Texas State Auto Insurance Laws are crucial for understanding your responsibilities as a driver in the Lone Star State. Navigating the complex world of insurance can be overwhelming, but having a solid grasp of these laws is essential for protecting yourself and your finances.

This guide will delve into the key aspects of Texas auto insurance, covering everything from minimum requirements and coverage types to financial responsibility laws and consumer protection measures. Whether you’re a new driver, a seasoned motorist, or simply looking for a better understanding of your insurance needs, this information will provide valuable insights.

Texas State Minimum Auto Insurance Requirements

Texas law requires all drivers to have a minimum amount of auto insurance coverage to protect themselves and others in case of an accident. These requirements ensure financial responsibility for damages caused by a driver.

Minimum Financial Responsibility Limits

Texas law mandates specific minimum financial responsibility limits for each type of coverage. These limits represent the maximum amount an insurance company will pay for covered damages.

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident. The minimum limits are:

- Bodily Injury Liability: $30,000 per person / $60,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured Motorist Coverage: This protects you if you are injured by an uninsured or hit-and-run driver. The minimum limit is:

- Bodily Injury Liability: $30,000 per person / $60,000 per accident

Penalties for Driving Without Insurance

Driving without the required minimum auto insurance in Texas is a serious offense. The consequences can include:

- Fines: You can face fines of up to $350 for a first offense and up to $1,000 for subsequent offenses.

- License Suspension: Your driver’s license can be suspended for up to six months for a first offense and up to two years for subsequent offenses.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Jail Time: In some cases, you may be required to serve jail time.

- Financial Responsibility: You are still responsible for any damages you cause, even if you don’t have insurance.

Types of Auto Insurance Coverage in Texas

While Texas law requires drivers to carry minimum liability insurance, there are other types of coverage that can provide additional protection and financial security in case of an accident. Understanding the different types of auto insurance coverage can help you make informed decisions about your policy and ensure you have the right protection for your needs.

Liability Coverage

Liability coverage is designed to protect you financially if you cause an accident that results in injuries or damage to another person or property. This coverage pays for the other driver’s medical expenses, property damage, and legal fees, up to the limits of your policy.

There are two main types of liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers in their vehicle.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damaged in the accident.

It is crucial to have adequate liability coverage because if you cause an accident and your coverage is insufficient, you could be held personally responsible for the damages exceeding your policy limits.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be very beneficial if you have a newer or more expensive vehicle.

Collision coverage can be particularly useful if you are involved in an accident with an uninsured or underinsured driver.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. This coverage is also optional, but it can be valuable if you have a newer or more expensive vehicle.

Comprehensive coverage is often helpful in situations where your vehicle is damaged due to unforeseen circumstances, such as a tree falling on it during a storm.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. This coverage pays for your medical expenses, lost wages, and pain and suffering, up to the limits of your policy.

UM/UIM coverage is essential because it can provide financial protection if you are involved in an accident with a driver who cannot afford to cover the damages.

Medical Payments Coverage

Medical payments coverage (MedPay) pays for your medical expenses, regardless of who is at fault, up to the limits of your policy. This coverage is optional and can be particularly helpful if you have a high deductible on your health insurance or if you are injured in an accident with an uninsured or underinsured driver.

MedPay can help cover expenses such as ambulance fees, hospital bills, and doctor’s visits.

Personal Injury Protection (PIP)

Personal injury protection (PIP) is a type of coverage that is available in some states, including Texas. PIP coverage pays for your medical expenses, lost wages, and other expenses, regardless of who is at fault.

PIP coverage can be a valuable addition to your auto insurance policy, especially if you are concerned about covering your medical expenses after an accident.

Factors Influencing the Cost of Auto Insurance Coverage

Several factors can influence the cost of your auto insurance coverage, including:

- Your driving history: Drivers with a history of accidents, speeding tickets, or DUI convictions will typically pay higher premiums.

- Your age and gender: Younger drivers and male drivers tend to pay higher premiums than older drivers and female drivers.

- Your location: The cost of auto insurance can vary depending on where you live, due to factors such as traffic density, crime rates, and the cost of car repairs.

- Your vehicle: The type, make, model, and year of your vehicle can affect the cost of your insurance. For example, sports cars and luxury vehicles tend to be more expensive to insure than standard sedans.

- Your coverage limits: The higher your coverage limits, the higher your premium will be.

- Your deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible will generally result in a lower premium.

Texas Financial Responsibility Laws

Texas’s financial responsibility laws are designed to ensure that drivers have the means to cover damages they may cause to others in an accident. These laws aim to protect victims of accidents by guaranteeing they can receive compensation for their losses.

Proving Financial Responsibility After an Accident

To demonstrate financial responsibility after an accident, drivers must provide proof of insurance or other financial coverage. This can be done through:

- Presenting a valid insurance policy: This is the most common method. Drivers must show proof of insurance coverage that meets the minimum requirements set by the state.

- Providing a surety bond: A surety bond is a financial guarantee issued by a surety company. It assures that the driver will be able to pay for damages up to a specific amount.

- Demonstrating self-insurance: A driver may be able to prove financial responsibility by demonstrating they have sufficient assets to cover potential damages. This typically requires a substantial financial reserve and may involve a formal process to establish self-insurance.

Consequences of Failing to Meet Financial Responsibility Requirements

Drivers who fail to meet the state’s financial responsibility requirements face serious consequences, including:

- License suspension: The Texas Department of Motor Vehicles (TxDMV) can suspend the driver’s license for failing to provide proof of insurance or other financial coverage.

- Vehicle registration suspension: The TxDMV can also suspend the vehicle’s registration until proof of financial responsibility is provided.

- Financial penalties: Drivers may be subject to fines and other financial penalties for violating financial responsibility laws.

- Civil lawsuits: Victims of accidents caused by uninsured or underinsured drivers may pursue civil lawsuits to recover damages.

Texas Auto Insurance Claims Process

Filing an auto insurance claim in Texas can be a complex process, but understanding the steps involved can make it smoother.

Steps Involved in Filing an Auto Insurance Claim

The steps involved in filing an auto insurance claim in Texas generally include the following:

- Report the Accident: Immediately contact your insurance company to report the accident. This should be done as soon as possible after the incident. Provide them with the details of the accident, including the date, time, location, and any injuries involved.

- File a Claim: After reporting the accident, you will need to file a formal claim with your insurance company. You will typically be asked to provide information about the accident, including a police report, photos of the damage, and witness statements.

- Investigation: Your insurance company will investigate the claim to determine liability and the extent of the damage. This may involve inspecting the vehicle, interviewing witnesses, and reviewing police reports.

- Negotiate a Settlement: Once the investigation is complete, your insurance company will offer you a settlement. This may cover the cost of repairs, medical bills, and other expenses related to the accident. You may need to negotiate with your insurance company to reach a fair settlement.

- Receive Payment: After the settlement is agreed upon, your insurance company will issue payment. This may be sent directly to you or to the repair shop, depending on the type of claim.

Information Required for a Claim

To file an auto insurance claim in Texas, you will typically need to provide the following information:

- Your policy information: This includes your policy number, the name of your insurance company, and the date your policy was issued.

- Details of the accident: Provide information about the date, time, and location of the accident, as well as a description of what happened.

- Information about the other driver(s): This includes their name, address, driver’s license number, and insurance information.

- Information about your vehicle: This includes the year, make, model, and VIN number of your vehicle.

- Photos of the damage: Take photos of the damage to your vehicle, including any injuries sustained.

- Police report: If a police report was filed, obtain a copy and provide it to your insurance company.

- Witness statements: If there were any witnesses to the accident, get their contact information and ask them to provide a statement.

- Medical bills: If you sustained injuries in the accident, provide copies of your medical bills to your insurance company.

Potential Outcomes of an Auto Insurance Claim, Texas state auto insurance laws

The outcome of an auto insurance claim in Texas can vary depending on the circumstances of the accident, the severity of the damage, and the insurance policies involved. Some potential outcomes include:

- Claim Approved: If your insurance company approves your claim, they will pay for the costs associated with the accident, such as repairs, medical bills, and lost wages.

- Claim Denied: Your insurance company may deny your claim if they determine that you were not at fault for the accident, or if you did not meet the requirements of your insurance policy.

- Partial Payment: Your insurance company may offer you a partial payment if they determine that you are only partially responsible for the accident.

- Litigation: If you are dissatisfied with the outcome of your claim, you may have to file a lawsuit against your insurance company or the other driver(s) involved in the accident.

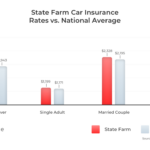

Texas Auto Insurance Rate Factors

Your auto insurance premiums in Texas are influenced by various factors. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Factors Affecting Auto Insurance Rates in Texas

Your driving history, vehicle type, and location are among the key factors influencing your auto insurance rates.

- Driving History: Your driving record plays a significant role in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, accidents, speeding tickets, and DUI convictions can significantly increase your rates.

- Vehicle Type: The type of vehicle you drive is another major factor. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles typically have lower insurance premiums.

- Location: Your location in Texas can impact your insurance rates. Areas with higher rates of car theft, accidents, or other risks will generally have higher insurance premiums.

- Age and Gender: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk can lead to higher insurance premiums. Gender can also play a role, with young men often paying higher rates than young women.

- Credit Score: Your credit score can also affect your auto insurance rates. While not always a direct factor, insurers may use credit scores as a proxy for risk. Individuals with good credit scores are generally considered less risky to insure, leading to potentially lower premiums.

- Coverage Levels: The amount of coverage you choose can also impact your premiums. Higher coverage limits, such as higher liability limits, will generally result in higher premiums.

- Discounts: Several discounts can help lower your auto insurance premiums. These include discounts for good driving records, safety features, multi-car policies, and bundling with other insurance products.

Tips for Lowering Auto Insurance Premiums in Texas

Here are some tips to help you lower your auto insurance premiums:

- Maintain a Clean Driving Record: Avoid accidents, traffic violations, and DUI convictions.

- Choose a Safe Vehicle: Opt for a vehicle with safety features and a lower risk of theft.

- Shop Around for Quotes: Compare quotes from different insurance companies to find the best rates.

- Consider Increasing Your Deductible: A higher deductible can lower your premiums, but you’ll need to pay more out of pocket if you file a claim.

- Bundle Your Policies: Combining your auto insurance with other insurance products, such as homeowners or renters insurance, can often lead to discounts.

- Take Advantage of Discounts: Ask your insurer about available discounts for good driving records, safety features, multi-car policies, and bundling.

Texas Auto Insurance Consumer Protection

Texas has robust consumer protection laws in place to safeguard drivers and ensure fair treatment in the auto insurance market. These laws aim to prevent unfair practices, ensure transparency, and empower consumers to make informed decisions.

The Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a crucial role in protecting consumers by overseeing the auto insurance industry. It enforces state laws and regulations, investigates consumer complaints, and educates the public about their rights and responsibilities.

- The TDI investigates and resolves consumer complaints related to auto insurance, such as unfair claim denials, excessive premiums, or deceptive marketing practices.

- The TDI also has the authority to impose penalties on insurance companies that violate state laws or regulations, including fines, cease-and-desist orders, and license suspensions.

- The TDI provides educational resources to consumers, including brochures, online guides, and consumer alerts, to help them understand their insurance policies and navigate the claims process.

Consumer Protection Laws

Texas law provides several protections for auto insurance consumers.

- Right to a Fair Premium: Insurance companies must base premiums on factors such as driving history, age, and vehicle type, but they cannot discriminate based on race, gender, or other protected characteristics.

- Right to Transparency: Insurance companies must provide consumers with clear and understandable information about their policies, including coverage details, exclusions, and premium calculations.

- Right to Fair Claims Handling: Insurance companies must investigate and process claims promptly and fairly, and they cannot deny claims without a legitimate reason.

- Right to Appeal a Claim Denial: Consumers have the right to appeal a claim denial if they believe it is unfair. The TDI provides a formal complaint process for consumers to dispute claim denials.

Resources for Texas Drivers

Texas drivers can access various resources to file complaints or seek assistance with auto insurance issues.

- Texas Department of Insurance (TDI): The TDI website provides a comprehensive guide to consumer protection laws, complaint filing procedures, and other resources. You can file a complaint online or by phone.

- Texas Office of the Attorney General (OAG): The OAG investigates consumer complaints related to unfair or deceptive business practices, including auto insurance issues. You can file a complaint online or by phone.

- Texas Association of Insurance Agents (TAIA): TAIA is a professional organization that represents independent insurance agents in Texas. You can contact TAIA for information about insurance policies, agents, and consumer rights.

Texas Auto Insurance for High-Risk Drivers

Being labeled a high-risk driver in Texas can make obtaining affordable auto insurance a significant challenge. Insurance companies often perceive these drivers as having a higher likelihood of accidents, leading to increased premiums.

Factors That Contribute to High-Risk Driver Status

High-risk drivers are often associated with factors that increase the probability of accidents, leading to higher insurance premiums. These factors can include:

- A history of accidents or traffic violations: Multiple accidents or traffic violations, particularly serious ones, can significantly increase your insurance premiums.

- Driving record: A history of speeding tickets, DUI convictions, or reckless driving charges can significantly increase your insurance premiums.

- Age and driving experience: Younger drivers and those with less experience often face higher premiums due to their higher risk profile.

- Type of vehicle: Certain types of vehicles, such as high-performance cars or SUVs, are considered riskier to insure and may result in higher premiums.

- Location: Areas with higher crime rates or traffic congestion may have higher insurance rates due to the increased risk of accidents.

- Credit score: In some states, including Texas, insurance companies may consider your credit score when determining your insurance rates. A lower credit score can indicate a higher risk and may lead to higher premiums.

SR-22 Insurance in Texas

SR-22 insurance is a form of financial responsibility insurance required by the state of Texas for certain high-risk drivers. This insurance is a certificate of financial responsibility that proves you have the minimum required auto insurance coverage.

- SR-22 insurance is typically required for drivers who have been convicted of serious traffic offenses, such as DUI or reckless driving, or those who have had their licenses suspended for not having insurance.

- The SR-22 certificate is filed with the Texas Department of Motor Vehicles (TxDMV) by your insurance company to ensure you maintain the required insurance coverage.

- If you fail to maintain the required coverage, your SR-22 certificate will be canceled, and your license could be suspended.

Tips for Finding Affordable Insurance as a High-Risk Driver

Finding affordable auto insurance as a high-risk driver can be challenging, but it’s not impossible. Consider the following tips:

- Shop around: Compare quotes from multiple insurance companies to find the best rates.

- Improve your driving record: Avoid traffic violations and accidents, and consider defensive driving courses to reduce your risk profile.

- Consider a higher deductible: Choosing a higher deductible can lower your monthly premiums, but remember you’ll have to pay more out of pocket if you have an accident.

- Ask about discounts: Many insurance companies offer discounts for things like good student status, safety features in your vehicle, or bundling multiple policies.

- Look for specialized insurers: Some insurance companies specialize in insuring high-risk drivers, so they may be able to offer you better rates.

Texas Auto Insurance for New Drivers

New drivers in Texas face unique challenges when it comes to auto insurance. They have less driving experience, which can lead to higher insurance premiums. Understanding the factors that influence insurance rates for new drivers and implementing strategies to find affordable and comprehensive coverage is crucial.

Factors Influencing Insurance Rates for New Drivers

The cost of auto insurance for new drivers is often higher than for experienced drivers due to a lack of driving history. Insurance companies consider new drivers as high-risk, as they are statistically more likely to be involved in accidents. Several factors influence insurance rates for new drivers in Texas, including:

- Driving Record: New drivers have limited driving records, which makes it difficult for insurance companies to assess their risk. A clean driving record with no accidents or traffic violations is essential for securing lower rates.

- Age: Younger drivers, particularly those under 25, are generally considered higher risk due to their inexperience. Insurance companies often offer discounts for older drivers who have a proven track record of safe driving.

- Vehicle Type: The type of vehicle a new driver owns can also affect insurance rates. Sports cars and high-performance vehicles are often more expensive to insure due to their higher repair costs and greater risk of accidents.

- Location: Where a new driver lives can influence insurance rates. Areas with higher traffic density and accident rates tend to have higher insurance premiums.

- Driving Habits: New drivers should be aware that their driving habits, such as driving at night, commuting long distances, or driving in congested areas, can affect their insurance rates.

- Credit Score: In some states, including Texas, insurance companies can use credit scores to assess risk. A good credit score can help new drivers secure lower insurance rates.

Tips for New Drivers to Find Affordable and Comprehensive Insurance

New drivers in Texas can take several steps to find affordable and comprehensive insurance:

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and coverage options. Online comparison tools can streamline the process.

- Consider Bundling Policies: Bundling auto insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your insurance premiums low. Defensive driving courses can help new drivers develop safe driving habits.

- Take Advantage of Discounts: Insurance companies offer various discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Inquire about available discounts and ensure you qualify for them.

- Increase Your Deductible: Raising your deductible can lower your monthly premium. However, it’s important to ensure you can afford the higher out-of-pocket expense if you need to file a claim.

- Consider a Telematics Program: Some insurance companies offer telematics programs that use devices to track your driving behavior. Safe driving habits can lead to lower premiums.

Texas Auto Insurance for Seniors

Senior drivers in Texas face unique considerations when it comes to auto insurance. As age can influence insurance rates, it’s important for seniors to understand how their age affects their premiums and how to ensure they have adequate and affordable coverage.

How Age Affects Insurance Rates

Seniors may benefit from lower insurance rates due to their driving experience and lower risk profile. Insurance companies generally consider seniors to be safer drivers, as they tend to have fewer accidents and traffic violations. This is often reflected in lower premiums compared to younger drivers. However, it’s important to remember that individual driving records and other factors still play a significant role in determining rates.

Tips for Maintaining Affordable and Adequate Coverage

- Shop around for the best rates. Compare quotes from multiple insurance companies to find the most competitive rates for your specific needs.

- Consider discounts. Many insurance companies offer discounts for seniors, such as safe driver discounts, multi-car discounts, and good student discounts. Ask your insurer about available discounts and make sure you’re taking advantage of all that apply to you.

- Review your coverage needs. As you age, your driving habits and needs may change. Consider adjusting your coverage levels to ensure you have the right amount of protection while avoiding unnecessary expenses. For instance, you might consider reducing your liability coverage if you drive less frequently or if you’re not the primary driver in your household.

- Maintain a clean driving record. A clean driving record is essential for keeping your insurance rates low, regardless of your age. Avoid traffic violations and accidents to maintain a good driving history.

- Consider a senior-specific insurance plan. Some insurance companies offer specialized plans designed specifically for seniors, which may include additional benefits or discounts tailored to their needs. Explore these options to see if they fit your requirements.

Final Summary: Texas State Auto Insurance Laws

Understanding Texas auto insurance laws is paramount for drivers, ensuring they comply with legal obligations and protect themselves financially. By knowing your rights and responsibilities, you can navigate the insurance landscape with confidence and make informed decisions about your coverage. This guide serves as a valuable resource for drivers of all experience levels, empowering them to navigate the complexities of Texas auto insurance with ease.

Expert Answers

What happens if I get into an accident without insurance in Texas?

Driving without the required minimum insurance in Texas can result in hefty fines, license suspension, and even jail time. Additionally, you’ll be fully responsible for all damages and injuries caused in the accident, leaving you vulnerable to significant financial repercussions.

How often should I review my auto insurance policy?

It’s recommended to review your auto insurance policy at least annually, or whenever there are significant life changes like a new car, marriage, or change in driving habits. This ensures your coverage remains adequate and reflects your current needs.

Can I choose to have less coverage than the minimum requirements?

No, Texas law mandates that all drivers carry at least the minimum required insurance coverage. You cannot choose to have less coverage, as this would be a violation of the law.

What factors can influence my auto insurance rates?

Several factors can influence your auto insurance rates, including your driving record, age, vehicle type, location, and credit score. It’s important to understand these factors to make informed decisions about your coverage and potentially reduce your premiums.