Texas State Auto Insurance Minimums are a crucial aspect of driving in the Lone Star State. Understanding these minimums is essential to ensure you’re legally protected on the road. Texas law requires all drivers to carry liability insurance, which covers damages to others in case of an accident. This coverage comes in three main parts: bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. Each of these provides financial protection in specific scenarios, and failing to have the required minimums can lead to serious consequences, including fines, license suspension, and even jail time.

Beyond the legal minimums, there are several other coverage options available to drivers. These can provide additional protection and peace of mind in the event of an accident. Collision coverage, for example, helps pay for repairs to your own vehicle after an accident, regardless of who was at fault. Comprehensive coverage covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of who was at fault. Choosing the right coverage options can be a complex process, and it’s important to weigh the potential benefits and costs carefully.

Texas State Auto Insurance Requirements

In Texas, having auto insurance is mandatory, and driving without it can lead to serious consequences. The state mandates minimum liability coverage to protect drivers and their property in case of accidents.

Minimum Liability Coverage Requirements

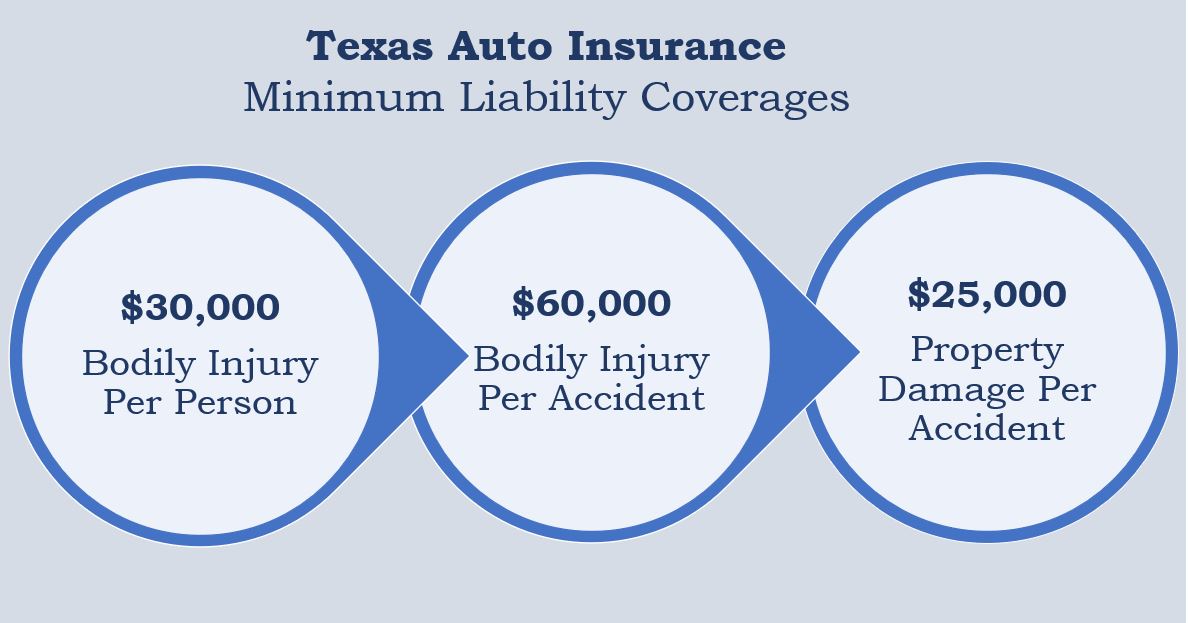

Texas law requires all drivers to carry minimum liability insurance to cover damages caused to others in case of an accident. These minimums are divided into three categories:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries caused to others in an accident. The minimum required coverage in Texas is $30,000 per person and $60,000 per accident. This means that the insurance company will pay up to $30,000 for injuries sustained by one person in an accident, and up to $60,000 for injuries to all people involved in the accident.

- Property Damage Liability: This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident. The minimum required coverage in Texas is $25,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It covers your medical expenses, lost wages, and other damages. The minimum required coverage in Texas is $30,000 per person and $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

Consequences of Driving Without Insurance

Driving without the minimum required auto insurance in Texas is illegal and can result in severe penalties, including:

- Fines: You could face a fine of up to $350 for driving without insurance. This fine can be significantly higher if you are involved in an accident without insurance.

- License Suspension: Your driver’s license can be suspended for up to two years if you are caught driving without insurance. This suspension will prevent you from driving legally until you obtain insurance and pay any outstanding fines.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance. You will also be responsible for any towing and storage fees.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally liable for all damages, including medical expenses, property damage, and legal fees. This can lead to significant financial hardship and even bankruptcy.

Understanding Different Coverage Types

While Texas law mandates specific minimum insurance coverage, it’s crucial to understand that these minimums might not be sufficient to fully protect you and your finances in case of an accident. Additional coverage options can provide a safety net and peace of mind, safeguarding you against potential financial burdens.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially if you have a financed or leased vehicle.

Collision coverage is essential if you have a loan or lease on your vehicle, as it helps you avoid significant financial losses if your car is damaged or totaled.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. It can also cover damage caused by falling objects or fire.

Comprehensive coverage is a valuable addition if you live in an area prone to natural disasters or if your vehicle is parked in a high-crime area.

Medical Payments Coverage

Medical payments coverage (MedPay) pays for medical expenses for you and your passengers, regardless of who is at fault, in case of an accident. It can cover expenses such as doctor visits, hospital stays, and ambulance services.

MedPay is especially beneficial if you have limited health insurance or if you frequently have passengers in your vehicle.

Comparison of Coverage Types

Here’s a table summarizing the key features of these coverage types:

| Coverage Type | Benefits | Potential Costs |

|—|—|—|

| Collision Coverage | Pays for repairs or replacement of your vehicle after an accident, regardless of fault | Higher premiums |

| Comprehensive Coverage | Covers damage from events other than collisions, such as theft, vandalism, and natural disasters | Higher premiums |

| Medical Payments Coverage | Pays for medical expenses for you and your passengers, regardless of fault | Lower premiums |

Factors Affecting Insurance Premiums

Your auto insurance premiums are calculated based on various factors that assess your risk as a driver. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Your age is a significant factor in determining your insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to factors like inexperience and risk-taking behavior. Insurance companies often charge higher premiums for younger drivers to reflect this increased risk. As you gain experience and age, your premiums tend to decrease. For instance, a 20-year-old driver may pay significantly more than a 40-year-old driver with a similar driving record.

Driving History

Your driving history is another critical factor. A clean driving record with no accidents or traffic violations will result in lower premiums. However, any incidents like accidents, speeding tickets, or DUI convictions can significantly increase your premiums. Insurance companies use your driving history to assess your risk of future accidents. For example, a driver with a history of multiple accidents may be considered a higher risk and charged higher premiums compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance rates. Luxury vehicles, high-performance cars, and vehicles with expensive safety features tend to cost more to repair or replace. Insurance companies consider this factor when calculating your premiums. For instance, a driver with a luxury SUV may pay more than a driver with a standard sedan, even if their driving history and other factors are similar.

Location

Your location, specifically your zip code, is a significant factor in determining your insurance premiums. Insurance companies consider factors like traffic density, crime rates, and the frequency of accidents in your area. Areas with higher rates of accidents or theft may result in higher insurance premiums. For example, a driver living in a densely populated urban area with high traffic volume may pay more than a driver living in a rural area with lower traffic density.

Tips for Lowering Premiums, Texas state auto insurance minimums

- Maintain a clean driving record by avoiding accidents and traffic violations.

- Consider taking a defensive driving course to improve your driving skills and potentially earn discounts.

- Choose a vehicle with safety features like airbags, anti-lock brakes, and stability control, which can qualify you for discounts.

- Increase your deductible to lower your monthly premium. However, ensure you can afford to pay the deductible in case of an accident.

- Bundle your auto insurance with other policies like homeowners or renters insurance for potential discounts.

- Shop around for quotes from different insurance companies to compare rates and find the best deal.

- Ask about discounts available for good students, safe drivers, and other factors.

Finding and Choosing Insurance Providers

Once you understand the minimum coverage requirements and various types of insurance in Texas, the next step is finding the right insurance provider for your needs. This involves comparing quotes from different providers and carefully considering factors beyond just the price.

Comparing Auto Insurance Quotes

Finding the best auto insurance deal requires comparing quotes from multiple providers. Fortunately, numerous resources can help you do this efficiently:

- Online Comparison Websites: Websites like NerdWallet, PolicyGenius, and The Balance allow you to enter your information once and receive quotes from various insurance companies. This saves you time and effort by streamlining the comparison process.

- Insurance Company Websites: You can also visit the websites of individual insurance companies like State Farm, Geico, Progressive, and others to get quotes directly. This allows you to explore the specific coverage options and features offered by each provider.

- Insurance Brokers: Insurance brokers act as intermediaries, working with multiple insurance companies to find the best rates and coverage for you. They can provide personalized advice and handle the paperwork on your behalf.

Factors Beyond Price

While price is a crucial factor, it’s essential to consider other aspects when choosing an auto insurance provider:

- Customer Service: Look for an insurer with a strong reputation for excellent customer service. Consider factors like ease of contacting customer support, responsiveness to inquiries, and the overall experience of interacting with the company.

- Claims Handling: A reliable insurance provider should have a smooth and efficient claims handling process. Investigate the company’s reputation for timely and fair claim settlements. Check online reviews and customer testimonials to gauge their claims handling practices.

- Financial Stability: Choosing a financially stable insurer is crucial, especially in the event of a major claim. Check the company’s financial ratings from agencies like A.M. Best or Standard & Poor’s to assess their financial strength and ability to fulfill their obligations.

Top Auto Insurance Providers in Texas

Here’s a comparison of the top 5 auto insurance providers in Texas based on key metrics:

| Provider | Average Annual Premium | Customer Satisfaction Rating | Financial Strength Rating |

|---|---|---|---|

| State Farm | $1,500 | 4.5/5 | A+ |

| Geico | $1,400 | 4.2/5 | A+ |

| Progressive | $1,350 | 4.0/5 | A+ |

| USAA | $1,250 | 4.8/5 | A+ |

| Farmers | $1,600 | 3.8/5 | A+ |

Understanding Your Policy

Your auto insurance policy is a crucial document that Artikels the terms and conditions of your coverage. Carefully reviewing it ensures you understand your rights and responsibilities as an insured individual.

Policy Terms and Conditions

Your policy will contain several essential terms and conditions that define your coverage and how it applies to different situations.

- Deductibles: This is the amount you pay out of pocket for each claim before your insurance coverage kicks in. For example, if you have a $500 deductible and your car is damaged in an accident, you will pay the first $500 of repair costs, and your insurance will cover the remaining amount.

- Coverage Limits: These are the maximum amounts your insurance company will pay for specific types of claims. Coverage limits can vary significantly depending on the type of coverage and the policy you choose. For example, your liability coverage might have a limit of $100,000 per accident for bodily injury and $50,000 per accident for property damage.

- Exclusions: These are specific situations or circumstances that are not covered by your policy. For example, most auto insurance policies exclude coverage for damages caused by wear and tear, mechanical failure, or driving under the influence of alcohol or drugs.

Navigating Your Policy

Understanding your policy can be overwhelming, but it’s essential to familiarize yourself with its contents.

- Read the entire policy: It’s important to read through your entire policy carefully, not just the summary or highlights. This will help you understand all the nuances of your coverage and identify any potential gaps.

- Ask questions: If you have any questions about your policy, don’t hesitate to contact your insurance agent or company representative. They are there to help you understand your coverage and answer any concerns you may have.

- Keep your policy organized: Store your policy documents in a safe and accessible location. You may also want to consider keeping a digital copy on your computer or in a cloud storage service for easy access.

Last Point

Navigating the world of auto insurance in Texas can be a bit overwhelming, but it’s essential to have the right coverage to protect yourself and others on the road. By understanding the legal minimums, exploring different coverage options, and taking steps to potentially lower your premiums, you can ensure you have the right insurance policy to meet your needs. Remember to review your policy carefully and don’t hesitate to reach out to your insurance provider if you have any questions.

Questions Often Asked: Texas State Auto Insurance Minimums

What happens if I get into an accident and don’t have the required minimum auto insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You would also be responsible for covering the costs of any damages or injuries you caused, which could be substantial.

How do I find out the exact minimum coverage amounts required in Texas?

You can find this information on the Texas Department of Insurance website or by contacting an insurance agent.

Can I choose to have more coverage than the minimum requirements?

Yes, you can choose to have more coverage than the minimum requirements. This can provide you with additional protection and peace of mind in the event of an accident.

How often should I review my auto insurance policy?

It’s a good idea to review your policy at least once a year to ensure it still meets your needs and to look for ways to potentially save money on your premiums.