State of florida insurance company search – Navigating the complex world of insurance in Florida can be daunting, but finding the right insurance company doesn’t have to be. Whether you’re a homeowner, driver, or seeking health coverage, understanding the unique characteristics of Florida’s insurance landscape is crucial. This guide will equip you with the knowledge and tools to confidently navigate the process of finding the insurance company that best meets your needs.

From understanding the different types of insurance companies and their coverage options to evaluating financial stability and obtaining competitive quotes, we’ll delve into each step of the process. We’ll also explore the key regulatory bodies and their role in ensuring a fair and transparent insurance market.

Understanding Florida’s Insurance Landscape: State Of Florida Insurance Company Search

Florida’s insurance market is unique and complex, shaped by the state’s geographical location, climate, and economic factors. The state faces significant risks from hurricanes, which can cause widespread damage and lead to substantial insurance claims. This has a significant impact on the availability and affordability of insurance in Florida.

Major Insurance Categories in Florida, State of florida insurance company search

Florida offers a wide range of insurance products to meet the needs of its residents and businesses. The most common categories include:

- Homeowners Insurance: This covers damage to homes and personal property from various perils, including hurricanes, windstorms, fire, and theft. It is essential for homeowners in Florida, given the high risk of hurricanes.

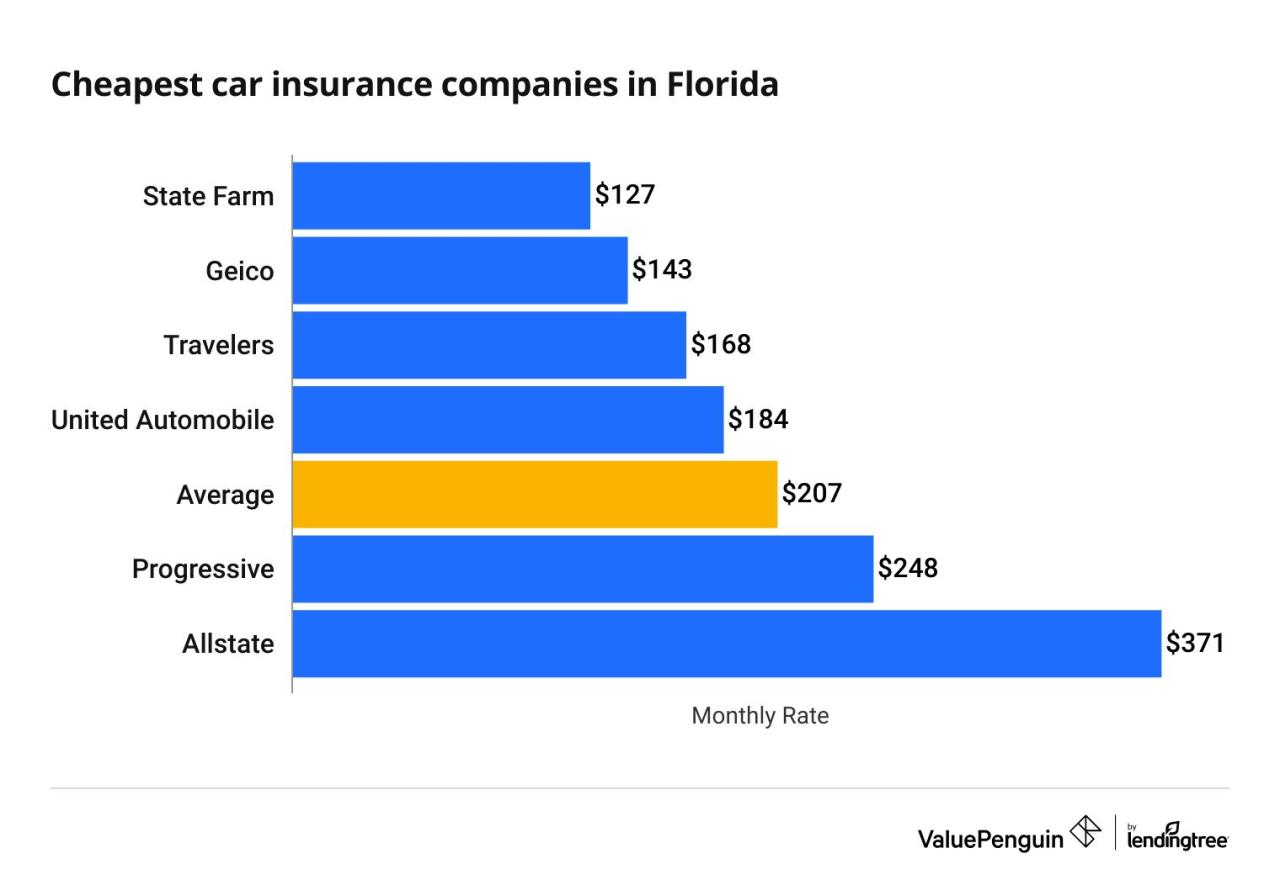

- Auto Insurance: Florida requires all drivers to have auto insurance, which covers liability for accidents, property damage, and medical expenses. It is also available for collision and comprehensive coverage, which protects against damage to your vehicle.

- Health Insurance: Florida residents can access health insurance through various programs, including the Affordable Care Act marketplace, employer-sponsored plans, and Medicare/Medicaid. Health insurance is crucial for covering medical expenses and ensuring access to healthcare.

- Flood Insurance: This insurance protects against damage caused by flooding, which is a significant risk in Florida, especially in coastal areas. Flood insurance is typically not included in standard homeowners insurance policies and must be purchased separately.

- Business Insurance: Businesses in Florida need various insurance products to protect their assets and operations. These can include property insurance, liability insurance, workers’ compensation insurance, and more, depending on the industry and business size.

Key Regulatory Bodies in Florida’s Insurance Industry

The Florida insurance industry is regulated by several key bodies, ensuring fair and transparent practices and consumer protection. These include:

- Florida Office of Insurance Regulation (OIR): The OIR is the primary regulatory body for insurance in Florida. It sets rules and regulations for insurance companies, licenses insurance agents and brokers, and investigates consumer complaints. The OIR also oversees the Florida Insurance Guaranty Association (FIGA), which protects policyholders in the event of an insurer’s insolvency.

- Florida Department of Financial Services (DFS): The DFS is responsible for overseeing the financial stability of insurance companies in Florida. It monitors the financial condition of insurers, conducts audits, and takes action to protect consumers from fraudulent or unsound practices.

- Florida Insurance Guaranty Association (FIGA): FIGA is a non-profit organization funded by insurance companies in Florida. It provides financial protection to policyholders in the event of an insurer’s insolvency. FIGA pays claims up to certain limits, ensuring that policyholders are not left without coverage.

Navigating Insurance Company Options

Choosing the right insurance company in Florida is crucial, as it directly impacts your coverage and financial protection. This section delves into different types of insurance companies and provides insights into selecting the best option for your needs.

Types of Insurance Companies

Understanding the different types of insurance companies can help you make a more informed decision. Here’s a breakdown of the most common types:

- Mutual Insurance Companies: These companies are owned by their policyholders. Policyholders have a say in company operations and receive dividends based on the company’s profits. Mutual companies are known for their focus on long-term customer relationships and potential for lower premiums.

- Stock Insurance Companies: Stock companies are owned by shareholders. They generate profits for shareholders and typically have more flexibility in pricing policies. Stock companies often offer a wider range of coverage options and may be more focused on growth and expansion.

- Captive Insurance Companies: Captive companies are owned by a specific entity, like a business or group of businesses. They primarily serve the insurance needs of their parent company or group, offering customized coverage and potentially lower premiums.

Local vs. National Insurance Companies

The decision between working with a local or national insurance company depends on your priorities and preferences.

- Local Insurance Companies: Local companies often have a deep understanding of the specific risks and needs of their community. They may offer personalized service, quicker claims processing, and stronger community involvement. However, they may have fewer resources and coverage options compared to national companies.

- National Insurance Companies: National companies typically have a broader range of coverage options, more financial resources, and potentially lower premiums due to their larger scale. They may have more experience dealing with complex claims and can provide coverage across multiple states. However, they may lack the personalized service and local expertise of smaller companies.

Evaluating Financial Stability and Reputation

It’s essential to assess the financial stability and reputation of any insurance company you consider. Here are some key factors to evaluate:

- Financial Ratings: Reputable rating agencies, like A.M. Best, Standard & Poor’s, and Moody’s, provide financial ratings for insurance companies. A strong financial rating indicates the company is financially sound and likely to be able to meet its obligations to policyholders.

- Claims Payment History: Research the company’s track record of paying claims promptly and fairly. Look for reviews and customer testimonials to gauge their responsiveness and customer satisfaction.

- Customer Service: Consider the company’s reputation for customer service and responsiveness. Look for companies with a strong track record of resolving customer issues quickly and efficiently.

- Industry Reputation: Look for companies with a good reputation within the insurance industry. Research their history, any past controversies, and any awards or recognitions they have received.

Finding the Right Insurance Company

Selecting the right insurance company for your needs in Florida is crucial. This involves careful consideration of various factors to ensure you secure comprehensive coverage at a competitive price.

Factors to Consider When Choosing an Insurance Company

When evaluating insurance companies, several essential factors should be considered. This comprehensive assessment helps ensure you make an informed decision that aligns with your specific needs and budget.

| Factor | Description | Importance |

|---|---|---|

| Financial Stability | The insurer’s ability to meet its financial obligations and pay claims. | A financially sound company is crucial for ensuring your claims are paid promptly and in full. |

| Customer Service | The responsiveness and helpfulness of the insurer’s customer service representatives. | Good customer service ensures a positive experience when dealing with claims or policy adjustments. |

| Coverage Options | The range of insurance products offered, including different types of coverage and policy options. | Ensure the insurer offers the specific coverage you require, such as homeowners, auto, or health insurance. |

| Pricing and Discounts | The cost of insurance premiums and any available discounts for safe driving, bundling policies, or other factors. | Compare prices and discounts to find the most competitive rates for your specific needs. |

| Claims Process | The insurer’s process for handling claims, including speed of processing and claim resolution. | A streamlined claims process ensures a smooth and efficient experience when filing a claim. |

| Reputation and Reviews | The insurer’s reputation in the industry, based on customer reviews and independent ratings. | Researching an insurer’s reputation provides valuable insights into their reliability and customer satisfaction. |

Searching for and Choosing an Insurance Company

The process of searching for and choosing an insurance company involves a series of steps to ensure you find the best option for your needs.

Reliable Resources for Researching Insurance Companies

Several reliable resources can assist you in researching insurance companies and comparing their offerings. These resources provide valuable information to make informed decisions.

- Online Directories: Websites like Insure.com, Policygenius, and NerdWallet offer comprehensive directories of insurance companies, allowing you to compare quotes and coverage options.

- Consumer Reports: Organizations like Consumer Reports provide independent ratings and reviews of insurance companies based on customer satisfaction, claims handling, and financial stability.

- State Insurance Departments: Each state’s insurance department maintains a database of licensed insurers, including their financial information and consumer complaints.

- Industry Associations: Organizations like the National Association of Insurance Commissioners (NAIC) and the American Association of Insurance Services (AAIS) provide resources and information on insurance industry trends and best practices.

Understanding Insurance Policies and Coverage

Choosing the right insurance policy goes beyond simply picking a company. Understanding the various types of coverage, policy terms, and options available is crucial for ensuring you have the protection you need at a price that fits your budget. This section delves into the intricacies of insurance policies and helps you make informed decisions.

Coverage Types and Limits

Insurance policies are designed to provide financial protection against specific risks. Each policy category offers different types of coverage, each with its own set of limits and deductibles. Understanding these elements is essential for determining the level of protection a policy provides.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically translates to lower premiums, while a lower deductible results in higher premiums.

- Coverage Limits: This refers to the maximum amount your insurance company will pay for a covered event. For example, a homeowner’s insurance policy might have a coverage limit of $500,000 for dwelling coverage. This means the insurer will pay up to $500,000 for damage to your home, but you will be responsible for any costs exceeding that amount.

- Coverage Types: Different insurance categories offer various coverage types. For instance, a homeowner’s insurance policy might include coverage for dwelling, personal property, liability, and additional living expenses, while an auto insurance policy might cover collision, comprehensive, liability, and medical payments.

Common Insurance Policy Terms

Insurance policies are filled with specialized terms that can be confusing for the average person. Familiarizing yourself with these terms is crucial for understanding your policy’s coverage and limitations.

- Premium: The periodic payment you make to your insurance company to maintain your coverage. Premiums can be paid monthly, quarterly, or annually.

- Policy Period: The duration for which your insurance policy is in effect. Typically, policy periods are one year long.

- Claim: A formal request for compensation from your insurance company for a covered loss. You must submit a claim to receive payment for covered damages or expenses.

- Exclusions: Certain events or circumstances that are not covered by your insurance policy. It’s essential to carefully review your policy’s exclusions to understand what situations are not covered.

- Endorsements: Additional coverage options that can be added to your policy for an extra premium. These endorsements can expand your coverage to include specific risks or situations.

Comparing Policy Options and Costs

Insurance companies offer a wide range of policy options, each with its own set of coverage features and premiums. Comparing different policy options and their associated costs is crucial for finding the best value for your needs.

- Coverage Levels: Different policies offer varying levels of coverage, from basic to comprehensive. Higher coverage levels typically come with higher premiums.

- Deductibles: As mentioned earlier, higher deductibles usually result in lower premiums, while lower deductibles lead to higher premiums.

- Discounts: Many insurance companies offer discounts for various factors, such as safe driving records, home security systems, and multiple policy bundling. Taking advantage of available discounts can significantly reduce your premium costs.

Understanding Policy Language

Insurance policies are written in legal jargon, which can be difficult to understand. It’s crucial to carefully review your policy document and seek clarification from your insurance agent or company representative if you have any questions.

“It’s important to remember that insurance policies are legal contracts. It’s crucial to understand the terms and conditions of your policy before you sign it.”

Obtaining Quotes and Making a Decision

Once you’ve established your insurance needs and understood the various types of coverage available, the next step is to start gathering quotes from different insurance companies. This process allows you to compare prices, coverage options, and customer service, ultimately helping you make an informed decision.

Obtaining Insurance Quotes

To get the most accurate and competitive quotes, it’s essential to provide each insurance company with the same information. This includes your personal details, vehicle information (if applicable), property details, and the coverage options you’re seeking. Most insurance companies have online quote forms that streamline the process, allowing you to submit your information quickly and receive a quote within minutes. However, you can also obtain quotes by phone or by contacting an insurance agent in person.

- Online Quote Forms: Many insurance companies have user-friendly online quote forms that allow you to input your information and receive a quote within minutes. This method is often convenient and saves time.

- Phone Calls: Contacting insurance companies directly by phone allows you to speak with a representative and get personalized guidance during the quote process.

- Insurance Agents: Meeting with an insurance agent in person provides a more personalized experience, as they can discuss your specific needs and offer tailored advice on different coverage options.

Factors Influencing Insurance Premiums

Insurance premiums are calculated based on several factors, including your risk profile, location, and the type of coverage you choose. Understanding these factors can help you negotiate your premium and potentially save money.

- Risk Profile: Your driving history, credit score, and age can all influence your insurance premiums. Drivers with a history of accidents or violations may pay higher premiums compared to those with clean records.

- Location: Insurance premiums vary depending on your location, as factors such as crime rates, weather patterns, and traffic congestion can impact the likelihood of claims.

- Coverage Options: Choosing comprehensive coverage options, such as collision and comprehensive coverage for your car, will typically result in higher premiums compared to basic liability coverage.

Negotiating Insurance Premiums

While insurance premiums are largely determined by factors outside your control, there are strategies you can employ to potentially negotiate lower rates.

- Bundle Policies: Combining multiple insurance policies, such as home and auto insurance, with the same company can often lead to discounts.

- Improve Your Credit Score: A higher credit score can demonstrate financial responsibility and potentially qualify you for lower premiums.

- Shop Around: Getting quotes from multiple insurance companies and comparing prices is crucial to finding the best rates.

- Consider Deductibles: Increasing your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lower your premiums. However, make sure you can afford the higher deductible in case of an accident.

- Ask for Discounts: Insurance companies often offer discounts for various factors, such as safe driving, good student status, or being a member of certain organizations.

Essential Documents and Information

To apply for insurance, you’ll need to provide the insurance company with certain documents and information. This information helps them assess your risk profile and determine the appropriate premium for your coverage.

- Personal Information: This includes your name, address, date of birth, and contact information.

- Driving History: If you’re applying for auto insurance, you’ll need to provide your driving record, including any accidents or violations.

- Vehicle Information: For auto insurance, you’ll need to provide details about your vehicle, such as the year, make, model, and VIN number.

- Property Information: If you’re applying for home or renters insurance, you’ll need to provide information about your property, including its address, square footage, and any security features.

- Credit Score: Some insurance companies may request your credit score as part of their risk assessment.

Concluding Remarks

By following the tips and strategies Artikeld in this guide, you can empower yourself to make informed decisions about your insurance coverage in Florida. Remember, a thorough understanding of your insurance needs and the available options is key to finding the right company that provides the protection you deserve.

Q&A

What are some common insurance scams in Florida?

Be wary of unsolicited calls or emails offering insurance deals that seem too good to be true. Legitimate insurance companies won’t contact you out of the blue. Additionally, avoid companies that pressure you into making a quick decision or require upfront payments before providing policy details.

How can I check if an insurance company is licensed in Florida?

You can verify an insurance company’s license status on the Florida Department of Financial Services website. This ensures the company is authorized to operate in the state.

What are the minimum insurance requirements for driving in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. However, it’s recommended to have higher limits to protect yourself financially in case of an accident.