Washington State car insurance is a crucial aspect of responsible driving, ensuring financial protection in case of accidents. Understanding the state’s requirements, factors influencing rates, and available discounts can help drivers make informed decisions and secure the best coverage at a reasonable price.

This guide delves into the complexities of Washington State car insurance, covering everything from mandatory coverage to top providers and tips for saving money. Whether you’re a new driver or a seasoned veteran, this comprehensive resource will empower you to navigate the insurance landscape with confidence.

Washington State Car Insurance Overview

Washington State has a competitive car insurance market, with numerous insurance companies vying for customers. Understanding the state’s requirements and market dynamics is crucial for securing the best coverage at a reasonable price.

Mandatory Car Insurance Coverage Requirements

Washington State law mandates that all drivers carry specific car insurance coverage to protect themselves and others in the event of an accident. These mandatory coverages include:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It includes bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage.

- Financial Responsibility Coverage: This coverage ensures you have sufficient financial resources to cover the costs associated with an accident, such as medical bills, property damage, and legal fees.

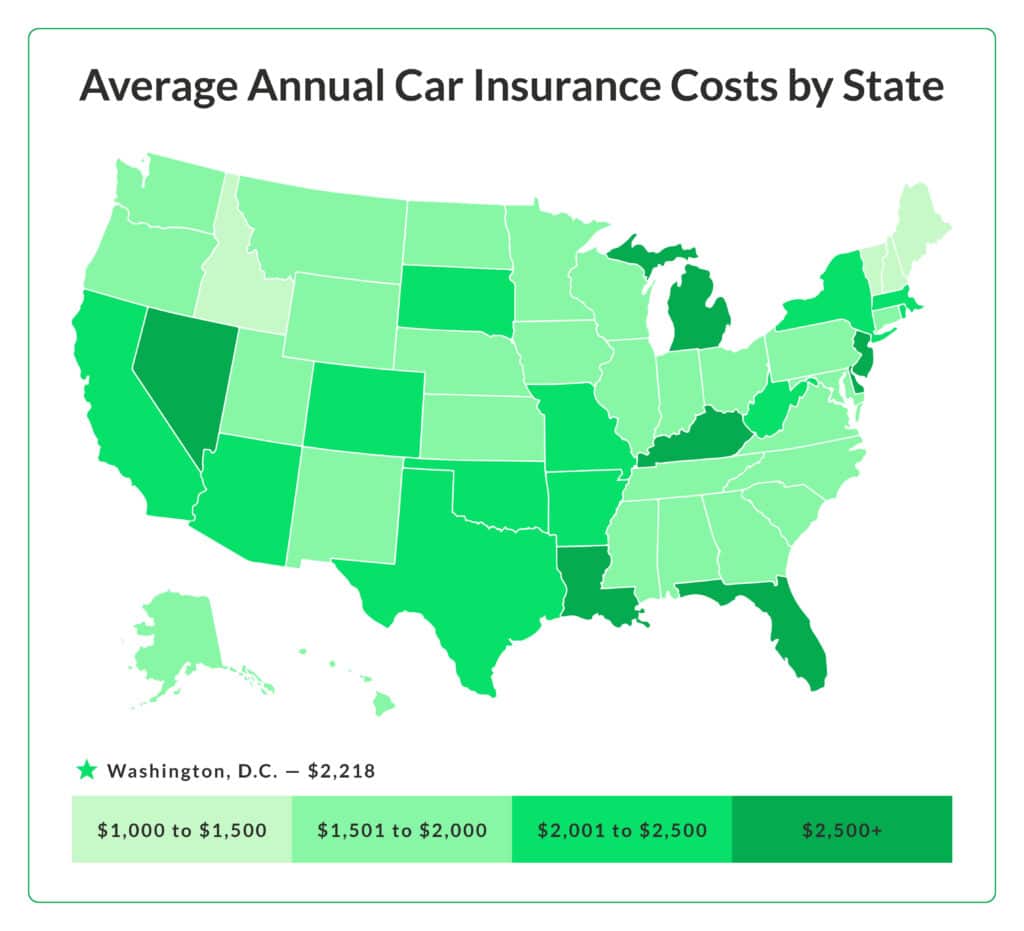

Average Cost of Car Insurance in Washington State

The average cost of car insurance in Washington State can vary significantly depending on several factors, including:

- Driving History: Drivers with a clean driving record generally pay lower premiums than those with a history of accidents or traffic violations.

- Age and Gender: Younger drivers, especially males, often face higher premiums due to their increased risk of accidents.

- Vehicle Type and Value: The make, model, year, and value of your vehicle can influence the cost of insurance. More expensive and high-performance vehicles typically attract higher premiums.

- Location: Insurance rates can vary depending on the location of your residence, as certain areas may have higher rates of accidents or theft.

The average cost of car insurance in Washington State is estimated to be around $1,500 per year. However, this figure can fluctuate significantly depending on the individual factors mentioned above.

Factors Influencing Car Insurance Rates in Washington State

Car insurance rates in Washington State, like in other states, are determined by a variety of factors that assess your risk as a driver. Insurance companies use these factors to calculate premiums, ensuring that those who are more likely to file claims pay higher rates.

Driving History

Your driving history plays a significant role in determining your car insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Accidents: Each accident, regardless of fault, can lead to a rate increase. The severity of the accident, such as the number of vehicles involved or injuries sustained, can further impact your premiums.

- Traffic Violations: Even minor violations like speeding tickets can affect your rates. Multiple violations or more serious offenses like reckless driving can result in much higher premiums.

- DUI Convictions: A DUI conviction can have a severe impact on your insurance rates, potentially leading to a significant increase or even cancellation of your policy.

Age

Your age is another crucial factor that influences your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher premiums.

- Teen Drivers: Teen drivers typically pay the highest premiums due to their lack of experience and higher risk of accidents. However, some insurance companies offer discounts for good grades or driver’s education courses.

- Mature Drivers: Drivers over 65 often enjoy lower premiums because they have more experience and are statistically less likely to be involved in accidents.

Vehicle Type

The type of vehicle you drive also impacts your car insurance rates.

- Expensive Cars: Luxury or high-performance vehicles tend to have higher insurance rates due to their higher repair costs and potential for theft.

- Safety Features: Cars equipped with safety features like anti-lock brakes, airbags, and stability control can qualify for discounts, reducing your insurance premiums.

Credit Score

In Washington State, insurance companies can use your credit score to determine your car insurance rates. This practice is based on the correlation between credit history and driving behavior. Individuals with good credit scores tend to be more responsible and have a lower risk of filing claims.

- Impact of Credit Score: A higher credit score can lead to lower insurance premiums, while a lower credit score can result in higher rates.

- Credit Score and Insurance: It’s important to note that credit score is only one factor among many considered by insurance companies. Other factors, such as driving history and age, also play a significant role in determining your rates.

Location

Your location, including your zip code and the city or county you reside in, can influence your car insurance rates. Insurance companies consider the risk of accidents and theft in different areas.

- Urban vs. Rural: Urban areas with high traffic density and congestion tend to have higher insurance rates due to a greater risk of accidents.

- Crime Rates: Areas with higher crime rates, particularly car theft, may also have higher insurance premiums.

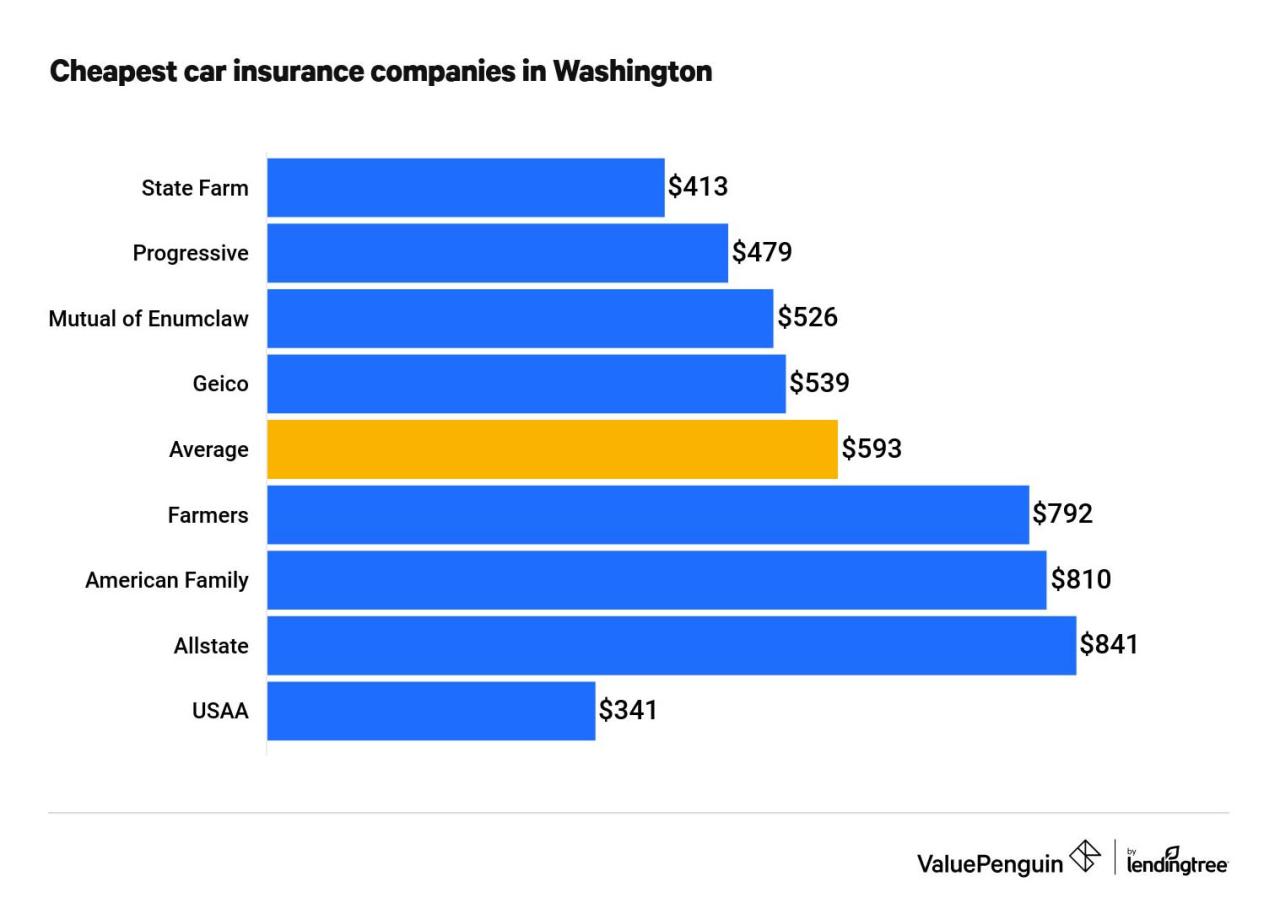

Top Car Insurance Providers in Washington State

Choosing the right car insurance provider is crucial for ensuring you have adequate coverage at a reasonable price. Washington State boasts a diverse range of insurance companies, each offering unique features and benefits. Understanding the top providers and their offerings can help you make an informed decision.

Leading Car Insurance Providers in Washington State

Here are some of the leading car insurance companies operating in Washington State:

- State Farm

- Geico

- Progressive

- USAA

- Liberty Mutual

- Farmers Insurance

- Allstate

- Nationwide

- American Family Insurance

Comparison of Key Features and Customer Service Ratings

This table provides a comparison of key features, coverage options, and customer service ratings for some of the top providers in Washington State.

| Provider | Key Features | Coverage Options | Customer Service Rating (J.D. Power) |

|---|---|---|---|

| State Farm | Wide range of coverage options, strong financial stability, extensive agent network | Liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection, rental car reimbursement | 4 out of 5 stars |

| Geico | Competitive rates, easy online and mobile access, 24/7 customer service | Liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection, rental car reimbursement | 3.5 out of 5 stars |

| Progressive | Innovative features like Name Your Price tool, customizable coverage options, strong online presence | Liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection, rental car reimbursement | 3 out of 5 stars |

| USAA | Exclusive service for military members and their families, strong financial stability, excellent customer service | Liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection, rental car reimbursement | 4.5 out of 5 stars |

| Liberty Mutual | Wide range of discounts, strong financial stability, comprehensive coverage options | Liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection, rental car reimbursement | 3.5 out of 5 stars |

Average Premiums for Different Coverage Levels

The average premiums for different coverage levels can vary significantly depending on factors such as your driving history, vehicle type, and location. Here’s a comparison of average premiums for leading insurers in Washington State:

| Provider | Liability Only (Minimum Coverage) | Full Coverage |

|---|---|---|

| State Farm | $700 – $800 | $1,500 – $1,700 |

| Geico | $650 – $750 | $1,400 – $1,600 |

| Progressive | $600 – $700 | $1,300 – $1,500 |

| USAA | $550 – $650 | $1,200 – $1,400 |

| Liberty Mutual | $750 – $850 | $1,600 – $1,800 |

Note: These premiums are estimates and may vary based on individual circumstances. It’s essential to get personalized quotes from multiple insurers to compare rates effectively.

Car Insurance Discounts Available in Washington State: Washington State Car Insurance

Car insurance discounts are a great way to save money on your premiums. Many different discounts are available in Washington State, and they can significantly reduce your overall cost.

Discounts for Safe Driving

Safe drivers are rewarded with lower premiums. Here are some of the most common discounts:

- Good Driver Discount: This discount is offered to drivers with a clean driving record, meaning no accidents or traffic violations for a certain period. The discount amount varies depending on the insurance company and your driving history.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can earn you a discount. These courses teach safe driving techniques and can help you avoid accidents.

- Accident-Free Discount: If you haven’t had an accident in a specific number of years, you may qualify for this discount.

Discounts for Good Student Records

Insurance companies recognize that good students tend to be responsible drivers.

- Good Student Discount: This discount is available to students with a certain GPA or who are enrolled in a college or university.

Discounts for Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in significant savings.

- Multi-Policy Discount: This discount is offered when you purchase multiple insurance policies from the same company.

Discounts for Anti-Theft Devices, Washington state car insurance

Having anti-theft devices installed in your vehicle can deter theft and lower your insurance premiums.

- Anti-Theft Device Discount: This discount is available for vehicles equipped with anti-theft devices such as alarms, immobilizers, or tracking systems.

Discounts for Vehicle Safety Features

Vehicles with safety features are generally considered safer, leading to lower insurance premiums.

- Safety Feature Discount: This discount is available for vehicles equipped with safety features such as airbags, anti-lock brakes, and electronic stability control.

Discounts for Driver Training Programs

Taking a driver training program can demonstrate your commitment to safe driving and may qualify you for a discount.

- Driver Training Discount: This discount is available for drivers who have completed a recognized driver training program.

Understanding Car Insurance Policies in Washington State

Choosing the right car insurance policy in Washington State involves understanding the different types of coverage available and their benefits. This section will delve into the specifics of each policy type, outlining their coverage limits and the protection they provide.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance in Washington State. It protects you financially if you are found at fault in an accident that causes injury or damage to another person or their property.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries you cause to another person in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement costs of another person’s vehicle or property that you damage in an accident.

Washington State requires all drivers to carry a minimum amount of liability coverage:

| Coverage Type | Minimum Coverage Limit |

|---|---|

| Bodily Injury Liability per person | $25,000 |

| Bodily Injury Liability per accident | $50,000 |

| Property Damage Liability | $10,000 |

While meeting the minimum requirements is essential, it’s crucial to consider higher coverage limits to safeguard yourself against significant financial burdens in the event of a serious accident.

Collision Coverage

Collision coverage is an optional coverage that protects you against financial losses when your vehicle is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement costs, minus your deductible.

Collision coverage is often recommended for newer vehicles, as it can help offset the cost of repairs or replacement in the event of an accident.

Comprehensive Coverage

Comprehensive coverage is another optional coverage that protects you against damage to your vehicle caused by events other than accidents. This includes incidents like theft, vandalism, fire, hail, and natural disasters.

Comprehensive coverage is particularly beneficial if your vehicle is financed or leased, as it can help ensure you are not responsible for the entire cost of repairs or replacement if your vehicle is damaged due to events outside of your control.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you are involved in an accident with a driver who is either uninsured or has insufficient insurance to cover your losses.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance.

- Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has insurance, but their coverage limits are not enough to cover your losses.

This coverage is essential, as it can help cover medical expenses, lost wages, and other damages resulting from an accident caused by an uninsured or underinsured driver.

Tips for Saving on Car Insurance in Washington State

Car insurance in Washington State can be expensive, but there are several ways to reduce your premiums. By following some simple tips, you can save money on your car insurance without sacrificing coverage.

Comparing Quotes From Multiple Insurers

It is crucial to compare quotes from multiple insurers to find the best rates. Each insurer uses its own formula to calculate premiums, which can lead to significant differences in pricing. You can easily compare quotes online using comparison websites or by contacting insurers directly.

Maintaining a Good Driving Record

Your driving record is one of the most significant factors influencing your car insurance premiums. Maintaining a clean driving record is essential for keeping your rates low. Avoid traffic violations, accidents, and other driving offenses. By demonstrating responsible driving habits, you can significantly reduce your insurance costs.

Taking Advantage of Available Discounts

Many car insurance companies offer discounts to their policyholders. Some common discounts include:

- Good student discount: This discount is available to students who maintain a certain GPA.

- Safe driver discount: This discount is awarded to drivers with a clean driving record.

- Multi-car discount: This discount is offered to policyholders who insure multiple vehicles with the same insurer.

- Loyalty discount: This discount is given to long-term policyholders.

- Bundling discount: This discount is offered to policyholders who bundle their car insurance with other insurance products, such as homeowners or renters insurance.

Choosing a Higher Deductible

A deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium. However, you should only do this if you can afford to pay the higher deductible in case of an accident.

Making Your Car Less Risky to Insure

Some features make your car more expensive to insure. You can reduce your premiums by making your car less risky. For example, consider:

- Installing anti-theft devices: Anti-theft devices can deter theft and lower your insurance premiums.

- Choosing a car with safety features: Cars with safety features, such as airbags and anti-lock brakes, are generally less expensive to insure.

- Parking in a garage: Parking your car in a garage can reduce the risk of theft and damage, leading to lower premiums.

Negotiating Your Premium

Don’t be afraid to negotiate your car insurance premium. Contact your insurer and explain your situation. You may be able to get a lower rate if you can demonstrate that you are a responsible driver with a good driving record.

Reviewing Your Policy Regularly

It’s essential to review your car insurance policy regularly to ensure that you are still getting the best rate. Your insurance needs may change over time, so it’s important to adjust your policy accordingly.

Navigating Car Insurance Claims in Washington State

Filing a car insurance claim in Washington State can be a stressful experience, but understanding the process and your rights can help you navigate it smoothly. This guide provides a step-by-step approach to filing a claim, outlining the necessary documentation, timelines, and your responsibilities as a policyholder.

Filing a Car Insurance Claim

Filing a claim begins with reporting the incident to your insurance company. It is important to do this promptly, ideally within 24 hours of the accident. You can usually file a claim online, over the phone, or by visiting your insurance agent.

- Report the Incident: Contact your insurance company immediately after the accident. Provide them with the details of the incident, including the date, time, location, and any injuries involved.

- Gather Information: Collect all relevant information from the other parties involved in the accident. This includes their names, contact information, insurance company details, and license plate numbers. It is also helpful to obtain contact information from any witnesses.

- Document the Incident: Take pictures of the damage to your vehicle, the other vehicles involved, and the accident scene. If possible, obtain a police report. Keep a detailed record of the incident, including a timeline of events and any conversations with the other parties involved.

The Claim Process

Once you have reported the accident, your insurance company will begin the claim process. This typically involves:

- Claim Review: Your insurance company will review your claim and gather any necessary documentation. This may include a police report, medical records, repair estimates, and photos of the damage.

- Investigation: Your insurance company may investigate the claim to verify the details and determine fault. This may involve interviewing witnesses, reviewing security footage, or consulting with experts.

- Negotiation: Once the investigation is complete, your insurance company will negotiate a settlement with you. This may involve paying for repairs, medical bills, or other expenses.

Timelines for Claims

The timeframe for processing a car insurance claim in Washington State can vary depending on the complexity of the claim. However, it is generally expected that:

- Initial Claim Reporting: You should report the accident to your insurance company within 24 hours.

- Claim Review and Investigation: This process can take a few days to a few weeks, depending on the complexity of the claim.

- Negotiation and Settlement: Once the investigation is complete, the negotiation process can take a few days to a few weeks.

Policyholder Rights and Responsibilities

As a policyholder, you have certain rights and responsibilities during the claim process.

- Right to Fair Treatment: You have the right to be treated fairly and respectfully by your insurance company throughout the claim process.

- Right to Information: You have the right to be informed about the status of your claim and the reasons for any decisions made.

- Responsibility to Cooperate: You are responsible for cooperating with your insurance company by providing them with all necessary information and documentation.

- Responsibility to Mitigate Damages: You are responsible for taking reasonable steps to mitigate damages to your vehicle. This may involve securing your vehicle, getting it towed, or making temporary repairs.

Understanding Your Policy

It is crucial to understand the terms and conditions of your car insurance policy before filing a claim. Your policy will Artikel the coverage you have, the deductibles you are responsible for, and the limitations of your coverage.

- Coverage: Your policy will specify the types of coverage you have, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductibles: Your policy will Artikel the amount you are responsible for paying out of pocket before your insurance coverage kicks in.

- Limitations: Your policy will have limitations on coverage, such as maximum payout amounts and exclusions.

Tips for a Smooth Claim Process

To ensure a smooth claim process, consider these tips:

- Be Prepared: Keep your insurance policy handy and familiarize yourself with its terms and conditions.

- Document Everything: Take photos and videos of the accident scene, the damage to your vehicle, and any injuries.

- Be Honest and Accurate: Provide your insurance company with accurate and complete information. Do not embellish or omit details.

- Be Patient: The claim process can take time. Be patient and communicate with your insurance company regularly.

Resources for Car Insurance Consumers in Washington State

Navigating the world of car insurance can be complex, but Washington State provides numerous resources to assist consumers. These resources offer guidance, support, and avenues for addressing insurance-related concerns.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumer rights. These agencies provide valuable information, complaint resolution mechanisms, and oversight of insurance practices.

- Washington State Office of the Insurance Commissioner (OIC): The OIC is the primary regulatory body for insurance in Washington State. It ensures that insurance companies operate fairly and comply with state laws. The OIC provides a wealth of information on car insurance, including consumer guides, FAQs, and complaint filing procedures. You can reach the OIC by phone at (800) 562-6900 or visit their website at [https://www.insurance.wa.gov/](https://www.insurance.wa.gov/).

- Washington State Department of Licensing (DOL): The DOL oversees vehicle registration and licensing in Washington State. While not directly involved in insurance regulation, the DOL provides information on insurance requirements for vehicle registration. You can contact the DOL by phone at (360) 664-6000 or visit their website at [https://www.dol.wa.gov/](https://www.dol.wa.gov/).

Consumer Advocacy Groups

Consumer advocacy groups provide independent support and guidance to consumers facing insurance-related challenges. These organizations offer valuable resources, education, and advocacy on behalf of consumers.

- Washington State Department of Financial Institutions (DFI): The DFI provides consumer protection services, including assistance with insurance complaints. You can contact the DFI by phone at (877) 833-4357 or visit their website at [https://www.dfi.wa.gov/](https://www.dfi.wa.gov/).

- Consumer Federation of America (CFA): The CFA is a national consumer advocacy organization that advocates for consumer rights in various sectors, including insurance. They provide information and resources on car insurance, including consumer guides and tips for navigating the insurance process. You can visit their website at [https://www.consumerfed.org/](https://www.consumerfed.org/).

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. They provide information on insurance issues, including consumer protection resources. You can visit their website at [https://www.naic.org/](https://www.naic.org/).

Insurance Industry Organizations

Insurance industry organizations provide information and resources for consumers and insurance professionals. These organizations often offer consumer guides, educational materials, and industry best practices.

- Insurance Information Institute (III): The III is a non-profit organization that provides information on insurance issues, including car insurance. They offer consumer guides, FAQs, and statistics on insurance trends. You can visit their website at [https://www.iii.org/](https://www.iii.org/).

- American Insurance Association (AIA): The AIA is a trade association that represents the property and casualty insurance industry. They provide information on insurance issues, including consumer protection resources. You can visit their website at [https://www.aiadc.org/](https://www.aiadc.org/).

Filing Complaints

If you have a complaint or dispute with your car insurance company, you have the right to file a complaint with the Washington State Office of the Insurance Commissioner (OIC). The OIC will investigate your complaint and attempt to resolve the issue. You can file a complaint online, by mail, or by phone.

- Online: You can file a complaint online through the OIC’s website at [https://www.insurance.wa.gov/](https://www.insurance.wa.gov/).

- Mail: You can mail a complaint to the OIC at:

Washington State Office of the Insurance Commissioner

PO Box 40250

Olympia, WA 98504-0250 - Phone: You can call the OIC at (800) 562-6900 to file a complaint by phone.

Conclusion

Navigating the world of car insurance can feel overwhelming, but with the right information and resources, it becomes a manageable process. By understanding Washington State’s regulations, comparing quotes, and taking advantage of available discounts, drivers can secure the coverage they need while staying within their budget. Remember, choosing the right car insurance policy is an essential step in responsible driving, ensuring peace of mind and financial security on the road.

Popular Questions

What is the minimum car insurance coverage required in Washington State?

Washington State requires drivers to carry liability insurance, which covers damages to others in case of an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How often can I expect my car insurance rates to change?

Car insurance rates can fluctuate due to various factors, including driving history, age, vehicle type, and location. Insurance companies typically review and adjust rates annually, but they may also make changes more frequently based on individual circumstances.

What are some common discounts available for car insurance in Washington State?

Common discounts include safe driving records, good student records, multiple policy discounts, anti-theft devices, vehicle safety features, and driver training programs.