States with lowest auto insurance rates are a hot topic for drivers looking to save money. Factors like demographics, driving history, vehicle type, and location all play a significant role in determining how much you pay for car insurance. Some states have lower average premiums than others, making them attractive for those seeking affordable coverage.

This article explores the top 5 states with the lowest average auto insurance premiums, analyzing the factors that contribute to these lower rates. We’ll delve into the regulations, competition, and driving conditions that influence insurance costs, and provide insights on how to find the best value and coverage for your individual needs.

Factors Influencing Auto Insurance Rates

Auto insurance rates are not uniform across the country. They vary significantly based on a range of factors that insurance companies consider when assessing risk. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Demographics

Demographics play a significant role in determining insurance rates. Insurance companies often use demographic data to assess risk, as certain characteristics are statistically associated with higher accident probabilities.

- Age: Younger drivers, especially those under 25, generally have higher insurance rates. This is due to their lack of experience, higher risk-taking behavior, and increased likelihood of accidents. As drivers gain experience and age, their rates typically decrease.

- Gender: Historically, men have been associated with higher risk profiles, resulting in higher insurance rates compared to women. This is attributed to factors like driving habits and accident statistics. However, this gap is narrowing as more women are driving, and driving habits are becoming more similar between genders.

- Marital Status: Married individuals tend to have lower insurance rates than single individuals. This is often attributed to greater stability, responsibility, and a lower likelihood of engaging in risky behavior.

- Credit History: In some states, insurance companies consider credit history as a factor in determining rates. The rationale behind this is that individuals with good credit history are seen as more responsible and less likely to file claims. However, this practice has been controversial, with some arguing it is discriminatory.

Driving History

A driver’s past driving record is a crucial factor in determining insurance rates. This is because it provides a direct indication of their driving behavior and accident history.

- Accidents: Drivers who have been involved in accidents, particularly at-fault accidents, will generally face higher insurance rates. The severity of the accident, the number of accidents, and the time since the last accident all influence the impact on rates.

- Traffic Violations: Traffic violations, such as speeding tickets, DUI/DWI offenses, and reckless driving citations, can significantly increase insurance rates. These violations indicate a higher risk of future accidents and lead to higher premiums.

- Driving Record Cleanliness: Drivers with clean driving records, without any accidents or violations, are considered low-risk and typically enjoy lower insurance rates. Maintaining a clean record is essential for keeping premiums affordable.

Vehicle Type

The type of vehicle you drive is another significant factor influencing insurance rates. Different vehicles have different safety features, repair costs, and theft risks, all of which contribute to the cost of insuring them.

- Make and Model: Certain car makes and models are statistically associated with higher accident rates or higher repair costs. For example, sports cars and luxury vehicles often have higher insurance rates due to their performance capabilities and expensive parts.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, generally have lower insurance rates. These features can reduce the severity of accidents and lower the likelihood of claims.

- Value and Age: Newer and more expensive vehicles tend to have higher insurance rates due to their higher replacement costs and potential for greater damage in accidents. Older vehicles, on the other hand, may have lower insurance rates due to their lower value and depreciation.

Location

Where you live can significantly impact your auto insurance rates. Factors such as population density, traffic volume, crime rates, and weather conditions all contribute to the risk associated with driving in a particular area.

- Urban vs. Rural: Urban areas generally have higher insurance rates than rural areas due to increased traffic congestion, higher accident rates, and higher theft risks.

- Weather Conditions: Areas with severe weather conditions, such as hurricanes, tornadoes, or heavy snowfall, can lead to higher insurance rates due to the increased risk of accidents and damage to vehicles.

- Crime Rates: Areas with higher crime rates, particularly for vehicle theft, may have higher insurance rates to account for the increased risk of loss.

States with the Lowest Auto Insurance Rates

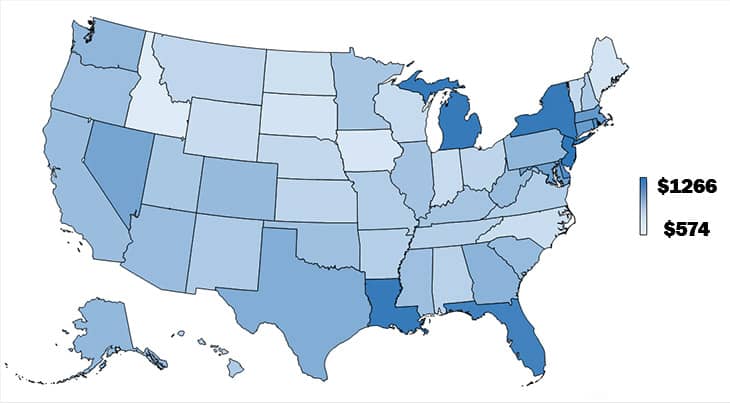

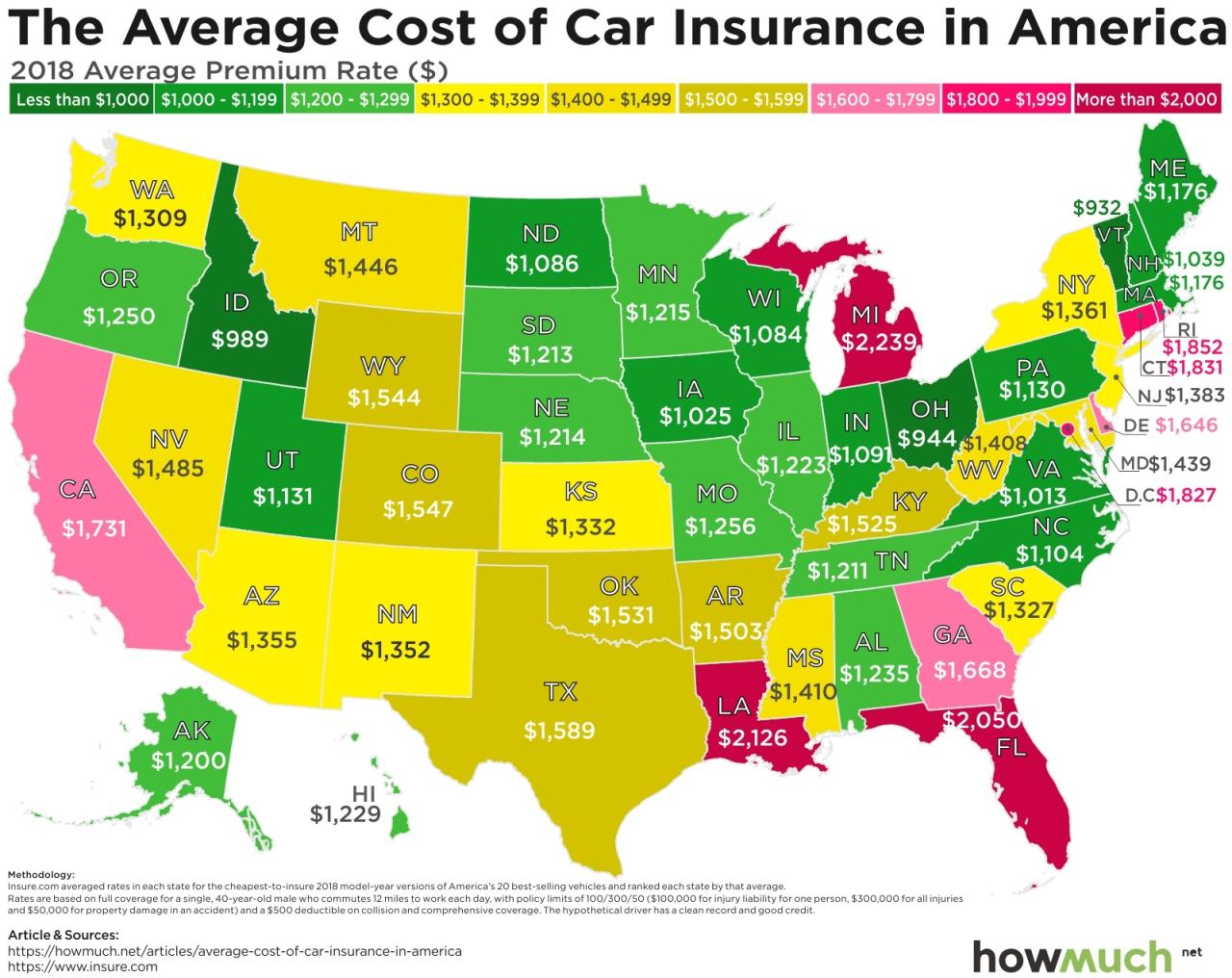

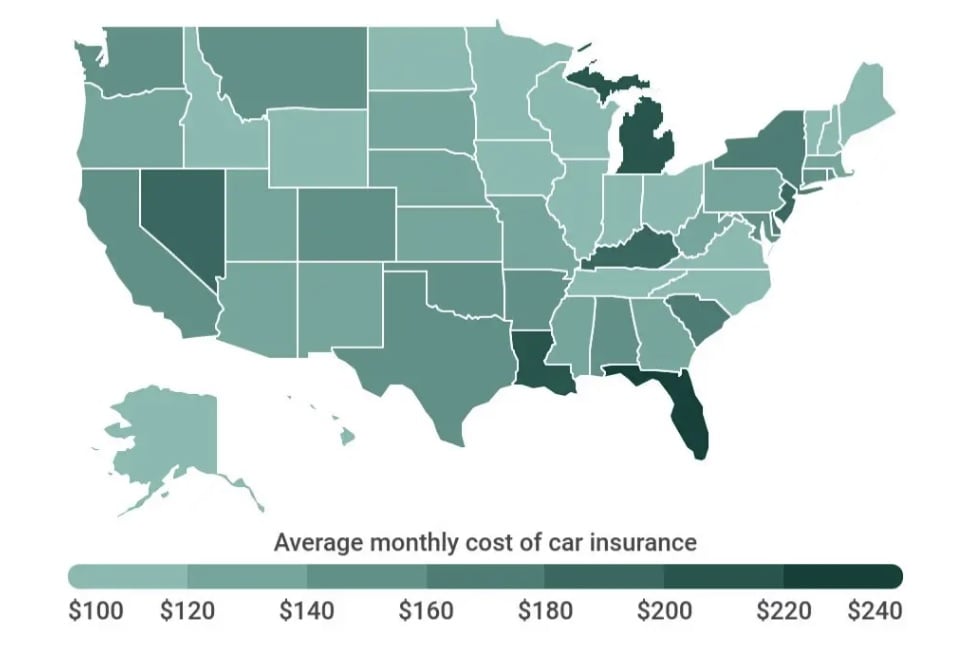

Finding affordable auto insurance is a priority for many drivers. The cost of auto insurance varies significantly across the United States, influenced by factors such as population density, traffic congestion, and claims history. Some states consistently offer lower average premiums than others, making them attractive for budget-conscious drivers.

Top 5 States with the Lowest Average Auto Insurance Premiums

Based on recent data from the National Association of Insurance Commissioners (NAIC), the following five states consistently rank among those with the lowest average auto insurance premiums:

| State | Average Annual Premium |

|---|---|

| Idaho | $679 |

| Maine | $706 |

| North Dakota | $719 |

| Vermont | $748 |

| Wyoming | $759 |

These figures represent average annual premiums for minimum liability coverage, which is the legally required amount of insurance in most states. It’s important to note that individual premiums can vary based on factors such as driving history, vehicle type, age, and coverage levels. However, these states consistently demonstrate lower average premiums compared to other parts of the country.

Reasons for Lower Rates in Specific States

The states with the lowest auto insurance rates generally share some common characteristics that contribute to their affordability. These factors include favorable driving conditions, robust competition among insurance companies, and state regulations that promote lower premiums.

State Regulations

State regulations play a significant role in determining the cost of auto insurance. Some states have regulations that limit the factors insurers can consider when setting rates, while others have regulations that encourage competition. These regulations can directly impact the overall cost of insurance in a state.

- No-Fault Laws: No-fault insurance laws require drivers to file claims with their own insurance company, regardless of who is at fault in an accident. These laws can help to reduce the number of lawsuits and claims, which can lower insurance costs. For example, Michigan has a no-fault system, and its insurance rates are among the highest in the nation. Conversely, states like Florida and Texas have limited no-fault laws or no no-fault laws at all, which can contribute to lower rates.

- Rate Regulation: Some states have regulations that limit the amount insurers can charge for insurance. These regulations can help to keep premiums affordable, but they can also limit the ability of insurers to offer discounts or adjust rates based on individual risk factors. States with more lenient rate regulations tend to have more competitive pricing, resulting in lower rates for consumers.

- Minimum Coverage Requirements: States have minimum coverage requirements that specify the types and amounts of insurance that drivers must carry. States with higher minimum coverage requirements generally have higher insurance rates because drivers are required to carry more insurance. States with lower minimum coverage requirements may have lower rates, but they may also have a higher risk of uninsured drivers.

Competition Among Insurance Companies, States with lowest auto insurance rates

A competitive insurance market can lead to lower rates. When there are many insurance companies operating in a state, they must compete for customers by offering lower prices and better coverage options.

- Number of Insurers: States with a large number of insurance companies tend to have more competitive pricing. For example, California has a large number of insurers, and its auto insurance rates are relatively low.

- Direct-to-Consumer Insurers: The rise of direct-to-consumer insurers, which sell insurance directly to consumers online or over the phone, has increased competition in the insurance market. These insurers often have lower overhead costs, which allows them to offer lower rates.

Driving Conditions

Driving conditions can also impact insurance rates. States with safer driving conditions, such as lower accident rates and less traffic congestion, may have lower insurance rates.

- Accident Rates: States with lower accident rates tend to have lower insurance rates. For example, Idaho has a relatively low accident rate, and its insurance rates are among the lowest in the nation.

- Traffic Congestion: Traffic congestion can increase the risk of accidents, which can lead to higher insurance rates. States with less traffic congestion tend to have lower insurance rates.

Considerations for Choosing Auto Insurance

Finding the right auto insurance policy can feel overwhelming, especially with the wide range of options and varying costs. To make informed decisions, it’s crucial to understand the factors that influence rates and how to compare policies effectively.

Comparing Quotes from Multiple Insurers

It’s essential to get quotes from several insurance companies before making a decision. This allows you to compare prices, coverage options, and customer service levels. Online comparison tools can streamline this process by providing multiple quotes from different insurers in a single location. By comparing quotes, you can identify the best value for your specific needs.

Factors to Consider When Selecting an Insurance Policy

- Coverage Levels: Consider the minimum coverage requirements in your state and your individual risk tolerance. Higher coverage limits can provide greater financial protection in the event of an accident. Common coverage types include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductibles: Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you’ll have to pay more in the event of a claim. Choose a deductible that balances affordability with your financial risk tolerance.

- Discounts: Insurers often offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling insurance policies. Explore available discounts and ensure you’re taking advantage of all applicable options.

- Customer Service and Claims Process: Research insurers’ customer service reputation and claims handling process. Look for companies known for their responsiveness, efficiency, and fairness in settling claims.

- Financial Stability: It’s crucial to choose an insurer with a solid financial standing. You want to ensure your insurer will be able to pay out claims if needed. Check the insurer’s ratings from reputable organizations like A.M. Best or Moody’s.

Finding the Best Value and Coverage

To find the best value and coverage for your needs, consider these tips:

- Understand your specific needs: Evaluate your driving habits, vehicle type, and risk tolerance to determine the appropriate coverage levels and deductibles.

- Compare quotes thoroughly: Don’t just focus on the lowest price. Compare coverage options, discounts, and customer service levels across different insurers.

- Ask questions: Don’t hesitate to contact insurers directly to clarify coverage details, discuss discounts, and inquire about their claims process.

- Read policy documents carefully: Before finalizing a policy, thoroughly review the policy documents to understand your coverage, exclusions, and responsibilities.

- Consider bundling policies: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant savings.

Tips for Saving on Auto Insurance

Finding affordable auto insurance is a priority for most drivers. Several strategies can help you significantly reduce your premiums and keep your wallet happy.

Discounts for Safe Drivers

Drivers with clean records are often rewarded with lower insurance rates. Insurance companies recognize that safe drivers pose a lower risk of accidents, leading to fewer claims.

- Good Driver Discounts: Many insurers offer discounts for drivers with no accidents or traffic violations for a specified period, typically three to five years.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Insurance companies may offer discounts to drivers who successfully complete these courses.

Bundling Policies

Combining your auto insurance with other types of insurance, such as homeowners, renters, or life insurance, can lead to significant savings.

- Multi-Policy Discounts: Insurers often offer discounts for bundling multiple policies, as it simplifies their administrative processes and increases their customer loyalty.

Vehicle Safety Features

Modern vehicles come equipped with advanced safety features that can reduce the risk of accidents and injuries. These features can also lower your insurance premiums.

- Anti-theft Devices: Cars with anti-theft systems, such as alarms or immobilizers, are less likely to be stolen, reducing the risk for insurers.

- Airbags and Anti-lock Brakes (ABS): These features are standard in most new vehicles and can significantly reduce the severity of accidents, lowering insurance costs.

- Electronic Stability Control (ESC): ESC helps prevent skidding and loss of control, reducing the risk of accidents.

Negotiating Rates

Don’t hesitate to negotiate your auto insurance rates with your insurer.

- Shop Around: Compare quotes from multiple insurers to find the best rates. Online comparison tools can make this process quick and efficient.

- Review Your Coverage: Ensure you have the right amount of coverage for your needs. You may be able to reduce your premiums by lowering your coverage limits if you have a higher deductible.

- Loyalty Discounts: Some insurers offer discounts to long-term customers. Inquire about any loyalty programs or discounts available.

Closing Summary

Finding the best auto insurance rates requires careful research and comparison. By understanding the factors that influence premiums, you can make informed decisions about your coverage and save money. Whether you’re moving to a new state or simply looking for a better deal, exploring the states with the lowest auto insurance rates can be a smart move for your wallet.

FAQ Section: States With Lowest Auto Insurance Rates

What are the top 5 states with the lowest auto insurance rates?

The top 5 states with the lowest average auto insurance premiums typically include Idaho, Maine, North Dakota, Vermont, and Wyoming. However, it’s important to note that rates can vary within each state based on individual factors.

How can I find the best auto insurance rates in my state?

Compare quotes from multiple insurers, consider discounts for safe driving, bundling policies, or vehicle safety features, and negotiate rates to find the most affordable options.

Is it worth moving to a state with lower auto insurance rates?

Moving solely for lower insurance rates might not be the best decision. Consider other factors like cost of living, job opportunities, and quality of life before making a move.