What states have Tesla Insurance? This question is on the minds of many Tesla owners, especially those seeking unique and potentially more affordable insurance options. Tesla Insurance, launched in 2019, offers a blend of traditional coverage and innovative features tailored to Tesla vehicles, promising a more personalized and potentially cost-effective experience. However, the availability of this service is currently limited to specific states, leaving many Tesla owners curious about its expansion and future accessibility.

This article delves into the current landscape of Tesla Insurance availability, exploring the criteria driving its expansion, the features and benefits it offers, and how its pricing compares to traditional insurance providers. We’ll also analyze customer feedback and discuss the potential for Tesla Insurance to become a more widely available option in the future.

Tesla Insurance Availability

Tesla Insurance is a relatively new offering from the electric car manufacturer, designed to provide comprehensive coverage for Tesla owners. It’s currently available in a limited number of states, but the company is actively expanding its reach.

Current Availability, What states have tesla insurance

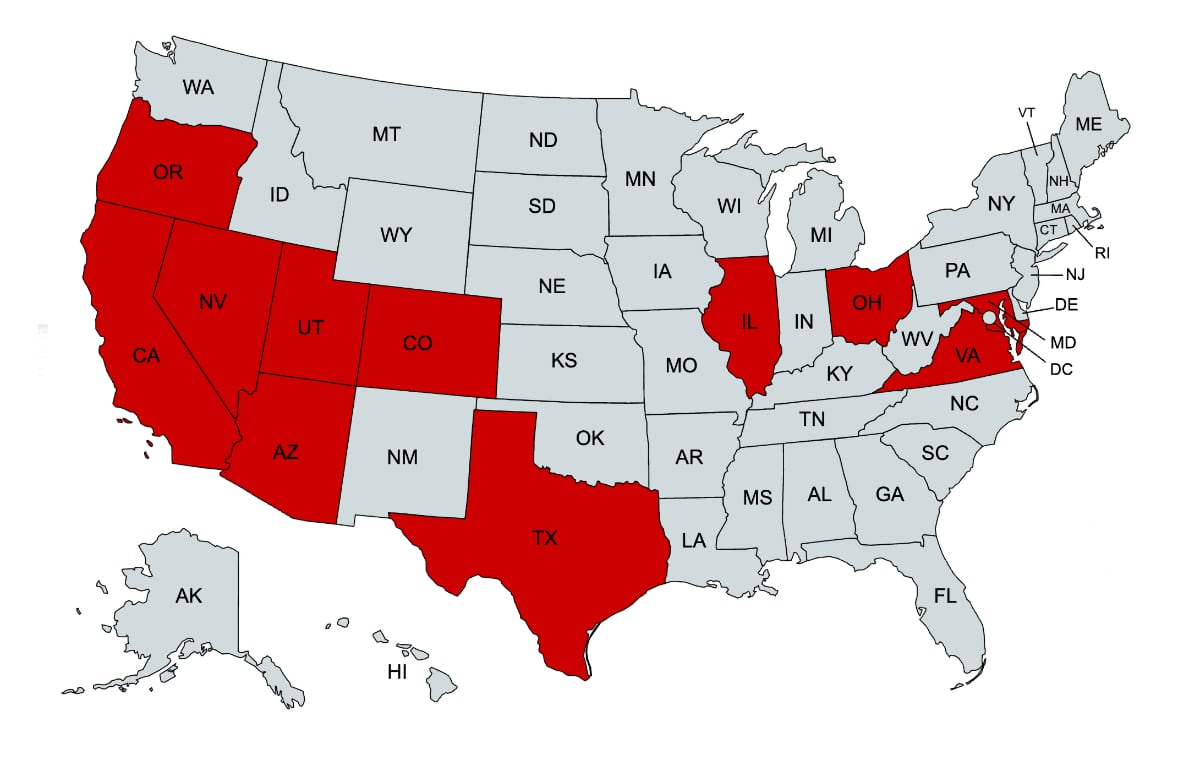

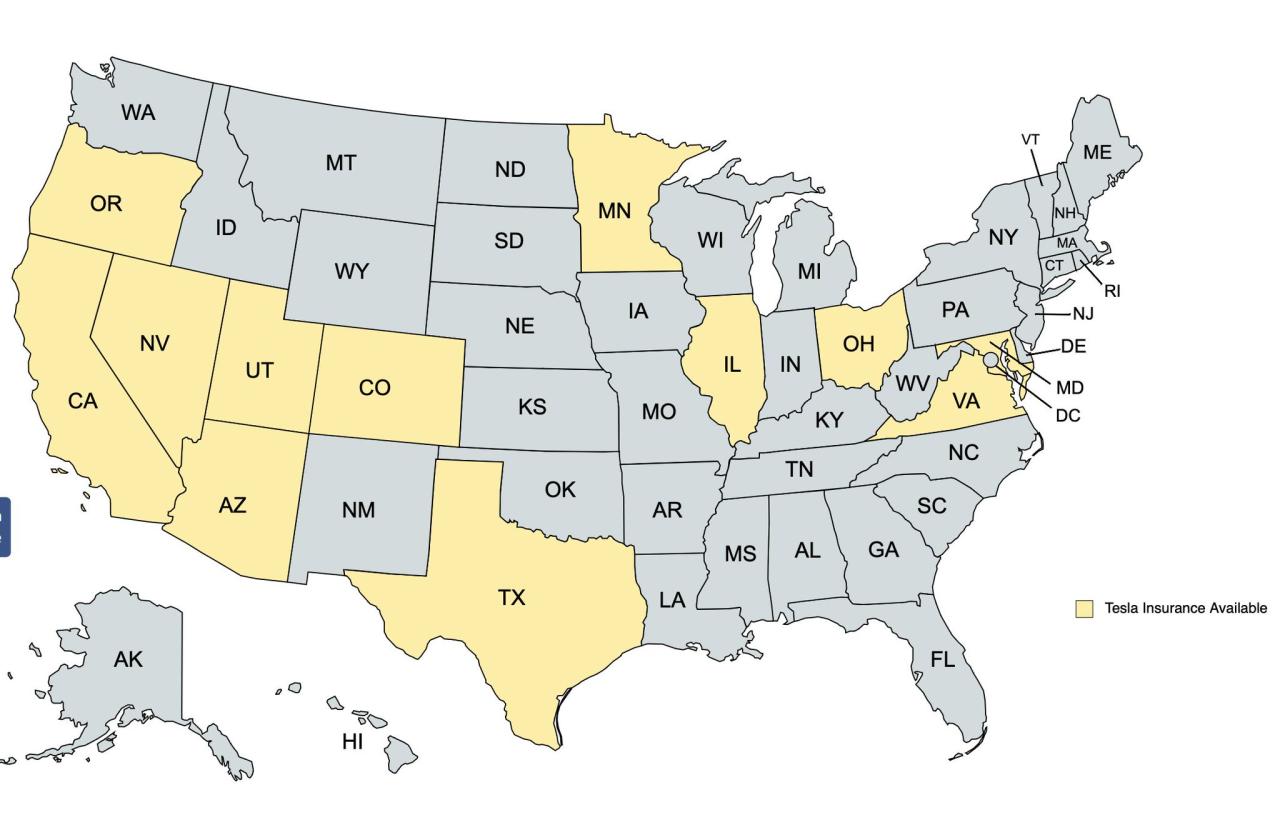

Tesla Insurance is currently available in the following states:

- Arizona

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Wisconsin

Factors Determining Availability

Tesla considers several factors when deciding whether to offer insurance in a particular state, including:

- Regulatory Environment: Tesla needs to ensure that the state’s insurance regulations are conducive to offering its insurance product. This includes factors like licensing requirements, pricing regulations, and data privacy laws.

- Market Demand: Tesla evaluates the number of Tesla owners in a state and the potential demand for its insurance offering. States with a large number of Tesla owners are more likely to be prioritized.

- Competition: Tesla analyzes the existing insurance market in a state, considering the competition from other insurers and the potential for success in the market.

- Operational Feasibility: Tesla assesses its ability to efficiently operate in a state, considering factors like infrastructure, staffing, and data availability.

Timeline for Expansion

Tesla has not publicly announced a specific timeline for expanding Tesla Insurance to other states. However, based on its current expansion strategy, it’s likely that the company will continue to enter new states in a phased manner, focusing on states with high Tesla ownership, favorable regulatory environments, and strong market potential.

Tesla Insurance Features

Tesla Insurance is a relatively new entrant in the insurance market, offering a unique blend of traditional coverage and innovative features tailored specifically for Tesla vehicle owners. This insurance program leverages Tesla’s technological prowess and data insights to provide personalized coverage and potential cost savings.

Coverage Options

Tesla Insurance offers a comprehensive suite of coverage options designed to meet the needs of Tesla vehicle owners. These options include:

- Liability Coverage: This coverage protects you financially if you are found responsible for an accident that causes damage to another person’s property or injuries.

- Collision Coverage: This coverage helps pay for repairs or replacement of your Tesla if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your Tesla against damage from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

Discounts

Tesla Insurance offers various discounts to eligible policyholders, potentially reducing their premium costs. These discounts may include:

- Safe Driving Discount: This discount rewards drivers with a clean driving record and low-risk driving behavior.

- Tesla Owner Discount: This discount is typically available to Tesla owners who insure their vehicles with Tesla Insurance.

- Multi-Car Discount: This discount is offered to policyholders who insure multiple vehicles with Tesla Insurance.

- Bundling Discount: This discount is available to policyholders who bundle their Tesla Insurance with other insurance products, such as homeowners or renters insurance.

Benefits

Tesla Insurance offers several benefits to its policyholders, including:

- Personalized Pricing: Tesla Insurance uses data from your Tesla vehicle, such as driving history and safety features, to provide personalized pricing based on your individual risk profile.

- Seamless Integration with Tesla Vehicles: Tesla Insurance seamlessly integrates with Tesla vehicles, allowing for features like usage-based pricing and remote claims reporting.

- Convenient Online Access: Tesla Insurance offers a user-friendly online platform for managing your policy, making payments, and filing claims.

- Dedicated Customer Support: Tesla Insurance provides dedicated customer support to assist you with any questions or concerns.

Comparison with Traditional Insurance Providers

Tesla Insurance stands out from traditional insurance providers by leveraging Tesla’s technological capabilities and data insights. While traditional insurance providers primarily rely on factors like age, driving history, and location to assess risk, Tesla Insurance incorporates data from your Tesla vehicle, such as:

- Driving History: Tesla Insurance analyzes your driving data, such as speed, braking, and acceleration, to assess your driving habits and potentially offer discounts for safe driving.

- Safety Features: Tesla vehicles are equipped with advanced safety features, such as Autopilot and Full Self-Driving, which can influence your insurance premium.

- Usage-Based Pricing: Tesla Insurance can utilize your vehicle’s usage data, such as mileage and driving times, to adjust your premium based on your actual driving habits.

Tesla Insurance offers a more personalized and potentially cost-effective approach for Tesla owners. However, it’s essential to compare quotes from both Tesla Insurance and traditional insurance providers to find the best coverage and price for your needs.

Integration with Tesla Vehicles

Tesla Insurance seamlessly integrates with Tesla vehicles, offering several benefits to policyholders.

- Usage-Based Pricing: Tesla Insurance utilizes data from your Tesla vehicle, such as mileage and driving times, to determine your premium based on your actual driving habits. This allows for more personalized pricing, rewarding safe and responsible drivers.

- Safety Features: Tesla Insurance considers the advanced safety features of your Tesla vehicle, such as Autopilot and Full Self-Driving, when calculating your premium. These features can potentially lower your premium due to the reduced risk of accidents.

- Remote Claims Reporting: Tesla Insurance offers convenient remote claims reporting through your Tesla vehicle’s touchscreen. This allows you to report an accident directly from your vehicle, streamlining the claims process.

- Real-Time Data Sharing: Tesla Insurance can access real-time data from your Tesla vehicle, such as location, speed, and braking information, to provide more accurate and timely assistance in case of an accident.

Tesla Insurance Cost

Tesla Insurance pricing is influenced by several factors, including your driving history, vehicle model, location, and coverage options. You can find out if you are eligible for Tesla Insurance and get a personalized quote by visiting their website or contacting a Tesla Insurance representative.

Tesla Insurance Cost Comparison

Tesla Insurance aims to provide competitive rates for Tesla owners. The company claims to offer lower premiums than traditional insurance providers due to their deep understanding of Tesla vehicles and their ability to leverage data from the cars’ sensors and software. However, the actual cost of Tesla Insurance can vary depending on individual factors, such as your driving history, location, and the specific coverage options you choose.

Factors Affecting Tesla Insurance Premiums

- Vehicle Model: The cost of insuring a Tesla Model S will likely be higher than insuring a Model 3, as the Model S is a more expensive and powerful vehicle.

- Driving History: Drivers with a clean driving record and no accidents or traffic violations will typically receive lower insurance premiums.

- Location: Insurance rates can vary significantly depending on your location. For example, premiums in urban areas with high traffic density may be higher than in rural areas.

- Coverage Options: The type and amount of coverage you choose will also affect your premium. Comprehensive and collision coverage will generally be more expensive than liability coverage.

- Safety Features: Tesla vehicles are equipped with advanced safety features such as Autopilot and Full Self-Driving. These features may help reduce your insurance premiums, as they can contribute to a lower risk of accidents.

Tesla Insurance Premiums

It is difficult to provide a definitive table of Tesla Insurance premiums as they can vary greatly based on individual factors. However, the following table provides a general overview of potential premium ranges for different Tesla models, driver profiles, and locations:

| Vehicle Model | Driver Profile | Location | Estimated Premium Range |

|---|---|---|---|

| Model 3 | Clean Driving Record, 30 Years Old | Los Angeles, CA | $100 – $150 per month |

| Model S | Clean Driving Record, 30 Years Old | Los Angeles, CA | $150 – $250 per month |

| Model Y | Clean Driving Record, 30 Years Old | Phoenix, AZ | $80 – $120 per month |

| Model X | Clean Driving Record, 30 Years Old | Phoenix, AZ | $120 – $180 per month |

Note: These are just estimates, and actual premiums may vary based on individual factors.

Customer Feedback on Tesla Insurance

Tesla Insurance has garnered mixed reviews from customers, with some praising its features and pricing while others express concerns about its customer service and claims handling process. Understanding customer feedback is crucial for Tesla Insurance to improve its services and maintain customer satisfaction.

Common Themes and Concerns

Customer reviews and feedback on Tesla Insurance reveal recurring themes and concerns. These insights can help Tesla Insurance address areas for improvement and enhance its customer experience.

- Pricing and Value: Many customers appreciate Tesla Insurance’s competitive pricing, particularly for Tesla owners. However, some feel the pricing is not always transparent, and the value proposition needs further clarification.

- Customer Service: While some customers praise Tesla Insurance’s responsive and helpful customer service, others report difficulties reaching customer support representatives or experiencing long wait times.

- Claims Process: Some customers have reported smooth and efficient claims processing experiences, while others have faced delays or difficulties in getting their claims approved.

- Limited Availability: Tesla Insurance is currently only available in a limited number of states, which can be a deterrent for potential customers in other regions.

Pros and Cons of Tesla Insurance

The following table summarizes the pros and cons of Tesla Insurance based on customer feedback:

| Pros | Cons |

|---|---|

| Competitive pricing for Tesla owners | Limited availability |

| Integration with Tesla vehicles for features like safety score discounts | Customer service issues reported by some |

| Positive reviews from some customers regarding claims processing | Concerns about transparency in pricing |

Final Conclusion

Tesla Insurance has emerged as a promising alternative for Tesla owners seeking tailored coverage and potential cost savings. While its current availability is limited, Tesla’s ongoing expansion efforts indicate a commitment to providing this service to a wider audience. As Tesla Insurance continues to evolve, its integration with Tesla vehicles and its focus on data-driven pricing are likely to reshape the automotive insurance landscape. For Tesla owners, staying informed about the latest developments and considering Tesla Insurance as a potential option is essential in navigating the ever-changing world of car insurance.

FAQ Overview: What States Have Tesla Insurance

What are the benefits of Tesla Insurance?

Tesla Insurance offers several benefits, including potentially lower premiums for Tesla owners, integration with Tesla vehicles for personalized pricing, and access to Tesla’s network of service centers for repairs.

Is Tesla Insurance available in all states?

No, Tesla Insurance is not currently available in all states. Its availability is limited to specific regions, and Tesla is gradually expanding its coverage area.

How do I get a quote for Tesla Insurance?

You can obtain a quote for Tesla Insurance through the Tesla website or mobile app. You’ll need to provide information about your vehicle, driving history, and location.

What are the requirements for Tesla Insurance?

To be eligible for Tesla Insurance, you must own a Tesla vehicle and reside in a state where the service is available. You also need to meet the general eligibility criteria for auto insurance, such as having a valid driver’s license and a good driving record.

How does Tesla Insurance compare to traditional insurance providers?

Tesla Insurance aims to provide a more personalized and potentially cost-effective experience for Tesla owners compared to traditional insurance providers. It leverages data from Tesla vehicles and driver behavior to tailor premiums and offers features like usage-based pricing.