Texas State Minimum Insurance Coverage is a crucial aspect of driving in the Lone Star State. It Artikels the minimum levels of financial protection required for all drivers, ensuring that victims of accidents are compensated for their losses. Understanding these requirements is essential for all Texas drivers, as failing to comply can result in serious legal consequences.

This guide will delve into the specifics of Texas minimum insurance coverage, exploring the legal basis, required coverage types, minimum amounts, and potential ramifications of driving without adequate insurance. We’ll also discuss financial responsibility laws, exemptions, and the importance of having sufficient coverage beyond the minimum requirements. By understanding these regulations, Texas drivers can ensure they are protected on the road and financially responsible in the event of an accident.

Texas Minimum Insurance Requirements: Texas State Minimum Insurance Coverage

In Texas, it’s mandatory for all vehicle owners to have at least the minimum amount of liability insurance. This law ensures that those involved in accidents have financial protection to cover damages and injuries. The Texas Department of Transportation (TxDOT) enforces these requirements to promote road safety and ensure financial responsibility among drivers.

The Types of Coverage Required

The Texas Financial Responsibility Law mandates specific types of liability insurance coverage for all drivers. These coverages provide financial protection to the insured driver and their passengers, as well as to others involved in an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or damage to another person or property. It covers medical expenses, lost wages, and property repairs for the other party.

- Medical Payments Coverage (Med Pay): This coverage provides medical benefits for you and your passengers, regardless of who is at fault in an accident. It helps cover medical expenses like doctor’s visits, hospital stays, and rehabilitation.

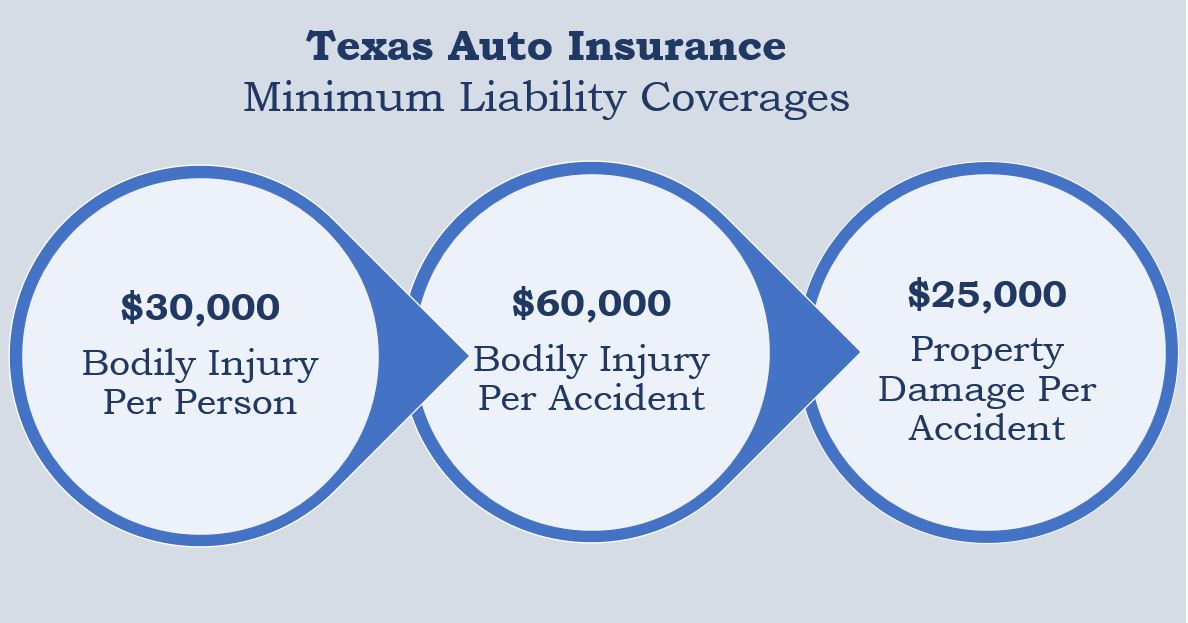

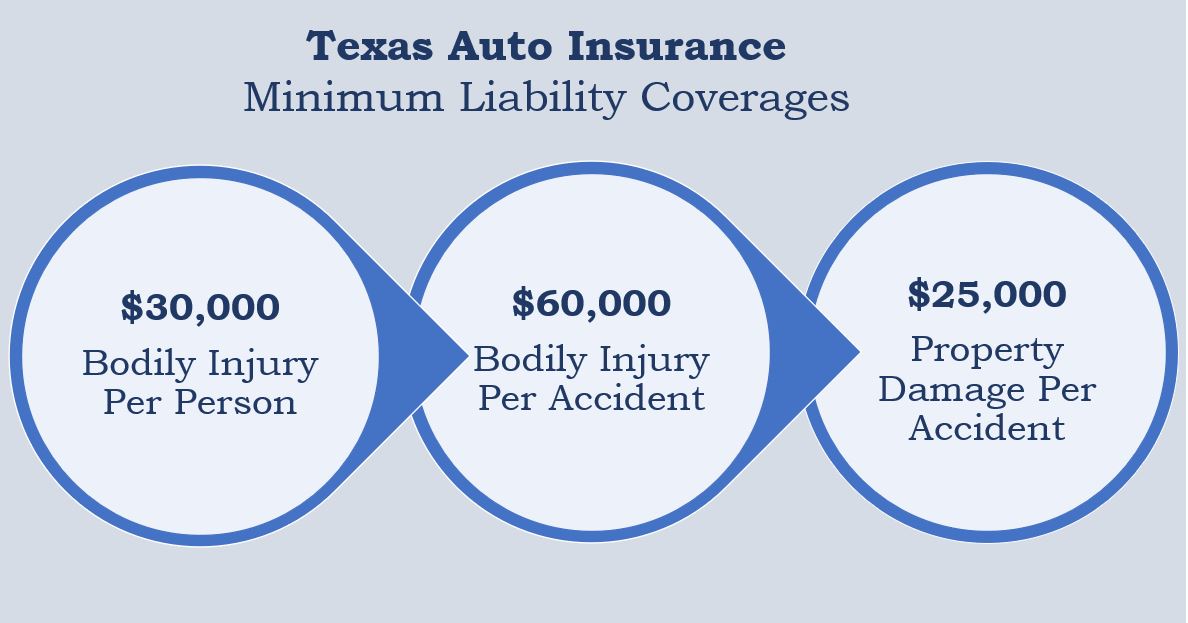

Minimum Coverage Amounts, Texas state minimum insurance coverage

Texas law sets specific minimum coverage amounts for each required type of insurance. These amounts represent the minimum financial protection you must have in case of an accident.

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Liability Coverage (per person) | $30,000 |

| Liability Coverage (per accident) | $60,000 |

| Liability Coverage (property damage) | $25,000 |

| Medical Payments Coverage (per person) | $2,500 |

Consequences of Driving Without Minimum Insurance

Driving without the minimum required insurance in Texas can lead to serious consequences.

- Financial Penalties: You could face fines and penalties, including license suspension and vehicle registration revocation.

- Legal Liability: If you cause an accident without insurance, you could be held personally liable for all damages and injuries, even if you are not at fault. This can lead to significant financial burdens.

- Criminal Charges: In some cases, driving without insurance can result in criminal charges, including jail time.

Coverage Types Explained

Texas law requires all drivers to have certain types of insurance coverage to protect themselves and others on the road. Understanding these coverage types is crucial for ensuring you’re adequately protected in case of an accident. Let’s delve into each coverage type and its real-world implications.

Liability Coverage

Liability coverage is the most important type of insurance required in Texas. It protects you financially if you cause an accident that results in injuries or property damage to another person. It covers:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the injured party.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle or any damaged property.

Consider a scenario where you accidentally rear-end another vehicle. Liability coverage would help pay for the other driver’s medical bills and car repairs, up to your policy limits.

Medical Payments Coverage (Med Pay)

Med Pay coverage is optional in Texas, but it’s a good idea to have it. It pays for your medical expenses, regardless of who caused the accident. This coverage applies to you, your passengers, and even pedestrians involved in an accident with your vehicle.

- Coverage for Medical Expenses: This coverage helps cover medical expenses like hospital bills, doctor visits, and ambulance services.

Imagine you’re involved in a collision and suffer minor injuries. Med Pay would help cover your medical expenses, even if you were at fault.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage protects you in case you’re hit by an uninsured or underinsured driver. It provides financial protection when the other driver’s insurance is insufficient to cover your losses.

- Uninsured Motorist Coverage: This coverage protects you when the other driver doesn’t have any insurance.

- Underinsured Motorist Coverage: This coverage helps when the other driver’s insurance coverage limits are lower than your damages.

If you’re hit by a driver without insurance or with insufficient coverage, UM/UIM coverage can help cover your medical bills, lost wages, and property damage.

Coverage Types Table

| Coverage Type | Description | Real-World Scenario |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that results in injuries or property damage to another person. | You accidentally rear-end another vehicle, causing damage to their car and injuring the driver. Liability coverage would help pay for their medical bills and car repairs. |

| Medical Payments Coverage (Med Pay) | Pays for your medical expenses, regardless of who caused the accident. | You’re involved in a collision and suffer minor injuries. Med Pay would help cover your medical expenses, even if you were at fault. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Protects you in case you’re hit by an uninsured or underinsured driver. | You’re hit by a driver who doesn’t have insurance or has insufficient coverage to cover your losses. UM/UIM coverage can help cover your medical bills, lost wages, and property damage. |

Financial Responsibility Laws

Texas law requires drivers to prove they can pay for damages they cause in an accident. This is known as financial responsibility, and it’s designed to protect other drivers and pedestrians.

The minimum insurance requirements discussed earlier are directly linked to these financial responsibility laws. By having the minimum insurance coverage, drivers are demonstrating their ability to pay for damages up to the specified limits.

Consequences of Failing to Meet Financial Responsibility Requirements

Failing to meet Texas’s financial responsibility requirements can have serious consequences. Here’s a breakdown of the potential legal ramifications:

- Suspension of Driver’s License: If you’re involved in an accident and don’t have the required insurance, your driver’s license can be suspended. This means you’re prohibited from driving legally.

- Vehicle Registration Suspension: Not only can your driver’s license be suspended, but your vehicle registration can also be suspended. This means you cannot legally drive the vehicle on public roads.

- Financial Penalties: You may face fines and other financial penalties for failing to meet the financial responsibility requirements. These penalties can be significant, depending on the severity of the violation.

- Civil Lawsuits: If you’re found liable for damages in an accident, the other party can sue you for compensation. Without insurance, you’ll be personally responsible for covering all costs, which can include medical bills, property damage, lost wages, and more.

- Criminal Charges: In some cases, failing to meet financial responsibility requirements can lead to criminal charges, particularly if you’re involved in an accident that results in serious injury or death.

Exemptions and Exceptions

While Texas law mandates minimum insurance coverage for most drivers, there are certain exemptions and exceptions that allow individuals to operate vehicles without meeting these requirements.

These exemptions are typically granted to specific vehicle types, individuals, or situations where traditional insurance requirements might not be applicable. It is crucial to understand these exemptions to ensure compliance with Texas law and avoid potential penalties.

Vehicles Exempt from Insurance Requirements

In Texas, certain types of vehicles are exempt from the minimum insurance coverage requirements. These exemptions are usually granted to vehicles that are not used for regular transportation on public roads or are considered low-risk.

Here are some examples:

- Vehicles used exclusively on private property: If a vehicle is only used on private property, such as a farm or ranch, it may be exempt from insurance requirements. This exemption applies only if the vehicle is not used for transporting goods or passengers for hire.

- Vehicles used for agricultural purposes: Vehicles used solely for agricultural purposes, such as tractors and combines, are generally exempt from insurance requirements. However, it’s important to note that this exemption may not apply if the vehicle is used for transporting goods or passengers for hire.

- Vehicles owned by the government: Vehicles owned by the federal, state, or local government are typically exempt from insurance requirements. This exemption extends to vehicles used by government agencies for official purposes.

- Vehicles used for parades or exhibitions: Vehicles used exclusively for parades or exhibitions may be exempt from insurance requirements. This exemption typically applies to vehicles that are not driven on public roads during the event.

Individuals Exempt from Insurance Requirements

In certain circumstances, individuals may be exempt from the minimum insurance requirements in Texas. These exemptions typically apply to individuals who do not regularly operate vehicles or who are covered by alternative insurance arrangements.

Here are some examples:

- Individuals who do not own or operate a vehicle: If an individual does not own or operate a vehicle, they are not required to maintain minimum insurance coverage. This exemption applies to individuals who rely on public transportation, ride-sharing services, or other means of transportation.

- Individuals who are covered by a self-insurance program: Some individuals may be exempt from insurance requirements if they are covered by a self-insurance program. This program requires the individual to demonstrate financial responsibility and ability to pay for damages in the event of an accident.

- Individuals who are covered by a surety bond: Individuals may be exempt from insurance requirements if they are covered by a surety bond. This bond guarantees financial responsibility in the event of an accident, providing compensation to injured parties or property owners.

- Individuals who are covered by a certificate of self-insurance: Certain businesses or organizations may be exempt from insurance requirements if they have a certificate of self-insurance. This certificate indicates that the business or organization has sufficient financial resources to cover potential damages in the event of an accident.

Situations Where Insurance Requirements May Be Waived

There are specific situations where the minimum insurance requirements may be waived. These situations typically involve vehicles that are not regularly driven on public roads or are subject to unique circumstances.

Here are some examples:

- Vehicles being transported on a trailer: If a vehicle is being transported on a trailer, it may be exempt from insurance requirements. This exemption typically applies to vehicles that are not being driven on public roads during transportation.

- Vehicles used for military purposes: Vehicles used for military purposes may be exempt from insurance requirements. This exemption applies to vehicles operated by military personnel while performing official duties.

- Vehicles used for emergency response: Vehicles used for emergency response, such as ambulances and fire trucks, may be exempt from insurance requirements. This exemption typically applies to vehicles that are not used for commercial purposes.

The Importance of Adequate Coverage

While Texas law requires you to carry minimum insurance coverage, relying solely on this minimum can leave you vulnerable to significant financial burdens in the event of an accident. Understanding the potential risks associated with minimum coverage is crucial for making informed decisions about your insurance needs.

Financial Implications of Minimum Coverage

Carrying only minimum insurance coverage can leave you with substantial out-of-pocket expenses if you are involved in an accident where the damages exceed the limits of your policy. This can include:

- Medical bills: If you are injured in an accident and your medical expenses exceed your policy’s medical payments coverage limit, you will be responsible for the difference.

- Property damage: If you cause damage to another person’s property and the cost exceeds your liability coverage limit, you will be responsible for the remaining amount.

- Lost wages: If you are unable to work due to injuries sustained in an accident, you will not be compensated for lost wages by your minimum insurance policy.

- Legal fees: In the event of a lawsuit, you may be responsible for legal fees even if you are not at fault. Minimum insurance coverage may not provide sufficient coverage for these expenses.

Here’s a scenario to illustrate the potential financial implications of minimum coverage:

Imagine you are driving your car in Texas, and you accidentally cause an accident resulting in significant property damage to another vehicle. The damages exceed your liability coverage limit of $25,000. You are now responsible for the remaining amount, which could be thousands of dollars, potentially impacting your finances and credit score.

Obtaining and Maintaining Insurance

Getting car insurance in Texas is a relatively straightforward process. You’ll need to provide your personal information, driving history, and vehicle details to an insurance company. They’ll use this information to calculate your premium, which is the amount you’ll pay for your coverage.

Finding Affordable Insurance Options

Finding affordable insurance options can be a challenge, but there are resources available to help you.

- Compare quotes from multiple insurance companies. You can use online comparison websites or contact insurance companies directly to get quotes. This will help you find the best rates for the coverage you need.

- Ask about discounts. Many insurance companies offer discounts for good driving records, safe driving courses, and other factors. Be sure to ask about all available discounts to see if you qualify.

- Consider increasing your deductible. A higher deductible means you’ll pay more out of pocket if you have an accident, but it can lower your monthly premium.

- Shop around regularly. Insurance rates can change over time, so it’s a good idea to shop around for new quotes every year or two to ensure you’re getting the best deal.

Reviewing Insurance Policies Regularly

It’s important to review your insurance policy regularly to ensure you have the right coverage and that your premium is still affordable.

- Review your policy at least once a year. This will help you identify any changes in your coverage or premium that you may not be aware of.

- Make adjustments as needed. If your needs have changed, such as buying a new car or getting married, you may need to adjust your coverage.

- Consider adding coverage. You may want to consider adding coverage such as collision or comprehensive coverage if your car is newer or worth more than your minimum liability coverage.

Maintaining Adequate Coverage

Maintaining adequate coverage throughout the year is essential to protect yourself financially in the event of an accident.

- Pay your premiums on time. Late payments can result in penalties and even cancellation of your policy.

- Keep your insurance company informed of any changes. If you move, change your address, or get a new car, be sure to update your insurance company.

- Avoid driving violations. Traffic violations can lead to higher insurance premiums.

- Maintain a good driving record. A clean driving record is one of the best ways to keep your insurance premiums low.

Closing Notes

Driving in Texas requires adhering to the state’s minimum insurance coverage regulations. While these requirements serve as a safety net, it’s crucial to remember that minimum coverage may not be enough to cover all potential damages or losses in a serious accident. Reviewing your insurance policy regularly, considering additional coverage options, and understanding the implications of driving without adequate insurance are essential steps towards safe and responsible driving in Texas.

Answers to Common Questions

What happens if I get into an accident and only have minimum insurance?

If your minimum insurance coverage is insufficient to cover the damages or injuries caused in an accident, you could be personally liable for the remaining costs. This can lead to significant financial burdens, including legal fees and medical expenses.

How can I find affordable insurance options in Texas?

Texas offers various resources for finding affordable insurance options, including online comparison websites, independent insurance agents, and state-run programs. It’s recommended to compare quotes from multiple providers and explore discounts offered for good driving records, safety features, and bundling policies.

What are the penalties for driving without insurance in Texas?

Driving without insurance in Texas is a serious offense. Penalties can include fines, license suspension, and even jail time. It’s crucial to maintain adequate insurance coverage at all times to avoid these consequences.