Texas state minimum car insurance is a crucial aspect of driving in the Lone Star State, ensuring financial protection in the event of an accident. This guide delves into the legal requirements, essential coverage types, and factors that influence the cost of minimum insurance. Understanding these intricacies empowers Texas drivers to make informed decisions about their insurance needs.

Texas law mandates specific minimum coverage levels for drivers, including liability, medical payments, uninsured/underinsured motorist, and property damage. These requirements aim to protect both drivers and others on the road by ensuring financial responsibility in case of accidents. The minimum coverage amounts are established to provide a safety net, but drivers should consider whether these limits are sufficient to cover potential liabilities.

Texas State Minimum Car Insurance Requirements

In Texas, it is mandatory for all vehicle owners to have a minimum level of car insurance. This requirement is designed to protect drivers and passengers in case of an accident. The state’s minimum car insurance requirements ensure that there is financial protection for individuals involved in accidents, covering potential costs related to injuries, property damage, and legal expenses.

Types of Required Coverage, Texas state minimum car insurance

The Texas Department of Transportation (TxDOT) mandates that all drivers carry the following types of insurance coverage:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It is further divided into two parts:

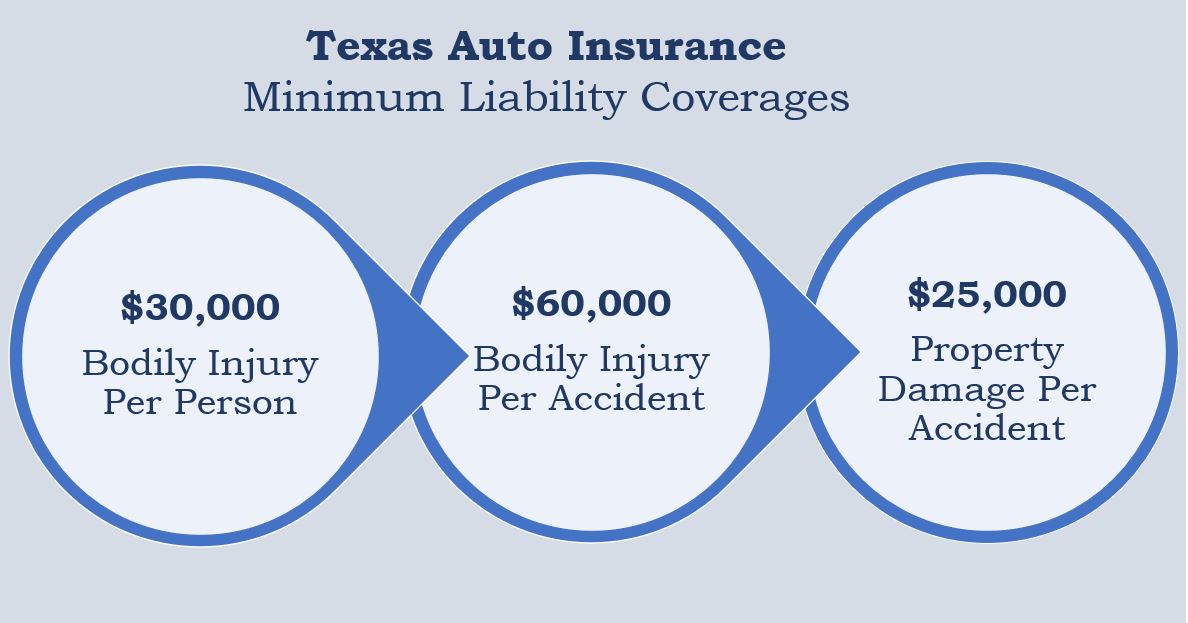

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages for injuries sustained by the other driver or passengers in the other vehicle. The minimum required coverage is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This covers damages to the other vehicle or property involved in the accident. The minimum required coverage is $25,000 per accident.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who caused the accident. The minimum required coverage is $2,500 per person.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. The minimum required coverage is $30,000 per person and $60,000 per accident.

Minimum Coverage Amounts

The following table summarizes the minimum coverage amounts required for each type of insurance in Texas:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Medical Payments Coverage | $2,500 per person |

| Uninsured/Underinsured Motorist Coverage | $30,000 per person / $60,000 per accident |

Understanding Texas Car Insurance Laws

Driving in Texas requires you to comply with specific insurance laws to ensure financial responsibility in case of an accident. These laws aim to protect drivers, passengers, and others involved in accidents by ensuring that those at fault have the financial means to cover damages.

Texas Financial Responsibility Law

The Texas Financial Responsibility Law mandates that all drivers in the state carry a minimum amount of liability insurance. This law is designed to protect victims of accidents by ensuring that they have access to financial compensation for their injuries and property damage.

- Liability Coverage: This coverage protects you from financial responsibility for injuries or property damage caused to others in an accident where you are at fault. The minimum liability limits required in Texas are:

- Bodily Injury Liability: $30,000 per person/$60,000 per accident.

- Property Damage Liability: $25,000 per accident.

Penalties for Driving Without Insurance

Driving without the required minimum insurance coverage in Texas can result in severe penalties, including:

- Fines: You can be fined up to $350 for driving without insurance. Repeat offenses can result in higher fines.

- License Suspension: Your driver’s license can be suspended for up to six months if you are caught driving without insurance. This suspension can be extended if you continue to drive without insurance.

- Vehicle Impoundment: Your vehicle can be impounded if you are caught driving without insurance. You will be responsible for towing and storage fees to retrieve your vehicle.

- Jail Time: In some cases, driving without insurance can result in jail time, especially if you are involved in an accident that causes serious injuries or property damage.

- Financial Responsibility: If you are involved in an accident without insurance, you will be held financially responsible for all damages and injuries caused, even if you were not at fault. This can include medical expenses, property damage, and lost wages.

Texas Motor Vehicle Safety Responsibility Act

The Texas Motor Vehicle Safety Responsibility Act (MVSR Act) Artikels the specific requirements for insurance coverage and financial responsibility for drivers in the state. This act aims to ensure that all drivers have adequate insurance coverage to protect themselves and others from the financial consequences of accidents.

- Proof of Financial Responsibility: The MVSR Act requires drivers to provide proof of financial responsibility, usually in the form of an insurance policy, when they are involved in an accident or are pulled over by a law enforcement officer.

- SR-22 Form: If you have been convicted of a traffic violation or have been involved in an accident without insurance, you may be required to file an SR-22 form with the Texas Department of Transportation. This form certifies that you have met the minimum insurance requirements for the state.

- Financial Responsibility Suspension: The MVSR Act allows the Texas Department of Transportation to suspend your driver’s license if you fail to maintain the required financial responsibility. This suspension can be lifted once you provide proof of insurance coverage.

Factors Affecting Minimum Car Insurance Costs

In Texas, while the state mandates minimum car insurance coverage, the cost of this coverage can vary significantly from person to person. This variation is influenced by a range of factors that insurance companies consider when calculating premiums. Understanding these factors can help you better grasp how your individual circumstances might impact the cost of your minimum car insurance.

Age

Your age is a significant factor in determining your car insurance premiums. Younger drivers, especially those under 25, generally pay higher premiums due to their higher risk of accidents. This is because younger drivers have less experience behind the wheel, making them more prone to making mistakes that can lead to accidents. As drivers gain experience and reach their mid-20s and beyond, their premiums typically decrease.

Driving History

Your driving history plays a crucial role in your car insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums. However, if you have a history of accidents, speeding tickets, or DUI convictions, your premiums will likely be higher. Insurance companies view this history as an indicator of your risk of future accidents.

Vehicle Type

The type of vehicle you drive can also influence your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are often associated with higher risks of accidents and more expensive repairs. As a result, insurance companies may charge higher premiums for these vehicles. Conversely, smaller, less expensive cars typically have lower premiums.

Location

Where you live in Texas can also impact your car insurance rates. Areas with higher traffic density, crime rates, or accident rates tend to have higher premiums. Insurance companies consider the risk of accidents and claims in different locations when setting their rates.

Credit Score

Surprisingly, your credit score can also affect your car insurance premiums in Texas. Some insurance companies use credit scores as a proxy for risk assessment. They believe that people with good credit are more likely to be responsible drivers and less likely to file claims. This practice, however, is controversial and not used by all insurance companies.

Finding Affordable Minimum Car Insurance in Texas

Securing minimum car insurance in Texas is a legal requirement, but finding the most affordable option that meets your needs can be challenging. This section explores practical strategies and tips to help you navigate the Texas insurance market and find the best deal for your situation.

Comparing Insurance Providers and Their Offerings

Understanding the diverse range of insurance providers and their offerings is crucial to finding the most suitable policy. Each company has its unique pricing structure, coverage options, and customer service approach. Comparing quotes from multiple insurers allows you to identify the most competitive rates and the coverage features that align with your specific requirements.

- Online Comparison Websites: Platforms like Policygenius, Insurify, and QuoteWizard streamline the process of obtaining multiple quotes from different insurers simultaneously. These websites gather your basic information and present a range of options, allowing you to compare premiums, coverage details, and company ratings.

- Direct Insurers: Companies like Geico, Progressive, and State Farm operate directly with consumers, offering competitive prices and simplified online processes. These insurers often have lower overhead costs compared to traditional agents, which can translate into lower premiums.

- Independent Insurance Agents: These agents represent multiple insurance companies and can provide personalized recommendations based on your individual needs. They can compare quotes from different providers, negotiate rates, and offer expert advice on the best policy options.

The Importance of Going Beyond Minimum Coverage

While Texas law mandates minimum car insurance coverage, relying solely on these minimums can leave you vulnerable to significant financial hardship in the event of an accident. Understanding the limitations of minimum coverage and the potential consequences of underinsurance is crucial to making informed decisions about your car insurance needs.

The Risks of Minimum Coverage

Minimum coverage provides only the bare minimum required by law. This means that if you’re involved in an accident where you are at fault, the coverage may not be sufficient to cover the full cost of damages to the other driver’s vehicle or injuries sustained by the other driver or passengers.

- You could be held personally liable for the remaining costs, potentially leading to financial ruin.

- Your driver’s license could be suspended, preventing you from driving legally.

- You could face legal action from the injured party.

End of Discussion

Navigating Texas car insurance laws can be complex, but understanding the state’s minimum requirements is a vital step toward responsible driving. While minimum coverage fulfills legal obligations, it’s crucial to assess individual needs and consider the potential risks of relying solely on minimum limits. By exploring available options, comparing insurance providers, and making informed decisions, drivers can secure the best coverage for their unique circumstances and drive with peace of mind.

FAQ Compilation: Texas State Minimum Car Insurance

What happens if I get into an accident and only have minimum coverage?

If you cause an accident and only have minimum coverage, you might not have enough insurance to cover the full cost of damages or injuries. This could lead to financial hardship, lawsuits, or even the loss of your driver’s license.

Can I get a discount on my car insurance if I have a good driving record?

Yes, most insurance companies offer discounts for drivers with clean driving records. This can significantly reduce your premiums.

Is it illegal to drive without car insurance in Texas?

Yes, driving without car insurance in Texas is illegal and can result in fines, license suspension, and even jail time.