Texas State Minimum Car Insurance is a legal requirement for all drivers in the state. This means that every driver must carry a minimum amount of insurance to cover potential financial losses in case of an accident. Understanding these requirements is crucial for all drivers, as failing to comply can lead to serious consequences, including fines, license suspension, and even jail time.

This guide delves into the specifics of Texas State Minimum Car Insurance, explaining the mandatory coverage types, their financial responsibility limits, and the potential repercussions of driving without adequate insurance. We’ll also explore various car insurance options available in Texas, providing insights into their benefits and drawbacks, and offer tips for finding affordable coverage.

Texas State Minimum Car Insurance Requirements

In Texas, driving without the minimum required car insurance is illegal and can result in serious consequences. Understanding the state’s minimum insurance requirements is crucial for all drivers to ensure they are legally compliant and financially protected in case of an accident.

Minimum Financial Responsibility Limits

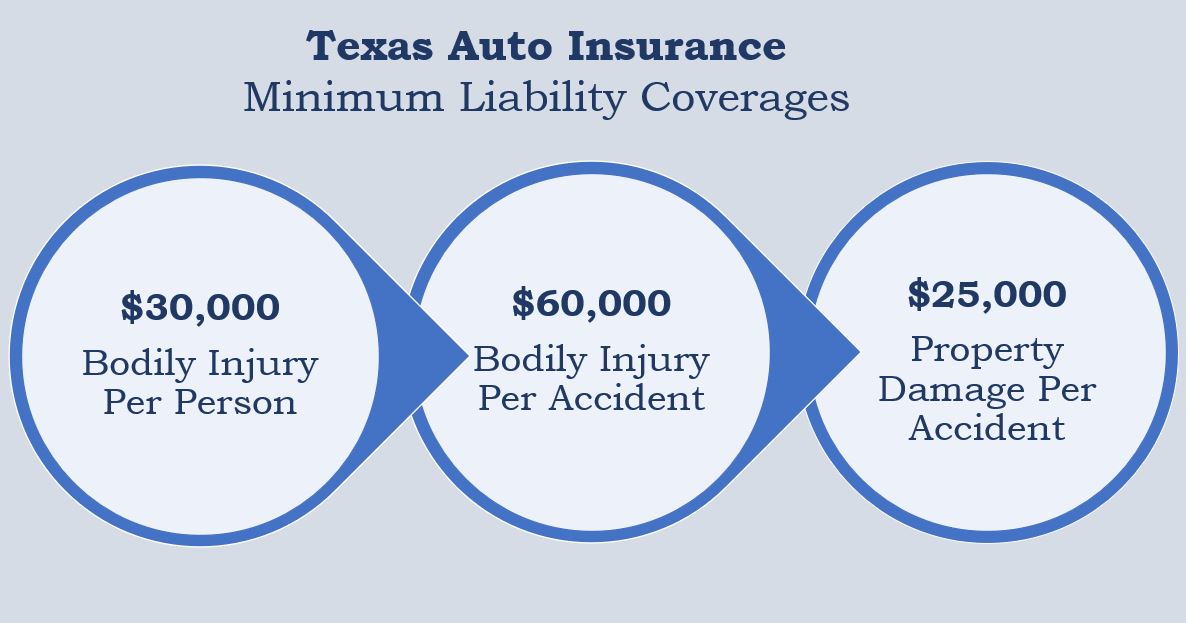

Texas law mandates that all drivers carry a minimum amount of liability insurance to cover potential damages and injuries caused to others in an accident. These minimum financial responsibility limits are as follows:

- Bodily Injury Liability: $30,000 per person/$60,000 per accident. This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident caused by the insured driver.

- Property Damage Liability: $25,000 per accident. This coverage pays for damages to another person’s vehicle or property, such as a building or fence, in an accident caused by the insured driver.

It’s important to note that these are minimum requirements, and it’s highly recommended to carry higher limits to protect yourself from potential financial ruin in case of a serious accident.

Consequences of Driving Without Insurance

Driving without the minimum required insurance in Texas is a serious offense with significant consequences.

- Fines and Penalties: Drivers caught driving without insurance can face fines ranging from $175 to $350, depending on the offense. These fines can be significantly higher if the driver has been previously cited for driving without insurance.

- License Suspension: If a driver is found to be driving without insurance, their driver’s license can be suspended for up to six months. This can severely impact their ability to drive legally and access transportation.

- Vehicle Impoundment: The vehicle of a driver caught driving without insurance can be impounded until proof of insurance is provided. This can result in additional costs for storage fees and towing charges.

- Financial Responsibility: Even if a driver is not at fault in an accident, they can be held financially responsible for damages and injuries if they do not have insurance. This can lead to significant debt and legal complications.

Understanding Texas Car Insurance Coverage Options

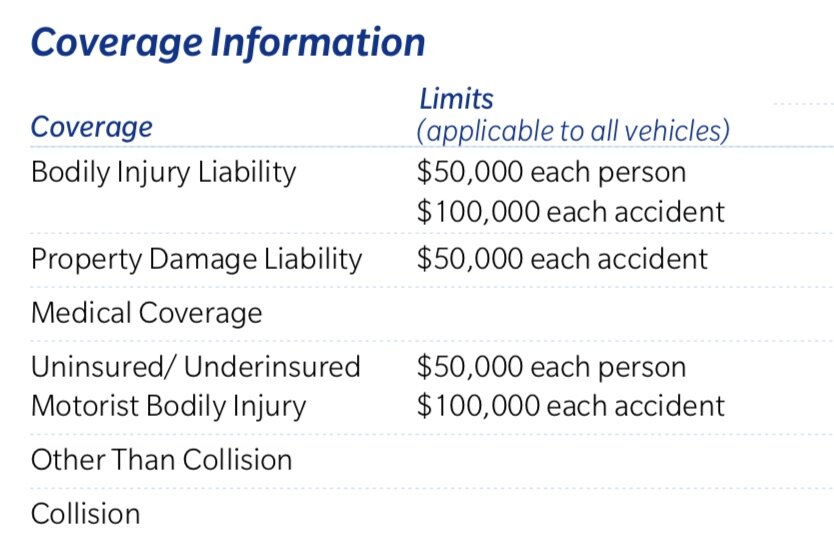

While Texas law mandates specific minimum car insurance coverage, you have the option to purchase additional coverage beyond the basic requirements. This can provide greater financial protection in the event of an accident.

Collision Coverage

Collision coverage protects you against damages to your vehicle caused by an accident, regardless of who is at fault. This coverage reimburses you for repairs or replacement of your vehicle, minus your deductible.

- Benefit: It provides financial assistance to repair or replace your car after an accident, even if you are at fault.

- Drawback: You’ll have to pay your deductible before the insurance company covers the remaining costs. Additionally, collision coverage is not required by law and can increase your premium.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, natural disasters, or animal strikes. This coverage reimburses you for repairs or replacement of your vehicle, minus your deductible.

- Benefit: It offers protection against a wide range of events that can damage your car.

- Drawback: You’ll have to pay your deductible before the insurance company covers the remaining costs. Additionally, comprehensive coverage is not required by law and can increase your premium.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover medical expenses, lost wages, and property damage.

- Benefit: It offers financial protection in case you are involved in an accident with an uninsured or underinsured driver.

- Drawback: The coverage limits may not be sufficient to cover all your losses. While it’s not mandatory, it’s highly recommended.

Medical Payments Coverage

Medical payments coverage (Med Pay) covers medical expenses for you and your passengers, regardless of fault, after an accident. This coverage is typically limited to a certain amount, such as $1,000 or $5,000.

- Benefit: It provides immediate financial assistance for medical expenses after an accident, regardless of who is at fault.

- Drawback: The coverage limits may not be sufficient to cover all your medical expenses. It’s important to consider the limits and your potential medical needs.

Coverage Options Comparison

| Coverage | Cost | Potential Benefits |

|---|---|---|

| Collision Coverage | Higher premium | Repairs or replacement of your vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Higher premium | Repairs or replacement of your vehicle for damages caused by events other than collisions. |

| Uninsured/Underinsured Motorist Coverage | Moderate premium | Protection against financial losses from accidents with uninsured or underinsured drivers. |

| Medical Payments Coverage | Moderate premium | Coverage for medical expenses for you and your passengers after an accident, regardless of fault. |

Factors Influencing Texas Car Insurance Rates

Car insurance premiums in Texas are determined by a complex interplay of various factors. These factors help insurance companies assess your risk of filing a claim, allowing them to tailor your rates accordingly. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a significant factor in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Vehicle Type

The type of vehicle you drive also plays a crucial role in your insurance rates. Factors like the vehicle’s make, model, year, safety features, and value all contribute to the premium calculation. For example, a high-performance sports car is generally more expensive to insure than a basic sedan due to its higher repair costs and potential for higher risk.

Age

Age is another factor that insurance companies consider. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk often translates into higher premiums. However, as drivers mature and gain experience, their rates tend to decrease. Conversely, older drivers, especially those over 65, may face higher rates due to potential health concerns and slower reaction times.

Location

Your location, including the city and zip code, influences your insurance rates. Areas with higher crime rates, traffic congestion, or a greater number of accidents generally have higher premiums. Insurance companies also consider the density of vehicles in your area and the frequency of natural disasters, such as hurricanes or earthquakes.

Credit Score

In Texas, insurance companies are allowed to consider your credit score when calculating your car insurance rates. This practice is controversial, but insurance companies argue that credit score can be a good predictor of risk. A good credit score typically translates into lower premiums, while a poor credit score can lead to higher rates.

| Factor | Potential Impact on Premiums |

|---|---|

| Driving History | Clean record: Lower premiums; Accidents or violations: Higher premiums |

| Vehicle Type | High-performance car: Higher premiums; Basic sedan: Lower premiums |

| Age | Younger drivers: Higher premiums; Mature drivers: Lower premiums |

| Location | High-risk areas: Higher premiums; Low-risk areas: Lower premiums |

| Credit Score | Good credit score: Lower premiums; Poor credit score: Higher premiums |

Finding Affordable Texas Car Insurance

Finding affordable car insurance in Texas can seem daunting, but with some smart strategies, you can secure a policy that fits your budget without compromising on essential coverage.

Comparing Quotes

Comparing quotes from multiple insurance providers is crucial for finding the best deal. You can use online comparison websites, contact insurance agents directly, or work with an insurance broker.

- Online comparison websites: These platforms allow you to enter your information once and receive quotes from various insurers, simplifying the process.

- Insurance agents: Working with an insurance agent can provide personalized guidance and help you understand the different coverage options available.

- Insurance brokers: Brokers represent you and can shop around for the best rates from multiple insurers, often saving you time and effort.

Seeking Discounts

Many insurance companies offer discounts that can significantly reduce your premium.

- Good driving record: Maintaining a clean driving record with no accidents or violations is a significant factor in obtaining lower rates.

- Safety features: Vehicles equipped with safety features like anti-theft devices, airbags, and anti-lock brakes often qualify for discounts.

- Bundling policies: Combining your car insurance with other policies like homeowners or renters insurance can lead to substantial savings.

- Paying in full: Opting to pay your premium in full upfront instead of monthly installments may result in a discount.

- Membership discounts: Certain organizations or professional groups may offer discounts to their members.

Exploring Alternative Coverage Options

While it’s essential to have adequate coverage, you may be able to save money by considering alternative coverage options.

- Higher deductible: Choosing a higher deductible means you pay more out of pocket in case of an accident but can lower your premium.

- Lower coverage limits: Reducing your coverage limits, such as liability or collision, can result in lower premiums but may leave you with less financial protection.

Understanding Texas Insurance Claims Process

Filing a car insurance claim in Texas can be a daunting process, but understanding the steps involved can make it more manageable. It’s crucial to know your rights and responsibilities to ensure a smooth and successful claim.

Reporting an Accident

Reporting an accident promptly is crucial. The Texas Department of Transportation (TxDOT) requires you to file an accident report with the authorities if there’s property damage exceeding $1,000 or if someone is injured.

- Contact the authorities: Call 911 if there are injuries or if the accident involves a fatality. If there are no injuries and the damage is minimal, you can file an accident report online through the TxDOT website.

- Exchange information: Get the other driver’s contact information, including their name, address, phone number, driver’s license number, and insurance information. If possible, take pictures of the damage to both vehicles and the accident scene.

- Seek medical attention: If you’re injured, seek medical attention immediately. It’s crucial to document any injuries and obtain medical records.

Documentation Required for a Claim, Texas state minimum car insurance

To file a car insurance claim in Texas, you’ll need to provide your insurance company with certain documentation.

- Police report: If the accident involved injuries or property damage exceeding $1,000, a police report is required.

- Your insurance information: Provide your policy number, coverage details, and contact information.

- Driver’s license: Submit a copy of your driver’s license.

- Vehicle registration: Provide your vehicle registration details.

- Photographs of the damage: Take clear pictures of the damage to your vehicle, the other vehicle, and the accident scene.

- Medical records: If you were injured, provide medical records and bills.

- Repair estimates: Obtain repair estimates from reputable mechanics.

The Role of Insurance Adjusters

After you file a claim, your insurance company will assign an adjuster to investigate the accident and assess the damage.

- Investigate the accident: The adjuster will review the police report, examine the vehicles, and interview witnesses to determine the cause of the accident and liability.

- Assess the damage: The adjuster will determine the extent of the damage to your vehicle and estimate the cost of repairs or replacement.

- Negotiate a settlement: Once the adjuster has gathered all the necessary information, they will negotiate a settlement with you for the damages.

Negotiating a Settlement

Negotiating a settlement can be a challenging process, but it’s important to understand your rights and responsibilities.

- Review the adjuster’s offer: Carefully review the adjuster’s offer and ensure it covers all your expenses, including repairs, medical bills, and lost wages.

- Be prepared to negotiate: If you believe the offer is too low, be prepared to negotiate with the adjuster. Provide evidence to support your claim, such as repair estimates, medical bills, and lost wage statements.

- Seek legal advice: If you can’t reach a settlement with the adjuster, you may want to consult with an attorney. An attorney can help you understand your legal rights and negotiate a fair settlement.

Summary

Navigating the world of car insurance can be complex, especially when it comes to understanding the minimum requirements and available options. This guide has provided a comprehensive overview of Texas State Minimum Car Insurance, equipping you with the knowledge to make informed decisions about your coverage. Remember, choosing the right car insurance is a crucial step towards financial protection and peace of mind on the road.

FAQ Resource

What happens if I get into an accident without the required minimum insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You would also be responsible for all damages and injuries caused by the accident, even if you were not at fault.

How can I find affordable car insurance in Texas?

There are several ways to find affordable car insurance in Texas. You can compare quotes from different insurance providers, look for discounts, and consider alternative coverage options.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle, regardless of who is at fault.