Washington State Minimum Auto Insurance Requirements are essential for all drivers. These regulations ensure that drivers have sufficient financial protection in case of an accident. They cover liability, uninsured/underinsured motorist, and personal injury protection. These minimums are designed to protect both the driver and others on the road.

The minimum coverage amounts for liability, uninsured/underinsured motorist, and personal injury protection are Artikeld in a table. It is important to understand these requirements and the potential consequences of driving without proper insurance. The penalties for driving without the required minimum insurance can be severe and include fines, license suspension, and even jail time.

Washington State Minimum Auto Insurance Requirements

Washington State requires all drivers to have a minimum amount of auto insurance. This requirement helps protect drivers and their passengers in the event of an accident. It also ensures that those responsible for an accident are financially responsible for the damages they cause.

Minimum Coverage Amounts

The following table summarizes the minimum coverage amounts required in Washington State:

| Coverage Type | Minimum Amount |

|---|---|

| Liability (per person) | $25,000 |

| Liability (per accident) | $50,000 |

| Liability (property damage) | $10,000 |

| Uninsured/Underinsured Motorist (per person) | $25,000 |

| Uninsured/Underinsured Motorist (per accident) | $50,000 |

| Personal Injury Protection (PIP) | $10,000 |

Penalties for Driving Without Insurance, Washington state minimum auto insurance requirements

Driving without the required minimum auto insurance in Washington State can result in serious consequences. These penalties include:

- Fines: Drivers caught driving without insurance can face fines of up to $1,000.

- License Suspension: Your driver’s license can be suspended for up to 90 days.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You may be required to pay court costs if you are found guilty of driving without insurance.

- Higher Insurance Premiums: After you obtain insurance, your premiums may be higher due to your driving record.

Liability Coverage

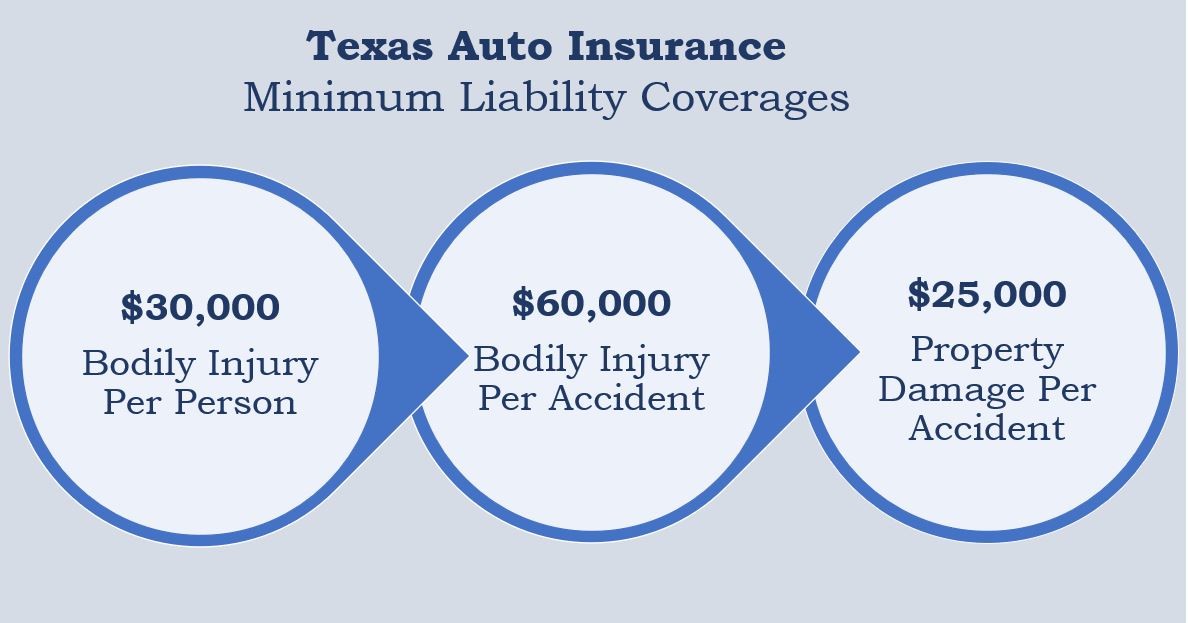

Liability coverage is an essential part of any auto insurance policy. It helps protect you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. In Washington State, liability coverage is mandatory for all drivers.

Liability coverage works by paying for the costs associated with an accident, such as medical bills, property damage, and lost wages. It also helps to cover legal fees if you are sued as a result of the accident.

Situations Where Liability Coverage is Needed

Liability coverage can be crucial in various situations. Here are some examples:

- You cause an accident that results in injuries to another driver or passenger. Liability coverage would help pay for their medical expenses, lost wages, and other related costs.

- You hit a parked car and cause damage. Liability coverage would cover the cost of repairs to the other vehicle.

- You are driving and cause an accident that results in property damage, such as damage to a fence or building. Liability coverage would help pay for the repairs or replacement of the damaged property.

- You are involved in an accident where someone accuses you of negligence, even if you were not at fault. Liability coverage can help defend you against these claims.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is a crucial component of auto insurance in Washington State. It safeguards drivers and passengers from financial burdens arising from accidents involving drivers who lack sufficient insurance or are uninsured altogether. This coverage provides financial protection when the other driver’s insurance is inadequate to cover your losses, ensuring that you can receive compensation for injuries, medical expenses, and property damage.

How UM/UIM Coverage Protects Drivers

UM/UIM coverage functions as a safety net for drivers involved in accidents with uninsured or underinsured motorists. When the at-fault driver lacks sufficient insurance to cover your losses, your UM/UIM coverage steps in to compensate you for:

- Medical expenses: Covers medical bills related to injuries sustained in the accident, including hospital stays, doctor visits, and rehabilitation.

- Lost wages: Compensates for income lost due to the inability to work after the accident.

- Pain and suffering: Provides financial compensation for the emotional and physical distress caused by the accident.

- Property damage: Covers damage to your vehicle or other property resulting from the accident.

Scenarios Where UM/UIM Coverage is Crucial

- Hit-and-run accidents: In cases where the at-fault driver flees the scene, leaving no information or insurance details, UM/UIM coverage is vital.

- Accidents with drivers who are uninsured: If the at-fault driver has no insurance at all, your UM/UIM coverage will be your primary source of compensation.

- Accidents with underinsured drivers: If the at-fault driver’s insurance policy has insufficient coverage to cover your losses, your UM/UIM coverage will fill the gap.

- Accidents involving drivers with out-of-state insurance: Even if the at-fault driver has insurance in another state, their coverage might not be sufficient to cover your losses in Washington State. UM/UIM coverage can protect you in such scenarios.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage is a crucial component of auto insurance in Washington State, designed to protect you and your passengers in the event of an accident, regardless of who is at fault.

Benefits of PIP Coverage

PIP coverage provides financial assistance for various expenses related to injuries sustained in an accident.

- Medical Expenses: PIP coverage helps pay for necessary medical treatment, including doctor’s visits, hospital stays, surgeries, and rehabilitation. This ensures that you receive the medical care you need without worrying about the financial burden.

- Lost Wages: If you are unable to work due to your injuries, PIP coverage can provide income replacement to help cover your lost wages. This financial support ensures that you can maintain your financial stability while recovering.

Examples of PIP Coverage Assistance

Here are a few scenarios illustrating how PIP coverage can be a lifeline in accident recovery:

- Scenario 1: A driver sustains a broken leg and requires surgery after a car accident. PIP coverage helps cover the costs of their medical treatment, including doctor’s visits, hospital stays, and rehabilitation.

- Scenario 2: A passenger in an accident suffers a concussion and needs to take time off work to recover. PIP coverage provides financial assistance to cover their lost wages during this period.

Other Optional Auto Insurance Coverages

In addition to the minimum insurance requirements, you can choose to purchase additional optional coverage for your vehicle. These coverages can provide greater financial protection in case of an accident or other unforeseen events.

Collision Coverage

Collision coverage protects you from financial loss if your vehicle is damaged in an accident, regardless of who is at fault. This coverage will pay for repairs or replacement of your vehicle, minus your deductible.

- Benefits: Collision coverage can help you avoid significant out-of-pocket expenses for repairs or replacement of your vehicle, even if you are at fault for the accident.

- Limitations: Collision coverage usually has a deductible, which is the amount you are responsible for paying before your insurance kicks in. The deductible amount can vary depending on your policy. Additionally, collision coverage may not cover damage caused by certain events, such as wear and tear, flood, or earthquake.

- Example: If you are involved in an accident and your vehicle is totaled, collision coverage will pay for the replacement value of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects you from financial loss if your vehicle is damaged by events other than an accident, such as theft, vandalism, fire, hail, or flood. This coverage will pay for repairs or replacement of your vehicle, minus your deductible.

- Benefits: Comprehensive coverage can provide peace of mind knowing that your vehicle is protected from a variety of risks.

- Limitations: Comprehensive coverage usually has a deductible, which is the amount you are responsible for paying before your insurance kicks in. The deductible amount can vary depending on your policy. Additionally, comprehensive coverage may not cover damage caused by certain events, such as wear and tear or mechanical failure.

- Example: If your vehicle is stolen, comprehensive coverage will pay for the replacement value of your vehicle, minus your deductible.

Rental Reimbursement Coverage

Rental reimbursement coverage helps cover the cost of renting a vehicle while your car is being repaired after an accident or other covered event. This coverage can be helpful if you rely on your vehicle for transportation and need to rent a car while yours is being repaired.

- Benefits: Rental reimbursement coverage can help you avoid the inconvenience and expense of having to rely on public transportation or other forms of transportation while your vehicle is being repaired.

- Limitations: Rental reimbursement coverage usually has a daily or weekly limit on the amount of rental reimbursement you can receive. The limit can vary depending on your policy. Additionally, rental reimbursement coverage may not cover all types of rental vehicles, such as luxury or specialty vehicles.

- Example: If your vehicle is damaged in an accident and you need to rent a car while it is being repaired, rental reimbursement coverage can help cover the cost of the rental car, up to the policy limit.

Obtaining and Maintaining Auto Insurance

In Washington State, obtaining auto insurance is a straightforward process. You’ll need to contact insurance companies, provide them with information about yourself and your vehicle, and choose the coverage options that best suit your needs.

Factors Influencing Auto Insurance Premiums

Your auto insurance premiums are determined by several factors. Understanding these factors can help you make informed decisions about your insurance policy.

- Driving History: Your driving record plays a significant role in determining your premium. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

- Age: Younger drivers, particularly those under 25, often face higher premiums due to their statistically higher risk of accidents. As you age and gain experience, your premiums may decrease.

- Vehicle Type: The type of vehicle you drive also influences your premium. High-performance cars or expensive vehicles are often associated with higher repair costs, leading to higher insurance premiums.

- Location: Your location can affect your premiums. Areas with high traffic density or a higher incidence of accidents may have higher insurance rates.

- Credit Score: In some states, including Washington, insurance companies may use your credit score as a factor in determining your premiums. A good credit score can potentially lead to lower rates.

Maintaining Adequate Auto Insurance Coverage

Once you have obtained auto insurance, it’s crucial to maintain adequate coverage. This ensures you are financially protected in the event of an accident or other covered event.

- Review Your Policy Regularly: It’s a good practice to review your policy annually to ensure it still meets your needs. Your circumstances may change, such as a new vehicle, a change in driving habits, or a change in your financial situation. These changes could affect your insurance requirements and premiums.

- Shop Around for Better Rates: Don’t be afraid to compare quotes from different insurance companies. You may be able to find a more affordable policy with comparable coverage.

- Maintain a Good Driving Record: A clean driving record is essential for maintaining low premiums. Avoid speeding, driving under the influence, or engaging in other risky driving behaviors.

- Consider Discounts: Many insurance companies offer discounts for various factors, such as good student discounts, safe driver discounts, or multi-policy discounts. Ask your insurer about available discounts to potentially lower your premiums.

Summary

Driving in Washington State requires understanding and adhering to the minimum auto insurance requirements. It is crucial to ensure you have the appropriate coverage to protect yourself and others on the road. Remember to review your insurance policy regularly to ensure it meets your needs and that you are aware of the coverage amounts.

Top FAQs: Washington State Minimum Auto Insurance Requirements

How much liability coverage is required in Washington State?

The minimum liability coverage required in Washington State is $25,000 per person for bodily injury and $50,000 per accident for bodily injury, and $10,000 for property damage.

What is uninsured/underinsured motorist coverage and why is it important?

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. This coverage can help pay for your medical expenses, lost wages, and property damage.

What are the penalties for driving without minimum auto insurance in Washington State?

Penalties for driving without minimum auto insurance in Washington State can include fines, license suspension, and even jail time.

How can I obtain auto insurance in Washington State?

You can obtain auto insurance in Washington State by contacting an insurance agent or broker. You can also compare quotes online.

What factors influence auto insurance premiums?

Factors that influence auto insurance premiums include your driving history, age, vehicle type, and location.