State workers compensation insurance – State workers’ compensation insurance sets the stage for this enthralling narrative, offering readers a glimpse into a system designed to protect both workers and employers in the face of workplace injuries and illnesses. This intricate web of laws and regulations aims to provide financial support and medical care to injured workers while also shielding employers from potentially crippling lawsuits.

This comprehensive guide delves into the intricacies of state workers’ compensation insurance, exploring its purpose, eligibility criteria, claims process, benefits, premiums, safety implications, and legal aspects. We will unravel the complexities of this essential safety net, shedding light on its impact on individuals, businesses, and the overall economy.

What is State Workers’ Compensation Insurance?

State workers’ compensation insurance is a system that provides financial and medical benefits to employees who are injured or become ill as a result of their work. This system is designed to protect both employers and employees by providing a predictable and fair way to handle workplace injuries and illnesses.

Purpose of State Workers’ Compensation Insurance

The purpose of state workers’ compensation insurance is to ensure that employees who are injured or become ill on the job receive the necessary medical treatment and financial support to recover and return to work. This system also protects employers from potentially costly lawsuits and helps to create a safer workplace environment.

Types of Injuries and Illnesses Covered

State workers’ compensation insurance typically covers a wide range of injuries and illnesses that occur on the job. This includes:

- Injuries resulting from accidents, such as falls, slips, and collisions.

- Illnesses caused by exposure to hazardous materials, such as asbestos or chemicals.

- Repetitive strain injuries, such as carpal tunnel syndrome or back pain.

- Mental health conditions, such as stress or anxiety, that are caused by work-related factors.

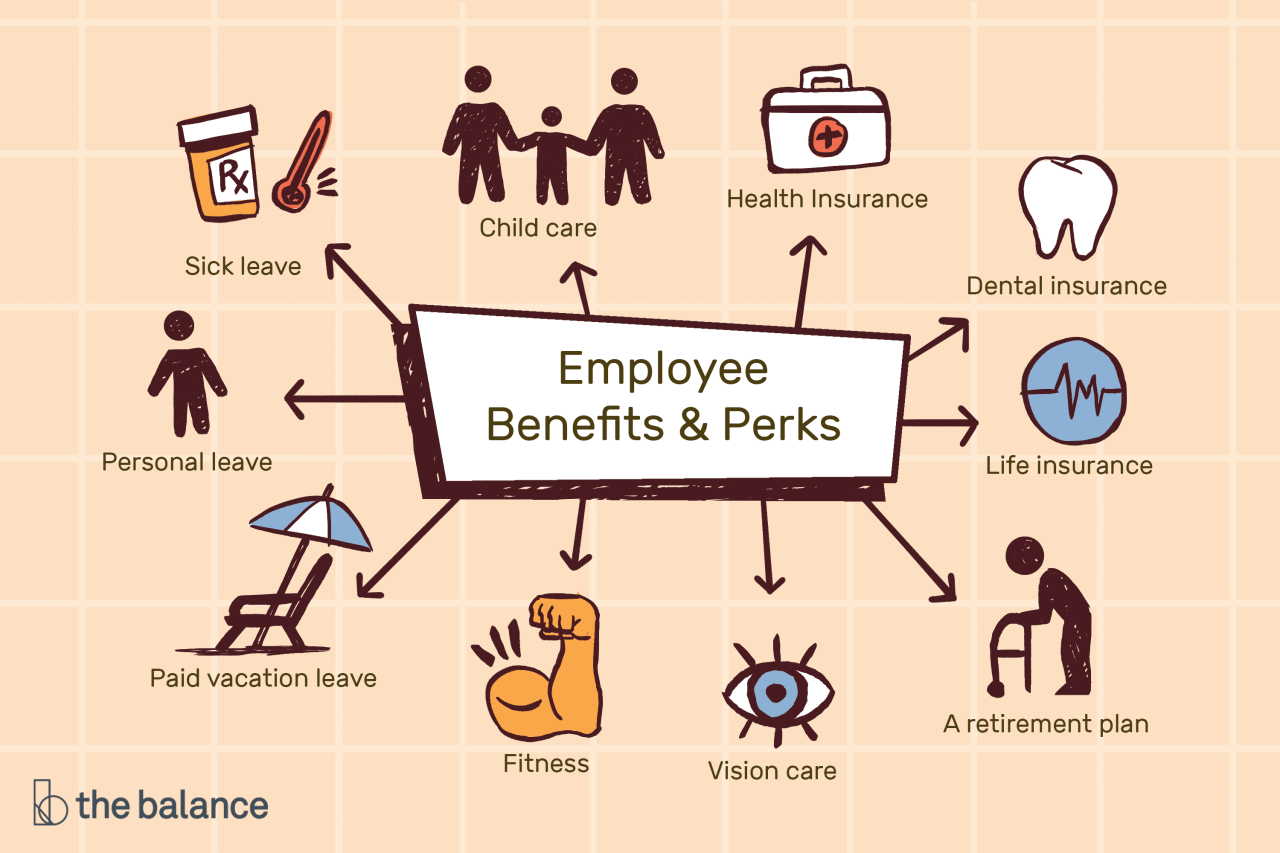

Benefits Provided to Injured Workers

State workers’ compensation insurance provides a variety of benefits to injured workers, including:

- Medical benefits: Coverage for all necessary medical treatment, including doctor visits, hospital stays, surgery, and rehabilitation.

- Lost wage benefits: Compensation for lost wages while the injured worker is unable to work.

- Permanent disability benefits: Payments for permanent impairments, such as loss of limb or vision.

- Death benefits: Payments to surviving dependents in the event of a work-related fatality.

Role of State Government in Regulating Workers’ Compensation

Each state government has its own workers’ compensation laws and regulations. These laws establish the types of injuries and illnesses covered, the benefits provided, and the procedures for filing claims. State governments also regulate insurance companies that provide workers’ compensation coverage.

Eligibility for Workers’ Compensation

Workers’ compensation insurance is designed to protect employees who are injured or become ill as a result of their work. However, not all workers are eligible for this coverage. Eligibility depends on several factors, including the nature of the worker’s employment and the state’s specific requirements.

Full-Time, Part-Time, and Contract Workers

Generally, full-time, part-time, and contract workers are eligible for workers’ compensation coverage if they meet the state’s employment criteria. This typically includes working a certain number of hours per week or being employed for a specific duration.

- Full-time employees are usually considered eligible for workers’ compensation, as they meet the minimum hours requirement for employment.

- Part-time employees may also be eligible, depending on the state’s regulations and the number of hours they work. Some states may have a minimum number of hours worked per week or month for part-time employees to be eligible.

- Contract workers are sometimes eligible for workers’ compensation, but this can vary depending on the specific contract terms and the state’s laws. In some cases, contract workers may be considered independent contractors and therefore not eligible for workers’ compensation.

Independent Contractors

Independent contractors are generally not eligible for workers’ compensation coverage. This is because they are considered self-employed and responsible for their own insurance.

An independent contractor is typically someone who works for themselves, sets their own hours, and provides their own tools and equipment. They are not subject to the control or direction of an employer.

However, there are some exceptions to this rule. For example, some states may require businesses to provide workers’ compensation coverage for certain types of independent contractors, such as those who perform hazardous work.

Examples of Specific Job Roles

Here are some examples of specific job roles and their eligibility for workers’ compensation:

- Office workers: Full-time office workers are generally eligible for workers’ compensation. Part-time office workers may also be eligible, depending on the state’s regulations.

- Construction workers: Construction workers are typically eligible for workers’ compensation, as their work is considered hazardous.

- Truck drivers: Truck drivers are generally eligible for workers’ compensation, as their work involves long hours and potential risks.

- Nurses: Nurses are usually eligible for workers’ compensation, as their work involves direct patient care and potential exposure to infectious diseases.

- Independent contractors: Independent contractors, such as freelancers or consultants, are generally not eligible for workers’ compensation. However, there may be exceptions depending on the state’s regulations and the nature of their work.

The Workers’ Compensation Claims Process

Filing a workers’ compensation claim can be a complex process, but understanding the steps involved can help you navigate it successfully. This section Artikels the general process, including the role of employers and the potential consequences of fraudulent claims.

Steps Involved in Filing a Claim

The first step in filing a workers’ compensation claim is to notify your employer about the injury or illness. This notification should be made as soon as possible, preferably in writing. Your employer is required to provide you with a form to report the injury or illness.

Once your employer has been notified, they will usually file a claim with the state’s workers’ compensation agency. The agency will then review the claim and determine if it is eligible for benefits. If the claim is approved, you will receive benefits for lost wages and medical expenses.

- Notify your employer immediately: Inform your employer about the injury or illness as soon as possible, preferably in writing. This is crucial for starting the claims process.

- Complete the required forms: Your employer will provide you with a form to report the injury or illness. Complete the form accurately and thoroughly.

- Seek medical attention: See a doctor as soon as possible to get treatment for your injury or illness. Your employer may have a list of approved doctors, so it is important to check with them before seeking medical care.

- File a claim with the state agency: Your employer will usually file a claim with the state’s workers’ compensation agency on your behalf. However, you may need to file a claim yourself in some cases.

- Follow up with the agency: Check on the status of your claim regularly and keep track of all deadlines.

Role of Employers in the Claims Process

Employers play a crucial role in the workers’ compensation claims process. They are responsible for providing a safe work environment, notifying the state agency about the claim, and ensuring that their employees receive the necessary medical treatment.

- Maintaining a safe work environment: Employers are legally obligated to provide a safe work environment for their employees. This includes providing proper training, safety equipment, and procedures to minimize the risk of workplace injuries and illnesses.

- Filing the claim: Employers typically file the workers’ compensation claim with the state agency on behalf of their employees. They are responsible for providing accurate information and completing the necessary paperwork.

- Providing medical treatment: Employers are responsible for ensuring that their employees receive necessary medical treatment for work-related injuries or illnesses. They may have a list of approved doctors or provide employees with the option to choose their own healthcare provider.

- Cooperating with the agency: Employers must cooperate with the state workers’ compensation agency throughout the claims process. This includes providing documentation, responding to inquiries, and participating in any required investigations.

Appealing a Denied Claim

If your workers’ compensation claim is denied, you have the right to appeal the decision. The appeal process varies by state, but generally involves filing a formal request for review with the state agency. You may need to provide additional evidence or documentation to support your claim.

Consequences of Fraudulent Claims

Filing a fraudulent workers’ compensation claim is a serious offense that can result in severe consequences. These consequences can include:

- Criminal charges: Filing a false claim can lead to criminal charges, including fraud and perjury.

- Fines and imprisonment: If convicted of fraud, you may face fines and imprisonment.

- Loss of benefits: You may be denied workers’ compensation benefits if your claim is found to be fraudulent.

- Reputational damage: A fraudulent claim can damage your reputation and make it difficult to find future employment.

Types of Workers’ Compensation Benefits

Workers’ compensation benefits are designed to provide financial and medical assistance to employees who have been injured or become ill as a result of their job. These benefits vary depending on the state and the specific circumstances of the injury or illness.

Medical Benefits

Medical benefits cover the costs of treatment for work-related injuries or illnesses. This can include:

- Doctor’s visits

- Hospital stays

- Surgery

- Physical therapy

- Prescription drugs

- Home health care

- Durable medical equipment (e.g., crutches, wheelchairs)

The specific medical benefits available and the coverage limits may vary depending on the state. Some states may require employees to use a designated provider network, while others allow employees to choose their own doctors.

Lost Wages Benefits

Lost wages benefits are designed to replace a portion of an employee’s lost wages while they are unable to work due to a work-related injury or illness. These benefits are typically calculated as a percentage of the employee’s average weekly wage. The specific percentage and maximum benefit amount may vary depending on the state.

Temporary Total Disability Benefits (TTD)

TTD benefits are paid to employees who are temporarily unable to work due to a work-related injury or illness. These benefits are typically paid for a limited period of time, such as a few weeks or months, and are often subject to a maximum benefit amount. The amount of TTD benefits is typically calculated as a percentage of the employee’s average weekly wage.

Permanent Total Disability Benefits (PTD)

PTD benefits are paid to employees who are permanently unable to work due to a work-related injury or illness. These benefits are typically paid for the rest of the employee’s life. The amount of PTD benefits is typically calculated as a percentage of the employee’s average weekly wage.

Permanent Partial Disability Benefits (PPD)

PPD benefits are paid to employees who have a permanent impairment as a result of a work-related injury or illness. These benefits are typically paid as a lump sum or a series of payments, depending on the state. The amount of PPD benefits is typically calculated based on the severity of the impairment.

Death Benefits

Death benefits are paid to the surviving dependents of an employee who dies as a result of a work-related injury or illness. These benefits can include:

- Funeral expenses

- Income benefits

- Medical benefits for surviving dependents

The specific death benefits available and the eligibility criteria may vary depending on the state.

Other Benefits

In addition to the core benefits listed above, some states may offer other benefits, such as:

- Rehabilitation benefits

- Vocational training benefits

- Mental health benefits

These benefits are designed to help employees return to work or find new employment after a work-related injury or illness.

Benefit Calculation Examples

Example 1: Temporary Total Disability Benefits (TTD)

An employee in California earns $1,000 per week. They are injured at work and are unable to work for 4 weeks. California’s TTD benefit rate is 68% of the employee’s average weekly wage. Therefore, the employee would receive TTD benefits of $680 per week for 4 weeks, totaling $2,720.

Example 2: Permanent Partial Disability Benefits (PPD)

An employee in Texas suffers a permanent impairment to their left arm as a result of a work-related injury. The impairment is rated at 20%. Texas uses a schedule of benefits for PPD, which assigns a monetary value to each body part. The value for a 20% impairment to the left arm is $10,000. Therefore, the employee would receive PPD benefits of $10,000.

Workers’ Compensation Insurance Premiums

Workers’ compensation insurance premiums are the costs businesses pay to secure coverage for their employees in case of work-related injuries or illnesses. The premium amount is determined by several factors, including the company’s industry, the type of work performed, and the company’s claims history.

Factors Influencing Premium Rates

The premium rates for workers’ compensation insurance are calculated based on several factors. These factors are used to assess the risk of workplace injuries and illnesses, and they ultimately determine the cost of coverage.

- Industry: Some industries are inherently more hazardous than others. For example, construction, manufacturing, and mining have higher rates of workplace injuries compared to industries like retail or office work. This means businesses in these high-risk industries will generally pay higher premiums.

- Job Type: Within an industry, certain job types carry a higher risk of injury. For example, a construction worker performing heavy lifting tasks has a higher risk of injury compared to an office worker. This risk is reflected in the premium rates for different job types.

- Company Size: Larger companies often have more employees, which means they have a greater potential for workplace injuries. However, they also tend to have better safety programs and risk management practices. This can result in lower premiums for larger companies.

- Claims History: A company’s claims history is a significant factor in determining its premium rates. Companies with a history of frequent or high-cost claims will typically pay higher premiums. Conversely, companies with a good safety record and low claims frequency will often receive lower rates.

- State Regulations: Each state has its own workers’ compensation laws and regulations, which can influence the cost of insurance. Some states have higher benefit levels, which can lead to higher premiums.

Impact of Industry, Job Type, and Company Size, State workers compensation insurance

The impact of industry, job type, and company size on workers’ compensation insurance premiums can be significant. Companies operating in high-risk industries, with employees performing hazardous tasks, or with a large workforce will generally face higher premiums.

- For example, a construction company with a large workforce and employees performing high-risk tasks, such as working at heights or operating heavy machinery, will likely have a higher premium rate compared to a retail store with a smaller workforce and employees performing less hazardous tasks.

Comparison of Workers’ Compensation Insurance Costs Across States

The cost of workers’ compensation insurance varies considerably across different states. This is primarily due to differences in state laws, benefit levels, and the prevalence of workplace injuries.

- For example, states with higher benefit levels, such as California and New York, generally have higher workers’ compensation insurance premiums compared to states with lower benefit levels, such as Texas and Florida.

Managing Workers’ Compensation Insurance Premium Costs

Companies can take several steps to manage their workers’ compensation insurance premium costs.

- Implement a Strong Safety Program: A robust safety program is crucial for reducing the risk of workplace injuries. This can include training employees on safe work practices, providing personal protective equipment, and conducting regular safety inspections.

- Promote a Safety Culture: Creating a safety-conscious workplace culture is essential for preventing injuries. This can involve encouraging employees to report unsafe conditions, recognizing safe work practices, and promoting open communication about safety concerns.

- Reduce Risk Factors: Companies can also reduce their premium costs by identifying and addressing potential risk factors in their workplace. This may involve redesigning work processes, implementing ergonomic solutions, or providing additional training to employees.

- Review and Negotiate Coverage: Regularly reviewing insurance policies and negotiating with insurance providers can help companies obtain the most favorable rates. This may involve exploring different coverage options, comparing quotes from multiple insurers, and negotiating discounts based on the company’s safety record and risk profile.

- Invest in Loss Control: Companies can invest in loss control measures, such as hiring safety professionals, implementing safety management systems, and conducting regular safety audits. These investments can help reduce the frequency and severity of workplace injuries, ultimately leading to lower premiums.

Workers’ Compensation and Safety

Workers’ compensation insurance plays a crucial role in promoting workplace safety. It creates a financial incentive for employers to prioritize safety measures, as the cost of workplace injuries and illnesses directly impacts their insurance premiums.

Insurance Premiums as a Safety Incentive

Insurance premiums for workers’ compensation are calculated based on the employer’s risk profile, which is determined by factors such as the industry, size of the workforce, and past claims history. Employers with a history of workplace accidents and injuries tend to pay higher premiums, reflecting their increased risk of future claims. Conversely, employers with a strong safety record and low claim frequency enjoy lower premiums, rewarding their commitment to safety.

Common Workplace Hazards and Safety Protocols

Workplace hazards can be broadly categorized into physical, chemical, biological, and ergonomic risks. Some common examples include:

- Physical hazards: Slips, trips, and falls; exposure to loud noise; machinery and equipment hazards; and working at heights.

- Chemical hazards: Exposure to toxic substances, flammable liquids, and corrosive materials.

- Biological hazards: Exposure to bacteria, viruses, and other pathogens.

- Ergonomic hazards: Repetitive motions, awkward postures, and heavy lifting.

To mitigate these hazards, employers must implement comprehensive safety protocols that address each specific risk. This includes:

- Training and education: Providing employees with training on safety procedures, hazard identification, and personal protective equipment (PPE) use.

- Engineering controls: Implementing design changes to equipment and workspaces to eliminate or minimize hazards.

- Administrative controls: Establishing work procedures, policies, and guidelines to promote safe work practices.

- Personal protective equipment (PPE): Providing employees with appropriate PPE, such as safety glasses, gloves, respirators, and hearing protection.

Impact of Safety on Insurance Premiums

Let’s consider a hypothetical scenario:

Two construction companies, Company A and Company B, operate in the same industry and have similar workforce sizes. However, Company A prioritizes safety and has implemented robust safety protocols, resulting in a low rate of workplace accidents. Company B, on the other hand, has a lax approach to safety, leading to a higher frequency of accidents and injuries.

As a result of their respective safety records, Company A enjoys a lower workers’ compensation insurance premium compared to Company B. This illustrates how prioritizing safety not only reduces the risk of accidents and injuries but also leads to significant cost savings in the form of lower insurance premiums.

Workers’ Compensation and Legal Issues

While workers’ compensation is designed to be a straightforward system, legal disputes can arise. These disputes can involve the eligibility for benefits, the extent of benefits, or the process for obtaining them.

Common Legal Disputes

Legal disputes in workers’ compensation cases often stem from disagreements about the nature of the injury or illness, the cause of the injury or illness, or the extent of the disability. Here are some common legal disputes:

- Whether an injury or illness is work-related: This can be a complex issue, especially when the injury or illness is not immediately apparent or has a gradual onset. For example, a worker who develops carpal tunnel syndrome may have difficulty proving that their condition was caused by their work.

- The extent of disability: Disputes may arise about the extent of a worker’s disability and how it affects their ability to work. This is particularly relevant in cases where a worker is claiming permanent disability benefits. For example, a worker who has suffered a back injury may be able to return to work with some restrictions, but may be unable to perform their previous job duties. In such cases, the worker may be eligible for partial disability benefits.

- The amount of benefits: Disputes may arise about the amount of benefits a worker is entitled to. This can be a complex issue, as benefits are often calculated based on a worker’s lost wages. For example, a worker who is self-employed may have difficulty proving their lost wages, as they may not have a fixed salary.

- The process for obtaining benefits: Disputes may arise about the process for obtaining benefits. This can include issues such as the timeliness of payments, the denial of claims, or the appeal process. For example, a worker may be denied benefits because they did not file their claim within the required timeframe.

Role of Attorneys

Attorneys play a crucial role in workers’ compensation cases. They can help workers navigate the complex legal system and protect their rights. Here are some of the key roles of attorneys in workers’ compensation cases:

- Provide legal advice: Attorneys can advise workers on their rights and obligations under the workers’ compensation system. They can also help workers understand the claims process and the different types of benefits available.

- File claims and appeals: Attorneys can file claims on behalf of workers and appeal denied claims. They can also negotiate settlements with insurance companies.

- Represent workers at hearings: Attorneys can represent workers at hearings before administrative law judges. They can also represent workers in court if their case is appealed.

Workplace Discrimination Related to Claims

It’s important to note that workers who file workers’ compensation claims are protected from workplace discrimination. This means that employers cannot retaliate against workers for filing a claim. Examples of workplace discrimination related to workers’ compensation claims include:

- Demotion: An employer may demote a worker who has filed a workers’ compensation claim. For example, an employer may transfer a worker to a less desirable position or reduce their responsibilities.

- Termination: An employer may terminate a worker who has filed a workers’ compensation claim. This is illegal and can be grounds for a lawsuit.

- Harassment: An employer may harass a worker who has filed a workers’ compensation claim. This can include verbal abuse, threats, or other forms of intimidation.

Impact of Legal Precedent

Legal precedent, also known as *stare decisis*, plays a significant role in workers’ compensation law. This means that courts will generally follow the decisions of previous courts in similar cases. This ensures consistency and predictability in the application of the law. However, legal precedent can also change over time as courts consider new arguments and evidence. For example, in recent years, courts have been more likely to recognize the validity of mental health claims related to workplace stress.

Ultimate Conclusion

Understanding state workers’ compensation insurance is crucial for both employees and employers. This system serves as a vital safety net, ensuring that workers receive necessary care and support in the event of an injury or illness. By navigating the intricacies of this complex system, individuals and businesses can ensure their rights and responsibilities are met, fostering a safer and more secure workplace for all.

Expert Answers: State Workers Compensation Insurance

What happens if my employer doesn’t have workers’ compensation insurance?

If your employer does not have workers’ compensation insurance, they are in violation of the law. You may be able to file a claim directly with the state, and your employer could face fines and penalties.

How long do I have to file a workers’ compensation claim?

The time limit for filing a workers’ compensation claim varies by state, but it’s typically within a few months of the injury or illness. It’s important to consult with your state’s regulations or a legal professional for specific details.

Can I choose my own doctor for treatment under workers’ compensation?

In most cases, your employer or the insurance company will designate a doctor for your treatment. However, you may be able to request a change of physician under certain circumstances. It’s advisable to check your state’s regulations and consult with a legal professional if you have any questions.