States with no fault auto insurance – States with no-fault auto insurance set the stage for this enthralling narrative, offering readers a glimpse into a unique approach to auto insurance that has both advantages and disadvantages. This system, unlike traditional fault-based insurance, shifts the focus from assigning blame to providing immediate coverage for accident-related expenses. No-fault insurance is designed to streamline the claims process and reduce litigation, potentially leading to faster compensation and lower insurance premiums. However, it’s crucial to understand the nuances of these laws, as they vary significantly from state to state, and their impact on drivers can be complex.

This guide delves into the intricacies of no-fault auto insurance, exploring its history, core principles, and the diverse range of no-fault systems employed across the United States. We’ll analyze the benefits and drawbacks of this system, considering its impact on drivers, insurance companies, and the overall landscape of auto insurance.

What is No-Fault Auto Insurance?

No-fault auto insurance is a type of insurance system where drivers are required to file claims with their own insurance company, regardless of who caused the accident. This is in contrast to traditional fault-based insurance systems, where the at-fault driver’s insurance company is responsible for covering the damages of the other driver.

Core Principles of No-Fault Insurance

No-fault insurance operates on the principle of “first-party coverage,” meaning that drivers are primarily responsible for covering their own losses, regardless of fault. The core principles of no-fault insurance include:

- Personal Injury Protection (PIP): This coverage provides benefits for medical expenses, lost wages, and other related costs incurred due to an accident, regardless of fault.

- Limited Tort Option: This option restricts the ability to sue for pain and suffering unless the injuries meet specific criteria, such as serious injury or death.

- No-Fault Thresholds: These thresholds define the minimum severity of injuries required to sue for pain and suffering.

Comparison with Fault-Based Insurance

No-fault insurance differs significantly from traditional fault-based insurance systems. In fault-based systems, the at-fault driver’s insurance company is responsible for covering the damages of the other driver. This often leads to complex investigations and litigation to determine fault. In contrast, no-fault insurance simplifies the process by eliminating the need to establish fault for basic coverage.

Benefits of No-Fault Insurance

No-fault insurance offers several benefits for both drivers and insurance companies:

- Faster Claim Processing: No-fault insurance streamlines the claims process by eliminating the need to determine fault. This results in faster claim settlements and reduced litigation costs.

- Reduced Litigation: By limiting the ability to sue for pain and suffering, no-fault insurance reduces the number of lawsuits related to auto accidents. This can lead to lower insurance premiums for drivers.

- Guaranteed Coverage: Drivers are guaranteed coverage for their own losses, regardless of who caused the accident. This provides peace of mind and ensures that they will receive compensation for their injuries and damages.

Drawbacks of No-Fault Insurance

Despite its benefits, no-fault insurance also has some drawbacks:

- Higher Premiums: No-fault insurance can lead to higher premiums for drivers, as insurance companies may have to pay for more claims.

- Limited Compensation: The limited tort option and no-fault thresholds can restrict the amount of compensation available for pain and suffering, particularly for serious injuries.

- Increased Claims: The ease of filing claims under no-fault insurance can lead to an increase in the number of claims, which can strain insurance company resources.

States with No-Fault Auto Insurance

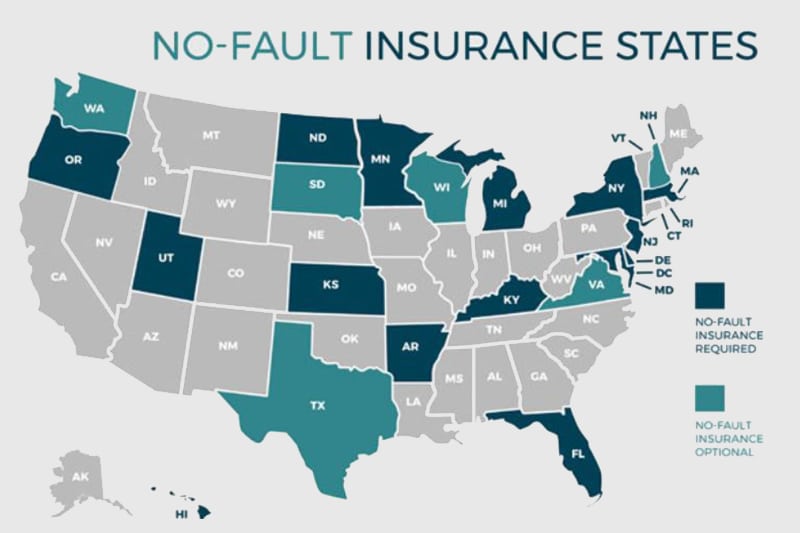

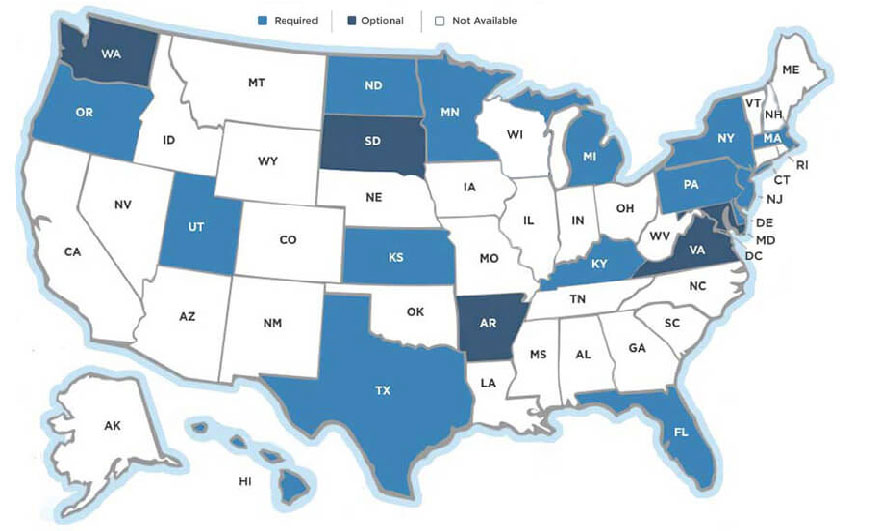

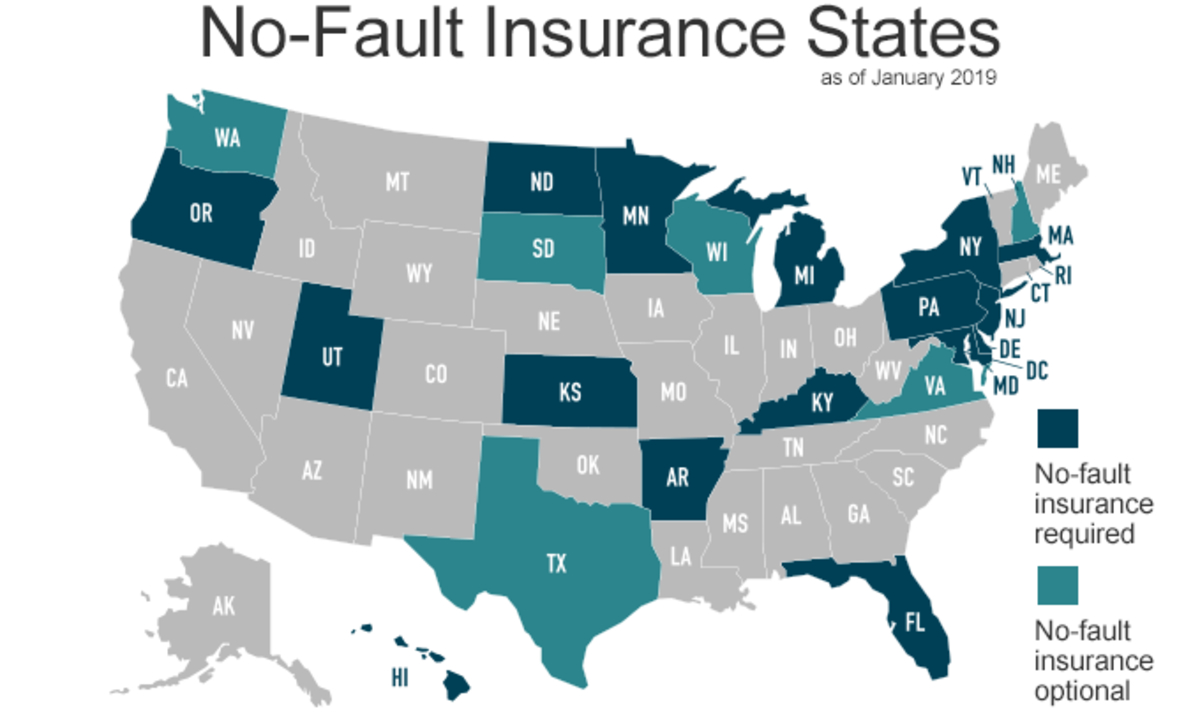

No-fault auto insurance is a system where drivers involved in accidents are required to file claims with their own insurance companies, regardless of who was at fault. This system aims to simplify the claims process and reduce litigation. Currently, 12 states and the District of Columbia have no-fault auto insurance laws.

States with No-Fault Auto Insurance

This section lists the states with no-fault auto insurance laws, along with their specific laws and effective dates.

| State | No-Fault Law | Effective Date |

|---|---|---|

| Florida | Pure No-Fault | October 1, 1971 |

| Hawaii | Modified No-Fault | July 1, 1974 |

| Kansas | Modified No-Fault | July 1, 1974 |

| Kentucky | Modified No-Fault | July 1, 1975 |

| Massachusetts | Modified No-Fault | January 1, 1971 |

| Michigan | Pure No-Fault | October 1, 1973 |

| Minnesota | Modified No-Fault | January 1, 1972 |

| New Jersey | Modified No-Fault | January 1, 1973 |

| New York | Modified No-Fault | February 1, 1974 |

| North Dakota | Modified No-Fault | January 1, 1975 |

| Pennsylvania | Modified No-Fault | July 1, 1975 |

| Rhode Island | Modified No-Fault | January 1, 1971 |

| District of Columbia | Modified No-Fault | January 1, 1975 |

Types of No-Fault Systems

The no-fault system can be categorized into two main types: pure no-fault and modified no-fault.

- Pure No-Fault: In this system, drivers are only allowed to sue for non-economic damages (such as pain and suffering) if they meet specific thresholds, like a certain amount of medical expenses or permanent disability. This system aims to reduce lawsuits and litigation. Examples of states with pure no-fault systems include Florida and Michigan.

- Modified No-Fault: This system allows drivers to sue for damages beyond their own insurance coverage if their injuries meet certain thresholds. This system provides more flexibility than pure no-fault but still aims to reduce lawsuits. Examples of states with modified no-fault systems include New York, Massachusetts, and New Jersey.

Key Features of No-Fault Laws

No-fault auto insurance laws are designed to simplify the claims process and reduce litigation following car accidents. These laws typically require drivers to file claims with their own insurance companies, regardless of who was at fault for the accident. This approach aims to streamline the process and expedite compensation for accident-related expenses.

Mandatory Coverage Requirements

No-fault laws mandate certain coverage requirements for all drivers. These requirements ensure that individuals have access to essential coverage for injuries and damages resulting from accidents.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault. The amount of PIP coverage varies by state, with some states offering unlimited coverage while others have limits.

- Medical Payments Coverage (Med Pay): Med Pay coverage is similar to PIP, but it covers medical expenses for the policyholder and passengers, even if they are not at fault for the accident. This coverage is often optional and has lower limits than PIP.

Fault Determination and Liability

No-fault laws aim to simplify the process of determining fault and liability in accidents. However, they do not completely eliminate the concept of fault.

- Thresholds for Filing Suit: Many no-fault states have “thresholds” that determine when an injured party can sue the other driver for damages. These thresholds typically involve reaching a specific monetary limit for medical expenses or experiencing a serious injury, such as permanent disability or death.

- Limited Liability: Even if a driver is found at fault, no-fault laws often limit the liability of the at-fault driver to specific types of damages, such as pain and suffering or non-economic losses. This limitation aims to reduce the number of lawsuits and keep insurance premiums lower.

Impact on Insurance Premiums and Deductibles

No-fault laws can impact insurance premiums and deductibles in various ways.

- Lower Premiums: The streamlined claims process and reduced litigation associated with no-fault laws can lead to lower insurance premiums. However, the extent of this reduction depends on the specific features of the no-fault law and the state’s overall insurance market.

- Higher Deductibles: No-fault laws may result in higher deductibles for drivers, as insurance companies may offset the lower premiums by requiring policyholders to pay more out-of-pocket for covered expenses. This higher deductible can help reduce the overall cost of insurance for the insurer.

Advantages of No-Fault Auto Insurance

No-fault auto insurance, a system where drivers file claims with their own insurance company regardless of fault, offers several potential benefits for drivers and the overall insurance landscape. While the specifics of no-fault laws vary by state, the core principles aim to streamline the claims process, reduce litigation, and potentially lower insurance premiums.

Faster Claim Processing and Reduced Litigation

No-fault insurance eliminates the need for lengthy legal battles to determine fault after an accident. This streamlined process can significantly reduce the time it takes for drivers to receive compensation for their injuries and vehicle damage. With less time spent on litigation, insurance companies can allocate more resources to claim processing and customer service, potentially leading to faster and more efficient payouts.

Lower Insurance Premiums and Increased Access to Healthcare

No-fault insurance systems are often associated with lower insurance premiums for drivers. This is because the reduced litigation costs and streamlined claims process allow insurance companies to operate more efficiently. Additionally, no-fault insurance can promote increased access to healthcare for accident victims. Many no-fault systems require drivers to carry Personal Injury Protection (PIP) coverage, which provides medical benefits regardless of fault. This ensures that drivers have access to necessary medical treatment without having to prove fault or rely on the other driver’s insurance.

Impact on Traffic Congestion and Accident Rates

No-fault insurance can potentially have a positive impact on traffic congestion and accident rates. The reduced litigation and faster claim processing associated with no-fault systems can help to reduce the time vehicles are involved in accidents. This can lead to smoother traffic flow and potentially fewer secondary accidents. Additionally, the availability of medical benefits through PIP coverage can encourage accident victims to seek medical attention promptly, which can lead to better recovery outcomes and potentially reduce the likelihood of long-term injuries.

Disadvantages of No-Fault Auto Insurance: States With No Fault Auto Insurance

While no-fault insurance has its advantages, it also has drawbacks that are important to consider. The system’s potential to limit compensation for serious injuries, inflate insurance premiums, and create opportunities for abuse and fraud are significant concerns.

Limited Compensation for Serious Injuries

No-fault systems generally cap the amount of compensation available for pain and suffering, medical expenses, and lost wages. These limits can be particularly problematic for individuals who sustain severe injuries, as their medical bills and lost income may exceed the coverage provided by their insurance.

For instance, in some states, the maximum amount of compensation for pain and suffering is capped at a certain dollar amount, regardless of the severity of the injuries. This can leave victims with significant out-of-pocket expenses, particularly if they require long-term medical care or rehabilitation.

Higher Insurance Premiums

In some cases, no-fault insurance can lead to higher insurance premiums. This is because no-fault systems often require drivers to carry higher levels of coverage, which can increase the cost of insurance.

Additionally, the potential for fraud and abuse in no-fault systems can also contribute to higher premiums. When insurance companies have to pay out more claims due to fraudulent activity, they often pass these costs onto policyholders in the form of higher premiums.

Potential for Abuse and Fraud, States with no fault auto insurance

No-fault insurance systems can be susceptible to abuse and fraud. This is because the system relies on self-reporting of injuries and expenses. In some cases, individuals may exaggerate their injuries or expenses in order to receive higher payouts from their insurance company.

This type of fraud can lead to higher insurance premiums for everyone, as insurance companies are forced to pay out more claims due to fraudulent activity. Additionally, it can also create a disincentive for some individuals to settle their claims fairly, as they may believe they can receive more money by claiming more significant injuries.

Recent Developments in No-Fault Insurance

The landscape of no-fault auto insurance is constantly evolving, with states reevaluating their laws and considering changes to address concerns and adapt to evolving circumstances. These developments are driven by factors such as rising healthcare costs, concerns about fairness, and the emergence of new technologies.

Changes in No-Fault Laws

Recent changes and proposed changes to no-fault laws in different states reflect a range of motivations, from addressing perceived shortcomings to adapting to changing societal needs.

- Increased Thresholds for Tort Liability: Some states have raised the threshold for pursuing a traditional negligence lawsuit after an accident. For instance, New York has increased the “serious injury” threshold, making it more difficult for drivers to sue for pain and suffering. This change aims to reduce frivolous lawsuits and potentially lower insurance premiums.

- Expansion of Coverage: States like Michigan have expanded no-fault coverage to include benefits like lost wages and medical expenses, addressing concerns about the adequacy of previous coverage levels. This expansion aims to provide greater financial protection to accident victims.

- Cost-Containment Measures: Several states have implemented measures to control the rising cost of no-fault insurance, such as setting limits on medical expenses or introducing fee schedules for medical providers. These measures aim to create a more sustainable system and prevent premiums from escalating.

Impact on Drivers and Insurance Companies

These changes in no-fault laws have a direct impact on both drivers and insurance companies.

- Drivers: For drivers, the impact can be both positive and negative. Higher thresholds for tort liability may mean fewer lawsuits and potentially lower premiums. However, limited coverage or stricter requirements for accessing benefits could negatively affect those with serious injuries.

- Insurance Companies: Changes in no-fault laws can significantly affect insurance companies. Higher thresholds for lawsuits could reduce their liability, potentially leading to lower premiums. However, expanded coverage or stricter regulations on medical expenses could increase their costs and necessitate adjustments to premiums.

Debate Regarding No-Fault Insurance Effectiveness

The effectiveness of no-fault insurance continues to be debated. Some argue that it simplifies the claims process, reduces litigation, and lowers premiums. Others contend that it can lead to higher costs and discourage accident victims from seeking necessary medical treatment.

- Supporters of No-Fault: Proponents of no-fault argue that it streamlines the claims process, reducing the need for lengthy legal battles and associated costs. They believe that it promotes fairness by providing automatic coverage to all accident victims, regardless of fault.

- Critics of No-Fault: Critics argue that no-fault insurance can lead to higher costs due to the potential for abuse of the system by medical providers. They also express concerns that the system may discourage accident victims from seeking appropriate medical treatment, fearing that they will be limited in their ability to pursue legal remedies later.

Future of No-Fault Insurance

The future of no-fault insurance remains uncertain. Some states may continue to adjust their laws to address specific concerns and adapt to changing circumstances. Others may consider moving away from no-fault altogether, returning to a traditional fault-based system. The debate is likely to continue, with various stakeholders advocating for different approaches.

Summary

Navigating the world of auto insurance can be challenging, especially when considering the complexities of no-fault systems. This guide has provided a comprehensive overview of no-fault auto insurance, shedding light on its unique features, benefits, and drawbacks. By understanding the nuances of no-fault laws, drivers can make informed decisions about their insurance coverage and navigate the claims process effectively. Whether you’re a resident of a no-fault state or simply curious about this alternative approach to auto insurance, this guide has equipped you with the knowledge to confidently navigate the road ahead.

Quick FAQs

What is the difference between no-fault and fault-based auto insurance?

In fault-based insurance, the at-fault driver is responsible for covering the other driver’s damages. In no-fault insurance, each driver’s insurance company covers their own expenses, regardless of who caused the accident.

Can I sue the other driver in a no-fault state?

In most no-fault states, you can only sue the other driver for serious injuries or damages exceeding a certain threshold, such as “serious injury” or “economic loss” thresholds.

Are no-fault insurance premiums lower than fault-based insurance premiums?

No-fault insurance premiums can be lower or higher depending on the state and the specific no-fault system in place. The potential for reduced litigation can lead to lower premiums, but mandatory coverage requirements and limited compensation can also contribute to higher premiums.

What are the main types of no-fault systems?

There are three main types: pure no-fault, modified no-fault, and add-on no-fault. Pure no-fault eliminates all tort liability, while modified no-fault allows for limited lawsuits for serious injuries. Add-on no-fault provides additional coverage options on top of traditional fault-based insurance.

What are some examples of states with no-fault auto insurance?

Some examples include Florida, Michigan, New York, and Pennsylvania. Each state has its own unique no-fault system with specific rules and regulations.