The state of Iowa insurance encompasses a diverse landscape, shaping the financial well-being of its residents and businesses. From traditional property and casualty coverage to specialized insurance solutions, Iowa offers a wide range of options to meet the unique needs of its population.

This overview delves into the key aspects of Iowa’s insurance market, providing insights into its regulatory framework, available coverage options, and the evolving trends that are shaping the future of insurance in the state.

Iowa Insurance Landscape

The Iowa insurance market is a dynamic environment, characterized by a diverse range of players, evolving customer needs, and ongoing regulatory changes. Understanding the current state of the market, key trends, and challenges is crucial for insurance companies seeking to thrive in this competitive landscape.

Key Trends and Challenges, State of iowa insurance

The Iowa insurance market faces a number of key trends and challenges that are shaping the industry. These include:

- Growing Demand for Digital Solutions: Consumers are increasingly seeking convenient and accessible insurance solutions, driving the demand for digital platforms and mobile applications. Insurance companies are responding by investing in technology to enhance customer experience and streamline operations.

- Rising Healthcare Costs: Rising healthcare costs are putting pressure on insurance companies, particularly in the health insurance sector. Companies are exploring innovative strategies to manage costs and provide affordable coverage to their customers.

- Natural Disaster Risk: Iowa is susceptible to various natural disasters, including tornadoes, floods, and severe weather events. Insurance companies are facing increased claims related to these events, leading to higher premiums and stricter underwriting practices.

- Cybersecurity Threats: The growing threat of cyberattacks poses a significant risk to insurance companies. Data breaches and system disruptions can lead to financial losses, reputational damage, and regulatory scrutiny.

Regulatory Changes

The insurance industry in Iowa is subject to a complex regulatory framework, which is constantly evolving. Recent changes include:

- Data Privacy Regulations: The state of Iowa has adopted data privacy regulations similar to the European Union’s General Data Protection Regulation (GDPR). These regulations require insurance companies to protect the personal information of their customers and ensure transparency in data handling practices.

- Telemedicine Coverage: Iowa has expanded coverage for telemedicine services, allowing insurance companies to offer virtual healthcare options to their policyholders. This has increased the demand for telemedicine services and created opportunities for insurance companies to innovate in healthcare delivery.

- Rate Regulation: Iowa’s insurance commissioner has implemented rate regulations to ensure fair and competitive pricing in the insurance market. These regulations aim to prevent excessive premium increases and protect consumers from unfair pricing practices.

Competitive Landscape

The Iowa insurance market is characterized by a mix of national and regional insurance companies. The competitive landscape is dynamic, with new entrants and mergers and acquisitions shaping the market. Key factors driving competition include:

- Price and Value: Consumers are increasingly price-sensitive and seeking value for their insurance premiums. Companies are competing on price and offering a range of coverage options to attract customers.

- Customer Experience: Providing excellent customer service and digital capabilities is becoming increasingly important for insurance companies. Companies are investing in technology and customer service initiatives to enhance customer satisfaction.

- Innovation and Product Development: Insurance companies are continuously developing new products and services to meet the evolving needs of their customers. This includes offering customized insurance solutions and leveraging data analytics to personalize coverage.

Types of Insurance in Iowa: State Of Iowa Insurance

Iowa residents, like all Americans, face a wide range of risks that can threaten their financial well-being. From natural disasters to accidents and health issues, these risks necessitate having proper insurance coverage. This section delves into the major types of insurance available in Iowa, explaining their key features and benefits.

Auto Insurance

Auto insurance is a legal requirement in Iowa, protecting drivers and vehicle owners from financial losses arising from accidents.

- Liability Coverage: This protects you from financial responsibility if you cause an accident, covering damages to other vehicles and injuries to other people.

- Collision Coverage: This covers repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: This protects your vehicle against non-accident damages, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re hit by a driver without insurance or with insufficient coverage.

Iowa residents should carefully consider their individual needs and driving habits when choosing auto insurance coverage. Factors like the value of their vehicle, driving history, and location can influence their insurance premiums.

Homeowners Insurance

Homeowners insurance protects your home and belongings from various perils, offering financial security in case of damage or loss.

- Dwelling Coverage: This covers the structure of your home against damage from perils like fire, windstorm, and hail.

- Personal Property Coverage: This protects your belongings inside your home, such as furniture, electronics, and clothing.

- Liability Coverage: This protects you from financial responsibility if someone is injured on your property or if your property causes damage to others.

- Additional Living Expenses Coverage: This covers temporary living expenses if your home becomes uninhabitable due to a covered event.

Iowa’s climate and potential for severe weather events, such as tornadoes and hailstorms, make homeowners insurance a crucial investment for protecting your home and financial well-being.

Health Insurance

Health insurance is essential for covering medical expenses and protecting individuals from financial ruin due to unexpected illnesses or injuries.

- Individual Health Insurance: This is purchased directly by individuals and provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Employer-Sponsored Health Insurance: This is offered by employers to their employees, typically with a wider range of plans and lower premiums compared to individual plans.

- Medicare: This is a federal health insurance program for individuals aged 65 and older, as well as people with certain disabilities.

- Medicaid: This is a joint federal and state program that provides health insurance to low-income individuals and families.

Iowa residents have access to a variety of health insurance options through the Affordable Care Act marketplace, which allows individuals to compare plans and enroll in coverage that meets their needs.

Life Insurance

Life insurance provides financial protection for your loved ones in case of your death, ensuring their financial stability and fulfilling your financial obligations.

- Term Life Insurance: This provides coverage for a specific period, typically 10 to 30 years, and is generally more affordable than permanent life insurance.

- Permanent Life Insurance: This provides lifelong coverage and includes a cash value component that accumulates over time. It can be used for savings, investments, or borrowing against the policy.

Life insurance is crucial for families with dependents, individuals with outstanding debts, and those who want to provide financial security for their loved ones.

Other Types of Insurance

Besides the major types of insurance discussed above, Iowa residents may also consider other insurance options based on their individual needs and circumstances.

- Disability Insurance: This provides income replacement if you become disabled and unable to work.

- Long-Term Care Insurance: This covers the costs of long-term care services, such as nursing homes or assisted living facilities.

- Renters Insurance: This protects your belongings and provides liability coverage if you live in a rental property.

- Business Insurance: This covers various risks faced by businesses, including property damage, liability claims, and employee injuries.

Insurance Regulations in Iowa

Iowa has a comprehensive regulatory framework for insurance, ensuring consumer protection and maintaining the stability of the insurance market. The Iowa Insurance Division, part of the Iowa Department of Banking and Insurance, plays a crucial role in overseeing the insurance industry within the state.

The Role of the Iowa Insurance Division

The Iowa Insurance Division is responsible for regulating all aspects of the insurance industry in Iowa, including:

- Licensing and supervising insurance companies, agents, and brokers.

- Ensuring compliance with state insurance laws and regulations.

- Investigating complaints from consumers and insurance companies.

- Approving insurance rates and forms.

- Monitoring the financial solvency of insurance companies.

The Iowa Insurance Division works to protect consumers by ensuring that insurance companies are financially sound and that they are selling insurance products that are fair and competitive.

Key Regulations and Compliance Requirements

Insurance companies operating in Iowa must comply with a wide range of regulations, including:

- Financial Solvency Requirements: Insurance companies must maintain adequate capital and reserves to ensure they can meet their financial obligations to policyholders. The Iowa Insurance Division regularly monitors the financial health of insurance companies and may take action if a company is deemed to be in danger of insolvency.

- Rate Regulation: The Iowa Insurance Division has the authority to review and approve insurance rates to ensure they are fair and reasonable. This includes ensuring that rates are not unfairly discriminatory and that they reflect the actual costs of providing insurance.

- Consumer Protection Regulations: Iowa has numerous laws and regulations designed to protect consumers from unfair or deceptive insurance practices. These regulations cover areas such as:

- Disclosure requirements for insurance policies.

- Prohibition of unfair or deceptive advertising practices.

- Consumer rights to dispute insurance claims.

- Licensing Requirements: Insurance companies, agents, and brokers must be licensed by the Iowa Insurance Division before they can operate in the state. Licensing requirements include background checks, financial stability requirements, and continuing education.

Recent Changes and Updates to Iowa Insurance Regulations

The Iowa Insurance Division regularly updates its regulations to reflect changes in the insurance industry and to ensure that consumers are protected. Some recent changes include:

- Increased Transparency in Insurance Pricing: The Iowa Insurance Division has implemented new regulations requiring insurance companies to provide consumers with more information about how their insurance rates are calculated. This includes requiring insurers to provide consumers with a personalized rate quote that reflects their individual risk factors.

- Enhanced Consumer Protections for Health Insurance: The Iowa Insurance Division has strengthened consumer protections for health insurance, including requiring insurers to cover essential health benefits and prohibiting insurers from denying coverage based on pre-existing conditions.

- Cybersecurity Regulations: The Iowa Insurance Division has implemented new cybersecurity regulations to protect consumer data and to ensure that insurance companies have adequate safeguards in place to prevent data breaches.

Consumer Resources and Information

Navigating the insurance landscape can be overwhelming, especially for consumers seeking reliable information and resources. This section aims to equip Iowa residents with the necessary tools and knowledge to make informed decisions about their insurance needs.

Available Resources and Information

Iowa insurance consumers have access to a range of resources and information to assist them in understanding their insurance options and navigating the process.

| Resource | Description | Contact Information |

|---|---|---|

| Iowa Insurance Division | The Iowa Insurance Division is the primary regulatory body for insurance in the state. It provides consumer protection, oversees insurance companies, and offers resources and guidance to consumers. | Phone: (515) 281-5705 Email: insurance@iowa.gov Website: https://www.iid.iowa.gov/ |

| National Association of Insurance Commissioners (NAIC) | The NAIC is a national organization that promotes uniformity in insurance regulation across the United States. It provides consumer information and resources, including complaint resolution tools. | Phone: (202) 737-0900 Email: info@naic.org Website: https://www.naic.org/ |

| Iowa Insurance Information Service | This non-profit organization provides education and information about insurance to Iowa consumers. | Phone: (515) 288-3111 Email: info@iowainsuranceinfo.org Website: https://www.iowainsuranceinfo.org/ |

Choosing the Right Insurance Coverage

Selecting the appropriate insurance coverage is crucial to ensuring adequate protection for individuals and their assets. Here’s a step-by-step guide for Iowa residents:

- Assess your needs and risks: Consider your individual circumstances, such as age, family size, property ownership, and potential liabilities. Identify the risks you need to protect yourself from, such as accidents, illnesses, property damage, or legal claims.

- Research different insurance options: Explore various types of insurance policies available, including auto, home, health, life, and disability insurance. Compare coverage options, premiums, and deductibles to find the best fit for your needs.

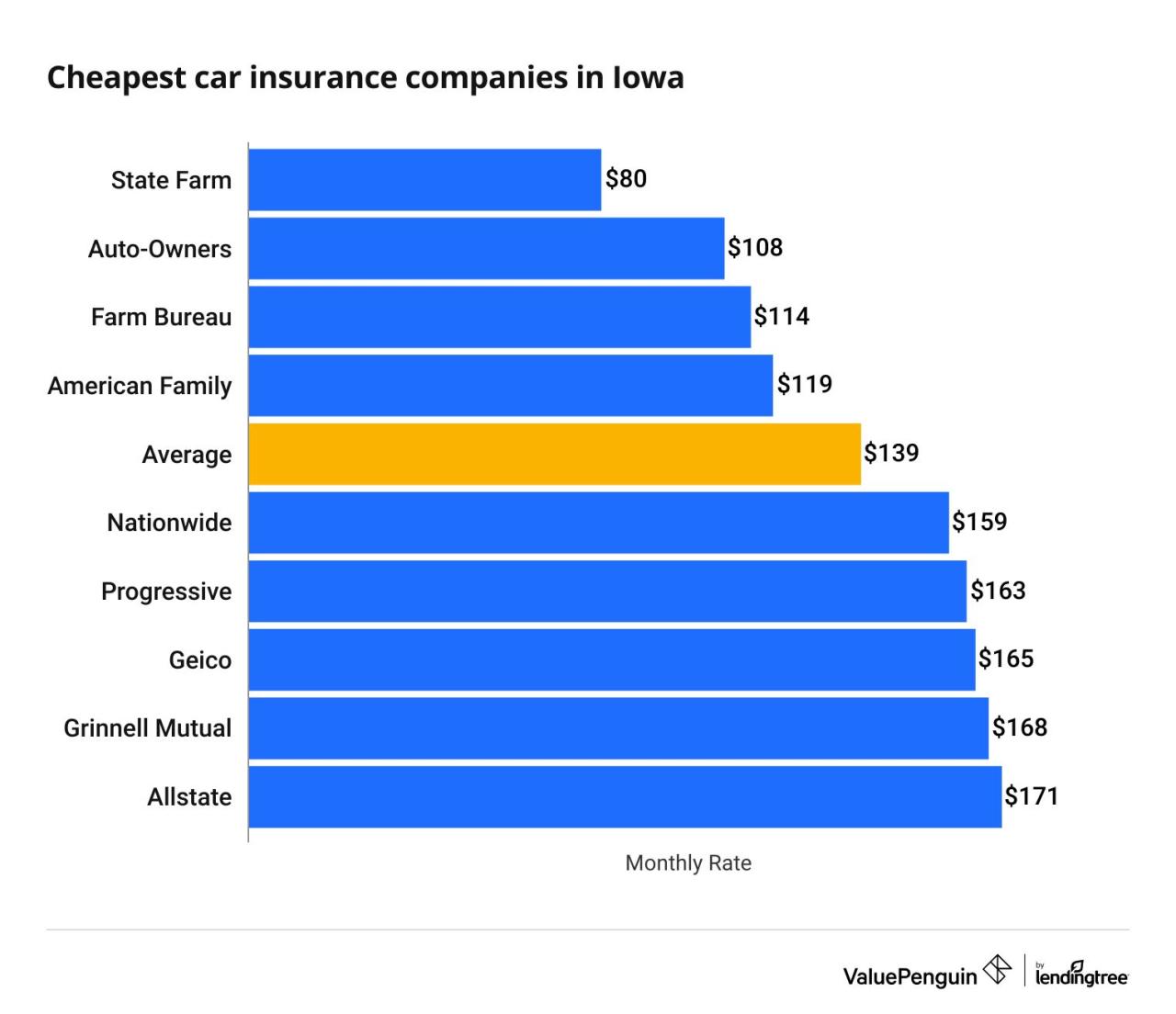

- Get quotes from multiple insurers: Contact several insurance companies to obtain quotes for similar coverage. This allows you to compare prices and coverage options to find the most competitive offer.

- Review policy details carefully: Before signing up, carefully review the policy terms and conditions, including coverage limits, exclusions, and deductibles. Make sure you understand the policy’s provisions and ask any questions you may have.

- Consider your budget and affordability: Choose a policy that provides adequate coverage without straining your finances. Factor in the cost of premiums, deductibles, and potential out-of-pocket expenses.

Reputable Insurance Companies Operating in Iowa

Numerous reputable insurance companies operate in Iowa, offering a wide range of coverage options.

- American Family Insurance

- State Farm Insurance

- Farmers Insurance

- Progressive Insurance

- UnitedHealthcare

- Blue Cross Blue Shield of Iowa

- Principal Financial Group

- Aetna

- Cigna

This is not an exhaustive list, and it’s essential to research and compare multiple companies before making a decision.

Filing Claims and Resolving Insurance Disputes

When filing a claim, it’s crucial to follow the proper procedures and documentation requirements to ensure a smooth and timely process.

- Notify your insurer promptly: Contact your insurance company as soon as possible after an incident, accident, or loss. Provide them with the necessary details and follow their instructions.

- Gather documentation: Collect relevant documentation, such as police reports, medical records, receipts, and photographs, to support your claim.

- Submit your claim: Follow your insurer’s procedures for filing a claim, typically through their website, mobile app, or by contacting their customer service line.

- Keep track of communication: Document all communications with your insurer, including dates, times, and the content of conversations. This can be helpful in case of any disputes.

- Understand your rights: Familiarize yourself with your rights as an insured person, including the right to appeal a claim decision or seek assistance from the Iowa Insurance Division if you believe your insurer is not acting fairly.

In case of a dispute with your insurer, you have several options:

- Negotiate with your insurer: Attempt to resolve the dispute directly with your insurance company. Be prepared to present your case clearly and provide supporting documentation.

- File a complaint with the Iowa Insurance Division: If you are unable to reach a resolution with your insurer, you can file a complaint with the Iowa Insurance Division. They will investigate the matter and attempt to mediate a solution.

- Consider mediation or arbitration: Mediation or arbitration can provide a neutral forum for resolving insurance disputes. These processes involve a third party who facilitates communication and attempts to reach a mutually agreeable solution.

- Seek legal counsel: In some cases, it may be necessary to consult with an attorney specializing in insurance law. They can advise you on your legal options and represent you in court if necessary.

Future of Iowa Insurance

The Iowa insurance industry, like its counterparts nationwide, is poised for significant transformation. Several factors, including technological advancements, evolving consumer preferences, and the changing economic landscape, will shape the future of insurance in the state.

Technological Advancements in Iowa Insurance

Technological advancements are profoundly impacting the insurance industry in Iowa. From artificial intelligence (AI) to blockchain technology, these innovations are streamlining operations, enhancing customer experiences, and creating new opportunities.

- AI-powered risk assessment and underwriting: AI algorithms can analyze vast amounts of data to assess risk more accurately and efficiently, leading to faster and more personalized insurance quotes.

- Digital insurance platforms: Online platforms and mobile apps provide customers with convenient access to insurance information, policy management, and claims filing.

- Telematics and connected devices: Insurance companies are leveraging data from connected vehicles and wearable devices to offer usage-based insurance (UBI) programs, rewarding safe driving habits with lower premiums.

- Blockchain for fraud detection and claims processing: Blockchain technology can enhance transparency and security in claims processing, reducing the risk of fraud and streamlining the payment process.

Evolving Needs and Preferences of Iowa Insurance Consumers

Iowa insurance consumers are becoming increasingly tech-savvy and demanding more personalized and convenient insurance solutions. They value transparency, digital accessibility, and customized coverage options.

- Demand for personalized insurance: Consumers want insurance products tailored to their specific needs and risk profiles, rather than one-size-fits-all solutions.

- Increased focus on digital channels: Consumers prefer to interact with insurance companies through online platforms, mobile apps, and chatbots.

- Emphasis on customer experience: Consumers expect seamless and efficient interactions with insurance companies, including quick response times and personalized communication.

- Growing interest in bundled insurance products: Consumers are seeking convenient options that combine multiple insurance products, such as home, auto, and health insurance, into a single package.

Potential for New Insurance Products and Services in Iowa

The evolving needs of Iowa insurance consumers and technological advancements are paving the way for new insurance products and services. These innovations address emerging risks and cater to the evolving preferences of consumers.

- Cybersecurity insurance: As cyberattacks become more sophisticated, demand for cybersecurity insurance is rising to protect businesses and individuals from financial losses due to data breaches and other cyber incidents.

- Climate change-related insurance: With increasing extreme weather events, insurance products tailored to address the risks associated with climate change are becoming increasingly important. This includes coverage for flood damage, wildfire risk, and other climate-related hazards.

- Insurance for the gig economy: The growth of the gig economy has created a need for insurance products tailored to independent contractors and freelancers, providing coverage for liability, income protection, and other risks specific to their work arrangements.

- Insurtech solutions: Insurtech companies are developing innovative insurance products and services that leverage technology to improve customer experiences and address emerging needs. These solutions include AI-powered claims processing, personalized pricing models, and data-driven risk assessment.

Conclusion

Understanding the state of Iowa insurance is crucial for individuals and businesses alike. By navigating the available resources, choosing the right coverage, and staying informed about industry developments, residents can ensure they are adequately protected and prepared for the future. The Iowa insurance market is dynamic, constantly evolving to meet the changing needs of its stakeholders.

Question Bank

What are the main types of insurance available in Iowa?

Iowa residents have access to a wide range of insurance options, including auto, home, health, life, business, and liability insurance, among others.

How can I find a reputable insurance company in Iowa?

The Iowa Insurance Division provides a list of licensed insurance companies operating in the state. You can also seek recommendations from friends, family, or financial advisors.

What are the most common insurance claims filed in Iowa?

Auto accidents, property damage, and health-related claims are among the most frequently filed insurance claims in Iowa.