States with low auto insurance rates – Finding affordable auto insurance can feel like a daunting task, especially when you’re faced with a wide range of rates and policies. But there’s good news: some states consistently offer lower average auto insurance premiums than others. This article explores the reasons behind these lower rates and how you can benefit from them.

We’ll delve into the factors that influence auto insurance costs, including state-specific regulations, competition among insurance companies, and driving habits. By understanding these factors, you can gain insights into how states with low auto insurance rates achieve their affordability and how you can potentially find more affordable coverage in your area.

Understanding Auto Insurance Rates

Auto insurance rates can vary significantly, and understanding the factors that influence these costs is crucial for making informed decisions about your coverage. Several factors contribute to the final price you pay for your policy, including your driving history, the type of vehicle you drive, and your location.

State-Specific Regulations, States with low auto insurance rates

State regulations play a significant role in shaping auto insurance rates. Each state has its own set of laws governing how insurance companies can calculate premiums. These regulations can impact several aspects of insurance pricing, including:

- Minimum Coverage Requirements: States have different minimum coverage requirements, which dictate the minimum amount of liability coverage you must carry. States with higher minimum coverage requirements generally have higher average insurance rates.

- Rate Regulation: Some states regulate insurance rates directly, setting limits on how much insurance companies can charge. These regulations can help to keep rates lower, but they can also limit the ability of insurance companies to offer discounts or adjust rates based on individual risk factors.

- No-Fault Laws: Some states have no-fault laws, which require drivers to file claims with their own insurance company, regardless of who is at fault in an accident. These laws can help to reduce the number of lawsuits and keep insurance rates lower, but they can also lead to higher premiums for drivers who are involved in accidents.

Examples of State Approaches

States have different approaches to calculating insurance rates. Some states use a “risk-based” system, which considers factors such as your driving history, age, and the type of vehicle you drive. Other states use a “territory-based” system, which considers factors such as the population density and accident rates in your area.

- Pennsylvania: Pennsylvania uses a risk-based system, which considers factors such as your driving history, age, and the type of vehicle you drive. The state also has a “good driver discount” program that rewards drivers with clean driving records.

- Texas: Texas uses a territory-based system, which considers factors such as the population density and accident rates in your area. The state also allows insurance companies to use other factors, such as your credit score, to calculate your rates.

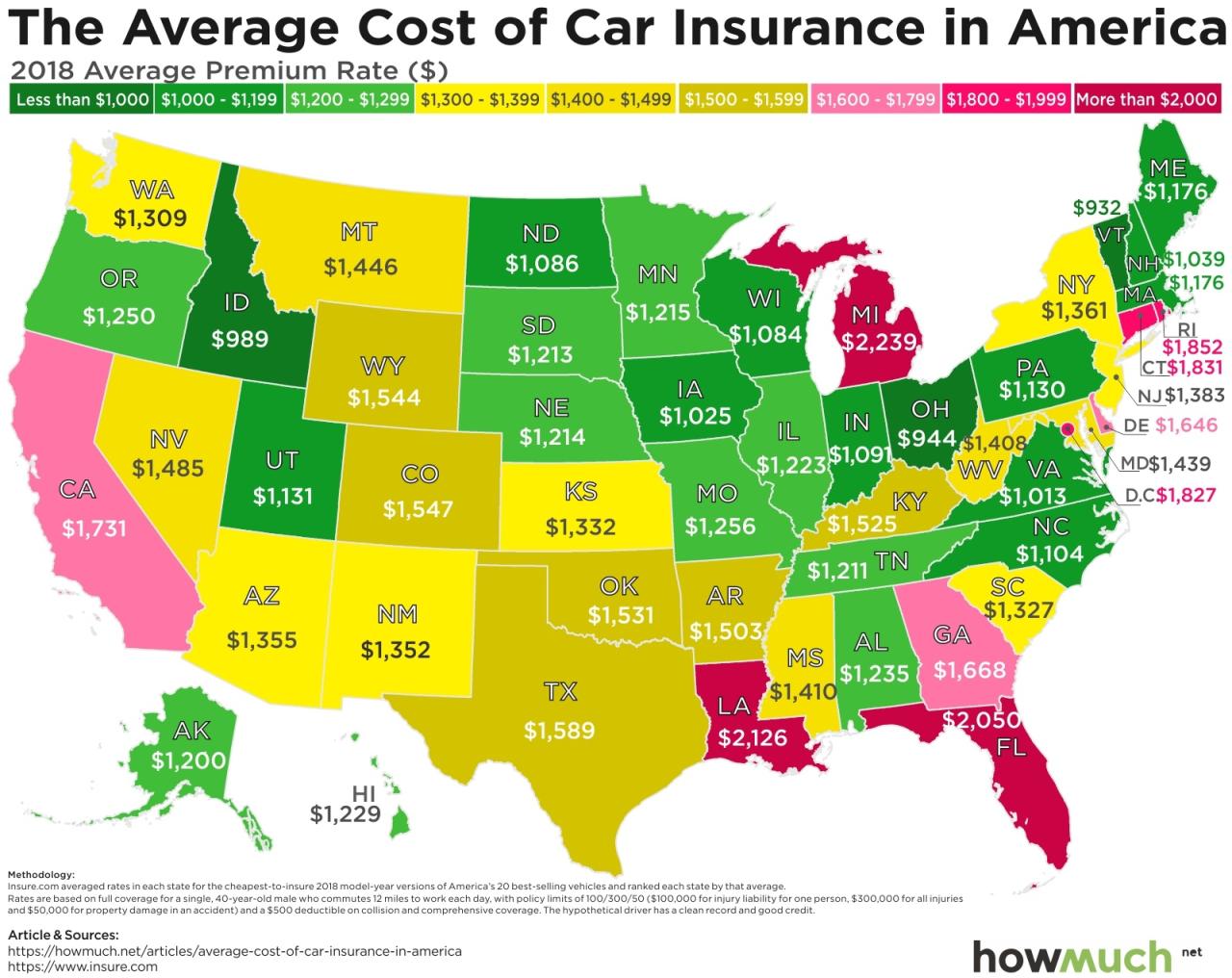

States with Low Auto Insurance Rates

Navigating the world of auto insurance can be a complex and often confusing process. One of the most significant factors influencing your premiums is the state you reside in. Some states consistently boast lower average auto insurance rates than others, making them attractive for budget-conscious drivers. Let’s explore the states with the lowest average auto insurance premiums and delve into the reasons behind their affordability.

Top 5 States with the Lowest Average Auto Insurance Premiums

Based on data from the National Association of Insurance Commissioners (NAIC), the following five states consistently rank among the lowest in average auto insurance premiums:

- Idaho: With an average annual premium of $694, Idaho claims the top spot for the lowest average auto insurance rates in the country.

- Maine: Maine closely follows Idaho, with an average annual premium of $710.

- North Dakota: North Dakota’s average annual premium of $727 places it third on the list.

- South Dakota: South Dakota’s average annual premium of $739 falls slightly behind North Dakota.

- Iowa: Rounding out the top five is Iowa, with an average annual premium of $767.

Comparison with National Averages

The national average annual premium for auto insurance in the United States is $1,548. This means that the five states listed above have average premiums significantly lower than the national average. The difference in premiums between these states and the national average can be attributed to various factors, including:

Factors Contributing to Lower Rates

The lower auto insurance rates in these states can be attributed to several factors, including:

- Lower Population Density: States with lower population densities, like Idaho and Maine, tend to have fewer accidents and traffic congestion, contributing to lower insurance premiums.

- Favorable Driving Conditions: States with favorable driving conditions, such as milder weather and fewer challenging road conditions, generally experience lower accident rates, resulting in lower insurance premiums.

- State Regulations: State regulations can significantly impact auto insurance rates. Some states have regulations that limit the amount of money insurance companies can charge for certain coverage or require them to offer specific discounts, leading to lower premiums.

- Competition in the Insurance Market: A highly competitive insurance market with many different insurance companies vying for customers can drive down premiums. States with a larger number of insurance companies tend to have lower average premiums.

- Lower Costs of Living: States with lower costs of living generally have lower healthcare costs and repair costs, which can contribute to lower auto insurance premiums.

Factors Contributing to Lower Rates

Several factors contribute to lower auto insurance rates in certain states. These factors can be attributed to the interplay of competition among insurance companies, state-specific regulations, and driving habits and demographics.

Competition Among Insurance Companies

The presence of numerous insurance companies vying for customers in a state can lead to lower rates. Competition encourages companies to offer more competitive prices and a wider range of coverage options to attract policyholders. States with a high density of insurance companies often experience greater competition, which translates into lower premiums for consumers.

State-Specific Regulations, States with low auto insurance rates

State regulations play a significant role in shaping auto insurance rates. States with stricter regulations on coverage requirements, deductibles, and other factors can influence the overall cost of insurance. For example, states with mandatory minimum coverage limits may have higher rates due to the increased liability risks. Conversely, states with lenient regulations might have lower rates, but this could lead to less comprehensive coverage for policyholders.

Driving Habits and Demographics

Driving habits and demographics also impact auto insurance rates. States with lower accident rates and fewer claims generally have lower premiums. Factors such as population density, age distribution, and the prevalence of risky driving behaviors can all influence insurance costs. For instance, states with a large young population might have higher rates due to the higher risk associated with inexperienced drivers.

Impact of Driving Habits and Demographics: States With Low Auto Insurance Rates

Auto insurance premiums are significantly influenced by driving habits and demographic factors. Insurance companies meticulously analyze these aspects to determine the risk associated with individual drivers and adjust premiums accordingly. This section explores the relationship between accident rates and insurance premiums, examines how factors like age, driving experience, and vehicle type affect insurance costs, and provides examples of how states address specific demographic groups with tailored insurance policies.

Accident Rates and Insurance Premiums

The frequency of accidents is directly linked to insurance premiums. Drivers with a history of accidents or violations face higher premiums due to their increased risk of future claims. Insurance companies use complex algorithms to calculate risk scores based on driving records, considering factors like the number of accidents, severity of violations, and time elapsed since the last incident. These scores are then used to determine the premium, with higher scores indicating higher premiums. For instance, drivers with multiple speeding tickets or a history of accidents will generally pay more for insurance than those with clean driving records.

Age, Driving Experience, and Vehicle Type

- Age: Younger drivers, especially those under 25, tend to have higher accident rates due to inexperience, recklessness, and a higher likelihood of engaging in risky driving behaviors. This increased risk is reflected in higher insurance premiums for young drivers. Conversely, older drivers, particularly those over 65, often benefit from lower premiums due to their greater experience and reduced risk of accidents.

- Driving Experience: Drivers with more years of experience behind the wheel generally have lower accident rates and thus enjoy lower insurance premiums. This is because experienced drivers have a better understanding of road safety, traffic laws, and defensive driving techniques, reducing their likelihood of being involved in accidents.

- Vehicle Type: The type of vehicle driven also impacts insurance premiums. Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to repair or replace in case of an accident. As a result, insurance premiums for these types of vehicles tend to be higher than for standard cars.

State-Specific Insurance Policies

Some states implement tailored insurance policies to address specific demographic groups. For example, some states offer discounts for good student drivers, recognizing their responsible driving habits. Other states provide reduced premiums for senior citizens, acknowledging their lower accident rates. These initiatives aim to promote safe driving practices and make insurance more accessible to various demographics.

Finding Affordable Auto Insurance

Finding affordable auto insurance is crucial for most people. Many factors contribute to insurance premiums, and it’s important to understand how to lower your costs.

Comparing Auto Insurance Quotes

Comparing quotes from different insurance companies is essential to finding the best rates. Many online tools and resources allow you to quickly and easily get quotes from multiple companies.

- Online Comparison Websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from various insurers in one place. They use your information to provide personalized quotes and help you find the best deals.

- Insurance Company Websites: Most insurance companies have websites where you can get a quote. This can be helpful if you already have a preferred insurer and want to compare their rates to others.

- Independent Insurance Agents: These agents represent multiple insurance companies and can help you find the best rates for your needs. They can also provide valuable advice and support throughout the insurance process.

Final Summary

Navigating the world of auto insurance can be challenging, but understanding the factors that influence rates can empower you to make informed decisions. By researching states with lower average premiums, exploring competitive insurance providers, and practicing safe driving habits, you can potentially save money on your auto insurance. Remember, comparing quotes and seeking advice from insurance professionals can be valuable steps in finding the most affordable coverage for your needs.

Top FAQs

What are the main factors that affect auto insurance rates?

Several factors influence auto insurance rates, including your driving history, age, location, vehicle type, credit score, and the coverage you choose.

How can I find the best auto insurance rates in my state?

To find the best rates, compare quotes from multiple insurance companies using online comparison tools or contacting insurance agents directly. You can also consider adjusting your coverage or deductibles to potentially lower your premiums.

Are there any discounts available for auto insurance?

Yes, many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, multiple policy bundling, and even being a member of certain organizations.

What should I do if I’m unhappy with my current auto insurance policy?

If you’re unhappy with your current policy, you can contact your insurance company to discuss your concerns or consider switching to a different provider. Make sure to shop around and compare quotes before making any changes.