States with lowest car insurance rates offer a beacon of hope for drivers seeking to save money on their premiums. The cost of car insurance can vary significantly across the United States, influenced by factors like driving habits, demographics, and state regulations. Understanding these factors is crucial for navigating the complex world of car insurance and finding the most affordable coverage.

This guide delves into the reasons behind varying car insurance rates, highlighting states with the lowest average premiums. We’ll explore the key factors that contribute to these lower rates, providing valuable insights for drivers seeking to optimize their car insurance costs. From regional differences to insurance company practices, we’ll unravel the intricacies of car insurance pricing and equip you with the knowledge to make informed decisions about your coverage.

Factors Influencing Car Insurance Rates

Car insurance premiums are not uniform across the United States. Several factors determine the cost of car insurance, and these factors can vary significantly from state to state. This variation can lead to significant differences in car insurance rates across the country.

Factors Affecting Car Insurance Rates

The cost of car insurance is influenced by a variety of factors, including:

- Driving History: Your driving history, including accidents, traffic violations, and driving record, plays a significant role in determining your insurance premium. Drivers with a clean driving record generally enjoy lower premiums.

- Age and Gender: Younger drivers, especially males, are statistically more likely to be involved in accidents, leading to higher insurance premiums. As drivers age and gain experience, their premiums often decrease.

- Location: The location where you live can significantly affect your car insurance rates. States with higher population density, more traffic, and a greater number of accidents tend to have higher insurance premiums.

- Vehicle Type: The type of vehicle you drive also influences your insurance rates. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Credit Score: In many states, insurance companies use your credit score as a factor in determining your car insurance premium. Individuals with good credit scores are often seen as lower risk and may receive lower rates.

- Coverage Levels: The amount of coverage you choose for your car insurance policy, including liability, collision, and comprehensive coverage, directly affects your premium. Higher coverage levels typically mean higher premiums.

- State Regulations: State regulations, including minimum coverage requirements and insurance laws, can impact insurance rates. States with stricter regulations may have higher insurance premiums.

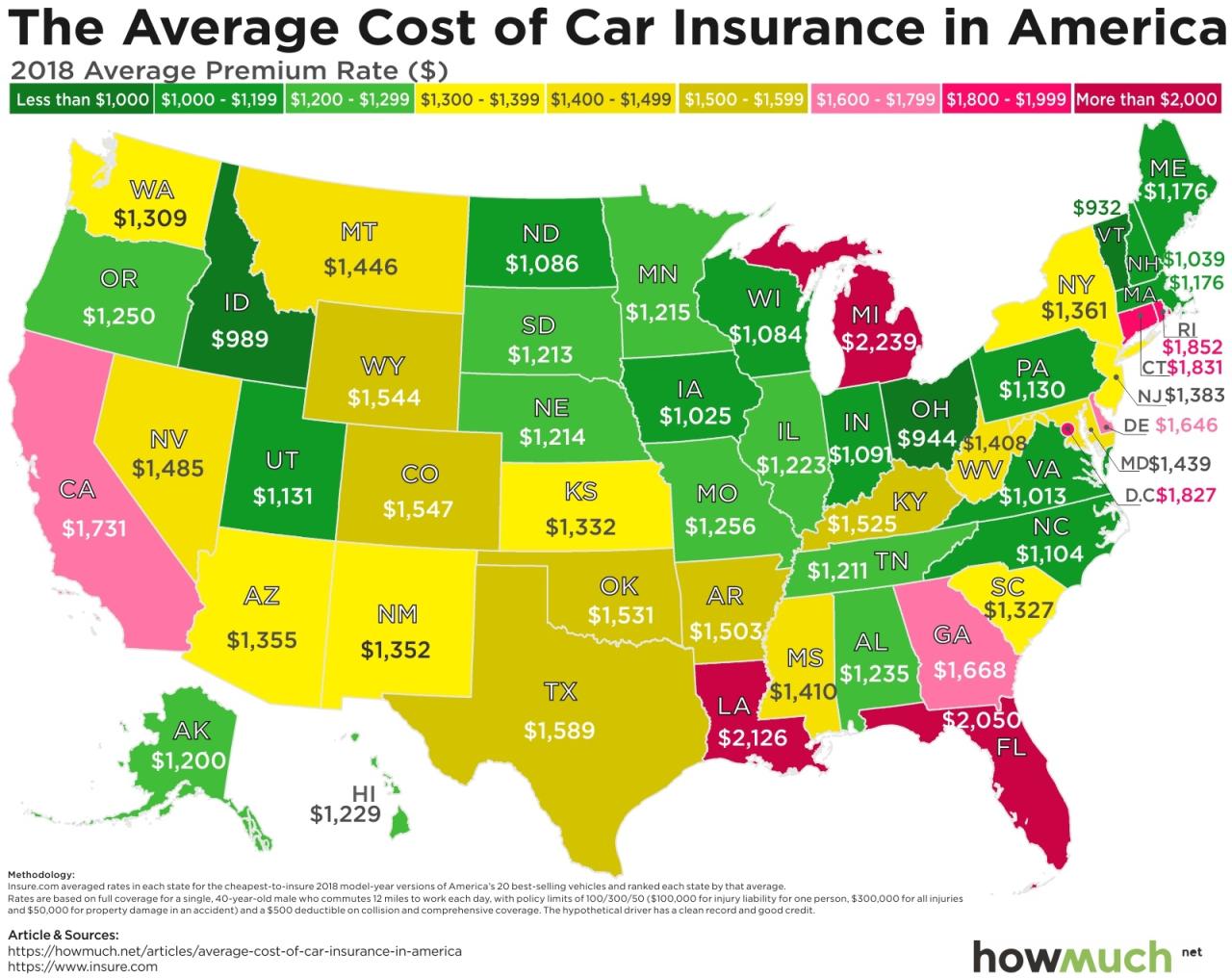

States with the Lowest Average Premiums

Finding affordable car insurance is a top priority for most drivers. While factors like driving history and vehicle type play a role, the state you reside in can significantly impact your insurance premiums. Some states consistently boast lower average car insurance rates compared to others. These states often have favorable insurance regulations, a lower risk of accidents, and a competitive insurance market, all contributing to lower premiums for their residents.

States with the Lowest Average Premiums

Here are some states with the lowest average car insurance premiums, along with key factors contributing to their affordability:

| State | Average Premium | Key Factors Contributing to Low Rates | Additional Insights |

|---|---|---|---|

| Idaho | $1,030 | Lower population density, favorable insurance regulations, and a competitive insurance market | Idaho has a relatively low number of accidents and a strong economy, further contributing to lower premiums. |

| Maine | $1,040 | Lower population density, a strong economy, and a competitive insurance market | Maine has a lower risk of accidents due to its rural nature and favorable driving conditions. |

| Utah | $1,050 | Lower population density, favorable insurance regulations, and a strong economy | Utah has a relatively low number of accidents and a strong economy, further contributing to lower premiums. |

| North Dakota | $1,060 | Lower population density, a strong economy, and a competitive insurance market | North Dakota has a lower risk of accidents due to its rural nature and favorable driving conditions. |

| Vermont | $1,070 | Lower population density, a strong economy, and a competitive insurance market | Vermont has a lower risk of accidents due to its rural nature and favorable driving conditions. |

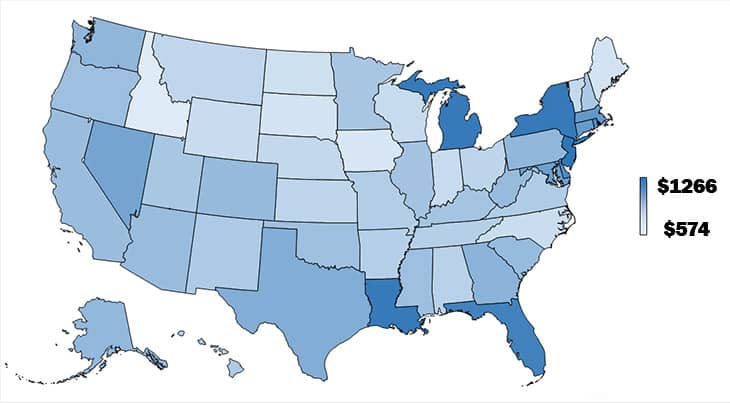

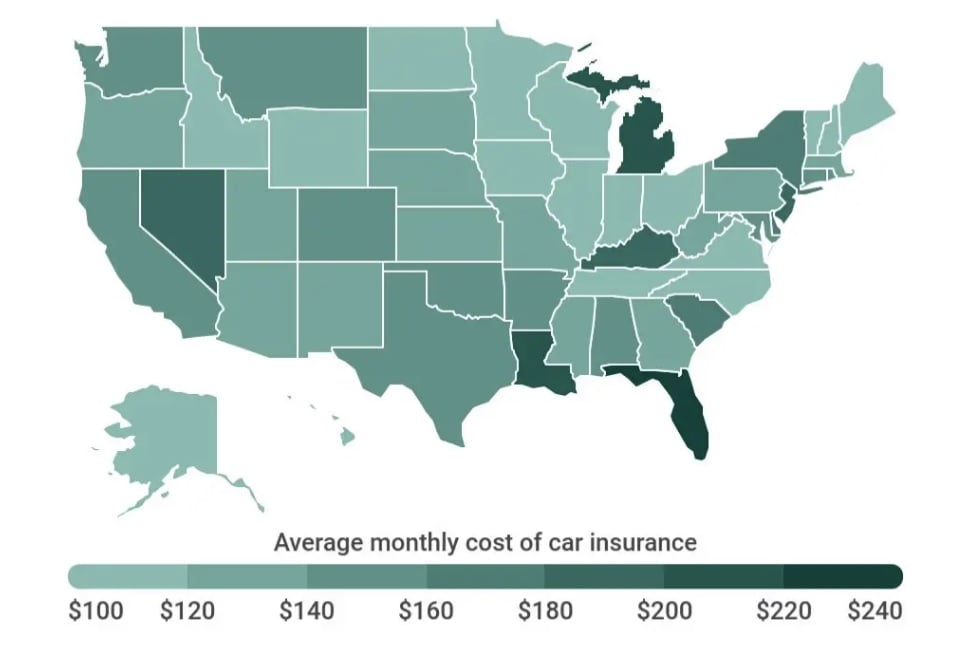

Regional Differences in Car Insurance Rates

Car insurance premiums vary significantly across different regions of the United States. This variation is not simply due to chance; it is influenced by a complex interplay of factors that are unique to each region.

Understanding these regional differences is crucial for drivers seeking the best insurance rates. By analyzing the factors that contribute to these variations, we can gain insights into the pricing strategies of insurance companies and make informed decisions about our insurance needs.

Factors Contributing to Regional Differences

Several factors contribute to the regional disparities in car insurance rates. These factors can be broadly categorized as:

- Density and Traffic: Urban areas with high population density and heavy traffic often have higher accident rates. Insurance companies factor in this increased risk by charging higher premiums.

- Cost of Repairs and Healthcare: Regions with high costs of car repairs and medical care tend to have higher insurance premiums. This is because insurance companies need to cover the expenses associated with accidents.

- Weather Conditions: Regions prone to severe weather events, such as hurricanes, tornadoes, and hailstorms, experience higher rates of car damage. Insurance companies adjust their premiums to reflect this increased risk.

- Crime Rates: Areas with high crime rates, including theft and vandalism, often have higher insurance premiums. Insurance companies consider the likelihood of car theft and damage when setting rates.

- Driving Habits: Regional driving habits, such as aggressive driving or speeding, can also influence insurance rates. Areas with a higher prevalence of risky driving behavior tend to have higher premiums.

- Insurance Regulations: State regulations regarding car insurance coverage and pricing can also impact premiums. States with more stringent regulations may have higher premiums.

Examples of Regional Variations

The following examples illustrate how car insurance rates can vary across different regions:

- Urban vs. Rural: Drivers in densely populated urban areas, like New York City or Los Angeles, often face higher insurance premiums than those in rural areas with lower population density and traffic. This is due to the increased risk of accidents in urban areas.

- Coastal vs. Inland: Coastal areas are more susceptible to hurricanes and other natural disasters, leading to higher insurance premiums. Drivers in inland areas, less exposed to these risks, typically enjoy lower rates.

- State-to-State Differences: States with different regulations and risk profiles often have significantly different insurance rates. For example, drivers in states with mandatory insurance coverage may face higher premiums than those in states with less stringent requirements.

Impact of Driving Habits and Demographics

Car insurance rates are not just determined by factors like the make and model of your car or your location. Your driving habits and personal demographics also play a significant role in shaping your premiums. Insurance companies use these factors to assess your risk profile and determine how much you should pay for coverage.

Impact of Driving Habits

Your driving habits have a direct impact on your car insurance rates. Insurance companies consider various factors, including:

- Mileage: Drivers who travel long distances are more likely to be involved in accidents. Therefore, higher mileage typically translates to higher insurance premiums. Conversely, those who drive less frequently benefit from lower rates.

- Driving History: Your driving history is a crucial factor in determining your insurance rates. A clean driving record with no accidents or violations results in lower premiums. However, if you have a history of accidents, traffic violations, or DUI convictions, you can expect higher premiums.

- Driving Experience: Newer drivers with less experience are statistically more prone to accidents. As a result, they often face higher insurance rates compared to experienced drivers. Over time, as you gain experience and maintain a clean driving record, your rates may decrease.

Impact of Demographics

Your personal demographics also play a significant role in determining your car insurance rates. Factors like age, gender, and marital status are used by insurance companies to assess your risk profile.

- Age: Young drivers, especially teenagers, are considered high-risk due to their lack of experience and judgment. Consequently, they often face higher insurance premiums. As drivers age and gain more experience, their rates tend to decrease. Older drivers, however, may face higher premiums due to factors like health conditions or declining eyesight.

- Gender: Historically, statistics have shown that men tend to be involved in more accidents than women. As a result, men often pay higher insurance premiums than women. However, this trend is changing, and some insurance companies are now offering gender-neutral rates.

- Marital Status: Married individuals are often perceived as more responsible drivers and tend to have lower insurance premiums compared to single individuals. This is partly because married drivers may have a greater sense of responsibility and are less likely to take risks while driving.

Impact of Driving Habits and Demographics on State-Level Rates, States with lowest car insurance rates

The impact of driving habits and demographics on car insurance rates varies across different states. For example, states with a large young population may have higher average premiums due to the higher risk associated with young drivers. Similarly, states with a higher percentage of married individuals may have lower average premiums due to the perceived lower risk associated with married drivers.

Insurance Company Practices and Regulations: States With Lowest Car Insurance Rates

Insurance company practices and regulations play a significant role in determining car insurance rates. While individual factors like driving history and vehicle type influence premiums, the policies and regulations set by insurance companies and state governments can significantly impact the overall cost of car insurance.

State Regulations and Their Influence on Car Insurance Rates

State regulations influence the cost of car insurance by setting minimum coverage requirements, dictating how insurers can calculate premiums, and regulating insurance company practices. For instance, states with higher minimum coverage requirements generally have higher average car insurance premiums. Similarly, states with stricter regulations on how insurers can use factors like credit scores to determine premiums may have lower average rates.

- Minimum Coverage Requirements: States with higher minimum coverage requirements, such as those requiring higher liability limits, tend to have higher average car insurance premiums. This is because drivers are required to carry more insurance, increasing the overall cost of coverage.

- Rate Calculation Regulations: States may restrict the use of certain factors, such as credit scores, in calculating premiums. This can lead to lower average premiums in states with stricter regulations. For example, California prohibits insurers from using credit scores to determine car insurance rates, potentially leading to lower premiums for individuals with lower credit scores.

- Insurance Company Practices: State regulations can also influence the practices of insurance companies. For instance, some states may have regulations regarding rate increases or cancellations, which can impact the overall cost of insurance for consumers.

Practices of Different Insurance Companies and Their Impact on Premiums

Insurance companies use various pricing models and strategies to determine premiums. These practices can significantly impact the cost of car insurance for consumers.

- Risk-Based Pricing: Many insurance companies use risk-based pricing models, which consider factors like driving history, age, and vehicle type to assess the likelihood of an accident. Companies with more sophisticated risk-based pricing models may offer lower premiums to individuals with lower risk profiles.

- Bundling Discounts: Insurance companies often offer discounts for bundling multiple policies, such as car and homeowners insurance. This can result in lower premiums for consumers who bundle their insurance needs with the same company.

- Loyalty Programs: Some insurance companies reward long-term customers with loyalty programs, offering discounts or other incentives for staying with the same company. This can lead to lower premiums for loyal customers compared to those who frequently switch providers.

- Usage-Based Insurance: Emerging technologies like telematics devices allow insurance companies to track driving behavior and offer discounts based on safe driving practices. This can lead to lower premiums for individuals who demonstrate safe driving habits.

Tips for Finding Affordable Car Insurance

Finding the most affordable car insurance can feel like a daunting task, but with a little research and some strategic planning, you can significantly lower your premiums. By understanding the factors that influence car insurance rates and implementing smart strategies, you can save money without compromising your coverage.

Compare Rates from Different Insurance Companies

To find the best rates, it’s essential to compare quotes from multiple insurance companies. Each insurer has its own pricing structure, so comparing their offerings is crucial to securing the most competitive rates.

- Use online comparison tools: Websites like Policygenius, The Zebra, and Insurance.com allow you to enter your information once and receive quotes from various insurance companies. This simplifies the comparison process and saves you time.

- Contact insurance companies directly: Don’t rely solely on online comparison tools. Contact insurance companies directly to get personalized quotes and ask specific questions about their coverage options.

- Consider bundling policies: Many insurance companies offer discounts for bundling your car insurance with other policies, such as homeowners or renters insurance. Bundling can result in significant savings.

Improve Driving Habits and Reduce Insurance Premiums

Your driving record significantly influences your car insurance premiums. By maintaining a clean driving record and practicing safe driving habits, you can lower your insurance costs.

- Avoid traffic violations: Traffic tickets, especially for serious offenses like speeding or reckless driving, can drastically increase your insurance premiums. Drive cautiously and obey traffic laws to maintain a clean record.

- Take a defensive driving course: Completing a defensive driving course demonstrates your commitment to safe driving practices and can earn you a discount on your insurance premiums.

- Maintain a safe driving record: Avoid accidents and claims, as these can significantly impact your insurance rates. A clean driving history is essential for keeping premiums low.

Conclusive Thoughts

Navigating the landscape of car insurance rates can be challenging, but armed with knowledge and the right strategies, you can find affordable coverage that meets your needs. By understanding the factors that influence premiums, comparing rates from different insurers, and implementing practical tips for safe driving, you can take control of your car insurance costs and drive with confidence.

Question Bank

What are the main factors that influence car insurance rates?

Car insurance rates are influenced by various factors, including driving history, age, gender, location, vehicle type, and credit score.

How can I find the cheapest car insurance?

To find the cheapest car insurance, compare quotes from multiple insurers, consider increasing your deductible, improve your driving record, and bundle your insurance policies.

Is it worth it to switch insurance companies to save money?

Switching insurance companies can be worthwhile if you find a better rate with another insurer. However, consider factors like your current coverage and any potential penalties for early termination.