Texas State Minimum Liability Insurance is a crucial aspect of driving in the Lone Star State. It serves as a safety net, providing financial protection in case of accidents. This coverage ensures you can meet your legal obligations and avoid significant financial burdens if you are found at fault in an accident.

Understanding the minimum liability insurance requirements, the various types of coverage available, and factors that influence premiums are essential for every Texas driver. This information empowers you to make informed decisions about your insurance policy and ensure you have the right protection.

Texas State Minimum Liability Insurance Requirements

In Texas, driving without the required minimum liability insurance is illegal and carries serious consequences. Understanding the state’s insurance requirements is crucial for all drivers to ensure they are legally compliant and financially protected in case of an accident.

Minimum Liability Insurance Coverage Amounts

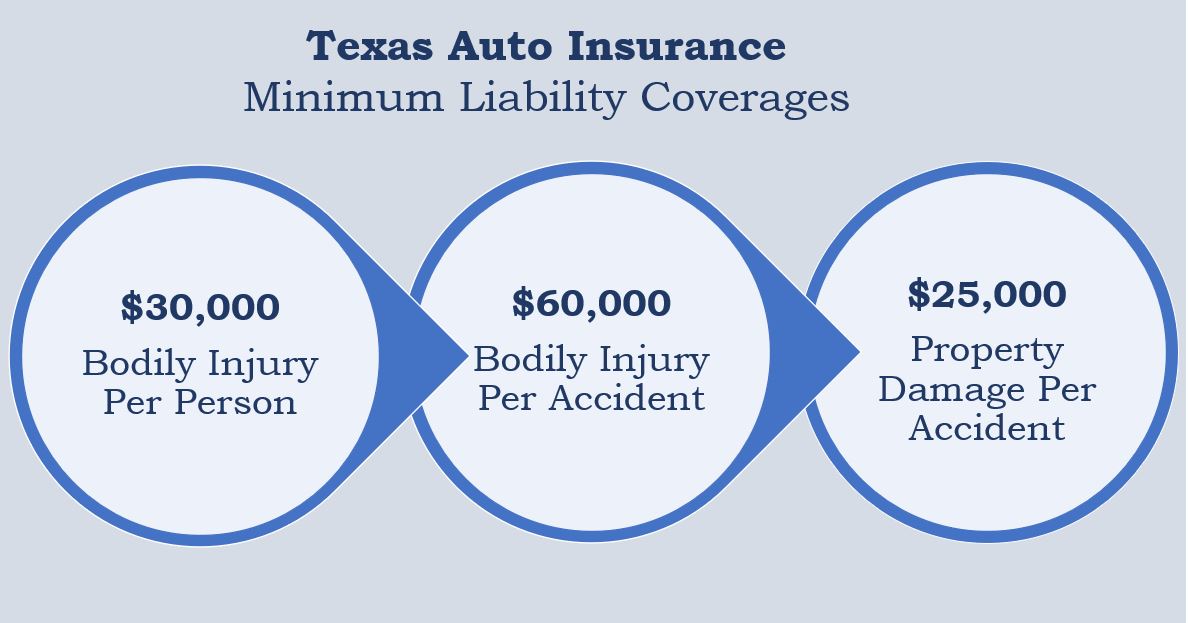

Texas law mandates that all drivers carry a minimum amount of liability insurance to cover potential damages caused to others in an accident. This coverage protects you financially if you are found at fault for an accident. Here’s a breakdown of the required coverage amounts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by someone else due to your negligence. The minimum requirement in Texas is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This coverage pays for damages to another person’s property, such as their vehicle or other possessions, if you are responsible for the accident. The minimum requirement in Texas is $25,000 per accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your losses. The minimum requirement in Texas is $30,000 per person and $60,000 per accident.

Penalties for Driving Without Insurance

Driving without the required minimum liability insurance in Texas is a serious offense. The penalties for this violation can be severe and include:

- Fines: You could face a fine of up to $350 for driving without insurance, and subsequent offenses can result in higher fines.

- License Suspension: Your driver’s license can be suspended for up to six months if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You may be required to pay court costs and other fees associated with the violation.

- Jail Time: In some cases, you could even face jail time for driving without insurance, especially if you are involved in an accident.

Understanding Liability Insurance Coverage

Liability insurance is an essential part of protecting yourself financially in case you are found responsible for causing harm to another person or their property. In Texas, liability insurance is required for all drivers, and it covers the costs of medical bills, property damage, and legal fees if you are involved in an accident.

Types of Liability Insurance Coverage

Liability insurance in Texas is divided into two main categories: bodily injury liability coverage and property damage liability coverage. Each type of coverage has its own limits, which are the maximum amounts the insurance company will pay for covered losses.

- Bodily injury liability coverage pays for medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident. The minimum amount of bodily injury liability coverage required in Texas is $30,000 per person and $60,000 per accident. This means that the insurance company will pay up to $30,000 for injuries to any one person involved in an accident, and up to $60,000 for all injuries caused in the accident.

- Property damage liability coverage pays for damage to other people’s property, such as their vehicles, homes, or other belongings. The minimum amount of property damage liability coverage required in Texas is $25,000. This means that the insurance company will pay up to $25,000 for damage to property caused by an accident.

Examples of Situations Where Liability Insurance is Necessary

Liability insurance can be crucial in many situations. Here are some examples:

- Car Accidents: If you are involved in a car accident and are found at fault, your liability insurance will cover the costs of repairing the other driver’s vehicle and paying for their medical expenses.

- Slip and Falls: If someone slips and falls on your property and is injured, your liability insurance may cover their medical expenses and legal fees.

- Dog Bites: If your dog bites someone, your liability insurance may cover the victim’s medical expenses and any other damages.

- Product Liability: If a product you manufactured or sold causes harm to someone, your liability insurance may cover the victim’s medical expenses, lost wages, and other damages.

Comparing Different Types of Liability Coverage, Texas state minimum liability insurance

| Type of Coverage | Benefits |

|---|---|

| Bodily Injury Liability Coverage | Pays for medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident. |

| Property Damage Liability Coverage | Pays for damage to other people’s property, such as their vehicles, homes, or other belongings. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Provides coverage for injuries and property damage caused by an uninsured or underinsured driver. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of fault, in an accident. |

| Collision Coverage | Covers damage to your vehicle, regardless of fault, in an accident. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. |

Factors Influencing Insurance Premiums

The cost of liability insurance in Texas is influenced by several factors. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your insurance premiums. Insurance companies assess your risk based on your past driving record, including:

- Accidents: A history of accidents, especially those involving fault, can significantly increase your premiums. Each accident is considered individually, taking into account factors such as severity and responsibility.

- Traffic Violations: Traffic violations like speeding tickets, running red lights, or driving under the influence can also lead to higher premiums. The severity of the violation and the number of offenses will impact your rates.

- Driving Record: A clean driving record with no accidents or violations will generally result in lower premiums. Maintaining a safe driving record is crucial for keeping your insurance costs manageable.

Age

Your age is another factor that insurance companies consider when calculating premiums. Younger drivers are statistically more likely to be involved in accidents, leading to higher premiums.

- Teenage Drivers: Teenagers have limited driving experience and are more prone to risky behavior, resulting in higher insurance rates.

- Mature Drivers: Drivers over the age of 65 may have lower premiums due to their generally safer driving habits and experience.

- Age Range: Drivers in their 20s and 30s often have lower premiums than teenagers but higher premiums than older drivers.

Vehicle Type

The type of vehicle you drive plays a role in your insurance premiums. Some vehicles are considered riskier to insure due to their performance, safety features, and value.

- Sports Cars and High-Performance Vehicles: These vehicles are often associated with higher speeds and riskier driving, resulting in higher insurance costs.

- Luxury Vehicles: Luxury cars tend to be more expensive to repair, leading to higher insurance premiums.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and stability control may qualify for lower premiums.

Location

Your location, including the city, state, and zip code, can affect your insurance premiums. Factors such as traffic density, crime rates, and the frequency of accidents in your area influence insurance rates.

- Urban Areas: Urban areas often have higher traffic congestion and crime rates, leading to higher insurance premiums.

- Rural Areas: Rural areas typically have lower traffic density and fewer accidents, potentially resulting in lower insurance premiums.

- State Regulations: State regulations and insurance laws can also influence premiums. Some states have higher insurance costs due to factors like mandatory coverage requirements or the prevalence of lawsuits.

The Importance of Adequate Coverage

In Texas, driving without the minimum liability insurance coverage is illegal. However, simply meeting the minimum requirements may not be enough to protect you financially in the event of an accident. Understanding the potential financial consequences of insufficient coverage is crucial to ensure you’re adequately protected.

Having inadequate coverage can leave you vulnerable to significant financial burdens. This can include covering medical expenses, property damage, and legal fees, potentially leading to financial hardship and even bankruptcy. The minimum liability insurance coverage may not be sufficient to cover all your legal obligations in the event of a serious accident, leaving you personally liable for the remaining costs.

Real-World Scenarios Illustrating the Importance of Adequate Coverage

Let’s consider some real-world scenarios to understand the importance of adequate coverage:

- Imagine you’re involved in an accident where you are at fault, and the other driver suffers serious injuries requiring extensive medical treatment. The medical bills could easily exceed the minimum liability coverage limits, leaving you responsible for the remaining amount. This could lead to financial distress, impacting your ability to pay for other expenses like rent, utilities, and food.

- Another scenario could involve an accident where you cause significant damage to another person’s property, such as a brand new car or a valuable piece of equipment. If your coverage limits are low, you may not be able to cover the full cost of repairs or replacement, leaving you financially liable for the difference.

Potential Costs Associated with Different Accident Scenarios

The following table illustrates the potential costs associated with different accident scenarios with varying insurance coverage levels. These are just examples, and actual costs can vary depending on factors like the severity of the accident, location, and medical expenses.

| Scenario | Minimum Coverage | Higher Coverage | Potential Out-of-Pocket Costs |

|---|---|---|---|

| Minor Accident: $5,000 in property damage | $25,000 | $100,000 | $0 (covered by minimum coverage) |

| Moderate Accident: $10,000 in property damage, $20,000 in medical expenses | $25,000 | $100,000 | $15,000 (covered by minimum coverage) |

| Serious Accident: $50,000 in property damage, $100,000 in medical expenses | $25,000 | $100,000 | $75,000 (covered by minimum coverage) |

Choosing the Right Insurance Policy

Selecting the appropriate liability insurance policy is crucial for protecting yourself financially in the event of an accident or incident. Your choice should be based on a careful assessment of your individual needs, driving habits, and financial circumstances.

Comparing Insurance Quotes

To find the best insurance policy for your needs, it’s essential to compare quotes from multiple insurance providers. This allows you to evaluate different coverage options, premiums, and discounts.

- Use online comparison tools: Many websites allow you to enter your information and receive quotes from multiple insurers simultaneously. This can save you time and effort.

- Contact insurance agents directly: You can also reach out to insurance agents in your area and request quotes. This gives you the opportunity to ask questions and discuss your specific needs.

- Review policy details carefully: Don’t just focus on the premium. Ensure you understand the coverage details, deductibles, and exclusions before making a decision.

Understanding Policy Terms and Conditions

Before you commit to an insurance policy, it’s crucial to thoroughly understand its terms and conditions. This ensures that you are aware of your coverage limits, deductibles, and any exclusions.

- Coverage limits: These refer to the maximum amount the insurer will pay for a covered claim. It’s important to choose limits that are adequate for your potential financial exposure.

- Deductibles: This is the amount you’ll pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, but you’ll have to pay more in the event of a claim.

- Exclusions: These are specific situations or events that are not covered by your insurance policy. It’s important to understand these exclusions to avoid any surprises later.

Additional Considerations

While Texas state minimum liability insurance fulfills the legal requirement, it might not offer adequate protection in all situations. Considering additional coverage can enhance your financial security and peace of mind.

Benefits of Optional Coverages

Optional coverages can provide significant financial protection beyond the minimum liability requirements. They offer valuable coverage for unexpected situations, ensuring you are financially prepared for potential risks.

Medical Payments Coverage

Medical payments coverage (Med Pay) provides financial assistance for medical expenses incurred by you, your passengers, or other drivers involved in an accident, regardless of fault. It covers medical bills, including ambulance charges, hospital stays, and doctor visits.

Med Pay can be especially beneficial in situations where you are at fault for an accident but the other driver does not have sufficient insurance coverage to cover their medical expenses.

Collision and Comprehensive Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object. Comprehensive coverage covers damage to your vehicle caused by events like theft, vandalism, fire, or natural disasters.

Collision and comprehensive coverage can be crucial for protecting your investment in your vehicle. They can help you avoid significant out-of-pocket expenses for repairs or replacement.

Importance of Regular Review

Regularly reviewing and updating your insurance coverage is essential to ensure it remains adequate for your current needs and circumstances. Factors like changes in your driving habits, vehicle value, or family size can impact your insurance requirements.

It is recommended to review your insurance coverage annually or whenever there are significant life changes.

Final Thoughts

In Texas, driving without the required minimum liability insurance can lead to severe penalties, including fines, license suspension, and even jail time. Therefore, it is imperative to understand the legal requirements and ensure you have adequate coverage. By carefully selecting a policy that meets your individual needs and circumstances, you can safeguard yourself and your finances in the event of an accident.

User Queries: Texas State Minimum Liability Insurance

What happens if I get into an accident and don’t have the required minimum liability insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You would also be responsible for covering the costs of any damages or injuries you cause, potentially leading to significant financial hardship.

How do I know if I have enough liability insurance coverage?

It’s best to consult with an insurance agent to determine the appropriate coverage based on your individual needs and circumstances. Factors like the value of your vehicle, your driving history, and your financial situation can all influence the amount of coverage you need.

Can I get a discount on my liability insurance premiums?

Yes, many insurance companies offer discounts for safe driving, good credit scores, and bundling multiple insurance policies. You can also lower your premiums by taking a defensive driving course or installing safety features in your vehicle.