State of Florida life insurance is a critical aspect of financial planning for residents of the Sunshine State. Florida’s unique demographics, climate, and regulatory landscape shape the life insurance market, making it essential for individuals to understand the options available to them.

This guide delves into the intricacies of life insurance in Florida, exploring the different types of policies, factors to consider when choosing coverage, and resources for finding the right provider. We’ll also examine the role of life insurance in estate planning and how it can help protect loved ones and minimize estate taxes.

Understanding Florida’s Life Insurance Landscape

Florida’s life insurance market is a unique and dynamic one, shaped by the state’s distinctive demographics, climate, and regulatory environment. Understanding the specific characteristics of this market is crucial for individuals and families seeking adequate life insurance coverage in the Sunshine State.

Florida’s Demographics and Life Insurance Needs

Florida’s population is characterized by a high concentration of seniors, a large number of retirees, and a significant influx of newcomers. These factors contribute to a higher demand for life insurance, particularly for coverage that addresses end-of-life expenses, estate planning, and financial security for surviving family members. Moreover, Florida’s warm climate and active lifestyle attract individuals who enjoy outdoor activities, potentially increasing the need for life insurance policies that cover unexpected events.

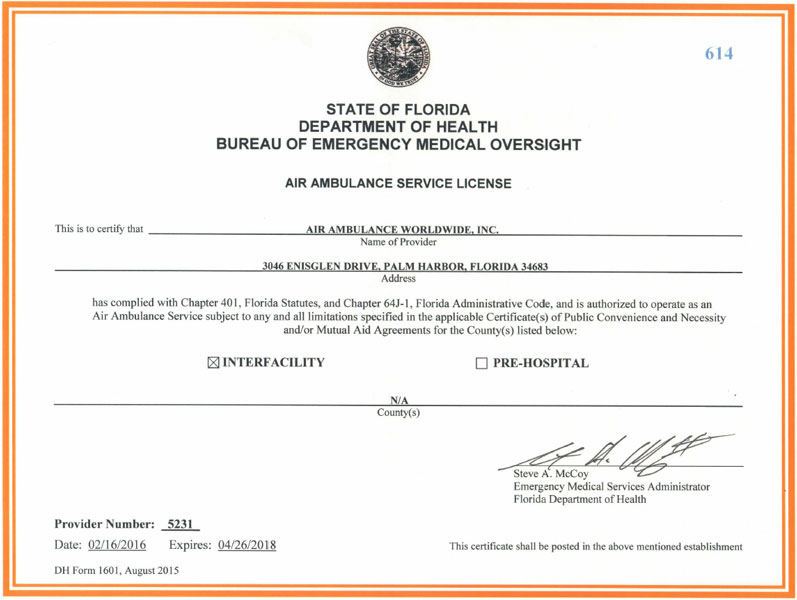

Florida’s Life Insurance Regulations

The state of Florida has a comprehensive regulatory framework for life insurance, designed to protect consumers and ensure fair market practices. The Florida Office of Insurance Regulation (OIR) plays a key role in overseeing life insurance companies and agents, setting standards for product offerings, and enforcing compliance with state laws. Key regulations include:

- Minimum Standards for Life Insurance Policies: Florida mandates minimum coverage amounts and benefit levels for various types of life insurance policies, ensuring consumers have access to adequate protection.

- Prohibition of Unfair or Deceptive Practices: Florida law prohibits life insurance companies and agents from engaging in unfair or deceptive sales practices, including misrepresenting policy benefits or using high-pressure tactics.

- Consumer Protection Laws: Florida has enacted various consumer protection laws that safeguard policyholders’ rights, such as the right to cancel a policy within a specified timeframe, the right to receive clear and concise policy documents, and the right to file complaints against insurers.

Florida’s Life Insurance Offerings, State of florida life insurance

Florida’s life insurance market offers a diverse range of products to meet the needs of different individuals and families. The most common types of life insurance available in Florida include:

- Term Life Insurance: This type of policy provides coverage for a specific period, typically 10, 20, or 30 years. Term life insurance is generally more affordable than permanent life insurance and is often used to protect dependents during a specific period, such as while children are young or while a mortgage is outstanding.

- Whole Life Insurance: Whole life insurance provides lifetime coverage and includes a cash value component that grows over time. It offers a combination of death benefit and savings, making it a popular choice for long-term financial planning and estate planning.

- Universal Life Insurance: Universal life insurance is a flexible policy that allows policyholders to adjust their premiums and death benefit amounts. It provides greater control over the policy and offers potential for higher returns on the cash value component.

- Variable Life Insurance: Variable life insurance invests the cash value component in mutual funds, offering the potential for higher returns but also carrying higher risk. This type of policy is suitable for individuals with a higher risk tolerance and a longer investment horizon.

Comparison of Life Insurance Offerings in Florida and Other States

While Florida’s life insurance market offers a wide range of products, it’s essential to compare offerings across different states to ensure you are getting the best value and coverage. Factors to consider when comparing life insurance offerings include:

- Premium Rates: Life insurance premiums can vary significantly between states due to differences in regulatory environments, insurer competition, and risk factors.

- Policy Features: Life insurance policies can differ in their features, such as the death benefit amount, cash value options, and riders.

- Insurer Reputation: It’s crucial to choose an insurer with a strong financial rating and a history of reliable claims payments.

Types of Life Insurance in Florida

Florida residents have a wide array of life insurance options to choose from, each with its own unique features and benefits. Understanding these different types of life insurance policies is crucial for making an informed decision that aligns with your individual needs and financial goals.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is designed to protect your loved ones financially during a set timeframe, often while you are still working and have dependents.

- Key Features: Term life insurance offers a fixed premium for the duration of the policy, and your beneficiaries receive a death benefit if you pass away during the policy term.

- Benefits: It is generally the most affordable type of life insurance, making it an attractive option for individuals on a budget. Term life insurance provides a substantial death benefit to your loved ones, ensuring their financial security in the event of your passing.

- Drawbacks: Once the policy term expires, you will need to renew it, which may result in higher premiums or potentially even a denial of coverage. Additionally, term life insurance does not accumulate cash value, meaning there is no investment component.

Whole Life Insurance

Whole life insurance is a permanent life insurance policy that provides lifelong coverage. It combines death benefit protection with a cash value component that grows over time.

- Key Features: Whole life insurance premiums are typically higher than term life premiums, but they remain fixed for the duration of the policy. The cash value component grows at a guaranteed rate, allowing you to borrow against it or withdraw funds.

- Benefits: Whole life insurance offers lifelong coverage, ensuring that your loved ones are protected even if you live to a very old age. The cash value component can provide a source of funds for retirement, emergencies, or other financial needs.

- Drawbacks: Whole life insurance premiums are generally higher than term life premiums, and the cash value growth rate is typically lower than other investment options. The death benefit is also typically lower than term life insurance for the same premium amount.

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance policy that allows you to adjust your premium payments and death benefit.

- Key Features: Universal life insurance premiums are flexible, allowing you to adjust them based on your financial situation. The cash value component grows at a rate that is tied to the performance of underlying investments.

- Benefits: The flexibility of universal life insurance makes it a good option for individuals with fluctuating incomes or changing financial needs. The cash value component can be invested in a variety of options, potentially generating higher returns than traditional whole life insurance.

- Drawbacks: Universal life insurance premiums can fluctuate based on market performance, and the cash value growth is not guaranteed. It is also important to carefully consider the fees associated with this type of policy, as they can be higher than for term life insurance.

Variable Life Insurance

Variable life insurance is a permanent life insurance policy with a cash value component that is invested in mutual funds.

- Key Features: Variable life insurance premiums are typically higher than term life premiums, but they remain fixed for the duration of the policy. The cash value component is invested in a variety of mutual funds, providing the potential for higher returns but also higher risk.

- Benefits: Variable life insurance offers the potential for higher cash value growth than other types of life insurance. The death benefit can also be adjusted based on the performance of the underlying investments.

- Drawbacks: The cash value growth in variable life insurance is not guaranteed, and the death benefit can fluctuate based on market performance. This type of policy is generally more complex and requires a higher level of investment knowledge.

Comparing Life Insurance Policies

| Policy Type | Premiums | Death Benefit | Cash Value Accumulation | Flexibility |

|---|---|---|---|---|

| Term Life | Lower | High | None | Low |

| Whole Life | Higher | Lower | Guaranteed | Low |

| Universal Life | Flexible | Variable | Variable | High |

| Variable Life | Higher | Variable | Variable | High |

Factors to Consider When Choosing Life Insurance in Florida

Choosing the right life insurance policy in Florida involves careful consideration of various factors that align with your individual circumstances and financial goals. It’s crucial to understand that a one-size-fits-all approach doesn’t work when it comes to life insurance. This section will explore key factors that should guide your decision-making process.

Assessing Individual Needs and Risk Tolerance

Understanding your specific needs and risk tolerance is essential before you begin comparing life insurance policies. This involves considering factors such as your age, health, income, dependents, and financial goals. By analyzing these aspects, you can determine the appropriate level of coverage and the type of policy that best suits your situation.

- Age: Younger individuals generally have lower premiums due to their longer life expectancy. As you age, premiums tend to increase, reflecting the higher risk of mortality.

- Health: Your health status plays a significant role in determining your life insurance premium. Individuals with pre-existing health conditions may face higher premiums or even be denied coverage altogether.

- Income: Your income level is a key factor in determining the amount of life insurance you need. The goal is to replace your lost income and ensure your dependents’ financial security in the event of your untimely demise.

- Dependents: The number and ages of your dependents significantly influence your life insurance needs. If you have young children, you’ll likely require more coverage to provide for their future education and living expenses.

- Financial Goals: Your financial goals, such as paying off debts, funding your children’s education, or leaving an inheritance, should be factored into your life insurance decision.

Essential Considerations for Selecting the Right Policy

Once you have a clear understanding of your individual needs and risk tolerance, you can begin exploring the different types of life insurance policies available in Florida. Here’s a checklist of essential considerations to guide your selection:

- Coverage Amount: Determine the appropriate coverage amount based on your income, dependents, and financial goals.

- Premium Costs: Compare premiums from different insurers and policies to find the most affordable option that meets your needs.

- Policy Term: Decide on the duration of your policy, whether it’s a term life insurance policy with a specific timeframe or a permanent policy that provides lifelong coverage.

- Riders and Benefits: Explore additional riders and benefits offered by insurers, such as accidental death benefit, disability income coverage, or long-term care options.

- Financial Stability of the Insurer: Research the financial stability of the insurer you are considering. Look for companies with strong ratings from reputable agencies like A.M. Best.

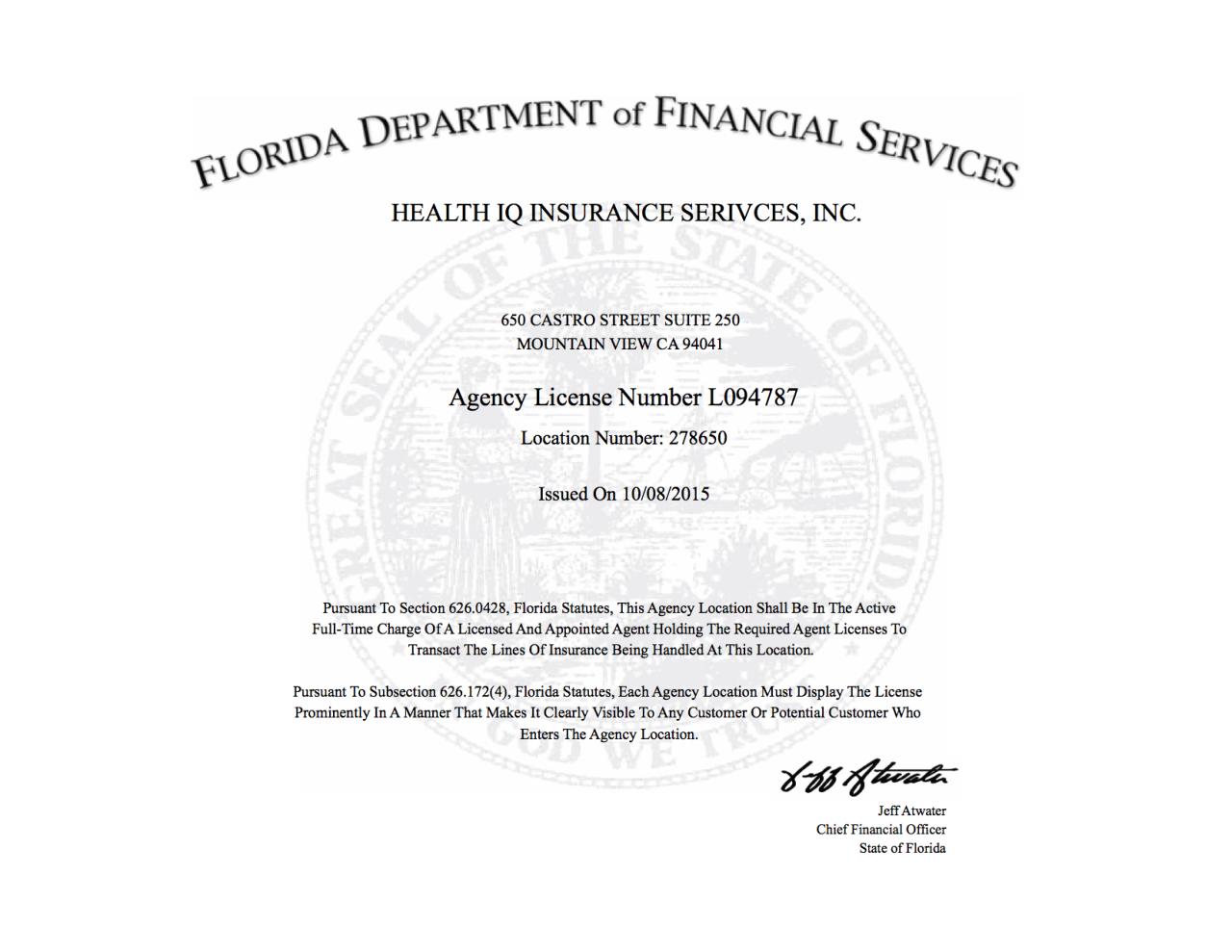

Finding the Right Life Insurance Provider in Florida

Choosing the right life insurance provider is crucial for ensuring your loved ones are financially protected in the event of your passing. In Florida, you have a wide range of options, each with its own strengths and weaknesses.

Comparing Life Insurance Providers in Florida

When evaluating life insurance providers in Florida, it’s essential to consider factors like reputation, financial stability, policy options, and customer service. These factors directly impact the value and reliability of the coverage you receive.

- Reputation: Look for providers with a strong track record of customer satisfaction and a reputation for fair and transparent practices. You can research online reviews, ratings from independent organizations like A.M. Best, and industry publications.

- Financial Stability: Ensure the provider is financially sound and has the resources to meet its obligations to policyholders. Check the company’s credit rating, which reflects its financial strength and ability to pay claims.

- Policy Options: Consider the types of life insurance policies offered, including term life, whole life, universal life, and variable life. Evaluate the coverage features, premiums, and benefits of each policy to find one that aligns with your needs and budget.

- Customer Service: A responsive and helpful customer service team is essential for resolving any questions or issues you may have. Look for providers with a strong reputation for customer support and accessibility.

Key Resources for Finding Life Insurance Quotes in Florida

Several resources can help you find and compare life insurance quotes in Florida. These resources provide valuable information and tools for making informed decisions.

- Online Comparison Websites: Websites like Policygenius, NerdWallet, and Insurance.com allow you to compare quotes from multiple providers simultaneously. These platforms often provide helpful resources and guides to help you understand the different types of policies.

- Independent Insurance Agents: Independent insurance agents can work with you to find the best life insurance policy based on your specific needs. They represent multiple insurance companies, allowing you to compare a wider range of options.

- Direct-to-Consumer Providers: Direct-to-consumer life insurance companies sell their policies directly to consumers, often online. These providers may offer competitive rates, but they typically have limited customer service options.

Tips for Negotiating the Best Possible Life Insurance Rates

While life insurance premiums are generally set by the insurer, you can still take steps to negotiate the best possible rates.

- Shop Around: Compare quotes from multiple providers to ensure you’re getting the most competitive rates.

- Improve Your Health: Maintaining a healthy lifestyle and addressing any health concerns can lower your premiums.

- Consider a Longer Policy Term: A longer policy term typically results in lower monthly premiums.

- Bundle Policies: Bundling life insurance with other policies, such as auto or home insurance, can sometimes qualify you for discounts.

- Negotiate Directly: Don’t hesitate to negotiate with the insurer directly, especially if you have a strong financial profile or a history of good health.

Understanding Life Insurance Costs in Florida

The cost of life insurance in Florida, like anywhere else, is influenced by a variety of factors. Understanding these factors can help you make informed decisions about your life insurance needs and budget.

Factors Affecting Life Insurance Costs in Florida

Several factors contribute to the cost of life insurance in Florida. These include:

- Age: Younger individuals generally pay lower premiums than older individuals. This is because younger people have a longer life expectancy, making them less likely to file a claim soon.

- Health: Your health plays a significant role in determining your life insurance premiums. Individuals with pre-existing health conditions or risky lifestyle choices might face higher premiums. Life insurance companies assess your health risks to determine the likelihood of you needing to file a claim.

- Smoking Status: Smokers typically pay higher premiums compared to non-smokers. Smoking is linked to a higher risk of health problems and a shorter lifespan, which increases the likelihood of a claim being filed.

- Policy Type: The type of life insurance policy you choose can significantly affect the cost. Term life insurance, which provides coverage for a specific period, usually has lower premiums than permanent life insurance, which offers lifelong coverage and investment features.

Life Insurance Premiums

Life insurance premiums are the regular payments you make to maintain your policy. They are calculated based on factors such as your age, health, policy type, and the amount of coverage you choose. The premium calculation involves a complex actuarial process that assesses the probability of you needing to file a claim.

Life Insurance Premium = (Death Benefit * Risk Factor) / (Expected Life Span)

This formula simplifies the calculation but highlights the factors influencing premium costs.

Examples of Life Insurance Premiums in Florida

Here are some examples of typical life insurance premiums for different individuals in Florida:

- A healthy 30-year-old non-smoker in Florida might pay around $20-$30 per month for a $250,000 term life insurance policy.

- A 50-year-old smoker with a pre-existing health condition might pay $50-$70 per month for the same coverage amount.

- A 60-year-old individual seeking a permanent life insurance policy with a death benefit of $500,000 could expect to pay $200-$300 per month.

Life Insurance and Estate Planning in Florida

Life insurance plays a vital role in estate planning, particularly in Florida, by helping to ensure financial security for your loved ones and minimize potential tax burdens. It can be a powerful tool to achieve your estate planning goals, whether you want to provide for your family’s financial well-being, protect your business, or minimize estate taxes.

Life Insurance and Estate Taxes in Florida

Life insurance proceeds are generally exempt from federal estate taxes. However, Florida has its own estate tax laws, which can impact how life insurance proceeds are treated. Understanding these laws is crucial for effective estate planning.

In Florida, the estate tax exemption is significantly higher than the federal exemption. As of 2023, the Florida estate tax exemption is $4,000,000, meaning estates worth less than this amount are not subject to estate taxes. This exemption is significantly higher than the federal exemption, which is currently $12,920,000.

However, if the value of your estate exceeds the Florida exemption, your beneficiaries will be subject to Florida estate taxes. Life insurance proceeds can be included in the taxable estate, so careful planning is needed to minimize potential tax liability.

Strategies for Using Life Insurance in Estate Planning

Here are some strategies for using life insurance to protect loved ones and minimize estate taxes:

Using Life Insurance to Pay Estate Taxes

One common strategy is to use life insurance proceeds to pay estate taxes. By naming your estate as the beneficiary of a life insurance policy, the death benefit can be used to cover any estate tax liability, ensuring that your beneficiaries receive the full inheritance you intended.

Using Life Insurance to Cover Final Expenses

Life insurance can be used to cover funeral expenses, outstanding debts, and other final expenses, easing the financial burden on your loved ones during a difficult time.

Using Life Insurance to Create a Trust

Setting up an irrevocable life insurance trust (ILIT) can help to minimize estate taxes and provide financial security for your beneficiaries. An ILIT is a trust that owns a life insurance policy, with the proceeds payable to the trust upon your death. Because the trust owns the policy, the proceeds are not included in your taxable estate.

Using Life Insurance to Fund a Business Succession Plan

If you own a business, life insurance can be used to fund a buy-sell agreement, ensuring that your business continues to operate smoothly after your death.

Using Life Insurance to Provide for Special Needs Beneficiaries

Life insurance can be used to provide for special needs beneficiaries, ensuring that they have the financial resources they need to maintain their quality of life.

Using Life Insurance to Protect Your Business

If you are a business owner, life insurance can be used to protect your business from financial hardship in the event of your death. This can be especially important if your business is heavily reliant on your skills and expertise.

Life Insurance and Probate

Life insurance proceeds can be subject to probate, depending on how the policy is structured. For example, if you name your estate as the beneficiary, the proceeds will be included in your probate estate.

To avoid probate, you can name a specific beneficiary, such as a family member or trust, directly on the policy. This will ensure that the proceeds are paid directly to the beneficiary without going through the probate process.

Choosing the Right Life Insurance Policy

The type of life insurance policy you choose will depend on your individual circumstances and financial goals. It is important to work with a qualified financial advisor to determine the best type of policy for your needs.

Choosing the Right Life Insurance Provider

When choosing a life insurance provider, it is important to consider the provider’s financial stability, reputation, and customer service. You should also compare quotes from multiple providers to ensure you are getting the best possible rates.

Life Insurance for Specific Needs in Florida: State Of Florida Life Insurance

Life insurance in Florida, like anywhere else, plays a crucial role in providing financial security for individuals and families. The specific needs for life insurance vary depending on factors such as age, family size, income, and financial goals. This section explores the unique life insurance requirements of different groups in Florida, highlighting the benefits and solutions tailored to their specific circumstances.

Life Insurance for Families in Florida

Families in Florida, like those across the nation, often rely on life insurance to protect their loved ones from financial hardship in the event of a breadwinner’s death. Life insurance provides a financial safety net, ensuring that essential expenses such as mortgage payments, child care, education, and living costs are covered. For families with young children, life insurance can be particularly vital, as it can help ensure their future financial stability and well-being.

Life Insurance for Business Owners in Florida

Business owners in Florida face unique challenges and opportunities, and life insurance can be a valuable tool for mitigating risks and securing the future of their enterprises. Life insurance can be used to:

- Provide financial compensation to the business in the event of a key employee’s death: This ensures the business can continue operating smoothly and maintain its profitability.

- Cover business debts and liabilities: This protects the business from financial distress and potential bankruptcy in the event of a key owner’s passing.

- Provide funds for business succession planning: Life insurance can help facilitate a smooth transition of ownership, ensuring the business continues to thrive under new leadership.

Life Insurance for Retirees in Florida

Retirement in Florida can be a fulfilling and enjoyable experience, but it’s essential to have a comprehensive financial plan in place to ensure financial security. Life insurance can play a vital role in retirement planning, providing:

- Financial protection for surviving spouses: This can help ensure a comfortable lifestyle and financial independence for the surviving spouse.

- Funds for long-term care expenses: As individuals age, the risk of needing long-term care increases, and life insurance can provide financial resources to cover these costs.

- Financial support for estate planning: Life insurance can be used to cover estate taxes and other expenses associated with estate administration, ensuring a smooth transition of assets to beneficiaries.

Life Insurance for Covering Final Expenses in Florida

Final expenses, such as funeral costs, burial arrangements, and outstanding debts, can be significant burdens on surviving family members. Life insurance can provide a dedicated fund to cover these expenses, relieving families of financial stress during a difficult time. In Florida, the average cost of a funeral is estimated to be around $9,000, and life insurance can help ensure these expenses are covered without placing a financial strain on loved ones.

Life Insurance for Debt Protection in Florida

Life insurance can provide financial protection against outstanding debts, such as mortgages, loans, and credit card balances. If the policyholder dies, the death benefit can be used to pay off these debts, preventing financial hardship for surviving family members. For example, if a homeowner has a mortgage with a significant balance and dies unexpectedly, life insurance can be used to pay off the mortgage, ensuring their family can keep their home.

Life Insurance for Income Replacement in Florida

For many families, the loss of a breadwinner’s income can have a devastating impact on their financial stability. Life insurance can provide a source of income replacement, ensuring that the family can continue to meet their financial obligations and maintain their standard of living. The death benefit from a life insurance policy can be used to replace the lost income, providing a crucial financial safety net for the surviving family members.

Ending Remarks

Navigating the world of life insurance in Florida can be overwhelming, but understanding the options and making informed decisions is crucial. By carefully considering your individual needs, financial goals, and risk tolerance, you can secure the right life insurance policy to provide peace of mind and financial security for yourself and your loved ones.

Key Questions Answered

What are the minimum coverage requirements for life insurance in Florida?

Florida does not have any specific minimum coverage requirements for life insurance. The amount of coverage you need will depend on your individual circumstances, such as your age, income, dependents, and financial goals.

How do I find a reputable life insurance provider in Florida?

You can find reputable life insurance providers in Florida by researching online, seeking recommendations from trusted sources, and comparing quotes from multiple companies. It’s also important to check the provider’s financial stability and customer satisfaction ratings.

Can I purchase life insurance online in Florida?

Yes, you can purchase life insurance online in Florida. Many life insurance providers offer online applications and quote comparison tools. However, it’s always advisable to speak with an insurance agent to discuss your needs and ensure you choose the right policy.

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10 to 30 years, while whole life insurance provides lifetime coverage. Term life insurance is generally more affordable but does not build cash value, while whole life insurance is more expensive but accumulates cash value that can be borrowed against or withdrawn.