Texas State Insurance sets the stage for this comprehensive guide, offering readers a detailed exploration of the state’s insurance landscape. From understanding the role of insurance in Texas to navigating the complexities of finding the right coverage, this guide provides valuable insights for residents and businesses alike.

Texas boasts a diverse insurance market, with a wide array of options available to meet the unique needs of its residents. This guide delves into the various types of insurance, including auto, health, homeowners, and business insurance, offering a detailed breakdown of each category and the specific coverage offered.

Texas State Insurance Overview

Texas is a state with a diverse economy and a large population, making insurance an essential part of its financial landscape. From protecting homes and businesses to ensuring financial security in case of unexpected events, insurance plays a crucial role in the lives of Texans.

Texas Insurance Regulations

The Texas Department of Insurance (TDI) is responsible for regulating the insurance industry in the state. It sets rules and guidelines for insurers to ensure fairness, transparency, and consumer protection.

Texas insurance regulations aim to:

- Protect consumers from unfair or deceptive practices by insurers.

- Ensure the financial stability of insurance companies.

- Promote competition in the insurance market.

The Texas Department of Insurance

The Texas Department of Insurance (TDI) is a state agency responsible for regulating the insurance industry in Texas. Its primary goal is to protect consumers and ensure the financial stability of insurance companies.

The TDI performs several key functions:

- Licensing and Supervision: The TDI licenses and supervises insurance companies, agents, and brokers operating in Texas. This includes ensuring they meet financial solvency requirements and adhere to state regulations.

- Consumer Protection: The TDI investigates consumer complaints against insurance companies and works to resolve disputes. It also provides educational resources and information to consumers about their insurance rights and responsibilities.

- Market Regulation: The TDI monitors the insurance market to identify potential problems and ensure fair competition. It also develops and implements regulations to address market issues.

- Financial Oversight: The TDI monitors the financial health of insurance companies to ensure they can meet their obligations to policyholders. It also conducts audits and reviews to ensure compliance with financial regulations.

Types of Insurance in Texas

Texas is a state with diverse needs, and its insurance market reflects this. From protecting your home to ensuring your business is covered, various insurance types cater to different requirements. Understanding the different types of insurance available in Texas is crucial for making informed decisions and securing the right protection for your needs.

Auto Insurance, Texas state insurance

Auto insurance is mandatory in Texas. It protects you financially in case of an accident involving your vehicle.

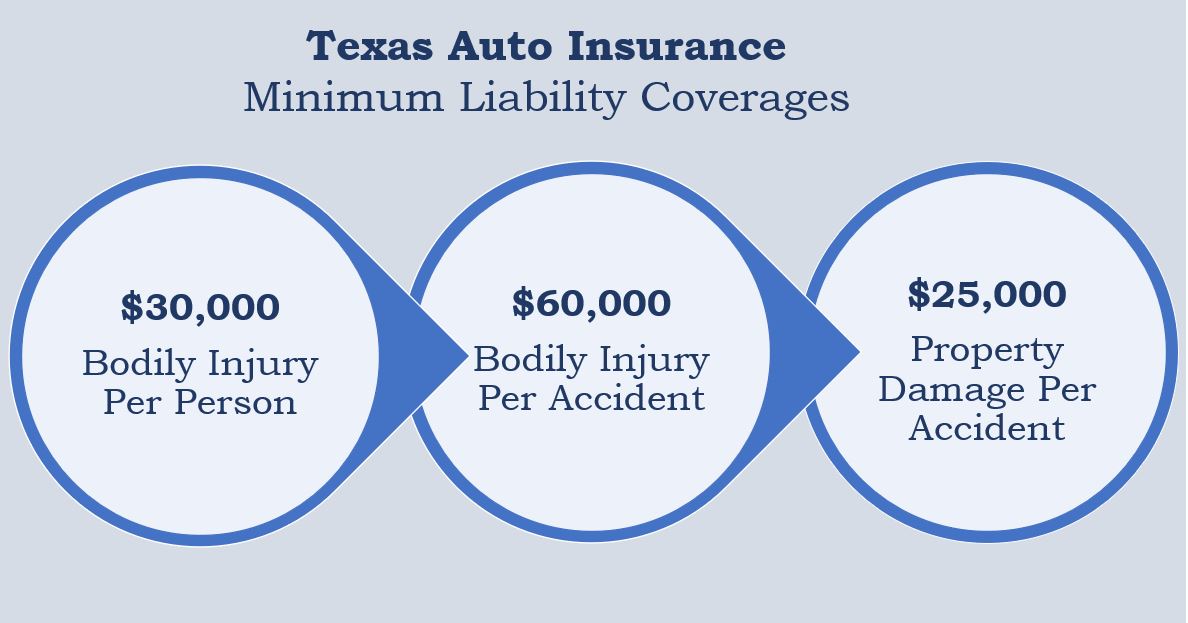

- Liability Coverage: This covers damages to other vehicles or property and injuries to others caused by an accident for which you are at fault.

- Collision Coverage: This covers damages to your vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damages to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no or insufficient insurance.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of who is at fault.

Homeowners Insurance

Homeowners insurance protects your home and belongings against various risks.

- Dwelling Coverage: This covers damages to your home’s structure, such as fire, windstorms, or hail.

- Personal Property Coverage: This covers your belongings inside your home, including furniture, electronics, and clothing.

- Liability Coverage: This protects you financially if someone is injured on your property or you cause damage to someone else’s property.

- Additional Living Expenses Coverage: This covers temporary living expenses if your home is uninhabitable due to a covered event.

Health Insurance

Health insurance covers medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Individual Health Insurance: This is purchased by individuals directly from insurance companies.

- Employer-Sponsored Health Insurance: This is provided by employers to their employees.

- Government-Sponsored Health Insurance: This includes programs like Medicare for seniors and Medicaid for low-income individuals.

Business Insurance

Business insurance protects your business from various risks, including property damage, liability claims, and employee-related issues.

- General Liability Insurance: This covers third-party liability claims arising from your business operations, such as bodily injury or property damage.

- Property Insurance: This covers damages to your business property, such as buildings, equipment, and inventory.

- Workers’ Compensation Insurance: This covers medical expenses and lost wages for employees injured on the job.

- Product Liability Insurance: This protects your business from claims arising from defective products.

- Professional Liability Insurance: This protects professionals, such as doctors and lawyers, from claims of negligence or malpractice.

Life Insurance

Life insurance provides financial protection to your loved ones in the event of your death.

- Term Life Insurance: This provides coverage for a specific period, typically 10 to 30 years.

- Whole Life Insurance: This provides lifelong coverage and builds cash value over time.

- Universal Life Insurance: This offers flexible premiums and death benefits, allowing you to adjust your coverage based on your needs.

Other Types of Insurance

Besides the major types mentioned above, other insurance types are available in Texas, including:

- Renters Insurance: This covers your belongings and liability in a rented property.

- Flood Insurance: This covers damages to your property caused by flooding.

- Umbrella Insurance: This provides additional liability coverage beyond your existing policies.

- Disability Insurance: This provides income replacement if you are unable to work due to an illness or injury.

Texas Insurance Market Trends

The Texas insurance market is a dynamic and complex landscape, influenced by various factors like population growth, economic conditions, and regulatory changes. Understanding current trends and their impact is crucial for both insurers and consumers.

Emerging Trends in the Texas Insurance Market

Several trends are shaping the Texas insurance market, leading to significant changes in how insurance is offered, consumed, and regulated.

- Increased Demand for Insurance: Texas’s booming population and economic growth have led to a surge in demand for various insurance products, particularly auto, home, and health insurance. This increased demand puts pressure on insurers to expand their reach and offer competitive pricing.

- Technological Advancements: Technology is transforming the insurance industry, with insurers adopting AI, machine learning, and data analytics to automate processes, personalize offerings, and improve customer experiences. Insurtech startups are also disrupting traditional insurance models, offering innovative solutions and challenging established players.

- Climate Change and Natural Disasters: Texas is increasingly vulnerable to extreme weather events like hurricanes, floods, and wildfires. These events drive up insurance premiums and lead to greater demand for catastrophe insurance products. Insurers are adapting by refining their risk assessment models and developing new insurance products tailored to these risks.

- Regulatory Changes: The Texas Department of Insurance (TDI) plays a crucial role in regulating the insurance market, implementing new rules and guidelines to protect consumers and ensure fair competition. Regulatory changes can impact insurance pricing, coverage, and distribution, influencing the overall market dynamics.

Finding the Right Insurance in Texas

Navigating the world of insurance in Texas can feel overwhelming, but it doesn’t have to be. This guide provides a step-by-step approach to finding the best coverage for your needs, ensuring you’re protected and financially secure.

Understanding Your Needs

Before you start shopping for insurance, it’s crucial to understand your specific needs. This involves considering factors like your lifestyle, assets, and potential risks. For instance, if you own a home, you’ll need homeowners insurance, while those with vehicles need auto insurance.

- Identify your assets: This includes your home, vehicles, valuables, and other possessions.

- Assess your risks: Consider potential hazards like natural disasters, accidents, or liability.

- Evaluate your budget: Determine how much you can afford to spend on insurance premiums.

Comparing Quotes

Once you’ve determined your needs, it’s time to start comparing quotes from different insurance providers. The internet has made this process much easier, allowing you to get multiple quotes within minutes.

- Use online comparison websites: These platforms allow you to input your details and receive quotes from various insurers simultaneously.

- Contact insurance agents directly: This gives you a chance to discuss your needs in detail and receive personalized advice.

- Ask for discounts: Many insurers offer discounts for things like good driving records, safety features, or bundling multiple policies.

Choosing the Right Insurer

After comparing quotes, it’s time to choose the insurer that best meets your needs and budget. Here are some factors to consider:

- Financial stability: Look for insurers with strong financial ratings, ensuring they can pay claims in the event of a loss.

- Customer service: Consider the insurer’s reputation for providing prompt and helpful customer service.

- Coverage options: Ensure the insurer offers the specific coverage you need, such as comprehensive, collision, or liability coverage.

Tips for Getting the Best Coverage

- Read the policy carefully: Understand the terms and conditions of the policy before signing.

- Ask questions: Don’t hesitate to clarify anything you don’t understand.

- Review your policy annually: Your needs may change over time, so it’s essential to review your policy and make adjustments as needed.

Insurance Claims in Texas

Filing an insurance claim in Texas can be a stressful experience, but understanding the process and navigating potential challenges can help ensure a smoother outcome. This section will provide a detailed overview of the insurance claims process in Texas, common challenges faced by residents, and strategies for maximizing claim payouts.

The Insurance Claims Process in Texas

The insurance claims process in Texas typically involves the following steps:

- Reporting the Claim: The first step is to notify your insurance company about the incident as soon as possible. This can be done by phone, email, or online through your insurer’s website. Be sure to provide accurate and detailed information about the event, including the date, time, and location.

- Initial Investigation: Once you report the claim, your insurance company will begin an investigation to verify the details of the incident and assess the damage. This may involve sending an adjuster to inspect the property or reviewing medical records.

- Claim Evaluation: Based on the investigation findings, your insurance company will evaluate your claim and determine the amount of coverage available. This includes considering the policy limits, deductibles, and any applicable exclusions.

- Negotiation and Settlement: Once the claim is evaluated, you may need to negotiate with your insurance company to reach a settlement. This can involve discussing the amount of compensation, the payment schedule, and any other relevant terms.

- Claim Payment: If you and your insurance company agree on a settlement, the payment will be processed according to the agreed-upon terms. This may involve a lump sum payment or a series of payments over time.

Common Challenges Faced by Texas Residents During Claims

While the insurance claims process is generally straightforward, Texas residents may encounter several challenges, including:

- Denial of Claims: Insurance companies may deny claims based on various reasons, such as policy exclusions, lack of evidence, or fraud. It’s crucial to understand your policy terms and gather sufficient documentation to support your claim.

- Delayed Payments: Delays in claim payments can be frustrating, especially when dealing with urgent financial needs. It’s essential to follow up with your insurance company regularly and document all communications.

- Low Settlement Offers: Insurance companies may offer low settlement amounts, which may not fully compensate for your losses. You may need to negotiate with your insurer or seek legal assistance to obtain a fair settlement.

- Unclear Policy Language: Insurance policies can be complex and difficult to understand. This can lead to confusion about coverage and potential disputes with your insurance company.

- Dealing with Adjusters: Adjusters are often trained to minimize payouts, which can make it challenging to negotiate a fair settlement. It’s important to be prepared and assertive when dealing with adjusters.

Maximizing Claim Payouts

To increase your chances of receiving a fair and timely claim payout, consider the following strategies:

- Understand Your Policy: Carefully review your insurance policy to understand your coverage limits, deductibles, and exclusions. This will help you avoid surprises during the claims process.

- Document Everything: Keep detailed records of all communications with your insurance company, including dates, times, and summaries of conversations. This documentation can be helpful in case of disputes.

- Gather Evidence: Collect any evidence that supports your claim, such as photographs, videos, witness statements, or medical records. The more evidence you provide, the stronger your case will be.

- Negotiate Effectively: Be prepared to negotiate with your insurance company to ensure you receive a fair settlement. If you’re not comfortable negotiating on your own, consider seeking legal advice.

- Know Your Rights: Texas has specific laws governing insurance claims, including time limits for filing claims and the right to appeal denied claims. Familiarize yourself with these rights to protect your interests.

Insurance for Specific Industries in Texas: Texas State Insurance

Texas boasts a diverse economy, with various industries contributing significantly to its economic growth. Each industry faces unique risks and requires tailored insurance solutions to protect their operations and financial stability.

Insurance Needs of Key Industries in Texas

Understanding the specific insurance needs of different industries in Texas is crucial for businesses to operate effectively and mitigate potential risks. Here’s a breakdown of key industries and their insurance requirements:

| Industry | Insurance Requirements | Specific Risks |

|---|---|---|

| Energy | Property, Liability, Workers’ Compensation, Environmental, Pollution, and Cyber Security Insurance | Oil spills, natural disasters, equipment failure, cyberattacks, and worker injuries. |

| Construction | Property, Liability, Workers’ Compensation, Builders Risk, and Surety Bonds | Construction site accidents, property damage, worker injuries, and project delays. |

| Healthcare | Medical Malpractice, General Liability, Workers’ Compensation, Cyber Security, and Data Breach Insurance | Medical errors, patient injuries, data breaches, and cyberattacks. |

| Technology | Cyber Security, Data Breach, Professional Liability, and Intellectual Property Insurance | Cyberattacks, data breaches, intellectual property theft, and software errors. |

| Agriculture | Crop Insurance, Livestock Insurance, Farm Liability, and Workers’ Compensation Insurance | Droughts, floods, pests, animal diseases, and farm accidents. |

Insurance Solutions for Specific Risks

Each industry faces unique risks that require specific insurance solutions. For instance, the energy industry needs comprehensive environmental and pollution insurance to cover potential spills or contamination. Similarly, the construction industry requires builders risk insurance to protect against property damage during construction.

Importance of Tailored Insurance Policies

It is essential for businesses in Texas to work with insurance brokers who understand the specific risks and insurance needs of their industry. Tailored insurance policies can provide the necessary coverage to protect businesses from financial losses and ensure their long-term sustainability.

Texas Insurance Industry Landscape

The Texas insurance industry is a significant contributor to the state’s economy, characterized by its size, diversity, and competitive nature. It is home to a wide array of insurance companies, ranging from national giants to regional and local providers, all vying for a share of the market. Understanding the major players, their market share, and competitive dynamics is crucial for anyone navigating the Texas insurance landscape.

Major Insurance Companies Operating in Texas

The Texas insurance market is dominated by a diverse group of companies, each with its own strengths and areas of specialization. These companies play a significant role in shaping the industry’s competitive landscape and influencing the availability and pricing of insurance products.

- State Farm: As the largest insurer in the United States, State Farm has a strong presence in Texas, offering a wide range of insurance products, including auto, home, life, and health insurance. Their extensive network of agents and customer service capabilities contribute to their market dominance.

- Farmers Insurance: Another major player in the Texas insurance market, Farmers Insurance offers a comprehensive suite of insurance products, including auto, home, business, and life insurance. They are known for their strong brand recognition and commitment to customer satisfaction.

- USAA: Focused on serving military personnel and their families, USAA has gained a significant market share in Texas. They offer a wide range of insurance products, including auto, home, life, and financial services, with a reputation for exceptional customer service and competitive pricing.

- Allstate: A well-established insurer with a national presence, Allstate provides a comprehensive range of insurance products in Texas, including auto, home, life, and business insurance. They are known for their innovative products and marketing strategies.

- Progressive: Known for its aggressive marketing campaigns and online presence, Progressive has carved a niche in the Texas insurance market by offering a variety of auto insurance products, including personalized coverage options and competitive pricing.

Competitive Landscape and Market Share Distribution

The Texas insurance market is highly competitive, with numerous companies vying for a share of the market. This competitive landscape has led to innovative products, competitive pricing, and a focus on customer satisfaction.

- Market Share Distribution: The market share distribution in the Texas insurance industry is dynamic and constantly evolving. While State Farm and Farmers Insurance hold significant market share, smaller companies and regional insurers are also making their mark. The competition is intense, with companies continuously seeking to differentiate themselves and attract new customers.

- Key Competitive Factors: The Texas insurance market is characterized by several key competitive factors, including price, product offerings, customer service, and brand reputation. Companies are constantly striving to innovate and offer competitive products and services to attract and retain customers.

- Impact of Technology: Technology is playing an increasingly important role in the Texas insurance market, enabling companies to streamline operations, improve customer service, and offer personalized products. Online insurance platforms and mobile apps are becoming increasingly popular, offering convenience and transparency to consumers.

Key Players and Their Strengths and Weaknesses

Identifying the strengths and weaknesses of key players in the Texas insurance market is crucial for understanding their competitive position and their ability to adapt to changing market conditions.

- State Farm: Strengths: Strong brand recognition, extensive agent network, comprehensive product offerings, and robust customer service. Weaknesses: Can be perceived as bureaucratic and slow to respond to customer needs.

- Farmers Insurance: Strengths: Strong brand recognition, focus on customer satisfaction, and a diverse product portfolio. Weaknesses: Can be perceived as expensive compared to some competitors.

- USAA: Strengths: Exceptional customer service, competitive pricing, and specialized focus on serving military personnel and their families. Weaknesses: Limited product offerings outside of their target market.

- Allstate: Strengths: Innovative products, strong marketing strategies, and a wide range of insurance options. Weaknesses: Can be perceived as expensive and inflexible in terms of policy customization.

- Progressive: Strengths: Aggressive marketing campaigns, online presence, and personalized coverage options. Weaknesses: Can be perceived as less reliable than some traditional insurers.

Last Point

Understanding Texas State Insurance is crucial for residents and businesses alike. This guide has provided a comprehensive overview of the state’s insurance market, from its regulations and trends to the complexities of finding the right coverage and navigating the claims process. By equipping readers with this knowledge, we aim to empower them to make informed decisions about their insurance needs and secure their financial well-being.

FAQ Summary

What is the role of the Texas Department of Insurance?

The Texas Department of Insurance regulates the insurance industry in Texas, ensuring fair and competitive practices, protecting consumers, and overseeing the financial solvency of insurance companies.

How do I file an insurance claim in Texas?

To file a claim, contact your insurance company as soon as possible after an incident. Provide them with all necessary details and documentation, and follow their instructions carefully.

What are the major insurance companies operating in Texas?

Texas is home to numerous insurance companies, both national and regional. Some of the major players include State Farm, Allstate, Farmers, and USAA.