States with cheapest car insurance can vary significantly, and understanding the factors that influence these costs is crucial for drivers seeking affordable coverage. From state regulations to individual driving habits, numerous elements contribute to the price of car insurance.

This guide explores the key factors that determine car insurance premiums, highlighting the states with the most affordable rates. We’ll also delve into strategies for obtaining competitive quotes and minimizing insurance expenses.

Factors Influencing Car Insurance Costs: States With Cheapest Car Insurance

Car insurance premiums are influenced by a multitude of factors, ranging from state-specific regulations to individual driving habits. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

State-Specific Regulations

State-specific regulations play a significant role in determining car insurance costs. These regulations, often set by state insurance departments, can influence various aspects of insurance, including:

- Minimum Coverage Requirements: States have varying minimum coverage requirements, such as liability limits and uninsured motorist coverage. States with higher minimum coverage requirements generally have higher average insurance premiums.

- No-Fault Laws: Some states have no-fault laws, which require drivers to file claims with their own insurance company, regardless of who is at fault in an accident. No-fault laws can lead to higher premiums, as they can result in more claims being filed.

- Rate Regulation: States have different approaches to regulating insurance rates. Some states allow insurers to set rates freely, while others have more stringent regulations, such as requiring insurers to file rates for approval. Stricter rate regulation can potentially lead to lower premiums.

Demographics, States with cheapest car insurance

Demographics, such as age and driving history, significantly impact car insurance premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents, leading to higher insurance premiums. As drivers gain experience and age, their premiums generally decrease. This is because younger drivers are statistically more likely to be involved in accidents, leading to higher insurance premiums.

- Driving History: Drivers with a clean driving record, free from accidents or traffic violations, generally enjoy lower premiums. On the other hand, drivers with a history of accidents or violations are considered higher risks, resulting in higher premiums. For example, a driver with a DUI conviction will likely face significantly higher premiums than a driver with a clean record.

Types of Coverage

The type of coverage you choose significantly impacts your insurance premium.

- Liability Coverage: Liability coverage is required in most states and covers damages to other vehicles or property if you are at fault in an accident. Higher liability limits generally result in higher premiums. For instance, choosing a higher liability limit of $100,000 per person and $300,000 per accident will likely lead to a higher premium compared to a lower limit of $25,000 per person and $50,000 per accident.

- Collision Coverage: Collision coverage covers damage to your vehicle in an accident, regardless of fault. This coverage is optional, but it is generally recommended if you have a loan or lease on your vehicle. Higher collision deductibles, the amount you pay out of pocket before your insurance covers the rest, generally result in lower premiums. For example, choosing a deductible of $1,000 will likely lead to a lower premium than a deductible of $500.

- Comprehensive Coverage: Comprehensive coverage covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. This coverage is also optional and can be expensive, especially for newer or more expensive vehicles. Like collision coverage, higher comprehensive deductibles can lead to lower premiums.

Number of Drivers and Vehicles

The number of drivers and vehicles in a state can affect insurance rates.

- Higher Density: States with a higher density of drivers and vehicles may have higher insurance premiums due to increased traffic congestion and the potential for more accidents. For example, a state with a high population density like California may have higher average premiums compared to a state with a lower population density like Wyoming.

Traffic Congestion and Accident Rates

Traffic congestion and accident rates can also influence car insurance premiums.

- Increased Risk: States with higher traffic congestion and accident rates are generally considered higher-risk areas, leading to higher insurance premiums. For example, a state with a high rate of traffic accidents, such as Florida, may have higher premiums compared to a state with a lower rate of accidents, such as Vermont.

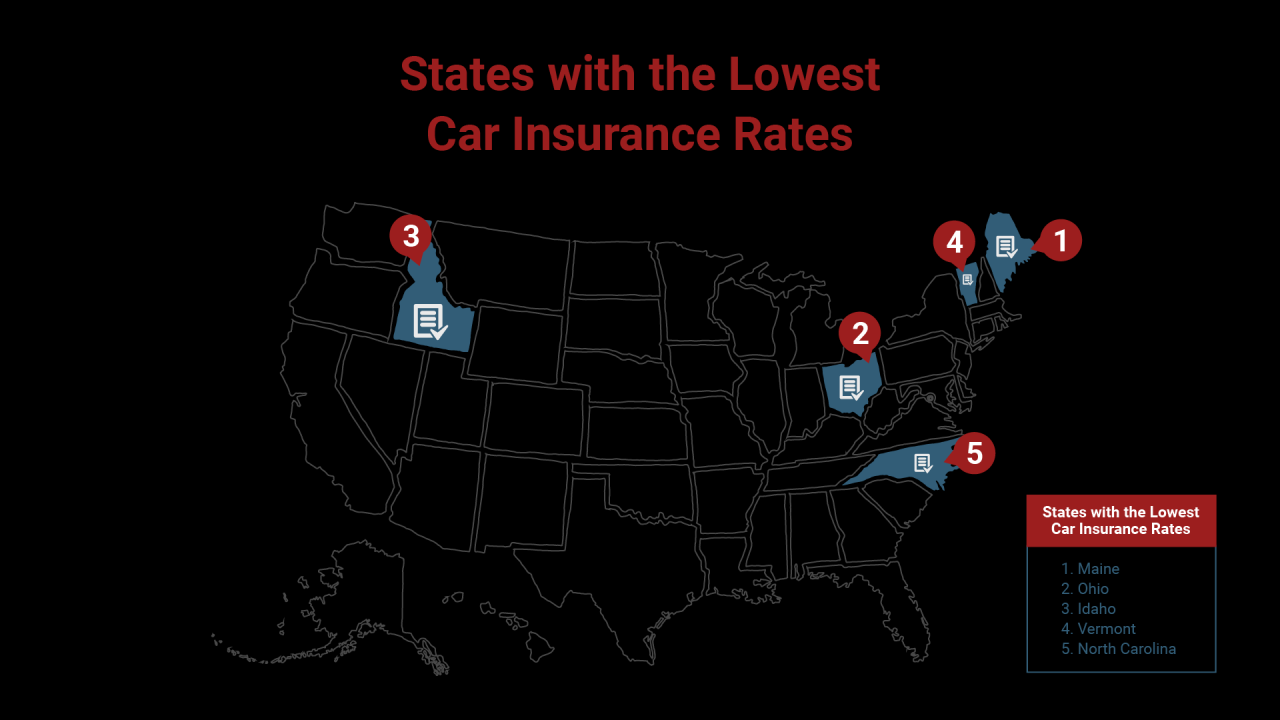

States with the Cheapest Car Insurance

Finding affordable car insurance is a priority for many drivers. While factors like driving history, vehicle type, and coverage levels play a role, your state of residence can significantly impact your insurance premiums. Some states have a lower average cost of car insurance than others, largely due to factors such as traffic density, accident rates, and the cost of living.

States with the Lowest Average Premiums

The following table shows the top 10 states with the lowest average car insurance premiums, according to recent data:

| Rank | State | Average Annual Premium |

|---|---|---|

| 1 | Maine | $1,015 |

| 2 | Idaho | $1,025 |

| 3 | Utah | $1,045 |

| 4 | Iowa | $1,055 |

| 5 | North Dakota | $1,065 |

| 6 | Wyoming | $1,075 |

| 7 | South Dakota | $1,085 |

| 8 | Vermont | $1,095 |

| 9 | New Hampshire | $1,105 |

| 10 | Oklahoma | $1,115 |

Average Annual Car Insurance Costs for a Specific Profile

The average annual car insurance costs for a 30-year-old driver with a clean driving record in various states are:

| State | Average Annual Premium |

|---|---|

| Maine | $950 |

| Idaho | $975 |

| Utah | $995 |

| Iowa | $1,015 |

| North Dakota | $1,035 |

| Wyoming | $1,055 |

| South Dakota | $1,075 |

| Vermont | $1,095 |

| New Hampshire | $1,115 |

| Oklahoma | $1,135 |

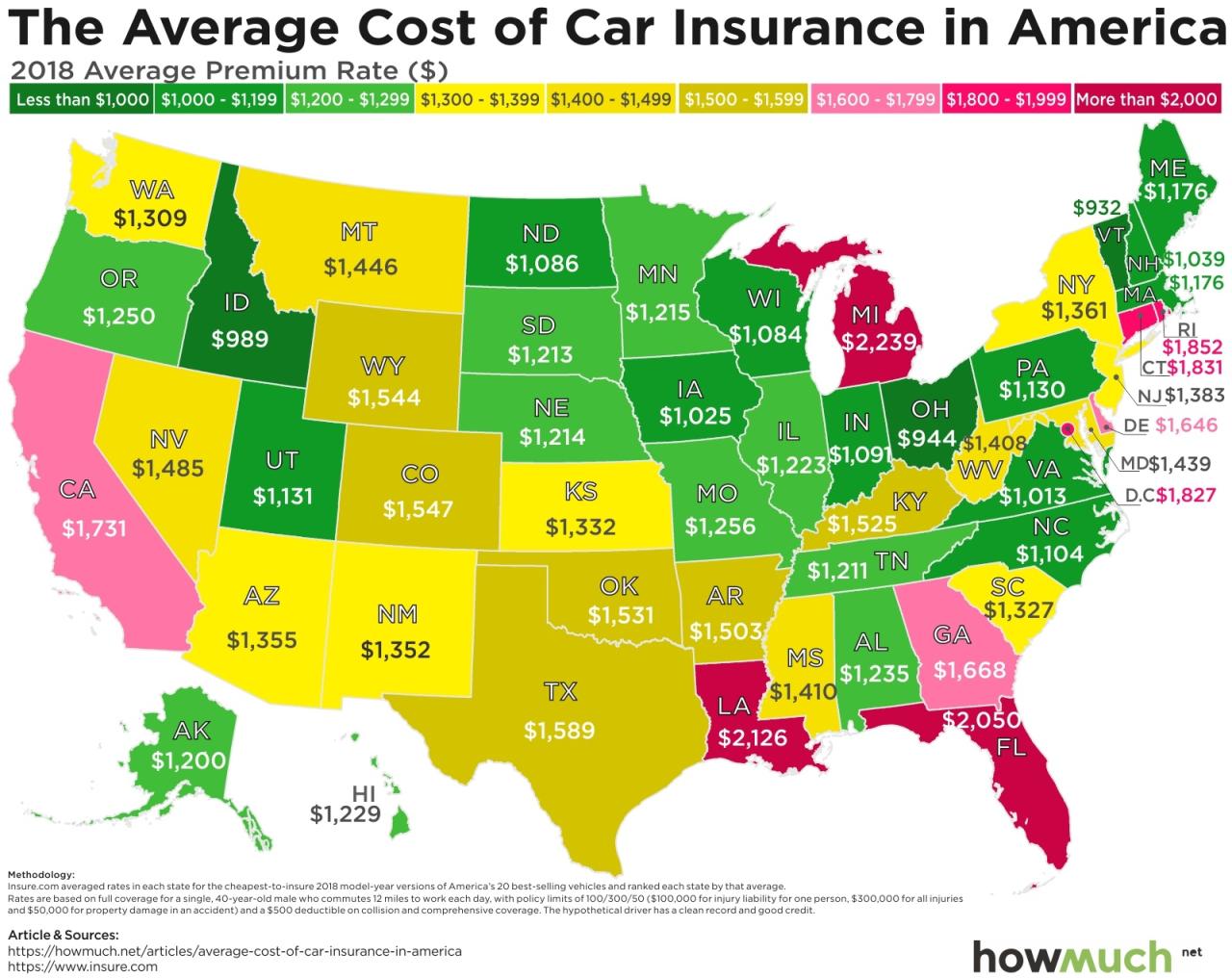

Map Highlighting States with Affordable Car Insurance

A map illustrating the states with the most affordable car insurance would show a darker shade for the states listed above, indicating lower average premiums. States with higher average premiums would be represented by lighter shades.

Understanding Insurance Quotes and Factors

Getting an accurate car insurance quote requires understanding the various factors that influence the price. Car insurance companies utilize a complex algorithm to assess risk and determine premiums.

Factors Influencing Insurance Quotes

Insurance companies consider a range of factors when calculating your car insurance premium. These factors are categorized into three main areas:

- Vehicle Factors: The make, model, year, and safety features of your vehicle play a significant role in determining your insurance costs. For instance, newer cars with advanced safety features like anti-lock brakes and airbags generally have lower premiums compared to older vehicles with fewer safety features.

- Driver Factors: Your driving history, age, and driving experience are key factors that insurers consider. A clean driving record with no accidents or violations will result in lower premiums. Younger drivers, particularly those under 25, typically pay higher premiums due to their higher risk of accidents.

- Location Factors: Your location, including the state, city, and neighborhood, influences insurance rates. Areas with high crime rates, traffic congestion, and a higher frequency of accidents tend to have higher insurance premiums. Furthermore, insurance rates can vary based on the availability of repair shops and the cost of living in your area.

Importance of Comparing Quotes

Comparing quotes from multiple insurance companies is crucial to secure the most favorable rates. Each insurer utilizes its own proprietary algorithm to calculate premiums, resulting in varying rates for the same coverage.

Obtaining quotes from at least three different insurers allows you to compare coverage options, deductibles, and overall pricing, ultimately leading to significant savings.

Tips for Obtaining the Best Insurance Rates

- Maintain a Clean Driving Record: Avoid traffic violations, accidents, and driving under the influence. A clean driving record demonstrates responsible driving habits and can lead to lower premiums.

- Increase Your Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance kicks in, can significantly reduce your monthly premium. However, ensure that you can afford the higher deductible in case of an accident.

- Bundle Your Policies: Combining your car insurance with other insurance policies like home or renters insurance can lead to discounts. Bundling policies demonstrates loyalty and reduces administrative costs for the insurer, resulting in lower premiums.

- Shop Around Regularly: Insurance rates can fluctuate over time. Reviewing and comparing quotes from different insurers every year or two can ensure you are getting the best possible rates.

Impact of Driving History and Credit Score

Your driving history and credit score play a significant role in determining your insurance premium.

- Driving History: A clean driving record with no accidents or violations is crucial for obtaining lower premiums. Insurers use your driving history to assess your risk of future accidents. Accidents, speeding tickets, and other violations can significantly increase your premium.

- Credit Score: Credit scores are increasingly being used by insurance companies to assess risk. A higher credit score generally translates to lower premiums, as it indicates financial responsibility and a lower likelihood of making insurance claims.

Strategies for Reducing Car Insurance Costs

Lowering your car insurance premiums can significantly impact your budget. Here are some strategies to help you reduce your car insurance costs.

Choosing a Car with Safety Features

Vehicles equipped with safety features often receive lower insurance premiums. This is because these features reduce the risk of accidents and injuries, leading to lower insurance claims. Some common safety features that can impact your insurance rates include:

- Anti-lock brakes (ABS)

- Electronic stability control (ESC)

- Airbags

- Backup cameras

- Lane departure warning systems

By investing in a car with safety features, you can potentially save money on your insurance premiums while enhancing your safety on the road.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium. This is because you are essentially taking on more financial responsibility for minor accidents.

For example, if you increase your deductible from $500 to $1000, you may see a 10-20% reduction in your premium.

However, it is important to choose a deductible you can comfortably afford in case of an accident.

Maintaining a Clean Driving Record

Your driving history significantly influences your insurance premiums. A clean driving record, free of accidents, traffic violations, and DUI convictions, will earn you lower rates.

- Avoid speeding tickets, reckless driving, and other traffic violations.

- Take defensive driving courses to improve your driving skills and knowledge.

- Report any accidents promptly and accurately to your insurance company.

A clean driving record demonstrates your responsible driving habits, leading to lower insurance premiums.

Last Recap

By understanding the factors that impact car insurance costs and employing smart strategies, drivers can secure affordable coverage while protecting themselves financially. Whether you’re looking for the cheapest car insurance in your state or seeking ways to reduce your premiums, this guide provides valuable insights and practical advice.

Q&A

What is the average car insurance cost in the United States?

The average annual car insurance cost in the United States is around $1,771, but this can vary significantly based on factors like location, driving history, and vehicle type.

How often should I compare car insurance quotes?

It’s recommended to compare car insurance quotes at least annually, or even more frequently if you experience significant life changes, such as a move, a new vehicle, or a change in driving habits.

What are some common discounts offered by car insurance companies?

Common car insurance discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining home and auto insurance.