United States auto insurance is a complex and vital aspect of American life, safeguarding drivers and their vehicles against unforeseen events. This comprehensive guide delves into the intricate landscape of the US auto insurance market, exploring its key players, diverse coverage options, and influential factors that shape premiums. From understanding the intricacies of policy terms to navigating the ever-evolving world of driving trends, this exploration aims to empower individuals with the knowledge they need to make informed decisions about their auto insurance.

The US auto insurance market is a dynamic ecosystem, characterized by a multitude of insurance providers, each offering a unique range of coverage options and pricing strategies. Understanding the different types of coverage available, such as liability, collision, comprehensive, and uninsured motorist, is crucial for making informed decisions about your insurance needs. Furthermore, factors such as driving history, vehicle type, location, and credit score can significantly influence your auto insurance premiums, highlighting the importance of careful consideration and comparison shopping.

The US Auto Insurance Landscape

The United States auto insurance market is a complex and dynamic ecosystem, characterized by a diverse range of players and a multitude of coverage options. This section delves into the structure of this market, exploring the key players and their roles, the various types of auto insurance coverage available, and the factors that influence auto insurance premiums.

Key Players and Their Roles

The US auto insurance market is primarily shaped by insurance companies, state governments, and consumers. Insurance companies play a central role in providing coverage, setting premiums, and managing claims. State governments regulate the industry, setting minimum coverage requirements, licensing insurance companies, and ensuring fair practices. Consumers, as policyholders, are the end users of auto insurance, seeking protection from financial losses arising from accidents or other incidents.

Types of Auto Insurance Coverage

Auto insurance policies in the US typically offer a range of coverage options, each designed to protect policyholders from specific risks. Here’s a breakdown of common types of coverage:

- Liability Coverage: This is the most basic type of auto insurance, covering damages to others and their property in case of an accident caused by the policyholder. It includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of the policyholder’s vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects against damages to the policyholder’s vehicle from non-collision events such as theft, vandalism, natural disasters, and falling objects.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in case of an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers medical expenses, lost wages, and other related costs for the policyholder and passengers in their vehicle, regardless of fault.

- Medical Payments Coverage (Med Pay): This coverage provides medical expense coverage for the policyholder and passengers in their vehicle, regardless of fault, up to a certain limit.

- Rental Reimbursement Coverage: This coverage provides reimbursement for rental car expenses while the policyholder’s vehicle is being repaired after an accident.

Factors Influencing Auto Insurance Premiums

Several factors contribute to the calculation of auto insurance premiums. These factors are used to assess the risk associated with insuring a particular driver and vehicle.

- Driving History: A driver’s past accidents, traffic violations, and driving record significantly impact their premium. Drivers with a clean driving record generally receive lower premiums.

- Age and Gender: Younger drivers and males tend to have higher premiums due to their statistically higher risk of accidents.

- Vehicle Type and Value: The type, make, model, and value of the vehicle influence premiums. Luxury vehicles and high-performance cars often have higher premiums due to their higher repair costs and potential for theft.

- Location: Geographic location plays a role in premium calculations, as accident rates and crime rates vary significantly across different regions.

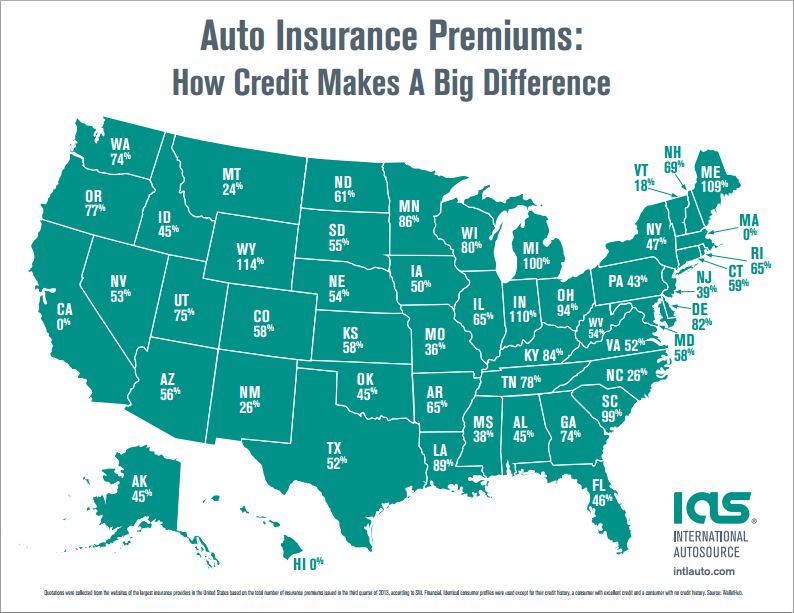

- Credit Score: In some states, insurance companies use credit scores as a proxy for risk assessment. Drivers with higher credit scores generally receive lower premiums.

- Coverage Levels: The level of coverage selected by the policyholder directly impacts premiums. Higher coverage limits generally result in higher premiums.

- Discounts: Insurance companies offer various discounts for safe driving habits, safety features in the vehicle, good student status, and other factors.

Key Considerations for US Auto Insurance

Choosing the right auto insurance policy is crucial for protecting yourself financially in the event of an accident or other covered event. It’s also essential to consider your individual needs and circumstances when selecting a policy.

Coverage Options

Understanding the different types of coverage available is vital for making an informed decision.

- Liability Coverage: This is the most basic type of auto insurance and is required in most states. It covers damages to other people’s property or injuries caused by an accident you are responsible for.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage: This protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This coverage, available in some states, provides coverage for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault.

Pricing

Insurance premiums vary based on several factors, including:

- Driving Record: A clean driving record with no accidents or violations will result in lower premiums.

- Age and Gender: Younger and male drivers generally pay higher premiums due to higher risk.

- Vehicle Type and Value: More expensive or high-performance vehicles typically have higher premiums.

- Location: Premiums can vary based on the location’s accident rates and crime statistics.

- Credit Score: Some insurers use credit scores to assess risk, with lower credit scores often leading to higher premiums.

- Deductible: A higher deductible, the amount you pay out of pocket before insurance coverage kicks in, usually leads to lower premiums.

Customer Service

- Claims Process: Look for insurers with a reputation for handling claims efficiently and fairly.

- Accessibility and Responsiveness: Ensure you can easily contact the insurer and receive timely responses to your inquiries.

- Customer Reviews and Ratings: Research customer reviews and ratings to gauge the insurer’s overall customer satisfaction.

Policy Terms and Conditions, United states auto insurance

- Exclusions: Understand what situations are not covered by the policy.

- Limits: Be aware of the maximum amount the insurer will pay for each type of coverage.

- Renewals: Understand how the policy renews and whether premiums can change.

Driving Trends and Their Impact on Auto Insurance

The automotive landscape is rapidly evolving, driven by technological advancements and changing consumer preferences. The emergence of autonomous vehicles (AVs) and ride-sharing services is reshaping the way we drive, with significant implications for the auto insurance industry.

Impact of Autonomous Vehicles on Auto Insurance

The advent of AVs presents both opportunities and challenges for the auto insurance industry. AVs have the potential to significantly reduce accidents due to their advanced safety features and ability to react faster than human drivers. This reduction in accidents could lead to lower insurance premiums for AV owners. However, the insurance industry needs to adapt to the unique characteristics of AVs, such as:

- Liability in the event of an accident: Determining liability in an accident involving an AV can be complex, as the responsibility may lie with the manufacturer, the software developer, or the owner.

- Data privacy: AVs collect vast amounts of data on driving habits, which raises concerns about data privacy and security. Insurers need to ensure that data collected from AVs is used responsibly and ethically.

- New coverage models: Traditional insurance models may not be suitable for AVs. New coverage models may be needed to address the unique risks and benefits associated with these vehicles.

Impact of Ride-Sharing Services on Auto Insurance

Ride-sharing services, such as Uber and Lyft, have disrupted the traditional taxi industry and have also had a significant impact on the auto insurance industry. Ride-sharing services operate in a grey area when it comes to insurance coverage.

- Coverage for drivers: Ride-sharing drivers typically need to have additional insurance coverage to protect themselves while driving for the platform. This coverage may be provided by the ride-sharing company or through a separate policy.

- Coverage for passengers: Passengers in ride-sharing vehicles may be covered by the ride-sharing company’s insurance policy or by the driver’s personal auto insurance policy. The specific coverage can vary depending on the platform and the state.

- Insurance for the ride-sharing company: Ride-sharing companies typically have their own insurance policies to cover their liability in the event of an accident.

Consumer Tips for Obtaining Optimal Coverage

Navigating the world of auto insurance can be overwhelming, but with a little preparation and knowledge, you can secure the best coverage at a price that fits your budget. This section provides practical tips to help you find the most suitable and cost-effective auto insurance policy.

Comparing Quotes and Choosing the Right Policy

To find the best insurance deal, it’s crucial to compare quotes from multiple insurers. Here’s a step-by-step guide to make the process efficient and effective:

- Gather your information. Before you start requesting quotes, have your driving history, vehicle information, and desired coverage details readily available. This includes your driver’s license number, vehicle identification number (VIN), and details about your current insurance policy, if any.

- Use online comparison tools. Several websites and apps allow you to compare quotes from multiple insurers simultaneously. These tools are convenient and save you time. However, remember to verify the information provided by these tools with the insurers directly, as some details might vary.

- Contact insurers directly. While online tools are helpful, contacting insurers directly allows you to discuss your specific needs and ask questions. This personalized approach ensures you understand the policy details and can clarify any doubts.

- Compare coverage options. Once you receive quotes, carefully compare the coverage options and premiums offered by different insurers. Consider factors like deductibles, limits, and the insurer’s reputation for claims handling.

- Choose the policy that best suits your needs. After comparing quotes and coverage options, select the policy that offers the best combination of price and protection for your specific situation. Remember, the cheapest policy isn’t always the best. Consider the overall value and coverage offered.

Negotiating with Insurance Companies

While many factors influence your insurance premium, there are ways to potentially reduce your costs. Here are some tips for negotiating with insurance companies:

- Shop around regularly. Even if you’re happy with your current insurer, it’s beneficial to compare quotes from other companies periodically. This ensures you’re getting the best rate and helps you leverage competition to negotiate better terms.

- Bundle your insurance policies. Combining your auto insurance with other policies, like homeowners or renters insurance, can lead to significant discounts. Ask your insurer about potential savings through bundling.

- Ask about discounts. Many insurers offer discounts for good driving records, safety features in your vehicle, and other factors. Be sure to inquire about any discounts you might qualify for.

- Be prepared to switch insurers. If you’re not satisfied with your current insurer’s rates or service, don’t hesitate to switch to another company. The threat of losing a customer can sometimes incentivize insurers to offer more competitive rates.

The Role of Technology in Auto Insurance: United States Auto Insurance

The auto insurance industry is undergoing a significant transformation driven by technological advancements. Telematics, data analytics, and artificial intelligence are playing a crucial role in reshaping the landscape, impacting how policies are priced, how claims are processed, and how consumers interact with their insurers.

Impact of Telematics and Data Analytics

Telematics, the use of technology to collect and analyze data from vehicles, has revolutionized auto insurance. Devices such as telematics black boxes or smartphone apps track driving behavior, providing valuable insights into risk profiles. Data analytics then processes this information to identify patterns and trends, allowing insurers to tailor premiums based on individual driving habits.

- Personalized Premiums: Telematics data allows insurers to assess individual risk more accurately. Drivers with good driving habits, such as maintaining a safe speed and avoiding hard braking, can receive lower premiums. Conversely, drivers with risky behavior may see higher premiums. This personalized approach to pricing offers greater fairness and encourages safer driving practices.

- Enhanced Customer Experience: Telematics can also enhance the customer experience by providing real-time feedback on driving habits. Some apps offer features like speed alerts, distraction warnings, and driving scorecards. These features help drivers become more aware of their driving behavior and make conscious efforts to improve their safety.

- Improved Claims Processing: Telematics data can also be used to streamline claims processing. In the event of an accident, telematics devices can provide valuable information, such as location, speed, and direction of travel. This data can help insurers quickly assess the severity of the accident and expedite the claims process.

Closing Summary

Navigating the United States auto insurance market can be a daunting task, but with the right knowledge and strategies, consumers can secure optimal coverage at a reasonable price. By understanding the key considerations, driving trends, and technological advancements shaping the industry, individuals can make informed choices that protect themselves and their vehicles while optimizing their insurance experience. Remember to compare quotes, negotiate with insurers, and stay informed about the latest developments in the auto insurance landscape to ensure you have the best possible coverage.

FAQ Resource

What are the different types of auto insurance coverage available in the US?

Common types of auto insurance coverage include liability, collision, comprehensive, uninsured motorist, and medical payments coverage. Each type provides different levels of protection against various risks associated with owning and operating a vehicle.

How can I reduce my auto insurance premiums?

Several strategies can help reduce your auto insurance premiums, including maintaining a good driving record, choosing a safe vehicle, increasing your deductible, bundling insurance policies, and exploring discounts offered by your insurer.

What is the role of technology in auto insurance?

Technology plays a significant role in auto insurance, with advancements in telematics, data analytics, and artificial intelligence transforming the industry. These technologies enable insurers to personalize premiums, enhance customer experiences, and improve risk assessment.