State of Maryland insurance plays a vital role in safeguarding residents and businesses. This guide delves into the Maryland insurance landscape, exploring the various types of coverage available, the factors influencing rates, and essential consumer resources. From understanding the regulatory environment to navigating insurance options, this comprehensive overview equips individuals with the knowledge needed to make informed decisions about their insurance needs.

Maryland’s insurance market is characterized by a diverse range of providers, each offering unique coverage options and services. The state’s regulatory framework ensures consumer protection and fair practices within the industry. This guide will shed light on the key aspects of Maryland insurance, empowering individuals to make informed choices for their personal and financial well-being.

Maryland Insurance Landscape

Maryland’s insurance market is a dynamic and diverse landscape, shaped by a combination of factors, including a robust regulatory environment, a thriving economy, and a significant population density. The state’s insurance industry plays a vital role in protecting individuals and businesses from various risks, ensuring financial stability and peace of mind.

Major Insurance Providers

The Maryland insurance market is home to a wide range of insurance providers, both national and regional. These companies compete to offer various insurance products, including health, auto, home, and life insurance.

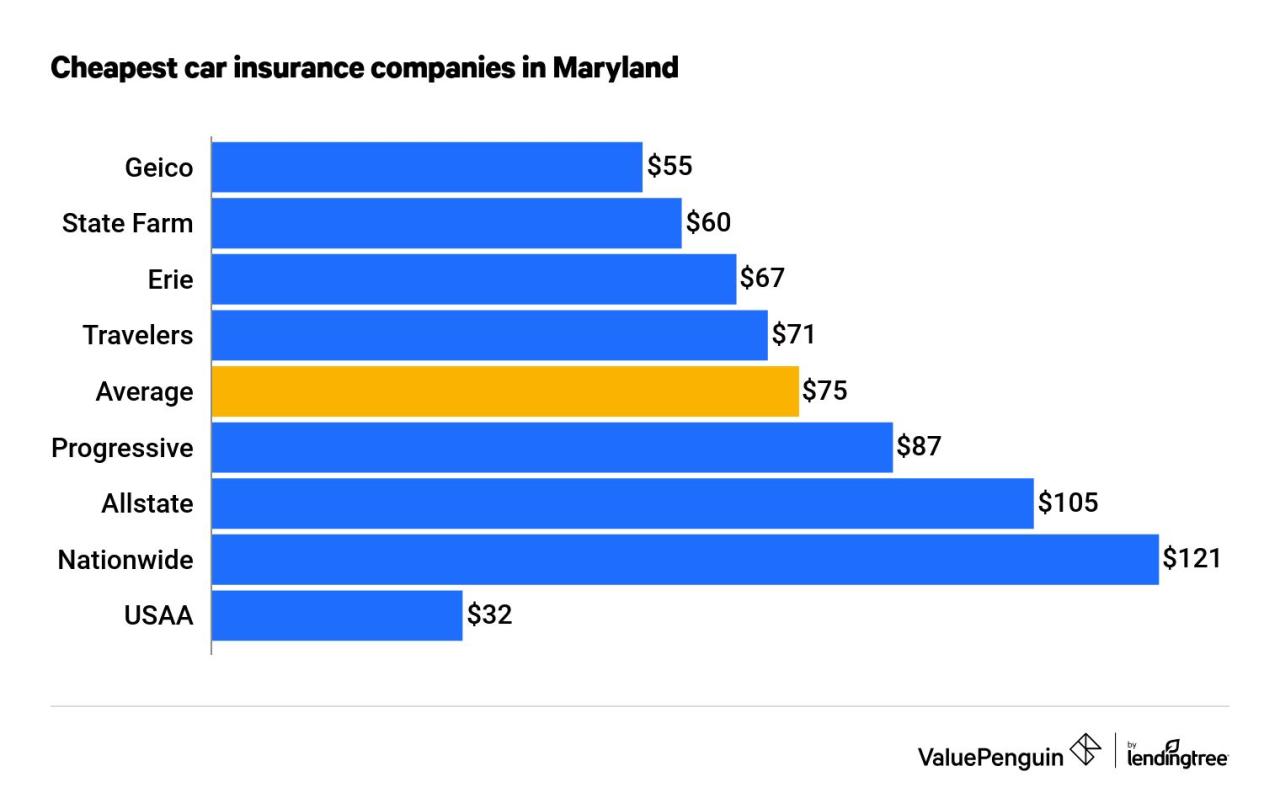

- National Insurance Providers: Major national insurance companies like State Farm, Geico, Allstate, and Progressive have a strong presence in Maryland. These companies offer a comprehensive range of insurance products and services, leveraging their extensive networks and resources to cater to diverse customer needs.

- Regional Insurance Providers: Several regional insurance companies, such as Erie Insurance and The Hartford, also operate in Maryland. These companies often focus on specific market segments, such as commercial insurance or niche products, providing specialized expertise and tailored solutions.

- Local Insurance Agencies: Maryland has a robust network of independent insurance agencies, which offer personalized advice and service to clients. These agencies often represent multiple insurance carriers, allowing them to provide customized insurance solutions based on individual needs and preferences.

Regulatory Environment

Maryland’s insurance industry is governed by a comprehensive regulatory framework, ensuring fair and transparent practices. The Maryland Insurance Administration (MIA) is the primary regulatory body responsible for overseeing the state’s insurance market.

- Maryland Insurance Administration (MIA): The MIA plays a crucial role in protecting consumers, ensuring the financial solvency of insurance companies, and promoting fair competition within the industry. The MIA sets and enforces regulations for all aspects of insurance, including rates, coverage, and claims handling.

- Maryland Insurance Commissioner: The MIA is headed by the Maryland Insurance Commissioner, who is appointed by the governor and serves as the chief executive officer of the agency. The Commissioner is responsible for setting policy, enforcing regulations, and representing the state in insurance-related matters.

Types of Insurance in Maryland

Maryland offers a wide range of insurance options to protect individuals and businesses from various risks. Understanding the different types of insurance available is crucial for making informed decisions about your coverage needs.

Health Insurance

Health insurance is essential for covering medical expenses, including doctor’s visits, hospital stays, and prescription drugs. Maryland offers several health insurance options, including:

- Individual Health Insurance: Purchased directly by individuals, providing coverage for the policyholder and their dependents.

- Employer-Sponsored Health Insurance: Offered by employers as a benefit to their employees. This type of insurance typically offers lower premiums than individual plans.

- Maryland Health Connection: A marketplace for individuals and families to find affordable health insurance plans.

- Medicaid: A government-funded health insurance program for low-income individuals and families.

- Medicare: A federal health insurance program for individuals aged 65 and older and people with disabilities.

Auto Insurance

Auto insurance is mandatory in Maryland and protects drivers and their vehicles against financial losses resulting from accidents, theft, or damage. Common coverage options include:

- Liability Coverage: Covers damages to other vehicles or property and injuries to other people in an accident caused by the insured driver.

- Collision Coverage: Covers damages to the insured vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to the insured vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects the insured driver in case of an accident with an uninsured or underinsured driver.

Home Insurance

Home insurance protects homeowners from financial losses due to damage or destruction of their property, including the structure, contents, and liability. Coverage options typically include:

- Dwelling Coverage: Covers damages to the home’s structure, including the roof, walls, and foundation.

- Contents Coverage: Covers damages to personal belongings inside the home, such as furniture, electronics, and clothing.

- Liability Coverage: Protects homeowners from lawsuits filed by others for injuries or damages that occur on their property.

- Additional Living Expenses Coverage: Covers temporary living expenses if the insured home becomes uninhabitable due to a covered event.

Life Insurance

Life insurance provides financial protection to beneficiaries upon the death of the insured. It can be used to cover funeral expenses, debt payments, or to provide income for dependents. Different types of life insurance include:

- Term Life Insurance: Provides coverage for a specific period, typically 10 to 30 years. It is generally less expensive than permanent life insurance but does not accumulate cash value.

- Whole Life Insurance: Provides lifelong coverage and accumulates cash value that can be borrowed against or withdrawn.

- Universal Life Insurance: Offers flexible premiums and death benefits, with the option to adjust coverage and cash value accumulation.

Insurance Rates and Factors

Insurance rates in Maryland, like in other states, are influenced by a variety of factors. These factors are designed to reflect the risk associated with insuring an individual or property. Understanding these factors can help Maryland residents make informed decisions about their insurance policies and potentially reduce their premiums.

Factors Influencing Insurance Rates

Several factors contribute to the calculation of insurance premiums in Maryland. These factors are categorized into personal and property-related aspects.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their risk profile generally decreases, leading to lower premiums.

- Location: The location where you live or drive can significantly impact your insurance rates. Areas with high crime rates, traffic congestion, or a history of accidents tend to have higher premiums.

- Driving History: Your driving history, including accidents, traffic violations, and DUI convictions, plays a crucial role in determining your insurance rates. A clean driving record usually translates to lower premiums, while accidents or violations can lead to higher premiums.

- Credit Score: In many states, including Maryland, insurance companies use credit scores as a proxy for risk assessment. A good credit score generally indicates responsible financial behavior, which can be associated with lower risk and lower insurance premiums.

- Vehicle Type: The type of vehicle you drive also influences your insurance rates. Sports cars and luxury vehicles, often associated with higher speeds and greater potential for damage, generally have higher premiums compared to standard sedans or hatchbacks.

- Coverage Levels: The amount of coverage you choose, such as liability limits, comprehensive and collision coverage, and uninsured motorist coverage, can affect your premiums. Higher coverage levels generally lead to higher premiums.

- Deductible: Your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can impact your premiums. A higher deductible generally means lower premiums, as you are assuming more financial responsibility in the event of a claim.

Impact of Factors on Different Insurance Types

These factors can impact different types of insurance in Maryland.

- Auto Insurance: Age, driving history, location, and credit score are key factors in auto insurance rates. For example, a young driver with a poor driving record living in a high-risk area may face significantly higher premiums compared to an older driver with a clean record living in a safer area.

- Homeowners Insurance: Location, age of the home, and its value are crucial factors in determining homeowners insurance premiums. Homes in high-risk areas prone to natural disasters, such as hurricanes or earthquakes, may have higher premiums.

- Health Insurance: Age, health status, and location are significant factors in health insurance premiums. Individuals with pre-existing conditions or residing in areas with high healthcare costs may face higher premiums.

Potential Range of Insurance Premiums

The following table provides a hypothetical example of potential premium ranges for different insurance scenarios in Maryland:

| Insurance Type | Scenario | Estimated Premium Range |

|---|---|---|

| Auto Insurance | Young driver (under 25) with a clean driving record living in a safe area | $100 – $200 per month |

| Auto Insurance | Older driver (over 50) with a poor driving record living in a high-risk area | $250 – $400 per month |

| Homeowners Insurance | Newly built home in a low-risk area | $50 – $100 per month |

| Homeowners Insurance | Older home in a high-risk area prone to natural disasters | $150 – $250 per month |

| Health Insurance | Healthy individual with no pre-existing conditions | $200 – $400 per month |

| Health Insurance | Individual with pre-existing conditions and residing in a high-cost area | $500 – $800 per month |

Note: These are hypothetical examples and actual premiums may vary depending on individual circumstances and specific insurance policies.

Consumer Resources and Information

Navigating the insurance landscape in Maryland can be challenging, especially when you’re trying to find the best coverage at the right price. Fortunately, there are various resources available to help Maryland residents make informed decisions about their insurance needs.

Maryland Insurance Administration (MIA)

The Maryland Insurance Administration (MIA) is the primary regulatory body for the insurance industry in the state. It plays a crucial role in protecting consumers by ensuring that insurance companies operate fairly and transparently. The MIA provides valuable resources and information for Maryland residents, including:

- Consumer Guides and Brochures: The MIA offers a range of free guides and brochures on various insurance topics, such as auto insurance, health insurance, and life insurance. These resources provide clear and concise explanations of insurance concepts, consumer rights, and important considerations when purchasing insurance.

- Complaint Resolution: If you have a complaint against an insurance company, you can file it with the MIA. The MIA investigates complaints and works to resolve disputes between consumers and insurers.

- Licensing and Oversight: The MIA licenses and regulates insurance companies, agents, and brokers operating in Maryland. This ensures that only qualified professionals are providing insurance services to Maryland residents.

- Market Monitoring: The MIA monitors the insurance market to identify potential problems and ensure fair competition among insurers.

Consumer Protection Laws and Regulations

Maryland has several consumer protection laws and regulations in place to safeguard the rights of insurance consumers. These laws ensure that consumers are treated fairly and receive the coverage they expect. Key consumer protection laws include:

- Maryland Insurance Code: This code Artikels the rights and responsibilities of both insurance companies and consumers. It covers various aspects of insurance, including policy terms, coverage requirements, and dispute resolution processes.

- Unfair Trade Practices Act: This law prohibits insurance companies from engaging in deceptive or unfair practices, such as misrepresenting coverage, refusing to pay claims without justification, or discriminating against consumers based on certain factors.

- Maryland Fair Credit Reporting Act: This law protects consumers’ privacy and ensures that their credit information is used responsibly by insurance companies.

Key Consumer Rights and Responsibilities

Understanding your rights and responsibilities as an insurance consumer is crucial for making informed decisions and protecting your interests. The following table summarizes key consumer rights and responsibilities:

| Consumer Rights | Consumer Responsibilities |

|---|---|

| The right to accurate and complete information about insurance policies | The responsibility to provide accurate and complete information to the insurance company when applying for insurance |

| The right to fair and non-discriminatory treatment by insurance companies | The responsibility to pay premiums on time and to comply with the terms of the insurance policy |

| The right to a prompt and fair review of insurance claims | The responsibility to notify the insurance company promptly of any events that may trigger coverage under the policy |

| The right to file a complaint with the MIA if you believe an insurance company has violated your rights | The responsibility to understand the terms and conditions of your insurance policy before purchasing it |

Insurance Trends and Future Outlook

The Maryland insurance market is dynamic and constantly evolving, driven by technological advancements, changing consumer needs, and regulatory shifts. Understanding these trends is crucial for both insurers and consumers to navigate the future of insurance in the state.

Technological Advancements

Technological advancements are reshaping the insurance landscape in Maryland, leading to increased efficiency, personalized experiences, and innovative solutions.

- Artificial Intelligence (AI): AI is being implemented in various aspects of insurance, from risk assessment and underwriting to claims processing and fraud detection. AI-powered tools can analyze vast amounts of data, identify patterns, and make more accurate predictions, leading to faster and more efficient decision-making.

- Internet of Things (IoT): Connected devices and sensors are generating real-time data about individuals and their environments. This data can be used to create personalized insurance policies based on actual usage and risk factors. For example, telematics devices in cars can track driving habits and provide discounts for safe driving.

- Blockchain Technology: Blockchain can revolutionize insurance by streamlining processes, enhancing transparency, and improving security. It can be used for managing claims, verifying identities, and creating immutable records.

Evolving Consumer Needs, State of maryland insurance

Consumers are increasingly demanding more personalized, convenient, and digital insurance solutions. This shift is driving insurers to adapt their products and services to meet these evolving needs.

- Digital-First Experiences: Consumers expect to be able to manage their insurance policies, make payments, and file claims online or through mobile apps. Insurers are investing in digital platforms to provide seamless and convenient experiences.

- Personalized Coverage: Consumers want insurance policies tailored to their specific needs and risk profiles. Insurers are using data analytics and AI to develop customized policies that offer greater value and affordability.

- Transparency and Communication: Consumers value clear and concise communication from their insurers. They want to understand their coverage, pricing, and claims processes. Insurers are improving their communication channels and providing more accessible information to enhance customer satisfaction.

Future Developments

Several key developments are expected to shape the future of insurance in Maryland, influencing both the industry and consumers.

- Climate Change and Natural Disasters: As climate change intensifies, the frequency and severity of natural disasters are increasing, leading to higher insurance premiums and a greater need for risk management strategies. Insurers are developing new products and services to address these challenges, such as parametric insurance that provides payouts based on predefined weather events.

- Cybersecurity Threats: Cyberattacks are becoming increasingly sophisticated, posing significant risks to businesses and individuals. Insurers are offering specialized cyber insurance policies to protect against data breaches, ransomware attacks, and other cyber threats.

- Regulatory Changes: State and federal regulations are constantly evolving to address new challenges and ensure consumer protection. Insurers must stay informed about these changes and adapt their operations accordingly.

Closing Summary: State Of Maryland Insurance

Understanding the intricacies of Maryland insurance is crucial for navigating the complexities of personal and business protection. This guide has provided a comprehensive overview of the state’s insurance landscape, encompassing types of coverage, rate determinants, consumer resources, and future trends. By equipping individuals with this knowledge, we aim to empower them to make informed decisions and secure the appropriate insurance solutions for their specific needs.

FAQ Overview

What are the major insurance providers in Maryland?

Maryland’s insurance market is home to a wide range of providers, including national giants like State Farm, Geico, and Allstate, as well as regional and local companies. It’s essential to compare quotes from multiple providers to find the best rates and coverage options.

How do I file a claim in Maryland?

The process for filing a claim varies depending on the type of insurance and the specific provider. Generally, you’ll need to contact your insurer as soon as possible after an incident and provide them with the necessary information, such as a police report or medical records. Your insurer will then guide you through the claim process.