What is the cheapest car insurance in Washington state? This question is a top priority for many drivers, as car insurance premiums can significantly impact your budget. Understanding the factors that influence car insurance rates in Washington state is crucial for finding the most affordable option.

Several factors play a role in determining your car insurance premiums, including your driving history, the type of vehicle you drive, your age, your location, and the coverage options you choose. Washington state also has specific coverage requirements that can affect your insurance costs.

Factors Affecting Car Insurance Costs in Washington State

Car insurance premiums in Washington state, like in other states, are influenced by a combination of factors that assess your risk as a driver. Understanding these factors can help you make informed decisions that may lead to lower insurance costs.

Driving History, What is the cheapest car insurance in washington state

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums. Insurance companies consider your driving history as a strong indicator of your future driving behavior.

Vehicle Type

The type of vehicle you drive is another crucial factor influencing your insurance rates. High-performance cars, luxury vehicles, and SUVs tend to have higher insurance premiums due to their higher repair costs and greater potential for accidents. On the other hand, smaller, less expensive cars generally have lower insurance premiums.

Age

Your age is a factor that insurance companies consider because younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk translates to higher insurance premiums for younger drivers. As you age and gain more experience, your insurance rates may decrease.

Location

The location where you live can also affect your car insurance rates. Areas with higher crime rates, denser populations, and more traffic congestion tend to have higher insurance premiums due to the increased likelihood of accidents.

Coverage Options

The type and amount of coverage you choose will directly impact your insurance premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will result in higher premiums. However, it’s essential to consider the potential financial consequences of accidents and choose coverage that adequately protects you and your assets.

State-Mandated Coverage Requirements

Washington state mandates specific minimum coverage requirements for all drivers, including liability coverage for bodily injury and property damage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). These state-mandated requirements contribute to the overall cost of car insurance in Washington.

Types of Car Insurance Coverage in Washington State

Understanding the different types of car insurance coverage available in Washington state is crucial for making informed decisions about your policy. These coverages protect you financially in various scenarios, ensuring you are adequately prepared for potential risks on the road.

Liability Coverage

Liability coverage is mandatory in Washington state and is essential for protecting you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of:

- Medical Expenses: This covers the medical bills of the other driver and any passengers in their vehicle if you are at fault for the accident.

- Property Damage: This covers the cost of repairs or replacement of the other driver’s vehicle and any other property damaged in the accident.

- Legal Defense: If you are sued by the other driver, liability coverage can help pay for your legal defense costs.

Liability coverage is typically expressed as a split limit, such as 25/50/10, which means:

$25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

Choosing insufficient liability coverage could result in significant financial hardship if you are involved in a serious accident. For example, if you have a 25/50/10 policy and cause an accident resulting in $30,000 in medical expenses for the other driver, you would be personally responsible for the remaining $5,000.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Scenario: If you hit a parked car and damage your vehicle, collision coverage will help cover the repair costs.

- Deductible: You will be responsible for paying your deductible before the insurance company covers the remaining costs.

You can choose to waive collision coverage if your vehicle is older or has a lower value, as the cost of repairs may exceed the vehicle’s worth. However, it’s important to consider the potential financial consequences of not having collision coverage. For example, if you are involved in a major accident and your vehicle is totaled, you would be responsible for the entire cost of replacement without collision coverage.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as:

- Theft: If your vehicle is stolen, comprehensive coverage will help pay for its replacement or repair.

- Vandalism: If your vehicle is damaged by vandalism, comprehensive coverage will cover the repair costs.

- Natural Disasters: Damage caused by events like hailstorms, floods, or earthquakes can be covered by comprehensive coverage.

Like collision coverage, you will need to pay a deductible before your insurance company covers the remaining costs. You can choose to waive comprehensive coverage if your vehicle is older or has a lower value. However, consider the potential risks associated with not having comprehensive coverage. For example, if your vehicle is damaged by a hailstorm, you would be responsible for the entire repair cost without comprehensive coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you financially if you are injured in an accident caused by a driver who is uninsured or has insufficient insurance. It covers:

- Medical Expenses: UM/UIM coverage can help pay for your medical bills if you are injured in an accident caused by an uninsured or underinsured driver.

- Lost Wages: If you are unable to work due to injuries sustained in an accident, UM/UIM coverage can help compensate for lost wages.

- Pain and Suffering: This coverage can help compensate for the emotional and physical pain you experience due to the accident.

UM/UIM coverage is optional in Washington state, but it is highly recommended. If you are involved in an accident with an uninsured driver, you may be left with significant medical bills and other expenses. UM/UIM coverage can help ensure you are financially protected in such situations.

Finding the Cheapest Car Insurance in Washington State

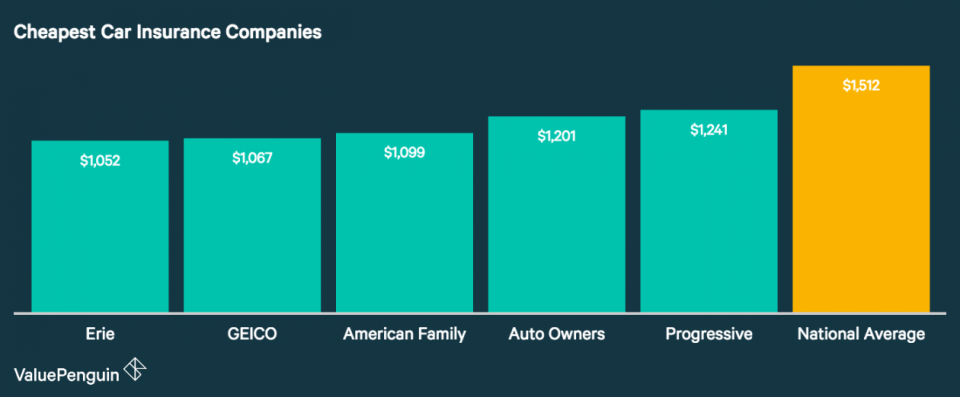

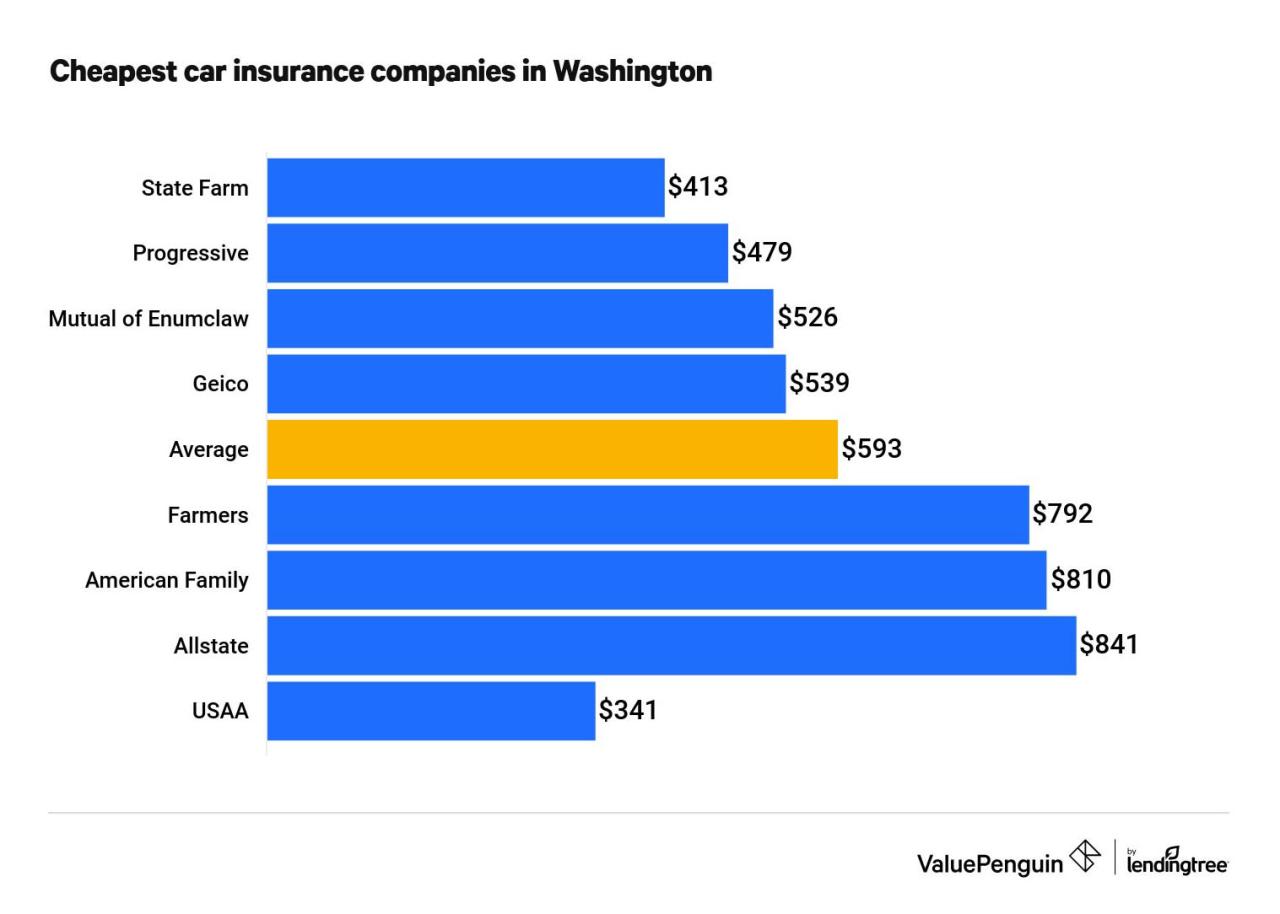

Finding the cheapest car insurance in Washington state requires comparing quotes from multiple insurers and understanding the factors that influence pricing. This involves identifying reputable providers, comparing their pricing strategies, and employing strategies to obtain competitive quotes.

Reputable Car Insurance Companies in Washington State

Several reputable car insurance companies operate in Washington state, offering various coverage options and pricing strategies.

- National Brands:

- State Farm: Known for its widespread presence, strong customer service, and competitive rates.

- Geico: Renowned for its affordable rates and convenient online services.

- Progressive: Offers a variety of discounts and personalized coverage options.

- Allstate: Provides comprehensive coverage and a strong focus on customer satisfaction.

- Regional Providers:

- Farmers Insurance: A well-established regional provider with a strong presence in Washington.

- American Family Insurance: Offers competitive rates and a variety of discounts.

- Liberty Mutual: Provides a wide range of coverage options and personalized service.

Comparing Pricing Strategies

Insurers employ various pricing strategies, which can impact the cost of your car insurance.

- Risk Assessment: Insurers assess your risk profile based on factors such as driving history, age, location, and vehicle type. Those considered higher risk typically pay higher premiums.

- Discount Programs: Many insurers offer discounts for factors like good driving records, safety features in your vehicle, and bundling multiple insurance policies.

- Customer Loyalty: Some insurers reward long-term customers with lower rates or special discounts.

Strategies for Obtaining Competitive Quotes

Several strategies can help you obtain competitive car insurance quotes.

- Compare Quotes Online: Utilize online comparison websites to gather quotes from multiple insurers simultaneously.

- Contact Insurers Directly: Reach out to insurers directly to discuss your specific needs and obtain personalized quotes.

- Negotiate: Don’t hesitate to negotiate with insurers to try and secure a lower rate.

- Review Your Policy Regularly: Periodically review your policy to ensure you’re still getting the best rates and coverage.

Discount Opportunities for Car Insurance in Washington State

Car insurance companies in Washington State offer various discounts to help policyholders save money on their premiums. These discounts can significantly reduce your overall insurance costs, so it’s essential to explore them and take advantage of any that apply to you.

Safe Driver Discounts

Safe driver discounts reward drivers with a clean driving record. These discounts are typically offered to drivers who have not been involved in any accidents or traffic violations for a specific period.

For instance, a driver with a five-year accident-free record might qualify for a 10% discount on their premium.

Good Student Discounts

Good student discounts are available to students who maintain a certain GPA. These discounts are often offered to high school and college students who demonstrate academic excellence.

A student with a GPA of 3.5 or higher might receive a 15% discount on their insurance premium.

Multi-Car Discounts

Multi-car discounts are offered to policyholders who insure multiple vehicles with the same company. This discount incentivizes customers to bundle their insurance policies, which can save them money on their premiums.

A family insuring two cars with the same company might qualify for a 10% discount on each vehicle’s premium.

Other Discounts

In addition to the above, car insurance companies in Washington State may offer other discounts, including:

- Anti-theft device discounts: Offered to drivers who have installed anti-theft devices in their vehicles, such as alarms or GPS tracking systems.

- Defensive driving course discounts: Available to drivers who have completed a defensive driving course.

- Loyalty discounts: Offered to customers who have been with the same insurance company for a certain period.

- Early payment discounts: Given to policyholders who pay their premiums in full or on time.

- Group discounts: Available to members of certain organizations or groups, such as alumni associations or professional groups.

- Military discounts: Offered to active-duty military personnel or veterans.

Navigating the Car Insurance Purchasing Process in Washington State

Securing car insurance in Washington state involves a series of steps, each crucial in finding the best policy that meets your needs and budget. This process involves gathering information, comparing quotes, and ultimately selecting the most suitable coverage.

Understanding the Steps Involved

The car insurance purchasing process in Washington state is fairly straightforward. Here’s a step-by-step guide:

- Gather Essential Information: Before you start getting quotes, have your vehicle information (make, model, year, VIN), driving history (including any accidents or violations), and personal details (name, address, date of birth, and contact information) readily available. This information is essential for insurance companies to assess your risk and generate accurate quotes.

- Obtain Quotes from Multiple Insurers: Once you have your information gathered, you can start getting quotes from different insurance companies. Several online platforms allow you to compare quotes from multiple insurers simultaneously, saving you time and effort. Consider contacting insurance agents directly for personalized guidance and advice.

- Compare Quotes and Coverage Options: Carefully compare the quotes you receive, paying attention to the coverage options offered by each insurer. Consider factors such as deductibles, premiums, and the types of coverage included in each policy. It’s important to understand the differences in coverage options and their implications. For instance, higher deductibles generally result in lower premiums, but you’ll pay more out-of-pocket in case of an accident.

- Review Policy Documents: Before finalizing your choice, thoroughly review the policy documents provided by the insurer. Pay attention to key terms like deductibles, coverage limits, exclusions, and any additional fees. Understanding these terms ensures you’re aware of your rights and obligations under the policy.

- Select and Purchase Your Policy: Once you’ve compared quotes and reviewed the policy documents, select the insurance company and policy that best meet your needs and budget. You can usually purchase your policy online, over the phone, or through an insurance agent. Make sure to keep a copy of your policy for your records.

Understanding Policy Documents and Key Terms

Understanding the terms and conditions of your car insurance policy is crucial for making informed decisions and navigating potential claims. Some key terms to familiarize yourself with include:

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means a lower premium, but you’ll have to pay more in case of an accident.

- Coverage Limits: These refer to the maximum amount your insurance company will pay for covered losses. Understanding these limits is essential to ensure you have sufficient coverage for potential claims.

- Exclusions: These are specific events or situations that are not covered by your insurance policy. It’s important to be aware of any exclusions to avoid surprises during a claim.

- Premium: This is the regular payment you make to your insurance company for coverage. Premiums are typically paid monthly, quarterly, or annually.

Negotiating Insurance Premiums

While finding the cheapest car insurance in Washington state is a priority, it’s also essential to ensure you have adequate coverage. Here are some tips for negotiating insurance premiums and securing the best possible rates:

- Shop Around: Getting quotes from multiple insurers is essential for comparing prices and coverage options. Don’t settle for the first quote you receive. Explore different insurers and use online comparison tools to streamline the process.

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts. Ask insurers about bundling options and see if it’s beneficial for you.

- Improve Your Driving Record: Maintaining a clean driving record with no accidents or violations can significantly lower your premiums. Driving safely and responsibly can save you money in the long run.

- Consider Increasing Your Deductible: Increasing your deductible can lead to lower premiums. However, remember that you’ll have to pay more out-of-pocket in case of an accident. Carefully consider your financial situation and risk tolerance before making this decision.

- Ask About Discounts: Many insurers offer discounts for various factors, such as good student discounts, safe driver discounts, and discounts for installing anti-theft devices. Ask about available discounts and see if you qualify.

- Negotiate with Your Current Insurer: If you’ve been with your current insurer for a while and have a good driving record, consider negotiating your premium. Explain your situation and see if they’re willing to offer a lower rate.

Final Conclusion: What Is The Cheapest Car Insurance In Washington State

Finding the cheapest car insurance in Washington state requires a combination of research, comparison shopping, and understanding your individual needs. By carefully considering your coverage options, exploring available discounts, and utilizing online tools, you can secure a policy that provides adequate protection while minimizing your insurance costs.

FAQ Explained

How can I compare car insurance quotes online?

Many online insurance comparison websites allow you to enter your information and receive quotes from multiple insurance companies simultaneously. This can help you quickly compare prices and coverage options.

What are some common discounts offered by car insurance companies in Washington state?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and discounts for anti-theft devices. Check with individual insurance companies to see what discounts they offer.

What is the minimum car insurance coverage required in Washington state?

Washington state requires drivers to carry liability insurance, which covers damages to other people and their property in an accident. The minimum required coverage amounts are specified by the state.