Washington state auto insurance sets the stage for this comprehensive guide, offering readers a clear understanding of the state’s insurance requirements, rate factors, and coverage options. This guide will explore the intricacies of Washington’s auto insurance landscape, providing valuable insights for drivers seeking affordable and adequate coverage.

Navigating the world of auto insurance can be daunting, especially when faced with complex regulations and varying rates. Understanding the nuances of Washington state’s auto insurance system is crucial for making informed decisions and securing the best possible coverage for your individual needs and budget.

Washington State Auto Insurance Laws and Regulations

Driving in Washington State requires drivers to comply with specific insurance laws and regulations. These rules ensure financial protection for drivers and their passengers in the event of an accident.

Mandatory Insurance Requirements

Drivers in Washington state are required to carry at least the minimum amount of liability insurance. This coverage protects other drivers and their property if you are found at fault in an accident. The minimum liability limits required by law are:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

Washington State’s No-Fault Insurance System

Washington State operates under a no-fault insurance system. This means that in the event of an accident, your insurance company will cover your medical expenses and lost wages, regardless of who is at fault. However, you can only pursue a claim against the other driver for pain and suffering if your injuries meet certain criteria.

The “serious injury” threshold in Washington State requires a person to have suffered:

- Death

- Dismemberment

- Significant disfigurement

- A fracture

- Permanent loss of a bodily function

- A permanent injury

- A loss of consciousness for more than 24 hours

If your injuries do not meet this threshold, you can only recover for medical expenses and lost wages from your own insurance company, even if the other driver was at fault.

Factors Affecting Auto Insurance Rates in Washington

Auto insurance premiums in Washington, like in most states, are determined by a complex interplay of factors that insurance companies carefully assess to calculate your individual rate. Understanding these factors can empower you to make informed decisions and potentially lower your insurance costs.

Vehicle Type, Washington state auto insurance

The type of vehicle you drive significantly influences your insurance premium. Insurance companies categorize vehicles based on factors such as safety features, repair costs, and theft risk. Generally, high-performance vehicles, luxury cars, and vehicles with a history of frequent accidents tend to have higher insurance rates. Conversely, vehicles with excellent safety ratings and lower repair costs may attract lower premiums.

Driver Demographics

Insurance companies consider various demographic factors when setting your premium. These include:

- Age: Younger drivers, particularly those under 25, often face higher premiums due to their higher risk of accidents. As drivers gain experience and age, their rates generally decrease.

- Gender: Historically, male drivers have had higher insurance rates than female drivers. However, this gap is narrowing in many states, including Washington.

- Marital Status: In some cases, married individuals may receive slightly lower insurance rates than single individuals. This is often attributed to the assumption that married drivers may have more stable lifestyles and potentially lower risk-taking behavior.

Geographic Location

Where you live plays a significant role in determining your auto insurance premium. Areas with higher population density, traffic congestion, and crime rates tend to have higher insurance rates. This is because these factors increase the likelihood of accidents and claims.

Driving History

Your driving record is one of the most crucial factors influencing your insurance premium. Insurance companies carefully review your driving history to assess your risk profile. Factors that can affect your rates include:

- Accidents: Any at-fault accidents you have been involved in will significantly increase your insurance premium. The severity of the accident and the number of claims filed will influence the premium increase.

- Traffic Violations: Speeding tickets, DUI convictions, and other traffic violations can lead to higher insurance premiums. The severity of the violation and the frequency of violations will impact the premium increase.

Credit Score

In Washington, insurance companies are permitted to use your credit score as a factor in determining your auto insurance premium. This practice is based on the theory that individuals with good credit scores are more likely to be financially responsible and therefore less likely to file claims.

Coverage Options

The type and amount of coverage you choose will directly affect your insurance premium. Higher coverage limits, such as higher liability limits, comprehensive coverage, and collision coverage, will generally result in higher premiums.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. Higher liability limits provide greater protection in the event of a serious accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects you from damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

Choosing the Right Auto Insurance Coverage in Washington

Choosing the right auto insurance coverage in Washington is essential for protecting yourself financially in the event of an accident. You need to consider your individual needs, driving habits, and risk tolerance to determine the appropriate coverage levels.

Types of Auto Insurance Coverage

Understanding the different types of auto insurance coverage available in Washington is crucial for making informed decisions. Here’s a table outlining the common types of coverage:

| Coverage Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| Liability Coverage | Covers damages to other people and their property if you cause an accident. | Protects you from significant financial losses in the event of an accident. | May not cover your own vehicle’s damages. |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of fault. | Provides peace of mind knowing your vehicle will be repaired or replaced after an accident. | Can be expensive, especially for newer or high-value vehicles. |

| Comprehensive Coverage | Covers damages to your vehicle from non-accident events, such as theft, vandalism, or natural disasters. | Protects your vehicle from a wider range of risks. | May have a deductible, and may not cover all types of damage. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Covers damages to you and your passengers if you are hit by an uninsured or underinsured driver. | Provides protection in situations where the at-fault driver lacks sufficient insurance. | May require a separate premium. |

Benefits and Drawbacks of Coverage Types

Each type of auto insurance coverage has its own set of benefits and drawbacks, which you should carefully consider when making your decision.

Liability Coverage

Liability coverage is mandatory in Washington, and it’s essential for protecting yourself from significant financial losses in the event of an accident.

For example, if you cause an accident that results in injuries to another person, liability coverage will help pay for their medical expenses, lost wages, and other related costs.

However, liability coverage only covers damages to other people and their property, not your own vehicle.

Collision Coverage

Collision coverage is optional, but it’s highly recommended for most drivers. This coverage helps pay for repairs or replacement of your vehicle if you are involved in an accident, regardless of who is at fault.

For instance, if you hit a parked car or are involved in a single-car accident, collision coverage will help cover the costs of repairing or replacing your vehicle.

However, collision coverage can be expensive, especially for newer or high-value vehicles.

Comprehensive Coverage

Comprehensive coverage is another optional coverage that protects your vehicle from damages caused by non-accident events, such as theft, vandalism, or natural disasters.

For example, if your vehicle is stolen or damaged by a hailstorm, comprehensive coverage will help cover the costs of repairs or replacement.

However, comprehensive coverage may have a deductible, and it may not cover all types of damage.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage is optional, but it’s crucial for drivers in Washington, as it provides protection in situations where the at-fault driver lacks sufficient insurance.

For instance, if you are hit by an uninsured driver who is at fault, UM/UIM coverage will help pay for your medical expenses, lost wages, and other related costs.

UM/UIM coverage may require a separate premium, but it can provide valuable peace of mind.

Optional Coverage Additions

In addition to the basic types of coverage, you can also consider adding optional coverage additions to your policy, such as:

* Rental car reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

* Roadside assistance: This coverage provides assistance with services like flat tire changes, jump starts, and towing.

Adding optional coverage additions can increase your premium, but they can also provide valuable benefits in the event of an unexpected situation.

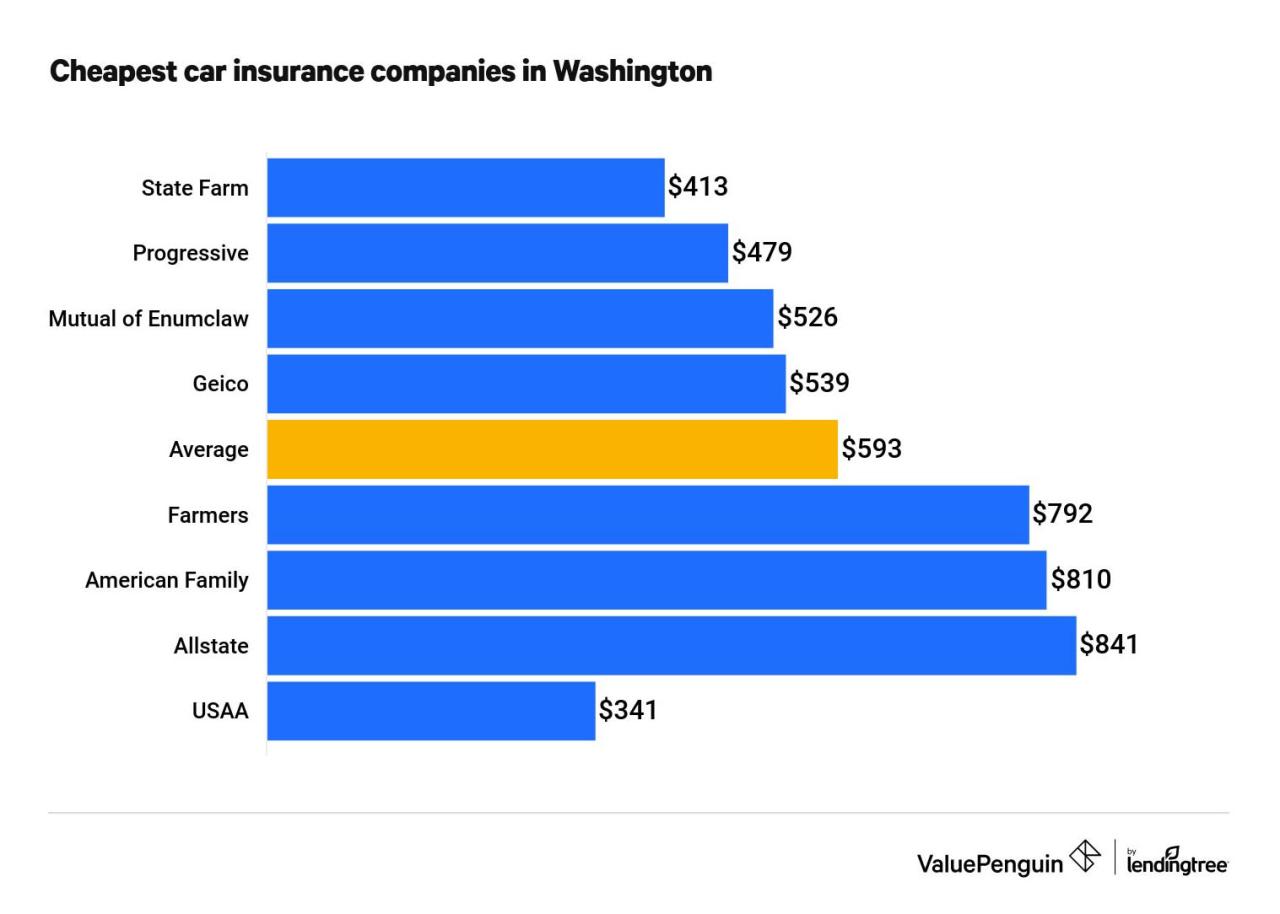

Finding Affordable Auto Insurance in Washington: Washington State Auto Insurance

Securing affordable auto insurance in Washington is crucial for responsible drivers. With a competitive market, finding the best rates requires diligent research and strategic approaches.

Comparing Insurance Quotes

To find the most favorable rates, comparing quotes from multiple insurance providers is essential. This involves gathering quotes from various companies and analyzing them side-by-side to identify the most competitive offers.

- Request quotes online: Many insurance companies offer online quote tools, allowing you to enter your details and receive personalized quotes within minutes. This method is convenient and saves time.

- Contact insurance agents: Reach out to insurance agents or brokers who represent multiple companies. They can provide quotes from various providers and offer expert advice based on your specific needs.

- Compare coverage details: When comparing quotes, ensure you are comparing similar coverage levels. Some companies may offer lower premiums but with limited coverage, while others may have higher premiums with comprehensive protection.

Benefits of Using Online Comparison Tools

Online comparison tools have become increasingly popular for their convenience and efficiency in comparing auto insurance quotes.

- Streamlined process: These tools simplify the process of gathering quotes from multiple providers, eliminating the need for numerous phone calls or visits to different offices.

- Time-saving: Online comparison tools allow you to compare quotes quickly and easily, saving you valuable time and effort.

- Transparency: Many tools provide detailed breakdowns of coverage options and pricing, enabling you to make informed decisions.

Working with Insurance Brokers

Insurance brokers act as intermediaries between you and insurance companies. They can provide valuable assistance in finding the right coverage at the best rates.

- Expertise: Brokers have extensive knowledge of the insurance market and can guide you through the complex process of choosing the right policy.

- Negotiation skills: They can leverage their relationships with insurance companies to negotiate favorable rates on your behalf.

- Personalized service: Brokers take the time to understand your individual needs and recommend policies that best suit your situation.

Potential Discounts Offered by Insurance Companies

Insurance companies in Washington offer various discounts to eligible policyholders, potentially reducing their premiums.

- Safe driver discount: This discount is awarded to drivers with a clean driving record, demonstrating their responsible driving habits.

- Good student discount: Students who maintain a certain GPA may qualify for this discount, reflecting their commitment to academic excellence.

- Multi-policy discount: Bundling multiple insurance policies, such as auto and homeowners, with the same company can often result in significant savings.

- Other discounts: Additional discounts may be available based on factors such as vehicle safety features, anti-theft devices, and membership in certain organizations.

Filing an Auto Insurance Claim in Washington

Filing an auto insurance claim in Washington after an accident is a crucial step in ensuring you receive the necessary compensation for damages and injuries. It’s important to understand the process and follow the right steps to maximize your chances of a successful claim.

Steps Involved in Filing an Auto Insurance Claim

Following a car accident, you should immediately take the following steps to file an auto insurance claim:

- Contact the authorities: Call 911 to report the accident, especially if there are injuries or significant property damage. This will create a record of the incident and ensure that the necessary emergency services are dispatched.

- Gather information: Exchange contact and insurance information with all parties involved. Take photos of the damage to all vehicles involved, as well as any injuries or other evidence related to the accident. This will help you build your case.

- Contact your insurance company: Report the accident to your insurance company as soon as possible, following the instructions provided in your policy. This will initiate the claim process and provide you with the necessary guidance.

- File a claim: Your insurance company will provide you with the necessary forms and instructions for filing your claim. Be sure to complete all sections accurately and provide any requested documentation.

- Cooperate with the adjuster: Your insurance company will assign an adjuster to your claim. The adjuster will investigate the accident, assess damages, and determine the amount of compensation you are eligible for. It’s important to cooperate with the adjuster and provide any requested information promptly.

Essential Documents and Information

When filing an auto insurance claim, you’ll need to provide your insurance company with specific documents and information. This includes:

- Police report: The police report provides an official account of the accident, including the details of the incident, involved parties, and any contributing factors. It’s essential evidence for your claim.

- Photos of the damage: Photos of the damage to your vehicle and any other property involved in the accident are crucial for documenting the extent of the damage. These photos will be used by the adjuster to assess the cost of repairs.

- Medical records: If you sustained injuries in the accident, you’ll need to provide your insurance company with medical records documenting the treatment you received. This includes doctor’s notes, hospital bills, and any other relevant documentation.

- Repair estimates: Obtain repair estimates from reputable mechanics for the damage to your vehicle. These estimates will help the adjuster determine the cost of repairs.

- Proof of ownership: Provide your insurance company with proof of ownership of your vehicle, such as the title or registration. This will confirm your legal right to file a claim.

- Your insurance policy: Review your insurance policy to understand your coverage limits and any relevant exclusions. This will help you determine what expenses are covered by your policy.

The Role of the Insurance Adjuster

The insurance adjuster plays a critical role in the claims process. They are responsible for investigating the accident, assessing damages, and determining the amount of compensation you are eligible for. The adjuster will typically:

- Review the police report: The adjuster will review the police report to gather information about the accident and identify any contributing factors.

- Inspect the damage: The adjuster will inspect the damage to your vehicle and any other property involved in the accident. This will help them determine the cost of repairs.

- Review medical records: If you sustained injuries, the adjuster will review your medical records to assess the severity of your injuries and determine the amount of medical expenses covered by your policy.

- Negotiate a settlement: Once the adjuster has completed their investigation, they will negotiate a settlement with you. This settlement will include compensation for damages to your vehicle, medical expenses, lost wages, and any other eligible expenses.

Negotiating a Settlement

Negotiating a settlement with the insurance adjuster can be challenging. It’s important to:

- Understand your rights: Be aware of your rights as a policyholder and understand the terms of your insurance policy. This will help you negotiate a fair settlement.

- Be prepared to negotiate: Be prepared to negotiate with the adjuster and present your case clearly and concisely. Provide supporting documentation to back up your claims.

- Consider hiring an attorney: If you are having difficulty negotiating a settlement with the adjuster, you may want to consider hiring an attorney. An attorney can help you understand your rights and negotiate a fair settlement on your behalf.

Understanding Washington State’s Auto Insurance Laws and Consumer Protections

Navigating the world of auto insurance can be overwhelming, especially when it comes to understanding your rights and protections. Washington State has a comprehensive set of laws and regulations designed to safeguard consumers and ensure fair treatment in the auto insurance industry.

The Role of the Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) plays a crucial role in regulating the auto insurance industry. The OIC is responsible for:

- Licensing and overseeing insurance companies operating in the state.

- Ensuring compliance with state insurance laws and regulations.

- Investigating consumer complaints against insurance companies.

- Educating consumers about their rights and responsibilities.

- Promoting fair competition and preventing unfair or deceptive practices.

The OIC’s oversight helps to protect consumers from unfair or abusive practices and ensures a level playing field for insurance companies.

Consumer Rights and Protections Under Washington’s Auto Insurance Laws

Washington State provides several consumer rights and protections under its auto insurance laws, including:

- Right to Choose Your Own Insurance Company: Consumers have the right to choose their own insurance company and coverage options, ensuring competition and diverse choices.

- Right to Renew Your Policy: Insurance companies are generally required to renew your policy unless there are specific reasons for non-renewal, such as non-payment of premiums or a change in risk factors.

- Right to Fair Pricing: Insurance rates must be based on factors related to the risk of insuring you, such as your driving record, age, and vehicle type. Rates cannot be based on discriminatory factors like race or gender.

- Right to Access Your Insurance Records: You have the right to review your insurance records, including your driving history and claims history, to ensure accuracy and identify any potential errors.

- Right to File a Complaint: If you believe an insurance company has violated your rights or engaged in unfair practices, you can file a complaint with the OIC.

Resources for Consumers

The OIC offers various resources to assist consumers with insurance-related issues:

- Website: The OIC website (insurance.wa.gov) provides comprehensive information about auto insurance laws, consumer rights, and frequently asked questions.

- Consumer Hotline: Consumers can call the OIC’s consumer hotline at 1-800-562-6900 to report complaints, seek assistance, or get answers to their questions.

- Online Complaint Form: Consumers can file complaints online through the OIC’s website, providing a convenient and accessible option.

Closing Summary

By understanding the intricacies of Washington state auto insurance, drivers can make informed decisions about their coverage, ensure they meet legal requirements, and protect themselves financially in the event of an accident. Armed with this knowledge, you can confidently navigate the complexities of Washington’s auto insurance landscape and secure the peace of mind that comes with knowing you have adequate protection.

Question & Answer Hub

How do I find the cheapest auto insurance in Washington?

Comparing quotes from multiple insurance companies is crucial. Utilize online comparison tools and consider working with an insurance broker.

What are some common discounts available in Washington?

Many insurance companies offer discounts for safe drivers, good students, multi-policy holders, and those who install anti-theft devices.

What are the consequences of driving without auto insurance in Washington?

Driving without insurance is illegal in Washington. You could face fines, license suspension, and even jail time. Additionally, you would be responsible for all costs associated with an accident, including medical bills and property damage.

What is the role of the Washington State Office of the Insurance Commissioner?

The Office of the Insurance Commissioner regulates the auto insurance industry, protects consumer rights, and handles insurance-related complaints.