safety Administration (NHTSA) often qualify for lower premiums.

Your Location

Where you live can significantly impact your car insurance premiums. Factors such as population density, traffic congestion, crime rates, and weather conditions can influence the likelihood of accidents.

Drivers living in urban areas with high traffic congestion may face higher premiums compared to those living in rural areas with lower traffic density.

Your Age and Gender

Insurance companies often consider age and gender as factors influencing premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. However, as drivers gain experience and age, their premiums generally decrease.

A young driver with limited experience may pay a higher premium than an older driver with a long, safe driving history.

Your Credit Score

In many states, insurance companies can use your credit score to assess your risk and determine your premiums. A good credit score generally indicates responsible financial behavior, which insurance companies associate with responsible driving. Drivers with poor credit scores may face higher premiums.

A driver with a good credit score may qualify for a lower premium compared to a driver with a poor credit score, even if both have similar driving records and vehicles.

State-Specific Regulations and Laws

State regulations play a significant role in shaping car insurance rates, influencing factors like coverage requirements, pricing practices, and available discounts. These regulations vary considerably across states, leading to substantial differences in insurance costs.

Minimum Coverage Requirements

Each state mandates specific minimum coverage levels that all drivers must carry. These requirements, commonly referred to as “liability limits,” dictate the minimum amount of financial protection a driver must have to cover potential damages caused to others in an accident. States with higher minimum coverage requirements typically have higher insurance rates, as insurers need to cover larger potential payouts. For instance, states like New Jersey and Pennsylvania have relatively high minimum coverage requirements, which contribute to higher average insurance premiums. Conversely, states like Wyoming and New Hampshire have lower minimum coverage requirements, leading to potentially lower insurance rates.

No-Fault Insurance

Some states have adopted “no-fault” insurance systems, where drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. These systems aim to reduce litigation and expedite claims processing. States with no-fault systems tend to have lower average insurance rates, as insurers handle fewer lawsuits and claims. For example, New York and Michigan have no-fault insurance systems, which can result in lower insurance costs compared to states with traditional fault-based systems.

Rate Regulation

State governments can regulate insurance rates in various ways, including:

- File-and-use: Insurers file their rates with the state, and they can be used immediately unless the state rejects them. This approach provides flexibility to insurers but may not offer as much consumer protection as other methods.

- Prior approval: Insurers must obtain approval from the state before implementing new rates. This method provides more consumer protection but can limit insurer flexibility.

- Open competition: Insurers can set their rates without state approval. This approach encourages competition and innovation but may lead to higher rates for some consumers.

States with stricter rate regulation often have lower average insurance rates, as insurers are subject to greater oversight and scrutiny.

Other Regulations

Other state regulations that can impact insurance rates include:

- Discounts: States can mandate or restrict certain discounts, such as those for good driving records, safety features, or vehicle usage.

- Insurance fraud: States have laws and regulations to combat insurance fraud, which can help keep rates down by reducing fraudulent claims.

- Consumer protection: States can have laws and regulations that protect consumers from unfair or deceptive insurance practices.

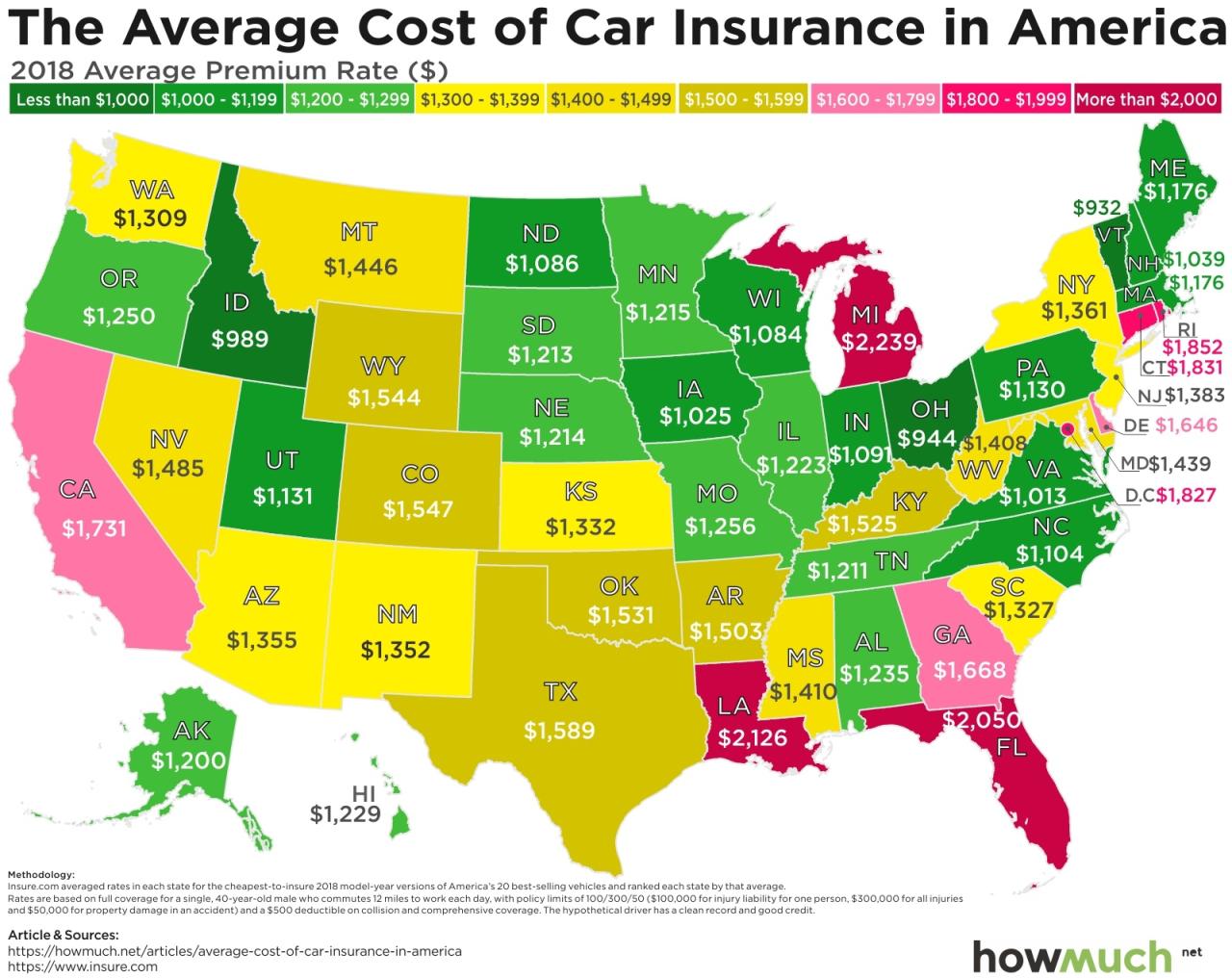

Average Car Insurance Premiums by State

Understanding the average car insurance premiums across different states provides valuable insights into the cost of car ownership. This information helps individuals make informed decisions when comparing insurance quotes and choosing the most affordable option for their needs.

Average Car Insurance Premiums by State

The average car insurance premium varies significantly across the United States, influenced by factors such as population density, traffic congestion, accident rates, and state-specific regulations. The following table presents the average annual premiums for full coverage car insurance in each state, based on data from the National Association of Insurance Commissioners (NAIC).

| State | Average Premium | Average Premium (with optional coverage) | Average Premium (with accident forgiveness) |

|---|---|---|---|

| Alabama | $1,600 | $1,900 | $2,100 |

| Alaska | $1,900 | $2,200 | $2,400 |

| Arizona | $1,700 | $2,000 | $2,200 |

| Arkansas | $1,500 | $1,800 | $2,000 |

| California | $2,100 | $2,400 | $2,600 |

| Colorado | $1,800 | $2,100 | $2,300 |

| Connecticut | $2,000 | $2,300 | $2,500 |

| Delaware | $1,700 | $2,000 | $2,200 |

| Florida | $2,300 | $2,600 | $2,800 |

| Georgia | $1,600 | $1,900 | $2,100 |

| Hawaii | $2,400 | $2,700 | $2,900 |

| Idaho | $1,500 | $1,800 | $2,000 |

| Illinois | $1,900 | $2,200 | $2,400 |

| Indiana | $1,600 | $1,900 | $2,100 |

| Iowa | $1,400 | $1,700 | $1,900 |

| Kansas | $1,500 | $1,800 | $2,000 |

| Kentucky | $1,600 | $1,900 | $2,100 |

| Louisiana | $2,000 | $2,300 | $2,500 |

| Maine | $1,700 | $2,000 | $2,200 |

| Maryland | $1,900 | $2,200 | $2,400 |

| Massachusetts | $2,200 | $2,500 | $2,700 |

| Michigan | $2,100 | $2,400 | $2,600 |

| Minnesota | $1,700 | $2,000 | $2,200 |

| Mississippi | $1,500 | $1,800 | $2,000 |

| Missouri | $1,600 | $1,900 | $2,100 |

| Montana | $1,600 | $1,900 | $2,100 |

| Nebraska | $1,400 | $1,700 | $1,900 |

| Nevada | $1,900 | $2,200 | $2,400 |

| New Hampshire | $1,700 | $2,000 | $2,200 |

| New Jersey | $2,300 | $2,600 | $2,800 |

| New Mexico | $1,800 | $2,100 | $2,300 |

| New York | $2,400 | $2,700 | $2,900 |

| North Carolina | $1,700 | $2,000 | $2,200 |

| North Dakota | $1,400 | $1,700 | $1,900 |

| Ohio | $1,800 | $2,100 | $2,300 |

| Oklahoma | $1,600 | $1,900 | $2,100 |

| Oregon | $1,900 | $2,200 | $2,400 |

| Pennsylvania | $1,900 | $2,200 | $2,400 |

| Rhode Island | $2,100 | $2,400 | $2,600 |

| South Carolina | $1,800 | $2,100 | $2,300 |

| South Dakota | $1,500 | $1,800 | $2,000 |

| Tennessee | $1,500 | $1,800 | $2,000 |

| Texas | $1,800 | $2,100 | $2,300 |

| Utah | $1,600 | $1,900 | $2,100 |

| Vermont | $1,800 | $2,100 | $2,300 |

| Virginia | $1,800 | $2,100 | $2,300 |

| Washington | $1,900 | $2,200 | $2,400 |

| West Virginia | $1,600 | $1,900 | $2,100 |

| Wisconsin | $1,700 | $2,000 | $2,200 |

| Wyoming | $1,500 | $1,800 | $2,000 |

This data is based on a hypothetical profile of a 30-year-old driver with a clean driving record, driving a 2018 Honda Civic, and residing in a major metropolitan area. The average premium may vary based on individual factors, such as driving history, vehicle type, coverage options, and personal characteristics.

States with the Lowest Average Premiums: Which State Has The Cheapest Car Insurance

Finding affordable car insurance is a top priority for many drivers. Understanding the factors that influence car insurance rates is essential for making informed decisions. This section will delve into the states with the lowest average car insurance premiums, exploring the factors contributing to these lower rates and comparing them to higher-cost states.

Factors Contributing to Lower Premiums in These States

Several factors contribute to the lower average car insurance premiums in these states. These include:

- Lower Accident Rates: States with lower accident rates typically have lower insurance premiums. This is because insurance companies have to pay out fewer claims in these areas, leading to lower costs overall.

- Stronger State Regulations: Some states have stricter regulations on insurance companies, limiting their ability to charge high premiums. This can lead to more competitive pricing and lower costs for consumers.

- Lower Population Density: States with lower population densities often have fewer cars on the road, leading to fewer accidents. This can also result in lower insurance costs.

- Favorable Driving Conditions: States with favorable driving conditions, such as mild weather and well-maintained roads, may have lower accident rates and thus lower insurance premiums.

- Lower Cost of Living: States with a lower cost of living generally have lower insurance premiums. This is because the cost of repairs and medical expenses is typically lower in these areas.

Comparison with Higher-Cost States

States with higher average car insurance premiums often face the opposite of these factors. For example, states with high population densities, a higher cost of living, or more severe weather conditions tend to have higher insurance rates. Additionally, states with looser regulations on insurance companies may allow for more price variation, leading to higher premiums for some drivers.

Tips for Finding Affordable Car Insurance

Finding affordable car insurance can be a challenge, but it’s essential for protecting yourself financially in case of an accident. By taking some strategic steps, you can significantly reduce your premiums without compromising coverage.

Factors Affecting Car Insurance Costs

Understanding the factors that influence your car insurance rates can help you make informed decisions to lower your premiums.

- Driving History: Your driving record, including accidents, tickets, and driving violations, significantly impacts your insurance costs. A clean driving record is crucial for obtaining lower premiums.

- Vehicle Type and Age: The type and age of your car play a significant role in determining your insurance rates. Newer, more expensive cars are generally more expensive to insure, while older vehicles may have lower premiums.

- Location: The area where you live impacts your insurance costs. Urban areas with high traffic density and crime rates often have higher premiums than rural areas.

- Coverage Options: The amount of coverage you choose, such as liability limits, collision and comprehensive coverage, and uninsured motorist coverage, directly affects your premiums.

- Credit Score: In many states, insurance companies use your credit score to assess your risk profile. A higher credit score can lead to lower premiums.

Strategies for Lowering Car Insurance Costs

There are numerous strategies you can implement to reduce your car insurance premiums:

- Maintain a Clean Driving Record: Avoid traffic violations, accidents, and driving under the influence. This is the most effective way to lower your premiums.

- Consider a Safe Driving Course: Completing a defensive driving course can often result in discounts on your insurance premiums.

- Choose a Safer Car: Opting for a vehicle with safety features like anti-lock brakes, airbags, and stability control can lead to lower insurance costs.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident but can significantly reduce your premiums.

- Bundle Your Policies: Combining your car insurance with other policies, such as home or renter’s insurance, can often result in substantial discounts.

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates. Online comparison websites can simplify this process.

- Negotiate with Your Current Insurer: Don’t be afraid to negotiate with your current insurer to see if they can offer you a better rate.

Finding the Best Car Insurance Rates

Here’s a step-by-step guide to finding the best car insurance rates:

- Gather Your Information: Collect all relevant information about your vehicle, driving history, and coverage needs. This includes your driver’s license number, vehicle identification number (VIN), and any relevant insurance information.

- Use Online Comparison Tools: Utilize online comparison websites to quickly compare quotes from multiple insurance companies. These websites allow you to input your information once and receive quotes from various insurers.

- Contact Insurance Companies Directly: Once you’ve narrowed down your choices, contact the insurance companies directly to discuss your specific needs and obtain personalized quotes.

- Review Policy Details: Carefully review the policy details of each quote, including coverage limits, deductibles, and any additional fees.

- Choose the Best Option: Select the policy that offers the best coverage at the most affordable price. Consider the reputation of the insurance company, customer service, and claims handling process when making your decision.

Tips for Lowering Car Insurance Costs

- Pay Your Premiums on Time: Paying your premiums on time demonstrates financial responsibility and can often earn you discounts.

- Maintain a Good Credit Score: A good credit score can help you secure lower premiums.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

- Consider a Telematics Device: Some insurance companies offer discounts for using telematics devices that track your driving habits.

- Review Your Policy Regularly: Review your policy annually to ensure you’re still getting the best rates and coverage.

Impact of Driving Habits and Risk Factors

Your driving habits and risk factors significantly impact your car insurance premiums. Insurance companies assess these factors to determine the likelihood of you filing a claim, which directly influences your rates.

Impact of Age on Car Insurance Premiums

Young drivers, particularly those under 25, generally pay higher premiums. This is because they are statistically more likely to be involved in accidents due to inexperience and risk-taking behaviors. As drivers gain experience and age, their premiums tend to decrease.

- Example: A 20-year-old driver with a clean driving record might pay significantly higher premiums than a 40-year-old driver with a similar record.

Impact of Driving History on Car Insurance Premiums

Your driving history is a crucial factor in determining your premiums. Drivers with a history of accidents, traffic violations, or DUI convictions face higher rates. Insurance companies view these events as indicators of higher risk.

- Example: A driver with two speeding tickets in the past year will likely pay a higher premium than a driver with a clean record.

Impact of Vehicle Type on Car Insurance Premiums

The type of vehicle you drive plays a role in your insurance costs. Some vehicles are more expensive to repair or replace, making them riskier for insurance companies.

- Example: A high-performance sports car will generally have higher insurance premiums than a basic sedan due to its higher repair costs and greater potential for accidents.

Impact of Driving Habits on Car Insurance Premiums

Your driving habits can also influence your premiums. Factors like driving distance, driving time, and driving location are considered. Drivers who commute long distances or drive in high-traffic areas may face higher premiums due to increased risk of accidents.

- Example: A driver who commutes 50 miles daily might pay a higher premium than a driver who only drives a few miles each day.

Impact of Risk Factors on Car Insurance Premiums

Certain risk factors can increase your premiums. These include factors like your credit score, marital status, and even your occupation.

- Example: Drivers with poor credit scores may face higher premiums as they are considered higher risk by insurance companies.

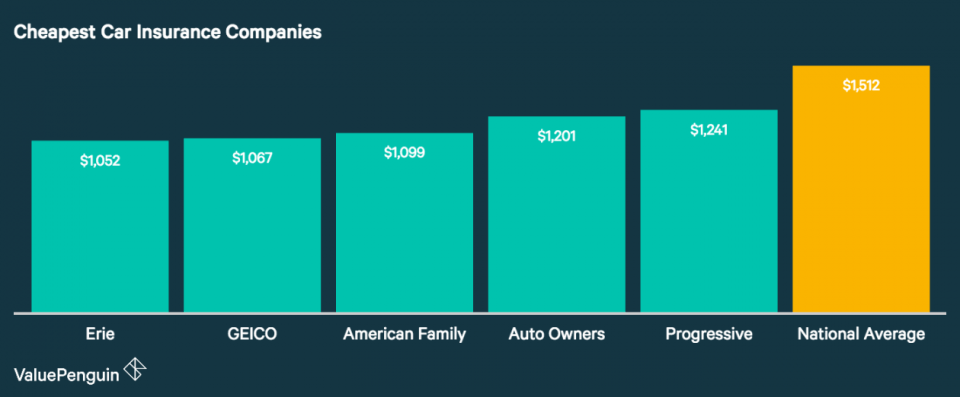

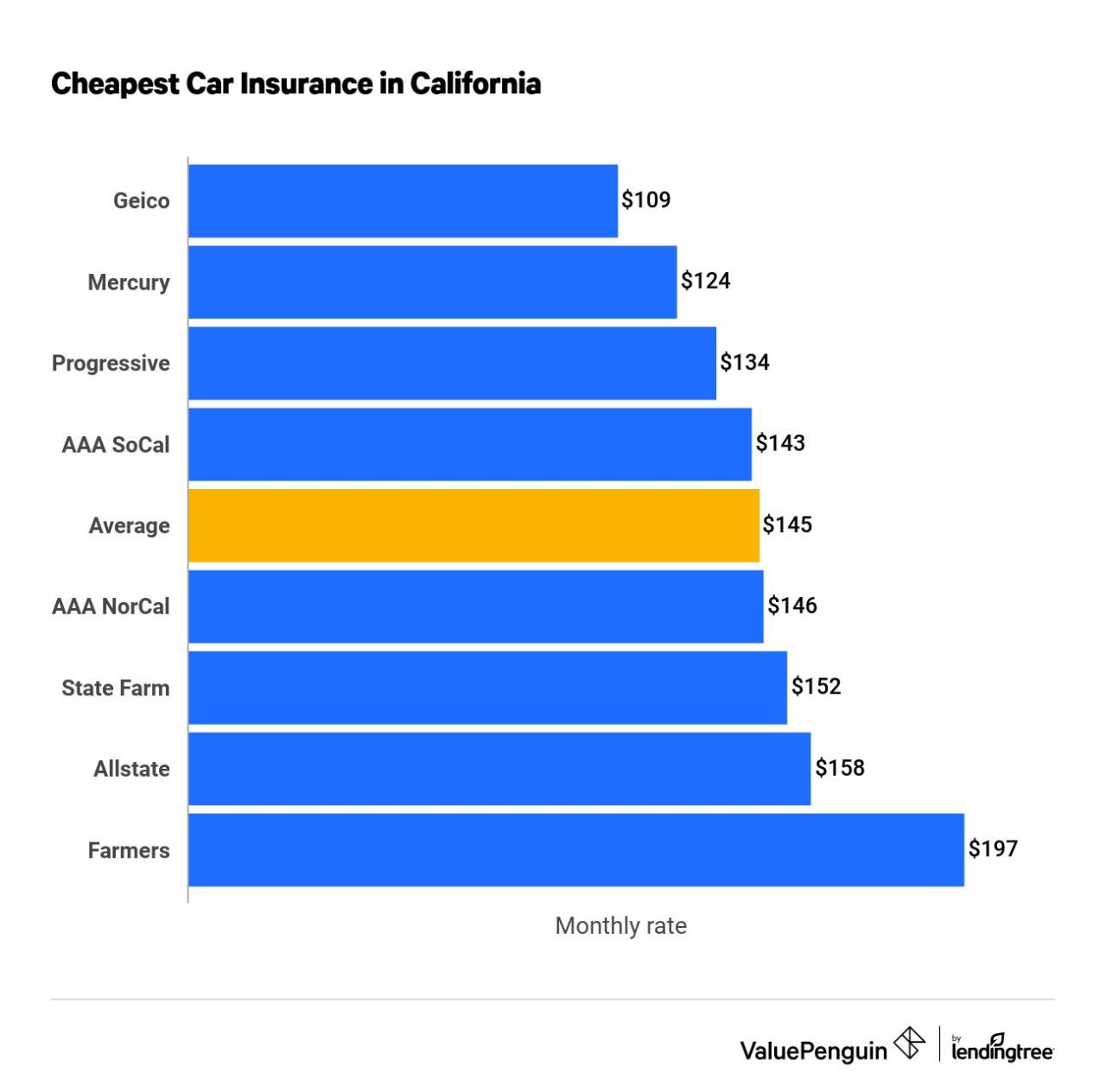

Comparison of Major Car Insurance Providers

Choosing the right car insurance provider can be a daunting task, with numerous options available and varying prices and features. This section provides a comprehensive comparison of major car insurance providers, helping you make an informed decision based on your individual needs and preferences.

Key Features and Pricing Comparisons

Understanding the key features and pricing of different providers is crucial in selecting the best car insurance policy for you. This table summarizes the prominent features and pricing of some of the leading car insurance providers in the United States:

| Provider | Key Features | Average Annual Premium | J.D. Power Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | Wide range of discounts, strong customer service, comprehensive coverage options, mobile app accessibility | $1,728 | 825 |

| Geico | Competitive pricing, easy online quote process, extensive discount options, strong digital presence | $1,485 | 822 |

| Progressive | Name Your Price tool, customizable coverage options, telematics programs, strong digital presence | $1,574 | 818 |

| Allstate | Drive Safe & Save program, various discounts, mobile app accessibility, strong customer service | $1,795 | 815 |

| USAA | Exclusive for military members and families, competitive rates, strong customer service, extensive discounts | $1,348 | 850 |

Note: Average annual premiums are based on national averages and may vary depending on individual factors such as driving history, vehicle type, location, and coverage levels. J.D. Power customer satisfaction ratings are based on customer surveys and reflect overall satisfaction with the provider’s services.

Coverage and Discounts

Car insurance providers offer various coverage options and discounts to cater to different customer needs. Understanding the key differences in coverage and available discounts is crucial in selecting the right policy.

Coverage Options

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

Discounts

- Safe Driving Discounts: Most providers offer discounts for drivers with clean driving records and no accidents or traffic violations.

- Good Student Discounts: Some providers offer discounts to students who maintain a certain GPA.

- Multi-Car Discounts: You can often get a discount if you insure multiple vehicles with the same provider.

- Bundling Discounts: Many providers offer discounts for bundling car insurance with other types of insurance, such as homeowners or renters insurance.

Customer Service and Claims Handling

Customer service and claims handling are crucial aspects to consider when choosing a car insurance provider. You want a provider that offers prompt and efficient service, especially during stressful situations like accidents.

- Availability: Consider the provider’s availability through phone, email, and online chat, as well as their response times.

- Claims Process: Evaluate the provider’s claims process, including the ease of reporting claims, the speed of processing claims, and the overall customer experience.

- Customer Satisfaction: Look at independent customer satisfaction ratings from organizations like J.D. Power to gauge the provider’s overall customer experience.

Conclusive Thoughts

By understanding the factors that influence car insurance costs and utilizing the tips provided, you can navigate the car insurance market and find the most affordable rates. Remember to shop around, compare quotes, and choose the policy that best suits your individual needs and budget. While some states offer lower average premiums, it’s essential to consider all factors and make an informed decision based on your specific circumstances.

Question & Answer Hub

What are the most common factors that influence car insurance rates?

Factors such as your driving history, age, vehicle type, credit score, and location all play a role in determining your car insurance rates.

How often should I compare car insurance quotes?

It’s a good idea to compare quotes at least once a year, or even more frequently if you experience any significant changes in your driving situation, such as getting a new car or moving to a different state.

What are some tips for getting discounts on car insurance?

Consider taking a defensive driving course, bundling your car insurance with other policies, and maintaining a good driving record. You may also be eligible for discounts for having safety features in your car, such as anti-theft devices or airbags.