Washington State Liability Insurance is crucial for businesses and individuals alike, providing financial protection against lawsuits and claims arising from accidents, injuries, or property damage. It acts as a safety net, shielding you from potentially devastating financial consequences and allowing you to focus on your endeavors with peace of mind.

This guide delves into the intricacies of Washington State liability insurance, covering essential aspects like different types, legal requirements, premium factors, claims processes, and valuable resources. Understanding these aspects will empower you to make informed decisions and secure adequate coverage for your specific needs.

Types of Liability Insurance in Washington State

Liability insurance is crucial for individuals and businesses in Washington State to protect them from financial losses arising from claims of negligence or wrongdoing. It covers legal expenses and potential damages awarded in lawsuits.

General Liability Insurance

General liability insurance is a broad form of coverage that protects businesses and individuals from various types of liability claims.

- Coverage Details: This insurance covers legal expenses and damages resulting from bodily injury, property damage, personal injury, and advertising injury caused by the insured’s negligence or actions.

- Industries/Individuals: General liability insurance is essential for a wide range of industries, including retail, manufacturing, construction, and service providers. It is also recommended for individuals involved in activities that pose potential liability risks, such as home-based businesses or property owners.

- Key Exclusions: Common exclusions include intentional acts, professional services, products, and automobiles.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from claims arising from negligent acts, errors, or omissions in their professional services.

- Coverage Details: This insurance covers legal expenses and damages resulting from professional negligence, such as providing incorrect advice, failing to meet industry standards, or breaching a contract.

- Industries/Individuals: Professional liability insurance is essential for professionals in fields like healthcare, law, accounting, consulting, and financial advising.

- Key Exclusions: Common exclusions include intentional acts, criminal acts, and claims arising from services outside the professional’s scope of practice.

Product Liability Insurance

Product liability insurance protects manufacturers, distributors, and retailers from claims arising from defective products that cause injury or damage.

- Coverage Details: This insurance covers legal expenses and damages resulting from product defects, including design flaws, manufacturing errors, or inadequate warnings.

- Industries/Individuals: Product liability insurance is crucial for businesses involved in the manufacturing, distribution, and sale of products, such as food and beverage companies, electronics manufacturers, and clothing retailers.

- Key Exclusions: Common exclusions include intentional acts, products not manufactured by the insured, and claims arising from product misuse.

Auto Liability Insurance

Auto liability insurance is mandatory in Washington State and covers damages and injuries caused by the insured’s vehicle to others.

- Coverage Details: This insurance covers legal expenses and damages resulting from accidents involving the insured’s vehicle, including bodily injury, property damage, and medical expenses incurred by the other party.

- Industries/Individuals: Auto liability insurance is mandatory for all vehicle owners in Washington State. It is essential for individuals, businesses, and organizations that operate vehicles.

- Key Exclusions: Common exclusions include intentional acts, damages to the insured’s vehicle, and injuries to the insured driver.

Washington State Liability Insurance Requirements

Washington State has specific liability insurance requirements for businesses and individuals, designed to protect people from financial harm caused by accidents or negligence. These requirements ensure that victims have access to compensation for injuries or damages, promoting fairness and responsibility within the state.

Minimum Liability Insurance Requirements for Businesses

Businesses in Washington State are generally required to carry liability insurance to cover potential risks associated with their operations. This insurance protects businesses from financial losses arising from lawsuits, claims, or legal actions stemming from injuries or property damage caused by their activities.

- General Liability Insurance: Most businesses in Washington State need general liability insurance, which provides coverage for bodily injury, property damage, and personal injury claims. It covers incidents like slip and falls on business property, product defects causing injury, or advertising errors leading to financial harm. The minimum coverage amounts for general liability insurance can vary depending on the specific industry and business size. However, it’s generally recommended to have at least $1 million in coverage for each occurrence and $2 million in aggregate coverage per policy year.

- Commercial Auto Insurance: Businesses operating vehicles for their business activities need commercial auto insurance. This coverage protects the business from financial liability arising from accidents involving their vehicles. The minimum coverage amounts for commercial auto insurance are determined by the type of vehicle used and the nature of the business. The minimum coverage requirements for commercial auto insurance in Washington State include:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $10,000 per accident.

- Workers’ Compensation Insurance: Businesses with employees are required to carry workers’ compensation insurance. This insurance covers medical expenses, lost wages, and other benefits for employees injured on the job. The minimum coverage amounts for workers’ compensation insurance are set by the Washington State Department of Labor & Industries (L&I).

Minimum Liability Insurance Requirements for Individuals

Individuals in Washington State also need to carry liability insurance, particularly for vehicle ownership and certain recreational activities.

- Auto Insurance: All vehicle owners in Washington State are required to carry liability insurance. The minimum coverage amounts for auto insurance include:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $10,000 per accident.

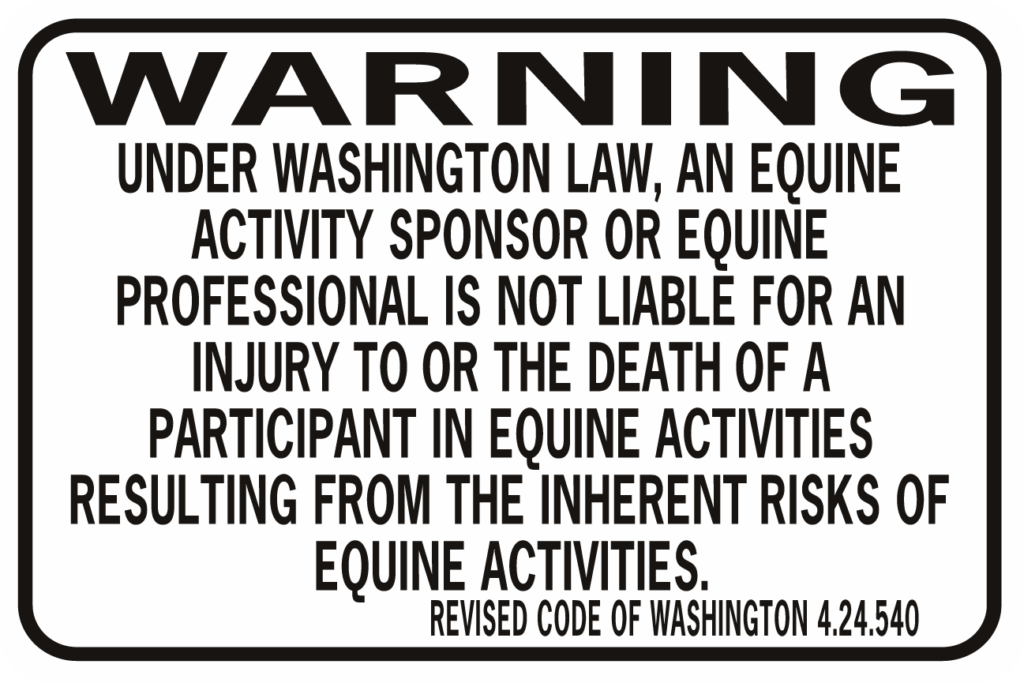

- Recreational Activities: Certain recreational activities, such as boating or operating a personal watercraft, may require specific liability insurance coverage. The minimum coverage amounts for recreational liability insurance can vary depending on the activity and the type of watercraft involved. It’s essential to check with the Washington State Department of Natural Resources for specific requirements.

Consequences of Operating Without Adequate Liability Insurance

Operating a business or engaging in activities without adequate liability insurance can have severe financial consequences. If you are found liable for an accident or injury, you could be held personally responsible for all damages and legal fees, potentially leading to significant financial losses, including:

- High Legal Costs: Defending yourself in a lawsuit can be very expensive, even if you are not ultimately found liable. Legal fees, court costs, and expert witness fees can quickly add up.

- Large Damage Awards: If you are found liable, you could be ordered to pay significant damages to the injured party, including medical expenses, lost wages, pain and suffering, and property damage.

- Business Closure: For businesses, a large liability claim could result in bankruptcy or forced closure, especially if they lack the financial resources to cover the damages.

- Personal Assets at Risk: Without adequate liability insurance, your personal assets, such as your home, savings, and investments, could be at risk if you are sued and found liable.

Industries with Additional Liability Insurance Requirements

Certain industries in Washington State have additional liability insurance requirements beyond the general standards. These requirements are tailored to the specific risks associated with their operations. Some examples include:

- Healthcare: Healthcare providers, including hospitals, clinics, and doctors, are required to carry medical malpractice insurance to protect themselves from lawsuits arising from medical errors or negligence.

- Construction: Construction companies are often required to carry higher limits of liability insurance due to the inherent risks involved in construction projects, such as falls from heights, heavy equipment accidents, and hazardous materials exposure.

- Transportation: Transportation companies, including trucking firms, taxi services, and ride-sharing companies, need to carry commercial auto insurance with higher coverage limits to protect themselves from liability claims arising from accidents involving their vehicles.

- Financial Services: Financial institutions, including banks, credit unions, and investment firms, may be required to carry specific types of liability insurance to protect themselves from claims related to fraud, negligence, or breach of fiduciary duty.

Factors Affecting Washington State Liability Insurance Premiums

Several factors influence the cost of liability insurance in Washington State, impacting the premiums you pay. Understanding these factors can help you navigate the insurance market effectively and find the best coverage at a competitive price.

Business Size

The size of your business plays a significant role in determining your liability insurance premiums. Larger businesses generally face higher premiums due to increased potential for liability claims. For example, a large construction company with numerous employees and projects is likely to have a higher premium than a small home-based business.

Industry

The industry in which you operate also impacts your premiums. Some industries, like construction, manufacturing, and healthcare, are considered high-risk due to the inherent nature of their operations. These industries may have higher premiums to reflect the increased likelihood of accidents and potential liability claims.

Claims History

Your past claims history is a major factor influencing your premiums. If you have a history of frequent or significant claims, your premiums will likely be higher. Conversely, a clean claims history can lead to lower premiums as insurers view you as a lower risk.

Location

Your business location can affect your premiums. Areas with high crime rates, congested traffic, or natural disaster risks may have higher premiums due to the increased likelihood of accidents and claims.

Coverage Limits

The amount of coverage you choose will also affect your premiums. Higher coverage limits, which provide greater financial protection in case of a claim, will typically result in higher premiums.

Premium Differences Between Insurance Providers

Insurance providers in Washington State offer varying premiums for similar coverage. Comparing quotes from multiple insurers can help you find the best value for your needs. Factors such as company size, financial stability, and customer service can influence premium differences.

Risk Management Strategies

Implementing effective risk management strategies can significantly impact your liability insurance premiums. By reducing the likelihood of accidents and claims, you can demonstrate to insurers that you are a lower risk, potentially leading to lower premiums. Some risk management strategies include:

- Employee training programs to minimize workplace accidents

- Regular safety inspections and maintenance of equipment

- Implementing comprehensive security measures to prevent theft or vandalism

- Developing clear policies and procedures to minimize liability risks

Liability Insurance Claims Process in Washington State

Filing a liability insurance claim in Washington State can be a complex process, but understanding the steps involved can help you navigate it effectively. This section Artikels the process from reporting the incident to receiving compensation.

Reporting the Incident

It is crucial to report the incident to your insurance company promptly. This step initiates the claims process and allows the insurer to start investigating the claim.

- Contact your insurance company as soon as possible after the incident.

- Provide accurate details about the incident, including the date, time, location, and parties involved.

- Document the incident thoroughly, including taking photographs or videos if possible.

- Obtain contact information from any witnesses.

Investigation and Evaluation

After you report the incident, your insurance company will begin investigating the claim.

- The insurer will gather information from all parties involved, including witnesses, police reports, and medical records.

- They will assess the validity of the claim and determine the extent of your liability.

- The insurer will evaluate the damages and determine the amount of compensation you are entitled to.

Negotiation and Settlement

Once the investigation is complete, your insurance company will present you with a settlement offer.

- You have the right to negotiate the settlement offer.

- If you are not satisfied with the offer, you can appeal the decision.

- It is recommended to consult with an attorney to understand your rights and options.

Common Reasons for Claim Denial, Washington state liability insurance

There are several reasons why a liability insurance claim might be denied.

- Lack of Coverage: The incident may not be covered under your policy.

- Exclusions: Your policy may have exclusions that prevent coverage for certain types of incidents.

- Fraudulent Claim: If the insurer determines that the claim is fraudulent, it will be denied.

- Failure to Meet Policy Requirements: Failing to comply with the terms and conditions of your policy can lead to claim denial.

Appeals Process

If your claim is denied, you have the right to appeal the decision.

- You will need to submit a written appeal to your insurance company.

- The appeal should include evidence supporting your claim.

- The insurer will review the appeal and make a final decision.

Navigating the Claims Process Effectively

Here are some tips for navigating the claims process effectively:

- Be Prompt: Report the incident to your insurance company as soon as possible.

- Be Accurate: Provide accurate information about the incident.

- Be Organized: Keep all documentation related to the claim organized.

- Be Patient: The claims process can take time.

- Seek Professional Help: If you are having difficulty navigating the claims process, consider seeking help from an attorney.

Resources for Washington State Liability Insurance

Finding the right liability insurance in Washington State can be a daunting task, but it doesn’t have to be. This section provides resources and guidance to help you navigate the process and secure the appropriate coverage for your needs.

Reputable Insurance Providers in Washington State

Here’s a list of reputable insurance providers in Washington State specializing in liability insurance:

- State Farm: Known for its wide range of insurance products, including liability coverage for individuals and businesses. They have a strong network of agents throughout Washington State.

- Allstate: Another major insurance provider offering liability insurance for various needs, including homeowners, renters, and businesses. They have a strong reputation for customer service.

- Farmers Insurance: Offers comprehensive liability insurance options, including personal and commercial coverage, tailored to meet specific needs. They have a strong presence in Washington State.

- Liberty Mutual: A national insurer with a strong focus on liability insurance, providing coverage for individuals, businesses, and commercial vehicles. They have a robust online presence and customer support.

- GEICO: Known for its competitive rates and convenient online services, GEICO offers a range of liability insurance options, including auto, homeowners, and renters insurance.

Official Resources

The Washington State Department of Insurance and other relevant organizations provide valuable resources for understanding and obtaining liability insurance.

- Washington State Department of Insurance: The official source for information on insurance regulations, consumer protection, and complaint resolution in Washington State. You can find guidance on liability insurance requirements, consumer rights, and resources for filing complaints. [https://www.insurance.wa.gov/](https://www.insurance.wa.gov/)

- National Association of Insurance Commissioners (NAIC): A national organization that provides resources and information on insurance regulations and consumer protection across the United States. You can find information on liability insurance standards, consumer rights, and resources for filing complaints. [https://www.naic.org/](https://www.naic.org/)

Insurance Provider Comparison Table

Here’s a table comparing some key features of different insurance providers, to help you make an informed decision:

| Insurance Provider | Contact Information | Coverage Specialties | Customer Reviews |

|---|---|---|---|

| State Farm | 1-800-STATE-FARM (1-800-782-8332) | Homeowners, Renters, Auto, Business, Umbrella | Generally positive, with high ratings for customer service and claims handling. |

| Allstate | 1-800-ALLSTATE (1-800-255-7828) | Homeowners, Renters, Auto, Business, Umbrella | Mixed reviews, with some praising their customer service while others report issues with claims handling. |

| Farmers Insurance | 1-800-FARMERS (1-800-327-6377) | Homeowners, Renters, Auto, Business, Umbrella | Generally positive, with strong ratings for their local agent network and personalized service. |

| Liberty Mutual | 1-800-225-2464 | Homeowners, Renters, Auto, Business, Umbrella | Mixed reviews, with some praising their comprehensive coverage options while others report difficulties with claims processing. |

| GEICO | 1-800-432-5566 | Auto, Homeowners, Renters, Motorcycle, Boat | Generally positive, with high ratings for their competitive rates and online convenience. |

Final Wrap-Up

Navigating the world of liability insurance in Washington State can seem daunting, but with the right knowledge and resources, it becomes manageable. By understanding the different types of coverage, legal requirements, and factors influencing premiums, you can make informed choices that protect your assets and future. Remember, seeking professional advice from a reputable insurance provider is essential to ensure you have the right coverage tailored to your specific circumstances.

Expert Answers: Washington State Liability Insurance

What are the consequences of operating without liability insurance in Washington State?

Operating without adequate liability insurance in Washington State can lead to severe financial repercussions. If you’re found liable for damages, you could be personally responsible for paying out-of-pocket for legal fees, medical expenses, property repairs, and other costs associated with the incident. This could potentially bankrupt you, especially if you’re facing a significant claim. Additionally, you may face legal penalties, fines, and even license revocation, depending on the nature of the incident and industry.

How can I find a reputable insurance provider in Washington State?

Finding a reputable insurance provider in Washington State requires careful research and consideration. You can start by checking online directories, reading customer reviews, and contacting the Washington State Department of Insurance for recommendations. Additionally, seek referrals from trusted sources like friends, family, or business associates. It’s also advisable to compare quotes from multiple providers to find the best coverage at a competitive price.