States with cheapest auto insurance offer drivers significant savings on their annual premiums. These states often have unique factors that contribute to lower insurance costs, such as favorable regulations, strong competition among insurance companies, and lower accident rates. This article will delve into the reasons behind these lower premiums and provide valuable tips for finding affordable coverage.

The cost of auto insurance can vary significantly depending on where you live. Understanding the factors that influence these costs can help you make informed decisions about your insurance coverage. This article will explore the key drivers of auto insurance rates, including state regulations, demographic factors, traffic density, and vehicle characteristics. We will then highlight the states with the lowest average auto insurance premiums, examining the specific factors that contribute to their affordability.

Factors Influencing Auto Insurance Costs

Auto insurance premiums are determined by a complex interplay of factors, and understanding these influences can help you make informed decisions to potentially lower your costs. These factors can vary significantly depending on your location, individual circumstances, and the specific insurance provider you choose.

State Regulations

State governments play a crucial role in regulating the auto insurance market. They establish minimum coverage requirements, set guidelines for rate calculations, and monitor insurance companies’ practices. These regulations can have a direct impact on auto insurance premiums. For instance, states with mandatory coverage requirements, such as personal injury protection (PIP), often have higher average premiums than states with more limited requirements. Additionally, state-specific regulations regarding how insurance companies can factor in driving history, credit scores, and other factors can influence premium costs.

Demographic Factors

Demographic factors, such as age and driving history, are key considerations for insurance companies when setting premiums. Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents. As a result, they often face higher premiums. Conversely, older drivers with a clean driving record may qualify for discounts due to their lower risk profile. Similarly, individuals with a history of traffic violations or accidents will typically face higher premiums compared to drivers with a spotless record.

Traffic Density and Accident Rates

The location where you live and drive significantly influences auto insurance costs. Areas with high traffic density and frequent accidents generally have higher insurance premiums. This is because insurance companies face a greater risk of claims in these locations. Conversely, areas with lower traffic density and fewer accidents may have lower insurance premiums.

Vehicle Type and Value

The type and value of your vehicle also play a significant role in determining your auto insurance premium. Higher-value vehicles, especially luxury or sports cars, are often more expensive to repair or replace in case of an accident. Consequently, insurance companies charge higher premiums for these vehicles. Similarly, vehicles with advanced safety features, such as anti-lock brakes or airbags, may qualify for discounts due to their reduced risk of accidents and injuries.

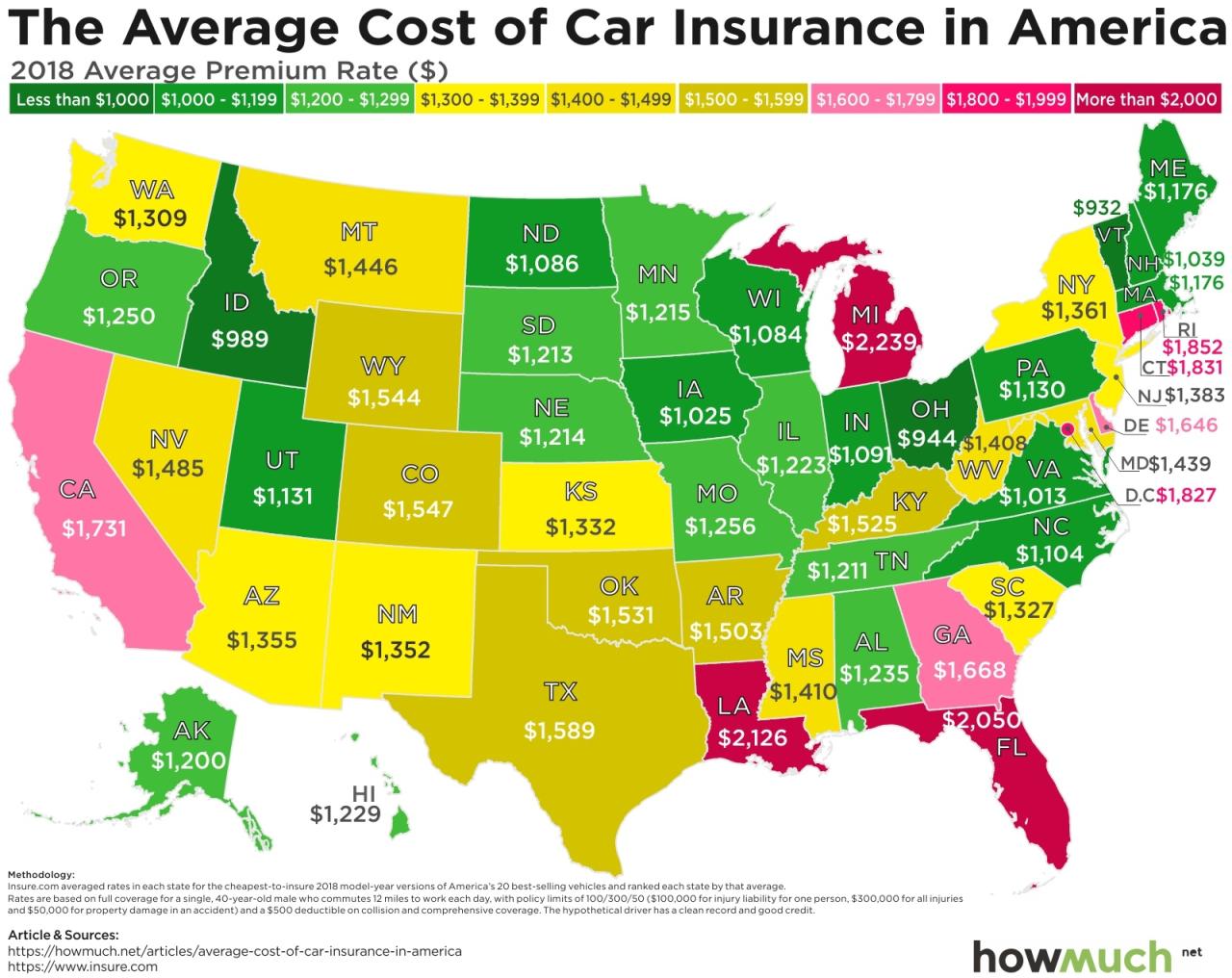

States with the Lowest Average Premiums

Finding affordable auto insurance is a top priority for most drivers. Some states consistently offer lower average premiums than others, making them attractive for budget-conscious individuals. This section will delve into the top 5 states with the lowest average auto insurance premiums, exploring the factors contributing to their affordability.

States with the Lowest Average Premiums

The following table presents the top 5 states with the lowest average auto insurance premiums, based on data from the National Association of Insurance Commissioners (NAIC) in 2023:

| State | Average Premium | Percentage Difference from National Average |

|---|---|---|

| Maine | $1,024 | -22% |

| Idaho | $1,037 | -21% |

| Vermont | $1,041 | -21% |

| Iowa | $1,045 | -21% |

| North Dakota | $1,052 | -20% |

Several factors contribute to these states’ lower average premiums:

- Lower Risk Profiles: States with lower population densities and fewer urban areas often have lower accident rates, which translates into lower insurance premiums. For example, Maine, Idaho, Vermont, and North Dakota have relatively low population densities compared to other states.

- Stronger Driver Safety Records: States with strict driver education programs and robust traffic enforcement measures tend to have lower accident rates, contributing to lower insurance premiums. Iowa, for instance, has a well-regarded driver education program and strong traffic enforcement.

- Competitive Insurance Markets: A highly competitive insurance market with multiple providers vying for customers can lead to lower premiums. States with a diverse range of insurance companies often see price wars, resulting in more affordable rates. For example, Vermont has a strong insurance market with a variety of providers.

- Lower Cost of Living: States with lower costs of living, including lower healthcare expenses, tend to have lower insurance premiums. This is particularly true for states like Idaho and North Dakota, where the cost of living is relatively low.

Factors Contributing to Lower Premiums in Specific States

Lower auto insurance premiums in certain states are a result of a complex interplay of factors, including regulatory environments, competitive insurance markets, and state-specific initiatives aimed at improving road safety. Understanding these factors provides valuable insights into the pricing of auto insurance across different regions.

Insurance Regulatory Environments

The regulatory environment plays a significant role in shaping auto insurance costs. State insurance departments set rules and regulations governing how insurance companies operate, including the types of coverage they offer, the rates they can charge, and the financial reserves they must maintain. Here’s a comparison of the insurance regulatory environments of the top 5 states with the lowest average premiums:

- Idaho: Idaho’s insurance regulatory environment is considered relatively lenient, allowing for more competition and potentially lower premiums. The state has a limited number of regulations on rate setting and coverage requirements, which can translate into more flexibility for insurance companies to offer competitive rates.

- Maine: Maine has a similar approach to Idaho, with a less restrictive regulatory environment that encourages competition. The state has a strong emphasis on consumer protection, but it allows insurers more freedom in setting rates, which can lead to lower premiums for certain drivers.

- North Dakota: North Dakota’s insurance regulations are designed to promote a competitive market, with minimal restrictions on rate setting and coverage requirements. This approach has resulted in a highly competitive insurance market, which can lead to lower premiums for consumers.

- Iowa: Iowa has a well-established regulatory framework that balances consumer protection with market flexibility. The state has a robust system for reviewing and approving insurance rates, ensuring that they are fair and reasonable.

- Vermont: Vermont’s insurance regulations are known for their emphasis on consumer protection and transparency. The state has a strong regulatory oversight system, which can help to ensure that insurance companies are operating fairly and competitively.

Competition Among Insurance Companies

A highly competitive insurance market can drive down premiums as companies strive to attract customers with lower rates. This competition can be influenced by several factors, including:

- Number of Insurance Companies: States with a larger number of insurance companies operating within their borders tend to have more competitive markets. This increased competition can drive down premiums as companies fight for market share.

- Availability of Online Insurance Options: The growth of online insurance platforms has increased competition, as consumers have more choices and can easily compare rates from multiple companies.

- State-Specific Regulations: Some states have regulations that promote competition, such as allowing insurance companies to offer discounts for good driving records or safety features.

State-Specific Safety Initiatives and Driver Education Programs, States with cheapest auto insurance

States with strong safety initiatives and driver education programs can help to reduce accidents, leading to lower insurance premiums. These initiatives may include:

- Traffic Safety Laws: States with stricter traffic safety laws, such as mandatory seatbelt use and stricter drunk driving penalties, can contribute to a safer driving environment and lower accident rates.

- Driver Education Programs: Comprehensive driver education programs that teach safe driving practices and traffic laws can help to reduce accidents and improve driver skills.

- Road Infrastructure Improvements: Investing in road infrastructure improvements, such as better lighting, signage, and road maintenance, can also contribute to safer roads and lower accident rates.

Driving Behaviors and Accident Rates

The prevalence of specific driving behaviors and accident rates can also influence auto insurance premiums. For example:

- Speeding: States with higher rates of speeding tend to have higher accident rates, which can lead to higher insurance premiums.

- Drunk Driving: States with higher rates of drunk driving incidents often have higher accident rates and higher insurance premiums.

- Distracted Driving: The increasing use of cell phones and other distractions while driving has contributed to a rise in accidents and insurance premiums in some states.

Tips for Finding Affordable Auto Insurance: States With Cheapest Auto Insurance

Finding the most affordable auto insurance policy requires careful research and comparison. There are several strategies you can employ to lower your premiums and save money on your insurance costs.

Shopping Around for Quotes

It is crucial to get quotes from multiple insurers before settling on a policy. Each insurer has its own pricing structure, and comparing quotes can reveal significant differences in premiums. Online comparison websites can streamline this process, allowing you to input your details and receive quotes from various insurers within minutes.

Negotiating Lower Premiums

Once you have obtained quotes, you can explore various negotiation tactics to potentially lower your premiums.

Bundling Policies

Combining your auto insurance with other types of insurance, such as homeowners or renters insurance, can often lead to discounts. Insurers often reward policyholders who bundle their coverage, as it simplifies their administrative processes and increases customer loyalty.

Increasing Deductibles

A higher deductible means you pay more out of pocket in case of an accident, but it also reduces your premium. This is because you are essentially accepting more financial responsibility for smaller claims, which translates to lower premiums for the insurer. Carefully consider your financial situation and risk tolerance before increasing your deductible.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors influencing your insurance premiums. Avoiding accidents, traffic violations, and driving under the influence can significantly reduce your premiums.

Improving Your Credit Score

Your credit score plays a surprising role in determining your auto insurance rates. Insurers use credit scores as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible drivers. Improving your credit score can potentially lower your premiums.

Participating in Defensive Driving Courses

Completing a defensive driving course can demonstrate your commitment to safe driving practices and potentially earn you a discount on your insurance. These courses teach valuable skills and strategies for avoiding accidents, which benefits both you and your insurer.

Additional Considerations for Choosing an Insurance Provider

While price is a crucial factor when choosing an auto insurance provider, it shouldn’t be the only one. Other factors can significantly impact your overall experience and satisfaction with your insurer.

Customer Service and Claims Handling

A reputable insurance provider should prioritize customer service and offer a smooth claims process. Look for companies that are known for their responsiveness, helpfulness, and ability to resolve issues quickly and fairly. Consider these factors:

- Availability: Are there multiple ways to contact the insurer, such as phone, email, or online chat? Are they available during convenient hours?

- Responsiveness: How quickly does the insurer respond to inquiries and requests?

- Friendliness: Are the customer service representatives courteous and helpful?

- Claims Process: How straightforward and efficient is the claims process? Does the insurer offer online claim filing options?

- Customer Reviews and Ratings: Research customer reviews and ratings on websites like J.D. Power, Consumer Reports, and the Better Business Bureau to get an idea of the insurer’s reputation for customer service and claims handling.

Coverage Options

Insurance companies offer various coverage options, and understanding these differences is crucial. Don’t settle for the bare minimum; ensure you have the right level of coverage for your needs.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault.

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged in an accident and needs repairs.

Financial Stability and Reputation

Choosing a financially stable insurer is essential to ensure that they can pay your claims when you need them. Look for companies with a strong track record of financial stability and a positive reputation.

- Financial Ratings: Check the insurer’s financial ratings from organizations like A.M. Best, Standard & Poor’s, and Moody’s. These ratings assess the insurer’s financial strength and ability to meet its obligations.

- Industry Recognition: Look for insurers that have received industry awards or recognition for customer satisfaction, financial performance, or innovation.

Innovation and Customer Satisfaction

Consider insurers that are known for their innovation and commitment to customer satisfaction. These companies often offer cutting-edge features and services that can enhance your insurance experience.

- Digital Tools and Services: Look for insurers that offer mobile apps, online portals, and other digital tools that make it easy to manage your policy, file claims, and access information.

- Customer-Centric Approach: Choose an insurer that prioritizes customer satisfaction and strives to provide a positive and seamless experience.

- Technological Advancements: Some insurers are incorporating new technologies, such as telematics, to offer personalized pricing and discounts based on driving behavior.

Outcome Summary

Finding affordable auto insurance requires a strategic approach. By understanding the factors that influence premiums, shopping around for quotes, and taking steps to improve your driving record, you can significantly reduce your insurance costs. Remember, insurance is a vital financial protection, so don’t compromise on coverage for the sake of price. Choose a reputable insurer that offers the right balance of affordability and comprehensive coverage.

FAQ Explained

What are the best states for finding cheap car insurance?

States with the lowest average auto insurance premiums often have strong competition among insurance companies, favorable regulations, and lower accident rates. Some of the top states for affordable car insurance include Maine, Idaho, Vermont, and North Dakota.

How can I get the best car insurance rate?

To get the best car insurance rate, shop around for quotes from multiple insurers, consider bundling your policies, increase your deductible, maintain a good driving record, and improve your credit score.

What factors should I consider when choosing an insurance provider?

Beyond price, consider factors like customer service, claims handling, financial stability, and coverage options. Choose a provider with a strong reputation for innovation and customer satisfaction.