Texas State Minimum Insurance Coverage is a crucial aspect of driving in the Lone Star State. It’s not just a legal requirement, it’s a safety net that protects you and others on the road. Understanding the minimum coverage amounts and their implications is vital for every driver in Texas.

This guide delves into the essential aspects of Texas minimum insurance coverage, explaining the different types of coverage, their importance, and the potential consequences of driving without sufficient insurance. We’ll also explore optional coverage options that can enhance your protection and provide additional peace of mind.

Texas Minimum Insurance Coverage Requirements

Texas law requires all drivers to carry a minimum amount of liability insurance to protect themselves and others in case of an accident. This ensures that financial responsibility is taken seriously, and victims of accidents have access to compensation for their losses.

Financial Responsibility Laws

Texas’s financial responsibility laws aim to ensure that drivers are financially accountable for any damages or injuries they cause while driving. These laws mandate that drivers carry a minimum amount of liability insurance or provide proof of financial responsibility through other means, such as posting a bond or cash deposit. Failure to comply with these laws can result in severe penalties, including license suspension and vehicle registration revocation.

Minimum Coverage Amounts

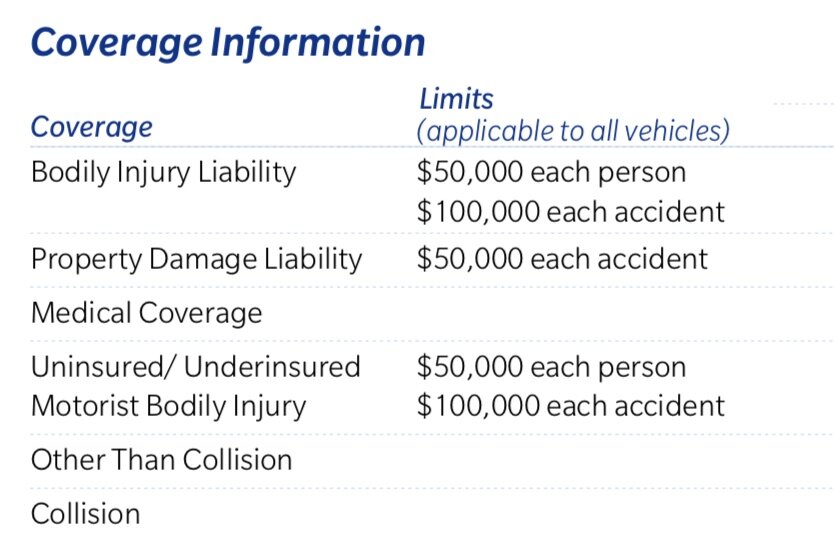

Texas mandates the following minimum coverage amounts for all drivers:

- Bodily Injury Liability: $30,000 per person, $60,000 per accident. This coverage protects you financially if you cause an accident that injures another person. The coverage limit applies to medical expenses, lost wages, and other damages related to the injury.

- Property Damage Liability: $25,000 per accident. This coverage pays for damages to another person’s property, such as their vehicle or other belongings, if you are at fault in an accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): $30,000 per person, $60,000 per accident. This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver. It helps cover medical expenses, lost wages, and other damages not covered by the at-fault driver’s insurance.

Note: These minimum coverage amounts are the bare minimum required by law. You may want to consider purchasing higher coverage limits to protect yourself adequately in case of a serious accident.

Understanding Texas Minimum Insurance Coverage

Understanding the purpose and importance of Texas minimum insurance coverage is crucial for all drivers in the state. This coverage is designed to protect you and others financially in the event of an accident. By complying with these requirements, you contribute to a safer and more responsible driving environment.

Consequences of Driving Without Minimum Insurance Coverage

Driving without the required minimum insurance coverage in Texas can have serious consequences. The Texas Department of Transportation (TxDOT) enforces these regulations to ensure that drivers are financially responsible for any accidents they cause.

- Fines: Drivers caught driving without minimum insurance coverage face substantial fines. The amount of the fine can vary depending on the specific circumstances, but it can range from hundreds to thousands of dollars.

- License Suspension: In addition to fines, driving without insurance can lead to the suspension of your driver’s license. This suspension can prevent you from driving legally and can significantly impact your daily life.

- Legal Liabilities: The most significant consequence of driving without insurance is the potential for substantial legal liabilities. If you cause an accident, you could be held personally responsible for all damages and injuries, even if the accident was not your fault. This can include medical bills, property damage, and even legal fees.

Situations Where Minimum Insurance Coverage May Be Insufficient

While Texas minimum insurance coverage provides a basic level of protection, it may not be enough in all situations. There are several scenarios where you might need additional coverage:

- High-Value Vehicles: If you drive a luxury car or a vehicle with a high market value, the minimum coverage may not be sufficient to cover the cost of repairs or replacement in the event of an accident.

- Multiple Vehicles: If you own or operate multiple vehicles, the minimum coverage may not be adequate to cover all of your vehicles in the event of an accident.

- Significant Injuries: In cases of serious injuries or fatalities, the minimum coverage may not be enough to cover all medical expenses, lost wages, and other related costs.

- Uninsured or Underinsured Motorists: If you are involved in an accident with an uninsured or underinsured driver, the minimum coverage may not be sufficient to cover your losses.

Exploring Coverage Options Beyond Minimum Requirements

While Texas law requires you to carry specific minimum insurance coverage, it’s essential to consider the benefits of additional coverage beyond the bare minimum. These optional coverages can provide greater financial protection in the event of an accident, ensuring your financial stability and peace of mind.

Collision Coverage

Collision coverage protects you from financial losses resulting from accidents with another vehicle or an object, such as a tree or a building. It covers the cost of repairs or replacement for your vehicle, minus any deductible you choose. This coverage is crucial for drivers with financed or leased vehicles, as it helps protect the lender’s investment.

Collision coverage is particularly beneficial for drivers with newer or more expensive vehicles, as the cost of repairs or replacement can be significant.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses resulting from non-collision incidents like theft, vandalism, fire, or natural disasters. It covers the cost of repairs or replacement for your vehicle, minus any deductible you choose. This coverage is optional, but it can be valuable for drivers with newer or more expensive vehicles, as it provides protection against a wide range of unforeseen events.

Comprehensive coverage is often a wise choice for drivers who live in areas prone to natural disasters, such as hurricanes or earthquakes.

Medical Payments Coverage

Medical payments coverage (Med Pay) helps pay for medical expenses for you and your passengers in the event of an accident, regardless of fault. This coverage is separate from your health insurance and can provide valuable protection for those with limited or no health insurance.

Med Pay coverage is especially helpful for drivers who have high deductibles or limited coverage on their health insurance plans.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. It helps pay for medical expenses, lost wages, and property damage.

UM/UIM coverage is essential for drivers in Texas, as there are many uninsured or underinsured drivers on the road.

Gap Insurance

Gap insurance covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease. This coverage is particularly helpful for drivers with newer vehicles, as the value of a car can depreciate quickly.

Gap insurance can help protect you from significant financial losses if your vehicle is totaled in an accident.

Rental Reimbursement Coverage

Rental reimbursement coverage helps pay for the cost of a rental car while your vehicle is being repaired after an accident. This coverage can be valuable for drivers who rely on their vehicle for work or daily commutes.

Rental reimbursement coverage can help minimize the inconvenience and disruption caused by an accident.

Towing and Labor Coverage

Towing and labor coverage helps pay for the cost of towing your vehicle to a repair shop after an accident or breakdown. This coverage can be particularly helpful for drivers who live in areas with limited access to roadside assistance.

Towing and labor coverage can help you avoid costly and inconvenient delays after an accident or breakdown.

Additional Considerations, Texas state minimum insurance coverage

The cost of optional coverage can vary depending on several factors, including your driving history, vehicle type, and the coverage limits you choose. It’s essential to weigh the potential benefits of additional coverage against the cost to determine the right coverage for your individual needs.

Remember that higher coverage limits generally mean higher premiums. It’s important to strike a balance between affordable premiums and adequate coverage.

Obtaining and Maintaining Texas Minimum Insurance Coverage

Securing the necessary car insurance coverage in Texas involves a straightforward process that begins with obtaining quotes, carefully comparing options, and understanding the terms of your policy.

Factors Influencing Insurance Premiums in Texas

Several factors influence the cost of car insurance premiums in Texas. Understanding these factors can help you make informed decisions to potentially lower your costs.

- Driving History: Your driving record is a significant factor. Accidents, violations, and even the number of years you’ve been driving can influence your premium. A clean driving record generally leads to lower premiums.

- Vehicle Type: The type of vehicle you drive also impacts your premium. Expensive, high-performance cars or those with a history of theft or accidents are typically more expensive to insure.

- Location: Where you live in Texas can affect your insurance rates. Urban areas with higher traffic density and crime rates may have higher premiums compared to rural areas.

- Age and Gender: Younger drivers and those with less driving experience tend to have higher premiums. This is because statistically, they are considered to be at a higher risk of accidents. Gender can also play a role, with some insurers charging slightly different rates based on historical claims data.

- Credit History: In Texas, insurance companies can use your credit history to determine your insurance rates. This practice is not universal in all states, but in Texas, a good credit history can lead to lower premiums.

Tips for Maintaining Affordable Insurance Coverage

Maintaining affordable insurance coverage while meeting Texas minimum requirements is possible with a few strategies:

- Shop Around for Quotes: Compare quotes from multiple insurance companies to find the best rates. Online comparison websites can make this process easier.

- Consider Bundling Policies: Combining your car insurance with other policies like homeowners or renters insurance can often lead to discounts.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your premiums low. Defensive driving courses can also help lower your premiums.

- Increase Your Deductible: Choosing a higher deductible can lower your monthly premiums. However, remember that you’ll be responsible for paying a larger amount out of pocket if you have an accident.

- Ask About Discounts: Many insurance companies offer discounts for good students, safe drivers, and other factors. Inquire about any available discounts to see if you qualify.

- Review Your Policy Regularly: Review your policy periodically to ensure you have the right coverage and that your premiums are still competitive.

Resources and Support for Texas Drivers

Navigating the world of car insurance in Texas can sometimes feel overwhelming. Fortunately, there are numerous resources and support systems available to help Texas drivers understand their insurance obligations, file claims, and address any issues that may arise.

Texas State Agencies and Organizations

Texas offers a variety of state agencies and organizations dedicated to providing information and assistance related to car insurance. These resources can help you understand your rights, file claims, and resolve disputes with your insurance company.

| Agency/Organization | Contact Information | Website |

|---|---|---|

| Texas Department of Insurance (TDI) | 1-800-252-3439 | https://www.tdi.texas.gov/ |

| Texas Office of the Attorney General | (512) 463-2100 | https://www.texasattorneygeneral.gov/ |

| Texas Department of Motor Vehicles (TxDMV) | (512) 465-2000 | https://www.txdmv.gov/ |

| Texas Education Agency (TEA) | (512) 463-9536 | https://tea.texas.gov/ |

Filing a Claim or Reporting an Accident

In the unfortunate event of an accident, it’s essential to know how to file a claim or report the incident properly.

It’s crucial to prioritize safety and seek medical attention if necessary before proceeding with any insurance-related steps.

- Contact your insurance company immediately. Inform them of the accident, providing details such as the date, time, location, and any injuries involved.

- Gather information from the other driver(s) involved. This includes their name, contact information, insurance company, and policy number.

- Document the accident scene. Take photographs of any damage to your vehicle, the other vehicle(s), and the accident location.

- File a police report. This is especially important if there are injuries, significant damage, or if you believe the other driver may be at fault.

- Keep a record of all communication with your insurance company. This includes dates, times, and summaries of conversations.

Final Wrap-Up

Navigating the world of car insurance in Texas can seem daunting, but armed with the right knowledge, you can make informed decisions to ensure you have the appropriate coverage. By understanding the minimum requirements and exploring additional options, you can drive confidently, knowing you’re adequately protected in case of an accident. Remember, it’s always best to consult with an insurance professional to determine the best coverage for your individual needs and circumstances.

Common Queries: Texas State Minimum Insurance Coverage

What happens if I get into an accident and don’t have the minimum insurance coverage?

You could face serious consequences, including fines, license suspension, and legal liabilities. You may also be responsible for covering all costs associated with the accident, even if you weren’t at fault.

How often do I need to renew my car insurance in Texas?

Car insurance policies in Texas typically have a term of six months or one year. You’ll need to renew your policy before it expires to maintain continuous coverage.

Can I choose my own insurance provider in Texas?

Yes, you have the freedom to choose an insurance provider that best suits your needs and budget. It’s recommended to compare quotes from multiple providers to find the best rates and coverage options.

What factors influence my car insurance premiums in Texas?

Several factors can affect your premiums, including your driving history, vehicle type, age, location, and credit score.