States with the cheapest car insurance can offer significant savings for drivers, but understanding the factors that influence premiums is crucial. Factors like driving history, vehicle type, location, age, and credit score all play a role in determining how much you pay for car insurance. Some states have lower average premiums due to factors like lower accident rates, competitive insurance markets, or favorable state regulations.

This guide explores the states with the lowest average car insurance premiums, providing insights into why these states offer more affordable coverage. We’ll also delve into state-specific considerations that can impact your insurance costs, offering tips on how to find affordable car insurance and the importance of having adequate coverage.

Factors Influencing Car Insurance Costs: States With The Cheapest Car Insurance

Car insurance premiums are determined by a variety of factors, and understanding these factors can help you make informed decisions about your coverage and potentially save money. While the specific factors and their impact can vary from state to state, some common influences include your driving history, the type of vehicle you drive, your location, your age, and your credit score.

Driving History

Your driving history is one of the most significant factors affecting your car insurance premiums. Insurance companies consider your past driving record to assess the risk you pose as a driver. A clean driving record with no accidents, violations, or claims typically results in lower premiums. Conversely, a history of accidents, traffic violations, or claims can significantly increase your premiums. For example, a DUI conviction can lead to a substantial increase in your insurance costs, reflecting the higher risk associated with such an offense.

Vehicle Type

The type of vehicle you drive also plays a crucial role in determining your car insurance premiums. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and value. For example, luxury cars or high-performance vehicles are often associated with higher insurance costs due to their higher repair costs and potential for more severe accidents. Conversely, older, less expensive cars with basic safety features may have lower premiums.

Location

Your location is another key factor that influences car insurance costs. Insurance companies consider factors like the population density, traffic volume, crime rates, and weather conditions in your area. For instance, cities with higher traffic congestion and higher crime rates may have higher car insurance premiums due to the increased risk of accidents and theft. Similarly, areas prone to natural disasters, such as hurricanes or earthquakes, may have higher premiums to account for the potential for damage to vehicles.

Age

Your age is a significant factor in determining your car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums for young drivers. As you age and gain more driving experience, your premiums generally decrease. However, drivers over the age of 65 may also see an increase in their premiums due to potential age-related health concerns that could impact their driving abilities.

Credit Score

While it may seem surprising, your credit score can also impact your car insurance premiums. Insurance companies believe that individuals with good credit scores are more financially responsible and less likely to file claims. Therefore, drivers with higher credit scores may qualify for lower premiums. Conversely, those with lower credit scores may face higher premiums due to the perceived higher risk of claims.

States with the Lowest Average Car Insurance Premiums

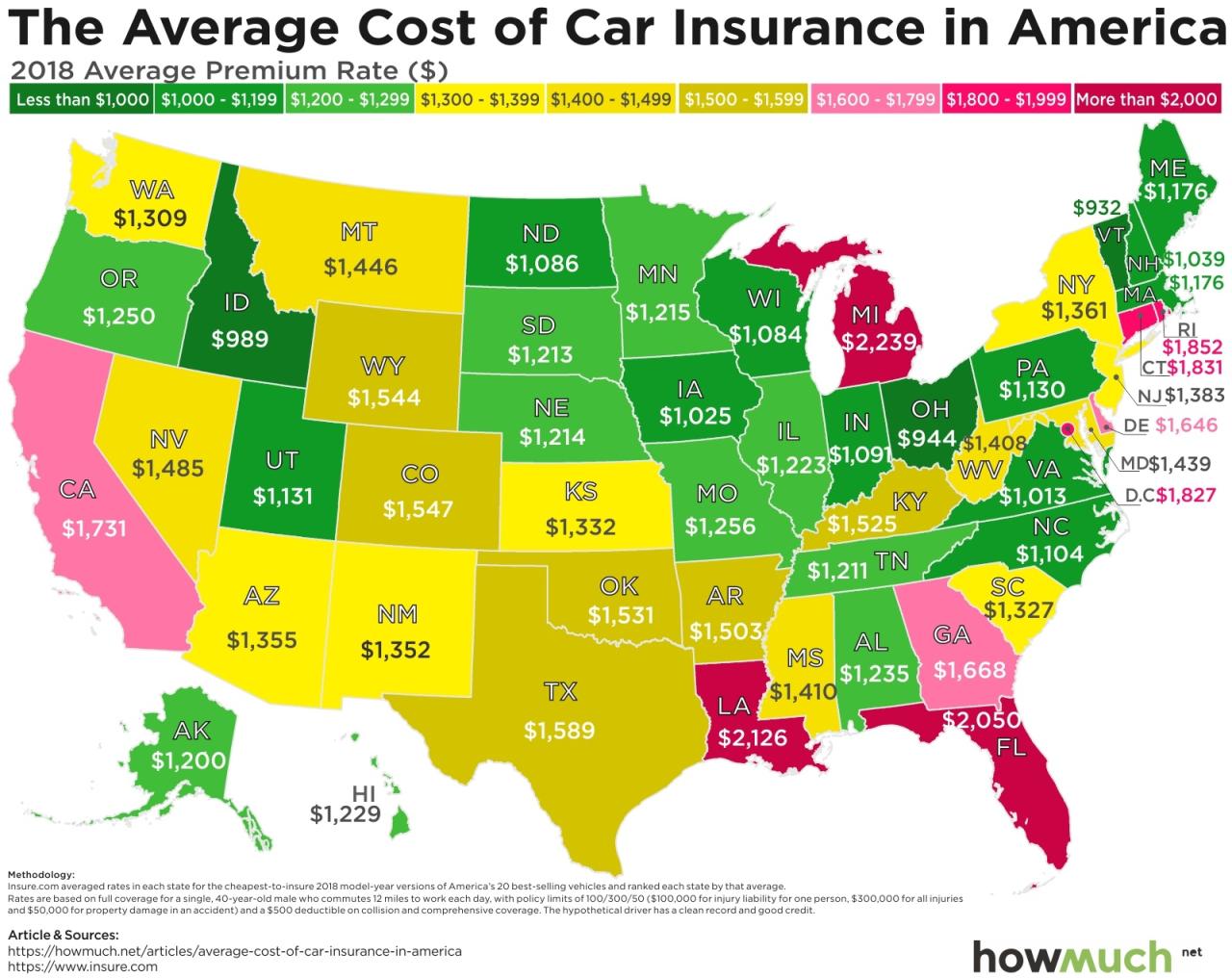

Finding affordable car insurance is a top priority for most drivers. While car insurance rates can vary widely based on individual factors, certain states consistently offer lower average premiums than others. This is often attributed to a combination of factors, including lower accident rates, competitive insurance markets, and favorable state regulations.

States with the Lowest Average Premiums

Based on recent data, the states with the lowest average car insurance premiums are:

| State | Average Annual Premium | Notable Factors |

|---|---|---|

| Idaho | $1,056 | Lower accident rates, competitive insurance market. |

| Maine | $1,064 | Lower population density, lower accident rates. |

| Utah | $1,072 | Favorable state regulations, competitive insurance market. |

| Vermont | $1,108 | Lower population density, lower accident rates. |

State-Specific Considerations

Beyond the general factors influencing car insurance costs, specific state-level characteristics can significantly impact premiums. These include traffic density, weather conditions, and the prevalence of certain vehicle types, among others. These state-specific factors can lead to significant variations in insurance costs, even for individuals with similar driving records and vehicle types.

Impact of Traffic Density

Traffic density can significantly impact the risk of accidents, which in turn influences insurance premiums. States with high traffic congestion, such as California and New York, tend to have higher insurance rates. This is because the increased likelihood of accidents due to heavy traffic translates to higher claims for insurance companies.

For example, a 2022 study by the Insurance Information Institute found that California had the highest average annual car insurance premium in the United States, largely attributed to the state’s high traffic density and number of accidents.

Influence of Weather Conditions

Weather conditions can also significantly impact insurance premiums. States prone to severe weather events, such as hurricanes, tornadoes, and hailstorms, often have higher insurance rates. This is because insurance companies need to factor in the increased risk of damage to vehicles due to these events.

For instance, Florida, a state susceptible to hurricanes, typically has higher car insurance rates compared to states with milder weather conditions.

Prevalence of Certain Vehicle Types

The prevalence of certain vehicle types within a state can also affect insurance premiums. States with a high concentration of luxury vehicles or high-performance sports cars often have higher insurance rates. This is because these vehicles are more expensive to repair or replace, resulting in higher claims for insurance companies.

For example, a state with a large number of luxury cars, such as California, might have higher insurance premiums due to the higher cost of repairing or replacing these vehicles.

Tips for Finding Affordable Car Insurance

Finding the right car insurance policy can feel like navigating a maze, especially when you’re trying to keep costs down. But with a bit of planning and effort, you can find affordable coverage that protects you and your vehicle.

Comparing Quotes

It’s essential to compare quotes from multiple insurance companies to find the best deal. You can use online comparison tools, contact insurers directly, or work with an insurance broker. When comparing quotes, make sure you’re comparing apples to apples. This means using the same coverage levels and deductibles for each quote. For example, if you’re comparing quotes for liability coverage, make sure the limits are the same for each insurer.

- Online Comparison Tools: Websites like Policygenius, NerdWallet, and The Zebra allow you to enter your information once and receive quotes from multiple insurers. These tools can save you time and effort by simplifying the comparison process.

- Contacting Insurers Directly: You can get quotes directly from insurance companies by visiting their websites, calling their customer service lines, or visiting their local offices. This gives you a chance to ask questions and learn more about their policies.

- Working with an Insurance Broker: An insurance broker can help you compare quotes from multiple insurers and find the best policy for your needs. Brokers are often independent and work with a variety of insurance companies, so they can offer you a wider range of options.

Negotiating with Insurers

Once you’ve received quotes from multiple insurers, you may be able to negotiate a lower price. Insurance companies are often willing to negotiate with customers who are willing to shop around. Here are a few tips for negotiating with insurers:

- Be Prepared to Switch Insurers: Let the insurer know you’re willing to switch if they don’t offer you a competitive price. This shows you’re serious about finding the best deal.

- Highlight Your Good Driving Record: If you have a clean driving record, point this out to the insurer. They may be willing to offer you a discount for being a safe driver.

- Ask About Discounts: Many insurers offer discounts for things like good grades, safe driving courses, and bundling policies. Ask about any discounts you may be eligible for.

Exploring Discounts

Insurance companies offer various discounts to help policyholders save money. These discounts can significantly reduce your premium.

- Good Driver Discounts: These discounts are awarded to drivers with a clean driving record, meaning no accidents or traffic violations. The discount amount varies depending on the insurer and the driver’s driving history.

- Safe Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your insurance. These courses often cover topics like defensive driving techniques, traffic laws, and accident prevention.

- Bundling Discounts: Many insurers offer discounts when you bundle multiple insurance policies, such as car insurance, home insurance, or renters insurance. Bundling your policies with the same insurer can save you money on your premiums.

- Other Discounts: Insurers may offer other discounts based on your occupation, vehicle features, or other factors. For example, some insurers offer discounts for drivers who work from home or have anti-theft devices installed in their vehicles.

Improving Your Driving History and Credit Score, States with the cheapest car insurance

Your driving history and credit score can significantly impact your car insurance premiums. Here are some tips for improving these factors:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations. These incidents can increase your insurance premiums for several years.

- Take a Defensive Driving Course: Completing a defensive driving course can help you become a safer driver and potentially earn you a discount on your insurance.

- Improve Your Credit Score: A good credit score can help you qualify for lower insurance premiums. You can improve your credit score by paying your bills on time, reducing your credit card balances, and avoiding opening new credit accounts unnecessarily.

The Importance of Coverage and Liability Limits

Car insurance is a vital financial safety net, providing protection against significant financial losses in the event of an accident. Understanding the different types of coverage and their limits is crucial for making informed decisions and ensuring you have adequate protection.

Liability Coverage

Liability coverage is essential for protecting yourself financially in the event of an accident where you are at fault. It covers the costs of injuries and property damage to others, including medical bills, lost wages, and vehicle repairs. Liability limits, expressed as a per-person and per-accident amount, determine the maximum amount your insurance company will pay. For example, a liability limit of 100/300 means your insurance company will pay up to $100,000 per person injured and up to $300,000 total per accident.

It is crucial to choose liability limits that reflect your potential financial risk.

If you are involved in an accident and cause significant injuries or property damage, exceeding your liability limits can leave you personally liable for the remaining costs, potentially leading to financial ruin.

Collision and Comprehensive Coverage

Collision coverage protects your vehicle against damage resulting from a collision with another vehicle or object. Comprehensive coverage, on the other hand, covers damage caused by non-collision events, such as theft, vandalism, or natural disasters. While not mandatory, these coverages are essential for ensuring your vehicle’s repair or replacement after an accident.

Examples of the Impact of Coverage Limits

Consider the following scenarios:

- Scenario 1: You are driving and accidentally rear-end another vehicle, causing significant injuries to the other driver. Your liability limit is 25/50, and the injured driver’s medical bills exceed $100,000. In this case, your insurance company will only pay $25,000 per person, leaving you personally liable for the remaining $75,000.

- Scenario 2: Your car is stolen and never recovered. You have comprehensive coverage with a limit of $20,000. This coverage will help you replace your vehicle or receive compensation for its value, depending on your policy terms.

Wrap-Up

Finding affordable car insurance requires a combination of understanding your individual risk factors, comparing quotes from different insurers, and taking advantage of available discounts. By taking proactive steps to manage your driving history, credit score, and insurance coverage, you can significantly reduce your car insurance premiums and enjoy the peace of mind of having adequate financial protection on the road.

Helpful Answers

What are some common discounts offered by insurance companies?

Insurance companies often offer discounts for good drivers, safe driving courses, bundling policies, and other factors like being a member of certain organizations or having safety features in your vehicle.

How can I improve my driving history to lower my premiums?

Avoid traffic violations, accidents, and other driving infractions. Maintaining a clean driving record can significantly reduce your insurance costs.

What is the difference between liability, collision, and comprehensive coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your vehicle in an accident, and comprehensive coverage covers damage to your vehicle from non-accident events like theft or natural disasters.