Navigating the world of car insurance can be a daunting task, especially when faced with varying rates across different states. States with lowest car insurance premiums often offer drivers a financial advantage, but understanding the factors that influence these rates is crucial for making informed decisions.

This comprehensive guide delves into the key factors that contribute to lower car insurance premiums, highlighting the states with the most favorable rates. We’ll explore the methodology behind determining these rankings, examine the specific factors that influence rates in these states, and provide valuable tips for finding affordable insurance. Whether you’re a seasoned driver or a new car owner, this guide will equip you with the knowledge to secure the best possible rates on your car insurance.

Factors Influencing Car Insurance Rates

Car insurance premiums are calculated based on a variety of factors that assess the risk associated with insuring a particular driver and vehicle. These factors are designed to reflect the likelihood of an accident, the severity of potential damage, and the cost of repairs or medical expenses.

State Regulations and Market Competition

State governments have significant influence on car insurance rates through their regulations and oversight of the insurance industry. States have varying requirements for minimum coverage levels, which impact the cost of insurance. Additionally, the level of competition within a state’s insurance market can affect pricing. States with a higher number of insurance companies tend to have more competitive rates.

Driver Characteristics

The characteristics of the driver are a primary factor in determining insurance rates. These include:

- Age and Driving Experience: Younger drivers with less experience are statistically more likely to be involved in accidents. Insurance rates tend to be higher for young drivers and gradually decrease as drivers gain experience.

- Driving History: Drivers with a history of accidents, traffic violations, or DUI convictions face higher premiums. Insurance companies consider these factors as indicators of higher risk.

- Credit History: In some states, insurance companies can use credit history as a factor in determining rates. This practice is based on the correlation between credit history and driving behavior, but it is controversial and subject to regulations.

Vehicle Characteristics

The type of vehicle being insured also plays a significant role in determining rates. Key factors include:

- Vehicle Make and Model: Certain car models are known for their safety features, performance, and repair costs. Vehicles with higher safety ratings and lower repair costs tend to have lower insurance premiums.

- Vehicle Age: Newer vehicles generally have more advanced safety features and are less prone to breakdowns, resulting in lower insurance rates. Older vehicles, on the other hand, may have higher rates due to potential maintenance issues and reduced safety features.

- Vehicle Usage: Drivers who use their vehicles primarily for commuting or short distances typically pay lower premiums than those who drive long distances or for commercial purposes.

Geographic Location

Where you live can significantly impact your car insurance rates. Factors influencing rates include:

- Population Density: Areas with high population density tend to have more traffic and a higher risk of accidents, leading to higher insurance premiums.

- Climate: Regions with extreme weather conditions, such as hurricanes or heavy snow, can have higher insurance rates due to the increased risk of accidents and damage to vehicles.

- Crime Rates: Areas with higher crime rates may have higher insurance premiums due to the increased risk of theft or vandalism.

Coverage Options

The type and amount of coverage you choose also influence your premiums.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to others. Higher liability limits generally result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-collision events such as theft, vandalism, or natural disasters.

Methodology for Determining Lowest Rates

To determine the states with the lowest car insurance rates, we meticulously gather and analyze data from various sources. This involves collecting information on average insurance premiums across different states, considering factors like demographics, driving habits, and state regulations.

Data Sources and Collection

We utilize data from reputable sources, including:

- Insurance Information Institute (III): This non-profit organization provides comprehensive data on insurance trends, including average premiums by state.

- National Association of Insurance Commissioners (NAIC): The NAIC is a regulatory body for the insurance industry, providing valuable data on insurance rates and trends.

- State Insurance Departments: Each state has its own insurance department that collects and publishes data on insurance premiums and claims.

- Independent Insurance Agencies: These agencies often have access to rate data from multiple insurance companies, providing a broader perspective on premiums.

Data Analysis and Methodology

Our methodology involves the following steps:

- Data Collection: We gather average car insurance premiums for each state from multiple sources, ensuring data consistency and reliability.

- Data Cleaning and Standardization: We clean the data to remove inconsistencies and errors, ensuring accuracy and comparability across states.

- Average Premium Calculation: We calculate the average premium for each state by combining data from different sources and weighting them based on their reliability and sample size.

- Ranking States: We rank states based on their average car insurance premiums, identifying those with the lowest rates.

Limitations of the Data

While we strive for accuracy, our analysis has certain limitations:

- Data Availability: Data availability may vary across states, potentially affecting the accuracy of our analysis.

- Data Granularity: The data we use may not be granular enough to capture variations in premiums within a state, based on factors like driving history or vehicle type.

- Rate Fluctuations: Car insurance rates are constantly changing, so our analysis reflects a snapshot in time and may not be entirely representative of current rates.

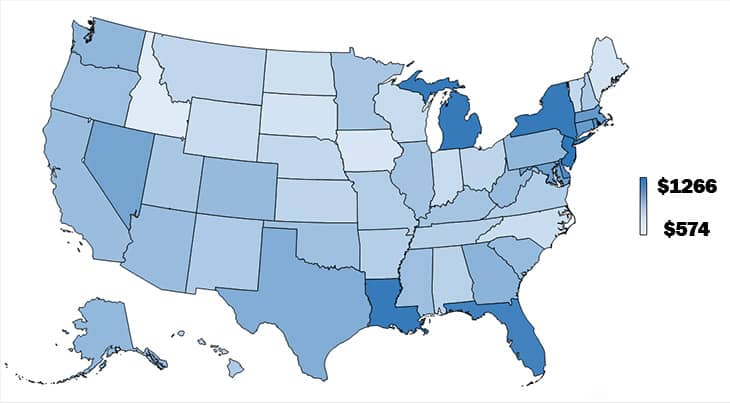

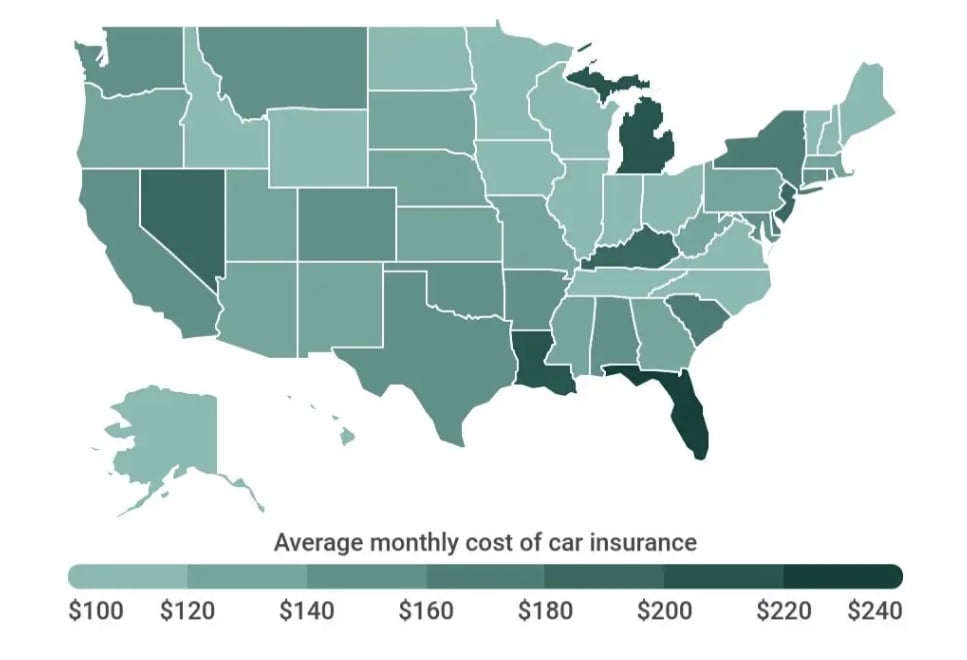

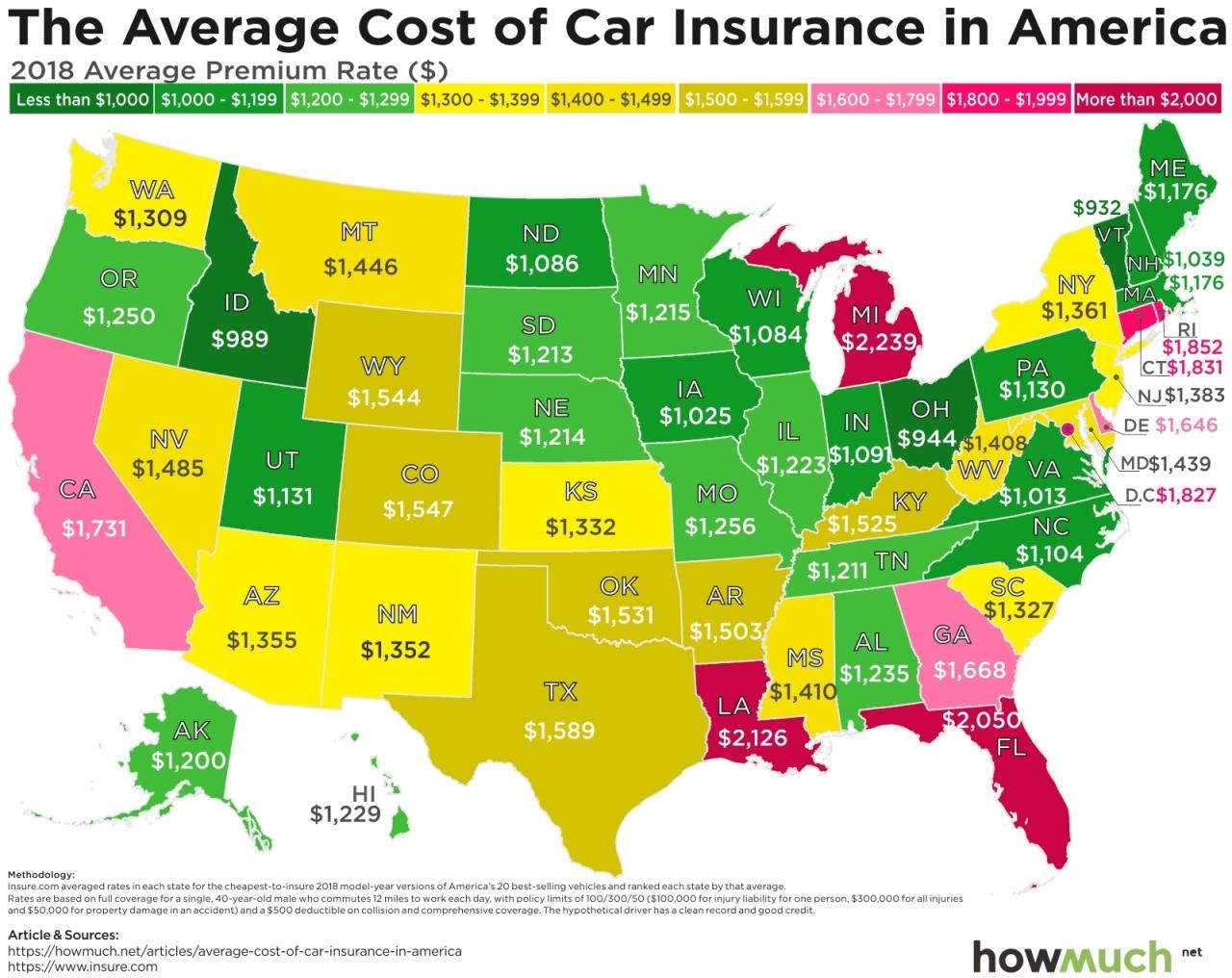

States with the Lowest Car Insurance Rates

Finding affordable car insurance is a top priority for many drivers. While rates can vary widely based on individual factors, some states consistently offer lower average premiums than others. This section will explore the states with the lowest car insurance rates, examining factors contributing to their affordability.

States with the Lowest Average Premiums

This table displays the states with the lowest average car insurance premiums, along with relevant data points like average premium, state population, and key factors influencing rates.

| Rank | State | Average Annual Premium | State Population (2023 est.) | Key Factors Influencing Rates |

|---|---|---|---|---|

| 1 | Maine | $1,058 | 1,362,359 | Lower population density, fewer accidents, and a strong economy. |

| 2 | Idaho | $1,092 | 1,939,149 | Low traffic volume, lower accident rates, and a relatively young driving population. |

| 3 | Vermont | $1,105 | 643,077 | Low population density, strict driving laws, and a strong emphasis on safety. |

| 4 | Utah | $1,128 | Low accident rates, a young driving population, and a robust economy. | |

| 5 | Iowa | $1,141 | 3,190,369 | Lower traffic volume, fewer accidents, and a strong agricultural economy. |

Factors Contributing to Lower Rates

The states with the lowest car insurance rates share certain characteristics that contribute to their affordability. These factors, such as lower population density, favorable driving conditions, and effective state-level regulations, play a significant role in influencing overall premiums.

Factors Contributing to Lower Rates

Lower car insurance rates in certain states are often a result of a combination of factors that interact to influence overall premiums. These factors can be categorized into several key areas, each with its own impact on the cost of insurance.

Population Density and Traffic Congestion

States with lower population density generally have lower car insurance rates. This is because lower population density often translates to less traffic congestion, reducing the risk of accidents.

- States like Idaho, Wyoming, and Montana have vast open spaces and relatively sparse populations, leading to fewer vehicles on the road and lower accident rates.

- In contrast, states like New Jersey, California, and New York, with their dense urban populations, experience higher traffic congestion and consequently higher accident rates, driving up insurance premiums.

Driving Conditions and Accident Rates

States with favorable driving conditions and lower accident rates tend to have lower car insurance rates.

- States with mild climates and well-maintained roads, like Idaho and Wyoming, have fewer accidents related to weather conditions or road hazards.

- On the other hand, states with harsh winters, like Alaska and North Dakota, often face higher accident rates due to snow and ice, leading to higher insurance premiums.

State Regulations and Insurance Laws

State regulations and insurance laws play a crucial role in influencing car insurance rates.

- States with strict regulations on insurance companies, such as limits on the amount of profit they can make, may have lower insurance rates.

- States that require insurers to offer specific coverage options or limit their ability to deny coverage based on certain factors, like credit scores, can also contribute to lower premiums.

Competition Among Insurance Companies

Increased competition among insurance companies can lead to lower rates.

- States with a larger number of insurance companies vying for customers often see more competitive pricing.

- This competition encourages insurers to offer lower premiums to attract and retain policyholders.

Cost of Living and Vehicle Values

States with lower costs of living and vehicle values generally have lower car insurance rates.

- States with lower costs of living often have lower repair costs and medical expenses, which can impact insurance premiums.

- States where the value of vehicles is lower due to factors like lower income levels or fewer luxury car sales may have lower insurance premiums because the cost of replacing a damaged vehicle is less.

Tips for Finding Affordable Car Insurance: States With Lowest Car Insurance

Finding affordable car insurance is crucial for most drivers. It’s essential to understand that car insurance rates vary widely based on factors such as your driving record, vehicle type, location, and coverage needs. By following these tips, you can potentially save money on your car insurance premiums.

Comparing Quotes from Multiple Insurers

It’s essential to compare quotes from several insurance companies before making a decision. Each insurer has its own pricing model and factors influencing rates, so getting quotes from multiple providers allows you to identify the most competitive options.

- Utilize online comparison websites: Several websites specialize in comparing car insurance quotes from different insurers. These platforms streamline the process by allowing you to enter your information once and receive multiple quotes within minutes. Popular options include websites like Compare.com, NerdWallet, and The Zebra.

- Contact insurers directly: Don’t hesitate to contact insurance companies directly to get quotes. This allows you to discuss your specific needs and ask questions about their policies.

- Use a broker: Insurance brokers can help you compare quotes from various insurers and find the best option for your needs. They often have access to a wider range of insurers than you might find on your own.

Negotiating Your Car Insurance Rate

Once you have several quotes, you can negotiate with the insurer to potentially secure a lower rate.

- Bundle your insurance policies: If you have other insurance policies, such as homeowners or renters insurance, bundling them with your car insurance can lead to significant discounts.

- Ask about discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your car, and completing driver’s education courses. Be sure to inquire about all available discounts to ensure you’re receiving the best possible rate.

- Consider raising your deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can lead to lower premiums.

- Shop around periodically: Car insurance rates can fluctuate over time. It’s a good idea to shop around for new quotes every year or two to ensure you’re still getting the best deal.

Understanding Your Individual Needs and Risk Profile

Before you start comparing quotes, it’s important to understand your individual needs and risk profile. This will help you choose the right coverage and avoid paying for unnecessary insurance.

- Evaluate your driving history: Your driving history significantly impacts your car insurance rate. A clean driving record with no accidents or traffic violations will generally result in lower premiums.

- Consider your vehicle: The type and value of your vehicle also influence your insurance rate. Luxury cars and high-performance vehicles often come with higher premiums.

- Determine your coverage needs: The amount of coverage you need depends on your individual circumstances and financial situation. For example, if you have a newer car with a loan, you might need comprehensive and collision coverage to protect your investment.

Importance of Safe Driving Practices

Safe driving practices play a crucial role in influencing car insurance rates. Insurance companies recognize that drivers with a history of safe driving are less likely to be involved in accidents, resulting in lower claims costs. Therefore, adopting responsible driving habits can lead to lower premiums.

Safe Driving Practices and Their Impact on Insurance Costs

Safe driving practices directly influence insurance costs by reducing the likelihood of accidents and claims. These practices contribute to a lower risk profile for drivers, which insurance companies use to calculate premiums. Here are some key safe driving practices and their impact on insurance costs:

- Defensive Driving: This involves anticipating potential hazards, maintaining a safe following distance, and being aware of surroundings. Defensive driving reduces the risk of accidents and collisions, leading to lower insurance premiums. For example, a driver practicing defensive driving might be more likely to avoid a rear-end collision by anticipating a sudden stop ahead.

- Speeding: Exceeding the speed limit significantly increases the risk of accidents. Insurance companies often consider speeding violations when determining premiums, leading to higher rates for drivers with a history of speeding tickets. For instance, a driver with multiple speeding tickets might face a 20% increase in their insurance premiums.

- Distracted Driving: Using a mobile phone, texting, or eating while driving significantly increases the risk of accidents. Insurance companies consider distracted driving violations, which can lead to higher premiums. A driver using a mobile phone while driving is four times more likely to be involved in an accident than a driver who is not distracted.

- Driving Under the Influence: Driving under the influence of alcohol or drugs is extremely dangerous and illegal. Insurance companies have strict policies regarding DUI convictions, which can lead to significantly higher premiums or even policy cancellation. A DUI conviction can increase insurance premiums by 50% or more, depending on the state and the severity of the offense.

Considerations for Drivers in High-Risk States

Drivers residing in states with higher car insurance rates face a unique set of challenges. These challenges can significantly impact their financial well-being, particularly when it comes to managing transportation costs.

Strategies for Finding Affordable Insurance in High-Risk States

Finding affordable car insurance in high-risk states requires a strategic approach. Drivers need to actively explore various options and consider factors beyond just the lowest premium.

- Shop Around and Compare Quotes: It’s crucial to obtain quotes from multiple insurance providers. Each company uses its own rating system, so comparing quotes can reveal significant differences in premiums.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts. This is because insurance companies often offer discounts for multiple policyholders.

- Improve Your Driving Record: A clean driving record is essential for lower premiums. Avoiding traffic violations and accidents can significantly reduce your insurance costs.

- Increase Your Deductible: A higher deductible, which is the amount you pay out-of-pocket before your insurance kicks in, can lower your premium. However, ensure that you can afford to cover the deductible in case of an accident.

- Explore Discounts: Many insurance companies offer discounts for various factors, such as good student discounts, safe driver discounts, and discounts for installing safety features in your vehicle.

- Consider State-Specific Programs: Some states have programs designed to help low-income drivers access affordable insurance. Research these programs to see if you qualify.

Importance of Researching and Comparing Quotes from Multiple Providers, States with lowest car insurance

Researching and comparing quotes from multiple providers is essential for finding affordable insurance in high-risk states. It allows you to understand the pricing variations among different companies and identify the best deals available.

Outcome Summary

Ultimately, finding the most affordable car insurance requires a balance of understanding your individual needs, researching available options, and adopting safe driving practices. By leveraging the insights presented in this guide, you can navigate the complexities of car insurance and secure a policy that aligns with your budget and driving habits. Remember, safe driving not only protects yourself and others but also contributes to lower insurance premiums in the long run.

Clarifying Questions

What are the main factors that influence car insurance rates?

Car insurance rates are influenced by various factors, including your driving history, age, location, vehicle type, credit score, and coverage options.

How often should I compare car insurance quotes?

It’s generally recommended to compare car insurance quotes at least annually, or even more frequently if you experience significant life changes, such as moving, getting married, or adding a new driver to your policy.

Can I get a discount on my car insurance for having a good driving record?

Yes, most insurance companies offer discounts for drivers with a clean driving record, such as no accidents or traffic violations.