Texas State Auto Insurance Laws are crucial for understanding your responsibilities as a driver in the Lone Star State. Whether you’re a seasoned driver or a new Texan, navigating the complexities of auto insurance can be daunting. This guide provides a comprehensive overview of Texas auto insurance requirements, rates, claims processes, and key regulations.

From the minimum liability coverage you need to the factors influencing your rates, we’ll break down everything you need to know to ensure you’re adequately protected on the road. We’ll also delve into the claims process, discuss the role of the Texas Department of Insurance, and address specific situations like high-risk drivers and commercial vehicles.

Texas State Auto Insurance Requirements

Texas is a state that requires all drivers to have a minimum amount of auto insurance coverage. This is to protect drivers and their passengers from financial hardship in the event of an accident. The state’s financial responsibility laws ensure that drivers are held accountable for any damages they may cause.

Minimum Liability Insurance Requirements

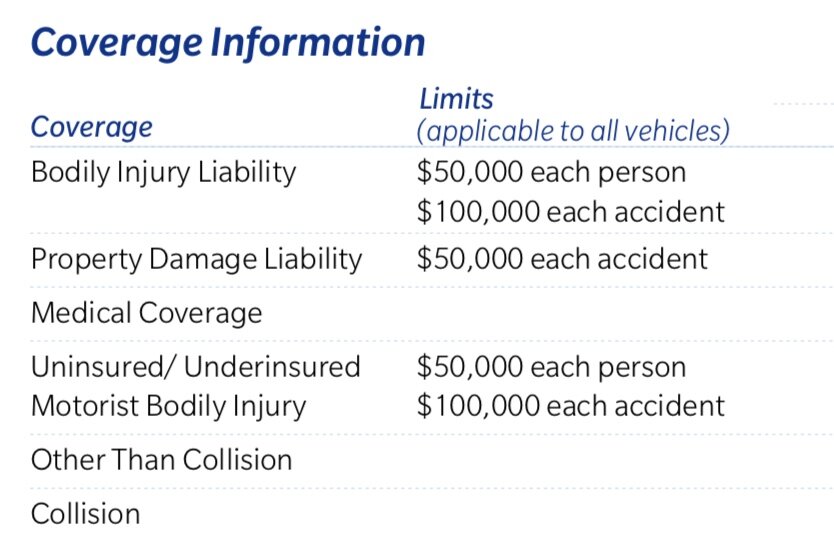

Texas requires all drivers to have a minimum amount of liability insurance coverage, which is intended to cover damages caused to others in the event of an accident. This minimum coverage includes:

- Bodily Injury Liability: This coverage protects you financially if you injure someone else in an accident. It covers medical expenses, lost wages, and pain and suffering. The minimum requirement is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident. The minimum requirement is $25,000 per accident.

Types of Auto Insurance Coverage

Texas law requires drivers to have the minimum liability coverage described above. However, drivers can choose to purchase additional coverage to protect themselves and their vehicles in various situations. These additional types of coverage include:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver. It can help cover medical expenses, lost wages, and other damages. This coverage is optional, but it is highly recommended.

- Collision Coverage: This coverage protects you if you are involved in an accident with another vehicle or object. It covers the cost of repairs or replacement of your vehicle, regardless of fault. This coverage is optional and may be excluded if your vehicle is older or has a low value.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. This coverage is optional and may be excluded if your vehicle is older or has a low value.

Financial Responsibility Laws

Texas has strict financial responsibility laws in place to ensure that drivers are held accountable for any damages they may cause. These laws require drivers to:

- Maintain the minimum required liability insurance coverage.

- Provide proof of insurance to law enforcement officers upon request.

- Pay for damages caused to others in an accident.

Drivers who fail to comply with these laws may face penalties, including:

- Fines: Driving without insurance in Texas can result in fines of up to $350.

- License Suspension: Drivers who are found to be driving without insurance may have their driver’s licenses suspended.

- Jail Time: In some cases, drivers who repeatedly violate financial responsibility laws may face jail time.

- Vehicle Impoundment: If a driver is caught driving without insurance, their vehicle may be impounded until they provide proof of insurance.

Texas Auto Insurance Rates and Factors

Auto insurance rates in Texas, like in any other state, are determined by a variety of factors that assess your risk as a driver. Understanding these factors can help you find the best possible rate for your individual needs.

Factors Influencing Auto Insurance Rates

Several factors contribute to your auto insurance premium in Texas. These include:

- Driving History: Your driving record is a significant factor in determining your insurance rate. A clean record with no accidents or traffic violations will generally result in lower premiums. However, if you have a history of accidents, speeding tickets, or DUI convictions, your rates will likely be higher.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher insurance rates. Rates typically decrease as you age and gain more driving experience.

- Vehicle Type: The type of vehicle you drive plays a role in your insurance premium. Sports cars, luxury vehicles, and vehicles with high-performance engines are generally considered riskier to insure due to their higher repair costs and potential for higher speeds.

- Location: Where you live can significantly affect your insurance rates. Areas with higher crime rates or more traffic congestion tend to have higher insurance premiums due to the increased risk of accidents.

- Credit Score: In Texas, insurers can use your credit score to determine your auto insurance rates. A good credit score generally translates to lower rates, while a poor credit score can lead to higher premiums.

Average Auto Insurance Rates in Texas

Texas typically has lower average auto insurance rates compared to other states. However, it’s important to note that these rates can vary significantly depending on the factors mentioned above.

- According to the Insurance Information Institute, the average annual premium for car insurance in Texas in 2023 was $1,580.

- This is lower than the national average of $1,722.

- However, it’s crucial to remember that these are just averages, and your individual rate may be higher or lower depending on your specific circumstances.

Discounts Available to Texas Drivers

Several discounts are available to Texas drivers that can help reduce their insurance premiums. These include:

- Safe Driver Discounts: Drivers with a clean driving record, free of accidents or traffic violations, can qualify for safe driver discounts.

- Good Student Discounts: Students who maintain a certain GPA or are enrolled in a college or university may be eligible for good student discounts.

- Multi-Car Discounts: If you insure multiple vehicles with the same insurer, you may qualify for a multi-car discount.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can qualify you for discounts.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and may result in a discount.

- Loyalty Discounts: Insurers may offer discounts to long-time customers who have maintained their policy for a certain period.

Texas Auto Insurance Claims Process

Filing an auto insurance claim in Texas can be a complex process, but understanding the steps involved can make it easier. After an accident, it’s important to take immediate action to protect yourself and your rights.

Steps Involved in Filing an Auto Insurance Claim

- Report the Accident to the Police: In Texas, it’s mandatory to report an accident to the police if there are injuries or property damage exceeding $1,000. This report serves as official documentation of the accident, which is crucial for insurance claims.

- Contact Your Insurance Company: Immediately notify your insurance company about the accident, providing them with the necessary details. This includes the date, time, location, and any injuries or property damage. The sooner you report, the faster the claim process can begin.

- Gather Evidence: Collect as much evidence as possible at the accident scene. This includes taking photographs of the damage to your vehicle and the other vehicles involved, recording witness contact information, and obtaining a copy of the police report. This evidence will be essential when supporting your claim.

- File a Claim: Once you have contacted your insurance company, they will provide you with a claim form. Fill out the form accurately and completely, providing all the necessary information. Be sure to include details about the accident, your injuries, and the property damage.

- Cooperate with the Insurance Company: Be responsive to all requests from your insurance company, including providing documentation, attending appointments, and answering questions. Your cooperation is crucial in ensuring a smooth and timely claim process.

Negotiating a Settlement

- Review Your Policy: Understand your insurance policy’s coverage limits and any exclusions that may apply to your claim. This knowledge will be crucial during negotiations with the insurance company.

- Understand Your Rights: Texas law protects your rights as an insured driver. You have the right to fair and reasonable compensation for your losses, including medical expenses, lost wages, and property damage. Research your rights to ensure you are not taken advantage of during negotiations.

- Document Your Losses: Keep detailed records of all your losses, including medical bills, repair estimates, and lost wages. This documentation will be crucial when presenting your claim to the insurance company.

- Negotiate with the Insurance Company: The insurance company will likely offer you a settlement. Carefully consider their offer and compare it to your documented losses. If you believe the offer is too low, you have the right to negotiate for a higher amount. If you are unable to reach a settlement, you may need to consult with an attorney.

Rights and Responsibilities of Drivers in Texas, Texas state auto insurance laws

- Texas is a “Fault” State: This means that the driver at fault for the accident is responsible for paying for the damages. This responsibility can include covering medical expenses, property damage, and lost wages.

- Financial Responsibility Laws: Texas law requires drivers to have liability insurance coverage to protect themselves and others in case of an accident. This coverage is typically required for bodily injury and property damage liability.

- Duty to Report an Accident: Drivers are required to report accidents to the police if there are injuries or property damage exceeding $1,000. Failure to report can result in penalties.

- Duty to Render Aid: Drivers involved in an accident are required to render aid to anyone injured, even if they are not at fault. This includes calling for emergency medical assistance if necessary.

- Duty to Exchange Information: Drivers involved in an accident are required to exchange their contact information and insurance information. This information is essential for filing insurance claims and resolving any disputes.

Texas Auto Insurance Companies

Choosing the right auto insurance company in Texas can be a daunting task, given the wide range of options available. It’s crucial to consider factors like coverage, pricing, customer service, and financial stability when making your decision.

Major Auto Insurance Companies in Texas

| Company Name | Contact Information | Website |

|---|---|---|

| State Farm | 1-800-STATE-FARM (1-800-782-8332) | https://www.statefarm.com/ |

| Progressive | 1-800-PROGRESSIVE (1-800-776-4737) | https://www.progressive.com/ |

| Geico | 1-800-442-4342 | https://www.geico.com/ |

| USAA | 1-800-531-USAA (1-800-531-8722) | https://www.usaa.com/ |

| Allstate | 1-800-ALLSTATE (1-800-255-7828) | https://www.allstate.com/ |

| Farmers Insurance | 1-800-FARMERS (1-800-327-6377) | https://www.farmers.com/ |

Company Strengths and Weaknesses

This section provides a brief overview of the strengths and weaknesses of the major auto insurance companies listed above.

- State Farm: Known for its extensive network of agents, strong financial stability, and competitive pricing. However, some customers have reported issues with customer service and claims processing.

- Progressive: Offers a wide range of coverage options, including discounts and unique features like Snapshot. It has a strong online presence and a user-friendly website. However, some customers have reported higher premiums compared to competitors.

- Geico: Known for its affordable rates and quick claims processing. It also offers a convenient online experience. However, some customers have reported difficulties contacting customer service representatives.

- USAA: Offers excellent customer service and competitive rates, particularly for military members and their families. However, it is only available to those who qualify for membership.

- Allstate: Known for its strong financial stability and a variety of coverage options. It also offers discounts and rewards programs. However, some customers have reported issues with claims processing and customer service.

- Farmers Insurance: Offers a strong network of agents and a wide range of coverage options. It also has a strong reputation for customer service. However, some customers have reported higher premiums compared to competitors.

Reputation and Customer Satisfaction Ratings

The reputation and customer satisfaction ratings of these companies are based on various sources, including J.D. Power, Consumer Reports, and independent customer reviews.

- State Farm: Consistently ranks high in customer satisfaction surveys, particularly for its agent network and claims handling.

- Progressive: Receives positive reviews for its online experience and discounts, but some customers have reported dissatisfaction with customer service.

- Geico: Known for its low rates and efficient claims processing, but some customers have reported challenges with customer service.

- USAA: Highly regarded for its customer service and financial stability, particularly among military members and their families.

- Allstate: Generally receives positive reviews for its coverage options and discounts, but some customers have reported issues with claims processing.

- Farmers Insurance: Known for its strong agent network and customer service, but some customers have reported higher premiums.

Texas Auto Insurance Laws and Regulations

Texas has a unique approach to auto insurance, with a strong emphasis on individual choice and responsibility. The state’s laws and regulations govern various aspects of auto insurance, from minimum coverage requirements to consumer protection measures. Understanding these regulations is crucial for Texas drivers to ensure they are adequately covered and protected.

Texas Department of Insurance Role

The Texas Department of Insurance (TDI) plays a vital role in regulating the auto insurance industry in Texas. Its primary responsibilities include:

- Licensing and supervising insurance companies operating in Texas.

- Enforcing state laws and regulations related to auto insurance.

- Protecting consumers from unfair or deceptive insurance practices.

- Resolving disputes between insurance companies and policyholders.

- Educating the public about auto insurance laws and consumer rights.

The TDI website, [website address], provides comprehensive information about auto insurance in Texas, including:

- Texas Minimum Liability Coverage Requirements

- Information on Filing a Complaint

- Resources for Consumers

- Details on the Texas Auto Insurance Plan (TAIP)

Consumer Protection Laws in Texas

Texas has several consumer protection laws designed to safeguard drivers’ rights and ensure fair treatment in auto insurance matters. Some key laws include:

- Texas Insurance Code: This code Artikels the minimum liability coverage requirements, defines unfair claims practices, and establishes consumer protection measures.

- Texas Deceptive Trade Practices-Consumer Protection Act (DTPA): This act allows consumers to sue insurance companies for deceptive or unfair practices, including failing to pay a claim or denying coverage without a valid reason.

- Texas Fair Credit Reporting Act: This act regulates the use of credit history in determining insurance rates and ensures consumers have access to their credit reports and the ability to dispute inaccuracies.

Texas Financial Responsibility Laws

Texas has financial responsibility laws that require drivers to demonstrate proof of financial responsibility to cover potential damages caused by an accident. These laws aim to protect innocent parties from financial losses resulting from uninsured or underinsured drivers.

- Texas Financial Responsibility Law: This law requires drivers to provide proof of insurance or financial responsibility, such as a surety bond or cash deposit, to cover potential liabilities.

- Texas Auto Insurance Plan (TAIP): This state-run program provides coverage for uninsured or underinsured motorists who cannot obtain coverage from private insurance companies. TAIP is a safety net for drivers who may have difficulty obtaining coverage due to factors such as driving history or credit score.

Texas Auto Insurance for Specific Situations

In Texas, auto insurance requirements and coverage options can vary depending on individual circumstances. This section explores specific situations where drivers might need to consider additional coverage or face different regulations.

Auto Insurance for High-Risk Drivers in Texas

Drivers considered high-risk in Texas may face higher insurance premiums due to factors like a poor driving record, multiple accidents, or a history of driving under the influence. These drivers might need to explore specialized insurance options or consider alternative ways to lower their premiums.

- High-Risk Auto Insurance Companies: Several insurance companies in Texas cater specifically to high-risk drivers. These companies might have more lenient underwriting criteria and offer coverage options for drivers with less-than-perfect driving histories. However, it’s important to compare quotes from different companies and ensure the coverage meets individual needs.

- SR-22 Forms: Drivers convicted of certain offenses, such as DUI, may be required to file an SR-22 form with the Texas Department of Motor Vehicles (TxDMV). This form certifies that the driver has the minimum required liability insurance coverage. Insurance companies often charge higher premiums for drivers who need SR-22 forms.

- Defensive Driving Courses: Completing a defensive driving course can help lower insurance premiums for high-risk drivers. These courses teach safe driving techniques and can reduce points on a driver’s record, leading to potential discounts from insurance companies.

Auto Insurance Coverage for Drivers with a DUI Conviction

Drivers with a DUI conviction in Texas face specific insurance requirements and potential challenges. Understanding these requirements and exploring available options can help ensure adequate coverage and potentially mitigate financial risks.

- SR-22 Requirement: A DUI conviction usually necessitates filing an SR-22 form with the TxDMV. This form serves as proof of financial responsibility and guarantees the driver maintains the minimum required liability insurance coverage.

- Higher Premiums: Drivers with DUI convictions typically face significantly higher insurance premiums due to the increased risk they pose.

- Limited Coverage Options: Some insurance companies may be hesitant to insure drivers with DUI convictions, or they may offer limited coverage options.

- Alternative Insurance Options: Drivers with DUI convictions might need to explore specialized insurance companies that cater to high-risk drivers. These companies might have more lenient underwriting criteria and offer coverage options despite a DUI history.

Auto Insurance for Commercial Vehicles in Texas

Commercial vehicles, used for business purposes, require different insurance coverage compared to personal vehicles. Understanding the specific coverage options available for commercial vehicles is crucial for businesses operating in Texas.

| Type of Coverage | Description |

|---|---|

| Liability Coverage | Protects against financial losses arising from accidents involving the commercial vehicle, covering damages to other vehicles, injuries to others, and legal expenses. |

| Collision Coverage | Covers damages to the commercial vehicle itself resulting from an accident, regardless of fault. |

| Comprehensive Coverage | Protects against damages to the commercial vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. |

| Cargo Coverage | Insures the goods being transported in the commercial vehicle against loss or damage. |

| Uninsured/Underinsured Motorist Coverage | Protects the business and its employees if an accident is caused by an uninsured or underinsured driver. |

| Medical Payments Coverage | Provides coverage for medical expenses incurred by the driver and passengers of the commercial vehicle, regardless of fault. |

| Physical Damage Coverage | Covers damages to the commercial vehicle caused by events like fire, theft, vandalism, or natural disasters. |

Closing Summary: Texas State Auto Insurance Laws

Understanding Texas auto insurance laws is essential for safe and responsible driving. By being informed about your coverage options, rates, and the claims process, you can navigate the complexities of auto insurance with confidence. Remember, driving without proper insurance can result in significant penalties, so prioritize your safety and financial well-being by ensuring you have the right coverage.

FAQs

What happens if I get into an accident without insurance?

Driving without insurance in Texas is illegal and can result in fines, license suspension, and even jail time. You could also be held personally liable for any damages or injuries caused in the accident.

How often do I need to renew my auto insurance in Texas?

Auto insurance policies in Texas are typically renewed annually. Your insurance company will send you a renewal notice before your policy expires.

Can I choose my own auto insurance company in Texas?

Yes, you have the freedom to choose from a wide range of auto insurance companies in Texas. It’s recommended to compare quotes and coverage options from different companies to find the best fit for your needs.

What are the benefits of having comprehensive auto insurance in Texas?

Comprehensive coverage protects you against damages to your vehicle from events like theft, vandalism, and natural disasters. It’s a valuable addition to your policy for peace of mind.

What are the consequences of driving with a suspended license in Texas?

Driving with a suspended license in Texas is a serious offense that can lead to fines, jail time, and further license suspension. It’s crucial to resolve any license suspension issues promptly.