State of Maryland life insurance offers a crucial safety net for residents, ensuring financial security for loved ones in the event of unexpected loss. Maryland’s unique life insurance landscape is shaped by factors such as a strong economy, a diverse population, and a robust regulatory environment.

This comprehensive guide explores the various types of life insurance available in Maryland, the regulatory framework that governs the industry, and the key considerations for choosing the right policy. We’ll also delve into the benefits of life insurance for Maryland residents, providing valuable resources and insights to help you make informed decisions about your financial future.

Maryland Life Insurance Overview

Maryland’s life insurance market is a significant sector within the state’s financial landscape. The state’s residents are increasingly recognizing the importance of life insurance, driving the demand for diverse coverage options.

Factors Influencing Demand for Life Insurance in Maryland

Several key factors influence the demand for life insurance in Maryland, including:

- Growing Population and Household Formation: Maryland’s population is steadily increasing, with a growing number of households. This trend directly impacts the demand for life insurance as individuals and families seek financial protection for their loved ones.

- Rising Cost of Living: The cost of living in Maryland, particularly in major metropolitan areas, is relatively high. This factor reinforces the need for life insurance to ensure financial stability for families in case of unexpected events.

- Shifting Demographics: Maryland’s population is becoming more diverse, with a growing number of younger individuals and families. These demographic changes influence life insurance preferences, as younger generations often prioritize financial security and protection.

- Increased Awareness of Financial Planning: Financial literacy and planning are becoming more prevalent in Maryland. Individuals are increasingly recognizing the importance of life insurance as a vital component of comprehensive financial planning.

Unique Characteristics of Maryland’s Life Insurance Landscape

Maryland’s life insurance landscape exhibits several distinctive features:

- Strong Regulatory Environment: Maryland has a robust regulatory framework for the life insurance industry, ensuring consumer protection and financial stability. This regulatory environment fosters trust and confidence among consumers.

- Diverse Insurance Provider Landscape: Maryland is home to a wide range of life insurance providers, offering a variety of coverage options to cater to different needs and budgets. This competitive market benefits consumers by providing choices and potentially lower premiums.

- Emphasis on Consumer Education: Maryland’s insurance regulators and industry associations actively promote consumer education initiatives to increase awareness about life insurance and its benefits. This focus on consumer education empowers individuals to make informed decisions.

Types of Life Insurance in Maryland

Maryland residents have a variety of life insurance options to choose from, each with its own set of benefits and drawbacks. Understanding these differences can help you select the policy that best fits your individual needs and financial goals.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you will no longer be covered.

Advantages

- Term life insurance is generally the most affordable type of life insurance, making it a good option for individuals on a budget.

- It offers significant coverage for a relatively low premium, providing financial protection for your family during a crucial period.

Disadvantages

- Term life insurance does not build cash value, so it does not provide any investment or savings benefits.

- Once the term expires, you will need to renew your policy or purchase a new one, which may be more expensive depending on your age and health.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning you will always be insured as long as you continue paying your premiums. In addition to providing a death benefit, whole life insurance policies also build cash value that you can borrow against or withdraw from.

Advantages

- Whole life insurance offers lifelong coverage, ensuring your beneficiaries will receive a death benefit regardless of when you pass away.

- The cash value component of whole life insurance can provide you with a source of funds for emergencies, retirement, or other financial needs.

Disadvantages

- Whole life insurance is significantly more expensive than term life insurance due to the cash value component.

- The cash value growth rate is often lower than other investment options, and it may not keep pace with inflation.

Universal Life Insurance

Universal life insurance combines death benefit coverage with a flexible investment component. You can adjust your premiums and death benefit amount, and you have the option to invest your premiums in a variety of sub-accounts.

Advantages

- Universal life insurance offers flexibility in premium payments and death benefit amounts, allowing you to adjust your coverage based on your changing needs.

- The investment component provides the potential for higher returns than whole life insurance, although it also carries more risk.

Disadvantages

- Universal life insurance can be complex and difficult to understand, requiring careful consideration and potentially professional advice.

- The investment component carries market risk, meaning your cash value could decrease if the investments perform poorly.

Variable Life Insurance

Variable life insurance is similar to universal life insurance, but it offers even greater investment flexibility. You can invest your premiums in a wider range of sub-accounts, including stocks, bonds, and mutual funds.

Advantages

- Variable life insurance offers the potential for higher returns than other types of life insurance, but it also carries more risk.

- The investment component provides greater control over your assets and allows you to customize your portfolio to meet your specific financial goals.

Disadvantages

- Variable life insurance is generally more expensive than other types of life insurance due to the higher investment risk.

- The investment component carries market risk, meaning your cash value could decrease significantly if the investments perform poorly.

Life Insurance Regulations in Maryland

Maryland has a comprehensive set of regulations governing the life insurance industry, ensuring fair practices and consumer protection. These regulations are enforced by the Maryland Insurance Administration (MIA), which plays a vital role in overseeing the industry and safeguarding the interests of Maryland residents.

Maryland Insurance Administration

The MIA is the state agency responsible for regulating the insurance industry in Maryland. Its primary function is to protect consumers by ensuring that insurance companies operate fairly and responsibly. The MIA achieves this through various means, including:

- Licensing and Monitoring: The MIA licenses and monitors insurance companies and agents operating in Maryland, ensuring they meet specific requirements and adhere to ethical standards.

- Enforcing Laws and Regulations: The MIA enforces state laws and regulations governing life insurance, including those related to product offerings, pricing, and consumer protection.

- Investigating Complaints: The MIA investigates consumer complaints regarding life insurance practices, addressing issues such as unfair treatment, misleading information, or improper claims handling.

- Providing Consumer Education: The MIA provides educational resources and guidance to consumers on life insurance topics, helping them make informed decisions about their coverage.

Consumer Protection Measures

Maryland residents have access to several consumer protection measures related to life insurance, ensuring they are treated fairly and their rights are upheld. These measures include:

- The Maryland Insurance Code: This code Artikels the legal framework for life insurance in Maryland, including provisions related to policy disclosures, claims procedures, and consumer rights.

- The Maryland Insurance Administration: The MIA acts as a consumer advocate, investigating complaints and resolving disputes between consumers and insurance companies.

- The Maryland Life and Health Insurance Guaranty Association: This association provides financial protection to policyholders in the event that an insurance company becomes insolvent, ensuring they receive their benefits.

- The Maryland Unfair Trade Practices Act: This act prohibits insurance companies from engaging in unfair or deceptive business practices, protecting consumers from misleading sales tactics or unfair pricing.

Choosing the Right Life Insurance Policy

Finding the right life insurance policy in Maryland can feel overwhelming, but with careful planning and understanding, you can make an informed decision. This guide will help you navigate the process of selecting a policy that meets your unique needs and budget.

Factors to Consider

When choosing a life insurance policy, several factors should be taken into account to ensure the policy meets your needs and provides adequate coverage.

- Coverage Amount: The coverage amount, or death benefit, is the sum paid to your beneficiaries upon your death. This amount should be sufficient to cover your outstanding debts, funeral expenses, and provide financial support for your loved ones.

- Premiums: Premiums are the regular payments you make to maintain your life insurance policy. They can vary significantly based on factors such as your age, health, lifestyle, and the type of policy you choose.

- Policy Terms: The policy terms define the length of time your coverage will remain in effect and the conditions under which the death benefit will be paid. Some policies offer a fixed term, while others offer lifetime coverage.

Comparing Quotes, State of maryland life insurance

Once you have a clear understanding of your life insurance needs, you can start comparing quotes from different insurers.

- Use Online Comparison Tools: Several websites allow you to compare quotes from multiple insurers simultaneously, making the process more efficient.

- Contact Insurers Directly: Reach out to insurance agents or brokers to get personalized quotes and discuss your specific needs.

- Review Policy Details Carefully: Don’t just focus on the premium amount. Pay attention to the coverage amount, policy terms, and any exclusions or limitations.

Tips for Finding the Best Value

Finding the best value for life insurance involves considering both the cost and the coverage provided.

- Shop Around: Get quotes from at least three different insurers to ensure you are getting a competitive price.

- Consider Your Health: If you are in good health, you may qualify for lower premiums.

- Look for Discounts: Many insurers offer discounts for nonsmokers, those who participate in health programs, or those who bundle their life insurance with other policies.

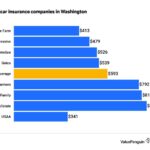

Life Insurance Companies in Maryland

Choosing the right life insurance company is a crucial step in securing your family’s financial future. Maryland offers a diverse range of reputable insurance providers, each with its own unique strengths and offerings. This section will provide a comprehensive overview of some of the top life insurance companies operating in Maryland.

Life Insurance Companies in Maryland

When selecting a life insurance company in Maryland, consider factors such as financial stability, customer service, policy options, and pricing. The following table provides information on several well-established companies:

| Company Name | Types of Policies Offered | Customer Reviews | Contact Information |

|---|---|---|---|

| Aetna | Term Life, Whole Life, Universal Life | 4.2/5 stars (based on independent reviews) | (800) 238-6272 |

| Allstate | Term Life, Whole Life, Universal Life | 3.8/5 stars (based on independent reviews) | (800) 255-7828 |

| Ameritas | Term Life, Whole Life, Universal Life, Indexed Universal Life | 4.0/5 stars (based on independent reviews) | (800) 552-7288 |

| Guardian Life Insurance Company | Term Life, Whole Life, Universal Life, Variable Universal Life | 4.3/5 stars (based on independent reviews) | (800) 482-7336 |

| MassMutual | Term Life, Whole Life, Universal Life, Variable Life | 4.5/5 stars (based on independent reviews) | (800) 272-7855 |

| MetLife | Term Life, Whole Life, Universal Life, Variable Life | 3.9/5 stars (based on independent reviews) | (800) 638-5433 |

| New York Life | Term Life, Whole Life, Universal Life, Variable Life | 4.6/5 stars (based on independent reviews) | (800) 223-1200 |

| Prudential | Term Life, Whole Life, Universal Life, Variable Life | 3.7/5 stars (based on independent reviews) | (800) 778-3833 |

| State Farm | Term Life, Whole Life | 4.1/5 stars (based on independent reviews) | (800) 955-7828 |

| Transamerica | Term Life, Whole Life, Universal Life | 3.5/5 stars (based on independent reviews) | (800) 872-6726 |

Remember that this is not an exhaustive list, and it’s essential to conduct thorough research before making a decision. Consider consulting with a qualified insurance agent or financial advisor to discuss your specific needs and goals.

Life Insurance Benefits for Maryland Residents

Life insurance offers significant benefits for Maryland residents, providing financial security and peace of mind for families and loved ones. It acts as a safety net, ensuring that your loved ones are financially protected in the event of your passing.

Financial Protection for Loved Ones

Life insurance plays a crucial role in providing financial security for surviving family members. In the unfortunate event of the policyholder’s death, the death benefit provides a lump sum payment to beneficiaries, helping them cover expenses such as:

- Funeral costs

- Outstanding debts, including mortgages, credit card bills, and student loans

- Living expenses, such as rent or mortgage payments, utilities, and groceries

- Educational expenses for children

- Medical bills and other unforeseen expenses

This financial support ensures that your family can maintain their standard of living and avoid financial hardship during a difficult time.

Debt Coverage

Life insurance can be a valuable tool for managing debt. The death benefit can be used to pay off outstanding debts, relieving your family of the burden of loan repayments and protecting their credit score. This is particularly beneficial for individuals with significant mortgages, student loans, or other substantial debts.

Estate Planning

Life insurance can be an integral part of estate planning. It allows you to provide for your loved ones and ensure that your assets are distributed according to your wishes. The death benefit can be used to:

- Cover estate taxes and other legal fees

- Fund charitable donations

- Establish trusts for beneficiaries

- Provide financial support for business ventures or investments

Achieving Financial Goals

Life insurance can be a powerful tool for achieving your financial goals. It can provide the necessary funds for:

- Starting a business

- Funding retirement

- Saving for a down payment on a home

- Covering college tuition

By using life insurance as a financial planning tool, Maryland residents can secure their financial future and ensure that their goals are met, even in unforeseen circumstances.

Real-World Examples

- A Maryland resident with a young family purchased a life insurance policy to provide financial security for his wife and children in the event of his death. The policy’s death benefit helped his family cover their living expenses, educational costs, and other financial needs, ensuring their well-being and financial stability.

- A Maryland resident used a life insurance policy to pay off a significant mortgage debt, ensuring that his family would not be burdened with loan payments after his passing. The death benefit provided the necessary funds to clear the mortgage, freeing his family from financial stress and allowing them to remain in their home.

Closure: State Of Maryland Life Insurance

Understanding the intricacies of Maryland life insurance is essential for securing your family’s financial well-being. By carefully considering your individual needs, exploring the different policy options, and utilizing the resources available, you can choose a life insurance policy that provides the protection and peace of mind you deserve.

Helpful Answers

What are the common types of life insurance available in Maryland?

Maryland residents can choose from various types of life insurance, including term life, whole life, universal life, and variable life. Each type has its own unique features, benefits, and costs.

How do I find the right life insurance company in Maryland?

When selecting a life insurance company in Maryland, consider factors such as financial stability, customer service, policy features, and pricing. You can research companies online, read customer reviews, and obtain quotes from multiple providers.

What are the benefits of having life insurance in Maryland?

Life insurance provides essential financial protection for Maryland residents, offering peace of mind knowing that your loved ones will be financially secure in the event of your passing. Benefits include covering funeral expenses, debt repayment, and providing income replacement for dependents.