Texas state minimum auto insurance coverage is a crucial aspect of driving legally and responsibly in the Lone Star State. Understanding these requirements is essential to avoid potential fines, legal complications, and financial burdens in the event of an accident. This guide will explore the specific coverage types, minimum financial responsibility limits, and the importance of adequate insurance protection.

Driving without the required minimum insurance can result in significant consequences, including fines, license suspension, and even jail time. Additionally, in the unfortunate event of an accident, you could be held personally liable for damages exceeding your coverage limits, potentially jeopardizing your financial stability.

Texas Minimum Auto Insurance Requirements

In Texas, it is mandatory to have auto insurance, ensuring that drivers are financially protected in case of an accident. The state mandates specific coverage types and minimum financial responsibility limits, which are crucial for drivers to understand.

Minimum Coverage Requirements

Texas requires drivers to carry a minimum amount of liability insurance, which covers damages caused to others in an accident. This minimum coverage, known as the “Texas Financial Responsibility Law,” is designed to protect victims and ensure they receive compensation for their losses.

The Texas Financial Responsibility Law requires drivers to carry a minimum amount of liability insurance.

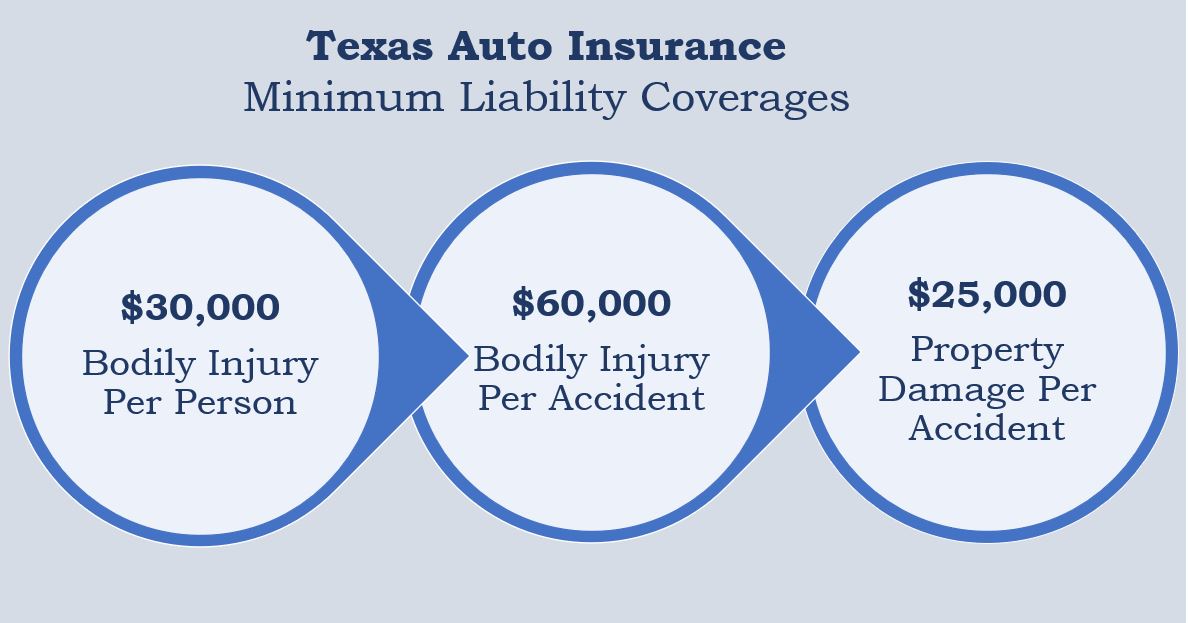

Here are the specific coverage types mandated by the state, along with their minimum financial responsibility limits:

- Bodily Injury Liability: This coverage protects you if you injure someone else in an accident. The minimum limit is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident. The minimum limit is $25,000 per accident.

It is important to note that these minimum limits are just that – minimums. You may want to consider purchasing higher coverage limits to protect yourself from potential financial losses.

Coverage Types and Their Importance

Texas law mandates specific types of auto insurance coverage to protect drivers, passengers, and others involved in accidents. Understanding these coverages and their significance is crucial for every Texas driver. Failure to carry the minimum required insurance can lead to significant financial hardship and legal consequences.

Types of Coverage and Their Minimum Limits

Texas law requires all drivers to have the following types of auto insurance:

- Liability Coverage: This coverage protects you from financial responsibility if you cause an accident that injures someone or damages their property. It covers medical expenses, lost wages, and property damage.

- Medical Payments Coverage (MPC): This coverage pays for medical expenses for you and your passengers, regardless of who caused the accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. It covers medical expenses, lost wages, and property damage.

The minimum limits for these coverages are as follows:

| Coverage Type | Minimum Limit | Real-World Application |

|---|---|---|

| Liability Coverage (per person) | $30,000 | If you cause an accident that results in $40,000 in medical expenses for the other driver, your liability coverage will pay $30,000, and you would be responsible for the remaining $10,000. |

| Liability Coverage (per accident) | $60,000 | If you cause an accident that injures multiple people, your liability coverage will pay a maximum of $60,000 per accident, regardless of the number of injured parties. |

| Liability Coverage (property damage) | $25,000 | If you cause an accident that damages another vehicle worth $30,000, your liability coverage will pay $25,000, and you would be responsible for the remaining $5,000. |

| Medical Payments Coverage (per person) | $2,500 | If you are injured in an accident, your MPC will pay up to $2,500 for your medical expenses, regardless of who caused the accident. |

| Uninsured/Underinsured Motorist Coverage (per person) | $30,000 | If you are involved in an accident with an uninsured driver, your UM coverage will pay up to $30,000 for your medical expenses, lost wages, and property damage. |

| Uninsured/Underinsured Motorist Coverage (per accident) | $60,000 | If you are involved in an accident with an underinsured driver, your UIM coverage will pay the difference between the other driver’s liability coverage and your actual damages, up to $60,000 per accident. |

Financial Risks of Driving Without Sufficient Insurance

Driving without sufficient auto insurance in Texas can lead to significant financial risks, including:

- Fines and Penalties: Driving without the minimum required insurance is illegal in Texas and can result in hefty fines and penalties. The cost of these fines can vary depending on the severity of the violation.

- License Suspension: If you are caught driving without insurance, your driver’s license can be suspended. This can make it difficult to drive legally and could impact your ability to work or travel.

- Financial Responsibility: If you cause an accident without sufficient insurance, you will be personally responsible for covering all damages and medical expenses, even if you were not at fault. This can lead to significant financial hardship and even bankruptcy.

- Legal Action: If you are involved in an accident and do not have sufficient insurance, the injured parties can sue you for damages. This can lead to costly legal fees and judgments that can impact your finances for years to come.

Consequences of Insufficient Coverage: Texas State Minimum Auto Insurance Coverage

Driving without the minimum required auto insurance in Texas can lead to significant consequences, both legal and financial. These consequences can have a lasting impact on your life, affecting your driving privileges, financial stability, and even your ability to obtain future insurance.

Penalties for Violating Texas Auto Insurance Laws

Failing to maintain the minimum required auto insurance in Texas is a serious offense that can result in various penalties, including:

- Fines: You could face a fine of up to $350 for driving without insurance, and an additional fine of up to $175 for each subsequent offense within a 12-month period.

- License Suspension: Your driver’s license may be suspended for up to six months if you are caught driving without insurance. The suspension period can be extended if you are convicted of a second or subsequent offense.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You may have to pay court costs if you are found guilty of driving without insurance.

- Jail Time: In some cases, driving without insurance can result in jail time, especially if you are involved in an accident.

Financial Impact of an Accident Without Sufficient Coverage

If you are involved in an accident without the minimum required insurance, you could face significant financial consequences. These consequences can include:

- Medical Expenses: You will be responsible for paying your own medical bills if you are injured in an accident, even if the accident was not your fault. If you are at fault for the accident, you will be responsible for the medical expenses of the other driver and passengers.

- Property Damage: You will be responsible for paying for the damage to your own vehicle and the other driver’s vehicle if you are at fault for the accident. If you are not at fault, your insurance company will cover the damage to your vehicle, but you may still be responsible for the damage to the other driver’s vehicle.

- Lawsuits: The other driver could sue you for damages if you are at fault for the accident. This could lead to significant financial losses, including legal fees, court costs, and settlements.

- Loss of Driving Privileges: You may lose your driving privileges if you are involved in an accident without insurance. This could have a significant impact on your ability to get to work, school, and other important appointments.

- Higher Insurance Rates: Even if you eventually obtain insurance, your rates will likely be higher than they would have been if you had maintained insurance continuously.

Choosing the Right Coverage

In Texas, you are legally required to carry minimum auto insurance coverage, but opting for additional coverage can provide significant protection and peace of mind. Understanding the benefits of exceeding minimum requirements is crucial in making an informed decision that aligns with your individual needs and financial situation.

Comparing Minimum and Additional Coverage, Texas state minimum auto insurance coverage

To make an informed decision about your auto insurance coverage, it’s essential to compare the minimum requirements with the additional options available. While the minimum coverage provides basic protection, it may not be sufficient in the event of a serious accident.

- Minimum Required Coverage: The minimum coverage in Texas includes liability coverage for bodily injury and property damage, as well as uninsured/underinsured motorist coverage. This coverage is designed to protect you financially if you are at fault in an accident, but it may not cover all your losses.

- Additional Coverage Options: Beyond the minimum requirements, you can choose from a range of additional coverage options, including collision, comprehensive, and medical payments coverage. These options offer enhanced protection for your vehicle and yourself, providing greater financial security in the event of an accident.

Benefits of Exceeding Minimum Requirements

While minimum coverage meets the legal requirements, exceeding these limits can offer several benefits:

- Enhanced Financial Protection: Additional coverage options, such as collision and comprehensive coverage, can protect you financially in the event of an accident involving your vehicle, regardless of who is at fault. This can help cover repair or replacement costs, ensuring you can get back on the road quickly.

- Greater Peace of Mind: Knowing you have sufficient coverage can provide peace of mind, allowing you to focus on your recovery and getting back on your feet after an accident, without the added stress of financial worries.

- Protection Against Uninsured/Underinsured Drivers: Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or no insurance at all. This coverage can help cover your medical expenses and property damage, even if the other driver is at fault.

Coverage Levels Comparison

| Coverage Level | Pros | Cons |

|---|---|---|

| Minimum Required Coverage | Meets legal requirements, lower premiums. | Limited protection, may not cover all losses, financial risk in case of a serious accident. |

| Additional Coverage (Collision, Comprehensive, Medical Payments) | Enhanced financial protection, greater peace of mind, protection against uninsured/underinsured drivers. | Higher premiums. |

Obtaining and Maintaining Coverage

Securing the minimum auto insurance coverage in Texas is a straightforward process, but it’s essential to understand the steps involved and the importance of maintaining your coverage.

This section will guide you through the process of obtaining the required auto insurance and emphasize the significance of actively maintaining your coverage to avoid any potential legal and financial consequences.

Obtaining Auto Insurance

Obtaining auto insurance in Texas involves a few key steps. It’s a relatively straightforward process that typically includes:

- Gather your information: Before you start shopping for insurance, you’ll need to have certain information readily available. This includes your driver’s license number, vehicle information (make, model, year, VIN), and any prior insurance information.

- Compare quotes from multiple insurance companies: One of the most crucial steps is comparing quotes from different insurance companies. This will help you find the best rate and coverage options that fit your specific needs and budget.

- Choose a policy and make the payment: Once you’ve compared quotes and selected the best option, you’ll need to choose a policy and make the initial payment. This will officially activate your insurance coverage.

- Receive your insurance card: After making the payment, you’ll receive your insurance card, which serves as proof of coverage. Keep this card readily accessible in your vehicle.

Shopping Around for the Best Rates

Shopping around for the best auto insurance rates is essential for saving money. Here’s how to make the most of this process:

- Utilize online comparison websites: Several online websites specialize in comparing quotes from different insurance companies. These platforms can save you time and effort by providing a comprehensive overview of available options.

- Contact insurance companies directly: Don’t hesitate to contact insurance companies directly to request quotes. This allows you to ask specific questions and clarify any details about their policies.

- Consider discounts: Many insurance companies offer discounts for safe driving records, good credit scores, and other factors. Inquire about any potential discounts that may apply to your situation.

- Review your policy periodically: It’s a good practice to review your insurance policy periodically to ensure that your coverage still meets your needs and that you’re getting the best possible rate. You can often negotiate better rates or make adjustments to your policy as your circumstances change.

Maintaining Coverage

Maintaining continuous auto insurance coverage is crucial in Texas. Failure to do so can result in significant consequences, including fines and potential license suspension. Here’s how to avoid lapses in your coverage:

- Make timely payments: Ensure you make your insurance payments on time to avoid any potential late fees or policy cancellations. Set reminders or utilize automatic payment options to ensure consistent payments.

- Notify your insurer of changes: If you experience any changes in your driving situation, such as a change of address, a new driver added to your policy, or a new vehicle purchase, notify your insurer immediately. These changes can affect your coverage and premiums.

- Review your policy regularly: It’s a good practice to review your insurance policy at least once a year to ensure it still meets your needs and that you’re receiving the best possible rate. You can often negotiate better rates or make adjustments to your policy as your circumstances change.

Resources for Information

Finding reliable and accurate information about Texas auto insurance requirements is crucial for making informed decisions about your coverage.

Government Agencies

Government agencies are primary sources for information about state laws and regulations.

- Texas Department of Insurance (TDI): The TDI is the primary regulatory body for insurance in Texas. Their website provides a wealth of information about auto insurance, including minimum coverage requirements, consumer guides, and complaint filing procedures. You can reach them at (800) 252-3439 or visit their website at https://www.tdi.texas.gov/.

- Texas Department of Motor Vehicles (TxDMV): The TxDMV handles vehicle registration and licensing in Texas. Their website provides information on obtaining a driver’s license and registering a vehicle, which are essential for auto insurance. You can reach them at (512) 465-3000 or visit their website at https://www.txdmv.gov/.

Insurance Organizations

Insurance organizations offer resources and support for consumers seeking information about auto insurance.

- Insurance Information Institute (III): The III is a non-profit organization that provides information and education about insurance. Their website offers articles, guides, and statistics on auto insurance, including safety tips and advice for consumers. You can visit their website at https://www.iii.org/.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance regulators from all 50 states, the District of Columbia, and five U.S. territories. Their website offers information about insurance laws and regulations, including resources for consumers. You can visit their website at https://www.naic.org/.

Online Resources

The internet provides a vast array of information about auto insurance.

- Texas Department of Insurance Website: The TDI website offers comprehensive information on auto insurance, including a dedicated section on “Understanding Auto Insurance” that explains coverage types, minimum requirements, and consumer rights.

- Insurance Information Institute Website: The III website provides detailed articles and guides on auto insurance, covering topics like choosing the right coverage, understanding insurance terms, and managing your policy.

- Consumer Reports: Consumer Reports is a non-profit organization that conducts independent testing and research on consumer products and services. Their website offers reviews and ratings of auto insurance companies, helping consumers compare options and find the best coverage for their needs.

Outcome Summary

While the Texas state minimum auto insurance coverage requirements are designed to protect drivers and their financial well-being, it’s crucial to consider the potential risks associated with relying solely on the minimum limits. By carefully evaluating your individual needs and circumstances, you can make informed decisions about your auto insurance coverage and ensure adequate protection for yourself and others on the road.

Q&A

What happens if I get into an accident without enough insurance?

You could be held personally liable for damages exceeding your coverage limits, potentially leading to significant financial burdens.

Can I choose to pay a fine instead of having insurance?

No, driving without the required minimum auto insurance in Texas is illegal and carries penalties that cannot be avoided by paying a fine.

How often do I need to renew my auto insurance policy?

Auto insurance policies in Texas typically have a term of six months or one year. It’s important to renew your policy before it expires to maintain continuous coverage.

Where can I find more information about Texas auto insurance requirements?

You can visit the Texas Department of Insurance website or contact your insurance agent for comprehensive information and guidance.