Texas State Auto Insurance is a vital aspect of driving in the Lone Star State, ensuring financial protection in case of accidents or other unforeseen events. Navigating the complexities of Texas auto insurance can be daunting, but understanding the key factors and available options empowers drivers to make informed decisions.

This comprehensive guide delves into the Texas auto insurance market, exploring its intricacies and providing insights for drivers seeking optimal coverage. From mandatory requirements to premium factors and claim procedures, we aim to demystify the process and equip you with the knowledge needed to choose the right policy.

Texas State Auto Insurance Market Overview

Texas boasts a robust auto insurance market, driven by a large and growing population, a high volume of vehicles, and a complex regulatory environment. The state’s unique characteristics shape the market’s dynamics, influencing both demand and competition.

Market Size and Growth

The Texas auto insurance market is one of the largest in the nation, with a significant number of insured vehicles. According to the Texas Department of Insurance, there were over 28 million registered vehicles in Texas in 2022, generating substantial premiums for insurance companies. The market’s growth is closely tied to population increases and economic activity, leading to a consistent expansion in the number of insured vehicles.

Competitive Landscape, Texas state auto insurance

The Texas auto insurance market is highly competitive, with numerous national and regional insurers vying for market share. Large national companies, such as State Farm, Geico, and Progressive, dominate the market, holding significant market share due to their extensive brand recognition and marketing capabilities. However, smaller regional and independent insurers also play a significant role, catering to specific customer segments and geographic areas.

Factors Influencing Demand

Several factors influence the demand for auto insurance in Texas, including:

- State Laws and Regulations: Texas mandates auto liability insurance for all drivers, driving demand for coverage. The state’s regulations also dictate minimum coverage requirements, influencing the types of policies purchased.

- Economic Conditions: Economic growth and prosperity typically lead to an increase in vehicle ownership and usage, boosting demand for auto insurance.

- Traffic Congestion and Accident Rates: Texas’s growing population and urban areas contribute to traffic congestion and higher accident rates, driving demand for coverage to mitigate financial risks.

- Consumer Awareness and Risk Perception: Increasing consumer awareness of potential financial losses from accidents and rising insurance costs can influence demand for coverage.

Key Considerations for Texas Drivers

Navigating the world of auto insurance in Texas can be overwhelming, but understanding the key considerations can help you make informed decisions and secure the right coverage for your needs. This section will Artikel the mandatory insurance requirements, different types of coverage available, and factors that influence your premiums.

Mandatory Auto Insurance Coverage in Texas

Texas law mandates that all drivers carry at least the minimum liability insurance coverage. This ensures that you are financially protected in case of an accident where you are at fault.

- Liability Coverage: This coverage protects you from financial losses if you cause an accident resulting in injuries or property damage to others. It typically includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others.

- Property Damage Liability: Covers repairs or replacement costs for damage to another person’s vehicle or property.

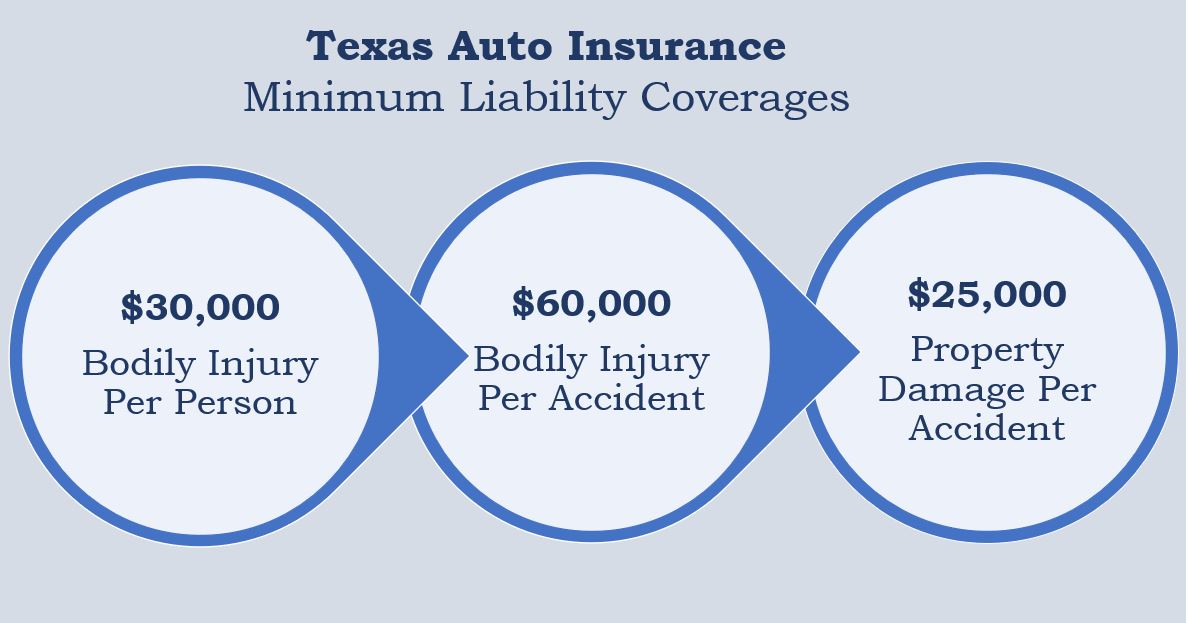

Texas requires a minimum liability coverage of $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

You can choose to purchase higher liability limits than the minimum requirements, providing greater financial protection in case of a serious accident.

Types of Auto Insurance Coverage

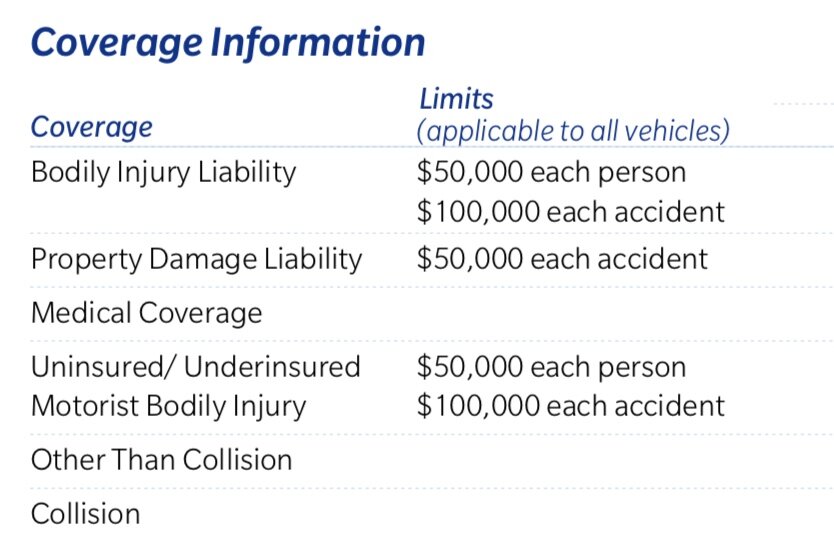

While liability coverage is mandatory, you can opt for additional coverage to further protect yourself and your vehicle.

- Collision Coverage: This coverage pays for repairs or replacement costs for your vehicle if it is damaged in an accident, regardless of who is at fault. It is often required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. It covers your medical expenses, lost wages, and property damage.

Factors Influencing Auto Insurance Premiums

Several factors can influence your auto insurance premiums in Texas, including:

- Driving History: Your driving record plays a significant role in determining your premium. A clean record with no accidents or violations generally results in lower premiums. However, traffic violations, accidents, or DUI convictions can significantly increase your rates.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher premiums. Older drivers, on the other hand, may benefit from lower rates due to their experience and safer driving habits.

- Vehicle Type: The type of vehicle you drive can also affect your premium. Sports cars, luxury vehicles, and high-performance cars are generally considered riskier and may have higher premiums compared to standard sedans or hatchbacks.

- Location: Your location in Texas can influence your premium. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents may have higher insurance costs.

Choosing the Right Auto Insurance Policy

Finding the right auto insurance policy in Texas is essential to protect yourself financially in case of an accident or other unforeseen events. With so many options available, it’s important to understand the process of obtaining quotes, comparing providers, and negotiating premiums to secure the best coverage at a competitive price.

Obtaining Auto Insurance Quotes in Texas

Getting auto insurance quotes in Texas is a straightforward process. You can obtain quotes online, over the phone, or by visiting an insurance agent in person. Online quote tools are generally the most convenient option, allowing you to compare multiple providers simultaneously. When requesting quotes, it’s crucial to provide accurate information about your vehicle, driving history, and desired coverage levels. This ensures you receive personalized quotes tailored to your specific needs.

Comparing Auto Insurance Providers in Texas

Once you have gathered quotes from various providers, it’s time to compare them based on coverage options, pricing, and customer service.

Coverage Options

- Liability Coverage: This is the most basic type of auto insurance, covering damages to other people and their property if you are at fault in an accident. Texas law requires a minimum liability coverage of $30,000 per person, $60,000 per accident, and $25,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s typically optional but highly recommended for newer vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by non-collision events, such as theft, vandalism, fire, or natural disasters. It’s also optional but can be valuable for protecting your investment.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of fault, if you are injured in an accident.

Pricing

Auto insurance premiums in Texas vary depending on several factors, including your driving history, age, location, vehicle type, and coverage levels. Some providers may offer lower premiums for certain groups, such as good drivers or those with a clean driving record. It’s important to compare prices from multiple providers to find the most affordable option without sacrificing essential coverage.

Customer Service

Customer service is a crucial factor to consider when choosing an auto insurance provider. You want a company that is responsive, helpful, and easy to work with. Look for providers with positive online reviews, strong customer satisfaction ratings, and readily available customer support channels.

Negotiating Auto Insurance Premiums and Finding Discounts

Negotiating auto insurance premiums can help you save money on your policy. Here are some tips:

Negotiating Premiums

- Shop around and compare quotes: Getting quotes from multiple providers allows you to leverage competition and potentially negotiate a lower price.

- Bundle your policies: Many insurers offer discounts for bundling your auto insurance with other policies, such as homeowners or renters insurance.

- Ask about discounts: Insurance companies offer various discounts, such as good driver discounts, safe driver discounts, and multi-car discounts. Be sure to inquire about all available discounts and provide any relevant documentation to qualify.

Finding Discounts

- Good Driver Discounts: These discounts are available to drivers with a clean driving record and no accidents or violations.

- Safe Driver Discounts: These discounts may be offered for drivers who have completed defensive driving courses or have installed safety features in their vehicles, such as anti-theft devices or airbags.

- Multi-Car Discounts: If you insure multiple vehicles with the same provider, you may qualify for a multi-car discount.

- Student Discounts: Some insurers offer discounts to students who maintain good grades or are enrolled in college.

- Loyalty Discounts: Long-time customers may be eligible for loyalty discounts.

Understanding Texas Auto Insurance Claims

Navigating the process of filing an auto insurance claim in Texas can be a complex task. Understanding the steps involved, the common types of claims, and the role of the Texas Department of Insurance can help you make informed decisions and ensure a smoother experience.

The Process of Filing an Auto Insurance Claim

When you’re involved in an accident, theft, or vandalism, it’s important to act quickly to initiate the claims process. Here’s a general Artikel:

- Contact Your Insurance Company: The first step is to contact your insurance company as soon as possible after the incident. They will guide you through the necessary steps and provide you with a claim number.

- File a Claim: You’ll need to file a claim with your insurance company, providing details about the incident, including date, time, location, and any witnesses.

- Provide Documentation: Be prepared to provide supporting documentation, such as a police report, photos of the damage, and medical records (if applicable).

- Investigation: Your insurance company will investigate the claim to verify the details and determine the extent of the damage or loss.

- Negotiation: Once the investigation is complete, you may need to negotiate with your insurance company regarding the settlement amount.

- Payment: If your claim is approved, your insurance company will process the payment for repairs, medical expenses, or other covered losses.

Common Types of Auto Insurance Claims

There are several common types of auto insurance claims in Texas, each with its own specific requirements and procedures.

Accident Claims

Accident claims are the most frequent type of auto insurance claim. These claims arise from collisions, rollovers, or other incidents involving your vehicle.

- Liability Claims: These claims occur when you are at fault for an accident and are responsible for covering the damages to the other party’s vehicle and any injuries.

- Collision Claims: These claims cover damage to your own vehicle when it collides with another vehicle or object, regardless of fault.

- Uninsured/Underinsured Motorist Claims: These claims are filed when you are injured in an accident caused by a driver who does not have insurance or has insufficient coverage.

Theft Claims

If your vehicle is stolen, you can file a theft claim with your insurance company.

- Comprehensive Coverage: This coverage protects you against theft, vandalism, and other non-collision incidents. It will cover the value of your vehicle or the cost of repairs, depending on the policy terms.

- Reporting the Theft: You should report the theft to the police immediately and obtain a police report. This document is essential for filing a claim.

- Documentation: You’ll need to provide your insurance company with documentation, such as the vehicle’s registration and title, as well as proof of ownership.

Vandalism Claims

If your vehicle is damaged by vandalism, you can file a claim with your insurance company.

- Comprehensive Coverage: Similar to theft claims, comprehensive coverage covers damage from vandalism.

- Reporting the Incident: Report the vandalism to the police and obtain a police report.

- Documentation: Provide your insurance company with photos of the damage, a police report, and any other relevant documentation.

The Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a crucial role in regulating the auto insurance industry in Texas.

- Licensing and Oversight: The TDI licenses and oversees insurance companies operating in Texas, ensuring they meet certain financial and operational standards.

- Consumer Protection: The TDI protects consumers by investigating complaints against insurance companies and enforcing state insurance laws.

- Market Regulation: The TDI monitors the auto insurance market to ensure fair and competitive pricing and coverage options.

Texas Auto Insurance Laws and Regulations

Driving in Texas requires complying with specific auto insurance laws and regulations. These laws ensure financial responsibility for drivers and protect individuals in case of accidents. Understanding these laws is crucial for every Texas driver to ensure they are adequately covered and avoid legal consequences.

Texas Financial Responsibility Law

The Texas Financial Responsibility Law mandates that all drivers in Texas must have proof of financial responsibility to operate a vehicle legally. This law aims to ensure that drivers can cover potential damages or injuries caused to others in an accident.

- Minimum Liability Coverage: Texas requires drivers to carry a minimum amount of liability insurance to cover damages or injuries to others. This includes bodily injury liability coverage, property damage liability coverage, and uninsured/underinsured motorist coverage.

- Financial Responsibility Proof: Drivers can provide proof of financial responsibility by presenting a valid insurance policy, a surety bond, or a certificate of self-insurance.

- Penalties for Non-Compliance: Drivers who fail to meet the financial responsibility requirements face penalties such as fines, license suspension, and vehicle registration suspension.

Texas Insurance Code

The Texas Insurance Code Artikels the specific requirements for auto insurance policies in the state. This code regulates the insurance industry and ensures fair and transparent practices.

- Policy Requirements: The Texas Insurance Code specifies the essential elements that must be included in every auto insurance policy, such as coverage limits, exclusions, and cancellation provisions.

- Rate Regulation: The code provides guidelines for insurance companies to set premiums and ensures that rates are reasonable and not discriminatory.

- Consumer Protection: The Texas Insurance Code includes provisions that protect consumers from unfair or deceptive practices by insurance companies. These provisions include requirements for clear and understandable policy language, consumer complaint resolution processes, and consumer education resources.

Recent Changes and Updates to Texas Auto Insurance Regulations

The Texas Department of Insurance (TDI) regularly updates and modifies auto insurance regulations to adapt to changing circumstances and ensure consumer protection.

- Increased Minimum Liability Coverage: In recent years, the minimum liability coverage requirements have been increased to ensure adequate coverage for drivers and passengers.

- Electronic Filing Requirements: The TDI has implemented electronic filing requirements for insurance companies, streamlining the process of submitting and managing insurance policies.

- Consumer Education Initiatives: The TDI actively engages in consumer education initiatives to help Texas drivers understand their insurance options and rights.

Role of the Texas Department of Insurance

The TDI plays a vital role in enforcing auto insurance laws and regulations in Texas. The TDI has the authority to investigate insurance companies, ensure compliance with state laws, and protect consumers from unfair or deceptive practices.

- Enforcement of Laws: The TDI has the power to impose penalties on insurance companies that violate state laws, including fines and license revocation.

- Consumer Complaint Resolution: The TDI provides a mechanism for consumers to file complaints against insurance companies. The TDI investigates these complaints and works to resolve disputes between consumers and insurance companies.

- Market Oversight: The TDI monitors the auto insurance market in Texas to ensure fair competition and prevent unfair practices. This includes reviewing rates, policies, and marketing materials.

Last Point: Texas State Auto Insurance

Understanding Texas auto insurance is crucial for every driver. By carefully considering your individual needs, comparing quotes, and staying informed about current regulations, you can secure the right coverage and protect yourself financially on the road. Remember, driving in Texas requires responsible choices, and having adequate auto insurance is a key component of safe and responsible driving.

Top FAQs

What is the minimum auto insurance coverage required in Texas?

Texas requires drivers to have liability coverage, which includes bodily injury liability and property damage liability. This coverage protects others in case of an accident you cause.

How do I get an auto insurance quote in Texas?

You can obtain quotes online, over the phone, or by visiting an insurance agent. Be sure to provide accurate information about your driving history, vehicle, and coverage needs.

What factors affect my auto insurance premium in Texas?

Factors influencing your premium include your driving record, age, vehicle type, location, and coverage choices. Good driving history and choosing higher deductibles can often lead to lower premiums.

How do I file an auto insurance claim in Texas?

Contact your insurance company immediately after an accident. They will guide you through the claims process, which may involve filing a police report, obtaining medical treatment, and providing documentation.