The State of Nevada Division of Insurance plays a vital role in safeguarding the interests of consumers and ensuring a fair and stable insurance market. Established to regulate the insurance industry, the Division has a rich history of protecting Nevada residents and businesses from unfair practices and financial risks. Its primary responsibility is to ensure that insurance companies operate responsibly and that consumers have access to reliable and affordable insurance products.

From licensing and registration requirements for insurance companies and agents to investigating insurance fraud and misconduct, the Division actively monitors and oversees the insurance market. It also provides consumer education and resources to empower individuals to make informed decisions about their insurance needs. This commitment to consumer protection is evident in the Division’s proactive approach to addressing consumer complaints and resolving disputes.

Overview of the Nevada Division of Insurance

The Nevada Division of Insurance (DOI) plays a crucial role in regulating the insurance industry in Nevada, protecting consumers, and ensuring the financial stability of insurance companies. The DOI is a state agency that operates under the Nevada Department of Business and Industry.

History of the Nevada Division of Insurance

The Nevada Division of Insurance has a long history dating back to the early 20th century. The first insurance commissioner was appointed in 1911, and the DOI was formally established in 1919. Over the years, the DOI has evolved to meet the changing needs of the insurance industry and the people of Nevada.

Key Functions and Responsibilities

The Nevada Division of Insurance has a wide range of functions and responsibilities, including:

- Licensing and regulating insurance companies and agents

- Examining insurance companies to ensure financial solvency

- Investigating consumer complaints and resolving disputes

- Developing and enforcing insurance laws and regulations

- Educating consumers about insurance products and services

- Promoting fair and competitive insurance markets

The DOI’s primary responsibility is to protect consumers by ensuring that insurance companies operate fairly and responsibly. The DOI also works to ensure that consumers have access to affordable and comprehensive insurance coverage.

Licensing and Regulating Insurance Companies and Agents

The DOI is responsible for licensing and regulating insurance companies and agents operating in Nevada. This includes ensuring that companies meet the state’s financial requirements and that agents are properly trained and qualified to sell insurance. The DOI also monitors the activities of licensed companies and agents to ensure compliance with state laws and regulations.

Examining Insurance Companies to Ensure Financial Solvency

The DOI conducts regular examinations of insurance companies to assess their financial health. This includes reviewing the companies’ assets, liabilities, and reserves to ensure that they have enough money to pay claims and meet their financial obligations. The DOI also monitors the companies’ investment strategies and risk management practices.

Investigating Consumer Complaints and Resolving Disputes

The DOI investigates consumer complaints about insurance companies and agents. This includes complaints about unfair or deceptive practices, claims denials, and other issues. The DOI works to resolve disputes between consumers and insurance companies, and it may take enforcement action against companies that violate state laws or regulations.

Developing and Enforcing Insurance Laws and Regulations

The DOI is responsible for developing and enforcing insurance laws and regulations in Nevada. This includes working with the Nevada Legislature to pass new laws and regulations, and it also includes interpreting and applying existing laws and regulations. The DOI’s goal is to ensure that the state’s insurance laws and regulations are fair, clear, and effective.

Educating Consumers About Insurance Products and Services

The DOI provides consumers with information about insurance products and services. This includes information about the different types of insurance available, the rights and responsibilities of policyholders, and how to file complaints. The DOI also offers educational materials and workshops to help consumers understand insurance concepts and make informed decisions about their insurance coverage.

Promoting Fair and Competitive Insurance Markets

The DOI works to promote fair and competitive insurance markets in Nevada. This includes ensuring that insurance companies do not engage in anti-competitive practices and that consumers have access to a variety of insurance options. The DOI also monitors the insurance market to identify potential problems and take steps to address them.

Regulatory Framework

The Nevada Division of Insurance operates within a comprehensive legal framework established by state and federal laws. These laws define the scope of the Division’s authority, Artikel insurance regulations, and protect the interests of consumers.

Types of Insurance Regulated

The Nevada Division of Insurance regulates a wide range of insurance products and services. These include:

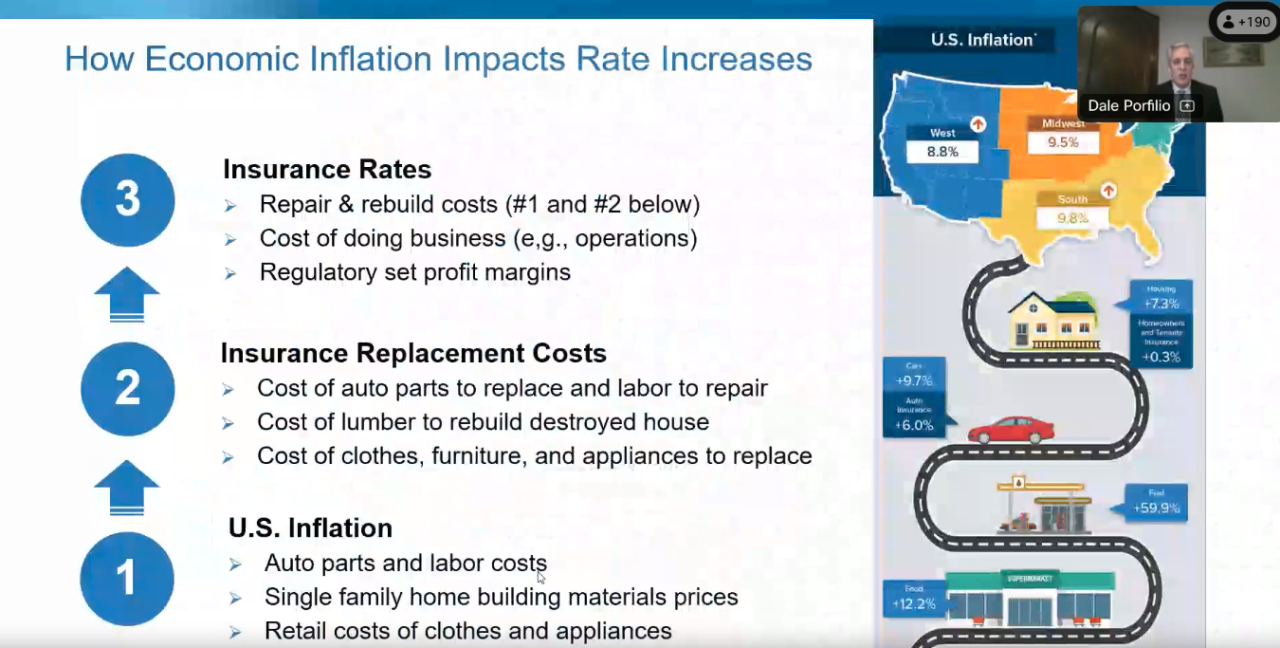

- Property and Casualty Insurance: This type of insurance covers losses to property, such as homes, vehicles, and businesses, and liability for injuries or damages caused to others. Examples include homeowners insurance, auto insurance, and commercial liability insurance.

- Life and Health Insurance: These policies provide financial protection for individuals and families in case of death, illness, or disability. Examples include life insurance, health insurance, disability insurance, and long-term care insurance.

- Workers’ Compensation Insurance: This type of insurance protects employees from financial losses due to work-related injuries or illnesses. It covers medical expenses, lost wages, and other benefits.

- Other Lines of Insurance: The Division also regulates various other types of insurance, including surety bonds, title insurance, and credit insurance.

Licensing and Registration Requirements

The Nevada Division of Insurance enforces strict licensing and registration requirements for insurance companies and agents operating in the state. These requirements are designed to ensure that only qualified and reputable entities are authorized to sell insurance products.

Insurance Companies

- Certificate of Authority: Before an insurance company can operate in Nevada, it must obtain a Certificate of Authority from the Division. This certificate demonstrates that the company meets the state’s financial solvency and regulatory standards.

- Financial Reporting: Insurance companies are required to submit regular financial reports to the Division, which allow regulators to monitor the company’s financial health and ensure its ability to meet its obligations to policyholders.

- Compliance with Laws and Regulations: Insurance companies must comply with all applicable state and federal laws and regulations, including those related to pricing, underwriting, and claims handling.

Insurance Agents

- Licensing: Insurance agents must be licensed by the Nevada Division of Insurance to sell insurance products in the state. The licensing process involves passing an exam and meeting specific educational and experience requirements.

- Continuing Education: Licensed insurance agents are required to complete continuing education courses to maintain their licenses and stay up-to-date on industry changes and regulations.

- Ethical Conduct: Insurance agents are expected to adhere to high ethical standards in their interactions with clients. They must act in the best interests of their clients and avoid engaging in any fraudulent or deceptive practices.

Consumer Protection

The Nevada Division of Insurance is committed to protecting insurance consumers. We work hard to ensure that consumers are treated fairly and have access to the information and resources they need to make informed decisions about their insurance.

The Division investigates complaints from consumers regarding insurance companies and agents. We also provide educational materials and resources to help consumers understand their rights and responsibilities. The Division has a dedicated team of consumer protection specialists who work to resolve consumer issues.

Common Consumer Complaints

The Division receives a variety of consumer complaints, but some of the most common include:

- Denial of claims

- Unfair or deceptive practices

- Problems with insurance agents

- Billing errors

Resources and Services for Consumers

The Division offers a variety of resources and services to help consumers protect themselves. These include:

- Consumer Complaint Form: This form allows consumers to file complaints with the Division. The form is available online and can be submitted electronically or by mail.

- Consumer Information: The Division website provides a wealth of information about insurance topics, including consumer rights, common insurance scams, and how to file a complaint.

- Insurance Company Information: Consumers can access information about insurance companies licensed in Nevada, including their financial ratings, consumer complaints, and contact information.

- Educational Materials: The Division offers a variety of educational materials, including brochures, fact sheets, and videos, on topics such as insurance basics, choosing the right insurance, and understanding your policy.

- Consumer Assistance: The Division’s consumer protection specialists are available to answer questions and provide assistance to consumers who have insurance-related problems.

Market Oversight and Supervision

The Nevada Division of Insurance plays a crucial role in ensuring the stability and integrity of the insurance market within the state. To accomplish this, the Division employs various methods to monitor the market, investigate potential fraud and misconduct, and handle situations involving insolvent insurance companies.

Monitoring the Insurance Market

The Division utilizes a comprehensive approach to monitor the insurance market, including:

- Financial Examinations: The Division conducts regular financial examinations of insurance companies operating in Nevada to assess their financial health and compliance with state regulations. These examinations involve reviewing financial statements, analyzing investment portfolios, and evaluating risk management practices.

- Market Conduct Examinations: The Division also conducts market conduct examinations to assess insurance companies’ adherence to fair business practices and consumer protection laws. These examinations focus on areas such as advertising, sales practices, claims handling, and customer service.

- Data Analysis: The Division leverages data analysis techniques to identify potential trends and patterns in the insurance market. This includes analyzing insurance premiums, claims data, and market share information to identify areas of concern and potential risks.

- Consumer Complaints: The Division carefully investigates consumer complaints received about insurance companies. These complaints can provide valuable insights into potential market conduct issues and help the Division identify companies requiring further scrutiny.

Investigating Insurance Fraud and Misconduct, State of nevada division of insurance

The Division is committed to protecting consumers from insurance fraud and misconduct. To accomplish this, the Division employs a dedicated team of investigators who are trained to identify and investigate various types of insurance fraud, including:

- Claims Fraud: This involves individuals or companies submitting fraudulent claims for insurance benefits. Examples include exaggerating injuries or losses, submitting false documentation, or staging accidents.

- Premium Fraud: This includes individuals or companies engaging in activities to avoid paying premiums, such as providing false information on applications or failing to disclose material facts.

- Agent Misconduct: This encompasses unethical or illegal practices by insurance agents, such as misrepresenting policy terms, engaging in unfair sales tactics, or failing to provide adequate disclosures.

The Division’s investigative process typically involves:

- Receiving and Reviewing Complaints: The Division starts by receiving and reviewing complaints from consumers, insurance companies, or other stakeholders. These complaints often provide initial clues about potential fraud or misconduct.

- Conducting Investigations: The Division conducts thorough investigations, which may involve interviewing witnesses, reviewing documents, and obtaining evidence. The investigators leverage their expertise and specialized training to identify and gather relevant information.

- Taking Action: Based on the findings of the investigation, the Division can take various actions, including issuing cease and desist orders, imposing fines, or referring cases to law enforcement agencies for criminal prosecution.

Handling Insurance Company Insolvencies

The Division has a responsibility to protect policyholders in the event of an insurance company insolvency. This involves:

- Monitoring Financial Health: The Division closely monitors the financial health of insurance companies operating in Nevada. This includes reviewing financial statements, analyzing investment portfolios, and evaluating risk management practices.

- Early Intervention: When the Division identifies potential financial difficulties in an insurance company, it may take early intervention measures, such as requiring the company to implement corrective actions or increase its capital reserves.

- Liquidation and Rehabilitation: In cases where an insurance company becomes insolvent, the Division may initiate liquidation or rehabilitation proceedings. Liquidation involves winding down the company’s operations and distributing assets to policyholders and creditors. Rehabilitation aims to restructure the company’s operations and restore its financial stability.

- Guaranty Fund: Nevada has a guaranty fund, which provides financial protection to policyholders in the event of an insurance company insolvency. The guaranty fund is funded by assessments levied on insurance companies operating in the state.

Industry Engagement

The Nevada Division of Insurance actively engages with the insurance industry to foster a healthy and competitive market. This engagement involves regular communication, participation in industry events, and collaboration with other regulatory bodies.

Industry Events and Conferences

The Division’s participation in industry events and conferences allows for valuable knowledge sharing, networking, and staying abreast of industry trends.

- The Division regularly attends and participates in conferences organized by the National Association of Insurance Commissioners (NAIC), which provides a platform for state insurance regulators to share best practices and coordinate regulatory initiatives.

- The Division also participates in conferences and workshops hosted by industry associations, such as the Nevada Insurance Council, to engage directly with insurance professionals and gain insights into industry perspectives.

- These events provide opportunities for the Division to present its regulatory priorities, gather feedback from industry stakeholders, and address emerging issues.

Collaboration with Other Regulatory Bodies

The Division recognizes the importance of collaboration with other regulatory bodies to ensure a consistent and effective regulatory environment.

- The Division actively collaborates with the NAIC to harmonize regulatory standards and promote uniformity across states.

- The Division also collaborates with other state insurance departments on issues of mutual concern, such as fraud investigations and market conduct examinations.

- This collaboration strengthens regulatory oversight, promotes efficiency, and ensures that consumers are protected across state lines.

Key Initiatives and Programs: State Of Nevada Division Of Insurance

The Nevada Division of Insurance is committed to fostering a fair, stable, and competitive insurance market that protects consumers and supports the industry. The Division accomplishes this through a variety of initiatives and programs designed to achieve specific goals and objectives.

Consumer Protection Initiatives

The Division prioritizes consumer protection by offering resources, tools, and services to empower individuals to make informed decisions about their insurance needs.

- Nevada Insurance Consumer Guide: This comprehensive guide provides consumers with information on various insurance products, rights, and responsibilities. It explains the complaint process and provides contact information for assistance.

- Consumer Education Programs: The Division regularly conducts workshops and seminars on topics such as understanding insurance policies, resolving insurance disputes, and navigating the claims process.

- Financial Literacy Initiatives: Recognizing the importance of financial literacy, the Division collaborates with community organizations to educate consumers about insurance concepts and financial planning.

Market Oversight and Supervision

The Division actively monitors the insurance market to ensure compliance with regulations and protect consumers from unfair or deceptive practices.

- Market Conduct Examinations: The Division conducts regular examinations of insurance companies to assess their compliance with state laws and regulations. These examinations ensure fair pricing, underwriting practices, and claims handling.

- Data Analysis and Monitoring: The Division utilizes sophisticated data analytics to identify trends, potential risks, and emerging issues in the insurance market. This allows for proactive oversight and timely interventions.

- Industry Collaboration: The Division collaborates with insurance companies, industry associations, and other stakeholders to promote best practices, identify potential risks, and enhance consumer protection.

Industry Engagement

The Division actively engages with the insurance industry to foster collaboration, communication, and understanding.

- Industry Advisory Groups: The Division convenes industry advisory groups to gather input on regulatory issues, discuss best practices, and promote a healthy and stable insurance market.

- Regulatory Guidance and Support: The Division provides clear and timely guidance to insurance companies on regulatory requirements, ensuring compliance and promoting a consistent approach to industry practices.

- Professional Development Programs: The Division offers professional development opportunities for insurance professionals to enhance their knowledge, skills, and understanding of the regulatory landscape.

Contact Information and Resources

The Nevada Division of Insurance is dedicated to providing comprehensive resources and support to consumers, insurance companies, and stakeholders. To ensure convenient access to information and assistance, the Division offers a variety of contact methods and online resources.

Contact Information

The Nevada Division of Insurance can be reached through various channels:

- Phone: (702) 486-4700

- Fax: (702) 486-4725

- Email: insurance.division@nv.gov

- Mailing Address: Nevada Division of Insurance, 1000 E. Williams Ave., Suite 100, Las Vegas, NV 89101

Online Resources and Publications

The Nevada Division of Insurance provides a wealth of information and resources online:

- Website: www.insurance.nv.gov: The official website offers comprehensive information on insurance regulations, consumer protection, industry news, and more. It also provides access to publications, forms, and frequently asked questions.

- Consumer Guides: The website features a library of consumer guides on various insurance topics, such as auto insurance, health insurance, and life insurance. These guides provide essential information to help consumers understand their rights and make informed decisions.

- News and Announcements: The website regularly publishes news articles, press releases, and announcements related to the insurance industry in Nevada. This section keeps stakeholders informed about important developments and updates.

- Publications: The Division publishes various reports, bulletins, and other documents that provide insights into the Nevada insurance market and regulatory landscape. These publications are available for download on the website.

Department Contact Information

The Nevada Division of Insurance is organized into several departments, each specializing in specific areas of insurance regulation and consumer protection. Below is a table listing the contact information for each department:

| Department | Phone | |

|---|---|---|

| Consumer Services | (702) 486-4700 | insurance.division@nv.gov |

| Market Conduct | (702) 486-4700 | insurance.division@nv.gov |

| Financial Analysis | (702) 486-4700 | insurance.division@nv.gov |

| Licensing and Examinations | (702) 486-4700 | insurance.division@nv.gov |

| Legal and Legislative Affairs | (702) 486-4700 | insurance.division@nv.gov |

Final Wrap-Up

The Nevada Division of Insurance stands as a crucial guardian of consumer rights and a key regulator of the insurance market. Through its comprehensive oversight, robust regulatory framework, and unwavering commitment to consumer protection, the Division ensures a stable and responsible insurance industry that benefits both consumers and businesses alike. Its dedication to fairness, transparency, and accountability continues to shape a strong and reliable insurance environment in Nevada.

FAQ Summary

How do I file a complaint against an insurance company?

You can file a complaint with the Nevada Division of Insurance online, by mail, or by phone. The Division will investigate your complaint and attempt to resolve it.

What types of insurance are regulated by the Nevada Division of Insurance?

The Division regulates all types of insurance, including health, auto, home, life, and business insurance.

How can I find an insurance agent in Nevada?

You can search for licensed insurance agents on the Nevada Division of Insurance website.