WA State car insurance is a necessity for all drivers in the state. Understanding the requirements, factors influencing rates, and how to find the best coverage is crucial for protecting yourself and your finances. This guide will delve into the intricacies of Washington’s car insurance landscape, providing insights to help you make informed decisions.

From mandatory coverage requirements and factors that influence premiums to tips for finding the best rates and navigating claims, this comprehensive resource covers all aspects of car insurance in Washington. Whether you’re a new driver or a seasoned motorist, this information will empower you to secure the right insurance protection for your needs.

Understanding Washington State Car Insurance Requirements

Driving in Washington state requires you to have car insurance, as it is a mandatory requirement. This ensures that you are financially protected in case of an accident, and it also protects others on the road. Understanding the different types of coverage and their minimum requirements is crucial to ensure you are adequately covered.

Minimum Liability Coverage Limits

The state of Washington mandates minimum liability coverage limits for all drivers. This coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries. The minimum liability coverage limits are as follows:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $10,000 per accident

These limits represent the maximum amount your insurance company will pay for damages caused by you. If the damages exceed these limits, you will be personally responsible for the remaining costs.

Understanding Different Types of Coverage

It is essential to understand the various types of car insurance coverage available to ensure you have adequate protection. While liability coverage is mandatory, you can choose to purchase additional coverage depending on your needs and risk tolerance. Some common types of coverage include:

- Collision Coverage: Covers damage to your vehicle resulting from an accident, regardless of who is at fault.

- Comprehensive Coverage: Protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of who is at fault.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault. This is a mandatory coverage in Washington state.

These are just a few of the common types of coverage available. It is crucial to discuss your specific needs with an insurance agent to determine the appropriate coverage for your situation.

Factors Influencing Car Insurance Rates in Washington

Car insurance rates in Washington are influenced by a variety of factors, all of which are designed to assess the risk a driver poses to insurance companies. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher rates.

- Accidents: Each accident you’ve been involved in, regardless of fault, will typically increase your rates. The severity of the accident, such as the amount of damage or injuries sustained, can further impact your premiums. For example, a minor fender bender might result in a smaller rate increase compared to a serious accident with significant property damage or injuries.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations will also increase your insurance rates. The severity of the violation will determine the impact on your premiums. For instance, a speeding ticket for exceeding the speed limit by a few miles per hour may result in a smaller rate increase than a reckless driving citation. It is important to note that some violations, such as DUI, can have a significant impact on your insurance rates and may even lead to the cancellation of your policy.

Age

Your age is another important factor that influences car insurance rates. Younger drivers, especially those under the age of 25, are generally considered higher risk due to their lack of experience and higher likelihood of accidents. As drivers gain experience and age, their rates tend to decrease. However, older drivers, particularly those over the age of 70, may also see higher rates due to potential health concerns that could affect their driving abilities.

Vehicle Type

The type of vehicle you drive can significantly affect your insurance rates. Sports cars, luxury vehicles, and high-performance cars are often associated with higher risk due to their speed and potential for more severe accidents. Conversely, smaller, less expensive vehicles are typically considered lower risk and may result in lower premiums.

- Vehicle Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, can also influence your rates. These features are designed to prevent accidents or minimize their severity, making your vehicle safer and reducing the risk for insurance companies. As a result, vehicles with these features may qualify for discounts.

- Vehicle Value: The value of your vehicle also plays a role in your insurance premiums. More expensive vehicles, such as luxury cars or trucks, will typically have higher rates because the cost to repair or replace them in case of an accident is higher. For example, a luxury sedan might require more expensive parts and labor to repair than a basic economy car, resulting in higher insurance costs.

Geographic Location

Where you live can also affect your car insurance rates. Areas with higher population density, increased traffic, and higher rates of accidents may have higher insurance premiums. For example, drivers in urban areas with heavy traffic and congestion may face higher rates compared to drivers in rural areas with lower traffic volumes.

- Crime Rates: Areas with higher crime rates may also have higher insurance rates due to an increased risk of vehicle theft or vandalism. Insurance companies consider these factors when setting premiums, reflecting the potential for higher claims in high-crime areas.

Credit Score

Your credit score can surprisingly influence your car insurance rates in some states, including Washington. Insurance companies believe that individuals with good credit scores are more financially responsible and less likely to file claims. Therefore, drivers with higher credit scores may qualify for lower premiums.

- Credit-Based Insurance Scores: Insurance companies use credit-based insurance scores, which are separate from your traditional credit score, to assess your risk. These scores take into account factors such as your payment history, credit utilization, and debt-to-income ratio. A higher credit-based insurance score can lead to lower premiums.

Finding the Best Car Insurance Rates in Washington

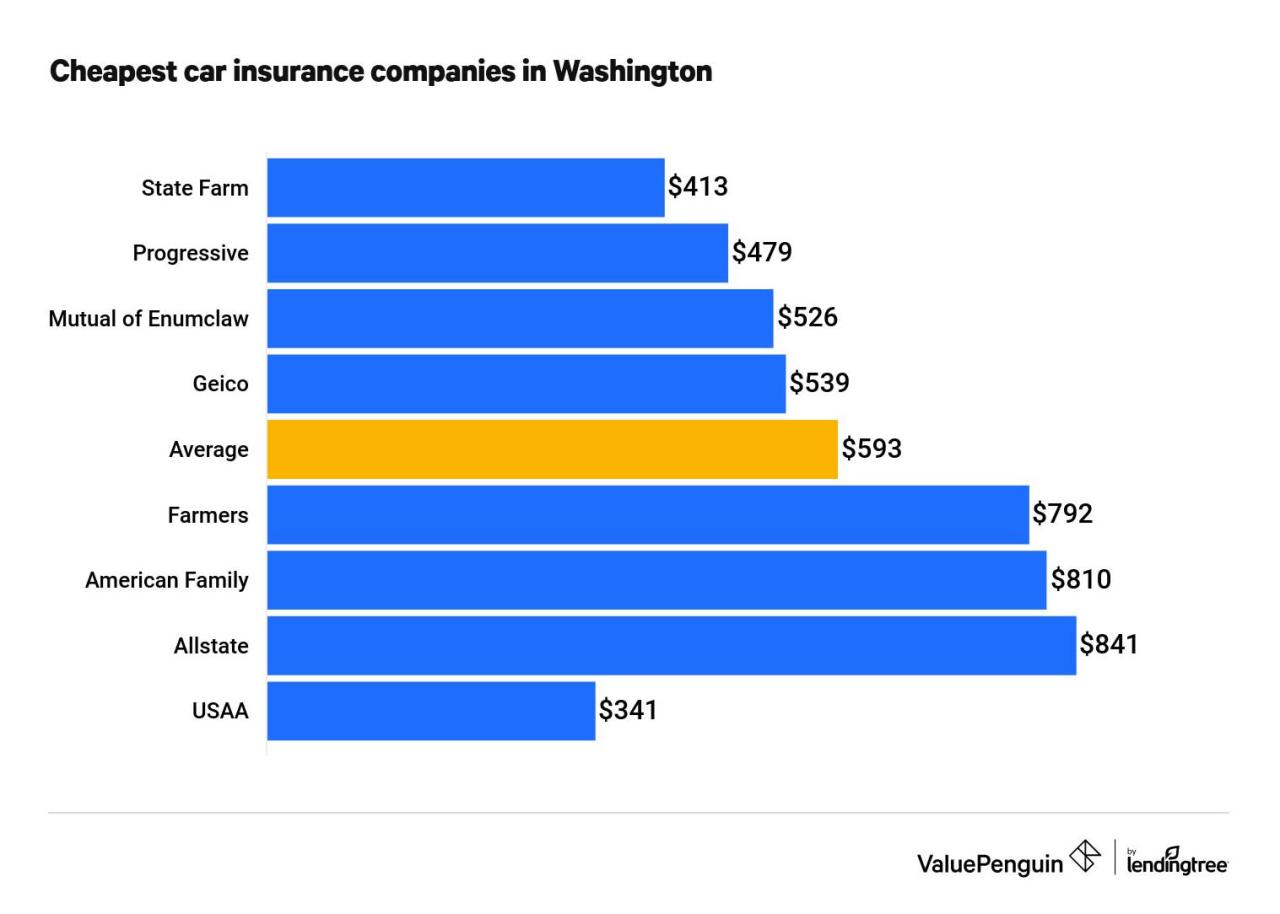

Finding the best car insurance rates in Washington involves careful comparison and understanding of various factors that influence pricing. By taking a proactive approach and exploring available options, you can secure a policy that meets your needs without breaking the bank.

Comparing Car Insurance Quotes

To find the best car insurance rates, it’s crucial to compare quotes from multiple providers. This allows you to assess different coverage options, pricing structures, and discounts offered by each insurer.

- Utilize online comparison websites: These platforms streamline the quote comparison process by allowing you to input your information once and receive quotes from multiple insurers simultaneously. Examples include Insurance.com, The Zebra, and Policygenius.

- Contact insurers directly: Reach out to insurance companies directly to obtain personalized quotes and discuss your specific needs. This allows for more in-depth conversations and tailored recommendations.

- Consider your driving history and vehicle details: Your driving record, including accidents, violations, and years of driving experience, significantly impacts your insurance premiums. Similarly, the make, model, and year of your vehicle play a role in determining your rate.

Understanding Coverage Options and Deductibles

Car insurance policies offer various coverage options, each with its own cost and benefits.

- Liability coverage: This is the most basic type of coverage, protecting you financially if you cause an accident that injures another person or damages their property. It’s typically mandatory in Washington.

- Collision coverage: This coverage reimburses you for repairs or replacement costs if your vehicle is damaged in an accident, regardless of who is at fault.

- Comprehensive coverage: This coverage protects you against damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Deductible: This is the amount you pay out of pocket for repairs or replacement costs before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

Seeking Discounts and Negotiating with Insurers, Wa state car insurance

Car insurance companies offer various discounts to reduce premiums.

- Safe driving discounts: These discounts are offered to drivers with a clean driving record and no accidents or violations.

- Multi-car discounts: You can receive a discount if you insure multiple vehicles with the same insurer.

- Good student discounts: Students with good grades may qualify for a discount, as they are statistically considered safer drivers.

- Bundling discounts: Some insurers offer discounts if you bundle your car insurance with other types of insurance, such as home or renters insurance.

- Negotiating: Once you’ve received quotes, don’t hesitate to negotiate with insurers. Explain your driving history, good credit score, and any other factors that might qualify you for lower rates. Be prepared to provide documentation to support your claims.

Understanding Car Insurance Claims in Washington

Navigating car insurance claims in Washington can feel overwhelming, especially during a stressful time like an accident. This section provides a detailed breakdown of the claims process, the role of the Washington State Office of Insurance Commissioner, and tips for handling car accidents and interacting with insurance companies.

Filing a Car Insurance Claim in Washington

The process of filing a car insurance claim in Washington typically involves the following steps:

- Contact your insurance company: Immediately notify your insurance company about the accident. Provide them with the details of the accident, including the date, time, location, and any injuries.

- File a claim: Your insurance company will guide you through the process of filing a claim. This may involve completing forms, providing documentation, and answering questions about the accident.

- Provide necessary information: You’ll need to provide your insurance company with information such as the police report number, the other driver’s insurance information, and any medical records if you sustained injuries.

- Get a claim number: Your insurance company will assign you a claim number to track the progress of your claim.

- Submit a proof of loss: This document Artikels the details of your damages and losses, including medical bills, repair estimates, and any other expenses related to the accident.

- Review the claim: Your insurance company will review your claim and determine if it’s covered under your policy.

- Receive a settlement: If your claim is approved, you’ll receive a settlement from your insurance company. This settlement may cover your damages, medical expenses, lost wages, and other related costs.

Role of the Washington State Office of Insurance Commissioner

The Washington State Office of Insurance Commissioner (OIC) plays a crucial role in regulating the insurance industry in Washington. The OIC ensures that insurance companies operate fairly and transparently. Here are some key responsibilities of the OIC:

- Licensing and oversight: The OIC licenses and regulates insurance companies operating in Washington. This includes ensuring they meet specific financial requirements and adhere to state laws.

- Consumer protection: The OIC advocates for consumer rights and provides resources and information to help policyholders understand their coverage and file claims.

- Dispute resolution: The OIC offers mediation and arbitration services to help resolve disputes between policyholders and insurance companies.

- Market regulation: The OIC monitors the insurance market to ensure that rates are fair and competitive.

Handling a Car Accident and Interacting with Insurance Companies

Dealing with a car accident can be stressful. Here are some tips for handling the situation and interacting with insurance companies:

- Stay calm: It’s important to remain calm and assess the situation. Ensure everyone involved is safe and check for injuries.

- Call the police: If there are injuries or significant property damage, call the police immediately. A police report will provide an official record of the accident.

- Exchange information: Exchange contact and insurance information with the other driver(s) involved.

- Document the accident: Take photos of the damage to your vehicle and the accident scene. Note the location, weather conditions, and any witnesses.

- Seek medical attention: If you or anyone else is injured, seek medical attention immediately. Even if you don’t feel injured, it’s important to have a medical evaluation.

- Contact your insurance company: Notify your insurance company about the accident as soon as possible. Follow their instructions carefully and provide them with all the necessary information.

- Don’t admit fault: Avoid admitting fault for the accident, even if you feel you may have been at fault. Let your insurance company handle the investigation and liability determination.

- Be truthful and cooperative: Be honest with your insurance company and provide accurate information about the accident. Cooperate with their investigation and answer their questions truthfully.

- Keep records: Keep copies of all documents related to the accident, including the police report, medical records, repair estimates, and insurance correspondence.

- Review your policy: Review your insurance policy to understand your coverage and any limitations.

Tips for Interacting with Insurance Companies

- Be prepared: Before contacting your insurance company, gather all the necessary information, such as the police report number, contact information for the other driver, and any medical records.

- Be polite and respectful: Even if you’re frustrated, be polite and respectful when dealing with insurance company representatives.

- Be persistent: If you’re not satisfied with the response from your insurance company, don’t be afraid to follow up and ask for clarification.

- Know your rights: Understand your rights as a policyholder and don’t hesitate to contact the Washington State Office of Insurance Commissioner if you believe your rights have been violated.

Resources for Car Insurance in Washington

Navigating the world of car insurance can feel overwhelming, especially when you’re trying to find the best options for your specific needs. Fortunately, Washington State offers a wealth of resources to help you make informed decisions.

Online Resources for Washington Car Insurance Information

These websites provide valuable information about car insurance requirements, regulations, and consumer protection in Washington State.

- Washington State Office of Insurance Commissioner (OIC): https://www.insurance.wa.gov/ – The OIC is your primary source for information about car insurance in Washington. You can find details on state regulations, consumer rights, and how to file complaints.

- Washington State Department of Licensing (DOL): https://www.dol.wa.gov/ – The DOL provides information on vehicle registration, driver’s licenses, and other relevant topics that may affect your car insurance needs.

- National Association of Insurance Commissioners (NAIC): https://www.naic.org/ – The NAIC is a national organization that works to standardize insurance regulations across the country. Their website offers information on insurance topics, including car insurance.

Reputable Car Insurance Companies in Washington

These companies are known for their reliable service, competitive rates, and strong financial standing.

- State Farm: A leading national insurer with a strong presence in Washington, known for its customer service and comprehensive coverage options.

- Geico: A well-known company known for its competitive rates and online convenience.

- Progressive: Offers a wide range of coverage options, including customized policies to meet specific needs.

- Farmers Insurance: A national insurer with a focus on personalized service and a strong network of local agents.

- USAA: Exclusively for active military members, veterans, and their families, known for its competitive rates and excellent customer service.

- Liberty Mutual: A large national insurer with a strong presence in Washington, known for its comprehensive coverage options and strong financial stability.

Washington State Office of Insurance Commissioner Contact Information

For assistance with insurance-related issues, you can reach out to the Washington State Office of Insurance Commissioner.

- Address: PO Box 4010, Olympia, WA 98504-4010

- Phone: (360) 684-4400

- Email: oic@insurance.wa.gov

Last Word

Navigating the world of car insurance in Washington can be complex, but with the right information and resources, you can find the coverage that fits your budget and provides the protection you need. By understanding the requirements, comparing quotes, and seeking out discounts, you can secure affordable and reliable car insurance that gives you peace of mind on the road.

User Queries: Wa State Car Insurance

What are the penalties for driving without car insurance in Washington?

Driving without the required car insurance in Washington can result in fines, license suspension, and even vehicle impoundment.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually, or whenever you experience a significant life change, such as a new car purchase, marriage, or a change in driving habits.

Can I get car insurance if I have a poor driving record?

Yes, you can still get car insurance even with a poor driving record, but your rates will likely be higher. It’s important to shop around and compare quotes from different insurers to find the best rates possible.