What states require boat insurance? It’s a question many boat owners ponder, especially those venturing into new waters. While boating offers a chance to relax and enjoy the open water, navigating the complexities of state regulations can be challenging. Understanding which states mandate boat insurance is crucial to ensure you’re complying with the law and protecting yourself financially in case of an accident.

Navigating the waters of boat insurance regulations can feel like sailing through a maze, but knowing the basics is essential. This guide explores the states requiring boat insurance, delves into the types of coverage available, and sheds light on the factors influencing insurance costs. We’ll also discuss exemptions and the potential consequences of operating a boat without insurance.

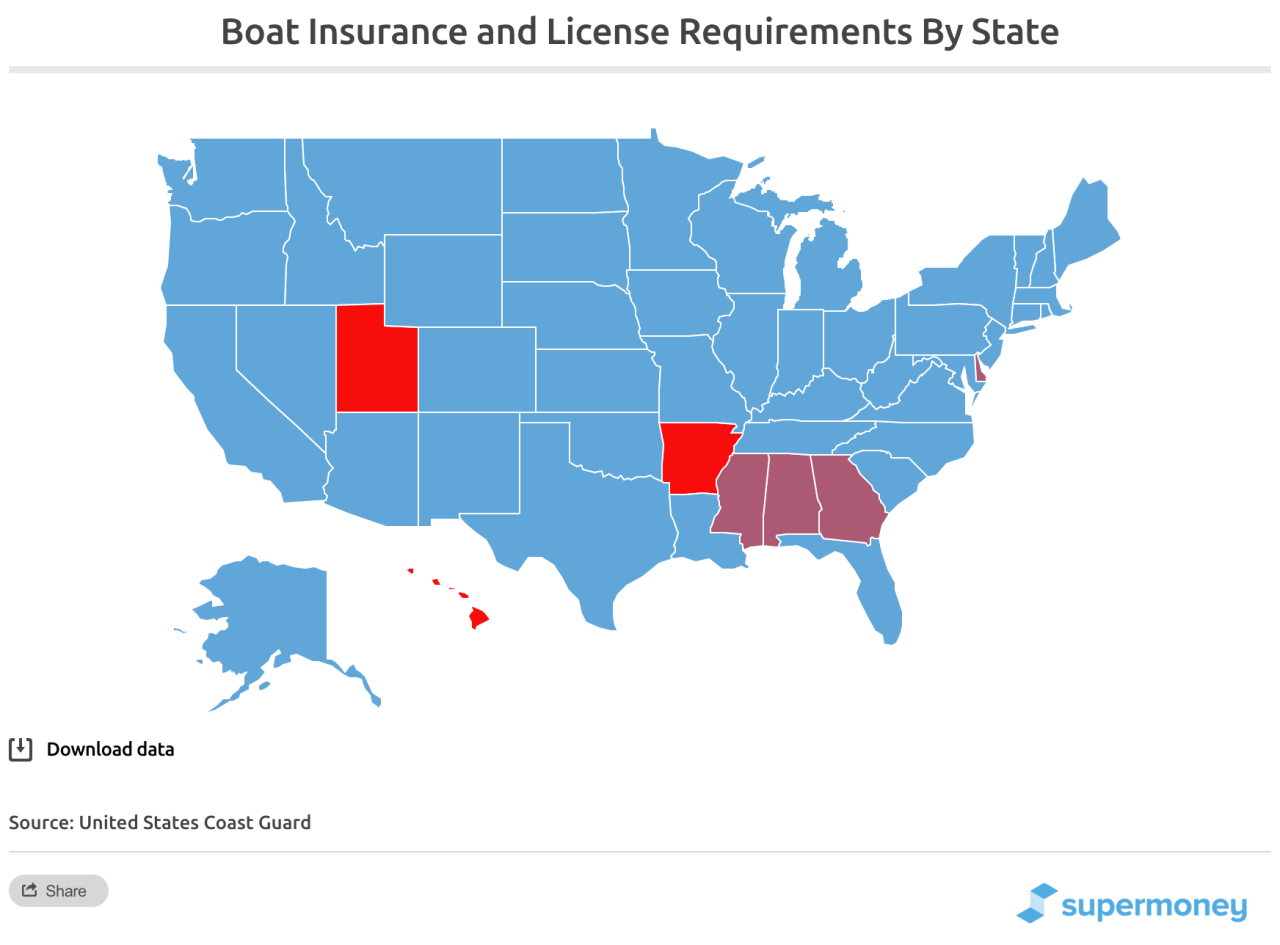

States Requiring Boat Insurance: What States Require Boat Insurance

Boat insurance is a type of coverage that protects boat owners from financial losses that may occur due to accidents, theft, or other incidents involving their boats. While not all states require boat insurance, some states have laws that mandate boat owners to carry a certain level of insurance coverage.

States with Boat Insurance Requirements

Several states require boat owners to carry boat insurance. These states have specific laws and regulations outlining the minimum insurance coverage requirements for boat owners.

- Alabama: Alabama requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Arkansas: Arkansas requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Connecticut: Connecticut requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Florida: Florida requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Georgia: Georgia requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Hawaii: Hawaii requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Illinois: Illinois requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Louisiana: Louisiana requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Maryland: Maryland requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Massachusetts: Massachusetts requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Michigan: Michigan requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Minnesota: Minnesota requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Mississippi: Mississippi requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Missouri: Missouri requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Montana: Montana requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Nebraska: Nebraska requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Nevada: Nevada requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- New Hampshire: New Hampshire requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- New Jersey: New Jersey requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- New Mexico: New Mexico requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- New York: New York requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- North Carolina: North Carolina requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- North Dakota: North Dakota requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Ohio: Ohio requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Oklahoma: Oklahoma requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Oregon: Oregon requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Pennsylvania: Pennsylvania requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Rhode Island: Rhode Island requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- South Carolina: South Carolina requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- South Dakota: South Dakota requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Tennessee: Tennessee requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Texas: Texas requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Utah: Utah requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Vermont: Vermont requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Virginia: Virginia requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Washington: Washington requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- West Virginia: West Virginia requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Wisconsin: Wisconsin requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

- Wyoming: Wyoming requires boat owners to have liability insurance with a minimum coverage of $25,000 for property damage and $50,000 for bodily injury per accident. The state also requires a $100,000 combined single limit for property damage and bodily injury per accident for boats that are 26 feet or longer.

Reasons for Boat Insurance Requirements

States typically require boat insurance for several reasons:

- Protecting the Public: Boat insurance protects the public from financial losses resulting from accidents caused by boat owners. It ensures that victims of accidents have access to compensation for their injuries and damages.

- Financial Responsibility: Boat insurance demonstrates the financial responsibility of boat owners. By requiring insurance, states encourage boat owners to be prepared to cover the costs associated with accidents or other incidents involving their boats.

- Safety on Waterways: By requiring boat insurance, states aim to promote safety on waterways. Knowing that they are financially protected, boat owners are more likely to operate their boats responsibly and adhere to safety regulations.

- Reducing Uninsured Boat Accidents: Boat insurance requirements help reduce the number of uninsured boat accidents. This is important because uninsured boat accidents can result in significant financial burdens for victims and taxpayers.

Types of Boat Insurance Coverage

Boat insurance policies provide financial protection against various risks associated with owning and operating a boat. Understanding the different types of coverage available is crucial for choosing the right policy to meet your specific needs.

Types of Boat Insurance Coverage

Boat insurance policies typically include a variety of coverage options, each designed to address specific risks. Some common types of coverage include:

- Hull Insurance: This coverage protects the physical structure of your boat against damage or loss caused by various perils, such as collisions, fire, theft, and storms. It covers repairs or replacement costs, subject to the policy’s terms and conditions.

- Liability Coverage: This coverage provides financial protection if you are found legally responsible for injuries or property damage to others while operating your boat. It covers legal defense costs and any settlements or judgments awarded against you.

- Medical Payments Coverage: This coverage pays for medical expenses incurred by you or your passengers in the event of an accident, regardless of who is at fault. It can help cover medical bills, ambulance fees, and other related expenses.

- Uninsured Boater Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured boater. It helps compensate for your losses, including medical expenses and property damage.

- Towing and Assistance Coverage: This coverage provides assistance in the event of a breakdown or other emergency situation while on the water. It covers towing costs, on-water repairs, and other necessary services.

- Personal Property Coverage: This coverage protects your personal belongings on board your boat, such as electronics, fishing gear, and clothing, against damage or loss. It can help replace or repair these items if they are damaged or stolen.

Comparing Boat Insurance Coverage

| Coverage Type | Key Features | Benefits |

|---|---|---|

| Hull Insurance | Protects the physical structure of the boat | Covers repairs or replacement costs for damage or loss |

| Liability Coverage | Protects against financial responsibility for injuries or property damage to others | Covers legal defense costs, settlements, and judgments |

| Medical Payments Coverage | Pays for medical expenses for you and your passengers | Covers medical bills, ambulance fees, and other related expenses |

| Uninsured Boater Coverage | Protects you if involved in an accident with an uninsured or underinsured boater | Compensates for losses, including medical expenses and property damage |

| Towing and Assistance Coverage | Provides assistance in the event of a breakdown or emergency | Covers towing costs, on-water repairs, and other services |

| Personal Property Coverage | Protects personal belongings on board the boat | Covers replacement or repair costs for damaged or stolen items |

Factors Affecting Boat Insurance Costs

Boat insurance premiums are influenced by various factors, each playing a significant role in determining the final cost. Understanding these factors can help boat owners make informed decisions about their insurance coverage and potentially save money.

Factors Influencing Boat Insurance Premiums, What states require boat insurance

The cost of boat insurance is determined by several factors, including the type of boat, its value, the owner’s experience, and the location where the boat is kept.

| Factor | Impact on Premiums |

|---|---|

| Type of Boat | The type of boat, including its size, engine type, and intended use, significantly impacts insurance costs. High-performance boats, for instance, generally have higher premiums due to their increased risk of accidents. |

| Boat Value | The value of the boat is a key factor in determining insurance premiums. Higher-value boats require more comprehensive coverage, resulting in higher premiums. |

| Owner’s Experience | Boat owners with a history of safe boating and a clean driving record often qualify for lower premiums. Insurance companies consider this factor as a measure of risk. |

| Location | The location where the boat is kept can influence insurance premiums. Areas with high boating traffic or a history of boating accidents may have higher premiums due to increased risk. |

| Usage | The frequency and type of boat usage also affect premiums. Boats used for recreational purposes typically have lower premiums than those used for commercial purposes. |

| Safety Features | Boats equipped with safety features such as automatic bilge pumps, fire extinguishers, and life jackets may qualify for lower premiums. |

| Claims History | Previous insurance claims can significantly impact premiums. A history of claims may result in higher premiums due to the perceived higher risk associated with the boat owner. |

Impact of Factors on Premiums

Each factor listed above influences the cost of boat insurance in different ways. For example, a high-performance boat will typically have a higher premium than a smaller, less powerful boat. Similarly, a boat kept in a high-risk area will likely have a higher premium than a boat kept in a low-risk area.

Exemptions from Boat Insurance Requirements

While most states mandate boat insurance, there are exceptions and exemptions to these rules. These exemptions typically apply to specific types of boats, situations, or owners.

It’s important to understand these exemptions to ensure compliance with your state’s regulations and avoid potential legal issues.

Exemptions Based on Boat Type

Some states exempt certain types of boats from insurance requirements. These exemptions often apply to smaller, non-motorized boats or those used for specific purposes.

Here are some examples:

* Non-motorized boats: States like Florida and Texas exempt non-motorized boats, such as canoes, kayaks, and rowboats, from insurance requirements. These exemptions may apply if the boat is used for recreational purposes and doesn’t exceed a specific length or weight limit.

* Boats used for specific purposes: Certain states exempt boats used for specific purposes, such as fishing or racing, from insurance requirements. These exemptions may have conditions, such as the boat being used solely for the designated purpose and not for commercial activities.

* Boats used in specific locations: Some states exempt boats used in specific locations, such as lakes or rivers, from insurance requirements. These exemptions may apply if the boat is used solely within the designated area and not for commercial activities.

Exemptions Based on Ownership

Some states exempt certain boat owners from insurance requirements. These exemptions may apply to government-owned boats, boats used for specific purposes, or boats owned by certain organizations.

Here are some examples:

* Government-owned boats: Boats owned by federal, state, or local governments are often exempt from insurance requirements. These exemptions may apply to boats used for official purposes and not for recreational activities.

* Boats used for specific purposes: Boats used for specific purposes, such as law enforcement or rescue operations, may be exempt from insurance requirements. These exemptions may apply if the boat is used solely for the designated purpose and not for commercial activities.

* Boats owned by certain organizations: Boats owned by certain organizations, such as non-profits or educational institutions, may be exempt from insurance requirements. These exemptions may apply if the boat is used for the organization’s designated purposes and not for commercial activities.

Exemptions Based on Other Factors

Some states offer exemptions from insurance requirements based on factors other than boat type or ownership. These exemptions may apply to boats used for specific activities or in specific locations.

Here are some examples:

* Boats used for specific activities: Boats used for specific activities, such as racing or competitions, may be exempt from insurance requirements. These exemptions may apply if the boat is used solely for the designated purpose and not for commercial activities.

* Boats used in specific locations: Boats used in specific locations, such as private lakes or ponds, may be exempt from insurance requirements. These exemptions may apply if the boat is used solely within the designated area and not for commercial activities.

It’s crucial to note that these exemptions can vary widely depending on the state and the specific circumstances. It’s essential to consult with your state’s boating regulations and a qualified insurance professional to determine if your boat is exempt from insurance requirements.

Consequences of Not Having Boat Insurance

Operating a boat without insurance can have serious consequences, both legal and financial. Not only can you face hefty fines and penalties, but you could also be held personally liable for any damages or injuries caused by your boat.

Legal Ramifications and Financial Liabilities

Navigating the waters without insurance exposes you to significant risks, making it crucial to understand the legal ramifications and financial liabilities you may face.

Potential Legal Ramifications

- License Suspension or Revocation: Many states have laws requiring boat owners to carry insurance, and failure to comply can result in license suspension or revocation. This can significantly impact your ability to operate a boat in the future.

- Criminal Charges: In some jurisdictions, operating a boat without insurance can be considered a criminal offense, leading to fines, jail time, or both.

- Civil Lawsuits: If you are involved in an accident and do not have insurance, you could be sued by the injured party. This can result in substantial financial losses, including medical expenses, property damage, and lost wages.

Potential Financial Liabilities

- Property Damage: If your boat causes damage to another vessel, dock, or other property, you will be responsible for the repair or replacement costs.

- Personal Injury: If someone is injured as a result of an accident involving your boat, you could be held liable for their medical expenses, lost wages, and pain and suffering.

- Environmental Damage: If your boat causes environmental damage, such as an oil spill, you could face significant fines and cleanup costs.

- Legal Fees: Even if you are not found liable in a lawsuit, you will still have to pay legal fees to defend yourself.

Penalties and Fines

Failing to comply with boat insurance requirements can result in various penalties and fines, depending on the state and the severity of the offense.

Examples of Penalties and Fines

- State of Florida: Operating a boat without insurance can result in a fine of up to $500.

- State of California: A first-time offense for operating a boat without insurance can result in a fine of $100, while subsequent offenses can lead to fines of up to $500.

- State of New York: The penalty for operating a boat without insurance can range from $100 to $500, depending on the type of boat and the circumstances of the violation.

It is crucial to note that these are just examples, and penalties can vary significantly depending on the specific state and circumstances.

Tips for Obtaining Boat Insurance

Securing the right boat insurance policy can provide peace of mind and financial protection in case of accidents, theft, or damage. Here are some tips to help you find the best coverage for your needs.

Comparing Quotes and Coverage Options

To ensure you’re getting the most competitive rates and comprehensive coverage, it’s essential to compare quotes from multiple insurance providers. This involves gathering information about various insurers and their policies, including:

- Coverage options: Familiarize yourself with different types of boat insurance coverage, such as liability, hull, and personal property coverage. Consider your specific needs and the risks associated with your boat to determine the most suitable coverage options.

- Deductibles: Higher deductibles generally result in lower premiums. Carefully assess your risk tolerance and financial capacity to determine the deductible amount that best suits your situation.

- Exclusions: Understand any limitations or exclusions in the policy, such as coverage for specific types of accidents or activities.

- Discounts: Inquire about potential discounts, such as safe boating courses, membership in boating organizations, and multiple policy discounts.

Negotiating Premiums and Obtaining Discounts

Once you’ve compared quotes and identified a policy that meets your needs, consider negotiating the premium.

- Shop around: Contact several insurance providers and compare their quotes. Be prepared to provide information about your boat, usage, and experience.

- Bundle policies: If you have other insurance policies, such as auto or home insurance, inquire about bundling your boat insurance with these policies for potential discounts.

- Improve your boating safety: Complete a safe boating course or demonstrate a good safety record to potentially qualify for discounts.

- Negotiate: Don’t be afraid to negotiate with insurers. Explain your specific circumstances and see if they’re willing to offer a lower premium.

Final Summary

Being aware of the specific requirements for boat insurance in your state is a vital step in responsible boating. By understanding the types of coverage, factors affecting costs, and potential consequences, you can make informed decisions to ensure a safe and enjoyable boating experience. Remember, checking with your insurance provider and researching local regulations will help you navigate the waters of boat insurance with confidence.

FAQ Resource

How much does boat insurance typically cost?

Boat insurance costs vary based on factors like boat size, type, age, value, and the location where it’s used. Getting quotes from multiple insurance providers is recommended to find the best rates.

What are the common exclusions in boat insurance policies?

Common exclusions include damage caused by wear and tear, acts of war, and intentional acts by the insured. It’s important to review the policy details carefully to understand what’s covered and what’s not.

Can I get discounts on boat insurance?

Yes, discounts are often available for factors like having a good driving record, completing a boating safety course, or having multiple policies with the same insurer.

What happens if I’m involved in a boating accident without insurance?

You could face significant financial liability, legal repercussions, and even fines for operating a boat without insurance in a state where it’s required.