States Without Car Insurance: Risks and Implications explores the complex landscape of driving without mandatory car insurance in the United States. While many states require drivers to carry insurance, a handful have chosen to forgo this requirement, creating a unique situation with its own set of risks and implications.

This article delves into the legal ramifications of driving without insurance, examining the potential penalties and consequences for uninsured drivers. We’ll also investigate the financial burden associated with driving without insurance, highlighting the potential for significant financial hardship in the event of an accident. Additionally, we’ll explore alternative insurance options for drivers who may not be able to afford traditional car insurance, offering insights into their benefits and drawbacks.

Legal Landscape of Driving Without Insurance

Driving without car insurance in the United States is a serious offense that carries significant legal consequences. It is a violation of state law, and drivers who are caught operating a vehicle without insurance can face a range of penalties and fines.

Penalties and Fines for Driving Without Insurance

Driving without insurance can result in a variety of penalties and fines, which vary depending on the state and the circumstances of the violation. In most states, driving without insurance is a misdemeanor offense. The penalties for this offense can include:

- Fines: These can range from a few hundred dollars to several thousand dollars, depending on the state and the number of offenses.

- License Suspension: The driver’s license can be suspended for a period of time, making it illegal to drive.

- Vehicle Impoundment: The vehicle may be impounded until the owner provides proof of insurance.

- Court Costs: Drivers may also have to pay court costs and other fees associated with the violation.

Consequences of an Accident Involving an Uninsured Driver

In the event of an accident involving an uninsured driver, the consequences can be severe and costly. The uninsured driver may be held liable for all damages, including:

- Property Damage: This includes damage to the other vehicle(s) involved in the accident.

- Medical Expenses: This includes the cost of treating injuries sustained by the other driver(s) and passengers.

- Lost Wages: This includes any income lost by the other driver(s) due to injuries sustained in the accident.

- Pain and Suffering: This includes compensation for emotional distress and other non-economic damages.

“In many cases, an uninsured driver may not have the financial resources to cover the costs of an accident. This can leave the other driver(s) and passengers in a difficult financial situation, potentially facing significant medical bills and other expenses.”

Examples of Legal Cases or Situations Involving Uninsured Drivers

There are numerous examples of legal cases and situations involving uninsured drivers. One common scenario is an accident where the uninsured driver is at fault. In such cases, the injured party may have to file a lawsuit against the uninsured driver to recover damages. This can be a lengthy and expensive process, and the outcome is uncertain.

Another common scenario involves uninsured drivers who are stopped by law enforcement for traffic violations. If the driver cannot provide proof of insurance, they may be cited and fined. In some cases, their vehicle may also be impounded.

States with Mandatory Car Insurance Requirements: States Without Car Insurance

Driving without insurance is a risky and potentially costly decision. In the United States, most states require drivers to carry car insurance to protect themselves and others from financial ruin in the event of an accident. This ensures that victims of accidents are compensated for their losses, and it helps to keep insurance premiums affordable for everyone.

States with Mandatory Car Insurance Requirements

The following states require all drivers to carry car insurance:

| State | Minimum Liability Coverage | Minimum Property Damage Coverage | Minimum Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|

| Alabama | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Alaska | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Arizona | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Arkansas | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| California | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Colorado | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Connecticut | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Delaware | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Florida | $10,000 per person/$20,000 per accident | $10,000 | $10,000 per person/$20,000 per accident |

| Georgia | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Hawaii | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Idaho | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Illinois | $20,000 per person/$40,000 per accident | $15,000 | $20,000 per person/$40,000 per accident |

| Indiana | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Iowa | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Kansas | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Kentucky | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Louisiana | $15,000 per person/$30,000 per accident | $10,000 | $15,000 per person/$30,000 per accident |

| Maine | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Maryland | $30,000 per person/$60,000 per accident | $15,000 | $30,000 per person/$60,000 per accident |

| Massachusetts | $20,000 per person/$40,000 per accident | $5,000 | $20,000 per person/$40,000 per accident |

| Michigan | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Minnesota | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Mississippi | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Missouri | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Montana | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nebraska | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nevada | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| New Hampshire | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| New Jersey | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| New Mexico | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| New York | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| North Carolina | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| North Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Ohio | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Oklahoma | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Oregon | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Pennsylvania | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Rhode Island | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Carolina | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Tennessee | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Texas | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| Utah | $25,000 per person/$65,000 per accident | $15,000 | $25,000 per person/$65,000 per accident |

| Vermont | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Virginia | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Washington | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| West Virginia | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wisconsin | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

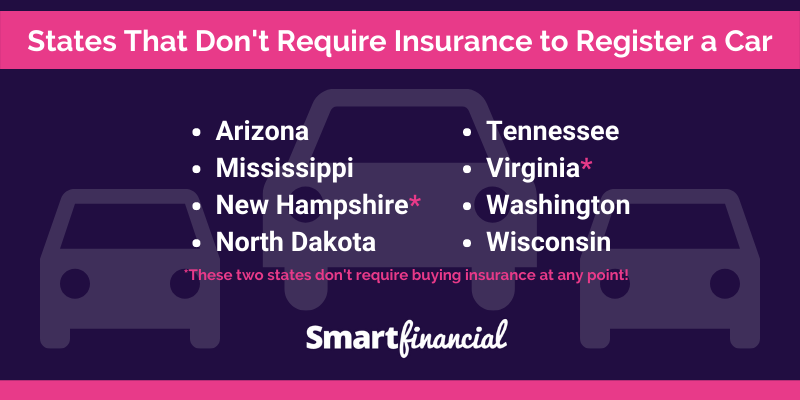

States with No Mandatory Car Insurance

There are only a handful of states in the United States that do not have mandatory car insurance laws. These states generally rely on a system of financial responsibility laws, which require drivers to prove their ability to pay for damages caused in an accident.

While these states do not mandate car insurance, they do have specific requirements that drivers must meet to demonstrate financial responsibility.

Reasons for Not Requiring Car Insurance

These states generally opt for a system of financial responsibility laws instead of mandatory car insurance for several reasons:

- Individual Freedom and Choice: Some argue that individuals should have the freedom to choose whether or not to purchase car insurance, as long as they can demonstrate financial responsibility in other ways.

- Lower Insurance Costs: The absence of mandatory car insurance can lead to lower insurance premiums, as insurance companies may not be required to cover as many high-risk drivers.

- Government Intervention: Some believe that government intervention in the form of mandatory insurance requirements is unnecessary and can lead to higher costs and bureaucratic complexities.

Potential Risks and Implications of Driving Without Insurance

While these states may not mandate car insurance, driving without insurance can have significant financial and legal consequences.

- Financial Ruin: If you cause an accident without insurance, you could be held personally liable for all damages, including medical expenses, property damage, and lost wages. This could lead to financial ruin, as you may have to sell your assets or declare bankruptcy.

- License Suspension: Even if you can afford to pay for damages caused by an accident, driving without insurance can lead to license suspension or revocation.

- Criminal Charges: In some states, driving without insurance can be considered a criminal offense, leading to fines, jail time, or both.

- Difficulty in Obtaining Insurance: If you have a history of driving without insurance, you may find it difficult to obtain insurance in the future, as insurance companies may view you as a high-risk driver.

Financial Implications of Driving Without Insurance

Driving without insurance can lead to significant financial hardship, potentially crippling your finances and causing long-term repercussions. Even a seemingly minor accident can snowball into a major financial burden, leaving you responsible for hefty expenses that you might not be able to afford.

Financial Burden of Driving Without Insurance

Driving without insurance exposes you to various financial risks, including fines, legal fees, and medical expenses. These costs can quickly accumulate, putting immense pressure on your finances.

- Fines: Most states impose hefty fines on drivers caught driving without insurance. These fines can range from hundreds to thousands of dollars, depending on the state and the number of offenses.

- Legal Fees: If you are involved in an accident without insurance, you could face legal action from the other party, potentially leading to expensive legal fees.

- Medical Expenses: If you or another person is injured in an accident, you will be responsible for all medical bills, including hospital stays, surgeries, and rehabilitation.

- Property Damage: If you cause damage to another person’s vehicle or property, you will be held liable for repairs or replacements.

Real-Life Scenarios

Here are some real-life examples of how driving without insurance can lead to financial hardship:

- A young driver in Florida was involved in a minor fender bender. Without insurance, he was responsible for the other driver’s medical bills and car repairs, totaling over $10,000. This unexpected expense significantly impacted his ability to pay for his own living expenses and education.

- An uninsured driver in California was found at fault for a serious accident that resulted in significant injuries to the other driver. He faced a lawsuit, leading to hefty legal fees and a large financial settlement to cover the other driver’s medical expenses and lost wages.

Hypothetical Case Study

Let’s consider a hypothetical scenario:

Scenario: A driver without insurance is involved in a collision with another vehicle. The driver is at fault for the accident, and the other driver sustains injuries.

Financial Consequences:

* Medical Expenses: The injured driver incurs $50,000 in medical bills.

* Property Damage: The other driver’s vehicle requires $10,000 in repairs.

* Legal Fees: The injured driver hires an attorney to pursue legal action against the uninsured driver, incurring $5,000 in legal fees.

* Lost Wages: The injured driver is unable to work for several months due to their injuries, resulting in a loss of $15,000 in wages.

Total Cost: The uninsured driver is responsible for a total of $80,000 in expenses.

Impact: This significant financial burden could lead to:

* Bankruptcy: The driver may be unable to afford the legal judgments and could face bankruptcy.

* Wage Garnishment: The driver’s wages could be garnished to pay off the debt.

* Lien on Property: The driver’s property could be subject to a lien to secure payment.

Alternatives to Traditional Car Insurance

For drivers who find traditional car insurance unaffordable, several alternative options exist. These alternatives may offer coverage tailored to specific situations, potentially reducing costs or providing coverage when traditional insurance is unavailable.

Self-Insurance

Self-insurance involves setting aside funds to cover potential car accident costs. It can be a viable option for drivers with strong financial resources and a low risk tolerance.

- Benefits:

- Potential for cost savings by avoiding premiums.

- Greater control over coverage and claims process.

- Drawbacks:

- Requires significant financial reserves to cover potential large expenses.

- Risk of financial hardship in case of a major accident.

- May not provide adequate coverage for all potential liabilities.

- Suitability:

- Drivers with substantial financial resources and a low risk tolerance.

- Drivers with a clean driving record and a history of safe driving.

High-Risk Insurance

High-risk insurance, also known as non-standard insurance, is designed for drivers with poor driving records or other risk factors that make them ineligible for traditional insurance.

- Benefits:

- Provides coverage for drivers who might otherwise be uninsured.

- Drawbacks:

- Significantly higher premiums than traditional insurance.

- Limited coverage options and stricter requirements.

- Suitability:

- Drivers with a history of accidents, traffic violations, or DUI convictions.

- Drivers with poor credit scores or limited driving experience.

Pay-Per-Use Insurance, States without car insurance

Pay-per-use insurance, also known as usage-based insurance, bases premiums on actual driving habits.

- Benefits:

- Potentially lower premiums for drivers who drive less frequently or safely.

- Flexibility in coverage based on individual driving needs.

- Drawbacks:

- May require the use of a telematics device to track driving behavior.

- Premiums may fluctuate based on driving habits.

- Suitability:

- Drivers who drive infrequently or commute short distances.

- Drivers who prioritize safe driving practices.

Safety and Societal Impact of Uninsured Drivers

Driving without insurance poses a significant risk to road safety and has a far-reaching impact on society as a whole. Uninsured drivers, due to their lack of financial responsibility, can contribute to a multitude of problems, including increased accidents, injuries, and strain on healthcare systems and emergency services.

Increased Accidents and Injuries

The absence of insurance coverage can lead to irresponsible driving behaviors. Uninsured drivers may be more likely to engage in risky actions, such as speeding, driving under the influence, or disregarding traffic laws. This can result in an increased frequency of accidents and a higher likelihood of severe injuries.

Epilogue

Ultimately, the decision to drive without insurance is a complex one, with potential risks and consequences that extend beyond individual drivers to the safety and well-being of society as a whole. This article provides a comprehensive overview of the topic, shedding light on the legal, financial, and societal implications of driving without car insurance, and encouraging drivers to consider the potential risks and make informed decisions.

Popular Questions

What are the states that don’t require car insurance?

Currently, only New Hampshire and Virginia do not require drivers to carry liability insurance, although they do require proof of financial responsibility in the event of an accident.

What happens if I get into an accident without insurance?

In most states, driving without insurance is illegal and can result in fines, license suspension, and even jail time. Additionally, you could be held personally liable for all damages and injuries resulting from the accident.

What are some alternatives to traditional car insurance?

Alternatives to traditional car insurance include self-insurance, high-risk insurance, pay-per-use insurance, and membership-based insurance programs. Each option has its own benefits and drawbacks, and the suitability of each option depends on individual circumstances.