Which state does not require car insurance? This question often sparks curiosity and debate, as most Americans consider car insurance a necessity. While it might seem counterintuitive, one state in the U.S. does not mandate car insurance for all drivers. This unique situation raises various questions about financial responsibility, driving safety, and the overall impact on individuals and society.

The state of New Hampshire is the only state that does not require drivers to carry car insurance. However, this doesn’t mean that driving without insurance is risk-free. New Hampshire drivers must demonstrate financial responsibility through a variety of alternative methods, such as surety bonds, cash deposits, or self-insurance. These alternatives offer different levels of coverage and financial protection, and drivers must carefully weigh the pros and cons before making a decision.

States with No Mandatory Car Insurance

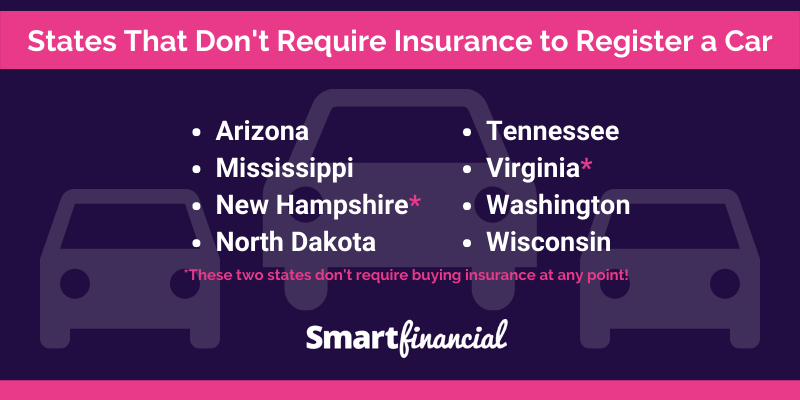

While most states in the U.S. mandate car insurance, there are a few exceptions. These states have chosen to not require drivers to carry car insurance, opting instead for a system based on financial responsibility laws.

States Without Mandatory Car Insurance

These states do not require drivers to have car insurance:

- New Hampshire: New Hampshire is the only state in the U.S. that does not require drivers to carry car insurance. Instead, the state has a financial responsibility law that requires drivers to prove they can pay for damages caused in an accident. This can be done by providing proof of financial responsibility, such as a bond or a certificate of self-insurance.

- Virginia: Virginia does not require drivers to carry car insurance, but it does have a financial responsibility law that requires drivers to prove they can pay for damages caused in an accident. Drivers in Virginia can fulfill this requirement by providing proof of insurance, a surety bond, or a certificate of self-insurance.

Consequences of Driving Without Car Insurance, Which state does not require car insurance

While these states do not require drivers to carry car insurance, it is still highly recommended. Driving without insurance can lead to serious financial consequences in the event of an accident. Here are some potential consequences:

- Financial Liability: In the event of an accident, you could be held personally liable for all damages, including medical bills, property damage, and lost wages. This could result in significant financial hardship, potentially even bankruptcy.

- License Suspension: Even though these states do not require insurance, they do have financial responsibility laws. If you are involved in an accident and cannot prove financial responsibility, your driver’s license could be suspended.

- Legal Action: The injured party could sue you for damages, and you would be responsible for defending yourself in court.

Financial Implications of Driving Without Insurance

Driving without car insurance is a risky decision that can have significant financial consequences. If you are involved in an accident without insurance, you could be responsible for covering all the costs associated with the accident, including medical expenses, property damage, legal fees, and lost wages. These costs can quickly add up and leave you facing a substantial financial burden.

Cost Breakdown of Driving Without Insurance

The costs of driving without insurance can be substantial, potentially exceeding the cost of maintaining a basic car insurance policy. Here’s a breakdown of the potential costs:

- Medical Expenses: If you are injured in an accident, you will be responsible for paying for your medical treatment, including hospital stays, surgeries, rehabilitation, and ongoing medical care. These costs can be substantial, especially in cases of serious injuries.

- Property Damage: You will be responsible for repairing or replacing any damage to your vehicle and any other vehicles or property involved in the accident. This can include costs for repairs, towing, and replacement parts.

- Legal Fees: If you are sued by the other party involved in the accident, you will be responsible for covering your legal defense costs, including attorney fees and court costs. These costs can be significant, especially if the case goes to trial.

- Lost Wages: If you are injured and unable to work, you will be responsible for covering your lost wages. This can be a significant financial burden, especially if your injuries are severe or long-lasting.

Alternatives to Traditional Car Insurance

While traditional car insurance is the most common form of coverage, states without mandatory insurance requirements present drivers with a few alternative options to consider. These alternatives offer varying levels of protection and financial implications, so it’s crucial to weigh the pros and cons carefully before making a decision.

Self-Insurance

Self-insurance involves taking on the financial responsibility for any damages or injuries resulting from an accident. This option can be attractive for drivers who are confident in their driving skills and believe they have a low risk of accidents.

- Advantages:

- Potentially lower costs compared to traditional insurance premiums, as you are not paying for coverage.

- Greater control over your finances, as you manage your own risk.

- Disadvantages:

- Significant financial risk in case of an accident, as you are fully responsible for all costs, including repairs, medical bills, and legal fees.

- Potential for financial hardship if a major accident occurs, especially if you lack sufficient savings.

- Limited protection against claims from other drivers, as you are not insured.

Surety Bonds

A surety bond is a type of insurance policy that guarantees payment to a third party in case of a covered event. In the context of car insurance, a surety bond acts as a financial guarantee that covers damages or injuries caused by the insured driver.

- Advantages:

- Provides financial protection to other drivers in case of an accident.

- May be less expensive than traditional insurance, depending on the bond amount and the driver’s risk profile.

- Disadvantages:

- Requires a significant upfront payment to secure the bond.

- May not cover all potential losses, as the bond amount is typically limited.

- Can be difficult to obtain for drivers with a poor driving record.

Cash Deposits

Some states allow drivers to make a cash deposit with the state in lieu of purchasing traditional insurance. This deposit acts as a guarantee that the driver can cover any damages or injuries caused by an accident.

- Advantages:

- May be a cheaper alternative to insurance, especially for drivers with a good driving record.

- Provides a certain level of financial protection for other drivers.

- Disadvantages:

- Requires a large upfront deposit, which can be a significant financial burden for some drivers.

- The deposit is not returned until the driver cancels their registration, which can be a long time.

- May not cover all potential losses, as the deposit amount is typically limited.

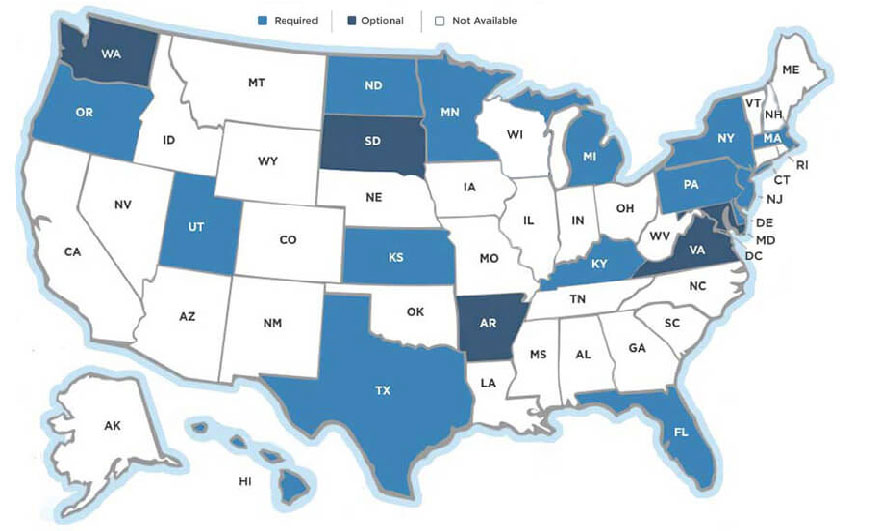

The Impact of No-Fault Insurance Systems

No-fault insurance systems represent a distinct approach to handling car accident claims compared to traditional fault-based systems. Understanding how these systems operate and their potential influence on insurance mandates is crucial for grasping the complexities of car insurance regulation.

The Mechanics of No-Fault Systems

In a no-fault system, drivers are primarily responsible for covering their own injuries and damages following an accident, regardless of who caused it. This contrasts with fault-based systems, where the at-fault driver’s insurance company is typically responsible for covering the other party’s losses.

- Personal Injury Protection (PIP): No-fault systems typically mandate Personal Injury Protection (PIP) coverage, which covers medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault. This coverage is usually capped at a specific amount.

- Limited Tort: Many no-fault states also implement a “limited tort” option, which restricts the right to sue for pain and suffering unless the injuries meet certain thresholds, such as significant medical expenses or permanent disability. This provision aims to reduce litigation and associated costs.

- No-Fault Thresholds: No-fault systems often establish “thresholds” that determine when a driver can sue the at-fault party. These thresholds can vary based on the severity of the injuries or the amount of medical expenses incurred.

No-Fault Systems and Insurance Mandates

No-fault insurance systems can impact the decision to require car insurance in several ways:

- Reduced Litigation: No-fault systems can potentially reduce the number of lawsuits related to car accidents, as drivers are less likely to sue for damages when they have their own PIP coverage. This can lead to lower insurance premiums overall.

- Increased Coverage: The mandatory PIP coverage in no-fault systems ensures that all drivers have some level of financial protection in case of an accident, regardless of fault. This can be seen as a positive factor in promoting road safety and providing financial security.

- Potential for Underinsurance: While no-fault systems provide some level of coverage, there is a risk that drivers may opt for lower coverage limits to reduce premiums. This could lead to underinsurance, where the PIP benefits are insufficient to cover the full extent of injuries or damages.

- Administrative Complexity: No-fault systems can introduce administrative complexity, as insurers must manage claims and payments under different rules and regulations compared to traditional fault-based systems.

Driving Safety and the Absence of Mandatory Insurance

The relationship between mandatory car insurance and driving safety is a complex one, with arguments presented on both sides. Some argue that mandatory insurance encourages safer driving, while others believe it has minimal impact. This section explores the potential correlation between the lack of mandatory car insurance and driving safety statistics.

Accident Rates and Insurance Claim Data

To understand the potential impact of mandatory insurance on driving safety, it is crucial to analyze accident rates and insurance claim data in states with and without mandatory insurance. Comparing these statistics can reveal any significant trends or patterns.

For example, a study by the Insurance Institute for Highway Safety (IIHS) found that states with mandatory insurance generally have lower accident rates than states without it. This finding suggests a possible correlation between mandatory insurance and improved driving safety. However, it is important to note that this correlation does not necessarily imply causation.

The study also found that states with mandatory insurance typically have higher insurance claim rates. This suggests that drivers in these states are more likely to file claims, which could be due to a greater awareness of their insurance coverage or a higher propensity to seek compensation for accidents.

To further analyze this relationship, it is important to consider other factors that might influence accident rates and insurance claim data, such as:

- Population density

- Road infrastructure

- Driving habits

- Economic conditions

By considering these factors in conjunction with insurance regulations, researchers can gain a more comprehensive understanding of the relationship between mandatory insurance and driving safety.

The Role of Financial Responsibility Laws: Which State Does Not Require Car Insurance

In states that don’t mandate car insurance, financial responsibility laws play a crucial role in ensuring that drivers are held accountable for any damages they cause while on the road. These laws aim to protect both drivers and pedestrians from the financial burden of accidents involving uninsured motorists.

Financial responsibility laws typically require drivers to demonstrate their ability to cover potential financial liabilities arising from accidents. This is usually achieved by providing proof of financial responsibility, such as insurance coverage, a surety bond, or a deposit of funds.

How Financial Responsibility Laws Protect Drivers and Pedestrians

Financial responsibility laws work to safeguard drivers and pedestrians in several ways:

* Compensating Victims: In the event of an accident, financial responsibility laws ensure that victims have access to compensation for their injuries and property damage, even if the at-fault driver is uninsured. This is achieved by requiring the uninsured driver to prove their ability to cover the costs, which can be through a surety bond, deposit of funds, or other means.

* Deterring Uninsured Drivers: These laws act as a deterrent, encouraging drivers to obtain insurance or secure other forms of financial responsibility. The potential consequences of driving without proof of financial responsibility, such as license suspension or vehicle registration revocation, can motivate drivers to comply with the law.

* Promoting Fair and Equitable Treatment: Financial responsibility laws ensure a level playing field for all drivers, regardless of their insurance status. They prevent uninsured drivers from escaping liability for their actions and ensure that victims are not left to bear the financial burden alone.

The Ethical Considerations of Driving Without Insurance

Driving without car insurance is not only a legal violation in most states, but it also raises serious ethical concerns. Choosing to forgo insurance not only puts the driver at risk but also potentially jeopardizes the well-being of others on the road.

The Impact on Others

The ethical implications of driving without insurance extend beyond the individual driver. The absence of insurance creates a significant burden on society as a whole. When an uninsured driver causes an accident, the victims often bear the financial burden of their injuries and property damage. This can lead to significant hardship, especially for those who are already struggling financially. Moreover, uninsured drivers contribute to a higher cost of insurance for everyone else. Insurance companies are forced to raise premiums to cover the costs associated with uninsured drivers, making car insurance more expensive for responsible drivers.

The Ethical Responsibility to Others

Driving is a privilege, not a right, and comes with inherent responsibilities. One of those responsibilities is to ensure that you are financially prepared to cover the potential costs of an accident. Choosing to drive without insurance demonstrates a disregard for the safety and well-being of others on the road. It creates a risk that could result in significant financial hardship for the victims of an accident. Uninsured drivers are essentially placing the burden of their potential negligence on others.

Last Word

While New Hampshire stands alone in its lack of mandatory car insurance, it’s important to remember that driving without insurance carries significant risks. Accidents can happen unexpectedly, and the financial consequences of being uninsured can be devastating. Even in states that don’t require insurance, drivers are strongly encouraged to consider the benefits of coverage, as it provides peace of mind and financial protection in the event of an accident.

Popular Questions

What are the consequences of driving without car insurance in New Hampshire?

Drivers without proof of financial responsibility can face fines, license suspension, and even vehicle impoundment. Additionally, they could be held personally liable for all damages and injuries resulting from an accident.

Is it cheaper to drive without insurance in New Hampshire?

While it may seem like a way to save money, the potential costs of an accident without insurance far outweigh any perceived savings. Even the most basic car insurance policy offers far greater financial protection than self-insurance or other alternatives.

What are the ethical implications of driving without car insurance?

Driving without insurance not only puts yourself at risk but also exposes others to potential financial hardship in the event of an accident. It’s an ethical dilemma that requires careful consideration of the potential consequences for both yourself and others.