State of Florida homeowners insurance is a crucial topic for anyone considering purchasing a home in the Sunshine State. Florida’s unique geography and susceptibility to hurricanes and other natural disasters significantly impact the cost and availability of homeowners insurance. Understanding the complexities of this market is essential for securing adequate coverage at a reasonable price.

This comprehensive guide will explore the factors that influence Florida homeowners insurance premiums, including location, construction type, and risk assessment. We will delve into the various coverage options available, including dwelling coverage, personal property coverage, and liability coverage. Additionally, we will discuss strategies for finding affordable insurance, the role of the Florida Insurance Guaranty Association (FIGA), and potential future trends in the market.

Florida Homeowners Insurance Market Overview

Florida’s homeowners insurance market is unique and complex, characterized by high premiums and a challenging environment for insurers. This is due to a confluence of factors, including the state’s vulnerability to hurricanes and other natural disasters, litigation costs, and regulatory complexities. Understanding these factors is crucial for comprehending the dynamics of the Florida homeowners insurance market.

Impact of Hurricanes and Natural Disasters

Hurricanes are the most significant factor driving the high cost of homeowners insurance in Florida. The state’s location on the Atlantic coast makes it highly susceptible to hurricanes, with devastating consequences for property and infrastructure. These events cause significant insured losses, forcing insurers to raise premiums to cover their risk. For instance, Hurricane Andrew in 1992 resulted in over $26 billion in insured losses, significantly impacting the insurance market.

Florida Homeowners Insurance Market History

The Florida homeowners insurance market has evolved significantly over the years, shaped by a series of events and regulatory changes. The state’s rapid population growth in the latter half of the 20th century led to a surge in demand for insurance, prompting the emergence of numerous insurers. However, the impact of major hurricanes, particularly Hurricane Andrew, led to a period of instability in the market, with several insurers facing financial difficulties or exiting the state altogether.

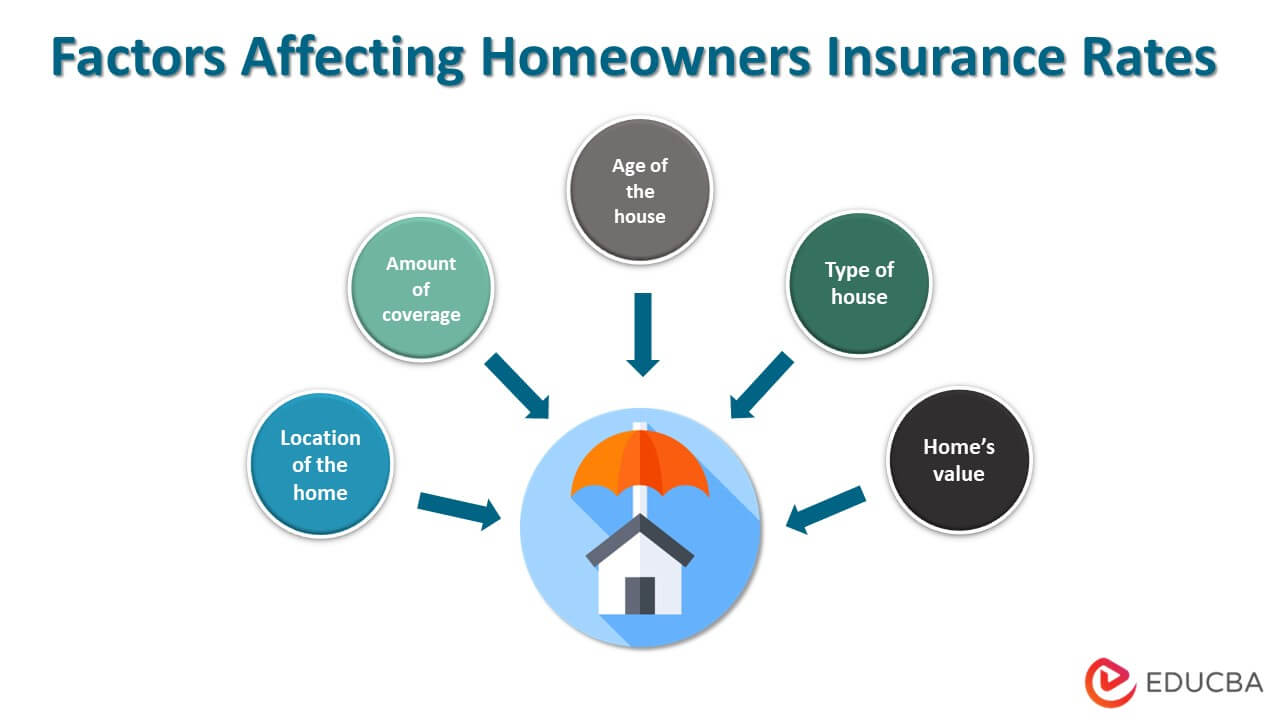

Factors Contributing to High Insurance Costs, State of florida homeowners insurance

Several factors contribute to the high cost of homeowners insurance in Florida, beyond the risk of hurricanes.

- Litigation Costs: Florida has a high volume of insurance-related lawsuits, driving up litigation costs for insurers. This is partly attributed to the state’s “assignment of benefits” (AOB) law, which allows policyholders to assign their insurance benefits to third-party contractors, who can then sue insurers for repairs.

- Reinsurance Costs: Reinsurance is a crucial risk management tool for insurers, allowing them to transfer some of their risk to other companies. Florida’s high hurricane risk drives up reinsurance costs, which are passed on to policyholders in the form of higher premiums.

- Regulatory Environment: Florida’s regulatory environment for homeowners insurance is complex and often subject to change. This uncertainty can make it challenging for insurers to operate in the state, leading to higher premiums as they factor in potential regulatory risks.

Key Insurance Coverage Considerations

Florida homeowners insurance policies offer essential coverage to protect your property and financial well-being. Understanding the different types of coverage and their limitations is crucial to ensure you have adequate protection.

Standard Coverage

Florida homeowners insurance policies typically include several standard coverage components:

- Dwelling Coverage: This covers the structure of your home, including the attached garage, and any permanent fixtures like built-in appliances. It protects against damage from perils such as fire, windstorms, hail, and lightning.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, electronics, clothing, and jewelry. It typically provides coverage for theft, fire, and other covered perils. However, there are often limits on the amount of coverage for certain items, such as jewelry and artwork.

- Liability Coverage: This protects you from financial responsibility if someone is injured on your property or if you are found liable for damages caused to another person’s property. It also covers legal defense costs in the event of a lawsuit.

- Additional Living Expenses (ALE): This coverage helps pay for temporary housing and other living expenses if your home is damaged and uninhabitable due to a covered peril. It can cover costs such as hotel stays, meals, and other essential expenses.

Flood Insurance

Flooding is a significant risk in Florida, and it is not typically covered by standard homeowners insurance policies.

Flood insurance is essential for protecting your home and belongings from flood damage.

- Availability: Flood insurance is available through the National Flood Insurance Program (NFIP) and private insurers. The NFIP provides coverage in areas designated as high-risk flood zones, while private insurers may offer coverage in other areas.

- Coverage: Flood insurance typically covers damage to the structure of your home, personal property, and other belongings. It also covers the cost of removing debris and cleaning up flood damage.

- Cost: The cost of flood insurance depends on factors such as the location of your home, the flood risk in your area, and the amount of coverage you choose.

Coverage Options

Florida homeowners insurance policies offer various coverage options to tailor your policy to your specific needs and budget.

- Dwelling Coverage: You can choose the amount of dwelling coverage that best suits your home’s value. You can opt for replacement cost coverage, which pays to rebuild or repair your home to its current value, or actual cash value coverage, which pays the replacement cost minus depreciation.

- Personal Property Coverage: You can choose the amount of personal property coverage that meets your belongings’ value. You can opt for actual cash value coverage, which pays the replacement cost minus depreciation, or replacement cost coverage, which pays to replace your belongings with new ones.

- Liability Coverage: You can choose the amount of liability coverage that best suits your needs. The standard liability coverage limit is typically $100,000, but you can purchase additional coverage for higher limits.

Factors Influencing Premiums: State Of Florida Homeowners Insurance

Homeowners insurance premiums in Florida are influenced by a variety of factors, making it crucial to understand these factors to make informed decisions about your coverage and cost.

Property Location

The location of your property plays a significant role in determining your insurance premium. Florida is prone to hurricanes, and the proximity of your home to the coast and the risk of hurricane damage directly impacts your premium. Coastal areas with a higher risk of hurricane damage typically have higher premiums than inland areas. Furthermore, the proximity to flood zones, earthquake zones, and areas prone to wildfires also influence premiums.

Age and Construction Type

The age and construction type of your home are also significant factors influencing your premium. Older homes, particularly those with outdated building materials and construction methods, are generally considered higher risk and may lead to higher premiums. Conversely, newer homes with modern building codes and materials tend to have lower premiums. The type of construction materials used in your home also plays a role. Homes built with hurricane-resistant materials, such as impact-resistant windows and reinforced roofs, may qualify for discounts.

Risk Assessment by Insurance Companies

Insurance companies use sophisticated risk assessment models to determine premiums. These models consider various factors, including:

- Your claims history: A history of frequent claims can lead to higher premiums.

- Credit score: A good credit score often indicates responsible financial behavior and can result in lower premiums.

- Safety features: Homes with safety features, such as smoke detectors, burglar alarms, and fire sprinklers, may qualify for discounts.

- Coverage amount: The amount of coverage you choose will impact your premium. Higher coverage amounts generally result in higher premiums.

- Deductible: A higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, typically results in lower premiums.

Insurance companies also consider factors like the type of roof, the presence of a pool, and the number of occupants in the home to assess risk. By understanding these factors, homeowners can take steps to reduce their premiums and ensure they have adequate coverage.

Finding Affordable Homeowners Insurance

Securing affordable homeowners insurance in Florida can be a challenging task, especially given the state’s vulnerability to hurricanes and other natural disasters. However, with careful planning and a strategic approach, you can find coverage that fits your budget without compromising your protection.

Strategies for Finding Affordable Homeowners Insurance

Finding affordable homeowners insurance in Florida requires a proactive approach. It involves exploring various options, understanding your coverage needs, and negotiating with insurance providers.

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurance providers is crucial for finding the best rates. Online comparison websites and insurance brokers can streamline this process.

- Increase Your Deductible: A higher deductible generally translates to lower premiums. Consider increasing your deductible if you can comfortably cover the out-of-pocket expenses in case of a claim.

- Reduce Your Coverage: Evaluating your coverage needs and potentially reducing unnecessary coverage can lower your premiums. Consider removing coverage for items you can afford to replace yourself.

- Bundle Policies: Combining your homeowners insurance with other policies, such as auto or renters insurance, can often result in discounts.

- Improve Your Home’s Security: Implementing safety measures like installing smoke detectors, burglar alarms, and impact-resistant windows can make your home less risky and potentially earn you discounts.

- Maintain a Good Credit Score: Your credit score can influence your insurance premiums. Maintaining a good credit score can lead to lower rates.

- Ask About Discounts: Many insurance companies offer discounts for various factors, such as being a long-time customer, being a member of certain organizations, or having a safe driving record.

Benefits of Shopping Around and Comparing Quotes

The competitive nature of the insurance market allows you to leverage your options to secure the best rates. By comparing quotes from multiple providers, you can:

- Identify the most competitive rates: Comparing quotes from different insurance companies can help you find the most affordable options.

- Discover various coverage options: Each insurance company offers unique coverage options and policy features. Shopping around allows you to explore these options and find the best fit for your needs.

- Negotiate better rates: Armed with quotes from other providers, you can leverage this information to negotiate better rates with your current insurer.

Impact of Increasing Deductibles and Reducing Coverage

While increasing your deductible and reducing coverage can lower your premiums, it’s crucial to weigh the potential financial impact in case of a claim.

- Higher Deductible: A higher deductible means you’ll pay more out of pocket in case of a claim. Consider your financial situation and ability to cover the deductible.

- Reduced Coverage: Reducing coverage means your insurance company will pay less in case of a claim. Evaluate your coverage needs and ensure you have sufficient protection for your assets.

The Role of the Florida Insurance Guaranty Association (FIGA)

The Florida Insurance Guaranty Association (FIGA) is a non-profit organization established to protect Florida homeowners in the event that their insurance company becomes insolvent. It acts as a safety net for policyholders, ensuring they don’t lose their coverage completely in such situations.

Purpose and Functions of FIGA

FIGA’s primary purpose is to provide financial protection to policyholders whose insurance companies become insolvent. This includes covering claims for covered losses, such as damage to a home from a hurricane or fire. FIGA operates by collecting assessments from insurance companies in Florida to build a fund that can be used to pay claims in the event of an insurer’s insolvency.

Limits and Conditions of Coverage Provided by FIGA

FIGA’s coverage is subject to certain limits and conditions. Here are some of the key points to remember:

- Coverage Limits: FIGA’s coverage is limited to a maximum of $300,000 per claim and $500,000 per insured. This means that if a homeowner’s claim exceeds these limits, they will be responsible for the difference.

- Types of Coverage: FIGA covers most types of homeowners insurance policies, including dwelling coverage, personal property coverage, and liability coverage. However, there are some specific exclusions, such as flood insurance and earthquake insurance.

- Deductibles: The deductible for a FIGA claim is the same as the deductible for the original policy.

- Time Limits: FIGA has a time limit for filing claims, which is typically one year from the date of the insolvency.

Potential Impact of FIGA on the Stability of the Florida Homeowners Insurance Market

FIGA plays a crucial role in maintaining stability within the Florida homeowners insurance market. By providing a safety net for policyholders, FIGA helps to prevent widespread panic and financial hardship in the event of an insurer’s insolvency. This can help to maintain confidence in the market and prevent a domino effect of insurer failures.

However, FIGA’s existence can also have some unintended consequences. For example, some argue that FIGA’s presence might encourage insurance companies to take on more risk, knowing that FIGA will be there to backstop them in case of insolvency. This could potentially lead to higher premiums for all homeowners.

“FIGA’s role is a complex one, balancing the need to protect homeowners with the need to maintain a stable and competitive insurance market.” – Florida Office of Insurance Regulation

Future Trends in Florida Homeowners Insurance

The Florida homeowners insurance market is constantly evolving, shaped by a confluence of factors, including technological advancements, climate change, and government policies. Understanding these trends is crucial for both insurers and homeowners to navigate the complexities of the market and prepare for the future.

Impact of Technology and Data Analytics

The increasing use of technology and data analytics is transforming the Florida homeowners insurance market. Insurers are leveraging these tools to improve risk assessment, pricing models, and customer service.

- Improved Risk Assessment: Advanced algorithms and data analytics allow insurers to analyze vast amounts of data, including historical claims data, weather patterns, building characteristics, and even satellite imagery. This helps them better understand the risk associated with specific properties and develop more accurate pricing models.

- Personalized Pricing: Data analytics enables insurers to offer personalized premiums based on individual risk profiles. This allows homeowners with lower risk factors to benefit from lower premiums, while those with higher risk factors may see slightly higher premiums. This approach promotes fairness and encourages homeowners to take steps to mitigate their risk.

- Enhanced Customer Service: Technology is streamlining the insurance process, offering homeowners more convenient and efficient ways to manage their policies. Online platforms and mobile apps allow homeowners to submit claims, track policy information, and communicate with their insurer easily. This improved customer experience can lead to greater satisfaction and loyalty.

Climate Change and Rising Sea Levels

Climate change and rising sea levels pose significant challenges to the Florida homeowners insurance market. Increased frequency and severity of weather events, such as hurricanes and floods, are driving up insurance premiums and raising concerns about coverage.

- Higher Premiums: As the risk of catastrophic events increases, insurers are forced to adjust their premiums to reflect the higher likelihood of claims. This can lead to significant increases in homeowners insurance costs, particularly for properties in coastal areas or those vulnerable to flooding.

- Limited Coverage: Some insurers may choose to limit or restrict coverage for certain types of risks, such as flood damage, due to the increasing costs associated with these events. This can leave homeowners with limited options and potentially inadequate coverage for the risks they face.

- Increased Reinsurance Costs: Insurers rely on reinsurance to mitigate their own risk from catastrophic events. However, rising reinsurance costs, driven by the increased risk of climate change, are putting pressure on insurers’ profitability and potentially leading to higher premiums for homeowners.

Government Policies and Regulations

Government policies and regulations play a crucial role in shaping the Florida homeowners insurance market. These policies can impact the availability and affordability of insurance, as well as the overall stability of the market.

- Building Codes and Regulations: Stringent building codes and regulations can help mitigate the impact of natural disasters by ensuring that new construction is more resilient to hurricanes and other extreme weather events. This can lead to lower insurance premiums for newer homes.

- Catastrophe Funds: Government-sponsored catastrophe funds provide financial support to insurers in the event of a major disaster. These funds can help stabilize the market and prevent insurers from becoming insolvent, ensuring that homeowners continue to have access to coverage.

- Market Regulation: State regulators play a vital role in overseeing the insurance market, ensuring that insurers are financially sound and operating fairly. This includes setting minimum capital requirements, monitoring rates, and addressing consumer complaints.

Closing Notes

Navigating the Florida homeowners insurance market can be challenging, but with careful planning and research, homeowners can find the coverage they need at a price they can afford. By understanding the key factors that influence premiums, comparing quotes from different insurance providers, and exploring strategies for reducing costs, homeowners can protect their investments and secure peace of mind.

FAQ Guide

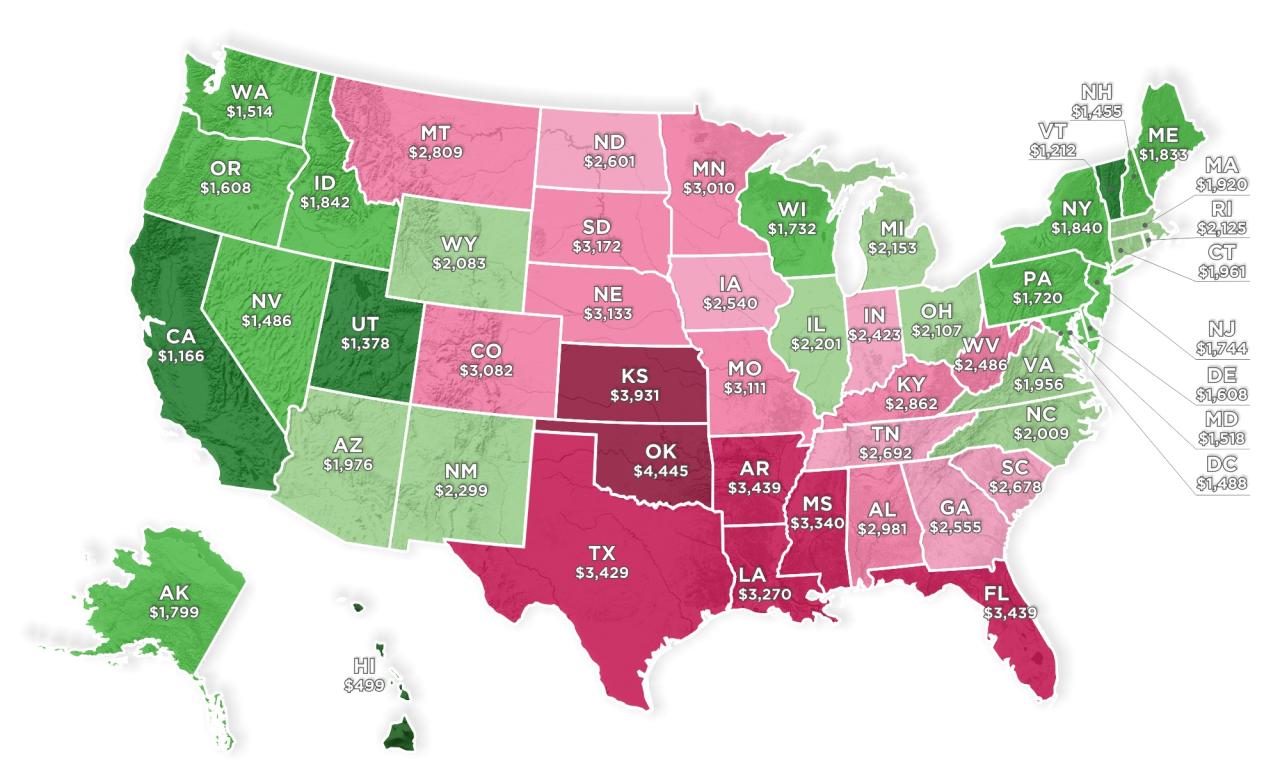

What is the average cost of homeowners insurance in Florida?

The average cost of homeowners insurance in Florida varies depending on factors such as location, property value, and coverage level. However, it is generally higher than in other states due to the risk of hurricanes and other natural disasters.

How can I reduce my homeowners insurance premiums in Florida?

There are several strategies for reducing homeowners insurance premiums in Florida, including increasing your deductible, installing safety features such as smoke detectors and burglar alarms, and bundling your homeowners and auto insurance policies.

What is the role of the Florida Insurance Guaranty Association (FIGA)?

FIGA is a non-profit organization that provides financial protection to homeowners in Florida in the event that their insurance company becomes insolvent. FIGA will pay claims up to certain limits, ensuring that homeowners are not left without coverage.