Washington State auto insurance increase is a topic that has been making headlines recently, as drivers across the state are facing higher premiums. The rising cost of auto insurance is a complex issue with multiple contributing factors, including increased healthcare costs, vehicle repair expenses, and legal settlements. This rise in premiums is impacting drivers of all ages and income levels, raising concerns about the affordability of transportation.

This article will delve into the reasons behind the recent increase in Washington State auto insurance premiums, exploring the impact on drivers and examining potential solutions. We will also discuss the role of state regulations and insurance company practices in shaping auto insurance rates, and offer practical tips and strategies for drivers to manage the impact of rising premiums.

Understanding the Increase

Auto insurance premiums in Washington state have been on the rise in recent years, leaving many drivers wondering why their costs are going up. Several factors contribute to this trend, making it crucial to understand the forces driving the increase in premiums.

Factors Contributing to the Increase

Rising costs for healthcare, vehicle repairs, and legal settlements are key drivers of the increase in auto insurance premiums.

- Healthcare Costs: The cost of treating injuries sustained in car accidents has significantly increased. This rise in medical expenses is directly reflected in higher insurance premiums as insurers need to cover these costs.

- Vehicle Repair Costs: Modern vehicles are increasingly complex, incorporating advanced technology and materials. This complexity leads to higher repair costs, particularly for collision damage. As repair costs rise, insurers need to adjust their premiums to cover these expenses.

- Legal Settlements: The cost of legal settlements in auto accident cases has also risen, impacting insurance premiums. These settlements can be substantial, especially in cases involving serious injuries or wrongful death. Insurers need to factor in these potential costs when setting premiums.

Comparison of Auto Insurance Rates

While auto insurance premiums in Washington state have increased, it’s essential to compare them to other states. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for full coverage auto insurance in Washington state is $2,280. This is higher than the national average of $1,870.

- Factors Affecting Rates: Several factors influence auto insurance rates, including population density, traffic congestion, accident rates, and the cost of living.

- State-Specific Regulations: State-specific regulations, such as minimum coverage requirements and no-fault laws, can also impact insurance rates.

“Washington state has a higher-than-average cost of living, which can contribute to higher auto insurance rates,” says an insurance industry expert.

Impact on Drivers

The increase in auto insurance premiums in Washington state will have a significant impact on drivers, particularly those with lower incomes and those who rely on their vehicles for transportation. The financial burden of higher premiums will vary depending on individual circumstances, such as driving history, vehicle type, and age.

Financial Burden on Drivers

The increase in auto insurance premiums will place a greater financial burden on drivers, especially those who are already struggling to make ends meet. The cost of living in Washington state is high, and many drivers are already facing financial challenges. A significant increase in auto insurance premiums could make it difficult for some drivers to afford other essential expenses, such as housing, food, and healthcare.

Impact on Different Demographic Groups

The impact of increased auto insurance premiums will vary across different demographic groups in Washington state. For example, drivers in low-income communities may be disproportionately affected by the increase, as they may have less financial flexibility to absorb the higher costs. Drivers in rural areas may also be more vulnerable, as they may have fewer transportation options and may rely on their vehicles for work and essential errands.

Impact on Driving Habits and Transportation Choices

The increase in auto insurance premiums could also influence driving habits and transportation choices. Some drivers may reduce their driving, particularly for non-essential trips, to save money on insurance and fuel costs. Others may consider alternative modes of transportation, such as public transit or biking, especially if these options are available and convenient.

Average Cost of Auto Insurance in Washington State

The following table illustrates the average cost of auto insurance for different types of drivers in Washington state, based on factors such as age, driving history, and vehicle type:

| Driver Type | Average Annual Premium |

|—|—|

| Young Driver (Under 25) with Clean Driving Record | $2,500 |

| Middle-Aged Driver (35-55) with Clean Driving Record | $1,800 |

| Senior Driver (Over 65) with Clean Driving Record | $1,500 |

| Young Driver (Under 25) with Multiple Traffic Violations | $3,500 |

| Driver with a DUI Conviction | $4,000 |

| Driver with a High-Performance Vehicle | $2,200 |

| Driver with a Family Sedan | $1,600 |

Note: These are just average figures and actual premiums may vary depending on individual circumstances.

State Regulations and Insurance Practices

The cost of auto insurance in Washington state is influenced by a complex interplay of state regulations and insurance company practices. Understanding these factors is crucial for drivers to make informed decisions about their insurance coverage and costs.

State Regulations and Their Impact on Rates

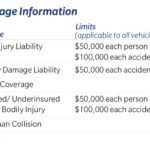

State regulations play a significant role in shaping the auto insurance market in Washington. The Washington State Office of the Insurance Commissioner (OIC) sets the minimum coverage requirements for all drivers, including liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. These requirements ensure that drivers have a minimum level of financial protection in case of an accident.

The OIC also regulates insurance rates to prevent unfair pricing practices. They establish guidelines for how insurance companies can calculate rates, considering factors such as driving history, age, and vehicle type. This regulatory framework aims to ensure that rates are fair and equitable for all drivers.

Insurance Company Practices and Premium Costs

Insurance companies utilize various practices to assess risk and determine premiums. These practices include:

- Risk Assessment: Insurance companies use sophisticated algorithms to evaluate drivers’ risk profiles based on factors such as driving history, age, location, and vehicle type. Drivers with a history of accidents or traffic violations are generally considered higher risk and may face higher premiums.

- Claims Processing: The way insurance companies handle claims can significantly impact premium costs. Efficient and transparent claims processing can help keep premiums lower. However, if claims are frequently disputed or delayed, it can lead to higher premiums for all policyholders.

- Marketing and Advertising: Insurance companies invest heavily in marketing and advertising to attract new customers. These costs are ultimately passed on to policyholders through higher premiums.

Usage-Based Insurance: An Alternative Model

Usage-based insurance (UBI) is an emerging model that uses telematics devices to track driving behavior and offer discounts based on safe driving habits. UBI programs can potentially reward drivers who demonstrate safe driving practices, such as avoiding speeding or hard braking. However, privacy concerns and the potential for data misuse are issues that need to be addressed before UBI becomes widely adopted.

Comparison of Regulatory Frameworks

Washington state’s auto insurance regulations are generally considered to be more stringent than those in some other states. For example, Washington requires drivers to carry PIP coverage, which is not mandatory in all states. However, Washington’s regulations are less stringent than those in states that have adopted no-fault insurance systems, where drivers are primarily compensated by their own insurer regardless of fault.

Consumer Tips and Strategies: Washington State Auto Insurance Increase

Facing rising auto insurance premiums in Washington can be daunting, but there are steps you can take to manage the impact. Understanding your options and making informed decisions can help you find the best coverage at a price that fits your budget.

Shopping Around for Quotes, Washington state auto insurance increase

Comparing quotes from different insurance providers is essential to finding the best deal. Insurance companies use various factors to determine rates, so what one company considers a good risk, another may not.

- Use online comparison tools to get quotes from multiple insurers quickly and easily.

- Contact insurance agents directly to discuss your specific needs and get personalized quotes.

- Don’t be afraid to negotiate with insurers to see if you can get a better rate.

Maintaining a Good Driving Record

Your driving record is a significant factor in determining your insurance premium. A clean record with no accidents or violations can earn you lower rates.

- Drive safely and follow traffic laws to avoid accidents and tickets.

- Consider taking a defensive driving course to improve your driving skills and potentially earn a discount.

- Review your driving record regularly and dispute any errors or inaccuracies.

Exploring Discounts

Many insurance companies offer discounts for various factors, such as:

- Good student discounts for young drivers with high GPAs.

- Safe driver discounts for drivers with a clean record.

- Multi-car discounts for insuring multiple vehicles with the same company.

- Discounts for safety features in your car, such as anti-theft devices or airbags.

Negotiating Auto Insurance Premiums

While it’s important to shop around for quotes, you can also try to negotiate your premium with your current insurer.

- Be prepared to discuss your driving record, safety features, and any other factors that might qualify you for discounts.

- Consider bundling your auto insurance with other policies, such as home or renters insurance, for a potential discount.

- Ask about payment options, such as paying your premium annually or semi-annually, to see if you can save on interest charges.

Future Outlook and Trends

Predicting the future of auto insurance rates in Washington state is complex, as numerous factors can influence them. These factors include economic trends, legislative changes, and the adoption of new technologies, particularly in the realm of autonomous vehicles. Understanding these trends can help drivers and insurance companies prepare for the future of auto insurance in Washington state.

Impact of Technological Advancements

Technological advancements, particularly the rise of autonomous vehicles, are poised to significantly impact auto insurance in Washington state. Autonomous vehicles, often referred to as self-driving cars, are designed to navigate and operate without human intervention. The implications of this technology for auto insurance are far-reaching and multifaceted.

- Reduced Accidents: Autonomous vehicles have the potential to significantly reduce the number of accidents. By eliminating human error, a major contributor to accidents, autonomous vehicles could lead to fewer claims and lower insurance premiums.

- Increased Data Collection: Autonomous vehicles generate vast amounts of data, including driving patterns, road conditions, and potential hazards. This data can be used to improve safety, develop new insurance models, and potentially tailor premiums based on individual driving behavior.

- New Insurance Models: The emergence of autonomous vehicles may necessitate the development of new insurance models. These models could focus on factors such as vehicle performance, software updates, and data-driven risk assessment, rather than traditional metrics like driver history and age.

Key Factors Influencing Future Premiums

Several factors will influence future auto insurance premiums in Washington state. These factors include:

- Economic Conditions: Economic factors such as inflation, interest rates, and unemployment can impact insurance costs. For example, higher inflation can lead to increased repair costs, which in turn can affect insurance premiums.

- Legislative Changes: State and federal legislation can significantly impact auto insurance. Changes to insurance regulations, such as requirements for minimum coverage or the introduction of new insurance products, can affect premiums.

- Catastrophic Events: Natural disasters such as earthquakes, floods, and wildfires can lead to increased insurance claims and higher premiums. Washington state is susceptible to earthquakes and wildfires, which can contribute to higher auto insurance rates.

- Competition in the Insurance Market: The level of competition in the insurance market can also affect premiums. Increased competition can drive down prices, while limited competition can lead to higher premiums.

Potential Changes in State Regulations or Insurance Industry Practices

The future of auto insurance in Washington state may involve changes to state regulations or insurance industry practices. These changes could include:

- Data-Driven Pricing: Insurance companies may increasingly rely on data analytics to personalize premiums based on individual driving behavior. This could lead to more accurate risk assessment and potentially lower premiums for safe drivers.

- Usage-Based Insurance: Usage-based insurance programs, which track driving habits and reward safe driving, are becoming increasingly popular. These programs can incentivize safe driving and potentially lower premiums.

- Autonomous Vehicle Insurance: As autonomous vehicles become more prevalent, insurance companies may develop specialized insurance products tailored to these vehicles. These products may focus on factors such as vehicle performance, software updates, and data-driven risk assessment.

Conclusion

The increase in Washington State auto insurance premiums is a significant concern for drivers, and understanding the factors driving this trend is crucial. By staying informed about state regulations, insurance practices, and consumer strategies, drivers can navigate this challenging landscape and find ways to mitigate the impact of rising costs. As technology continues to evolve and new insurance models emerge, it’s essential to stay updated on the latest developments in the auto insurance industry.

Top FAQs

What are the main reasons for the recent increase in Washington State auto insurance premiums?

The recent increase in auto insurance premiums in Washington State is attributed to a combination of factors, including rising healthcare costs, vehicle repair expenses, and legal settlements. Additionally, increased traffic congestion and a higher number of accidents have contributed to higher insurance claims.

Are there any discounts available to help reduce auto insurance premiums?

Yes, many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. It’s important to shop around and compare quotes from different providers to find the best discounts available.

What can I do to lower my auto insurance premiums?

There are several strategies to lower your auto insurance premiums, including maintaining a good driving record, comparing quotes from multiple insurers, taking advantage of discounts, and considering a higher deductible.