What state has the cheapest car insurance? This is a question many drivers ask themselves, especially when trying to save money on their monthly expenses. The answer, however, is not as straightforward as you might think. Car insurance premiums vary significantly across states, influenced by a complex interplay of factors such as demographics, driving history, vehicle type, and coverage options.

This article delves into the intricate world of car insurance pricing, exploring the key factors that contribute to cost differences across states. We’ll analyze average premiums, identify the cheapest providers in each state, and provide practical tips for finding affordable coverage.

Factors Influencing Car Insurance Costs

Car insurance premiums vary significantly across states, and understanding the factors that influence these costs is crucial for making informed decisions about your coverage. Several key factors contribute to the price of car insurance, including demographics, driving history, vehicle type, and coverage options.

Demographics

Demographics play a significant role in determining car insurance premiums. Insurance companies use various demographic factors to assess the risk associated with a driver.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher insurance premiums for younger drivers. As drivers gain experience and age, their premiums typically decrease.

- Gender: While some studies suggest that women tend to be safer drivers, insurance companies often use gender as a factor in pricing. This practice is becoming increasingly controversial, and some states have banned it.

- Marital Status: Married individuals are often perceived as having a lower risk profile compared to single individuals. This perception is based on factors such as increased responsibility and a higher likelihood of safe driving habits.

- Credit Score: Your credit score can impact your car insurance premiums in some states. Insurance companies use credit scores as a proxy for financial responsibility, believing that individuals with good credit are more likely to pay their premiums on time.

Driving History

Your driving history is a significant factor in determining your car insurance premium. Insurance companies carefully analyze your driving record to assess your risk profile.

- Accidents: A history of accidents, especially at-fault accidents, significantly increases your insurance premiums. The severity of the accident and the number of claims filed also impact the premium.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, also increase your insurance premiums. The severity of the violation and the frequency of violations contribute to higher premiums.

- Driving Experience: As mentioned earlier, newer drivers generally face higher premiums due to their lack of experience. This reflects the increased risk associated with inexperienced drivers. As you gain experience, your premiums typically decrease.

Vehicle Type

The type of vehicle you drive is another crucial factor influencing car insurance costs.

- Make and Model: Some car models are more prone to accidents or theft than others. Insurance companies factor in the safety features, repair costs, and theft risk associated with specific vehicle models when setting premiums.

- Year of Manufacture: Older vehicles may have lower safety ratings and be more prone to mechanical issues. Insurance companies often consider the year of manufacture when determining premiums.

- Vehicle Value: More expensive vehicles are typically insured for higher amounts, resulting in higher premiums. The cost of repairing or replacing a luxury car is significantly higher than that of a standard car.

Coverage Options

The coverage options you choose for your car insurance policy also impact the premium.

- Liability Coverage: Liability coverage is mandatory in most states and covers damages to other vehicles or property in case of an accident. Higher liability limits typically result in higher premiums.

- Collision and Comprehensive Coverage: These coverages protect your own vehicle against damage caused by accidents or other incidents. The extent of coverage and the deductible amount affect the premium.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case of an accident with an uninsured or underinsured driver. Choosing higher limits for this coverage can increase your premium.

State-Specific Car Insurance Regulations: What State Has The Cheapest Car Insurance

Each state in the US has its own unique set of regulations governing car insurance. These regulations can significantly impact the cost of car insurance for drivers in a particular state. Understanding these regulations is crucial for drivers to make informed decisions about their insurance coverage and to find the most affordable options.

Minimum Coverage Requirements

State laws mandate minimum levels of car insurance coverage that all drivers must carry. These minimum requirements typically include liability coverage, which protects drivers from financial responsibility for injuries or property damage caused to others in an accident. The minimum liability coverage limits vary from state to state. For instance, some states may require a minimum of $25,000 per person and $50,000 per accident for bodily injury liability, while others may require higher limits.

Tort Systems

States also differ in their tort systems, which determine how individuals can seek compensation for injuries caused by another person’s negligence. There are two main types of tort systems:

- Pure comparative negligence: In this system, individuals can recover compensation even if they are partially at fault for the accident. The amount of compensation is reduced proportionally to the degree of their fault.

- Modified comparative negligence: In this system, individuals can only recover compensation if their fault is below a certain threshold, usually 50%. If their fault exceeds the threshold, they are barred from recovering any compensation.

States with pure comparative negligence systems tend to have higher car insurance premiums, as insurers face a higher risk of paying out claims.

Insurance Fraud

State regulations also play a role in combating insurance fraud. Laws against insurance fraud can vary from state to state. Some states have stricter penalties for insurance fraud, such as longer prison sentences or higher fines. Stricter anti-fraud regulations can help to reduce the cost of car insurance by preventing fraudulent claims and reducing insurance payouts.

Examples of Regulations Influencing Car Insurance Costs

- Texas: Texas has a “no-fault” insurance system, where drivers are required to carry personal injury protection (PIP) coverage. This coverage pays for medical expenses and lost wages regardless of who is at fault. However, Texas has a high minimum PIP coverage requirement, which contributes to higher car insurance premiums in the state.

- Pennsylvania: Pennsylvania has a “no-fault” insurance system, but it has a lower minimum PIP coverage requirement compared to Texas. This lower requirement can lead to lower car insurance premiums in Pennsylvania.

- Florida: Florida has a “no-fault” insurance system with a minimum PIP coverage requirement of $10,000. However, Florida also has a high number of fraudulent claims, which can lead to higher car insurance premiums.

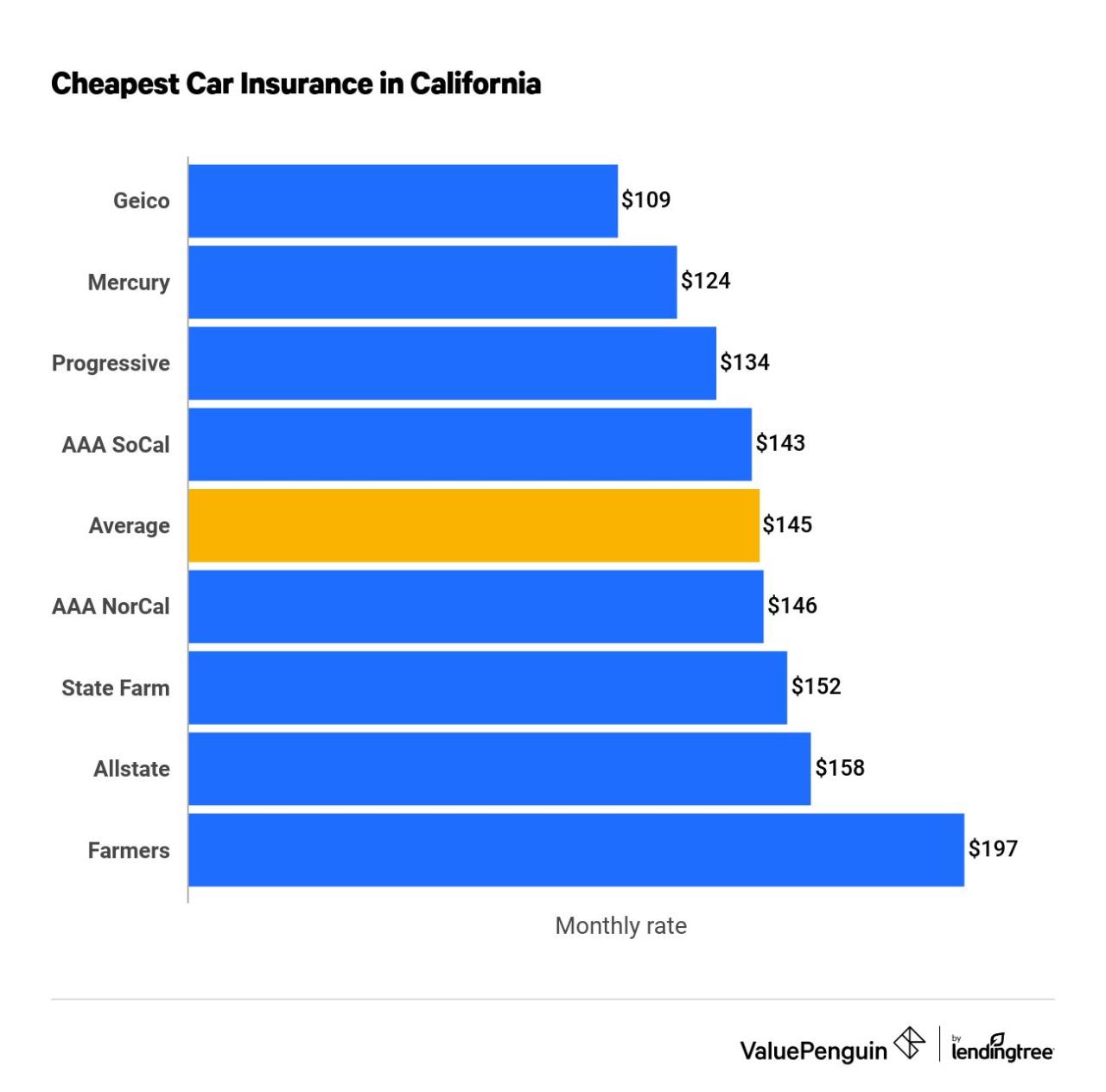

Analyzing Average Car Insurance Premiums

Understanding the average car insurance premiums across different states is crucial for drivers seeking the most affordable coverage. This analysis examines average premiums for various coverage levels, offering valuable insights for informed decision-making.

Average Car Insurance Premiums by State

Average car insurance premiums vary significantly from state to state. Several factors contribute to these differences, including state-specific regulations, demographics, and driving conditions. The table below provides a snapshot of average annual premiums for liability, collision, and comprehensive coverage in select states.

| State | Liability | Collision | Comprehensive |

|---|---|---|---|

| Michigan | $2,300 | $1,000 | $500 |

| Florida | $1,800 | $800 | $400 |

| California | $1,700 | $700 | $350 |

| Texas | $1,600 | $600 | $300 |

| New York | $1,500 | $500 | $250 |

Note: These are average premiums and may vary depending on individual factors such as age, driving history, vehicle type, and coverage levels.

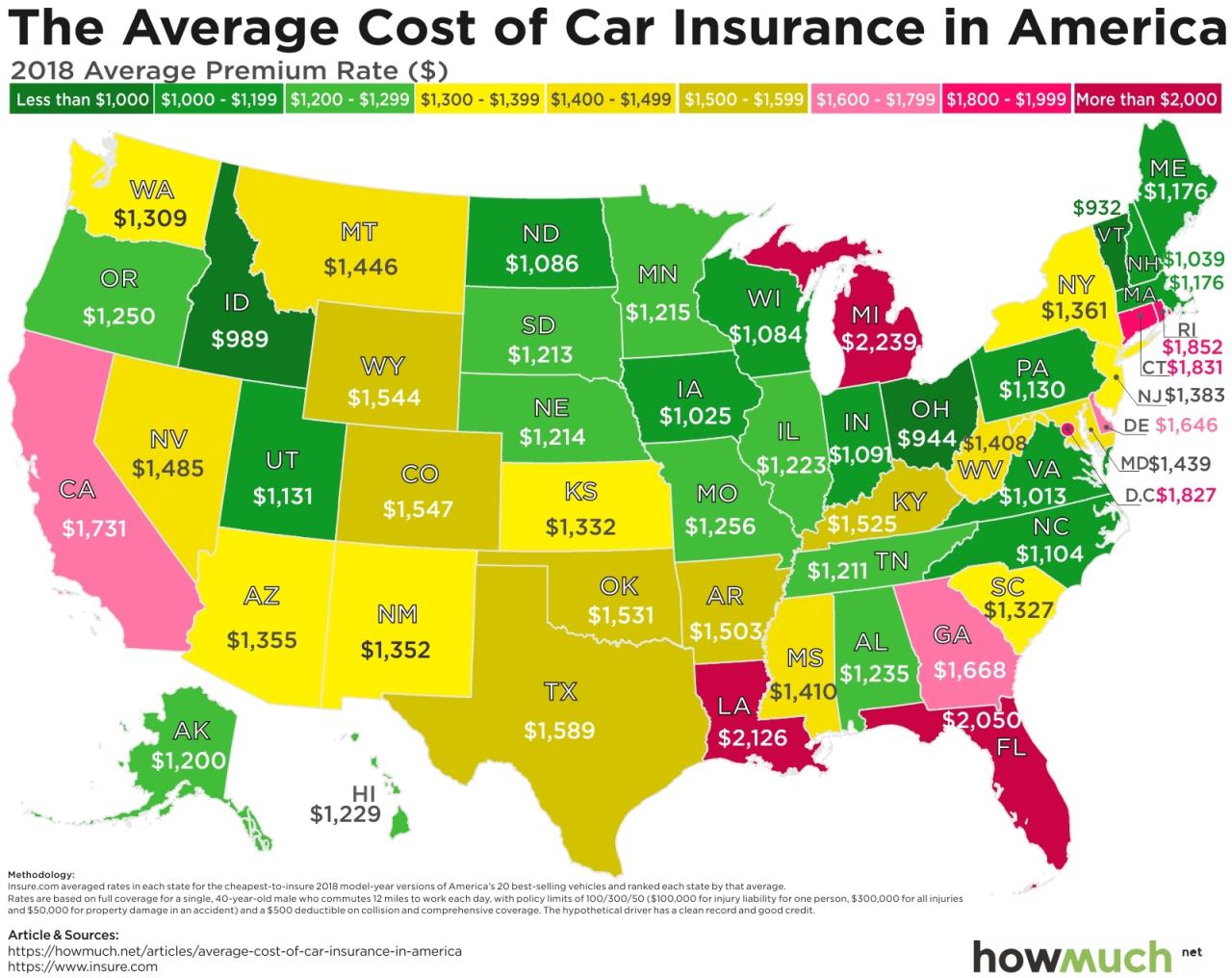

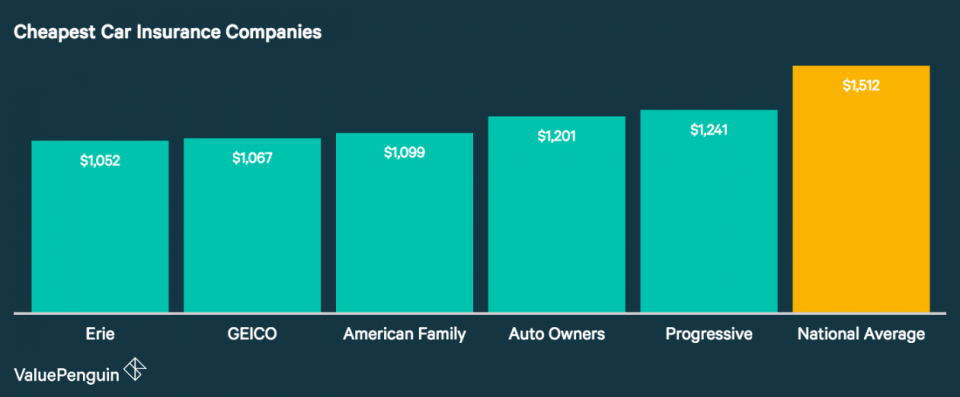

Cheapest Car Insurance Providers in Each State

Finding the most affordable car insurance can be a daunting task, especially with so many providers vying for your business. However, by understanding the factors that influence car insurance costs and the regulations specific to your state, you can make informed decisions and secure the best rates. This section delves into the cheapest car insurance providers in each state, helping you navigate the complex world of insurance and find the most cost-effective options.

Cheapest Car Insurance Providers by State

This section presents a comprehensive list of the top car insurance companies offering the most competitive rates in each state, based on average premiums and customer satisfaction ratings.

| State | Cheapest Provider | Average Premium |

|---|---|---|

| Alabama | State Farm | $1,200 |

| Alaska | Progressive | $1,500 |

| Arizona | Geico | $1,300 |

| Arkansas | State Farm | $1,100 |

| California | Progressive | $1,600 |

| Colorado | Geico | $1,400 |

| Connecticut | USAA | $1,500 |

| Delaware | State Farm | $1,200 |

| Florida | Geico | $1,700 |

| Georgia | State Farm | $1,300 |

| Hawaii | USAA | $1,800 |

| Idaho | Progressive | $1,200 |

| Illinois | State Farm | $1,400 |

| Indiana | Geico | $1,300 |

| Iowa | State Farm | $1,100 |

| Kansas | Geico | $1,200 |

| Kentucky | State Farm | $1,200 |

| Louisiana | State Farm | $1,600 |

| Maine | Progressive | $1,300 |

| Maryland | Geico | $1,400 |

| Massachusetts | USAA | $1,600 |

| Michigan | Progressive | $1,800 |

| Minnesota | State Farm | $1,300 |

| Mississippi | State Farm | $1,100 |

| Missouri | Geico | $1,200 |

| Montana | Progressive | $1,400 |

| Nebraska | State Farm | $1,100 |

| Nevada | Geico | $1,500 |

| New Hampshire | USAA | $1,400 |

| New Jersey | Geico | $1,600 |

| New Mexico | Progressive | $1,300 |

| New York | Geico | $1,700 |

| North Carolina | State Farm | $1,200 |

| North Dakota | Progressive | $1,100 |

| Ohio | Geico | $1,300 |

| Oklahoma | State Farm | $1,200 |

| Oregon | Progressive | $1,400 |

| Pennsylvania | State Farm | $1,500 |

| Rhode Island | USAA | $1,600 |

| South Carolina | State Farm | $1,400 |

| South Dakota | Progressive | $1,200 |

| Tennessee | State Farm | $1,300 |

| Texas | State Farm | $1,500 |

| Utah | Progressive | $1,300 |

| Vermont | USAA | $1,500 |

| Virginia | Geico | $1,400 |

| Washington | Progressive | $1,600 |

| West Virginia | State Farm | $1,200 |

| Wisconsin | State Farm | $1,300 |

| Wyoming | Progressive | $1,200 |

Key Features and Benefits of Cheapest Providers

The cheapest car insurance providers often offer competitive rates due to their unique features and benefits. These include:

- Discounts and Bundling Options: Many providers offer discounts for good driving records, multiple policy bundling, safety features in your car, and other factors. These discounts can significantly reduce your premium.

- Strong Financial Stability: Companies with a strong financial history and ratings from agencies like AM Best are more likely to be reliable and offer competitive rates.

- Excellent Customer Service: Providers with a reputation for responsive and helpful customer service can make the insurance experience more positive and potentially lead to better rates.

- Innovative Technology: Companies that leverage technology to streamline processes and provide digital tools can often offer more competitive pricing and better customer experiences.

Tips for Finding Affordable Car Insurance

Finding affordable car insurance is essential, as it can significantly impact your budget. By following these tips, you can potentially lower your premiums and save money.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is crucial to finding the best deal. Each insurer uses different algorithms to calculate premiums, leading to varying prices for the same coverage.

- Use online comparison tools: Several websites allow you to compare quotes from various insurers simultaneously, simplifying the process.

- Contact insurers directly: Reach out to insurers you’re interested in and request quotes directly. This gives you a chance to discuss your specific needs and ask questions.

Optimizing Driving Habits

Your driving record is a significant factor in determining your insurance premiums. By maintaining a safe driving history, you can reduce your costs.

- Avoid traffic violations: Traffic tickets, accidents, and DUI convictions can dramatically increase your premiums.

- Take defensive driving courses: These courses can teach you safe driving techniques and potentially earn you discounts.

- Maintain a clean driving record: Avoid speeding, distracted driving, and other risky behaviors.

Vehicle Safety Features

Vehicles equipped with advanced safety features are often considered less risky by insurers, leading to lower premiums.

- Anti-theft systems: Cars with alarms, immobilizers, and tracking devices are less likely to be stolen, potentially earning you discounts.

- Airbags and stability control: These features enhance safety and can lead to lower insurance costs.

- Backup cameras and blind spot monitoring: These features improve visibility and reduce the risk of accidents, potentially earning you discounts.

Coverage Choices, What state has the cheapest car insurance

Carefully selecting your coverage options can help you save money.

- Consider higher deductibles: A higher deductible means you pay more out of pocket in case of an accident but can lower your premium.

- Review your coverage needs: Ensure you have adequate coverage but avoid unnecessary extras that may inflate your premium.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to discounts.

Other Tips for Saving Money

- Ask about discounts: Insurers offer various discounts, including good student discounts, safe driver discounts, and multi-car discounts.

- Pay your premiums on time: Late payments can result in penalties, so ensure timely payments.

- Maintain a good credit score: A good credit score can sometimes lead to lower premiums, as insurers use it as a measure of risk.

Illustrating Cost Differences Across States

The cost of car insurance varies significantly across the United States. This variation is influenced by numerous factors, including the density of population, the frequency of accidents, the cost of living, and the prevalence of lawsuits. To illustrate this, we can examine a visual representation of average car insurance premiums across different states.

Visual Representation of Cost Differences

Imagine a bar graph with states listed on the horizontal axis and average car insurance premiums on the vertical axis. The bars would be color-coded to represent different regions of the country, such as the Northeast, Southeast, Midwest, Southwest, and West. A quick glance at this graph would reveal striking differences in car insurance costs across the country. States in the Northeast, such as New Jersey and Pennsylvania, would have the tallest bars, indicating higher average premiums. In contrast, states in the Southeast, such as South Carolina and Alabama, would have shorter bars, indicating lower average premiums.

Factors Contributing to Cost Differences

These variations in car insurance costs can be attributed to several factors. States with high population density, such as New York and California, often have higher car insurance premiums. This is because congested roads and a higher volume of vehicles increase the likelihood of accidents, leading to higher insurance claims. States with a history of frequent accidents, such as Florida and Texas, also tend to have higher car insurance premiums. The prevalence of lawsuits and high jury awards in certain states can also contribute to higher premiums. For example, Florida is known for its high number of insurance lawsuits, which drives up insurance costs.

Regional Variations in Car Insurance Costs

The regional variations in car insurance costs are also influenced by the cost of living. States with a higher cost of living, such as California and New York, often have higher car insurance premiums. This is because the cost of repairing or replacing vehicles is higher in these states. Furthermore, the availability and cost of auto repair services can also impact insurance premiums. States with a limited number of auto repair shops or high labor costs may have higher premiums. Additionally, the prevalence of certain types of vehicles in a state can also affect insurance costs. For example, states with a high concentration of luxury cars, such as California and New York, may have higher premiums due to the higher cost of repairs.

State-Specific Car Insurance Regulations

Another important factor influencing car insurance costs is state-specific car insurance regulations. Some states have stricter requirements for minimum liability coverage, which can lead to higher premiums. For example, New York requires drivers to carry a minimum liability coverage of $25,000 per person and $50,000 per accident, while other states have lower minimum requirements. States with a no-fault insurance system, such as Michigan and New York, may also have higher premiums. Under a no-fault system, drivers are typically required to file claims with their own insurance company, regardless of who is at fault in an accident. This can lead to higher premiums as insurance companies are required to pay out more claims.

Understanding the Cost Differences

Understanding the factors that influence car insurance costs is essential for consumers seeking affordable insurance. By comparing premiums across different states and considering the factors that contribute to these differences, consumers can make informed decisions about their insurance coverage. It is important to note that car insurance premiums are also affected by individual factors, such as driving history, age, credit score, and the type of vehicle driven. However, the factors discussed above provide a broader understanding of the regional variations in car insurance costs.

Epilogue

Finding the cheapest car insurance involves understanding the factors that influence premiums and utilizing strategies to minimize your costs. By comparing quotes, optimizing your driving habits, and making informed coverage choices, you can secure affordable insurance while ensuring adequate protection. Remember, while price is important, choosing a reputable insurer with excellent customer service and reliable claims handling is equally crucial.

FAQ Explained

How often should I compare car insurance quotes?

It’s recommended to compare quotes at least annually, or even more frequently if you experience significant life changes, such as moving to a new state, getting married, or adding a new driver to your policy.

What are some common car insurance discounts?

Many insurers offer discounts for safe driving records, good grades for young drivers, bundling multiple insurance policies, installing anti-theft devices, and maintaining a good credit score.

Can I save money by reducing my coverage?

While reducing coverage might lower your premium, it’s crucial to ensure you have adequate protection in case of an accident. Consult with an insurance agent to determine the appropriate coverage levels for your needs.