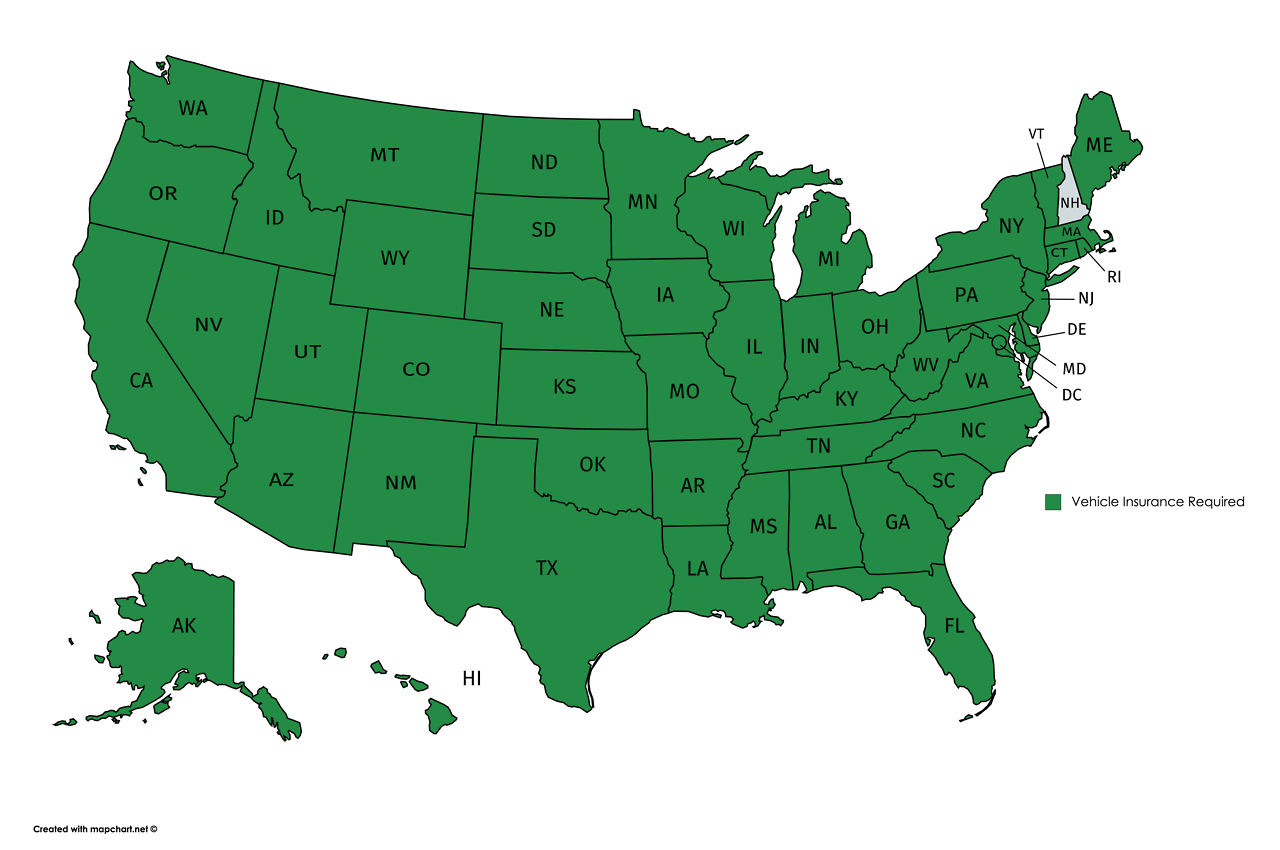

States that require auto insurance are a vital part of ensuring road safety and financial responsibility. Across the United States, every state, except New Hampshire, mandates that drivers carry auto insurance to protect themselves and others in the event of an accident. This comprehensive guide explores the intricacies of these laws, diving into the types of coverage required, factors influencing rates, and the consequences of driving uninsured. Join us as we navigate the complexities of auto insurance in the United States.

Understanding the nuances of auto insurance laws can seem daunting, but it’s crucial to navigate the roads safely and responsibly. Whether you’re a seasoned driver or just starting out, this guide aims to provide you with the knowledge and tools to make informed decisions about your auto insurance needs. Let’s delve into the world of auto insurance and ensure you’re equipped to make the right choices for your individual circumstances.

States with Mandatory Auto Insurance Laws

All states in the United States, except for New Hampshire, require drivers to carry auto insurance. This is a crucial requirement for ensuring financial protection in case of accidents and safeguarding the well-being of all road users.

Minimum Liability Coverage Requirements

Each state mandates specific minimum liability coverage requirements, which are designed to protect individuals involved in accidents. These requirements vary from state to state, reflecting different factors like population density, traffic volume, and economic conditions.

- Alabama: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Alaska: $50,000 bodily injury liability per person, $100,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Arizona: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- Arkansas: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- California: $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, $5,000 property damage liability per accident.

- Colorado: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- Connecticut: $20,000 bodily injury liability per person, $40,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Delaware: $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Florida: $10,000 bodily injury liability per person, $20,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Georgia: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Hawaii: $20,000 bodily injury liability per person, $40,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Idaho: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- Illinois: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $20,000 property damage liability per accident.

- Indiana: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Iowa: $20,000 bodily injury liability per person, $40,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Kansas: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Kentucky: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Louisiana: $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Maine: $50,000 bodily injury liability per person, $100,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Maryland: $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- Massachusetts: $20,000 bodily injury liability per person, $40,000 bodily injury liability per accident, $5,000 property damage liability per accident.

- Michigan: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Minnesota: $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Mississippi: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Missouri: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Montana: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Nebraska: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Nevada: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- New Hampshire:

No mandatory auto insurance requirement.

- New Jersey: $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, $5,000 property damage liability per accident.

- New Mexico: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- New York: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- North Carolina: $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- North Dakota: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Ohio: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Oklahoma: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Oregon: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $20,000 property damage liability per accident.

- Pennsylvania: $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, $5,000 property damage liability per accident.

- Rhode Island: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- South Carolina: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- South Dakota: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Tennessee: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- Texas: $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, $25,000 property damage liability per accident.

- Utah: $25,000 bodily injury liability per person, $65,000 bodily injury liability per accident, $15,000 property damage liability per accident.

- Vermont: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Virginia: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $20,000 property damage liability per accident.

- Washington: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- West Virginia: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Wisconsin: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $10,000 property damage liability per accident.

- Wyoming: $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident.

Penalties for Driving Without Auto Insurance

Driving without the required auto insurance in any state is a serious offense. Penalties can vary significantly from state to state, ranging from fines to license suspension and even jail time.

- Fines: Fines can range from a few hundred dollars to several thousand dollars, depending on the state and the number of offenses.

- License Suspension: Driving without insurance can result in the suspension of your driver’s license, preventing you from legally operating a vehicle.

- Jail Time: In some states, driving without insurance can lead to jail time, particularly if you are involved in an accident or have repeated offenses.

- Higher Insurance Premiums: Even if you eventually obtain insurance, you may face higher premiums due to your previous driving record.

- Financial Responsibility: Driving without insurance means you are personally responsible for any damages or injuries you cause in an accident, which can lead to significant financial hardship.

Types of Auto Insurance Coverage

Auto insurance is a crucial aspect of responsible car ownership, providing financial protection against potential risks on the road. Understanding the different types of coverage available can help you make informed decisions about your insurance policy.

Liability Coverage

Liability coverage is a fundamental component of most auto insurance policies. It safeguards you financially if you are at fault in an accident that causes injuries or property damage to others. Liability coverage typically includes two main components:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries to others caused by your negligence while driving. It usually has a per-person limit and a per-accident limit.

- Property Damage Liability: This coverage covers damages to other people’s property, such as their vehicles, buildings, or other assets, if you are responsible for the accident. It has a per-accident limit.

For example, if you are driving and cause an accident that injures another driver, bodily injury liability coverage will help pay for their medical bills and other related expenses, up to the policy’s limit. Similarly, if you damage another driver’s car, property damage liability coverage will help pay for the repairs.

Collision Coverage

Collision coverage protects your vehicle against damages caused by a collision with another vehicle or an object, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

For instance, if you collide with a parked car and damage your own vehicle, collision coverage will help pay for the repairs.

Comprehensive Coverage

Comprehensive coverage provides protection against damages to your vehicle caused by events other than collisions, such as:

- Theft

- Vandalism

- Natural disasters (e.g., hail, fire, floods)

- Animal collisions

Like collision coverage, comprehensive coverage also has a deductible, which you pay before the insurance company covers the remaining costs.

For example, if your car is stolen or damaged by a hailstorm, comprehensive coverage will help pay for its repair or replacement.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who either does not have insurance or has insufficient coverage to cover your damages.

- Uninsured Motorist Coverage (UM): This coverage protects you if you are injured by a driver who has no insurance at all. It will cover your medical expenses, lost wages, and other damages, up to the policy limit.

- Underinsured Motorist Coverage (UIM): This coverage comes into play if you are injured by a driver who has insurance but the coverage is not enough to cover your losses. UIM coverage will pay the difference between the other driver’s insurance limits and your own policy limits.

For instance, if you are hit by an uninsured driver and suffer significant injuries, UM coverage will help pay for your medical bills and other related expenses. Similarly, if you are involved in an accident with an underinsured driver and their insurance is not enough to cover your medical expenses, UIM coverage will pay the remaining amount, up to your policy limits.

Factors Influencing Auto Insurance Rates

Auto insurance premiums are not set in stone. Insurance companies use a variety of factors to determine your individual rates. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Driving History

Your driving history plays a significant role in determining your auto insurance rates. Insurance companies analyze your driving record to assess your risk of getting into an accident.

- Accidents: Having a history of accidents, especially at-fault accidents, will generally increase your premiums. The severity of the accident and the number of claims filed will influence the impact on your rates.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can also lead to higher premiums. These violations indicate a higher risk of future accidents.

- Driving Record Cleanliness: A clean driving record with no accidents or violations will generally result in lower premiums. Insurance companies view drivers with clean records as lower-risk individuals.

Vehicle Type

The type of vehicle you drive is another key factor in determining your insurance rates. Insurance companies consider the following aspects:

- Vehicle Make and Model: Some car models are statistically more likely to be involved in accidents or have higher repair costs. These vehicles may have higher insurance premiums.

- Vehicle Value: More expensive vehicles typically have higher insurance premiums because the cost to repair or replace them is higher.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and stability control can reduce your premiums. These features demonstrate a lower risk of accidents and injuries.

Age

Your age is also a factor that insurance companies consider. Generally, younger drivers have higher premiums due to their lack of experience and higher risk of accidents.

- Teenagers: Teenage drivers have the highest accident rates. Insurance companies may offer discounts for completing driver’s education courses or having good grades.

- Mature Drivers: Drivers over the age of 65 may see a slight increase in premiums due to potential health concerns. However, they often have lower accident rates than younger drivers.

Location

The location where you live can also affect your auto insurance rates. Insurance companies consider the following factors:

- Traffic Density: Areas with heavy traffic have a higher risk of accidents, leading to higher premiums.

- Crime Rates: Areas with high crime rates may have higher insurance premiums due to the increased risk of theft or vandalism.

- Weather Conditions: Areas with extreme weather conditions such as heavy snow or frequent hailstorms may have higher premiums due to the increased risk of accidents and damage.

Table of Factors Influencing Auto Insurance Rates, States that require auto insurance

| Factor | Impact on Rates |

|---|---|

| Driving History | Higher premiums for drivers with accidents or violations; lower premiums for drivers with clean records. |

| Vehicle Type | Higher premiums for vehicles with higher repair costs or lower safety ratings; lower premiums for vehicles with safety features. |

| Age | Higher premiums for younger drivers; lower premiums for mature drivers. |

| Location | Higher premiums for areas with heavy traffic, high crime rates, or extreme weather conditions. |

Finding Affordable Auto Insurance: States That Require Auto Insurance

Finding affordable auto insurance can be a daunting task, but with careful planning and research, you can find a policy that fits your budget and provides adequate coverage. This section will provide a step-by-step guide to help you find affordable auto insurance, compare different insurance providers and their rates, and understand the benefits of bundling insurance policies.

Comparing Insurance Providers and Rates

Comparing insurance providers and their rates is crucial to finding the most affordable option. Different insurance companies have varying pricing structures and coverage options. Here’s how to compare rates effectively:

- Use Online Comparison Tools: Several online comparison websites allow you to enter your information once and receive quotes from multiple insurance companies. This saves you time and effort by eliminating the need to contact each insurer individually.

- Contact Insurance Companies Directly: After using online comparison tools, contact the insurance companies that offer competitive rates directly. This allows you to ask specific questions about coverage options and discounts.

- Check for Discounts: Most insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Be sure to ask about available discounts and ensure you qualify for them.

Benefits of Bundling Insurance Policies

Bundling insurance policies, such as auto and home insurance, with the same insurer can lead to significant cost savings. This is because insurance companies often offer discounts for bundling multiple policies.

Bundling insurance policies can result in lower premiums due to the combined risk assessment and the insurer’s incentive to retain multiple policies from the same customer.

- Reduced Premiums: Bundling insurance policies typically results in lower premiums compared to purchasing individual policies. The discounts offered can vary depending on the insurer and the specific policies being bundled.

- Convenience: Having multiple policies with the same insurer simplifies the process of managing your insurance. You only need to contact one company for all your insurance needs, making it easier to make payments, file claims, and update your policy information.

- Improved Customer Service: Insurers often prioritize customers with multiple policies, providing them with enhanced customer service and support. You may have access to dedicated customer service representatives or priority handling of claims.

Exemptions and Exceptions to Auto Insurance Requirements

While most states mandate auto insurance, there are some exceptions and exemptions to these rules. These exceptions often apply to specific types of vehicles or circumstances, and understanding them is crucial to ensure compliance with state laws.

Exemptions for Antique Vehicles

Antique vehicles are often exempt from mandatory auto insurance requirements. These exemptions typically apply to vehicles that are:

- At least 25 years old.

- Registered as antique vehicles with the state.

- Used primarily for exhibitions, parades, or historical purposes.

- Not driven on public roads for daily transportation.

For example, a classic car owner who uses their vehicle solely for car shows and special events might be eligible for an exemption.

Exemptions for Certain Types of Vehicles

Some states may exempt specific types of vehicles from mandatory insurance requirements. These exemptions might include:

- Government-owned vehicles: Vehicles owned and operated by government agencies are often exempt from mandatory insurance requirements.

- Farm vehicles: Vehicles used exclusively for agricultural purposes may be exempt from mandatory insurance requirements in some states.

- Vehicles used for specific purposes: Some states may exempt vehicles used for specific purposes, such as construction equipment or vehicles used for hauling goods.

It’s essential to consult with your state’s Department of Motor Vehicles to determine the specific types of vehicles exempt from insurance requirements.

Exceptions for Specific Circumstances

In some situations, drivers may be temporarily exempt from mandatory insurance requirements. These exceptions may include:

- Driving to or from a vehicle repair shop: Drivers may be exempt from insurance requirements if they are driving their vehicle to or from a repair shop after an accident.

- Driving a vehicle owned by a licensed dealer: Drivers may be exempt from insurance requirements if they are driving a vehicle owned by a licensed dealer for the purpose of testing or demonstration.

- Driving a vehicle for a limited period: Some states may allow drivers to operate a vehicle without insurance for a limited period, such as when obtaining a new insurance policy or when moving to a new state.

These exceptions are typically temporary and require the driver to obtain insurance within a specific timeframe.

Other Exceptions

In addition to the above exemptions and exceptions, other circumstances may apply:

- Financial hardship: Some states may offer exemptions to drivers who can demonstrate financial hardship.

- Medical conditions: In some cases, drivers with medical conditions that prevent them from obtaining insurance may be eligible for exemptions.

These exceptions are typically granted on a case-by-case basis and require the driver to provide documentation to support their claim.

Consequences of Driving Without Insurance

Driving without auto insurance is a serious offense that can have significant consequences, both legal and financial. In the United States, every state mandates that drivers carry at least a minimum amount of auto insurance coverage. This is for the protection of both the driver and others on the road.

Fines and License Suspension

Driving without insurance is a violation of state law, and drivers who are caught can face hefty fines and license suspension. The severity of the penalties varies from state to state, but they can include:

- Fines ranging from hundreds to thousands of dollars.

- License suspension for a specified period.

- Court costs and other fees.

For example, in California, drivers caught driving without insurance can face a fine of up to $1,000, a license suspension for up to six months, and a vehicle impoundment.

Vehicle Impoundment

In many states, law enforcement officials have the authority to impound a vehicle if the driver is caught driving without insurance. The vehicle may be impounded until the driver provides proof of insurance or pays the necessary fees to have it released.

Financial Impact

Driving without insurance can have a devastating impact on your finances. If you are involved in an accident, you will be responsible for covering all costs associated with the accident, including:

- Medical expenses for yourself and others involved in the accident.

- Property damage to your vehicle and the vehicles of others.

- Legal fees and court costs.

Without insurance, you could face tens of thousands of dollars in debt, which can lead to financial ruin.

Credit Score Impact

If you are unable to pay your debts related to an uninsured accident, it can negatively affect your credit score. Unpaid medical bills, judgments, and other debt associated with the accident can be reported to credit bureaus, leading to a lower credit score. This can make it difficult to obtain loans, mortgages, or even credit cards in the future.

Real-Life Examples

There are numerous real-life examples of drivers who have faced severe consequences for driving without insurance. In one case, a driver in Florida was involved in an accident that resulted in a fatality. The driver was found to be uninsured and was charged with vehicular homicide. He was sentenced to prison and had to pay millions of dollars in damages to the victim’s family. In another case, a driver in California was involved in an accident that caused significant property damage. The driver was uninsured and was forced to pay the entire cost of the repairs, which totaled over $10,000.

Tips for Maintaining Auto Insurance Coverage

Maintaining continuous auto insurance coverage is crucial for responsible drivers. Lapses in coverage can lead to hefty fines, difficulty obtaining future insurance, and even the suspension of your driver’s license. Here are some key tips to help you keep your insurance policy active:

Notify Your Insurance Company of Changes

It’s essential to keep your insurance company informed of any significant changes in your driving situation. This includes:

- Change of Address: Update your insurance company with your new address to ensure they can reach you with important notices and policy updates. Failing to do so could result in missed payments or policy cancellations.

- New Vehicle: Adding a new vehicle to your policy is crucial. Your insurance company needs to assess the risk associated with the new vehicle, including its make, model, year, and safety features.

- Changes in Driving Habits: If you’re driving less frequently, switching to a lower-mileage driving plan could save you money. If your driving habits change drastically, such as commuting long distances or driving in high-risk areas, inform your insurance company for a possible policy adjustment.

- Changes in Family Composition: Adding or removing drivers from your policy is essential. Your insurance company will adjust your rates based on the driving history and age of each driver.

Benefits of a Good Driving Record

Maintaining a clean driving record is not only crucial for safety but also significantly impacts your auto insurance rates.

- Lower Premiums: Insurance companies reward safe drivers with lower premiums. A good driving record demonstrates that you are a low-risk driver, making you more attractive to insurers.

- Increased Coverage Options: A clean driving record often opens up access to more affordable and comprehensive insurance coverage options.

- Avoid Surcharges: A poor driving record, including traffic violations, accidents, or DUI convictions, can lead to significant surcharges or even policy cancellation.

Final Thoughts

Navigating the world of auto insurance can be a complex journey, but understanding the basics is essential for responsible driving. By adhering to your state’s auto insurance laws, you contribute to safer roads and protect yourself financially. Remember to regularly review your coverage needs and seek out competitive rates to ensure you’re adequately protected. Stay informed, drive safely, and let’s all work together to create a safer and more secure driving environment for everyone.

Top FAQs

What are the most common types of auto insurance coverage?

The most common types of auto insurance coverage include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each type provides specific protection for different situations.

Can I drive without auto insurance if my car is old?

Generally, even older vehicles require auto insurance, but some states might have exemptions for antique vehicles. Check your state’s regulations for specific requirements.

What happens if I get into an accident without auto insurance?

Driving without auto insurance can result in significant consequences, including fines, license suspension, and even vehicle impoundment. You could also face legal and financial repercussions for any damages or injuries caused.

How often should I review my auto insurance policy?

It’s recommended to review your auto insurance policy annually, or whenever there are significant life changes, such as a new vehicle, address, or driving record.

What are some tips for finding affordable auto insurance?

To find affordable auto insurance, compare quotes from multiple insurers, consider bundling policies, maintain a good driving record, and explore discounts offered by your insurer.