State of Georgia insurance verification is a crucial process that ensures individuals and businesses meet legal requirements and have access to necessary services. It’s a complex system involving various stakeholders, including insurance companies, employers, and healthcare providers, each playing a vital role in verifying the validity of insurance coverage.

This comprehensive guide explores the intricacies of Georgia insurance verification, outlining the purpose, methods, requirements, and challenges associated with this essential process. From understanding the different types of verification processes to navigating the legal and regulatory landscape, we’ll delve into the key aspects that ensure smooth and compliant insurance verification in Georgia.

Understanding Georgia Insurance Verification

Insurance verification in Georgia is a crucial process that ensures individuals have the necessary coverage to access healthcare services. It helps healthcare providers and insurance companies determine if a patient is eligible for coverage and what benefits they are entitled to.

Types of Insurance Verification Processes in Georgia

The verification process can vary depending on the type of insurance plan and the healthcare provider. Here are some common types:

- Pre-authorization: This process involves obtaining prior approval from the insurance company before a specific medical procedure or service is performed. It helps ensure the service is medically necessary and covered by the insurance plan.

- Real-time Eligibility Verification: This method allows healthcare providers to verify a patient’s insurance coverage and benefits in real-time using electronic systems. It provides instant information about coverage details and eliminates the need for manual verification processes.

- Manual Verification: This traditional method involves contacting the insurance company directly to confirm coverage details. It can be time-consuming but is still used in some cases.

Key Stakeholders Involved in Insurance Verification

Insurance verification involves several key stakeholders, each with a specific role in the process:

- Insurance Companies: Insurance companies provide coverage and manage benefits for their policyholders. They are responsible for verifying eligibility, determining coverage limits, and authorizing claims.

- Employers: Employers often provide health insurance plans to their employees. They play a role in selecting insurance providers and managing employee benefits.

- Healthcare Providers: Healthcare providers are responsible for delivering medical services to patients. They rely on insurance verification to ensure they are paid for their services and to inform patients about their out-of-pocket expenses.

- Patients: Patients are the ultimate beneficiaries of insurance verification. The process helps them access necessary healthcare services without incurring excessive costs.

Verification Methods in Georgia: State Of Georgia Insurance Verification

Insurance verification in Georgia is crucial for ensuring that individuals and businesses have adequate coverage and are compliant with state regulations. There are various methods available for verifying insurance, each with its own advantages and disadvantages.

Verification Methods in Georgia

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Online Portals | Several online portals, such as the Georgia Department of Insurance website, allow users to verify insurance coverage by entering the policyholder’s information. | Convenient and accessible, 24/7 availability, instant results. | May require accurate policy information, potential for technical issues, limited information provided. |

| Phone Calls | Insurance companies and verification services can be contacted by phone to verify coverage details. | Direct communication with an insurance representative, potential for clarification of information. | Time-consuming, limited availability, potential for human error. |

| Written Requests | Insurance companies and verification services may accept written requests for verification of coverage. | Formal and documented proof of verification, suitable for legal or official purposes. | Slow process, requires physical mail delivery, potential for delays. |

Legal and Regulatory Requirements

Insurance verification in Georgia is governed by specific legal and regulatory requirements. The Georgia Department of Insurance (DOI) plays a crucial role in overseeing insurance practices and ensuring consumer protection. The DOI sets forth guidelines for insurance verification, including the types of information that can be requested and the procedures for verification. For example, the DOI may require insurance companies to provide verification of coverage within a specified timeframe. Additionally, the DOI may investigate complaints related to insurance verification practices.

Verification Requirements for Specific Situations

In Georgia, insurance verification requirements vary depending on the specific situation. Understanding these requirements is crucial for individuals and businesses to comply with legal obligations and ensure smooth transactions.

Employment

Employers in Georgia are required to verify the insurance coverage of their employees. This verification process ensures that employees have access to necessary healthcare benefits and that employers meet their legal obligations.

The Georgia Department of Labor requires employers to verify the insurance coverage of their employees.

- Employers must verify that their employees have health insurance coverage that meets the minimum requirements of the Affordable Care Act (ACA).

- Employers may request proof of insurance from their employees in the form of an insurance card or a letter from the insurance company.

- Employers are also required to provide employees with information about their health insurance coverage, including the plan’s benefits and costs.

Healthcare

Healthcare providers in Georgia are required to verify the insurance coverage of their patients. This verification process ensures that patients have access to necessary medical care and that providers receive appropriate reimbursement from insurance companies.

- Healthcare providers must verify the insurance coverage of their patients before providing services. This includes verifying the patient’s eligibility for coverage and the plan’s benefits.

- Healthcare providers may use various methods to verify insurance coverage, including online verification systems, phone calls to insurance companies, and manual verification through insurance cards.

- Healthcare providers are also required to provide patients with information about their insurance coverage, including the plan’s benefits and costs.

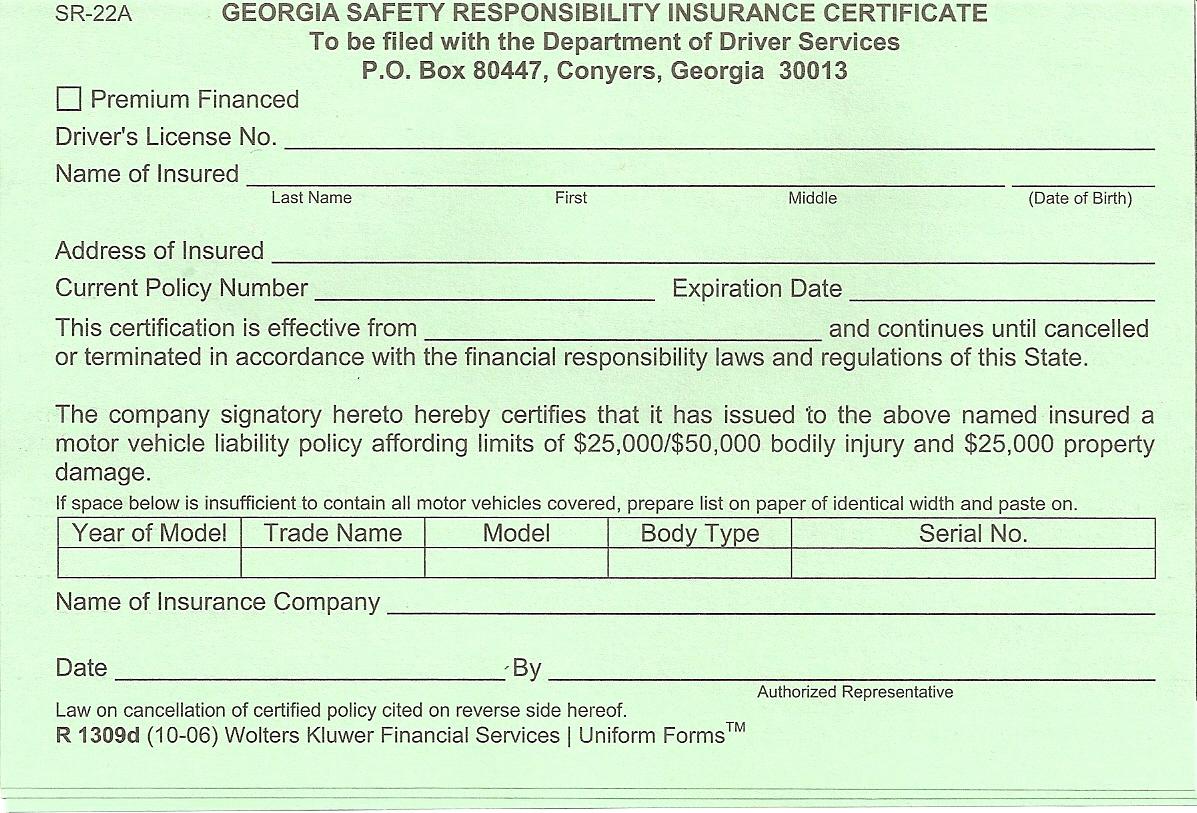

Motor Vehicle Registration

Georgia law requires all vehicle owners to maintain liability insurance coverage. The state Department of Motor Vehicles (DMV) verifies insurance coverage during vehicle registration.

Georgia law requires all vehicle owners to maintain liability insurance coverage.

- When registering a vehicle in Georgia, the DMV requires proof of insurance. This proof can be provided in the form of an insurance card or a letter from the insurance company.

- The DMV maintains a database of insured vehicles, which is used to verify insurance coverage. This database is accessed by law enforcement agencies to check if a vehicle is properly insured.

- Vehicle owners who fail to maintain insurance coverage may face fines, license suspension, and other penalties.

Common Challenges and Solutions

Insurance verification in Georgia, like in any other state, can come with its share of hurdles. From inaccurate information to delays and even potential fraud, these challenges can impact the smooth flow of healthcare services. Understanding these challenges and implementing effective solutions is crucial for ensuring accurate and timely insurance verification.

Common Challenges in Insurance Verification, State of georgia insurance verification

Several common challenges arise during insurance verification in Georgia. These challenges can significantly impact the efficiency and accuracy of the verification process.

- Inaccurate Information: One of the most common challenges is encountering inaccurate information on insurance cards or in the insurance provider’s database. This can include incorrect policy numbers, coverage details, or member information, leading to delays in verification and potential denial of claims.

- Delays in Verification: Insurance verification processes can be time-consuming, particularly when dealing with complex policies or when multiple parties are involved. Delays can occur due to factors such as inefficient communication channels, outdated systems, or a high volume of requests.

- Fraudulent Activity: Insurance fraud is a serious concern, and it can manifest in various ways, including falsified insurance cards, identity theft, or billing for services not rendered. These fraudulent activities can lead to financial losses and disrupt the healthcare system.

Best Practices and Solutions

Addressing these challenges requires a proactive approach and the implementation of best practices to streamline the verification process and mitigate potential risks.

- Data Accuracy and Validation: Implement robust data validation procedures to ensure the accuracy of insurance information. This can involve using electronic verification systems, cross-referencing data with multiple sources, and conducting regular audits to identify and correct inaccuracies.

- Streamlined Communication: Establish clear communication channels between healthcare providers, insurance companies, and patients. This can involve utilizing secure online platforms, automated verification systems, and standardized communication protocols to facilitate timely and accurate information exchange.

- Fraud Detection and Prevention: Implement fraud detection mechanisms, such as data analytics, risk assessment tools, and fraud prevention training for staff. Regular monitoring of insurance claims and suspicious activities can help identify and address potential fraud early on.

Common Errors and Solutions

Here’s a table outlining common errors in insurance verification and their corresponding solutions:

| Common Errors | Solutions |

|---|---|

| Incorrect policy number | Verify the policy number with the insurance company. |

| Missing or incomplete coverage information | Contact the insurance company to obtain missing information. |

| Outdated or invalid insurance card | Request a new insurance card from the insurance company. |

| Mismatched member information | Confirm member details with the insurance company and the patient. |

| Unauthorized billing codes | Review billing codes with the insurance company to ensure accuracy. |

Resources and Support

Navigating the complexities of insurance verification in Georgia can be challenging. Fortunately, various resources and support systems are available to assist individuals and businesses. These resources offer valuable information, guidance, and assistance in understanding and navigating the insurance verification process.

Government Websites

Government websites provide comprehensive information about insurance regulations, verification procedures, and consumer protection. These resources are essential for individuals and businesses seeking to understand their rights and responsibilities regarding insurance verification.

- Georgia Department of Insurance (DOI): The DOI is the primary regulatory body for insurance in Georgia. Its website offers a wealth of information, including consumer guides, FAQs, complaint forms, and contact information for assistance. The DOI also publishes a directory of licensed insurance companies operating in Georgia, which can be helpful for verifying the legitimacy of an insurance provider.

- Georgia Office of the Insurance Commissioner: The Office of the Insurance Commissioner provides information about insurance laws, regulations, and consumer rights. It also offers resources for filing complaints against insurance companies and resolving disputes.

Insurance Company Websites

Insurance company websites offer information about their specific policies, procedures, and verification processes. These resources are crucial for understanding the requirements and timelines for insurance verification.

- Insurance company websites: Most insurance companies provide detailed information about their verification processes on their websites. This information typically includes instructions for submitting verification requests, required documentation, and contact information for customer support.

Professional Organizations

Professional organizations dedicated to insurance provide valuable resources, education, and advocacy for individuals and businesses involved in the insurance industry.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. The NAIC website provides information about insurance regulations, consumer protection, and industry best practices. It also offers resources for understanding insurance verification procedures.

Role of the Georgia Department of Insurance

The Georgia Department of Insurance (DOI) plays a crucial role in ensuring the fair and transparent operation of the insurance industry in Georgia. It regulates insurance companies, investigates consumer complaints, and enforces insurance laws.

- Consumer protection: The DOI protects consumers by investigating complaints against insurance companies and ensuring that they comply with state laws and regulations. This includes verifying the legitimacy of insurance providers and ensuring that they provide accurate and complete information to consumers.

- Insurance regulation: The DOI sets and enforces insurance regulations, including those related to verification procedures. This ensures that insurance companies follow standardized processes for verifying insurance coverage and that consumers are treated fairly.

- Information and resources: The DOI provides information and resources to consumers about insurance policies, verification processes, and their rights. It also offers guidance on resolving disputes with insurance companies.

Wrap-Up

Understanding Georgia insurance verification is essential for navigating the complexities of healthcare, employment, and other aspects of daily life in the state. By familiarizing yourself with the process, methods, and requirements, you can ensure compliance and access to the services you need. Remember to leverage available resources and seek assistance when necessary to navigate the intricacies of insurance verification in Georgia.

FAQ Summary

What is the purpose of insurance verification in Georgia?

Insurance verification in Georgia ensures that individuals and businesses have valid insurance coverage for various purposes, including healthcare, employment, and motor vehicle registration.

What are the common verification methods used in Georgia?

Common verification methods include online portals, phone calls, written requests, and direct communication with insurance providers.

Who are the key stakeholders involved in insurance verification?

Key stakeholders include insurance companies, employers, healthcare providers, and the Georgia Department of Insurance.