What state has cheapest car insurance – What state has the cheapest car insurance? This question is on the minds of many drivers, as car insurance premiums can vary significantly across the country. From state regulations and driving risk profiles to the cost of living and the competitive landscape of the insurance industry, a multitude of factors influence the price of car insurance. This article will delve into the key factors that contribute to variations in car insurance premiums across different states, providing insights into what makes some states more affordable than others.

Understanding these factors can empower drivers to make informed decisions about their insurance coverage and potentially save money on their premiums. By exploring the regulatory environments, driving risk statistics, and economic factors that influence car insurance costs, we can gain a comprehensive understanding of the forces that shape the car insurance market in each state.

Factors Influencing Car Insurance Costs

Car insurance premiums are not uniform across the United States. Numerous factors contribute to these variations, resulting in significant differences in insurance costs between states. Understanding these factors is crucial for drivers to make informed decisions about their insurance needs and find the most affordable coverage.

Demographics

Demographics play a significant role in determining car insurance premiums. Insurance companies often use factors like age, gender, and marital status to assess risk. Younger drivers, for instance, are statistically more likely to be involved in accidents, leading to higher premiums. Conversely, older drivers with a clean driving record may qualify for discounts due to their lower risk profile. Similarly, married individuals tend to have lower premiums compared to single individuals, reflecting a perceived lower risk of accidents.

Driving History

A driver’s driving history is a critical factor influencing insurance costs. Drivers with a clean record, free of accidents, violations, and traffic tickets, are considered low-risk and typically receive lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions are considered high-risk and face higher premiums. This reflects the increased likelihood of future accidents and claims associated with a poor driving record.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. Luxury cars, sports cars, and high-performance vehicles are often more expensive to repair or replace in case of an accident, leading to higher insurance costs. Conversely, older, less expensive vehicles typically have lower premiums. Additionally, safety features like anti-lock brakes, airbags, and stability control can influence premiums, with vehicles equipped with such features often receiving discounts.

Location

The location where you reside plays a crucial role in determining car insurance costs. Urban areas with high population density and heavy traffic tend to have higher accident rates, leading to higher insurance premiums. Conversely, rural areas with lower population density and fewer traffic congestion often have lower accident rates, resulting in lower insurance premiums. Additionally, states with stricter traffic laws and more stringent enforcement may have lower premiums due to reduced accident rates.

State-Specific Regulations and Laws: What State Has Cheapest Car Insurance

The cost of car insurance varies significantly from state to state, and a major factor influencing this variation is the regulatory environment. Each state has its own set of laws and regulations governing car insurance, which can impact coverage requirements, minimum liability limits, and other aspects of insurance policies.

Impact of State-Specific Laws on Premiums

State regulations directly affect car insurance premiums. For example, states with higher minimum liability limits generally have higher premiums. This is because drivers are required to carry more coverage, leading to higher costs for insurance companies. States with more stringent regulations regarding coverage requirements or stricter penalties for uninsured drivers often have higher premiums as well.

Examples of State-Specific Regulations

Here are some examples of state-specific regulations that can influence car insurance costs:

- Minimum Liability Limits: States with higher minimum liability limits require drivers to carry more coverage, leading to higher premiums. For example, in Pennsylvania, the minimum liability limit for bodily injury is $15,000 per person and $30,000 per accident, while in Florida, the minimum liability limit is $10,000 per person and $20,000 per accident. This difference in liability limits can significantly impact insurance premiums.

- Uninsured Motorist Coverage: Some states require drivers to carry uninsured motorist coverage, which protects them in the event of an accident with an uninsured driver. This coverage can add to the cost of insurance. For example, New York requires drivers to carry uninsured motorist coverage, while Florida does not. This difference in coverage requirements can impact insurance premiums.

- No-Fault Laws: Some states have no-fault laws, which require drivers to file claims with their own insurance company regardless of who is at fault in an accident. This can lead to higher premiums, as insurance companies have to cover more claims. For example, Michigan has a no-fault law, while Texas does not. This difference in laws can impact insurance premiums.

Insurance Company Practices and Competition

The car insurance industry is a dynamic and competitive landscape, with numerous companies vying for customers. The level of competition can significantly impact premiums, as insurers try to attract policyholders with attractive rates and coverage options. This section delves into the competitive dynamics of the car insurance industry and its impact on pricing.

Competition and Premium Rates

The presence of a large number of insurers in a state can foster competition and potentially lead to lower premiums. This is because insurers are constantly trying to attract customers by offering more competitive rates and better coverage options. For instance, if there are 10 insurance companies in a state, each company is trying to attract customers from the other nine companies. This competitive pressure can lead to lower premiums as insurers try to undercut each other.

States with Strong Insurance Company Presence

States with a high concentration of insurance companies often see more competitive pricing due to the increased market dynamics. These states usually have a larger population and a greater demand for car insurance, making them attractive markets for insurers. Some examples of states with a high concentration of insurance companies include:

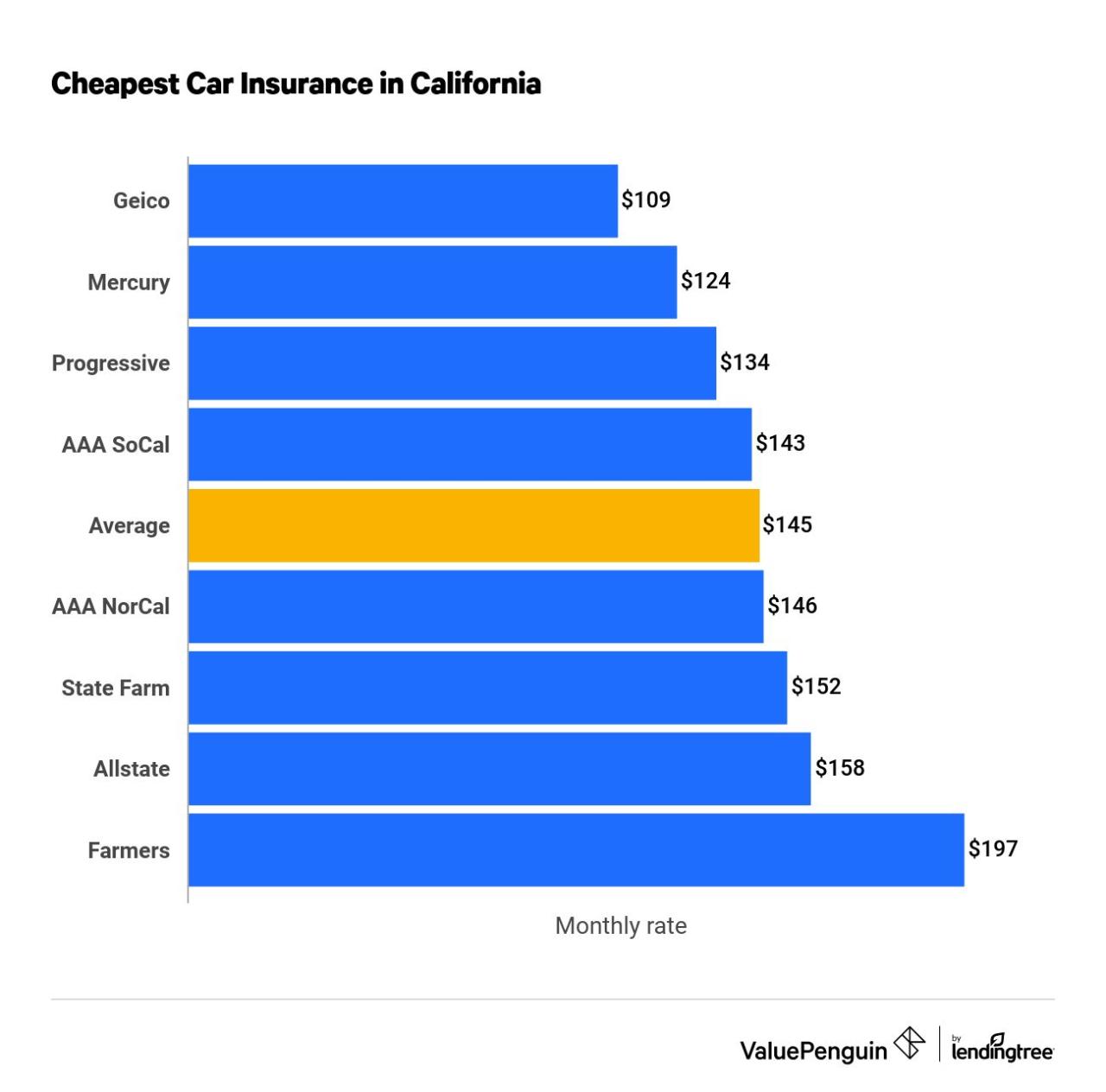

- California: California is home to a wide range of insurance companies, both large and small. The state’s large population and diverse driving conditions create a competitive market.

- Texas: Texas is another state with a large number of insurance companies, contributing to a competitive environment.

- Florida: Florida’s warm climate and popular tourist destinations make it a prime market for car insurance. The state has a high concentration of insurers, leading to competitive pricing.

Driving Risk and Safety Statistics

The cost of car insurance is heavily influenced by the driving risk associated with a particular state. States with higher accident rates, traffic congestion, and poor road conditions typically have higher insurance premiums. This is because insurance companies need to charge more to cover the increased risk of claims.

Accident Rates and Their Impact on Premiums

The number of accidents in a state is a key indicator of driving risk. States with higher accident rates tend to have higher insurance premiums.

- For example, according to the National Highway Traffic Safety Administration (NHTSA), Texas has the highest number of fatal car accidents in the United States, followed by California and Florida. This high number of accidents is likely to contribute to higher insurance premiums in these states.

- Conversely, states with lower accident rates, such as Vermont and New Hampshire, typically have lower insurance premiums. This is because insurance companies perceive these states as having a lower risk of claims.

Traffic Congestion and its Correlation with Insurance Premiums

Traffic congestion can increase the risk of accidents. This is because congested roads lead to more aggressive driving, distracted drivers, and more opportunities for collisions. States with high levels of traffic congestion, such as Los Angeles, California, and New York City, tend to have higher insurance premiums than states with less congestion.

Traffic congestion is a significant factor in driving risk, leading to increased accidents and potentially higher insurance premiums.

Road Conditions and Their Influence on Insurance Premiums

The condition of roads can also affect the risk of accidents. States with poorly maintained roads, potholes, and other road hazards have a higher risk of accidents. This is because poor road conditions can lead to vehicle damage and accidents. States with poor road conditions may have higher insurance premiums than states with well-maintained roads.

- For instance, a study by the National Transportation Safety Board (NTSB) found that a significant number of accidents are caused by poor road conditions, such as potholes and uneven pavement.

States with High and Low Driving Risk Profiles

States with high driving risk profiles, characterized by higher accident rates, traffic congestion, and poor road conditions, often have higher insurance premiums. Conversely, states with low driving risk profiles tend to have lower insurance premiums.

- For example, Texas, California, and Florida are often cited as states with high driving risk profiles, while states like Vermont and New Hampshire are considered to have lower driving risk profiles.

Cost of Living and Economic Factors

The cost of living in a state significantly impacts the average cost of car insurance. This is because several economic factors directly influence insurance premiums.

The cost of living in a state encompasses various aspects, including housing, healthcare, transportation, and groceries. These factors, along with income levels and property values, play a role in determining car insurance premiums.

Relationship Between Cost of Living and Car Insurance

The cost of living in a state directly influences the average cost of car insurance. States with a higher cost of living tend to have higher car insurance premiums. This is because the cost of repairs, medical expenses, and other factors associated with car accidents are generally higher in these areas.

For example, states with a high concentration of luxury vehicles or expensive car parts may experience higher insurance premiums due to the higher cost of repairs. Similarly, states with high healthcare costs may see higher insurance premiums due to the increased risk of medical expenses in case of an accident.

Impact of Income Levels and Property Values, What state has cheapest car insurance

Income levels and property values are closely related to the cost of living.

States with higher income levels often have higher property values. This is because residents in these areas can afford to purchase more expensive homes. Higher property values can lead to higher insurance premiums, as the potential cost of damage to vehicles and property is greater.

Additionally, states with higher income levels may have more expensive cars on the road. This can also contribute to higher insurance premiums, as the cost of repairs and replacement parts is greater.

Impact of the Cost of Repairs

The cost of repairs for vehicles is another factor that influences car insurance premiums. States with higher labor and parts costs will generally have higher car insurance premiums.

For instance, states with a high concentration of specialized car dealerships or repair shops may experience higher insurance premiums due to the higher cost of repairs. Similarly, states with strict regulations regarding car repair certifications may also see higher premiums, as only certified mechanics can perform repairs, potentially leading to higher labor costs.

States with High and Low Cost of Living

States with a particularly high cost of living, such as California, New York, and Hawaii, tend to have higher car insurance premiums.

Conversely, states with a lower cost of living, such as Mississippi, West Virginia, and Arkansas, generally have lower car insurance premiums. These differences in cost of living can significantly impact the affordability of car insurance for residents.

Data Visualization and Analysis

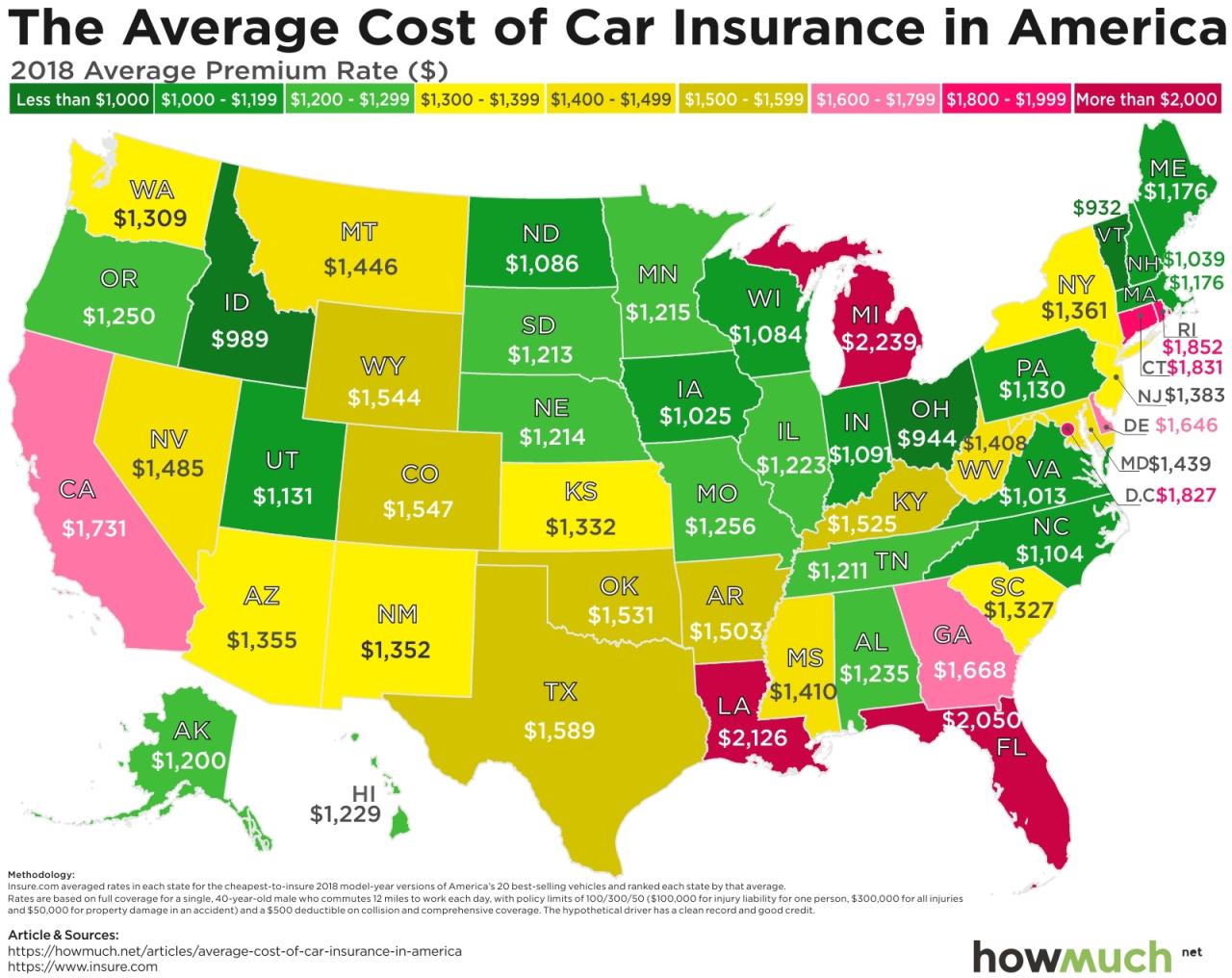

Visualizing and analyzing car insurance premium data across different states can provide valuable insights into the factors influencing insurance costs and help consumers make informed decisions. By comparing average premiums across states, we can identify trends, potential outliers, and interesting insights.

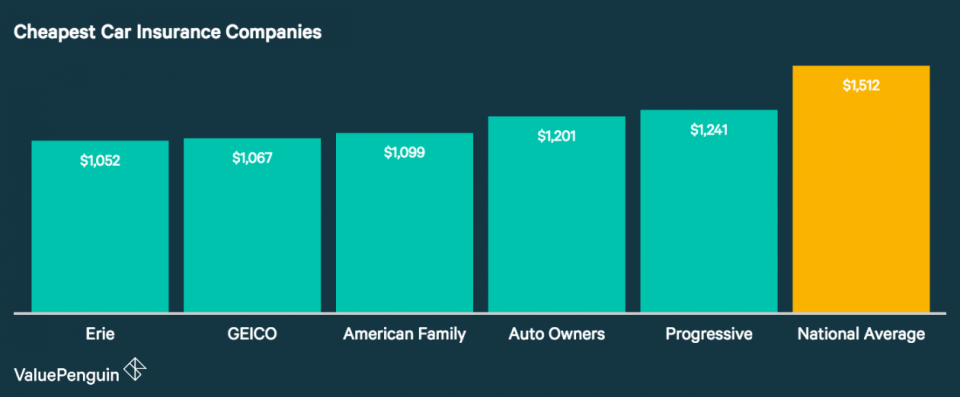

Average Car Insurance Premiums Across States

A visual representation of the average car insurance premiums across different states, such as a bar chart or interactive map, can effectively illustrate the variations in costs. For example, a bar chart could display the average annual premium for each state, with the bars arranged in ascending or descending order. This allows for a quick and easy comparison of premiums across different states.

Top 5 States with Cheapest and Most Expensive Car Insurance

To further understand the variations in car insurance costs, we can organize the data in a table format, highlighting the top 5 states with the cheapest and most expensive car insurance. This table would present the average annual premium for each state, allowing for a direct comparison of the most affordable and priciest options.

| Rank | State | Average Annual Premium |

|---|---|---|

| 1 | [State with cheapest insurance] | [Average annual premium] |

| 2 | [State with cheapest insurance] | [Average annual premium] |

| 3 | [State with cheapest insurance] | [Average annual premium] |

| 4 | [State with cheapest insurance] | [Average annual premium] |

| 5 | [State with cheapest insurance] | [Average annual premium] |

| 1 | [State with most expensive insurance] | [Average annual premium] |

| 2 | [State with most expensive insurance] | [Average annual premium] |

| 3 | [State with most expensive insurance] | [Average annual premium] |

| 4 | [State with most expensive insurance] | [Average annual premium] |

| 5 | [State with most expensive insurance] | [Average annual premium] |

Trends and Patterns in Car Insurance Premiums

Analyzing the data reveals interesting trends and patterns in car insurance premiums across states. For instance, states with higher population densities or urban areas often have higher insurance premiums due to increased traffic congestion, higher risk of accidents, and potential for greater damage claims. Conversely, states with lower population densities and rural areas may have lower premiums due to less congested roads, fewer accidents, and potentially lower property values.

Potential Outliers and Interesting Insights

While general trends can be observed, certain states may exhibit outlier behavior. For example, a state with a relatively low average premium despite a high population density might suggest factors like stricter driving regulations, a strong safety culture, or a high concentration of insurance companies offering competitive rates. Identifying these outliers can provide valuable insights into the unique factors influencing insurance costs in specific states.

Closure

Ultimately, finding the cheapest car insurance involves a combination of factors, including your individual driving history, vehicle type, and location. While some states consistently offer lower premiums than others, the best way to find the most affordable coverage is to compare quotes from multiple insurance companies and consider your own unique circumstances. By understanding the key factors that influence car insurance costs, you can make informed decisions about your insurance coverage and potentially save money in the process.

Commonly Asked Questions

How often should I shop for car insurance?

It’s generally recommended to compare quotes from different insurers at least once a year, or even more frequently if your driving habits or risk profile change. Rates can fluctuate, and you may find better deals by shopping around.

What are some tips for lowering my car insurance premiums?

There are several ways to potentially reduce your car insurance premiums, such as improving your driving record, increasing your deductible, bundling insurance policies, and maintaining a good credit score. Some insurers also offer discounts for safety features, driving courses, and good student status.

Is it cheaper to get car insurance online?

While you can often find competitive rates online, it’s best to compare quotes from both online and traditional insurance companies to ensure you’re getting the best deal.