Texas State Auto Insurance Minimums are crucial for all drivers in the state. Understanding these minimums ensures you are legally protected while driving, but it also goes beyond just meeting the law. This guide delves into the required liability coverage, providing a clear explanation of what you need to know and how to protect yourself financially in case of an accident.

Texas law requires drivers to carry specific types of liability insurance, covering potential damages to others in case of an accident. These minimums are not just legal requirements; they represent a safety net, protecting you from significant financial burdens if you are involved in an accident.

Texas State Auto Insurance Requirements

Driving a vehicle in Texas is a privilege that comes with responsibilities, including carrying the minimum required auto insurance. This ensures that drivers can financially compensate for any damages or injuries they cause to others in an accident. The state of Texas mandates specific types and minimum amounts of auto insurance coverage for all drivers.

Liability Coverage

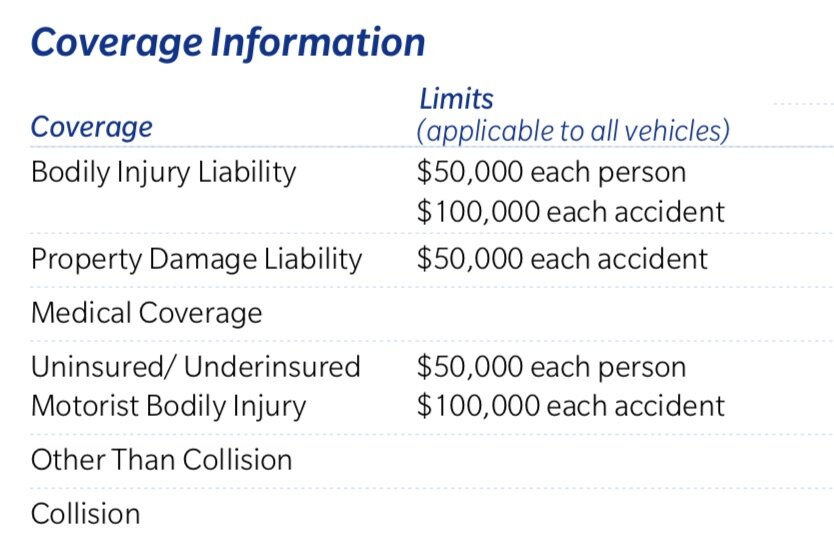

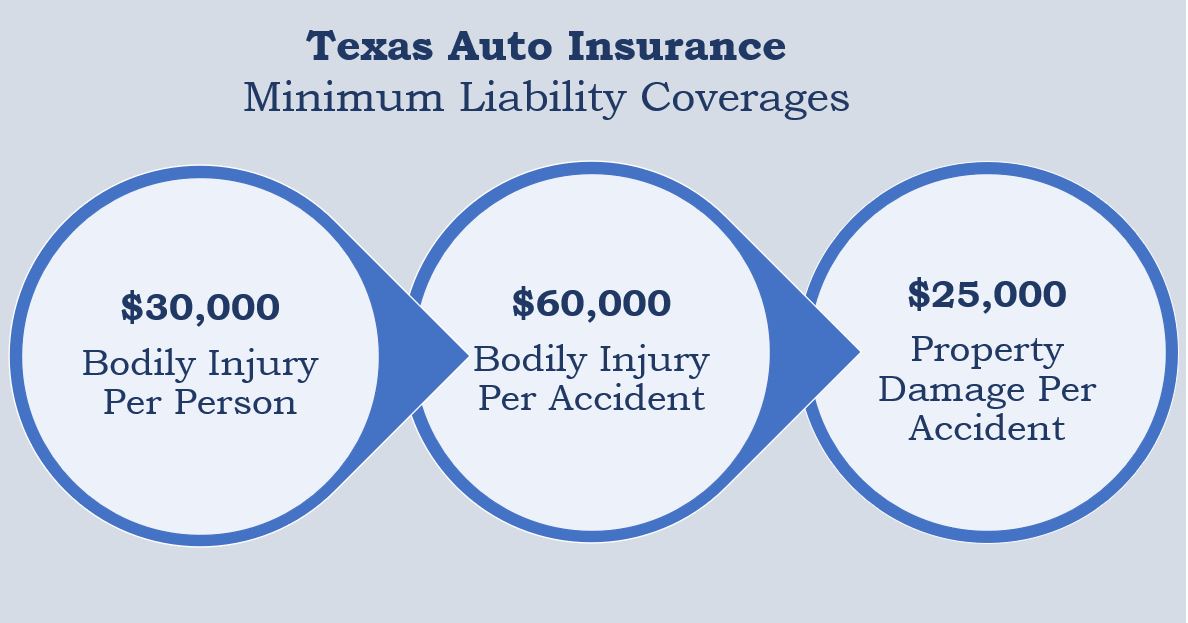

Liability insurance protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs associated with the other party’s medical expenses, lost wages, property repairs, and legal fees. Texas law requires all drivers to have the following minimum liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries caused to others in an accident. The minimum required amount is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement costs of property damaged in an accident, such as another vehicle or a building. The minimum required amount is $25,000 per accident.

Consequences of Driving Without Insurance

Driving without the minimum required auto insurance in Texas is illegal and carries serious consequences. If you are caught driving without insurance, you may face the following penalties:

- Fines: You could be fined up to $350 for a first offense and $500 for subsequent offenses.

- License Suspension: Your driver’s license could be suspended until you obtain the required insurance.

- Vehicle Impoundment: Your vehicle could be impounded until you obtain the required insurance.

- Court Costs: You may be required to pay court costs associated with the violation.

- Financial Responsibility: If you cause an accident without insurance, you will be personally responsible for all damages and injuries, even if you are not at fault. This could result in significant financial losses and legal complications.

Understanding Liability Coverage

Liability insurance is a crucial part of any car insurance policy. It safeguards you from financial responsibility if you cause an accident. This coverage helps cover the costs of injuries and property damage to others involved in the accident.

Bodily Injury Liability and Property Damage Liability

Liability coverage typically includes two main components: bodily injury liability and property damage liability. Understanding the difference between these two is essential for comprehending the extent of your coverage.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other related costs for injuries sustained by the other driver, passengers, or pedestrians involved in an accident caused by you. It also covers legal defense fees if you are sued. The coverage limits are typically expressed as a per-person and per-accident limit. For example, a 25/50 limit means your policy will cover up to $25,000 for injuries to one person and up to $50,000 for injuries to all people involved in the accident.

- Property Damage Liability: This coverage pays for repairs or replacement of damaged property, such as vehicles, buildings, or street signs, if you are at fault in an accident. The coverage limit is typically expressed as a single dollar amount, such as $50,000. This means your policy will cover up to $50,000 for damages to property belonging to others.

Additional Coverage Options

While Texas law mandates certain minimum auto insurance coverage, many drivers choose to purchase additional coverage to protect themselves financially in the event of an accident. These optional coverages provide broader protection beyond the basic requirements.

Collision Coverage, Texas state auto insurance minimums

Collision coverage reimburses you for damages to your vehicle if you are involved in an accident, regardless of who is at fault. This coverage is particularly beneficial for newer or more expensive vehicles, as it helps cover repair or replacement costs.

- Benefit: Provides financial protection for repairs or replacement of your vehicle after an accident, regardless of fault.

- Drawback: It is an optional coverage that comes with a deductible, meaning you pay a certain amount out of pocket before your insurance kicks in.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, natural disasters, and collisions with animals.

- Benefit: Provides financial protection for damages to your vehicle caused by non-collision events, offering peace of mind against unexpected incidents.

- Drawback: It is an optional coverage that comes with a deductible, meaning you pay a certain amount out of pocket before your insurance kicks in.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

UM/UIM coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover medical expenses, lost wages, and property damage.

- Benefit: Provides financial protection if you are involved in an accident with a driver who lacks sufficient insurance, ensuring you are not left financially responsible for your losses.

- Drawback: It is an optional coverage that requires you to pay an additional premium, but it offers vital protection against potential financial burdens.

Factors Affecting Insurance Costs

Several factors influence the cost of auto insurance premiums in Texas. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a significant factor in determining your insurance premiums. Insurance companies assess your driving record to evaluate your risk profile.

- Accidents: Having a history of accidents, particularly at-fault accidents, can increase your premiums significantly. Insurance companies view this as an indicator of higher risk.

- Traffic Violations: Receiving traffic tickets, such as speeding tickets or moving violations, can also lead to higher premiums. These violations indicate a higher likelihood of future accidents.

- DUI/DWI: A DUI or DWI conviction carries substantial penalties, including significant increases in insurance premiums. Insurance companies view this as a serious risk factor.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your insurance premiums.

- Make and Model: Certain car makes and models are known to be more expensive to repair or replace, resulting in higher insurance costs. For example, luxury vehicles or high-performance sports cars tend to have higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, often qualify for discounts. These features demonstrate a reduced risk of accidents and injuries.

- Vehicle Age: Newer vehicles generally have higher premiums due to their higher replacement cost. Older vehicles may have lower premiums, but they may also have fewer safety features.

Age

Your age is another factor that influences your insurance premiums.

- Young Drivers: Young drivers, particularly those under 25, typically have higher premiums due to their lack of driving experience and higher risk of accidents.

- Mature Drivers: Mature drivers, typically over 55, often have lower premiums because they have more driving experience and are statistically less likely to be involved in accidents.

Location

Your location, specifically your zip code, is a factor in determining your insurance premiums.

- Traffic Density: Areas with high traffic density generally have higher insurance premiums due to the increased likelihood of accidents.

- Crime Rates: Areas with higher crime rates may have higher insurance premiums due to the risk of theft or vandalism.

- Cost of Living: Areas with a higher cost of living, such as major cities, tend to have higher insurance premiums due to the higher cost of vehicle repairs and replacements.

Credit Score

In many states, including Texas, insurance companies use credit scores as a factor in determining insurance premiums.

“While credit scores are not directly related to driving ability, insurance companies have found a correlation between credit scores and insurance claims.”

- Higher Credit Score: A higher credit score generally indicates a lower risk profile, which can result in lower insurance premiums.

- Lower Credit Score: A lower credit score may indicate a higher risk profile, potentially leading to higher insurance premiums.

Finding Affordable Insurance

Finding the right auto insurance policy at a price that fits your budget is essential. Comparing quotes from different providers and exploring available discounts can help you save money. This section will provide guidance on navigating these aspects of finding affordable auto insurance.

Comparing Insurance Quotes

It’s crucial to compare quotes from multiple insurance companies to find the best rates. You can use online comparison websites, contact insurance companies directly, or work with an insurance broker. When comparing quotes, ensure you are comparing apples to apples by using the same coverage limits and deductibles for each quote.

- Online Comparison Websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to enter your information once and receive quotes from multiple insurers. This saves time and effort, making it easier to compare options.

- Direct Contact with Insurers: Contacting insurance companies directly allows you to discuss your specific needs and ask questions about their policies. This can be beneficial for those who prefer a more personalized approach.

- Insurance Brokers: Brokers work with multiple insurance companies and can help you find the best policy for your needs. They can also negotiate rates on your behalf, potentially saving you money.

Concluding Remarks

Being aware of Texas State Auto Insurance Minimums is essential for every driver. While meeting the minimum requirements is a legal obligation, it’s also a crucial step in ensuring financial protection in the event of an accident. By understanding the coverage types and their limits, you can make informed decisions about your insurance needs, ensuring peace of mind while on the road.

Quick FAQs: Texas State Auto Insurance Minimums

What happens if I get into an accident without the minimum required insurance?

Driving without the minimum required insurance in Texas can result in serious consequences, including fines, license suspension, and even jail time. You could also be held personally liable for all damages and injuries caused by the accident, which can be financially devastating.

Can I choose to have more coverage than the minimum requirements?

Yes, you can choose to have more coverage than the minimum requirements. This is often recommended, as the minimum limits may not be enough to cover all potential damages and injuries in a serious accident. Additional coverage options, like collision and comprehensive, can provide greater financial protection.

How do I find affordable insurance that meets the minimum requirements?

There are several ways to find affordable insurance. You can compare quotes from different insurance providers online, use an insurance broker, or contact an insurance agent directly. You can also explore discounts offered by insurers, such as good driver discounts or safe driving courses.