WA State auto insurance is a crucial aspect of driving in Washington. The state mandates specific coverage, ensuring drivers are protected in case of accidents. This guide explores the complexities of Washington’s auto insurance market, providing insights into key factors affecting rates, strategies for finding affordable coverage, and essential information about navigating claims.

Understanding the nuances of WA state auto insurance is essential for all drivers. Whether you’re a seasoned veteran of the road or a new driver, this comprehensive guide will equip you with the knowledge you need to make informed decisions about your insurance coverage.

Washington State Auto Insurance Overview

Washington State has a robust auto insurance market, with a wide range of insurance providers offering various coverage options to meet the diverse needs of drivers. Understanding the state’s auto insurance requirements and the role of the Washington State Office of Insurance Commissioner (OIC) is crucial for all drivers.

Mandatory Coverage Requirements

Washington State law mandates specific auto insurance coverage for all drivers, ensuring financial protection in case of accidents. These mandatory coverages are:

- Liability Coverage: This coverage protects drivers from financial responsibility for damages or injuries caused to others in an accident. It includes bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards drivers against financial losses when involved in accidents with uninsured or underinsured motorists. It provides coverage for medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage covers medical expenses, lost wages, and other related costs for the insured driver and passengers in an accident, regardless of fault.

Role of the Washington State Office of Insurance Commissioner (OIC)

The Washington State Office of Insurance Commissioner (OIC) plays a vital role in regulating the state’s auto insurance market. The OIC’s responsibilities include:

- Licensing and Supervision of Insurance Companies: The OIC licenses and supervises insurance companies operating in Washington State, ensuring they meet specific financial and operational standards.

- Consumer Protection: The OIC protects consumers from unfair or deceptive insurance practices, investigates complaints, and provides information and resources to help drivers understand their insurance policies.

- Rate Regulation: The OIC monitors and regulates auto insurance rates to ensure they are fair and reasonable, preventing excessive rate increases.

Key Factors Affecting Auto Insurance Rates

Auto insurance premiums in Washington State are influenced by a variety of factors. Understanding these factors can help you make informed decisions to potentially reduce your insurance costs.

Driving History

Your driving history plays a significant role in determining your insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, accidents, traffic violations, and DUI convictions can significantly increase your rates. Insurance companies use a system called a “risk score” to assess your driving history and assign you a premium based on your level of risk.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums. Factors like the vehicle’s make, model, year, and safety features are considered. Generally, newer vehicles with advanced safety features tend to have lower insurance rates compared to older vehicles with fewer safety features. Additionally, sports cars and high-performance vehicles often carry higher insurance premiums due to their increased risk of accidents.

Location

Your location, specifically your zip code, is a key factor in determining your insurance rates. Insurance companies consider the frequency of accidents, theft rates, and other factors within a particular geographic area. Areas with higher crime rates or a history of more accidents may have higher insurance premiums.

Optional Coverage Choices

The types of coverage you choose can significantly impact your premium costs. While some coverage options are required by law, others are optional. Adding optional coverages, such as comprehensive or collision coverage, can increase your premiums. However, these coverages can provide valuable protection in case of accidents, theft, or damage to your vehicle. It’s important to weigh the benefits and costs of optional coverage choices to determine what’s right for your individual needs.

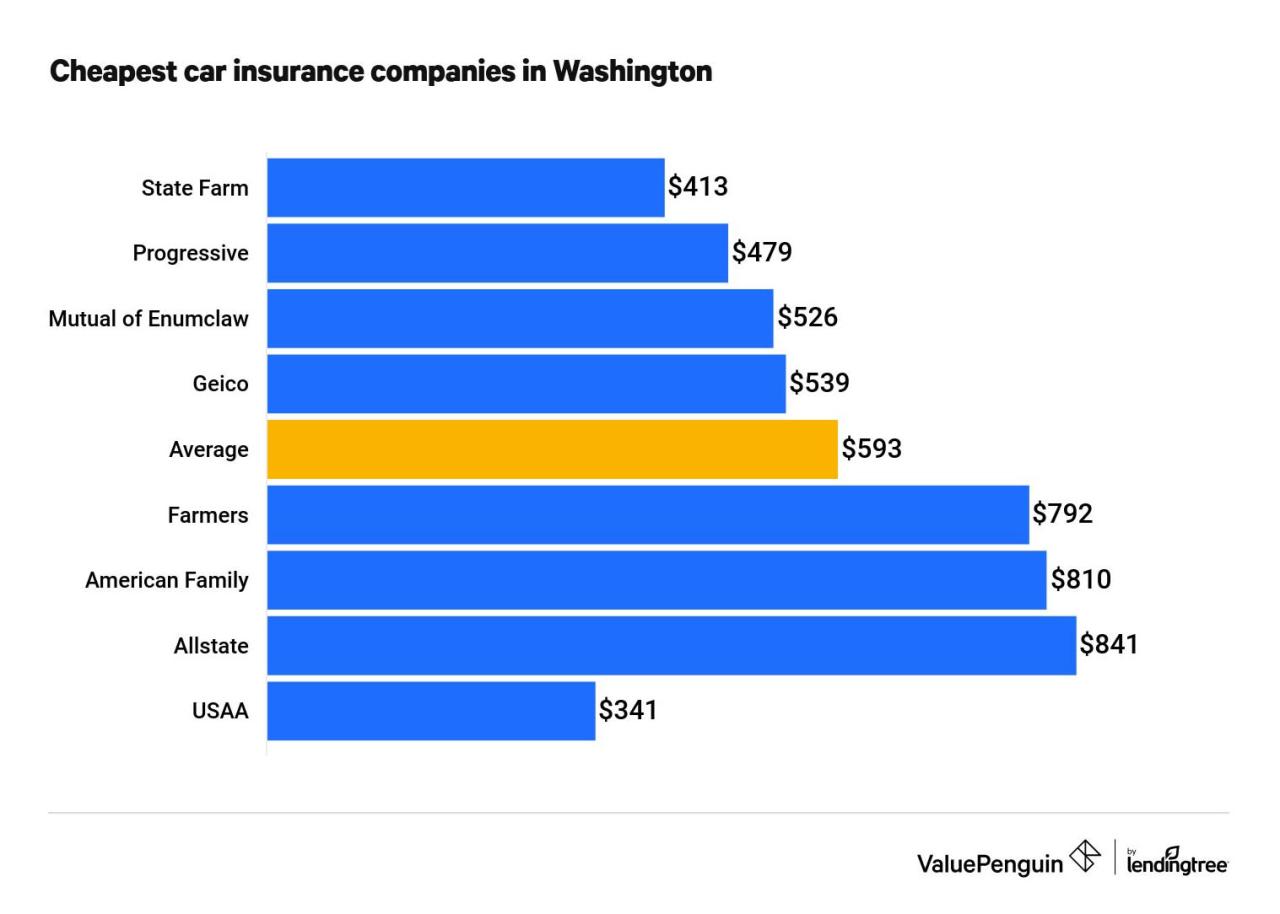

Finding Affordable Auto Insurance in Washington

Securing affordable auto insurance in Washington can feel like a daunting task, but with the right strategies, it’s definitely achievable. By understanding the key factors influencing your rates and actively taking steps to manage them, you can significantly lower your premiums.

Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurance providers is a fundamental step in securing the most favorable rates. Different insurers utilize varying algorithms to calculate premiums, considering factors like your driving history, vehicle type, and location. By comparing quotes, you can identify the insurer offering the most competitive rates for your specific circumstances.

- Online comparison tools like Policygenius or NerdWallet can streamline the process by allowing you to input your information once and receive quotes from various insurers.

- Consider contacting insurance brokers, who can assist in comparing quotes from multiple insurers and potentially negotiate better rates on your behalf.

Benefits and Drawbacks of Different Insurance Policies

Understanding the nuances of different insurance policies is crucial for selecting the coverage that best suits your needs and budget. Each policy type offers varying levels of protection and comes with its own set of advantages and disadvantages.

- Liability Coverage: This is the most basic type of auto insurance, providing financial protection to others if you cause an accident. It covers damages to their property and medical expenses, but does not cover your own vehicle.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. However, it usually comes with a deductible, which you’ll need to pay out of pocket before the insurance kicks in.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, or natural disasters. It also typically comes with a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured. It covers your medical expenses and property damage.

Understanding Common Auto Insurance Coverage Options

Auto insurance in Washington State is designed to protect you financially in case of an accident or other unforeseen event. It is mandatory to have at least liability coverage, but you can choose from various coverage options to tailor your policy to your needs. Understanding these options is crucial for making informed decisions about your auto insurance.

Liability Coverage

Liability coverage is the most basic type of auto insurance required in Washington. It protects you financially if you are at fault in an accident and cause injury or damage to others. This coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages to people injured in an accident you caused. It is usually expressed as a per-person limit and a per-accident limit, for example, $25,000/$50,000.

- Property Damage Liability: This covers damages to another person’s vehicle or property caused by an accident you are responsible for. This coverage is typically expressed as a single limit, for example, $25,000.

Liability coverage is essential because it protects you from significant financial losses if you are found responsible for an accident.

Collision Coverage, Wa state auto insurance

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is essential if you want to protect your investment in your vehicle.

- Deductible: With collision coverage, you pay a deductible, which is the amount you pay out of pocket before your insurance company covers the remaining costs. The higher your deductible, the lower your premium.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. It is also optional, but it is essential if you want to protect your vehicle from a wide range of risks.

- Deductible: Like collision coverage, comprehensive coverage also has a deductible, which is the amount you pay out of pocket before your insurance company covers the remaining costs. The higher your deductible, the lower your premium.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage is essential because it ensures you are financially protected even if the other driver cannot cover your losses.

- Coverage Limits: UM/UIM coverage limits typically match your bodily injury liability coverage limits, but you can choose to purchase higher limits.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault coverage, covers your medical expenses and lost wages regardless of who is at fault in an accident.

- Coverage Limits: PIP coverage limits are typically set by the state and cover a certain amount of medical expenses and lost wages.

Other Coverage Options

In addition to the basic coverage options, you can choose from other coverage options to further protect yourself and your vehicle, such as:

- Rental Car Coverage: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with flat tires, jump starts, and towing.

- Gap Coverage: This coverage pays the difference between the actual cash value of your vehicle and the amount you owe on your loan if your vehicle is totaled.

Choosing the Right Coverage

Choosing the right auto insurance coverage is essential for protecting yourself and your vehicle. Consider the following factors when making your decision:

- Your Driving History: Drivers with a clean driving record typically pay lower premiums than drivers with a history of accidents or traffic violations.

- Your Vehicle: The type, age, and value of your vehicle can affect your insurance premiums. Newer, more expensive vehicles typically have higher premiums.

- Your Driving Habits: Drivers who drive less frequently or for shorter distances typically pay lower premiums than drivers who drive more often or for longer distances.

- Your Location: The location where you live can also affect your insurance premiums. Areas with higher rates of accidents or theft typically have higher premiums.

Dealing with Accidents and Claims: Wa State Auto Insurance

Accidents happen, and if you find yourself in one, knowing how to handle the situation and navigate the claims process is crucial. In Washington State, understanding the steps involved in reporting an accident, the role of your insurance company, and the importance of proper documentation are essential for a smooth resolution.

Reporting an Accident in Washington

It’s important to report an accident to the authorities as soon as possible. This helps ensure everyone’s safety and provides a record of the incident. Here’s what you should do:

- Check for injuries: If anyone is injured, call 911 immediately.

- Move your vehicle to a safe location: If possible, move your vehicle out of the way of traffic. If it’s not safe to move, turn on your hazard lights and place warning triangles around your car.

- Exchange information: Get the other driver’s name, address, phone number, insurance company, and policy number. Also, obtain the names and contact information of any witnesses.

- Take photos: Document the scene of the accident by taking photos of the damage to all vehicles involved, the location of the accident, and any skid marks or debris.

- File a police report: Contact the local police department to report the accident. They will create an official report, which is important for your insurance claim.

The Claims Process

After reporting the accident, the next step is to file a claim with your insurance company. This process involves the following steps:

- Contact your insurance company: Inform them about the accident and provide the necessary details.

- Provide documentation: Your insurance company will likely ask for documentation, such as the police report, photos of the damage, and the other driver’s insurance information.

- Get an estimate: Your insurance company will arrange for an inspection of your vehicle to determine the extent of the damage and provide an estimate for repairs.

- Negotiate a settlement: If you have collision coverage, your insurance company will work with you to negotiate a settlement for the repairs or replacement of your vehicle.

The Importance of Documentation

Having proper documentation is crucial when dealing with an accident and filing a claim. This documentation can include:

- Police report: An official police report provides a neutral account of the accident and is essential evidence for your insurance claim.

- Photos: Photos of the accident scene, vehicle damage, and any skid marks or debris can provide valuable visual evidence.

- Witness statements: Statements from any witnesses who saw the accident can provide valuable information about what happened.

- Medical records: If you were injured in the accident, keep all medical records, including doctor’s notes and bills.

Resources for Washington Drivers

Navigating the world of auto insurance in Washington can feel overwhelming, but there are numerous resources available to help you make informed decisions and protect your interests. These resources can provide valuable information, support, and guidance throughout your insurance journey.

Official State Resources

The Washington State Office of the Insurance Commissioner (OIC) is your primary source for information and assistance related to auto insurance. The OIC is responsible for regulating the insurance industry in Washington and ensuring that consumers are protected.

- Website: https://www.insurance.wa.gov/

- Phone: (800) 562-6900

- Email: insurance.commissioner@insurance.wa.gov

The OIC website offers a wealth of information, including:

- Consumer guides: These guides provide clear and concise information on various aspects of auto insurance, such as choosing the right coverage, understanding your policy, and filing a claim.

- Insurance company ratings: The OIC publishes ratings of insurance companies based on their financial stability, customer service, and complaint history. This information can help you choose a reliable and trustworthy insurer.

- Complaint filing: If you have a problem with your insurance company, you can file a complaint with the OIC. The OIC will investigate your complaint and work to resolve the issue.

Consumer Protection Agencies

In addition to the OIC, there are other organizations that can provide assistance to Washington drivers. These organizations focus on consumer protection and advocate for the rights of consumers.

- Washington State Attorney General’s Office: https://www.atg.wa.gov/ The Attorney General’s Office investigates consumer complaints and enforces consumer protection laws.

- Better Business Bureau (BBB): https://www.bbb.org/ The BBB provides ratings and reviews of businesses, including insurance companies. You can use this information to research companies and make informed decisions.

Advocacy Groups

Several advocacy groups focus on protecting the rights of consumers and promoting fair insurance practices. These groups can provide information, support, and representation to drivers who are facing insurance-related issues.

- Consumer Federation of America (CFA): https://www.consumerfed.org/ The CFA is a national consumer advocacy group that works to protect consumers from unfair business practices, including in the insurance industry.

- National Association of Insurance Commissioners (NAIC): https://www.naic.org/ The NAIC is a non-profit organization that represents state insurance regulators. The NAIC develops model laws and regulations to promote uniformity and consistency in insurance regulation across the states.

Final Thoughts

Navigating the world of WA state auto insurance can be a daunting task, but with the right information and resources, it doesn’t have to be. By understanding the factors influencing rates, comparing quotes, and choosing the right coverage, you can ensure you’re protected on the road while maintaining affordability. Remember to review your policy regularly and stay informed about any changes in the market.

Essential FAQs

How much does auto insurance cost in Washington?

Auto insurance costs in Washington vary greatly depending on factors like driving history, vehicle type, location, and coverage choices. It’s essential to compare quotes from multiple insurers to find the best rate for your specific needs.

What are the penalties for driving without insurance in Washington?

Driving without insurance in Washington is illegal and can result in fines, license suspension, and even vehicle impoundment. It’s crucial to maintain valid auto insurance coverage at all times.

What is the role of the Washington State Office of Insurance Commissioner (OIC)?

The OIC regulates the insurance industry in Washington, ensuring fair practices and protecting consumers. They handle complaints, investigate insurance fraud, and provide information and resources to drivers.